Consult this publication on line at http://dx.doi.org/10.1787/9789264249455 -en.

This work is published on the OECD iLibrary, which gathers all OECD books, periodicals and statistical databases.

Visit www.oecd-ilibrary.org for more information.

OECD Public Governance Reviews

Financing Democracy

FUNDING OF POLITICAL PARTIES AND ELECTION

CAMPAIGNS AND THE RISK OF POLICY CAPTURE

OECD Public Governance Reviews

Financing Democracy

FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS

AND THE RISK OF POLICY CAPTURE

Contents

Part I. Funding of political parties and election campaigns, risks of policy capture and policy options

Chapter 1. Addressing the risks of policy capture

Chapter 2. Promoting a level playing field through balanced funding

Chapter 3. Increasing transparency and accountability through disclosure of political party

and election-campaign funding

Chapter 4. Fostering a culture of integrity among political parties, public officials and donors

Chapter 5. Ensuring compliance with political finance regulations

Part II. Country case studies

Chapter 6. Canada

Chapter 7. Chile

Chapter 8. Estonia

Chapter 9. France

Chapter 10. Korea

Chapter 11. Mexico

Chapter 12. United Kingdom

Chapter 13. Brazil

Chapter 14. India

ISBN 978-92-64-24944-8

42 2015 26 1 P

Financing DemocracyOECD Public Governance Reviews

OECD Public Governance Reviews

Financing Democracy

FUNDING OF POLITICAL PARTIES

AND ELECTION CAMPAIGNS

AND THE RISK OF POLICY CAPTURE

This work is published under the responsibility of the Secretary-General of the OECD. The opinions

expressed and arguments employed herein do not necessarily reflect the official views of OECD

member countries.

This document and any map included herein are without prejudice to the status of or sovereignty

over any territory, to the delimitation of international frontiers and boundaries and to the name of

any territory, city or area.

ISBN 978-92-64-24944-8 (print)

ISBN 978-92-64-24945-5 (PDF)

Revised version, February 2016.

Details of revisions available at: http://www.oecd.org/about/publishing/Corrigendum-Financing-Democracy.pdf

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such

data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West

Bank under the terms of international law.

Photo credits: Cover © Alexandru Nika/Shutterstock.com

Corrigenda to OECD publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm.

© OECD 2016

You can cop y, download or print OECD content for your own use, and you can include excerpts from OECD pub lications, databases and

multimedia products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable

ackno wledgement of OECD as source and copyright owner is given. All requests for public or commercial use and translation rights should

be submitted to [email protected]. Requests for permission to photocopy portions of this material for public or commercial use shall be

addressed directly to the Copyright Clearance Center (CCC) at [email protected] or the Centre français d’exploitation du droit de copie (CFC)

Please cite this publication as:

OECD (2016), Financing Democracy: Funding of Political Parties and Election Campaigns and the Risk of Policy Capture,

OECD Public Governance Reviews, OECD Publishing, Paris.

http://dx.doi.org/10.1787/9789264249455-en

FOREWORD – 3

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Foreword

Understanding and addressing the role of money and its influence in politics can no

longer be a taboo subject. When public policy making is captured by private interests, the

“rules of the game” for markets and opportunities may be bent to favour the few and

violate the interest of the many. The consequences include the erosion of democratic

governance, social cohesion, and equal opportunities for all, as well as the decline of trust

in democracy itself. The laborious recovery from the financial crisis, together with the

widening income gaps between rich and poor, heighten the risk of policy capture while

testing the ability of governments to develop and deliver policies and programmes that

benefit all citizens.

It is not enough to put in place policies to promote growth. Governments are expected

to ensure that the benefits of such growth are shared more evenly across society. The

design and implementation of structural reforms to create conditions for economic

recovery and sustain inclusive growth require a high-quality policy-making process that

citizens can trust.

This report takes a comparative approach to examining how the funding of political

parties and election campaigns has evolved, and how political finance regulations across

OECD member and partner countries have been established. In particular, the report

assesses the risks of policy capture through the funding of political parties and electoral

campaigns, identifies regulatory loopholes and implementation gaps in existing policies,

and suggests a comprehensive approach to integrity, including issues such as lobbying

and conflict of interest. One clear-cut lesson from this study is that ensuring the effective

implementation of political finance regulations still remains challenging in many

countries.

The Framework on Financing Democracy presented in this report is intended to

shape the global debate on risks and policy options, and provides tangible advice for the

funding of political parties and electoral campaigns. Efficient oversight and auditing,

meaningful sanctions, greater transparency and public scrutiny play a major role in

averting policy capture. In this regard, independent electoral management bodies are

becoming increasingly important. Such bodies currently exist in less than one-third of

OECD countries, and there is no one-size-fits-all model. But whatever the structure, the

institutions responsible for enforcing political finance regulations should have a clear

mandate, legal power and the capacity to conduct effective oversight and impose

sanctions.

4 – FOREWORD

This report is part of the policy toolkit being developed by the OECD Public

Governance Committee and contributes to the OECD agenda on inclusive growth and

trust. In democracies, public policy should never be for sale to the highest bidder. Better

policy making is a shared responsibility of governments, businesses and citizens. The

OECD brings together a wide range of stakeholders to make financing democracy a

subject of evidence, data, and good practices across countries.

Angel Gurría

OECD Secretary-General

ACKNOWLEDGEMENTS – 5

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Acknowledgements

This report was prepared by the Public Sector Integrity Division of the Directorate for

Public Governance and Territorial Development.

Under the guidance of Janos Bertok, the co-ordination and drafting of this report was

led by Yukihiko Hamada. Invaluable input and guidance were provided by Julio Bacio

Terracino. The preliminary draft report was prepared by Emma Cantera and

Ulrika Bonnier. Data cleaning and follow-up were carried out by Chad Burbank. Editorial

and administrative assistance was provided by Thibaut Gigou, Julie Harris,

Anaísa Goncalves and Anastasia Slojneva.

Special thanks go to the experts who drafted the country chapters, namely: Stephane

Perrault, Deputy Chief Electoral Officer, Regulatory Affairs, Elections Canada;

Pamela Figueroa Rubio, Chief of the Studies Division and Francisco Espinoza Rabanales,

Advisor of the Studies Division, Ministry General Secretariat of the Presidency of Chile;

Vello Pettai, Professor of Comparative Politics, University of Tartu, Member of Estonian

Party Funding Supervision Committee; Yves-Marie Doublet, Expert on Political Finance

Legislation for the Group of States against Corruption (GRECO), Deputy Director of the

National Assembly of France; Heeman Koo, International Cooperation Division, National

Election Commission of the Republic of Korea; Raphael Riva-Palacio, Director of

International Cooperation and Liaison, National Election Institute of Mexico;

Rupert Grist, Regulatory Lawyer and Nick Wright, Senior Project Officer, United

Kingdom Electoral Commission; José Antonio Dias Toffoli, President of the Superior

Electoral Court of Brazil, Justice of the Federal Supreme Court of Brazil;

Shahabuddin Yaqoob Quraishi, Former Chief Election Commissioner of India.

Particular appreciation goes to all the speakers and participants who actively engaged

in the debates and exchanged views during the OECD Forum on Financing Democracy

and Averting Policy Capture, organised in co-operation with the International Institute for

Democracy and Electoral Assistance (IDEA) and the Organization of American States on

3-4 December 2014 in Paris, and the OECD Policy Forum on Restoring Trust in

Government: Addressing Money and Influence in Public Decision Making on

14-15 November 2013 in Paris.

The Public Governance Committee and the Working Party of Senior Public Integrity

Officials reviewed and approved the report in the autumn of 2015.

TABLE OF CONTENTS – 7

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Table of contents

Executive summary .............................................................................................................. 15

Regulating political finance to minimise risks .................................................................. 15

Loopholes and implementation gaps ................................................................................. 15

Political finance regulation as part of an overall integrity framework .............................. 16

The way forward ............................................................................................................... 17

Part I. Funding of political parties and election campaigns, risks of policy

capture and policy options ........................................................................................ 19

Chapter 1. Addressing the risks of policy capture .............................................................. 21

Money and influence are necessary components of democratic representation ................ 22

Risk of policy capture through political finance is still prevalent in OECD countries ..... 23

Assisting inclusive growth though averting policy capture ............................................... 24

Captured policies lead to low levels of trust in government, and the fairness of

decision making is being questioned ................................................................................. 25

Trust in public institutions is driven not only by the substance and outcomes of

policies, but also by the policy-making process ................................................................ 26

OECD Framework on Financing Democracy ................................................................... 27

Third-party campaigners and transnational private interests present risks to

levelling the playing field .................................................................................................. 27

Institutionalising an enabling environment for better transparency and public scrutiny ... 28

Promoting a holistic approach to avert policy capture by connecting surrounding

integrity measures with political finance ........................................................................... 28

Increasing importance of independent electoral management body for effective

oversight ............................................................................................................................ 29

Country case studies provide in-depth analysis of political finance regulation

and its challenges in different institutional settings ........................................................... 29

Bibliography ...................................................................................................................... 32

Chapter 2. Promoting a level playing field through balanced funding ............................. 35

Finding the right combination of policy measures is key to ensuring a level

playing field ....................................................................................................................... 36

The financing of political parties and election campaigns: Private or public funding? .... 37

Framing private funding to level the playing field ............................................................ 46

Spending limits for election campaigns: Promoting integrity and fairness or a

limitation of political expression? ..................................................................................... 53

Abuse of state resources presents a risk to the level playing field, but most

OECD countries limit privileged access to state resources by the incumbents ................. 59

Notes .................................................................................................................................. 62

References ......................................................................................................................... 63

8 – TABLE OF CONTENTS

Chapter 3. Increasing transparency and accountability through disclosure of

political party and election-campaign funding ................................................ 65

Reporting requirements as a tool for ensuring accountability in the decision-making

process ............................................................................................................................... 66

Comprehensive disclosure of both public and private funding is crucial .......................... 66

Thorough auditing of political finance reports ensures transparency and

accountability .................................................................................................................... 67

Public availability of disclosures to enable public scrutiny .............................................. 70

References ......................................................................................................................... 76

Chapter 4. Fostering a culture of integrity among political parties, public officials

and donors ........................................................................................................... 79

Embedding political finance regulations in the overall integrity framework

addresses the risk of money in politics more effectively ................................................... 80

Codes of conduct can be seen as a commitment to integrity by political parties

and politicians, but the adoption of an enforceable code is still relatively limited

in OECD countries ............................................................................................................ 81

Mitigating risks such as conflict of interest and lobbying in relation to political

finance through proactive disclosure of related information is crucial ............................. 83

Over 60% of lobbyists support the disclosure of their contributions to political

campaigns .......................................................................................................................... 86

Whistleblower protection can strengthen a culture of integrity in relation to

political finance; countries are expected to consider introducing or strengthening

protection through dedicated legislation ........................................................................... 88

In addition to whistleblower protection, citizen complaint mechanisms can also

facilitate reporting of wrongdoing in political finance and safeguard public interest ....... 88

Private donors are also expected to share the responsibility of strengthening integrity .... 88

Self-regulation of lobbying is an encouraging sign, although its enforcement remains

challenging ........................................................................................................................ 91

Bibliography ...................................................................................................................... 93

Chapter 5. Ensuring compliance with political finance regulations ................................. 95

Countries should assure independent and efficient oversight over political finance ......... 96

How to ensure independence of oversight bodies poses a problem .................................. 97

Sufficient capacity and resources ensure the ability of electoral management bodies

to perform their tasks ......................................................................................................... 98

Clear mandate and sufficient power should be given to the electoral management

bodies............................................................................................................................... 100

Dissuasive and enforceable sanctions can deter breaches and promote compliance ....... 102

Education and training for political parties as a tool to promote compliance ................. 106

Appraising the system: Identifying evolving risks of policy capture and involving

stakeholders ..................................................................................................................... 107

References ....................................................................................................................... 108

TABLE OF CONTENTS – 9

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Part II. Country case studies .............................................................................................. 113

Chapter 6. Canada ............................................................................................................... 115

Overview of the mandate and political finance legislation

......................................... 116

Political finance rules

.................................................................................................... 117

Transparency and accountability

.................................................................................. 118

Compliance

..................................................................................................................... 119

Integrity

......................................................................................................................... 120

Challenges and risks ........................................................................................................ 121

Notes ................................................................................................................................ 122

Chapter 7. Chile ................................................................................................................... 123

Introduction ..................................................................................................................... 124

Promoting a level playing field: Equity in political competition .................................... 127

Ensuring more transparency ............................................................................................ 128

Integrity ........................................................................................................................... 128

Control, enforcement and supervision ............................................................................. 129

Penalties as mechanisms to ensure effective compliance ................................................ 130

Concrete measures to respond to citizens and adopt international standards on

money and politics ........................................................................................................... 130

Challenges ....................................................................................................................... 131

Note ................................................................................................................................. 132

Chapter 8. Estonia ............................................................................................................... 135

Overall description .......................................................................................................... 136

Practical implementation of political finance regulations ............................................... 137

Challenges and risks ........................................................................................................ 144

Notes ................................................................................................................................ 145

Bibliography .................................................................................................................... 146

Chapter 9. France ................................................................................................................ 147

Level playing field ........................................................................................................... 148

Transparency and accountability ..................................................................................... 150

Compliance and supervision............................................................................................ 152

Conclusions ..................................................................................................................... 153

Notes ................................................................................................................................ 154

Chapter 10. Korea ............................................................................................................... 155

Definition and basic principle of political funds ............................................................. 156

Restrictions on political fundraising and contributions ................................................... 157

Restrictions and reimbursements of campaign fund expenses ........................................ 158

Contributions of political funds through the National Election Commission ................. 159

Public subsidies to political parties ................................................................................. 159

Tax benefits for political funds ........................................................................................ 160

Income and expenditure of political funds available to the public through

financial reports ............................................................................................................... 161

Investigation and enforcement of control over political funds ........................................ 161

10 – TABLE OF CONTENTS

Chapter 11. Mexico .............................................................................................................. 163

Introduction ..................................................................................................................... 164

Finance for political parties and candidates .................................................................... 164

Limits and restrictions ..................................................................................................... 168

Accountability and transparency ..................................................................................... 169

Challenges ....................................................................................................................... 171

Note ................................................................................................................................. 171

Chapter 12. United Kingdom .............................................................................................. 173

Legislative framework ..................................................................................................... 174

Practical implementation of political finance law ........................................................... 174

Challenges and risks ........................................................................................................ 181

Notes ................................................................................................................................ 182

Chapter 13. Brazil ................................................................................................................ 183

Introduction ..................................................................................................................... 184

Applicable legislation – the main competencies and attributions of Brazilian

Electoral Courts in place to inspect, regulate and control party and electoral

funding mechanisms ........................................................................................................ 185

Transparency of parties’ and candidates’ accounts: On the requirement to render

accounts and sanctions in the event of failing to meet said requirement ......................... 192

Integrity in the political funding process; the support rendered to parties and

candidates, enabling them to comply with legal standards; and the bills drafted

to promote the reform of political funding ...................................................................... 192

Notes ................................................................................................................................ 195

Chapter 14. India ................................................................................................................. 197

Introduction ..................................................................................................................... 198

Political finance and disclosure norms in India ............................................................... 198

Transparency and accountability ..................................................................................... 201

Integrity ........................................................................................................................... 204

Compliance and oversight ............................................................................................... 205

Challenges ....................................................................................................................... 206

Conclusion ....................................................................................................................... 207

Note ................................................................................................................................. 207

TABLE OF CONTENTS – 11

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

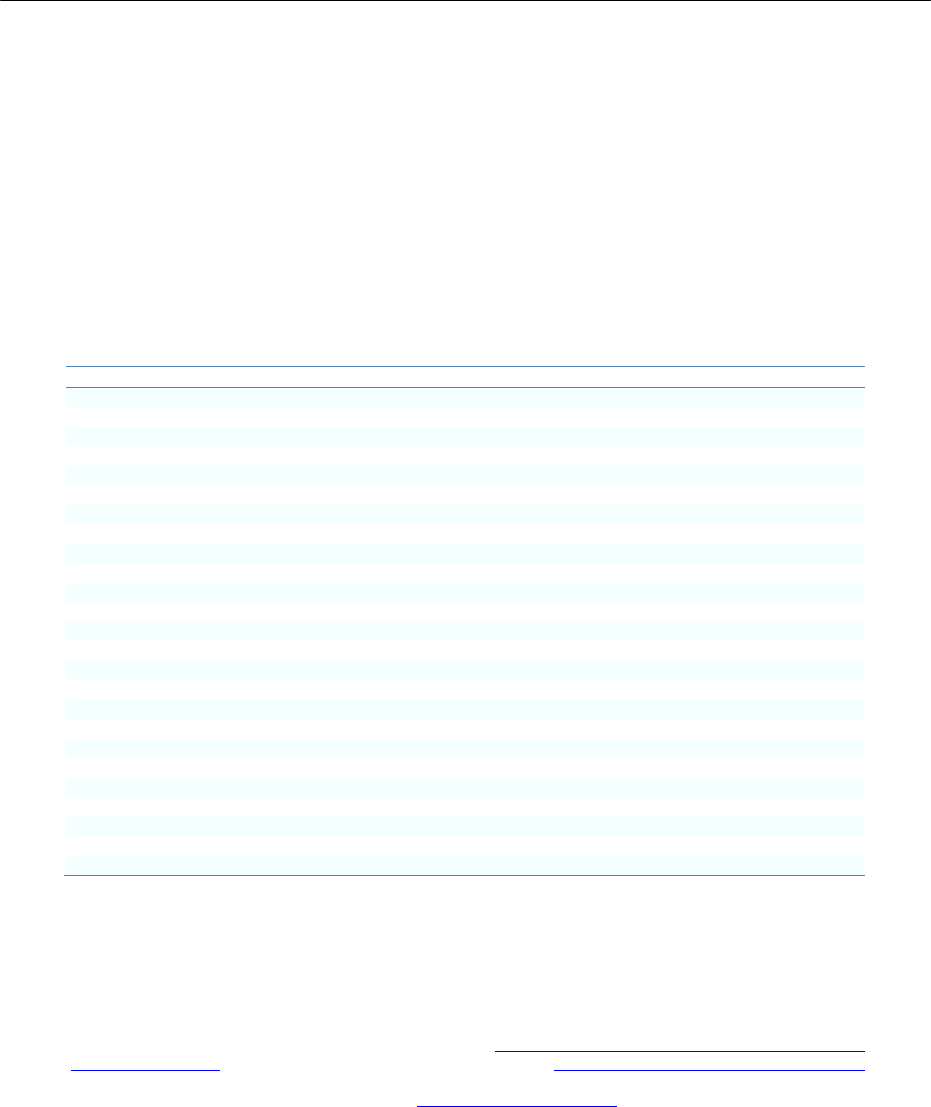

Tables

Table 1.1. Framework on Financing Democracy: Supporting Better Public Policies

and Averting Policy Capture ...................................................................................... 30

Table 2.1. The balance between public and private funding to political parties in

selected OECD countries, 2012 .................................................................................. 38

Table 2.2. Eligibility criteria for direct public funding to political parties in

OECD countries .......................................................................................................... 40

Table 2.3. Allocation calculation of direct public funding to political parties in

OECD countries .......................................................................................................... 42

Table 2.4. Maximum donation ceilings for individuals in selected OECD countries ................. 47

Table 2.5. Bans on foreign donations to political parties in OECD countries ............................. 51

Table 2.6. Top 20 US campaign donations from foreign-owned firms in 2012 .......................... 53

Table 2.7. Spending limits for political parties and candidates in OECD countries .................... 56

Table 2.8. Examples of third-party campaigning regulations in selected OECD

countries ..................................................................................................................... 58

Table 3.1. Public disclosure of information in reports from political parties and/or

candidates in OECD countries .................................................................................... 71

Table 3.2. Examples of online availability of political finance information in

selected OECD countries ............................................................................................ 73

Table 4.1. Promoting a culture of integrity in the public sector: Key elements .......................... 81

Table 4.2. Actions taken after collecting the private information for public officials

in the executive branch in OECD countries .............................................................. 86

Table 5.1. The institutional capacity of electoral management bodies in selected

OECD countries .......................................................................................................... 99

Table 5.2. Variation of sanctions across selected OECD countries ........................................... 104

Table 8.1. Personal campaign expenses incurred by candidates on party lists and by

independent candidates, 2015 Riigikogu elections, Estonia ..................................... 139

Table 8.2. Expenditures on political activities by the four parliamentary parties in

Estonia, 2014-15 ....................................................................................................... 140

Table 8.3. Categories of information to be provided within party finance reports,

Estonia ...................................................................................................................... 140

Table 11.1. Public finance at federal level for Mexican political parties in 2015 ....................... 166

Table 13.1. Percentage share of donations made in Brazilian municipal elections,

2004-12 .................................................................................................................... 188

Table 13.2. Percentage share of donations made in Brazillian general elections,

2006-14 ..................................................................................................................... 188

Table 13.3. Political party spending during the Brazilian presidential elections,

2002-14 ..................................................................................................................... 190

Table 14.1. Electoral expenditures, by category and party, in the 2014 Indian

general elections ....................................................................................................... 200

Table 14.2. Donations received in excess of EUR 280 by political parties in India,

2010-14 ..................................................................................................................... 200

12 – TABLE OF CONTENTS

Figures

Figure 1.1. Trust in government and political parties in 23 European OECD

countries, 2014 ........................................................................................................... 26

Figure 2.1. Expenditures during the 2010 parliamentary general election in the

United Kingdom ......................................................................................................... 36

Figure 2.2. Expenditures during the 2013 Upper House election in Japan ................................... 37

Figure 2.3. Direct public funding to political parties in OECD countries ..................................... 39

Figure 2.4. Most common types of indirect public funding in OECD countries .......................... 44

Figure 2.5. Free or subsidised access to media for political parties and for candidates

in OECD countries ..................................................................................................... 45

Figure 2.6. Types of banned private contributions in OECD countries ........................................ 46

Figure 2.7. Ban on anonymous donations to political parties in OECD countries ........................ 48

Figure 2.8. Spending limits for candidates and political parties in OECD countries .................... 55

Figure 2.9. OECD countries that ban state resources being unevenly given to, or

received by, political parties or candidates (excluding regulated

public funding) ........................................................................................................... 60

Figure 2.10. OECD countries that ban donations from corporations with government

contracts or partial ownership to political parties ...................................................... 61

Figure 3.1. Separate reporting of information on election campaigns by political

parties and/or candidates in OECD countries ............................................................. 67

Figure 3.2. Requirement to include the identity of donors in reports from political

parties and/or candidates in OECD countries ............................................................. 69

Figure 4.1. OECD countries with a central function responsible for the development

and maintenance of conflict-of-interest policies ......................................................... 84

Figure 4.2. Specific conflict-of-interest policy for particular categories of public

officials in OECD countries ....................................................................................... 84

Figure 4.3. Level of disclosure of private interests and public availability of

information in the three branches of government in OECD countries ....................... 85

Figure 4.4. Types of information that legislators and lobbyists believe should be

made publicly available in OECD countries .............................................................. 87

Figure 5.1. OECD country institution(s) receiving financial reports from political

parties and/or candidates ............................................................................................ 96

Figure 5.2. Sanctions for political finance infractions in OECD countries ................................. 102

Figure 5.3. Compliance rates in the United Kingdom, 2010-13 ................................................. 103

Figure 8.1. Sources of political party income in Estonia, 2014 .................................................. 138

Figure 12.1. Public funds and donations to political parties in the United Kingdom,

1 July 2005 to 30 June 2010 .................................................................................... 176

Figure 12.2. Candidate spending at the UK Parliamentary General Election 2010,

by political party in the long campaign and short campaign .................................. 177

Figure 12.3. Campaign expenditure, by category, at the UK Parliamentary general

election 2010 .......................................................................................................... 178

Figure 12.4. Campaign expenditure (non-party campaigners) at the UK

Parliamentary general election 2010 ...................................................................... 179

Figure 12.5. Compliance rate (statement of accounts) in the United Kingdom,

2010-13 ................................................................................................................... 180

Figure 12.6. Compliance rate (quarterly returns) in the United Kingdom, 2010-12 ................... 181

Figure 13.1. Percentage share of party fund money and private resources with

regard to campaign donations, Brazilian general elections, 2014 .......................... 188

Figure 13.2. Percentage share of individuals and legal entities with regard to

campaign donations, Brazilian general elections, 2014 ......................................... 189

Figure 13.3. Total spending of Brazil’s presidential candidates, 2002-14 .................................. 190

TABLE OF CONTENTS – 13

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Boxes

Box 1.1. Risks of policy capture in high-spending areas ............................................................. 23

Box 2.1. Eligibility criteria for receiving public funds in Austria, Belgium,

Chile and Turkey ........................................................................................................... 41

Box 2.2. Allocation criteria for public funds in Australia, Estonia and the

United States ................................................................................................................. 43

Box 2.3. Regulation of membership fees as a source of political party funding in

selected OECD countries .............................................................................................. 49

Box 2.4. Third-party campaigning during the 2015 parliamentary elections in Estonia ............. 59

Box 3.1. Verification of financial records sheds light on suspicious use of

political funding in Japan .............................................................................................. 68

Box 3.2.

Donor anonymity in small donations in Japan ........................................................... 69

Box 3.3. Transparency and accessible information in the United States ..................................... 74

Box 3.4. The monitoring role of CSOs in political finance in the Slovak Republic

and the United States ..................................................................................................... 75

Box 4.1. Various channels through which powerful special interests exert influence

over public policies: An example from the United States ............................................. 80

Box 4.2. UK Code of Conduct for Members of the House of Lords ........................................... 82

Box 4.3. The World Economic Forum Partnering Against Corruption Initiative

(PACI) Principles for Countering Bribery .................................................................... 90

Box 4.4. BNP Paribas’ charter for responsible representation with respect to

public authorities ........................................................................................................... 92

Box 5.1. Composition of the Estonian Party Funding Supervision Committee ........................... 98

Box 5.2. Supervisory, investigatory and sanctioning aspects of the electoral

management body’s regulatory role in the United Kingdom and Korea ..................... 100

Box 5.3. India International Institute of Democracy and Election Management ....................... 106

EXECUTIVE SUMMARY – 15

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Executive summary

This report addresses three key questions: What are the risks associated with the

funding of political parties and election campaigns? Why are existing regulatory models

still insufficient and not fully implemented to tackle those risks? What are the links

between money in politics and broader frameworks for integrity in the public sector? The

resulting analysis has produced a Framework on Financing Democracy for shaping the

global debate, providing policy options and a mapping of risks. The report also features

detailed country case studies of Canada, Chile, Estonia, France, Korea, Mexico, United

Kingdom, Brazil and India, providing in-depth analysis of their political finance

mechanisms and challenges in different institutional settings. The findings of these nine

case studies also confirm the relevance of the Framework and provide good practices that

can be applied to other countries.

Regulating political finance to minimise risks

Money in politics is a double-edged sword. It is a necessary component of the

democratic process, enabling the expression of political support as well as competition in

elections. Yet, the increasing concentration of economic resources in the hands of fewer

people presents a significant threat to political and economic systems. If the financing of

political parties and election campaigns is not adequately regulated, money may also be a

means for powerful special interests to exercise undue influence, and “capture” the policy

process.

For example, access to public procurement has been used by elected officials to

“return the favour” to corporations that made significant contributions to their campaigns

or to exclude those that supported their opponents. While high-spending areas such as

infrastructure and urban planning are particularly vulnerable to the risk of policy capture,

any policy-making process can be a target of powerful special interests. The consequence

may be the adoption of inadequate policies or policies that go against the public interest,

preventing inclusive growth and decreasing trust in government.

Loopholes and implementation gaps

Countries’ experiences have revealed that several shortcomings still exist and are

vulnerable to exploitation by powerful special interests. The allocation of public funding

and the rules for private funding continue to require special attention to ensure a level

playing field for all democratic actors. At the same time, loans, membership fees and

third-party funding can be used to circumvent existing regulations such as spending

limits. Many countries struggle to define and regulate third-party campaigning in

particular, to prevent the re-channelling of election spending through supposedly

independent committees and interest groups. At the moment, only a few countries, such

as Canada, Ireland, the Slovak Republic, the United Kingdom and the United States have

regulations for third-party campaigning.

16 – EXECUTIVE SUMMARY

Furthermore, countries have increasingly experienced that globalisation further

complicates the regulation of private funding. Many foreign companies and wealthy

individuals are deeply integrated with domestic business interests, blurring national

boundaries. Where limits and bans on foreign and corporate funding exist in many

countries, disclosure of donor identity has become important, serving as a deterrent to

undue influence. In this regard, 50% of OECD member countries such as France, Korea

and Mexico currently ban all anonymous donations to political parties, and 38% of

countries ban anonymous donations to parties above certain thresholds.

However, the information disclosed needs to be organised in an intelligible and user-

friendly way to facilitate effective public scrutiny. Civil society organisations and the

media can only be effective watchdogs if substantive political finance information is

publicly available for their analysis. Many countries have increasingly adopted online

technologies to enable comprehensive proactive disclosure; however, only a few

countries such as Estonia have so far managed to ensure that all reports are submitted and

published in a standardised, machine-readable format and are thus comparable, clear and

accessible for public scrutiny.

While most countries already have laws and regulations on party and election

financing, if oversight institutions lack the independence and/or legal authority to

meaningfully regulate potential violators, existing regulations cannot be fully enforced.

Only 29% of OECD countries have an independent electoral management body.

Moreover, the institutions responsible for enforcing political finance regulations

sometimes have rather limited human and financial capacity to effectively deal with large

volumes of oversight work. Data clearly show that sanctions have deterrent effects and

promote higher compliance. For instance, since the UK Electoral Commission was given

its civil sanction powers, compliance rates have increased by 9%. Yet, many countries

still struggle to ensure the right balance in defining sanctions that are both proportionate

and dissuasive.

Political finance regulation as part of an overall integrity framework

Political finance regulations are likely to be ineffective if they exist in isolation. They

need to be part of an overall integrity framework that includes the management of conflict

of interest and lobbying. On their own, political finance regulations are likely to result

merely in the re-channelling of money spent to obtain political influence through

lobbying and other activities. Therefore, integrity measures such as increasing

transparency in lobbying, better management of conflict of interest strengthen the

political finance regulations. However, incorporating various integrity policies into a

wider framework to effectively address the risks of party and election funding remains

challenging. Fewer than half of OECD countries have so far acted to set or tighten

lobbying standards. While disclosure of private interests by decision makers is widely

adopted by countries to manage conflict-of-interest situations and identify suspicious

financial flows in public decision making, verification and auditing of disclosure forms

are not strictly practiced. According to the OECD survey, only 32% of respondent

countries carry out audits or review the accuracy of the information reported by public

officials in the executive branch through disclosure forms, while 63% verify receipt of the

forms.

EXECUTIVE SUMMARY – 17

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

The way forward

Most countries still struggle to monitor the performance of policy measures in place

and there is an empirical deficit in assessing and comparing the practices of political

finance regulations in different country contexts. The OECD is committed to further

expanding comparative data and developing benchmarks and indicators relative to

financing democracy, integrity in the public policy-making process, and averting policy

capture in order to monitor and improve performance of existing measures. Addressing

concerns related to the funding of political parties and election campaigns is a key lever

for restoring trust in government and forming the foundation for inclusive growth.

Countries would benefit from highlighting and sharing good practices so as to identify the

conditions for policies and practices that effectively safeguard the integrity of the policy-

making process and curb the risks of policy capture by powerful special interests.

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Part I

Funding of political parties and election campaigns,

risks of policy capture and policy options

I.1. ADDRESSING THE RISKS OF POLICY CAPTURE – 21

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Chapter 1

Addressing the risks of policy capture

Money is a necessary component of the democratic processes, enabling the expression of

political support as well as competition in elections. Yet, the increasing concentration of

economic resources in the hands of fewer people presents a significant threat to political

and economic systems. This chapter highlights the risks of policy capture through

political finance and presents a Framework on Financing Democracy: Supporting Better

Public Policies and Averting Policy Capture, which provides policy options and a

mapping of risks.

22 – I.1. ADDRESSING THE RISKS OF POLICY CAPTURE

Money and influence are necessary components of democratic representation

Money plays a role both as a channel for citizens to support their candidates or

political parties, and as a means for candidates and political parties to reach out to their

constituencies, shaping the public debate with policy options. Access to resources for

political parties and candidates also shapes political competition. There is a correlation

between campaign spending and performance in elections, suggesting that well-funded

candidates are likely to defeat opponents with fewer resources (Silver, 2013; Speck and

Mancuso, 2013). However, whether the candidate is elected because he/she had more

resources than the opponent, or because he/she was able to mobilise more funds as a

result of a greater support from the electorate, is still unclear.

The legitimacy of financing the democratic process is tainted by risks that threaten to

undermine its very purpose. Although money is necessary for political parties and

candidates to operate and reach out to their voters, experience has shown that there is a

real and present risk that some parties and candidates, once in office, will be more

responsive to the interests of a particular group of donors rather than to the wider public

interest. Donors may also expect a sort of “reimbursement” for donations made during an

election campaign and to benefit in future dealings with the respective public

administration, for instance through public procurement or policies and regulations.

A basic distinction can be made between influencing where politicians make

decisions based on their discretionary power, and intermediation of favours granted by

public administration, which typically includes transgression of laws and regulations. In

the first case, lawmakers and governments shape laws and regulations of economic

activities taking into account demands and interests from campaign donors, but also from

lobbyists, public opinion, guidelines from political parties and their own convictions. In

the second case, elected officeholders use their influence on civil service to arrange for

donors to earn contracts, get access to public loans or earn other benefits. This involves

undue political influence on public service and unlawful behaviour of public servants

involved in policy making, public procurement, licensing, permissions or other areas

where companies expect illegal favours in return for campaign donations.

Public opinion might accept a representative speaking for the interest of a specific

economic segment, yet it may launch a public debate on the influence of donations. For

example, German political parties regularly receive donations from the German

automotive industry. Despite the fact that those donations are transparent, do not

contravene any law and Germany is one of the main sites for the car industry, it still can

lead to public debate on the influence of political donations in the policy-making process.

Globalisation shifts this debate as well. Where bans on foreign and corporate funding

exist in many countries, many multinational corporations have become part of the

economy of hosting countries, creating a large number of local jobs. The question of

whose money, and thus whose political preferences, should influence a country’s

elections and political parties is becoming more complex.

I.1. ADDRESSING THE RISKS OF POLICY CAPTURE – 23

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

Risk of policy capture through political finance is still prevalent in OECD countries

The other type of buying of economic favours by means of campaign donations

evokes a different response. For elected officeholders to be able to grant or intermediate

favours to individual companies, they need to have influence over parts of the public

administration responsible for public contracting, public loans, tax inspection or any other

state activity that is in contact with the private sector. While the term of the corrupting

influence of private donations on politics is often used metaphorically, it is in these cases

that campaign donations come closest to bribery in its original sense.

Policy capture occurs when the interests of a narrow group dominate those of other

stakeholders to the benefit of that narrow group. In a democratic context, this involves the

exclusion of parties and opinions, and violates basic democratic norms (Warren, 2003).

When policy making is captured by a handful of powerful interests, rules may be bent to

favour only the few in society. The consequences are likely to be the adoption of policies

that counter public interest. At the centre of policy capture, there are exchanges of

flavours between private and public actors, which can be set up for one exchange or

established and maintained on a regular, even highly institutionalised basis. In the latter

case, policy capture is best characterised as a stable flow of mutual favours among the

captor network.

Access to public procurement, for instance, has been used by elected officials to

“return the favour” to corporations that made important contributions to their campaigns

or to exclude corporations that supported the opponent as a means of retaliation.

Campaign donors can get access to overpriced public contracts; receive favourable

conditions in public loans or receive other forms of illegal benefits from public

administration (Box 1.1). Private companies depending on government contracts can also

be forced to make donations to the ruling party or be prevented from supporting

opposition parties.

Box 1.1. Risks of policy capture in high-spending areas

Research in Italy highlights that mayors who stayed in office for one extra term were

associated with deteriorated procurement outcomes, such as lower numbers of bidders, higher

prices, biased concentration of the local procurement market, and higher probability that the

winning firm was local. This quantitative evidence indirectly points at how the local heads of

administration could use their time in power to build a collusive network with bidding

companies capturing local public procurement spending (Coviello and Gagliarducci, 2010).

Another study indicates that large companies’ success on federal public procurement tenders

in the United States is highly dependent on their political connections. The strongest predictor of

these companies’ value of contracts won was whether they had a former politician on their

boards of directors associated with the political camp holding the power at the time (Goldman,

Rocholl and So, 2013).

A recent study also shows that firms specialising in public works projects in Brazil can

expect a substantial boost in contracts - at least 14 times the value of their contributions - when

they donate to a federal deputy (lower house) candidate from the ruling Workers’ Party and that

candidate wins office (Boas, Hidalgo and Richardson, 2013).

24 – I.1. ADDRESSING THE RISKS OF POLICY CAPTURE

Box 1.1. Risks of policy capture in high-spending areas (continued)

Similarly, if government favouritism is rampant, the change of government and the

corresponding turnover of political leadership are likely to affect the winning chances of firms in

the public procurement market in some countries. Research in Hungary highlights top managers

of large construction, information technology (IT), and healthcare companies supplying public

organisations expressed the view in which the swings in market shares of companies reflect the

changing preferences of the political leadership for particularly well-connected companies

(Fazekas, King and Tóth, 2013). According to this interpretation, success in the public

procurement market may depend much more on political connections than on the

competitiveness of companies, implying a preferential allocation of public resources. In the same

research (Fazekas, King and Tóth, 2013), such claims are demonstrated by tracking the changes

in market shares of the largest companies before and after the new government entered office. It

highlights that the companies with the largest market share throughout the one and a half years

leading up to the elections in the first half of the 2010 lost about 25-30% of their combined

market share. This change was accompanied by a comparable increase in the total market share

of companies dominating the post-election market between the second half of 2011 and 2012.

Source: OECD (forthcoming), Policy Making in the Public Interest: Curbing the Risks of Policy Capture,

OECD Publishing, Paris.

In addition to the awarding of public procurement contracts, other favours may

include granting tax breaks or state subsidies, preferential access to public loans, and

selling public assets below market prices. While high-spending areas, such as

infrastructure and urban planning, are particularly vulnerable to the risk of capture, any

policy-making process can be a target of powerful special interests. Policy capture

involves varieties of actors and means, but one of the most effective remedies to avert

policy capture in policy making is to adequately regulate the funding of political parties

and election campaigns.

Though much of the attention regarding political finance regulation focuses on

national parties and election campaigns, the risks of undue influence and corruption are

also present at the local or regional level as well. Local-level studies have pointed out the

most revealing experiences when it comes to vote buying, the exchange of public

contracts for political donations, and the role of illicit financial flows and organised

crime. It is also at local or regional level that capture of public authorities may occur

(Pinto-Duschinsky , 2013). For example, research argues that political party financing has

been the major corruption driver in France: a process that has been further accelerated by

administrative decentralisation and regionalisation in recent decades. Public contracts in

large cities like Paris have been granted to companies that have provided support to

political parties (Lalam, 2012).

Assisting inclusive growth though averting policy capture

Over the past three decades, income inequality has risen in most OECD countries,

reaching in some cases historical highs. The increasing concentration of economic

resources in the hands of fewer people presents a significant threat to increase the risks of

policy capture. When government policy making is captured by a handful of powerful

special interests, the rules may be bent to favour the rich. The consequences of a

widespread feeling that governments are not working in the wider public interest are

I.1. ADDRESSING THE RISKS OF POLICY CAPTURE – 25

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

grave, leading to the erosion of democratic governance, the pulling apart of social

cohesion, and the undermining of crucial concepts that underlie democracy such as equal

opportunities for all.

The challenges of the 21

st

century continue to test the ability of governments to

develop and deliver policies and programmes that benefit all citizens. In this regard, the

pursuit of inclusive growth has become one of the priorities for OECD countries. The

OECD Initiative on Inclusive Growth highlights that it is not enough to put in place

policies that harness growth, countries are also expected to ensure that the benefits of

growth are shared by everyone. The design and implementation of effective reforms to

create conditions for economic recovery and to sustain inclusive growth require a top-

quality, policy-making process that citizens can trust.

Embedding the policy-making process with mechanisms that safeguard the public

interest and curb the undue influence of money and power is essential to inclusive

growth. The relationship between inequality and undue influence in politics through

political financing is often overlooked. Socio-economic inequality is only the tip of an

iceberg of inequalities of different dimensions, including differences in influence, power

and voice. Consequently, governments are expected to proactively address high-risk areas

at the intersection of the public and private sectors, including lobbying, conflict of interest

in public decision making, and the influence of vested interests exercised through

political financing. In-depth analysis of facts and comparative evidence on political

finance and its associated risks to the fairness of policy making is needed to understand

the risks and opportunities in different institutional settings and to move away from an

ideological discussion.

Captured policies lead to low levels of trust in government, and the fairness of

decision making is being questioned

In a number of countries money is perceived as having undermined the government

decision-making process, which has led to low levels of trust in government. The 2013

Edelman Trust Barometer found that 52% of respondents surveyed in 26 countries

distrusted government. Among the key factors they cited to explain the prevailing distrust

were “wrong incentives driving policies” and “corruption/fraud”. Together, the two

factors accounted for half of all reasons for trusting government less. The figure stood at

the same level in the 2015 survey as well. In addition, the 2014 Eurobarometer shows that

while levels of trust in government are low, trust in political parties is even lower

(Figure 1.1).

26 – I.1. ADDRESSING THE RISKS OF POLICY CAPTURE

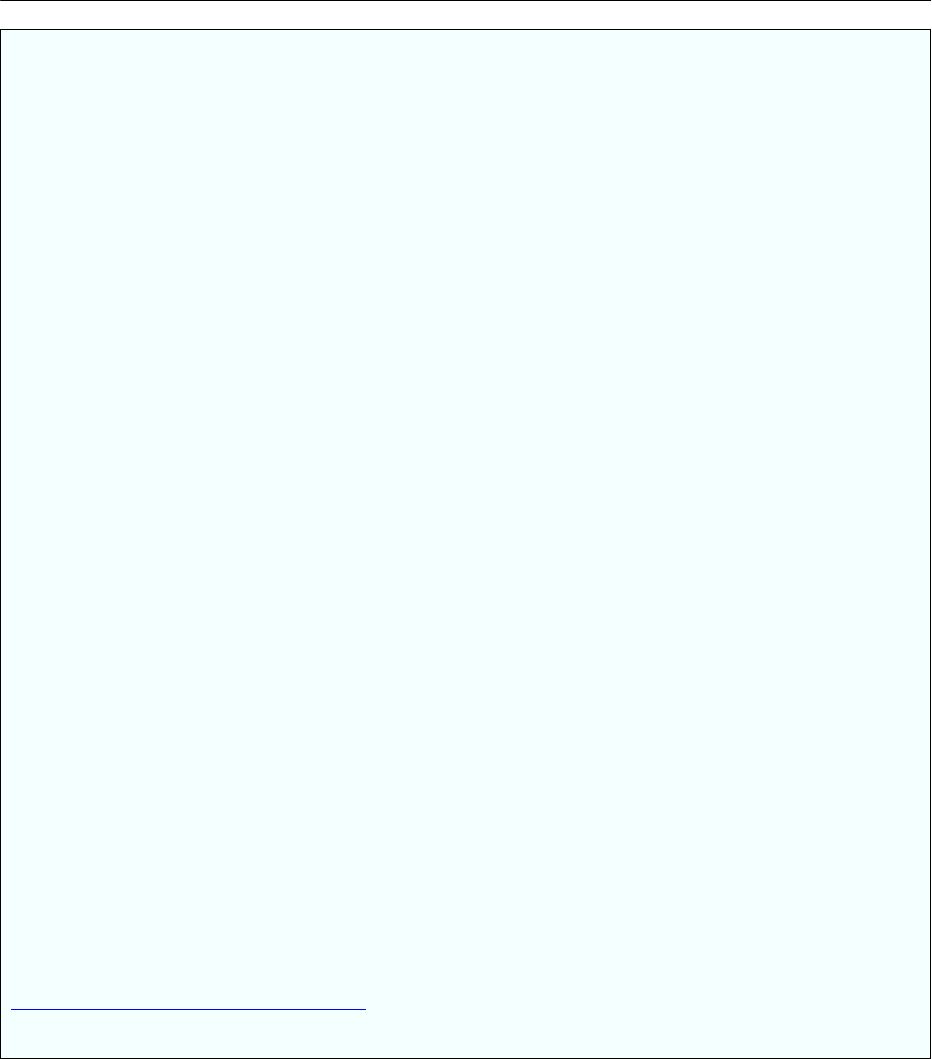

Figure 1.1. Trust in government and political parties in 23 European OECD countries, 2014

Note: Trust in national government and political parties: % of “tend to trust” answers to the question: I would like to ask you a

question about how much trust you have in certain institutions. For each of the following institutions, please tell me if you tend

to trust it or tend not to trust it; national government and political parties.

Source: European Commission (2014), “Standard Eurobarometer”, http://ec.europa.eu/public_opinion/archives/eb_arch_en.htm

(accessed on 27 October 2015).

Trust in public institutions is driven not only by the substance and outcomes of

policies, but also by the policy-making process

A solid foundation of trust for effective policy making is of particular importance in

the current economic situation, where structural reform involves difficult, unpopular

choices and requires the confidence of citizens and markets to reignite growth.

Accordingly, the OECD has put the building of trust in institutions and government at the

heart of its New Approaches to Economic Challenge (NAEC) Initiative and its forward-

looking Trust Agenda.

The OECD has identified five key policy dimensions for action by governments

seeking to invest in trust:

1. Integrity: The alignment of government and public institutions with broader principles

and standards of conduct that contribute to safeguarding the public interest while

mitigating the risk of corruption.

2. The fairness of public policy making: The ability to propose policy-making processes

and decisions that are perceived as fair and meet locally accepted standards.

3. Openness and inclusiveness: A systematic, comprehensive approach to

institutionalising two-way communication with stakeholders, whereby relevant, usable

information is provided and interaction fostered as a means to improve transparency,

accountability and engagement.

0

10

20

30

40

50

60

70

80

90

100

Trust in national government Trust in political parties

I.1. ADDRESSING THE RISKS OF POLICY CAPTURE – 27

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

4. Reliability: The ability of governments to minimise uncertainty in the economic, social,

and political environment of their citizens and act in a consistent and predictable

manner.

5. Responsiveness: The provision of accessible, efficient, and citizen-oriented public

services that effectively address the needs and expectations of taxpayers.

The first three policy dimensions - integrity, fairness, openness and inclusiveness -

are especially relevant to financing democracy, where it is essential to ensure fairness and

a level playing field for stakeholders who seek to influence the decision-making process.

All stakeholders are entitled to participate effectively in that process and the information

enabling their participation needs to be available. Furthermore, the integrity of decision

makers also needs to be ensured so that the wider public interest - and not only vested

interests that can afford to make large political contributions - forms the basis of policy

making.

In this context, trust in public institutions is driven not only by the substance and

outcomes of policies, but also by the process of policy making. The way policies are

designed and implemented, and the compliance that policy makers show with broader

principles and standards of behaviour, matters to trust.

OECD Framework on Financing Democracy

Recognising that adequately regulated political finance forms the foundation for

restoring trust in government and inclusive growth, this report builds on the discussions

and findings of the 2013 OECD Forum on Restoring Trust in Government: Addressing

Risks of Influence in Public Decision Making and the 2014 OECD Forum on Financing

Democracy and Averting Policy Capture, and presents a Framework on Financing

Democracy: Supporting Better Public Polices and Averting Policy Capture that maps a

range of risk areas and provides policy options to adequately regulate the financing of

political parties and electoral campaigns, thus strengthening the integrity and credibility

of the government decision-making process (see Table 1.1 at the end of this chapter).

The Framework has four main pillars: promoting a level playing field; ensuring

transparency and accountability; fostering a culture of integrity; and ensuring compliance

and review. The following four chapters look at each of the pillars with comparative data

to highlight the trend of political finance regulations and remaining areas for

improvement in OECD countries.

Third-party campaigners and transnational private interests present risks to

levelling the playing field

Chapter 2 reviews various policy options to promote a level playing field in financing

democracy. Allocation of public funding and the rules for private funding continue to

need special attention to ensure a level playing field for all stakeholders. To be effective,

a comprehensive regulation of political finance should focus on the whole cycle including

the pre-campaign phase, the campaigning period itself, and the period once the elected

official take office. Additionally, applying spending limits also contributes to stopping the

spending race and framing the impact of private funding. Privileged access to state

resources also needs to be understood through an analysis of the incumbency factor - the

advantage which entails that ruling political parties may have privileged access to public

resources.

28 – I.1. ADDRESSING THE RISKS OF POLICY CAPTURE

It also highlights that certain shortcomings in the regulations are particularly

vulnerable to exploitation by powerful special interests. Loans, membership fees and

third-party funding can be used to circumvent the regulations of private funding. Many

countries struggle to clearly define and regulate third-party funding to prevent re-

channelling of election spending through supposedly independent committees and interest

groups. Third-party campaigners are sometimes referred as non-party campaigners and

may include charities, faith groups, individuals or private firms that campaign in the run

up to elections, but do not stand as political parties or candidates. Increasing globalisation

also further complicates the regulation of private funding as many foreign companies and

wealthy individuals are deeply integrated with domestic business interests, blurring the

national boundaries. In addition to bans and regulations on foreign and corporate funding,

regulation of anonymous donation and disclosure of the donor identity serve as

complementary measures to minimise the impact of undue influence.

Institutionalising an enabling environment for better transparency and public

scrutiny

Chapter 3 focuses on measures to ensure transparency and accountability in financing

democracy. Keeping records of election campaigns expenditure as well as keeping books

and accounts of political parties and their affiliated entities forms a basis for greater

transparency and accountability. Comprehensive disclosure of income sources of political

parties and candidates contributes to greater transparency, serving as a deterrent measure

to limit undue influence. No oversight mechanism is complete without the participation of

civil society and media. In this regard, civil society organisations (CSOs) can be effective

watchdogs and have proven instrumental in advancing transparency and anti-corruption

efforts in the field of political finance.

For disclosure of information to make sense and inform the citizen, information needs

be organised in an intelligible and user-friendly way. In this regard, online technologies

facilitate countries developing more comprehensive proactive disclosure. Ideally, all

reports are submitted and published in a standardised, machine-readable format so as to

ensure their comparability, clarity and digestibility. CSOs and media can only be

effective watchdogs if substantive political finance information is publicly available for

their analysis. In order to mobilise CSO support in advocacy, political finance

information must be reliable and accessible, creating an enabling environment in which

CSOs, media and private citizens can conduct effective public scrutiny.

Promoting a holistic approach to avert policy capture by connecting surrounding

integrity measures with political finance

Chapter 4 looks at the importance of fostering a culture of integrity to effectively

promote a holistic approach to connect surrounding integrity issues, such as lobbying and

conflict of interest, to better understand the impact of money in politics on the quality of

policies. Matters such as conflict of interest, asset disclosure and lobbying cannot

realistically be considered without taking into account the role of political finance in

many countries. Conversely, controls of party and election funding are likely to be

ineffective if they exist in isolation. On their own, they are likely to result merely in the

re-channelling of money spent to obtain political influence through lobbying, and through

third-party financing. Any consideration of political funding needs to be part of an overall

strategy to assure public integrity and good governance. However, less than half of

I.1. ADDRESSING THE RISKS OF POLICY CAPTURE – 29

FINANCING DEMOCRACY: FUNDING OF POLITICAL PARTIES AND ELECTION CAMPAIGNS AND THE RISK OF POLICY CAPTURE © OECD 2016

OECD member countries have so far acted to set or tighten lobbying standards. While

disclosure of private interests by decision makers is also essential for managing conflict-

of-interest situations and spotting any suspicious financial flows in public decision

making, the level of disclosure of private interests (assets, liabilities, income source and

amount, paid and un-paid outside positions, gifts and previous employment) and the

public availability of the disclosed information varies considerably among and within

countries in the different branches of government.

Increasing importance of independent electoral management body for effective

oversight

Chapter 5 focuses on policy measures and institutional mechanisms to ensure the

compliance and review of political finance regulations. Regulating income and spending

are not sufficient if there is no proper and efficient oversight and enforcement. In many

cases, the responsibilities of monitoring and supervising breaches to political financing

regulations are rather diluted among various institutions. This raises concerns over

effective co-ordination, information sharing, and responsiveness. An independent

electoral management body (EMB) is desirable although there is no one-size-fits-all

model. In 29% of OECD countries, the EMB receives financial reports from political

parties and/or candidates for oversight. Institutions responsible for enforcing political

finance regulations should also have a clear mandate and power, not just the capacity, but

the legal power to conduct investigations, refer cases for prosecution, and impose

sanctions. Development of such powers is critical for the effective enforcement of a

transparent and equitable campaign finance regime. Well-staffed and well-funded

supervisory bodies that lack the independence and/or legal authority to meaningfully

regulate potential violators limit the extent to which existing regulation can be enforced.

Besides, sound political finance regulations need sanctions, serving as deterrents for

breaches and indirectly promoting compliance. However, countries still struggle to ensure

the right balance in penalising infringements to political finance regulations and define

sanctions that are proportionate and dissuasive.

Country case studies provide in-depth analysis of political finance regulation and its

challenges in different institutional settings

In order to examine practices and lessons learned in various country contexts, this

report features country case studies from Canada, Chile, Estonia, France, Korea, Mexico,

the United Kingdom, Brazil and India. Countries selected for case studies include both

OECD member countries and key partner countries in Europe, North America, South

America and Asia, providing detailed practices of political finance regulations and

challenges that are of particular importance in each country. Findings from these country

case studies also confirm the trend and emerging concerns in regulating political finance

as well. Further elucidating the risks of money in the government decision-making

process as well as identifying practical solutions based on evidence and good practices

will contribute to refining the framework and develop an associated toolbox that may be

useful in different country contexts.

30 – I.1. ADDRESSING THE RISKS OF POLICY CAPTURE

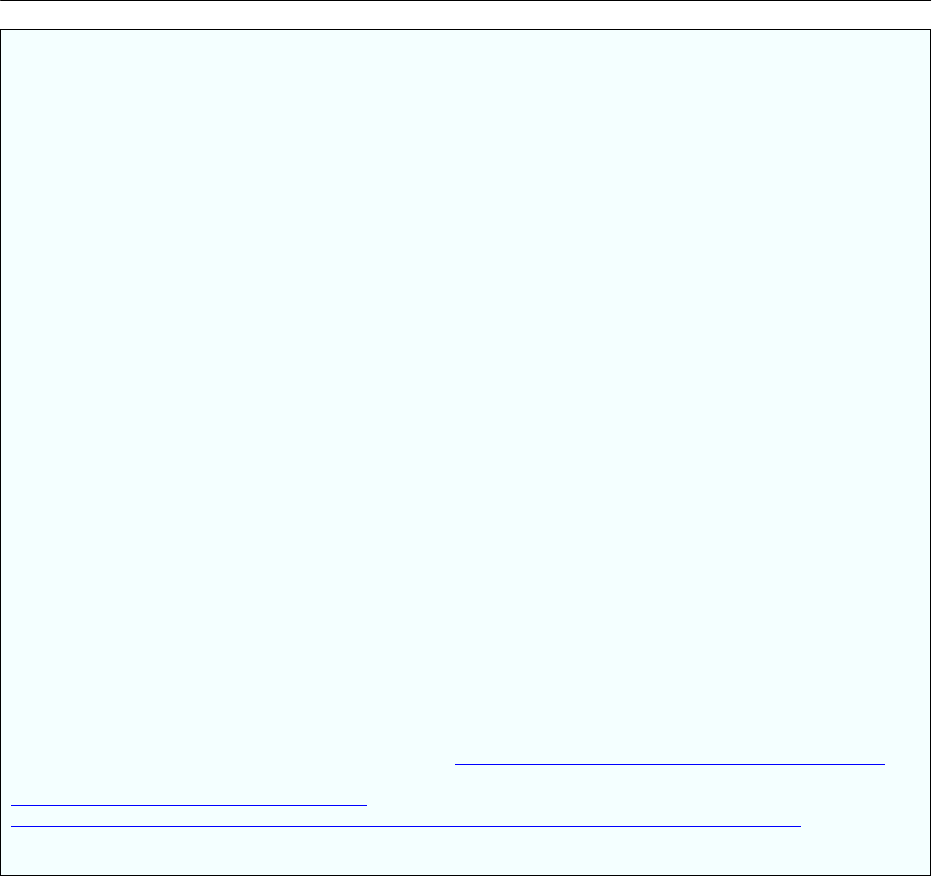

Table 1.1. Framework on Financing Democracy:

Supporting Better Public Policies and Averting Policy Capture

Overall

objective

Policy options and specific risks to mitigate

Promoting a level playing field

Balancing funding

through direct and

indirect public

contributions

Direct funding which entails a monetary transfe

r

to parties, candidates:

- clear and equitable criteria such as equal access and proportionality

- provision to promote gender equality.

Indirect funding, including tax exemptions, subsidised access to media, meeting rooms, etc.

Unintended consequences may include: