Palo alto unified School District

Supplementary Retirement Plan (SRP)

POST-ANALYSIS REPORT – REVISED

February 19, 2021

PARS | Public Agency Retirement Services

P A G E 1

Introduction

The primary objective of a retirement incentive is to increase and accelerate the retirement rate over and above

natural attrition in order to facilitate specific District objectives such as personnel restructuring, fiscal savings, etc.

Fiscal savings are achieved by replacing the retiring employee, who is typically at the top of the salary schedule, with

a replacement employee at the bottom of the salary schedule. With retirement incentives involving teachers, the

resulting salary differential is sufficient to pay for the costs of the plan and generate additional savings over and

above natural attrition.

Analysis Method of Calculation

The analysis compares the savings projected over a five-year period from offering the PARS Supplementary

Retirement Plan (SRP) during the 2020-21 academic year to the savings expected over the same period if natural

attrition runs its normal course. The analysis examines current and future costs and compensation differentials,

including projections of all compensation and benefit increases. This analysis has been used nationwide for well

over one thousand plans, and is a well-accepted model of calculation.

The basic model of calculation is as follows:

Palo Alto Unified School District

P A G E 2

Assumptions

Eligibility

Requirements

Certificated Non-Management Employees

• Age 55 with 12 years of District service

Certificated Management Employees

• Age 55 with 5 years of District service

Classified Management Employees

• Age 55 with 5 years of District service

Resignation from District employment effective at the end of the school year:

• On or before June 30, 2021

Benefit Level

50% of Final Pay Spend Amount*

*2020-21 Contract Salary (inclusive of longevity) multiplied by the participant’s current FTE.

Replacement

Salaries

Certificated Non-Management: $91,407*

Certificated Management: 90.00% (Step 6)

Classified Management: 88.00% (Step 6)

*Based on PARS 1-Year New Hire Study

Health Care Costs

Active Employee: $14,424 (Prorated by FTE)

Retired Employee: $14,424 (Prorated by FTE)

Health Care COLA

0.00% annually

PARS Plan Funding

5 years

Replacement Positions

100% to 0% replacement of positions, in varying increments

Fiscal projections illustrated in the post-analysis are based on the actual demographics of the retiring employees.

PARS has also provided non-replacement figures in this proposal with the District’s understanding that these non-

replacement numbers represent position cuts obtained through the offering of a retirement incentive plan. The

District should be sure not to budget a similar number of position cuts, thereby double counting savings within this

retirement incentive analysis and the budget. The following summarizes the results of the analysis:

Palo Alto Unified School District

P A G E 3

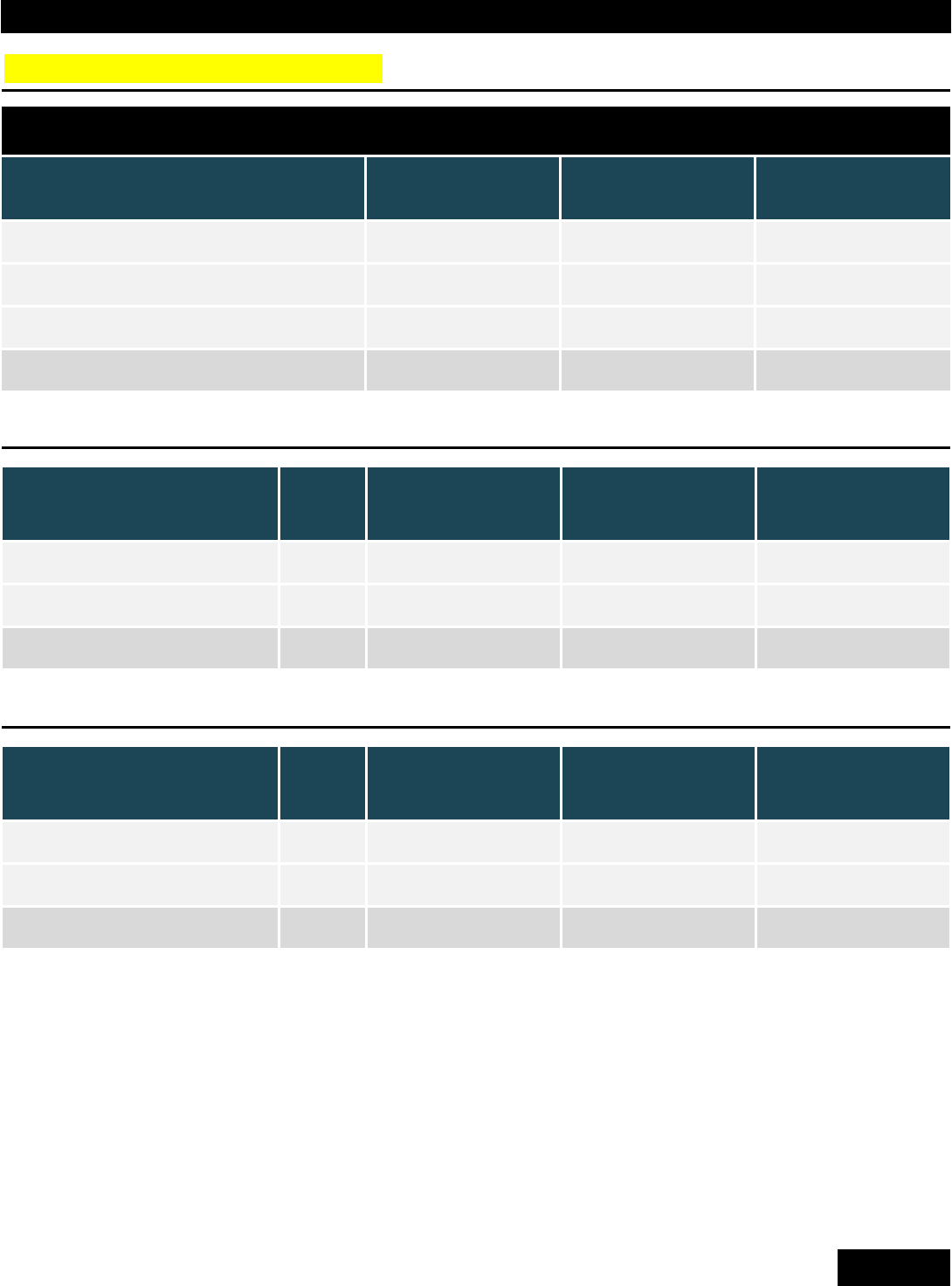

FISCAL SUMMARY OF SAVINGS

50% of Final Pay Spend Amount Benefit

2020-21 Retirements

Employee Group

# of

Eligible Employees

Retirements

with PARS SRP

Percentage

Retirements

Certificated Non-Management

140

33

23.57%

Certificated Management

14

6

42.86%

Classified Management

15

0

0.00%

TOTAL

169

39

23.08%

Projected Fiscal Impact: 100% Full-Replacement

Employee Group

Non-

Replace

PARS

Projected Savings

in Year 1

Projected Savings

over 3 Years

Projected Savings

over 5 Years

Certificated Non-Management

0.00

$329,256

$628,208

$553,894

Certificated Management

0.00

($24,411)

($158,179)

($374,406)

TOTAL

0.00

$304,845

$470,029

$179,488

Projected Fiscal Impact: Break-Even

Employee Group

Non-

Replace

PARS

Projected Savings

in Year 1

Projected Savings

over 3 Years

Projected Savings

over 5 Years

Certificated Non-Management

0.00

$329,256

$628,208

$553,894

Certificated Management

1.00

$106,578

$248,982

$336,271

TOTAL

1.00

$435,834

$877,190

$890,165

Palo Alto Unified School District

P A G E 4

FISCAL SUMMARY OF SAVINGS

50% of Final Pay Spend Amount Benefit

Certificated Non-Management

Replacement Scenario

Non-

Replace

PARS

Projected Savings

in Year 1

Projected Savings

over 3 Years

Projected Savings

over 5 Years

100% Replacement

0.00

$329,256

$628,208

$553,894

90% Replacement

3.30

$540,059

$1,277,340

$1,675,000

80% Replacement

6.60

$750,862

$1,926,473

$2,796,105

70% Replacement

9.90

$961,665

$2,575,605

$3,917,210

60% Replacement

13.20

$1,172,468

$3,224,737

$5,038,315

50% Replacement

16.50

$1,383,271

$3,873,869

$6,159,421

Certificated Management

Replacement Scenario

Non-

Replace

PARS

Projected Savings

in Year 1

Projected Savings

over 3 Years

Projected Savings

over 5 Years

100% Replacement

0.00

($24,411)

($158,179)

($374,406)

83% Replacement

1.00

$106,578

$248,982

$336,271

67% Replacement

2.00

$237,568

$656,142

$1,046,948

50% Replacement

3.00

$368,557

$1,063,302

$1,757,626

Palo Alto Unified School District

P A G E 5

Notice

This analysis attempts to quantify in economic terms - not budgetary terms - the fiscal impact of a retirement

incentive program at the District. This analysis is entirely driven by the assumptions set forth by the District. If the

assumptions are changed or modified by the District the results shall vary from what is set forth in this analysis.

The accuracy of any results and/or analysis will depend entirely upon the accuracy of the information provided and

the assumptions used.

The information, data and assumptions used in this analysis have been provided to Public Agency Retirement

Services (PARS) by the District. It shall be the responsibility of the District to certify the accuracy, content and

completeness of the information, data and assumptions so that PARS may rely on such information without further

audit. PARS shall be under no duty to question the information, data and assumptions received from the District

including, but not limited to, inquiries about how the analysis, information, data and assumptions work in

conjunction with the District's budget.

PARS shall not be liable for non-performance of Services if such non-performance is caused by or results from

erroneous and/or late delivery of information, data and assumptions.

PARS is not licensed to provide and does not offer tax, accounting, legal, investment or actuarial advice.