DURING 2022

A Report Prepared for the

Federal Open Market Committee

by the Markets Group of the

Federal Reserve Bank of New York

APRIL

2023

MARKET

OPERATIONS

OPEN

CONTENTS

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

This report, presented to the Federal Open Market

Committee by Roberto Perli, Manager of the

System Open Market Account, describes open

market operations of the Federal Reserve System

for the calendar year 2022. Christian Cabanilla,

Shafat Alam, Aidan Brown, Kathryn Chen,

Dayna Goodwin, Radhika Mithal, Linsey Molloy,

and Julie Remache were primarily responsible for

preparation of the report.

Overview .......................................................... 1

Key Developments in 2022 ............................................1

A Guide to This Report ...................................................2

The Federal Reserve’s Framework for

Monetary Policy Implementation .........................5

Open Market Operations .................................7

Money Market Developments and Related Policy Measures .....7

Reverse Repurchase Agreements ........................................ 7

Repurchase Agreements .................................................. 9

Central Bank Liquidity Swaps ..........................................10

Treasury Securities Operations ......................................... 10

Agency MBS Operations ............................................... 14

Securities Lending ........................................................ 17

Foreign Reserves Management ........................................ 18

Selected Balance Sheet Developments ...............19

Selected Assets ........................................................... 19

SOMA Domestic Securities Holdings ............................ 19

Portfolio Size and Composition ............................... 19

Portfolio Risk Metrics ............................................ 24

SOMA Repurchase Agreements ..................................24

Central Bank Liquidity Swaps .....................................24

SOMA Foreign Currency–Denominated Holdings ............ 24

Primary Credit Program ............................................. 25

Emergency Credit and Liquidity Facilities .......................26

Selected Liabilities........................................................ 27

Reserve Balances .................................................... 29

Federal Reserve Notes ............................................. 29

Reverse Repurchase Agreements ..................................30

Deposits .................................................................... 31

Financial Results ..........................................................32

SOMA Net Income ................................................. 32

Federal Reserve Remittances ......................................32

SOMA Unrealized Gains and Losses ...........................33

Projections ...................................................................... 35

Counterparties ..............................................41

Operational Flexibility and Resiliency .................43

Appendixes ...................................................... 45

Appendix 1: Terms for Desk Operations ............................. 45

Appendix 2: Governing Documents .................................. 50

Appendix 3: Operations Disclosures ................................. 52

Appendix 4: Summary of Projection Assumptions ................. 53

Appendix 5: Reference Web Pages ................................. 54

Endnotes .......................................................... 57

Index of Charts and Tables ..............................61

1

OVERVIEW

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

KEY DEVELOPMENTS IN 2022

During 2022, ination remained above the Federal Open Market

Committee’s longer-run target and the labor market remained

strong. In response, the Federal Open Market Committee (FOMC

or Committee) increased the target range for the federal funds rate

from zero to ¼ percent to 4 ¼ to 4 ½ percent by year-end. e

Federal Reserve’s monetary policy implementation framework

continued to be eective, with the eective federal funds rate

(EFFR) remaining within its target range during the year.

The Committee also began the process of reducing the size

of the Federal Reserve’s balance sheet during 2022. In January,

the Committee released its Principles for Reducing the Size of

the Federal Reserve’s Balance Sheet.

1

The release communicated

the high-level principles regarding the Committee’s intended

approach, including information on sequencing for removing

policy accommodation. The Committee subsequently issued

its Plans for Reducing the Size of the Federal Reserve’s Balance

Sheet in May.

2

The Committee stated that it intended to reduce

the Federal Reserve’s securities holdings in a predictable

manner, primarily by adjusting the reinvested amounts of

principal payments on System Open Market Account (SOMA)

securities holdings. Beginning on June 1, principal payments

from Treasury and agency securities held in the SOMA were

reinvested to the extent that they exceeded monthly caps. The

redemption caps were subsequently raised to their current level

starting in September. After reaching a high of $8.97 trillion

following the final net asset purchases in the first quarter, the

Federal Reserve’s balance sheet decreased to $8.55 trillion at

year-end 2022. Total assets as a share of nominal GDP (NGDP)

also declined, falling from 36 percent in 2021 to 33 percent by

the end of 2022.

e composition of Federal Reserve liabilities also shied

during 2022. e size of the overnight reverse repurchase

(ON RRP) facility saw material growth during the rst half

of the year, before ending the year at an average level of

$2.18 trillion in December. In contrast, reserve balances

decreased by $1.08 trillion to an average level of $3.09 trillion

in December 2022. e Treasury General Account (TGA) saw

signicant variation during the year, peaking in the second quarter

at $964.4 billion before declining to $446.7 billion at year-end

2022. (See Box 2 on page 28 for additional details on changes in

the composition of Federal Reserve liabilities.)

e ON RRP facility continued to serve its intended purpose

of supporting eective policy implementation by providing an

investment option for a broad base of money market investors. e

signicant growth in usage of the ON RRP facility in 2022 was

driven by the attractiveness of the ON RRP rate compared

to other short-term money market rates, as well as a broader

preference for shorter-duration investments, mainly from money

market funds (MMFs).

As overnight interest rates traded well below the top of the

federal funds target range, the standing repurchase agreement

facility (SRF) was not actively used. The SRF is intended to

act as a backstop to address temporary pressures in overnight

funding markets that could spill over to the federal funds

market and potentially impair the implementation of monetary

policy. The criteria for SRF counterparty eligibility were

expanded during 2022 and fourteen depository institutions

were added to the facility over the year, bringing the total

number of SRF counterparties to seventeen, in addition to

primary dealer counterparties.

2

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Global U.S. dollar funding markets remained stable throughout

the year amid broad increases in policy rates across several

jurisdictions and abundant dollar liquidity across the nancial

system, as reected in broadly lower average usage of U.S. dollar

central bank swap lines during 2022 compared to 2021. Usage of

the standing overnight repurchase agreement facility for foreign

and international monetary authorities (commonly referred to as

the FIMA repo facility) was limited to transactions undertaken by

FIMA account holders for operational readiness purposes.

e cumulative eect of increases in administered rates

into 2022 resulted in sharply higher interest expense, and

SOMA net income declined to $65.7 billion in 2022 from

$114.8 billion in 2021. e Federal Reserve remitted a total of

$76.0 billion to the U.S. Treasury in 2022. By September 2022,

most Reserve Banks had suspended weekly remittances to the

Treasury, and the Federal Reserve System started accumulating

a deferred asset, which totaled $16.6 billion at year-end.

3

(See

Box 3, “Understanding Net Income and Deferred Assets at

the Federal Reserve during 2022,” on page 34.) e deferred

asset, which reects the cumulative negative net income of the

Federal Reserve, has no implications for how the Federal Reserve

conducts monetary policy and does not constrain its ability to

meet its nancial obligations. e SOMA portfolio ended the

year with a signicant unrealized loss position, reecting broader

increases in market yields during the year; this unrealized position

has no eect on net income or remittances to the Treasury.

e Open Market Trading Desk at the Federal Reserve Bank

of New York (the Desk) did not conduct any foreign exchange

intervention activity during 2022, and the SOMA foreign currency

reserve portfolio totaled $18.6 billion at the end of the year. e

Desk continued to manage the SOMA foreign currency reserve

holdings in line with the portfolio’s investment objectives of

liquidity, safety, and return.

In coming years, the size and composition of the

Federal Reserve's balance sheet will continue to evolve. Sta

projections, which reect the FOMC’s plans for balance sheet

reduction, show the portfolio declining in size for several years,

then remaining generally steady through reinvestments, before

nally expanding to match the growth in Federal Reserve

liabilities. Over time, portfolio holdings shi toward Treasury

securities, consistent with the FOMC’s intention to return to

a portfolio composed primarily of Treasury securities. Using

survey-based assumptions about the path of interest rates, the

projections indicate that SOMA net income could remain negative

for several years, driven by the increased cost of interest-bearing

Federal Reserve liabilities, before returning to positive levels in

subsequent years.

Operational resilience is an important priority, and the

New York Fed continued to enhance its operational exiblity as

well as its cyber and geographic resilience. e Desk continued its

practice of undertaking small-value excercises with counterparties

in order to maintain its readiness to implement a range of

potiential FOMC directives.

e Federal Reserve continued to engage with other

authorities and private-sector parties on eorts that support

structural improvements to market functioning. A number of

initiatives related to enhancing Treasury market functioning

continued to make substantive progress during the year. e Desk

continues to monitor Treasury market functioning through a

suite of metrics and qualitative outreach to market participants.

(See Box 1, “Treasury Market Resiliency and Monitoring Market

Functioning,” on page 13.)

A GUIDE TO THIS REPORT

is report is divided into ve main sections:

1. e Federal Reserve’s Framework for Monetary Policy

Implementation: is section provides an overview of the

Federal Reserve’s framework for monetary policy implementation,

including the purpose and usage of the various tools employed by

the Desk. (pp. 5-6)

2. Open Market Operations: is section describes the steps

taken by the Desk within the framework to implement the

FOMC’s operating directives in money markets and securities

markets during 2022. e Desk’s operations to manage the

Federal Reserve’s portfolio of foreign currency–denominated

assets are also included in this section. (pp. 7-18)

3

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

3. Selected Balance Sheet Developments: is section examines

the composition of the Federal Reserve’s balance sheet, reviews

developments related to the SOMA portfolio, and discusses the

purposes of and recent trends in the Federal Reserve’s liabilities. It also

presents an illustrative projection of the balance sheet and SOMA net

income under a set of simplifying assumptions. (pp. 19-40)

4. Counterparties: is section reviews the trading

counterparties to the Desk’s domestic and foreign open market

operations. (pp. 41-42)

5. Operational Flexibility and Resiliency: is nal section

highlights actions implemented to enhance cyber resilience and

details operational readiness exercises undertaken during the

year. (pp. 43-44)

Appendix 1 provides summaries of the key terms for

each of the Desk’s operations. Appendix 2 highlights links

to the FOMC documents governing Desk operations.

Appendix 3 summarizes the Desk’s public disclosures about

its operations. Appendix 4 presents assumptions underlying

the scenarios for the SOMA portfolio and the SOMA net

income projections. Appendix 5 provides links to web

pages where source material for Federal Reserve–related

content can be found.

Underlying data for the charts shown in this report is

provided on the New York Fed’s website to the extent that its

release is permitted by data suppliers. Additional questions

regarding this report and the underlying data can be addressed to

ny.mkt.soma.annualreport@ny.frb.org.

4

5

THE FEDERAL RESERVE’S FRAMEWORK FOR

MONETARY POLICY IMPLEMENTATION

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

e Federal Reserve implements monetary policy in a

framework that includes a target range for the federal funds rate

to communicate the FOMC’s policy stance, a set of administered

rates set by the Federal Reserve, and market operations directed

by the FOMC and conducted by the Desk to promote money

market conditions consistent with the FOMC’s target range for

the policy rate. e FOMC can also employ forward guidance

for the target range for the policy rate and alter the size and

composition of the Federal Reserve balance sheet as a mechanism

for achieving its objectives. e framework supports the FOMC’s

pursuit of its maximum employment and price stability objectives,

mandated by Congress and articulated in the Committee’s

Statement on Longer-Run Goals and Monetary Policy Strategy,

which it rearmed in January 2022.

4

e money market tools used by the Federal Reserve for policy

implementation are designed to maintain short-term interest

rate control in an environment of ample reserves in the banking

system. e FOMC’s policy rate is the federal funds rate, which is

maintained within a target range set by the Committee. e federal

funds rate is the rate at which depository institutions and other

eligible entities conduct overnight unsecured transactions in central

bank balances. e Federal Reserve sets two main administered

rates: e rate of interest on reserve balances (IORB) is paid to

depository institutions with accounts at the Federal Reserve, while

the ON RRP rate is oered to a wide range of money market

lenders. ese administered rates are set at levels that support the

federal funds rate trading within the target range.

Given the safety and convenience of maintaining reserves

in Federal Reserve accounts, little incentive exists for banks

to lend to private-sector counterparties at rates lower than the

IORB rate. However, since not all money market participants

are eligible to hold Federal Reserve accounts or to earn the

IORB rate, the EFFR can trade below the IORB rate. As such,

the ON RRP facility supports control over the federal funds rate

by oering a broader range of money market participants an

overnight investment, which enhances their bargaining power in

negotiating similar private-sector transactions. Amid signicant

shis in reserve levels in recent years, the Federal Reserve has

been able to maintain control of the EFFR through use of its

administered rates.

In 2021, the Committee established two standing repurchase

agreement (repo) facilities, the SRF and the FIMA repo facility,

to serve as backstops in money markets to support the effective

implementation of monetary policy and smooth market

functioning. The Federal Reserve offers daily SRF operations

on a standing basis against Treasury, agency debt, and agency

mortgage-backed securities (MBS), with pricing set above the

general level of overnight interest rates. These features of the

SRF allow the facility to limit any potential upward pressure

in repo rates that could contribute to the federal funds rate

moving above its target range. The SRF is open to primary

dealers and eligible depository institutions. The FIMA repo

facility provides account holders, which consist of central

banks and other foreign monetary authorities, an alternative

means to access temporary U.S. dollar liquidity against their

holdings of Treasury securities other than through sales of

Treasury securities. As a result, the FIMA repo facility can

help address pressures in dollar funding markets that could

otherwise affect U.S. financial conditions. In this respect, the

FIMA repo facility complements the U.S. dollar liquidity swap

lines as a backstop for dollar funding.

6

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Changes in the size or composition of the balance sheet are an

important part of the monetary policy implementation framework,

although the purpose of these changes can vary depending on the

circumstances. Asset purchases can be used to maintain ample

levels of reserves in the banking system and support interest

rate control. Such reserve management purchases were a regular

feature of monetary policy prior to the global nancial crisis and

were also conducted in 2019 and 2020 to li the level of reserves

in the banking system.

Asset purchases can also be used to directly inuence nancial

conditions. In circumstances where the federal funds rate is

constrained by the eective lower bound, the FOMC may direct

the Desk to conduct asset purchases to further ease nancial

conditions. In such cases, asset purchases put downward pressure

on longer-term interest rates by reducing the stock of longer-term

debt held by the public. Such purchases were employed in the

wake of the global nancial crisis to put downward pressure on

yields and to promote a stronger economic recovery, and more

recently to foster accommodative nancial conditions in response

to the COVID-19 pandemic.

Lastly, on occasion, asset purchases can be used to address

severe disruptions to market functioning that could impede the

transmission of monetary policy and aect broader nancial

stability. Purchases can alleviate frictions in dealer intermediation,

establish clearing prices for the assets purchased, and ease balance

sheet constraints of private market participants. As such, these

factors can help restore the functioning of private markets and

support the ow of credit to the U.S. economy. For example, in

March 2020 asset purchases were conducted to address severe

disruptions in U.S. Treasury, agency MBS, and agency commercial

mortgage-backed securities (CMBS) markets and support

market functioning.

7

OPEN MARKET OPERATIONS

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

To implement monetary policy, the Desk conducts open

market operations as directed by the FOMC. Domestic open

market operations in 2022 included outright purchases of

Treasury securities and agency MBS, as well as repurchase

agreements and reverse repurchase agreements. ese operations

also included the securities lending program to support smooth

functioning of Treasury markets. e Desk also manages

the SOMA foreign reserves portfolio and maintains swap

arrangements with certain foreign central banks to provide dollar

liquidity to global funding markets.

MONEY MARKET DEVELOPMENTS AND

RELATED POLICY MEASURES

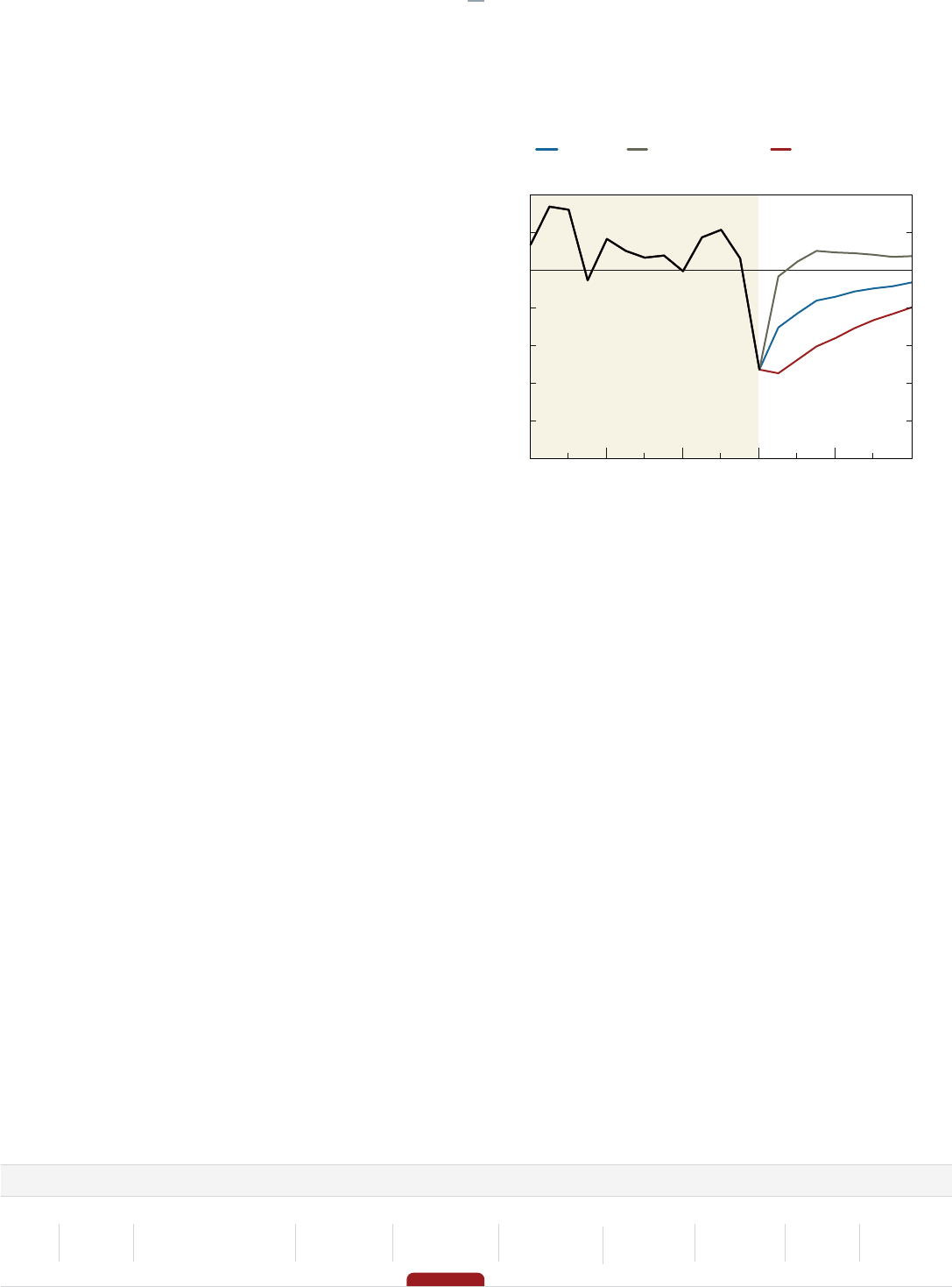

During 2022, the FOMC increased the target range for the federal

funds rate from 0 to ¼ percent to 4 ¼ to 4 ½ percent by year-end,

with four increases of 75 basis points each occurring between June

and November (Table 1 and Chart 1). roughout the year the

eective federal funds rate remained consistently within the target

range, generally at a spread of 8 basis points below the IORB

rate (Chart 2).

Uncertainty about the path of the economy and monetary policy

in 2022 led to greater investor preference for shorter-duration

investments, mainly from MMFs. Along with a declining supply

of Treasury bills, these factors put downward pressure on yields in

money markets. Private overnight repo rates oen traded below

the ON RRP rate and Treasury bill rates frequently traded below

comparable maturity money market rates during the year, which

increased the attractiveness of the rate oered at the ON RRP facility

and contributed to its growth, especially during the rst half of

2022.

5

In addition, deposit rates across the banking system increased

more slowly than the federal funds target range, which further

supported the amount of assets under management at MMFs and,

by extension, demand at the ON RRP facility.

As balance sheet runo proceeded into late 2022, a range of money

markets began to see some shis. ere were emerging signs of

greater competition for deposits and increases in demand for

wholesale borrowing by some banks. For example, advances from

Federal Home Loan Banks (FHLBs) and borrowing by domestic

banks in the federal funds market both saw increases into the

end of the year. In addition, Treasury bill yields and private repo

rates began to increase relative to the ON RRP rate during the

second half of 2022, in part due to higher levels of net Treasury

bill issuance. ON RRP take-up was lower on certain days, such

as Treasury settlement days, and there was a modest increase in

private repo borrowing activity toward the end of 2022.

REVERSE REPURCHASE AGREEMENTS

During 2022, the FOMC continued to direct the Desk to conduct

ON RRP operations at an oering rate 5 basis points above the

bottom of the target range for the federal funds rate. During 2022,

there were no changes to counterparty limits, overall limits on the

size of the facility, or eligibility requirements.

Operational Results

Usage of the ON RRP facility increased primarily during the rst

half of 2022 and remained more stable in the second half of the

year, outside of temporary increases near quarter- and year-end

periods. Daily take-up at the ON RRP averaged $2.18 trillion

during December, reaching a high of $2.55 trillion at year-end.

Over the year, MMFs, government-sponsored enterprises (GSEs),

8

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Source: Federal Reserve Bank of New York.

Notes: Figures are daily. For data prior to July 29, 2021, rate of interest on reserve balances refers to the rate of interest on excess reserves.

Federal Funds Target Range, Effective Federal Funds Rate, Rate of Interest on Reserve Balances, and ON RRP Rate

Percent

Federal funds target range

Effective federal funds rate

Rate of interest on reserve balances

ON RRP rate

Chart 1

2019 2020 2021 20222018

0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

Table 1

Key Policy Rates Effective in 2022

FOMC Meeting

Announcing

Policy Rate

Changes

Effective Date

Range for

Policy Rates

during 2022

Federal Funds

Target Range IORB Rate ON RRP Rate

Spread between

IORB and

ON RRP Rates SRF Rate

Rate

(Percent)

Change

(Basis

Points)

Rate

(Percent)

Change

(Basis

Points)

Rate

(Percent)

Change

(Basis

Points)

Level

(Basis Points)

Rate

(Percent)

Change

(Basis

Points)

March 2022

March 17 to

May 4

¼ to ½ 25 0.40 25 0.30 25 10 0.50 25

May 2022

May 5 to

June 15

¾ to 1 50 0.90 50 0.80 50 10 1.00 50

June 2022

June 16 to

July 27

1½ to 1¾ 75 1.65 75 1.55 75 10 1.75 75

July 2022

July 28 to

September 21

2¼ to 2½ 75 2.40 75 2.30 75 10 2.50 75

September

2022

September 22

to November 2

3 to 3¼ 75 3.15 75 3.05 75 10 3.25 75

November 2022

November 3 to

December 14

3¾ to 4 75 3.90 75 3.80 75 10 4.00 75

December 2022

December 15 to

December 31

4¼ to 4½ 50 4.40 50 4.30 50 10 4.50 50

Sources: Federal Open Market Committee; Board of Governors of the Federal Reserve System.

9

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

and primary dealers accounted for an average of 91 percent,

7 percent, and 3 percent of the participation in the ON RRP

facility, respectively (Chart 3).

6

(See the “Money Market

Developments and Related Policy Measures” section of this report

for additional detail on the increase in ON RRP usage.)

REPURCHASE AGREEMENTS

STANDING REPURCHASE AGREEMENT FACILITY

Under the SRF, the Desk oers daily overnight repo operations

against Treasury securities, agency debt securities, and agency

MBS at a backstop rate intended to limit upward pressure on

overnight interest rates. As directed by the FOMC, the Desk

oered daily overnight repo operations with a minimum bid

rate in line with the top of the federal funds target range and

an aggregate limit of $500 billion. e eligibility requirements

for SRF counterparties were adjusted in April 2022 to allow a

broader set of depository institutions to access the facility. (See the

“Counterparties” section of this report for additional detail.)

-

30

-

20

-

10

0

10

20

30

40

50

Note: Prior to July 29, 2021, interest on reserve balances (IORB) was referred

to as interest on excess reserves (IOER).

Source: Federal Reserve Bank of New York.

Chart 2

Effective Federal Funds Rate and Secured Overnight

Financing Rate Spreads to IORB

Basis points

SOFR-IORB spread

EFFR-IORB spread

Jan

2020

Apr Jul Oct Apr Jul Oct Apr Jul OctJan

2021

Jan

2022

400

0

800

1,200

1,600

2,000

2,400

2,800

Total RRP outstanding

S

ource: Federal Reserve Bank of New York.

N

ote: Figures are daily and include overnight and term operations.

B

illions of U.S. dollars

Money market funds

Government-sponsored enterprises Primary dealers

Banks

Chart 3

S

OMA Reverse Repo Amounts Outstanding by Counterparty Type

2018 2019 2020 2021 2022

10

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Operational Results

Given continued stable funding market conditions and repo

market rates trading well below the SRF’s minimum bid rate, the

facility had little usage in 2022. SRF counterparties participated

in periodic small-value transactions during 2022 that were

conducted for operational readiness purposes.

FOREIGN AND INTERNATIONAL MONETARY

AUTHORITY (FIMA) REPO FACILITY

As directed by the FOMC, the FIMA repo facility enables approved

account holders to enter overnight repo transactions with the

Federal Reserve against Treasury securities that are held in custody

at the New York Fed. FIMA repo transactions are conducted at

an oering rate equal to the minimum bid rate for the standing

repurchase agreement facility.

Operational Results

Usage of the FIMA repo facility was limited given stable

U.S. dollar funding market conditions, ample U.S. dollar liquidity,

and the backstop nature of the facility’s pricing. During 2022, there

was modest usage of the facility by FIMA account holders for

operational readiness purposes.

CENTRAL BANK LIQUIDITY SWAPS

In 2022, the FOMC continued to direct the Desk to maintain

standing U.S. dollar and foreign currency liquidity swap lines

with a network of ve other major central banks—the Bank of

Canada (BoC), Bank of England (BoE), Bank of Japan (BoJ),

European Central Bank (ECB), and Swiss National Bank (SNB).

During 2022, U.S. dollar swap operations were oered weekly at

a one-week tenor, which is the typical operating practice in stable

global dollar funding conditions.

e U.S. dollar liquidity swap lines, which involve a temporary

exchange of currencies between two central banks, provide a liquidity

backstop to ease strains in global funding markets or reduce the risk

that they could emerge, thereby helping to mitigate the eects of such

strains on the supply of credit to households and businesses, both

domestically and abroad. e foreign central bank receiving dollars

lends the dollars in secured transactions with local banks.

Operational Results

Overall, usage of U.S. dollar liquidity swap lines was modest in

2022, remaining well under $1 billion for most of the year, as

global dollar funding markets largely functioned smoothly against

a backdrop of elevated levels of bank reserves and abundant dollar

liquidity (Chart 4). Four of the ve central banks with standing

swap line arrangements drew on their lines in 2022, namely the

BoE, BoJ, ECB, and SNB. Usage reached a high of $11.3 billion

in mid-October, driven primarily by draws from the SNB, which

peaked at $11.1 billion. ese draws were associated with local

money market dynamics and were not reective of broader

oshore dollar funding strains.

7

Usage of the swap lines reverted to

low levels by late October.

TREASURY SECURITIES OPERATIONS

In early 2022, the FOMC directed the Desk to continue

slowing the pace of net purchases of Treasury securities,

50

0

100

150

200

250

300

350

400

450

500

Source: Federal Reserve Bank of New York.

Notes: Figures are daily. Temporary swap line counterparties include Bank of

Korea, Monetary Authority of Singapore, Banco de México, Reserve Bank of

Australia, Danmarks Nationalbank, and Norges Bank.

Bank of Japan

Bank of England

European Central Bank

Swiss National Bank

Temporary swap line counterparties

Billions of U.S. dollars

Chart 4

U.S. Dollar Liquidity Swaps Outstanding by Central Bank

Total

2020 2021 2022

11

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

continuing the process that began in late 2021. In line with

these directives, the Desk increased Treasury securities

holdings in the January and February monthly purchase

periods by smaller amounts than it had in previous months.

At its March meeting, the FOMC directed the Desk to reinvest

all maturing Treasury securities into newly issued Treasury

securities to maintain the size of the SOMA. Apart from

small-value exercises, the Desk did not conduct additional

operations to purchase Treasury securities after March.

Consistent with the FOMC’s Plans for Reducing the Size of

the Federal Reserve’s Balance Sheet, beginning in June SOMA

Treasury holdings were redeemed up to a monthly cap. In

months in which coupon maturities were less than the monthly

cap, Treasury bills were also redeemed in amounts needed

to meet the monthly cap. In the first phase of runoff from

June to August, the cap on redemption of Treasury securities

was $30 billion per month. Beginning in September, the cap

increased to $60 billion per month. The FOMC continued to

direct the Desk to reinvest at auction all principal payments

above the monthly redemption cap from SOMA holdings of

Treasury securities.

TREASURY SECURITY ASSET PURCHASES

Operational Results

Treasury security asset purchases during 2022 totaled $60 billion

and were conducted during the January and February monthly

purchase periods (Chart 5). e Desk’s purchases of Treasury

securities continued to be conducted across a range of maturities

roughly in proportion to the outstanding issuance of Treasury

securities (Chart 6). e Desk refrained from purchasing

Treasury bills given high investor demand and the marginal

impact of bill purchases on broader nancial conditions.

8

Oers

were generally attractive relative to indicative and theoretical

prices for these securities. Oered amounts in Treasury security

purchase operations were, on average, three times those of

securities purchased, reecting a slight increase compared to

levels from 2021.

Treasury asset purchases ended in early March 2022,

concluding the Federal Reserve’s purchases of Treasury securities

that began in March 2020. e Desk continued to conduct

small-value purchase and sales operations for operational

readiness purposes. (See the “Operational Readiness” section of

this report for a summary of small-value exercises.)

-200

200

0

400

800

1,000

2018 2019 2020 2021 2022

Source: Federal Reserve Bank of New York.

Reinvestment of maturing Treasury securities

Reserve management purchases

Reinvestment of maturing agency MBS into Treasury securities

RedemptionsTreasury security asset purchases

Billions of U.S. dollars

Chart 5

SOMA Treasury Transactions

12

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

REINVESTMENTS OF TREASURY SECURITY

PRINCIPAL PAYMENTS

Operational Results

From January to May, the Desk reinvested a total of $772.1 billion

of maturing Treasury securities at auction, composed of

$426.5 billion in Treasury bill reinvestments and $345.6 billion

in Treasury coupon reinvestments. Consistent with the FOMC’s

directives, in June the Desk began to reinvest maturing Treasury

securities only to the extent they exceeded the monthly cap.

From June through December, the Desk reinvested $715.7 billion

of maturing Treasury securities, comprising $539.5 billion

in Treasury bill reinvestments and $176.2 billion in Treasury

coupon reinvestments.

Maturing Treasury coupons were reinvested into coupon

securities and maturing Treasury bills were reinvested into

bills at auctions of newly issued Treasury securities. Bids

by the SOMA at auctions of Treasury securities are placed

as noncompetitive tenders and are treated as add-ons to

announced auctions sizes. Maturing amounts were apportioned

pro rata based on the issuance amounts of securities that settled

on thematchingmaturity date. Specifically, on mid-month

maturity dates the Desk reinvested maturing Treasury coupon

0

5

1

0

1

5

2

0

2

5

3

0

3

5

4

0

4

5

Source: Federal Reserve Bank of New York.

Note: Excludes purchases conducted for the purpose of testing operational

readiness.

B

illions of U.S. dollars

Chart 6

Distribution of SOMA Treasury Purchases across

Sectors in 2022

0-3 yrs 3-6 yrs 6-10 yrs 10-30 yrs TIPS

00

200

400

600

800

1,000

1,200

20

40

60

80

100

120

140

160

2-yr note 3-yr note 5-yr note 7-yr note 10-yr note 20-yr bond 30-yr bond TIPS FRNs Bills

(right scale)

Source: Federal Reserve Bank of New York.

Note: Bars show the cumulative amount of Treasury securities acquired through reinvestments in 2022.

Chart 7

Distribution of SOMA Reinvestments at Treasury Auctions in 2022

Billions of U.S. dollars Billions of U.S. dollars

13

Box 1

TREASURY MARKET RESILIENCY AND MONITORING MARKET FUNCTIONING

The U.S. Treasury market

remains the deepest and most

liquid securities market in the

world and is fundamental for the

transmission of monetary policy.

Maintaining these characteristics

of the U.S. Treasury market is

a goal of the Federal Reserve

and other U.S. government

agencies. The Desk actively

monitors U.S. Treasury market

functioning in support of these

goals. This box details how

the Federal Reserve monitored

U.S. Treasury market functioning

as liquidity worsened during

2022 and provides an

update on the progress of the

Inter-Agency Working Group

for Treasury Market Surveillance

(IAWG) on improving the

longer-term resiliency of the

U.S. Treasury market.

a

Monitoring

Treasury Market

Functioning

Extensive monitoring of

the U.S. Treasury market is

conducted by the Desk through

market outreach, monitoring of

market data, and analysis of

internal operations data. The

Desk conducts daily outreach

across a broad range of

market participants to gather

views on the functioning of

the Treasury markets. This

outreach complements a range

of nancial market indicators

that the Desk monitors to

assess trends in the liquidity

and functioning of Treasury

markets, which include more

common measures of liquidity

used across nancial markets,

such as relative value across

Treasury securities and the

ease with which U.S. Treasury

securities can be bought

and sold.

b

The Desk also

utilizes internal data across

the range of open market

operations it conducts to

analyze counterparty- and

aggregate-level metrics.

During 2022, an increase

in broader interest rate volatility

contributed to deterioration

in a range of Treasury market

liquidity and functioning metrics

tracked by the Desk. Market

outreach conducted by the Desk

suggested Treasury markets

continued to function effectively,

but with lower levels of liquidity.

For example, bid-ask spreads

widened modestly in 2022

but remained below the levels

observed during the onset of

the pandemic-related market

disruptions (Chart 8).

Although a range of metrics

suggested challenging liquidity

conditions, outreach by the

Desk indicated that market

participants continued to be

able to conduct trades, albeit at

higher transaction costs and in

smaller sizes. Treasury market

liquidity tends to be reduced

during periods of heightened

volatility, and the lower levels

of liquidity during 2022 were

broadly in line with the increases

in volatility during the year.

IAWG Progress

in Improving

Treasury Resilency

Market-monitoring efforts by the

Desk run parallel to the work of

the IAWG, which is focused on

improving the broader resilience

of the U.S. Treasury market.

The IAWG’s work has focused

on ve main areas—expanded

central clearing, the resilience

of market intermediation,

data quality and availability,

trading venue transparency and

oversight, and the effects of

leverage and fund liquidity risk

management. The IAWG made

signicant progress on these

goals during 2022, as detailed

in an IAWG-published Staff

Progress Report and discussed

at the 2022 U.S. Treasury

Market Conference.

c

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

2018 2019 2020 2021 2022

10-year5-year2-year

Daily Bid-Ask Spreads for On-the-Run Treasury Securities

(Five-Day Rolling Average)

Chart 8

Source: BrokerTec.

.

Note: Effective November 19, 2018, BrokerTec halved the tick size in the

two-year note from ¼ to

1

/

8

of a 32nd.

Ticks

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

continued on page 14

14

securities into newly issued three-, ten-, and thirty-year

Treasury securities. End-of-month maturing Treasury

securities were reinvested into newly issued two-, five-,

seven-, and twenty-year, floating rate, and inflation-linked

Treasury securities. Reinvestments of Treasury bills occurred

based on their weekly maturities, in line with U.S. Treasury

issuance cycles.

For the full year, a total of $330.0billion in Treasury securities

were redeemed and the Desk reinvested $1.49trillion of maturing

Treasury securities,downfrom $1.73trillion in2021(Chart 7,

page 12). Total bill reinvestments were $966.0 billion and total

coupon reinvestments were $521.8 billion.

9

AGENCY MBS OPERATIONS

As with Treasury securities, in early 2022, the FOMC directed

the Desk to further slow the pace of net agency MBS purchases,

continuing the process of reducing net purchases that began in

late 2021 (Chart 9). During this period, the FOMC directed the

Desk to increase agency MBS holdings by at least $20 billion

during the January purchase period and by at least $10 billion

during the nal February purchase period, and continued to

direct the Desk to reinvest principal payments of agency MBS into

agency MBS. At its March meeting, the FOMC directed the Desk

to reinvest principal payments of agency MBS to maintain the

size of the SOMA.

This progress includes:

Evaluating expanded

central clearing

. The

Securities and Exchange

Commission (SEC) proposed

a rule in September 2022

that would enhance risk

management practices for

central counterparties in the

Treasury market and result

in additional clearing of

secondary market transactions

in Treasury securities.

d

Bilateral repo data.

The

Treasury Department’s

Ofce of Financial Research

(OFR) in February 2022

announced a pilot program

to collect transaction-level

data on the historically

opaque non-centrally cleared

bilateral repo markets.

e

SEC dealer registration.

The SEC proposed new

rules in March 2022 that

would require market

participants acting in

dealer-like roles and/

or engaging in material

buying and selling of

government securities

to register with the SEC,

among other requirements.

f

Enhancements to public data

.

The SEC approved a proposal

to increase the frequency of

aggregate U.S. Treasury Trade

Reporting and Compliance

Engine, or TRACE, transaction

data releases and include

additional metrics. The SEC

also proposed an amendment

to require additional data

reporting in Form PF for

certain investment advisors.

a

The IAWG was formed by the Treasury Department, Securities and Exchange Commission (SEC), and Federal Reserve Board in 1992 to improve monitoring and

surveillance and strengthen interagency coordination with respect to the Treasury markets.

b

For example, see Michael Fleming and Claire Nelson, “How Liquid Has the Treasury Market Been in 2022?,” Federal Reserve Bank of New York Liberty Street Economics,

November 15, 2022, at https://libertystreeteconomics.newyorkfed.org/2022/11/how-liquid-has-the-treasury-market-been-in-2022; and Lorie K. Logan,

“The Federal Reserve’s Market Functioning Purchases: From Supporting to Sustaining,” remarks at SIFMA webinar, July 15, 2020,

at https://www.newyorkfed.org/newsevents/speeches/2020/log200715.

c

U.S. Treasury Department, Federal Reserve Board, Federal Reserve Bank of New York, Securities and Exchange Commission, and Commodity Futures Trading

Commission, 2021, “Recent Disruptions and Potential Reforms in the U.S. Treasury Market: A Staff Progress Report,” November 8, available at

https://home.treasury.gov/system/les/136/IAWG-Treasury-Report.pdf; and the 2022 U.S. Treasury Market Conference replay, available at

https://www.newyorkfed.org/newsevents/events/markets/2022/1116-2022.

d

See Securities and Exchange Commission, 2022, “Standards for Covered Clearing Agencies for U.S. Treasury Securities and Application of the Broker-Dealer

Customer Protection Rule with Respect to U.S. Treasury Securities,” at https://www.sec.gov/rules/proposed/2022/34-95763.pdf.

e

Samuel J. Hempel, R. Jay Kahn, Vy Nguyen, and Sharon Y. Ross, “Non-centrally Cleared Bilateral Repo,” OFR Blog, Ofce of Financial Research,

August 24, 2022, available at https://www.nancialresearch.gov/the-ofr-blog/2022/08/24/non-centrally-cleared-bilateral-repo/.

f

See Securities and Exchange Commission, “Further Denition of ‘As a Part of a Regular Business’ in the Denition of Dealer and Government Securities Dealer,”

Federal Register 87, no. 74, April 18, 2022: 23054-23106, at https://www.federalregister.gov/documents/2022/04/18/2022-06960/

further-denition-of-as-a-part-of-a-regular-business-in-the-denition-of-dealer-and-government.

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

15

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

Beginning in June, the FOMC directed the Desk to reduce

SOMA agency MBS holdings by reinvesting agency MBS

principal payments into agency MBS only to the extent that they

exceeded a monthly cap. e cap for agency MBS was initially

set at $17.5 billion per month for the June to August purchase

periods before increasing to $35 billion per month from the

September monthly purchase period onward. e FOMC directed

the Desk to continue to conduct dollar rolls and coupon swaps as

necessary to facilitate settlement of the Federal Reserve’s agency

MBS transactions.

AGENCY MBS ASSET PURCHASES

Operational Results

e Desk purchased a total of $123.8 billion of agency MBS

during the January and February mid-month purchase

periods. ese purchases were made up of $30.0 billion in

net purchases and $93.7 billion in reinvestments of principal

payments on existing agency MBS holdings. During the March

to May 2022 mid-month purchase periods, the Desk maintained

the size of agency MBS holdings by purchasing a total of

$112.7 billion in agency MBS to reinvest principal payments on

existing holdings. e Desk purchased a total of $32.8 billion in

agency MBS during the purchase periods of June, July, and August.

No purchases were executed from the September purchase period

to the end of 2022 as principal payments on agency MBS holdings

were under the monthly cap during that time.

10

e Desk allocated its purchases in line with the agency

MBS that were issued at the time. Prior to June 2022, most

MBS purchases had coupons of 4.0 percent or lower, reecting

prevailing primary mortgage rates. However, as primary mortgage

rates increased over the rest of the year, the Desk’s purchases of

production agency MBS also shied toward higher coupons. By

July 2022, more than half of monthly purchases were in 4.5 and

5.0 percent coupons.

Over the course of 2022, the Desk purchased a total of

$306.3 billion of agency MBS in the secondary market (Table 2),

including reinvestments of principal payments on existing MBS

holdings.

11

e Desk’s agency MBS purchases spanned een- and

thirty-year uniform agency MBS (UMBS) issued by Fannie Mae

and Freddie Mac, as well as thirty-year Ginnie Mae securities

(Charts 10 and 11). e Desk’s purchases of thirty-year securities

accounted for 90 percent of its agency MBS purchases. e Desk’s

fifteen-year UMBS purchases made up 10 percent of its total

-50

50

0

100

150

200

400

450

500

2018 2019 2020 2021 2022

Source: Federal Reserve Bank of New York.

Notes: Reinvestment and agency MBS asset purchases occur from mid-month to the following mid-month. Figures may be rounded.

Billions of U.S. dollars

Agency MBS asset purchases

Redemptions

Reinvestments from principal payments on agency debt

Reinvestments from principal payments on agency MBS

Chart 9

SOMA Agency MBS Transactions

16

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Table 2

Distribution of SOMA Agency MBS Operations in 2022

Agency

Coupon

(Percent)

Purchases

(Billions of

U.S. Dollars)

Purchases as a

Share of Gross Issuance

(Percent)

30-year

Uniform MBS 2.0 32.1 30

2.5 54.5 32

3.0 32.1 22

3.5 27.9 23

4.0 30.4 22

4.5 23.7 17

5.0 6.2 6

Ginnie Mae 2.0 6.0 15

2.5 17.8 23

3.0 14.2 21

3.5 9.3 17

4.0 11.4 16

4.5 7.7 10

5.0 1.8 3

Subtotal 274.9 18

15-year

Uniform MBS 1.5 5.2 34

2.0 11.2 36

2.5 5.9 35

3.0 3.9 35

3.5 3.7 42

4.0 1.4 21

4.5 0.1 2

Subtotal 31.4 32

Total 306.3 19

Sources: Federal Reserve Bank of New York; Knowledge Decision

Services, LLC.

Notes: Figures may be rounded. Gross issuance represents all xed-rate

agency MBS issued in 2022, including non-TBA-eligible securities. Subtotal

issuance comprises all coupons, including those not purchased for the

SOMA, with original terms to maturity of fteen or thirty years. Total

issuance comprises all coupons and all original terms to maturity. For TBA

outright purchases conducted after May 1, 2019, both Fannie Mae and

Freddie Mac securities are deliverable into Uniform MBS contracts.

20

40

60

80

100

Note: Figures are monthly and exclude purchases conducted for the purpose

of testing operational readiness.

a

The Desk did not conduct reinvestment purchases of agency MBS from

November 2018 to May 2019 and from October 2022 to December 2022, as

monthly principal payments of agency MBS were below the prevailing

reinvestment cap for each period.

Source: Federal Reserve Bank of New York.

a

SOMA Purchases of Fifteen-Year Agency MBS by Coupon

Percent

Chart 11

1.5%

2.0% 2.5% 3.0%

3.5% 4.0%

a

4.5%

2018 2019 2020 2021 2022

20

0

0

40

60

80

1

00

Note: Figures are monthly and exclude purchases conducted for the purpose

of testing operational readiness.

a

The Desk did not conduct reinvestment purchases of agency MBS from

November 2018 to May 2019 and from October 2022 to December 2022, as

monthly principal payments of agency MBS were below the prevailing

reinvestment cap for each period.

Source: Federal Reserve Bank of New York.

Chart 10

SOMA Purchases of Thirty-Year Agency MBS by Coupon

Percent

1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0%

a

a

2018 2019 2020 2021 2022

20

40

60

80

100

Note: Figures are monthly and exclude purchases conducted for the purpose

of testing operational readiness.

a

The Desk did not conduct reinvestment purchases of agency MBS from

November 2018 to May 2019 and from October 2022 to December 2022, as

monthly principal payments of agency MBS were below the prevailing

reinvestment cap for each period.

Source: Federal Reserve Bank of New York.

a

SOMA Purchases of Fifteen-Year Agency MBS by Coupon

Percent

Chart 11

1.5%

2.0% 2.5% 3.0% 3.5% 4.0%

a

4.5%

2018 2019 2020 2021 2022

20

0

0

40

60

80

100

Note: Figures are monthly and exclude purchases conducted for the purpose

of testing operational readiness.

a

The Desk did not conduct reinvestment purchases of agency MBS from

November 2018 to May 2019 and from October 2022 to December 2022, as

monthly principal payments of agency MBS were below the prevailing

reinvestment cap for each period.

Source: Federal Reserve Bank of New York.

Chart 10

SOMA Purchases of Thirty-Year Agency MBS by Coupon

Percent

1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0%

a

a

2018 2019 2020 2021 2022

17

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Endnotes

Federal Reserve

Framework for Monetary

Policy Implementation

purchases of agency MBS during 2022 and were concentrated in

2.0 and 2.5 percent coupon securities.

CUSIP Aggregation

In October 2022, the Desk announced plans to consolidate

many small, individual agency MBS into fewer and

larger-value securities.

12

Through this process, known as

CUSIP aggregation, several existing agency MBS with similar

characteristics—including issuing agency, coupon, and original

term to maturity—are consolidated into one larger security.

By reducing the number of individual securities held in the

SOMA portfolio, CUSIP aggregation can lower operational

risk, simplify back-office portfolio administration, and reduce

custodial costs that are assessed on an individual CUSIP

basis. During the fourth quarter of 2022, the Desk focused on

aggregating Freddie Mac MBS held in the SOMA that were issued

prior to June 2019 and had a forty-five-day payment delay. Over

the course of approximately three months, the total number of

agency MBS CUSIPs in the SOMA was reduced from 31,000 to

fewer than 30,000.

13

DOLLAR ROLLS

Operational Results

Given the forward-settling nature of the Desk’s agency MBS

transactions in the to-be-announced (TBA) market, agency

MBS can become scarce in the market during the time between

a transaction’s trade date and its settlement date. Because these

conditions could create settlement frictions, the Desk can

conduct dollar roll sales, which delay settlement of agency MBS

transactions to a future date to facilitate settlement. Dollar roll

sales allow dealers additional time to obtain securities to settle

transactions, in exchange for a market price that compensates the

Federal Reserve for the delay in settlement.

Mirroring the broader rise in primary mortgage rates,

origination of the underlying mortgages in agency MBS

shifted to higher-coupon securities during 2022. However,

as mortgage origination lags the moves in primary mortgage

rates, there was less supply of higher-coupon MBS to deliver

into TBAs for settlement, particularly in mid-2022. To facilitate

settlement, the Desk rolled a total of approximately $23 billion

of settlements during 2022, which represented approximately

5 percent of settlements, compared to 4 percent of settlements

in 2021 (Chart 12). Dollar rolls were concentrated in Ginnie

Mae securities and thirty-year UMBS.

SECURITIES LENDING

e FOMC has authorized the Desk to lend eligible Treasury and

agency debt securities held in the SOMA to primary dealers on

an overnight basis. ese operations provide a secondary and

temporary source of securities to the nancing market to promote

the smooth clearing of Treasury and agency debt securities.

Lending Treasury securities, especially those in which the SOMA

holds a signicant market share, helps mitigate periods of scarcity

in the market for these securities, such as when individual

issues experience high levels of short positioning or elevated

settlement fails.

1

0

2

0

3

0

4

0

00

10

20

30

40

50

Notes: Figures are monthly by settlement month. Share of expected

settlements is calculated excluding purchases conducted for the purpose of

testing operational readiness.

Source: Federal Reserve Bank of New York.

Chart 12

SOMA Dollar Roll Sales

Billions of U.S. dollars

Percent

Total (left scale)

Share of expected settlements (right scale)

2018 2019 2020 2021 2022

18

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Operational Results

In 2022, the Desk continued to conduct daily operations to lend

Treasury and agency debt securities from the SOMA portfolio to

primary dealers. Securities lending volumes in Treasury securities

averaged $41billion per day in 2022, up from $35 billion per day

in 2021, driven in part by higher demand for specic Treasury

securities across repo markets during 2022 (Chart13).

e slight increase in SOMA securities lending volumes

during 2022 in part reected the higher proportion of SOMA

holdings of Treasury securities to outstanding amounts compared

to previous years. Greater demand by investors across certain

Treasury issues led the volume-weighted average bid fee on

Treasury securities to rise to about16basis points in 2022, up

from 8 basis points in 2021.

FOREIGN RESERVES MANAGEMENT

The Federal Reserve holds a portfolio of euro- and

yen-denominated assets, which could be used to fund a

potential foreign exchange intervention.

14

The size and

currency composition of foreign reserve holdings are largely a

result of past intervention activity in foreign exchange markets.

In accordance with their statutory authorities, the FOMC and

U.S. Treasury make decisions on foreign exchange intervention

activity. In 2022, the Desk was not directed to undertake

any such activity.

INVESTMENT APPROACH

e Desk is directed by the FOMC to manage the SOMA’s foreign

currency holdings in a manner that ensures sucient liquidity,

maintains a high degree of safety, and, once these objectives

have been met, provides the highest rate of return possible in

each currency. e Desk passively manages its foreign currency

reserve holdings against an internal asset allocation target, which

is based on the FOMC’s stated objectives and updated on an

annual basis. e SOMA’s foreign currency reserves may be

invested on an outright basis in Dutch, French, German, and

Japanese government securities, as well as in deposits at the Bank

for International Settlements and foreign central banks such as

the Deutsche Bundesbank, Banque de France, De Nederlandsche

Bank, and Bank of Japan.

INVESTMENT ACTIVITY

In 2022, the Desk purchased Japanese yen–denominated

foreign sovereign debt securities in the secondary market

consistent with the investment approach. Purchases of

euro-denominated foreign sovereign debt securities were not

required to meet the target allocation. The Desk also continued

to hold foreign currency reserves in deposits at various official

institutions. As of year-end 2022, the SOMA foreign currency

portfolio totaled $18.6 billion, compared with $20.3 billion at

the end of 2021.

15

Since no transactions associated with foreign

exchange intervention were undertaken and the interest income

received was minimal due to the low interest rate environment

in the euro area and Japan, changes in the portfolio’s reported

U.S. dollar market value largely reflected changes in the foreign

exchange value of the dollar against the euro and Japanese yen

over the year.

16

(Foreign currency–denominated holdings are

described further in the “Selected Balance Sheet Developments”

section of this report.)

5

10

15

20

25

30

5

0 0

1

0

1

5

2

0

2

5

3

0

3

5

4

0

4

5

5

0

S

ource: Federal Reserve Bank of New York.

N

ote: Figures are monthly averages of daily lending results.

Securities lending (left scale)

Weighted average award rate (right scale)

Chart 13

SOMA Securities Lending in Treasuries

B

illions of U.S. dollars Basis points

2018 2019 2020 2021 2022

19

SELECTED BALANCE

SHEET DEVELOPMENTS

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

e size of the Federal Reserve’s balance sheet evolved in line

with the FOMC’s directives during the year, decreasing on

net over the course of 2022 (Table 3). Specically, the FOMC

directed the Desk to continue reducing net purchases of Treasury

securities and agency MBS through early March 2022, then

maintain the size of SOMA holdings by reinvesting principal

payments through May, before starting the process of balance

sheet runo in June. is resulted in total assets reaching a high

of $8.97 trillion in the second quarter of 2022 and subsequently

declining by $363.9 billion during the second half of the year.

Total assets ended 2022 at $8.55 trillion, $205.1 billion lower

than at year-end 2021. Total assets as a share of nominal GDP also

declined, to 33 percent of GDP in 2022 from 36 percent in 2021.

Along with the decline in the size of the Federal Reserve’s

balance sheet, the composition of liabilities shied over the

course of the year. Reserve balances declined by $959.5 billion

during 2022 and reached an average level during December of

$3.09 trillion. is decline is partly attributable to a signicant

increase in the ON RRP facility during the rst half of the year.

e Treasury General Account increased on net over the year,

peaking in the second quarter at $964.4 billion, before ending

2022 at $446.7 billion.

SOMA interest income reached historically high levels during

2022, driven by the large size of the SOMA portfolio. However,

the cumulative eect of increases in administered rates in late

2022 resulted in sharply higher interest expenses, and SOMA net

income declined to $65.7 billion in 2022 from $114.8 billion in

2021. By September 2022, most Reserve Banks had suspended

weekly remittances to the Treasury and the Federal Reserve

System started accumulating a deferred asset.

17

SELECTED ASSETS

e Federal Reserve’s assets can be divided into SOMA and

non-SOMA assets. e SOMA assets make up 95.2 percent of the

Federal Reserve’s assets and are mainly composed of domestic

securities holdings, along with smaller proportions of foreign

reserve portfolios, repurchase agreements, and U.S. dollar liquidity

swaps with foreign central banks. Non-SOMA assets include loans

to depository institutions through the primary and secondary

credit programs and asset holdings from the emergency credit

and liquidity facilities. ese assets are Federal Reserve assets but

are not part of the SOMA. All else equal, an increase (decrease)

in holdings of a particular asset leads to a corresponding increase

(decrease) in reserve balances or other liabilities.

SOMA DOMESTIC SECURITIES HOLDINGS

PORTFOLIO SIZE AND COMPOSITION

Most of the SOMA is composed of domestic holdings of Treasury

securities and agency MBS. e SOMA domestic securities

portfolio decreased to $8.14 trillion at year-end 2022 from

$8.27 trillion in 2021. e decline in the securities portfolio over

the year was driven by a roughly $153 billion decrease in Treasury

securities, while agency MBS holdings increased slightly on net

by nearly $26 billion, reecting the net eect of purchases in early

2022.

18

(See the “Agency MBS Holdings” section of this report for

additional details on agency MBS runo.) e domestic securities

portfolio at year-end 2022 was composed of Treasury securities

totaling $5.50 trillion (68 percent), agency MBS totaling

$2.64 trillion (32 percent), agency CMBS totaling $8.5 billion

(less than 1 percent), and agency debt totaling $2.3 billion (less

than 1 percent) (Chart 14).

19

20

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

Treasury Holdings

During 2022, SOMA Treasury securities holdings decreased

from $5.65 trillion to $5.50 trillion. is decline was mostly

driven by a $116.7 billion decrease in Treasury coupon holdings,

with the remaining decline coming from a $36.5 billion

decrease in Treasury bill holdings. Although asset purchases

of Treasury securities by the Desk ended in early March, total

holdings peaked at $5.77 trillion in the second quarter because

of increased ination compensation on holdings of Treasury

Inflation-Protected Securities (TIPS).

20

In line with the FOMC’s

Plans for Reducing the Size of the Federal Reserve’s Balance Sheet,

Table 3

Changes in Selected Federal Reserve Assets and Liabilities

Billions of U.S. Dollars

Assets

U.S.

Treasury

Securities

Agency

MBS,

Agency Debt,

and Agency

CMBS Repo

Central

Bank

Liquidity

Swaps

Primary

Credit

Program

Emergency

Credit and

Liquidity

Facilities

Other

Assets

Total

Assets

Outstanding as of:

December 31, 2021 5,652.5 2,617.9 0.0 3.3 0.6 52.8 429.3 8756.4

December 30, 2022 5,499.4 2,643.7 0.0 0.4 5.3 26.2 376.3 8,551.3

Changes in the period

Dec 31, 2021 to Dec 30, 2022 (153.1) 25.8 0.0 (2.9) 4.7 (26.6) (53.0) (205.1)

Liabilities and Capital

Reserves

Federal

Reserve

Notes

Treasury

General

Account ON RRP

FIMA

Reverse

Repo

Pool

Other

Liabilities

and

Capital

Subtotal of

Non-Reserve

Liabilities

Total

Liabilities

and

Capital

Outstanding as of:

December 31, 2021 3,644.3 2,187.1 406.1 1,904.6 278.5 335.8 5,112.1 8,756.4

December 30, 2022 2,684.8 2,259.0 446.7 2,553.7 335.8 271.3 5,866.5 8,551.3

Changes in the period

Dec 31, 2021 to Dec 30, 2022 (959.5) 71.8 40.6 649.1 57.4 (64.5) 754.4 (205.1)

Sources: Federal Reserve Bank of New York; Board of Governors of the Federal Reserve System.

Notes: These gures may differ from Federal Reserve Banks Combined Financial Statements due to nancial accounting adjustments for 2022 recorded after

year-end. Securities balances are listed at par value and exclude unsettled MBS. Emergency credit and liquidity facility outstanding balances exclude nonmarketable

portion of Treasury equity. Other assets include primarily unamortized net premium and accrued interest receivable on securities, foreign currency–denominated

holdings, and the LLC’s investments of U.S. Treasury equity in nonmarketable Treasury securities. Other Liabilities and Capital include primarily non-reserve deposits.

21

OPEN MARKET OPERATIONS DURING 2022

Overview

AppendixesOperational

Flexibility &

Resiliency

Selected

Balance Sheet

Developments

Counterparties Index of Charts

& Tables

Contents Open Market

Operations

Federal Reserve

Framework for Monetary

Policy Implementation

Endnotes

the start of balance sheet runo resulted in the Treasury portfolio

declining by roughly $270 billion during the second half of 2022.

e composition of the SOMA Treasury portfolio shied

modestly toward longer maturities by year-end. Nominal coupon

securities with less than three years to maturity, which continue

to make up the largest share of the SOMA Treasury securities

portfolio, and those with three to six years to maturity together

decreased by a total of $231.8 billion during 2022. Coupon

securities with ten to thirty years to maturity increased by

$100.5 billion over the same period (Chart 15).

e share of the outstanding Treasury universe held in the

SOMA portfolio decreased across most sectors during 2022.

e aggregate SOMA holdings of Treasury securities as a share

of the $23.93 trillion in marketable Treasury debt outstanding

(inclusive of SOMA holdings) decreased to 23 percent at the

end of 2022 from 25 percent at year-end 2021. is decline

was mainly driven by a $1.35 trillion increase in the overall

Treasury debt outstanding during the year, along with the

decrease of approximately $153 billion in SOMA Treasury

holdings. e SOMA continued to hold the greatest proportion

of outstanding Treasury securities within the ten- to thirty-year

nominal coupon sector (36 percent) (Chart 16). Approximately

40 percent of the SOMA holdings in this sector were acquired by

the Federal Reserve prior to 2020. e SOMA share of coupon

securities with up to three years remaining to maturity declined

from 30 percent to 26 percent, driven by larger Treasury issuance

in this sector during the year. e share of SOMA bills holdings

fell slightly, from 9 percent to 8 percent over the year.

e weighted average maturity of SOMA Treasury securities

(7.9 years) remained signicantly higher than that of the

outstanding Treasury universe (6.2 years). e dierence is

reective of the SOMA’s larger holdings of longer-maturity

nominal Treasury securities (ten to thirty years) relative to the

1

,000

0

2

,000

3

,000