.32(%0-31)-%11%4)%5.32(%0-31)-%11%4)%5

.+3,% 113% 02)#+%

/0)+

(%&2%0!6.02'!'%%9-!-#)-'.$%++.1%$.0,.+32).-(%&2%0!6.02'!'%%9-!-#)-'.$%++.1%$.0,.+32).-

!-$-!+71)1!-$-!+71)1

)#(!0$.++.5)++

//!+!#()!-2!2%-)4%01)27

)-$!.(-1.-

-)4%01)27.&.32(+.0)$!

.++.52()1!-$!$$)2).-!+5.0*1!2(22/1$)')2!+#.,,.-1'%.0')!1.32(%0-%$31"0

!02.&2(%31)-%11.,,.-1!-$2(%$3#!2).-.,,.-1

%#.,,%-$%$)2!2).-%#.,,%-$%$)2!2).-

.++.5)++)#(!0$!-$.(-1.-)-$!(%&2%0!6.02'!'%%9-!-#)-'.$%++.1%$

.0,.+32).-!-$-!+71)1

.32(%0-31)-%11%4)%5

.+1102)#+%

4!)+!"+%!2(22/1$)')2!+#.,,.-1'%.0')!1.32(%0-%$31"04.+)11

()1!02)#+%)1"0.3'(22.7.3&.0&0%%!-$./%-!##%11"72(%.30-!+1!2)')2!+.,,.-1%.0')!.32(%0-2

(!1"%%-!##%/2%$&.0)-#+31).-)-.32(%0-31)-%11%4)%5"7!-!32(.0)8%$!$,)-)120!2.0.&)')2!+

.,,.-1%.0')!.32(%0-.0,.0%)-&.0,!2).-/+%!1%#.-2!#2$)')2!+#.,,.-1'%.0')!1.32(%0-%$3

u

Mil

118

THE

AFTER-TAX

MORTGAGE

REFINANCING

MODEL:

CLOSED-FORM

/'

SOLUTION

AND

ANALYSIS

(.._)

Richard

A.

Fo

ll

owill

Linda L. Johnson

Introduction

The

use

of

a before-tax, cash-flO\v decision model rather than an after-

tax, cash-flow decision model to evaluate a mortgage loan

refinancing deci-

sion may lead investors to make either subopti

mal

or

wealth-reducing deci-

sions. This paper expands the before-tax mortgage refinancing decision

model

to both open and closed-forms

of

an after-tax decision model. A compari-

son

of

net present valu

es

derived from both the before-tax and after-tax de-

cision models shows how the two procedures may yield conflicting

recommendations for refinancing a mortgage even under condiuons

of

cer-

tainty. Graphical analysis highlight the net present

val

ue comparisons and

the sensitivity

of

net present value to chan

ges

in marginal tax rates and time

remaining on the mortgage loan.

Lastly, important 1mplicauons

of

the after-

tax refinan

ci

ng model are summarized and discu sed.

Except for the complexity

of

monthly principal amortization, the decision

"hether

to refinance a mortgage

1s

similar

to

the bond refunding decision.

Unlike the bond refunding deci 10n,

,vh1ch

has received extensi\e coverage

in

the

fi

nance literature (Ang, 1975 and 1978; Bowlin, 1966; Emer

y,

1978;

Kalotay, 1978; Livingston, 1980; Ofer and Taggart, 1980; Siegel, 1984; Sir-

mans and Jaffe,

1988;

Yaw

Ill

and Ander<,on, 1977;

Z1ese

and Taylor, 1977),

most finance and real estate in\estment textbooks

d1~cuss

the mortgage

refinancing decision in either a cursory manner

or

fai

l to present a model

of

the decision process (Allen, 1989; Brueggeman, Fisher and Stone, I 989;

Den111s,

1989; Epley and Millar, 1991; irmans and Jaffe, 1988; Sirota, 1989;

Unger and Melicher, 1989; Wiedemer, 1990). For example, the Brueggeman,

Fisher, and Stone

text (pp. 448-450), a widel, adopted real estate finance

text,

o

nl

, addresses the refinancing decision from a before-tax, discounted

cash flow perspective.

In the literature, H

endersho11,

Hu and

Yilla111

(I 983) consider only the after-

tax benefib

of

interest savings, ignoring the substanual changes in the size

and timing

of

incremental payments on principal and, therefore, misspecify

the beneficial net cash

fl

ows

of

refinancing. Fo

ll

a

in

and Tzang ( 1988) and

Fo

ll

O

\\

i

ll

and Johnson ( 1989) properl) specify the net after-tax cash flows

but present only open-form versions

of

the mortgage refinan

ci

ng model.

Th

is

paper more completely a nal

yzes

the mortgage r

ef

ina n

ci

ng d

eci

ion

by developing a

cl

o ed-fo

rm

decision model that

ex

plic

it

ly

considers taxe .

Exampl

es

are prese nted

wh

ic

h contrast the before-tax and

af

ter-tax models

and illustrate that re

li

ance on the curre

nt

pre-tax methodology can e

li

c

it

de-

cisions w

hi

ch reduce wealth.

The

After

-T

ax

Mortgag

e Re

financin

g

Model

From

a before-tax perspective, the net present value

of

refinancing a

mort-

gage

is

relatively simple

to

calculate as follows:

NPV

n

-CF

0

+ !

t=l

(l+k)t

(I)

where PV is

the

net present value

of

replacing

the

existing

mortgage,

CF

0

is

the present value

of

the

initial cash flow required

to

refinance, Pc

is

the

current

mortgage

payment,

and

P,

is

the new

mortgage

payment

for a

replacement mortgage with a term equal

to

the

remaining

term

of

the

c

ur

-

r

ent

mortga

ge.

The

appropriate

discount r

ate

is

denoted

as

k,

and

n

is

the

number

of

mortgage

payments remaining.

A

more

co

rr

ect

approach

to

modeling the refinancing decision considers

after-tax cash flows, recognizing the tax deductibility

of

interest paid

on

both

the current

and

replacement

loan

. Additionally,

the

model

should

recognize

that

the relevant

holding

period

may

be less

than

the

entire

remaining

term

of

the

mortgage.

The

current

mortgage

payment

i

comp

ri

sed

of

two

components,

a pay-

ment

on

the loan

balance

and

an interest

payment.

(2)

where

!\B

e.,

= the

portion

of

the t

1

h

payment

dire

cted

toward

reducing the

current

mortgage

loan

balan

ce;

l

e.,

= the interest

payment

based

on

the balance

of

the

current

mortga

ge

loan;

and

t = I , 2, 3,

...

, n.

The

amount

by which the

current

mort

gage

loan

bala

nce is redu

ced

by the

tth

pa

yment

1s

given by

(3)

where ic

is

the

current

mortgage

interest r

ate.

S

ub

st

ituting

e

qu

ation

(3)

into

equation

(2)

and

rearranging

th

e terms give

an

expression for the interest

co

mponent

of

the

t

th

c

urrent

mort

gage

payment,

2

(4)

Similarly, each payment on the proposed replacement mortgage

is

com-

prised

of

an interest payment component and a debt reduction component:

(5)

where tiB,.

1

is the portion

of

the

(lh

payment directed toward reducing the

replacement mortgage loan balance, and

1,

,

1

is

the

in

terest payment based

on the balance

of

the replacement mortgage loan.

The debt reduction component

of

the

(lh

payment

of

the replacement loan

is

defined by

tiB

,.

1

=

P,

(6)

( I

+i,)

n-1+ 1

where i, is the replacement mortgage interest rate.

The

interest payment component

of

the

t1

h payment on the replacement

mortgage loan

1s

1

,,

1

= P, -

P,

(7)

(I+

i,

)n

-1

+ I

Changing the pre-tax methodology

of

equation

(I)

to renect the deducti-

biltty

of

interest payments yields the follo,1.ing open-form, after-tax, net

pre ent value model:

m

-Cr

0

+ 1

t=I

(1

,,

1

- 1,.,

)(

I

-T)

+

(tiB

,

-tiB

,,

1

)

'

( I +

J..)

1

(8)

where

Ti~

the marginal tax rate and m represents the number

of

paymencs

remaining m the relevant holding period.I

For computauonal .

1mpli

c

11

y,

the model assumes a precomputed pre ent

value amount

of

refinancing co ts,

CF

0

,

a

nd

that a mortgage having n pay-

ments remaining

is

repla

ce

d by an n-payment mortgage. The relevant hold-

ing period, m, however, may be less than the full term

of

the mortgage (i.e.,

m n).

The after-tax, open-form model depicted by equati

on

(8)

cannot

be

com-

puted by discounting a constant annuity payment as in the before-tax model

given by equation

(I).

Becau

se

the principal amortization and intere

lex-

pen

se

portions change with each payment, the solution

10

the after-tax, open-

form model given by equation

(8)

can require a lar

ge

number

of

repetitive

3

calculations. The after-tax refinancing model

of

equation (8) can be used

more efficiently if

it

is

expressed as a closed-form equation that can be solved

with a hand-held calculator.

The closed-form

of

equation (8)

is:

-CF

o +

(1-T)(P

c

-P,)

[

(l+k)

m

-J]

+

(I

+k)

mk

TP,[(I

+ k)m-(1 +i,)m]

(I+ 1,)n(l +

k)m(k-1

,)

TPc[(l

+k)

m

-(1

+()

m]

(I

+!J"(l

+k)m(k-iJ

(9)

All

parameter~ are

as

previous!) defined, and the discount rate, k,

is

not equal

10

i, or

i,

Complete development

of

the after-tax, clo\ed-form refinancing

de-

cision

model

given

b:r

equation (9)

1s

presented

in

the Appendix.

When

k equals 1 , the after-tax, clo\ed-form equation

I\

\IP\=

-CF

> +

(1-T)(P

,-

P,) [

(11-k)m-I

(1-t-k)mk

_

TP

,[(l

+k)

m

-(J

+i

,)n]

(I+

i,)

0

(

I+

k)"'(k - i,)

+

mTP

,

(l+k)

n+

I

When

k equab

i,.

the after-tax,

clo~ed

-form equauon

1\

(10)

(1

+

k)rn-1

l\lP\

=

-CF

+

(1-T)(P

c-

P,) [ I +

(I

+k)mk

TPJ(l

+

k)rn-(1

+1

)m]

(I +l.}n(l

+k)nt(k-IJ

mTP,

(11)

(1

+k)n

+I

'\

et Pr

ese

nt

\ al

ue

Com

pa

ri

so

n,

A comparison

of

net

pre~ent

values generated

by

the pre-lax model and

1he

af!er-tax

model

for

a h:rpotheucal refinancing example

1llustra1es

that ignoring

the

ta,

deduc11b1ht,

of

interest payments can

result

in

an erroneom dem1on. The

example

u~es

a

30

year, monthly payment mortgage loan

with

an original balance

of

$100,000, a current interN rate

of

J0<r'o,

and

fixed

monthly payment\

of

$877 .57

.2

A ne\\ interest rate

of

8<r'o

can be obtained

by

refinancing at

an

after-

tax pre ent value cost

of

$4,000 imposed for points, processing

fees,

appraisal

fees,

and title search costs.

We

arbitrarily

use

a discount rate,

k,

equal to the ne\\ interest rate

of

807o,

1

and

assume

1hat

the

relevant

holding

period

is

equal 10 t

he

fu

U term

of

the

rep

l

ace-

4

. . . ·:,•·,.•,·' , .

:,•.

ment mortgage.

Be

fore-lax and after-lax net prese

nt

valu

es

for

mo

rtgage relinanc-

ing for various remaining terms

an

d borrower tax rat

es

are calc

ul

ated using

equation

(11

). Selected before-tax and after-tax net present value calculations for

the mortgage loan relinancing example are presented in

Tab

le I.

Ta

bl

e 1

PV

Co

mparisons

For

Re

fi

nancing a

$100

,

000,

30-Year,

Month

l

}-

Paym

e

nt

Mort

g

ag

e

(i.,

=

.1

0/ 12,

i,

=

.08/

12, P, = $877.57,

CF

0

= -$4,000; and k

.08.

12)

Holding Period, m

Pre-tax After Tax NP

Vs

($)

and

Months

Remaining, n PV ($)

T=.

15

T=.25 T=.35

T=.45

60

-2,023

-2,336

-2,545

-2,753

-2,%2

120

1,924

952 303

- 345 -

993

180

6,165 4,461 3,325 2,189 1,053

240

9,979 7,614 6,038

4,461 2,884

300 13,128

10,229 8,296 6,363

4,431

360

15,599 12,300

10,102 7,903 5,704

After-tax net presem values are consistently smaller than before-tax net presem

values, with higher tax rates yielding lower net present values. Although the in-

ter~t

portions

of

both the currem

and

replacement mortgage payments are deduct-

ible at the same rate,

T,

the tax-shield provided by the current mortgage

i,

always

larger than the tax-shield pro\1ded by a replacement mortgage

of

equal

matun-

ty.

For

this reason, the pre ent value

of

the after-tax cash

flO\\

tream

of

the

difference between payments

1\

largeM

\\hen T equals zero

and

declines as

1he

1ax

rate increases.

Bo1h

before-tax

and

af!er-tax net present values increase as

momh

remaining

on

1hc

mortgage loan increase. This

resul1

occur\ because the number

of

po

iti\e

cash

flO\\S

genera1ed by refinancing a longer 1erm mortgage increases. A com-

parison

of

net present values in Table I also how thal error (the difference

be1ween the

before-lax

and

af1er-1ax net pre

em

value ) increases

wi1h

months

remaining

and

1he

tax rate. In every

111stance,

however, before-lax

ne1

present

va

lues exceed af1er-

1ax

nel prcsem value .

Table

I shO\\S 1hat, \\ilh

120

momh

remaining

on

the loan 1erm,

1he

after-

tax relinancing dec1

s1on

model yiel

ds

negative net pre

em

values

of

-$345 and

-$993, respect

ive

ly, for a borrower in the

350"'0

or

450Jo

tax bracket.

Th

is

re ult

indicate tha1 refinancing reduces wealth in these pecific cases. The

before-tax

refinancing

mode

l, however, generates a

pos11ive

net present val ue

of

$1,924, a

result

1h

at contradicts the conclusion reached by the after-tax decision model.

Thus,

Tab

le I highli

gh

ts two cases where

an

erroneous deci ion can be reached

by

use o f a before-tax rather

th

an

an a fter-tax refi nancing model.

5

Both

before-tax and

af

ter-tax net present values are positive

when

T

is

.4

5

and the remaining term,

mor

n,

is

150 months. Such a

low

after-tax

net

prese

nt

value

as

$47,

however, may correctly

inOuence

a borrower to defer refinancing

with

the expectation that rates

will

decline funher. Vie\\ed \\ithin the context

of

option

pricing

theory,

refi

nancing a mongage involves exercising an option

to refinance

with

an

exercise

price

equal to

CF

0

•

Such an option

is

m-the-mon

ey

when

PV

is

positive. A borrower choosing to exercise this option

receive~

both

the

PV

of

refinancing and another

less

valuable out-of-the-money option to

refinance.

4

The optimal time to refinance a mongage docs not occur before the

combined

value

of

the after-tax

PV

and the ne\\ option

exceeds

the value of

the current, in-the-money option to refinance. Thus, a

positive

P\

docs not

ncces

arily warrant refinancmg.

In

our example, a borrower

who

refinances on

the

bcbis

of the before-tax

net

present value of

$4,068

at

150

months remaining

may

have

been

induced

to

exercise

his

refinancing opuon prematurel

y.

Table I shows that both before-tax and after-ta\

net

present values are

po~i

-

ti\e

for loam

\\

ith at least

150

months remaming. Conversely, for loans

with

90

months or les, remammg, both before-ta\ and after-tax

net

present

values

arc negative,

indi

cating that refinancing

is

not advisable

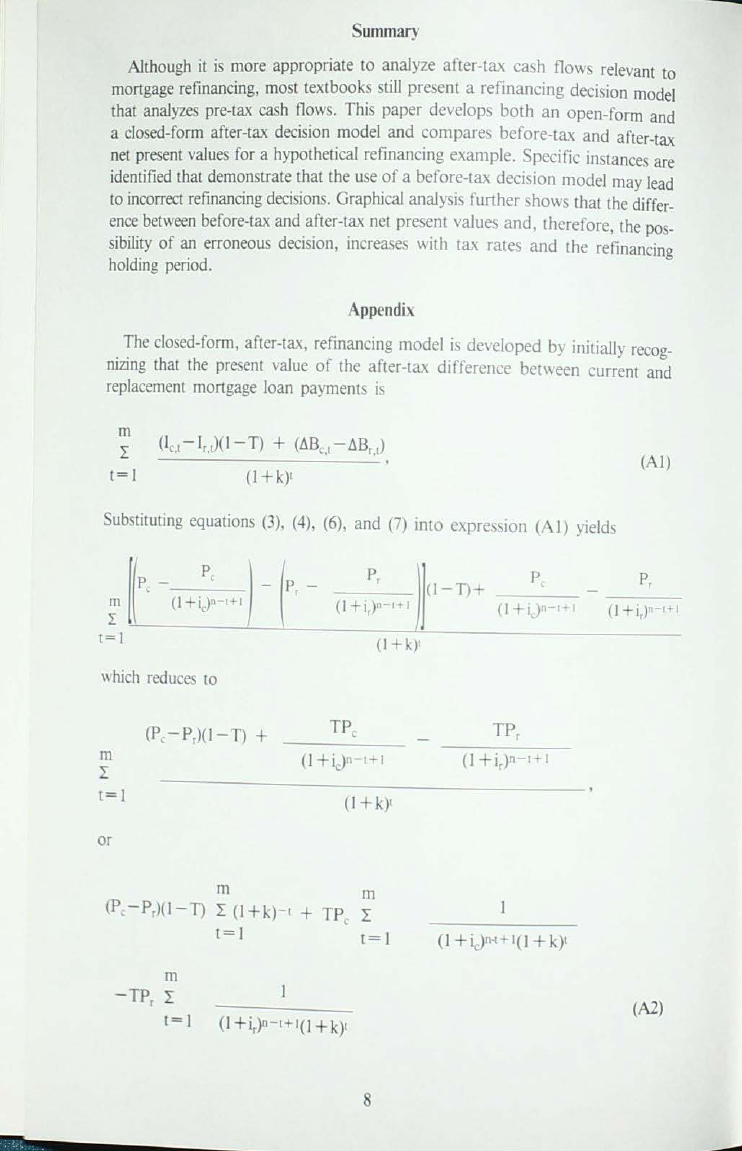

Figure I prO\idcs a graphical representation

of

the net

prescnr

values

of

the

mongage refinancing example depicted

by

Table I Figure

la

clearl}

illu

strates

the

positive, non-linear relationship bemeen net present \alue and time remain-

ing

on the mongage loan. It also

shO\\S

that

net

present \alues increase

\1ith

the holding period, but at a decreasing rate.

For

this

example, Figure

la

indicates that for a tax rate

of

45,

an erroneous

decision

to refinance

1s

reached

by

using a before-tax decision model

(T

=

0)

\I

hen

the remaining monj?age term

1s

greater than

90

months but

less

than

150

months.

An

erroneous

dcc1s1on

to

refinance

1s

more

likely

when a before-tax

de-

cbion

model

i,

used

by

borrowers

in

higher tax brackets.

Figure

lb

shows

the relation,hip

between

tax rates and

net

present

values

gener-

ated

by

equa11on

(

11)

for

a mongage loan

with

various remammg term,. The

graph indicates that

use

of

a before-tax model routine(;

yields

up\\ardly biased

net

present

values.

The relationship

between

net

present values and tax rates

ts

linear and in\er

se;

for any

given

n. 1

0

•

1 . and

k.

net

present value declines

b}

a constant amount for equal percentage

mcreases

m the tax rate. Moreover, the

rate

of

decline

in

net

present value increases as

11me

remaining on the mongage

loan

increcbes.

This result implies that the pre-tax cash now

dec1s1on

model

produces

the greatest errors m net present value

for

borrowers m high tax brack-

ets

with

long expected holding periods.

\\'hilc the refinancing example may

be

modified

by

changing the amount

of

the original mongage, the payment frequency, the term

of

the

rep

lacement mon-

gage

and holding period, the discount rate, the cost to refinance, and the current

and

rep

lacement mongage interest rates, the behavior

of

the

resu

lt

ing

net present

val

ues

ts

consistent

with

that depicted by Table I and

Fi

gu

res

I a and I b. T

hu

s,

an

analysis

of

net present val

ue

r

esu

lt

s for not only t

hi

s exam

pl

e, but for other

mongage loan r

efi

nan

ci

ng exa

mp

les

as

we

ll,

i

nd

ica

t

es

that the u

se

of

a befor

e-

tax refinancing model can eas

il

y

lea

d to an incor

rect

r

efi

nan

ci

ng

dec

ision.

6

.,

::l

ra

>

"'

"

E

C:

csj

.,

V,

J>

::l

.,

0

ct

..c:

OJ

t:.

z

.,

::l

ea

-:;;-

>

"

C:

V,

::l

.,

0

...

..c:

0..

t:.

0)

z

n

"

..

..

u

u

"

10

·•

·l

·•

·•

17

u

..

..

1'

u

"

,o

Figure

I

PVs

for

R

efi

nan

c

ing

an

Original

$100,000

,

30

-

year,

Monthly

-

Paym

e

nt

Mortgage.

(l .

10

/

12

, i, = .08,

12

, Pc = $877.57,

CF

0

=

-$4,000;

and k =

.08/

12)

Figure la

• - 0

..

"

..

:,o

eo

•o

.1.ao

st10

,eo

ts.a

a•o

a.,o :,oo :

no

:n o

Months Remaining on Loan

Figure

lb

·•

L-'----•

.J...-,

-.-'-,--0-',-,

--'o

L.-.-'--

.,

---=o.J..

,

:---:.--':

,~,

-.::-1-:-

.

--:.:-'::

,.

:-:-.':,

-'

Tax

Rate

s

7

S

umm

ar)

Although

ir

is

more

appropriare

to

analyze after-tax

ca~h

now~

relevant

10

mongage

refinancing,

most

textbooks

st

ill

present a refinancing

decision

mode

l

thar

analyzes

pre-tax

cash

now

s.

This

paper develops both an open-form

and

a

closed-form

after-tax

decision

model

and compares before-tax and after

-tax

net

present

values

for

a

hyporherical

refinancing example. Specilic

insrances

are

identified

that

demonstrate

rhat

rhe

use

of

a before-tax

dec1s1on

model

may

lead

to

incorrect

refinancing

decisions.

Graphical

analy

sis

funher shows that

the

differ-

ence

between

before-tax

and

after-tax

net

pre ent values and, therefore,

the

pos-

s

ibility

of

an

erroneous

decision,

increases

wirh

tax rates and the

relinancing

holding

period.

Appenfa

The

closed-form,

after-rax,

refinancing

model

i~

developed b)

irutially

recog-

nizing

that

the

present

value

of

the after-tax difference berwecn cur

rent

and

replacement

mongage

loan

payments

is

rn

2

t=l

(l

,_,

-I

,_.)

(1-T)

+

(liB

,.

1

-tiB

,.

1

)

(IH)c

Sub

tituting

equations

(3), (4), (6). and (7) into expression

(A

I)

yields

(Al)

P,

1)(1

-

T)+

pc

(~+~

--

()-l-1

)·

1

•+I

__

()

_+_

1,)_"·_•_~

which

reduce

10

m

2

(=)

or

(P

,

-P,)(1-T)

+

(l+k)'

(IH

..

)•

m m

(P

,

-P

,)(

1-T)

2

(IH:)

c + TP, 2

[=!

t=

I

m

TP

,

-TP

, 2

_____

(A2)

I=

I

(I+

i,)n-c+

I(

)+

k)t

8

The

closed-form for

the

first series

of

expression (A2), available from any basic

financial management text,

is

cPc-P,)(1-T)

(I

+k)"'

-

(I

+k)mk

(A3)

The

closed-form

of

the second series

of

expression (A2)

is

found by a straight-

forward application

of

the following relationship that gives the closed-form so-

lution for a j-term geometric series having an initial term, a,

and

a common ratio,

r.

j-1

L

ar'

= a

t=O

1

-rJ

1

-r

For

exposition the second series

of

expression (A2} i expanded as follows:

m

L

t=I

+

...

+

TP

c

TP

c

T Pc

+

_____

_

(l+iJn(I+k)

(l+lc)n

-t

(I+k)1

The

common

ratio for the sene

is

(I+

iJI(

I+

k); its closed-form

is

m

TP

, L

t=I

(l+t

c

}"

1+l

(l+k)t

TPcl(l+k)m

- (l +1Jm]

(I +i.:)"(I

+k)m(k-i,)

TP,

(I

+iJn(I

+k)

l-[(l+1J

(l+k)]m

I

-(I

+iJ

l (I +

k)

(A4)

A ,,rnilar procedure produce the closed-form olution

of

the third ene

of

e-.-

pres ion (A2}.

m

TP,

L

t=

I

(I

+i,)n

-t+

l( J

+k)t

9

TP,((I +

k)m

-

(I+

i,

)m]

k i i, (AS)

( I +

i,)"( I +

k)m(k

+ i,)

Summing

(A3),

(A

4), and

(AS)

yie

lds the closed-form equivalent to the

series

expressed

by

(Al). Substituting into equation

(8)

yield

the closed-form, after-

tax solution model, equation (9),

PV

= -

CFo

+

(1-l)(P

c

-P,)

(I+

k)m-

I ) + TPJ(l

+k)m-(1

+iJm]

(I

H)mk

(I +~)n(t

+k)m(k-iJ

TP,[(l

H)m-(1

+i,)m)

(I

+i

,

)n((

+k)m(k-i,)

E

ndn

ot

es

(A9)

1

The calculation

of

the

present

value

cash

flows

to

refinance,

CF

0

, should also

recognize

the tax deductibility

of

refinancing points which are amortized over

the

life

of

the ne\\ loan, unamortized points at the end

of

the holding period,

m, and prepayment penalties. The

initial

payment,

CF

0

,

is

calculated

as

follows:

M

CF

0

= P -

P·T

1(l+K)

- 1 -

LP-T(l+K)'t

+

PP(l-T)

+ FC

t=l

\\here

p

UP

:-.-1

T=

pp=

FC =

K =

points charged to refinance,

unamortized pomt ,

the

ne\\

mortgage term

in

years,

the holding period

in

years,

the marginal tax rate,

the deductible

prepayment penalty

other non-deductible financing

com,

and

the discount rate expressed

an effective annual rate.

2Monthly payment mortgage

rate~

are

generall}

stated as annual interest rates

compounded monthly.

J

Bond

refunding lnerature

extensively

discusses the appropriate discount rate

10

use

.

AJ1crnat1\e~

include the market rate, an after-tax market rate, or the cur-

rent

rate.

4

A discussion

of

the refinancing decision as an

op11on

pricing problem

is

provided by

Siegel,

(1984).

Referen

ces

Allen, Roger H. Re

al

E.s

tat

e

lm

es

tm

e

nt

S

trate

g

)'

. 3rd ed. Cincinnati: South-

Western Publishing Co., 1

989.

10

Ang, James, S.

"The

Two Faces

of

Bond Refunding," The

Jo

urn

al or Fm

ance

(June

19

75):869-874.

Ang, James S.

"The

Two

Faces

of

Bond

Refunding: Reply,"

Th

e Journal or

Finance (March

1978):354-356.

Bowlin, Oswald

D.

"The

Refunding

Decision:

Another Special Case

in

Capital

Budgeting," The Journal or

Finance

(March

1966):55-68.

Brueggeman,

William

B., Jeffrey

D.

Fisher and

Leo

D.

Stone.

Real

Estate

Fmance

.

8th ed. Homewood, Illinois: Richard

D.

Irwin,

In

c.,

1989.

Dennis, Marshall W. Res

id

ential Mortgage

Lending

. 2nd ed. Englewood Cliffs,

J: Prentice-Hall, Inc.,

1989.

Emery, Douglas

R.

"Overlapping Interest in Bond Refunding: A Reconsidera-

tion," Financial Management (Summer

1978):

19-20.

Epley, Donald

R.

and James

A.

Millar.

Basi

c

Real

Estate

Finance

and

Imest-

me

nu.

. 3rd ed.

ew

York: John

Wile}

& Sons, 1

991.

Follain,

Jam~

R.

and Dah-Nein Tzang. "Interest Rate Differential and

Refinanc-

ing

a Home Mortgage," The Appraisal Journal (April

1988):243-251.

Followtll, Richard

A.

and Linda

L.

Johnson.

"Taxe&

and Mortgage Refinanc-

ing,"

1l1e

Appraisal Journal (April

1989):

197

-

206.

Hendershott, P., S. Hu and K. Villani.

"The

Economic

of

1ortgage Termina-

tions: Implications for Mortgage Lenders and Mortgage Terms,"

Housin

g

Finan

ce

Re

,i

en

(April

1983):

127-142.

Kalotay, A.

J.

"On

the Advanced Refunding

of

Discounted Debt,"

Financial

Management (Summer

1978):

14-18.

Llvingsion,

Miles

. "Bond Refunding

Recon&idcrcd:

Comment,"

Th

e Journal or

Finance (March

1980):191

-

195.

Ofer,

A.

R.

and

R.

A. Taggart. "Bond Refunding Recon\idered: Reply,"

Th

e

Journal of Finance (March

1980):

196

-

200.

Siegel,

Jeremy J. "The Mortgage Refinancing

Dec1

10n," H

ous

in

g

Finance

Re,ien

(January

1984):91-97.

Sirmans, C. F. and Austin J. Jaffe.

Th

e

Co

mplet

e

Real

~

lat

e lm~tme

nt

Hand

-

book

. 4th ed. Englewood Cliffs, J: Prentice-Hall, Inc.,

1988.

11

I

•

Sirota, David.

Es.sentials

of

Real

E'.M

ate finan

ce.

5th ed. Chicago: Real Estate

Education Co.,

1989.

Unger, Maurice A. and Ronald

W.

Melicher. R

ea

l

E.s

tate f

in

ance. 3rd ed. Cin-

cinnati: South-Western Publishing Co.,

1989.

Wiedemer,

John P. R

ea

l

E'.Ma

tc finan

ce.

6th

ed.

Englewood Cliffs, J: Premice-

Hall, Inc.,

1990.

Yawitz,

Je s

B.

and James

A.

Anderson

"The

Effect

of

Bond Refunding on

Shareholder Wealth,"

Th

e Jo

urn

al of

fi

nance {December

1977):

1738-1746.

Ziese, Charles H. and Roger

K.

Taylor "Advance Refunding· A Practitioner's

Perspec11ve,"

f

in

ancial Management {Summer

1977):73-76

Richard A.

Follow11l

I an

A~s1stant

Professor

of

Finance, John A

\\

alker Col-

lege

of

Business

at Appalachian State Umversny. Linda

L.

Johnson

1s

an

As-

oc1ate

Prof~

or

of

finance, College

of

Busine~s

at Um\er~ny

of

South Flonda

at Fort

Myer .

12