(DT - OMB control number: 1545-0047/Expiration Date: 12/31/2019)(DOL - OMB control number: 1210-0147/Expiration date: 5/31/2022) Page 1 of 7

(HHS - OMB control number: 0938-1146/Expiration date: 10/31/2022)

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2024 – 12/31/2024

MMCP: Memorial Healthcare System Coverage for: Individual, Individual + Family Plan Type: HMO

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan

would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided

separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, call 954-622-

3499. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms,

see the Glossary. You can view the Glossary at www.cciio.cms.gov or call 954-622-3499 to request a copy.

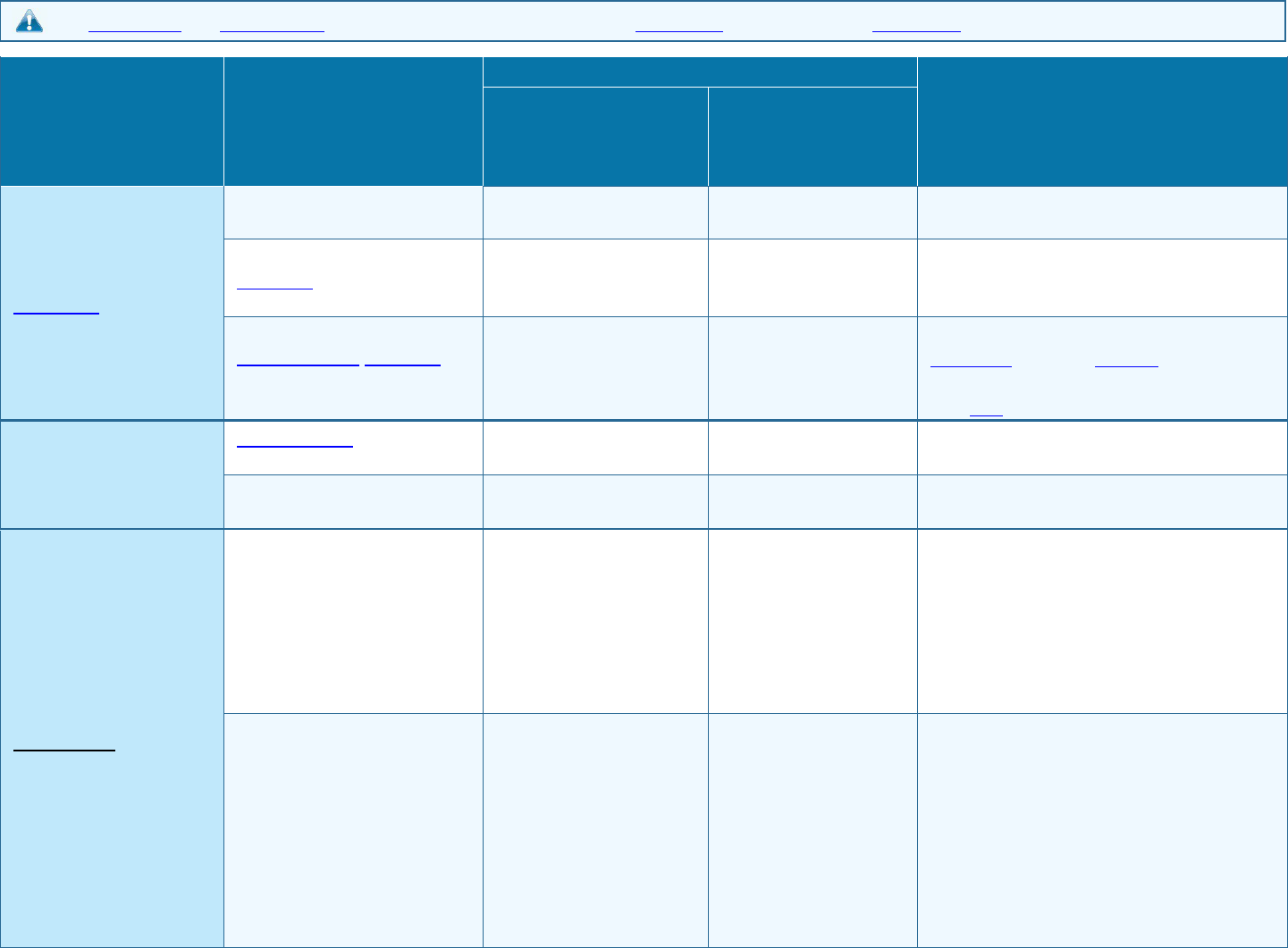

Important Questions Answers Why This Matters:

What is the overall

deductible?

Individual Family

In

-network: $100 $300

Generally, you must pay all of the costs from providers up to the deductible amount before

this plan begins to pay. If you have other family members on the plan, each

family member must meet their own individual deductible until the total amount of

deductible expenses paid by all family members meets the overall family deductible.

Are there services

covered before you meet

your deductible?

Yes. Preventive Services and

Pharmacy

This plan covers some items and services even if you haven’t yet met the annual deductible

amount.

But a copayment or coinsurance may apply.

For example, this plan covers certain preventive services without cost-sharing and before

you meet your deductible. See a list of covered preventive services at

www.healthcare.gov/coverage/preventive-care-benefits/.

Are there other

deductibles for specific

services?

No. You don’t have to meet deductibles for specific services.

What is the out-of-pocket

limit for this plan?

$4,000 for employee only /

$8,000

for employee plus spouse, employee

plus child(ren),

employee plus family

The out-of-pocket limit is the most you could pay in a year for covered services. If you have

other family members in this plan, they have to meet their own out-of-pocket limits until the

overall family out-of-pocket limit has been met.

What is not included in

the out-of-pocket limit?

Premiums and health care services

this plan doesn’t cover.

Even though you pay these expenses, they don’t count toward the out-of-pocket limit.

Will you pay less if you

use a network provider?

Yes

- The Memorial Health Network

(

MHN). For a list of preferred

provider

s, see the Lawson

website

, email

CCP.CustomerSvc@ccpcares.org,or

call 954-622-3499

This plan uses a provider network. You will pay less if you use a provider in the plan's

network. You will pay the most if you use an out-of-network provider, and you might

receive a bill from a provider for the difference between the provider’s charge and what your

plan pays (balance billing). Be aware, your network provider might use an out-of-network

provider for some services (such as lab work). Check with your provider before you get

services.

Do you need a referral to

see a specialist?

No. You can see the specialist you choose without a referral.

* For more information about limitations and exceptions, call 954 622 3499. Page 2 of 7

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

Common Medical Event Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Important Information

Network Provider

(You will pay the least)

Out-of-Network

Provider

(You will pay the

most)

If you visit a health care

provider’s office or

clinic

Primary care visit to treat an

injury or illness

$20 copay / visit after

deductible

Not Covered None

Specialist visit

$30 copay / visit

after

deductible

Not Covered

Chiropractor: $40 copay/visit (60 visit

maximum) – 20% after deductible for

infertility services - 1 Progyny Smart Cycle

Preventive care/screening/

Immunization

No charge Not Covered

You may have to pay for services that aren’t

preventive. Ask your provider if the services

you need are preventive. Then check what

your plan will pay for.

If you have a test

Diagnostic test (x-ray, blood

work)

$50 copay after

deductible

Not Covered

No Charge for Labs.

Imaging (CT/PET scans,

MRIs)

$100 copay / test after

deductible

Not Covered

MRI, CT/PET scans require prior

authorization

If you need drugs to

treat your illness or

condition

More information about

prescription drug

coverage is available

from Southern Scripts

at 1-800-710-9341 or

southernscripts.net

Generic drugs

$10 copay / 30 day

retail

supply,

$20 copay 90 day retail

supply*,

$20 copay / 90 day mail-

order supply

Not Covered

In-house Pharmacy

$10 copay / 30 day supply

$20 copay / 90 day supply

*One copay per month (3 copays) will apply

for 90 day retail prescriptions outside of the

First Choice network

Preferred brand drugs

$35 copay / 30 day retail

supply,

$70 copay 90 day retail

supply*,

$70 copay / 90 day mail-

order supply

Not Covered

In-house Pharmacy

$20 copay / 30 day supply

$55 copay / 90 day supply

*One copay per month (3 copays) will apply

for 90 day retail prescriptions outside of the

First Choice network

* For more information about limitations and exceptions, call 954 622 3499. Page 3 of 7

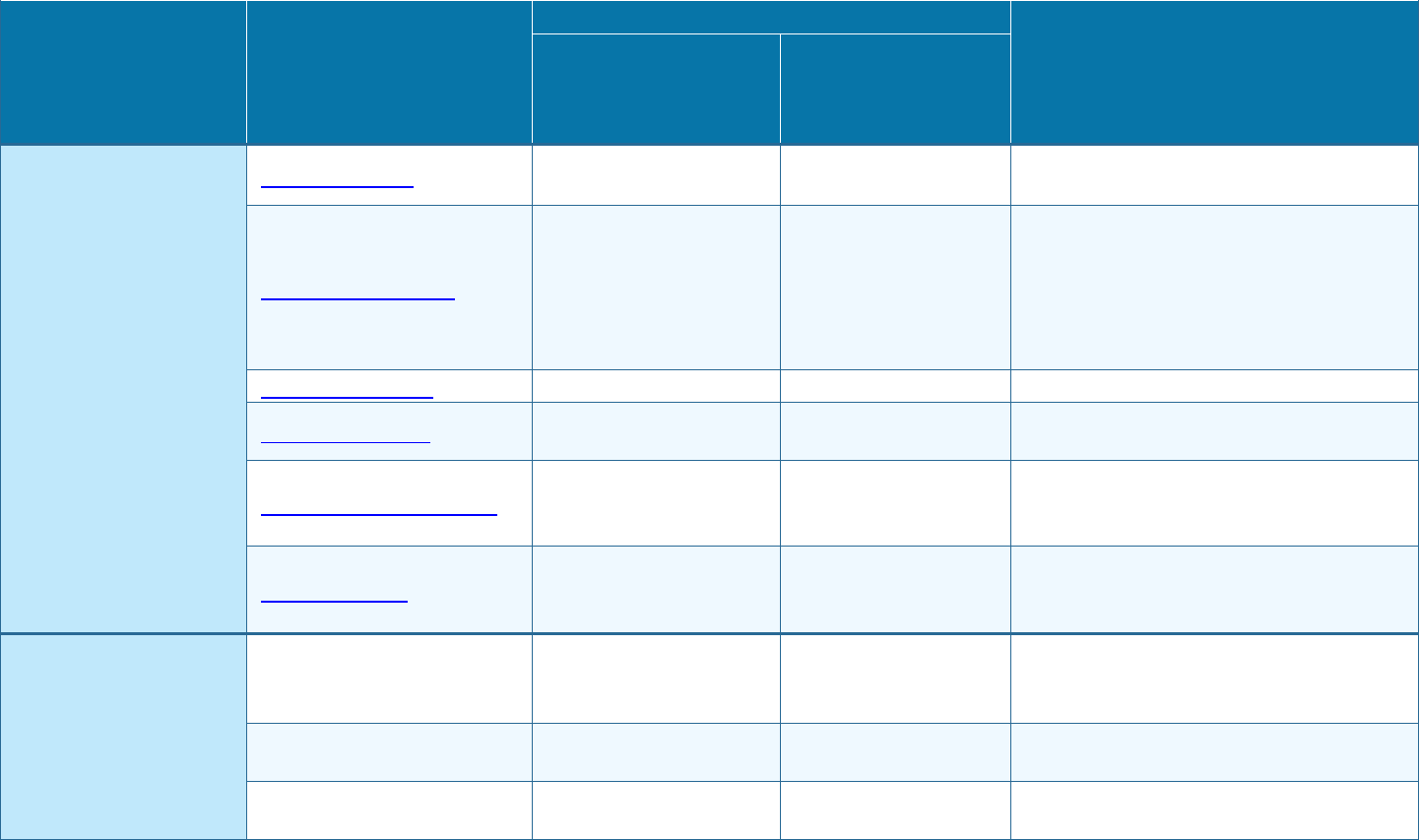

Common Medical Event Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Important Information

Network Provider

(You will pay the least)

Out-of-Network

Provider

(You will pay the

most)

Non-preferred brand drugs

40% ($50 minimum, $150

maximum) / 30 day retail

prescription,

40% ($150 minimum,

$210 maximum 90 day

retail supply*,

40% ($70 minimum, $210

maximum) / 90 day mail-

order supply

Not Covered

In-house Pharmacy

40% ($35 min, $135 max) / 30 day supply

40% ($55 min $195 max) / 90 day supply

* The coinsurance maximum applies per 30

day supply for 90 day retail prescriptions

outside of the First Choice network

In the event a Tier 1 equivalent medication

is available the member will be responsible

for a co-pay of 40% (a minimum $50 and a

maximum of $150) plus the cost difference

between the Tier 1 equivalent and the Tier 3

medication.

Specialty drugs

40% ($150 minimum

$300 maximum)

Not Covered

Only covered at MHS pharmacies and the

CRx Specialty Pharmacy.

If you have outpatient

surgery

Facility fee (e.g., ambulatory

surgery center)

$250 copay after

deductible

Not Covered, except in

an emergency

Some services may require prior

authorization. – 20% after deductible for

infertility services (1 Progyny Smart Cycle)

Physician/surgeon fees $0 copay after deductible Not Covered

20% after deductible for infertility services -

1 Progyny Smart Cycle

If you need immediate

medical attention

Emergency room care

$150 copay / visit, waived

if admitted after

deductible

$150 copay / visit,

waived if admitted after

deductible

None

Emergency medical

transportation

$50 copay / event after

deductible

$50 copay / event after

deductible

Non-emergency transportation requires

prior

authorization

Urgent care

• CVS Minute Clinic/

Walgreens

•

Memorial Primary

Care

$20 copay / visit

after

deductible

$20 copay / visit

after

deductible

$75 (Non-Memorial

Urgent Care Center)

after deductible

None

* For more information about limitations and exceptions, call 954 622 3499. Page 4 of 7

Common Medical Event Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Important Information

Network Provider

(You will pay the least)

Out-of-Network

Provider

(You will pay the

most)

• Holy Cross Urgent

Care Centers

• MHS Urgent Care

Centers

• Memorial Pembroke

24/7 Care Center

(Douglas Rd)

• MDNOW Urgent

Care

• Selected Broward

Health locations

$20 copay / visit

after

deductible

$20 copay / visit

after

deductible

$50 copay / visit

after

deductible

$75 copay / visit after

deductible

$75 copay / visit after

deductible

If you have a hospital

stay

Facility fee (e.g., hospital

room)

$150 copay per day (5

day max) after deductible

Not Covered, unless

admitted through an

emergency room

5 day max. Requires Prior Authorization

Physician/surgeon fees $0 copay after deductible Not Covered None

If you need mental

health, behavioral

health, or substance

abuse services

Outpatient services

$20 copay / per visit after

deductible

Not Covered None

Inpatient services

$150 copay per day

(5 day max) after

deductible

Not Covered

Copay applicable to first 5 days of each

admission. Requires Prior

Authorization

If you are pregnant

Office visits

$150 physician copay /

pregnancy

after

deductible

Not Covered

No prior authorization required for

initial

visit, but is required thereafter.

Childbirth/delivery

professional services

$0 copay after deductible Not Covered None

Childbirth/delivery facility

services

$0 copay

after deductible

Not Covered Requires prior authorization.

* For more information about limitations and exceptions, call 954 622 3499. Page 5 of 7

Common Medical Event Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Important Information

Network Provider

(You will pay the least)

Out-of-Network

Provider

(You will pay the

most)

If you need help

recovering or have

other special health

needs

Home health care

$15 copay / day after

deductible

Not Covered

Requires prior authorization. Limited

t

o 60

visits per calendar year.

Rehabilitation services

$20 per day after deductible

Cardiac Rehabilitation

covered in Full

Not Covered

Physical therapy,

occupational therapy and

speech therapy visits are limited to sixty (60)

visits per calendar year.

Cardiac rehabilitation is limited to 36 visits

per episode.

Habilitation services

Not Covered

Not Covered

None

Skilled nursing care $0 copay after deductible Not Covered

Requires Prior Authorization; limited to

45

days per calendar year.

Durable medical equipment $0 copay after deductible Not Covered

Some services may require prior

authorization. Subject to medical necessity

review

Hospice services $0 copay after deductible Not Covered

Requires prior authorization; limited to

a

maximum benefit of $10,000. Limited to life

expectancy of less than six months.

If your child needs

dental or eye care

Children’s eye exam $0 copay after deductible Not Covered

Limited to one exam per calendar year

for

covered children as a preventive service.

A

separate vision plan is available.

Children’s glasses Not Covered Not Covered

Not covered under the medical plan.

A separate vision plan is available.

Children’s dental check-up Not Covered Not Covered

Not covered under the medical plan.

A separate dental plan is available.

Excluded Services & Other Covered Services:

* For more information about limitations and exceptions, call 954 622 3499. Page 6 of 7

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.)

• Cosmetic surgery

•

Dental care

•

Habilitation Services

•

•

Long-term care

•

Non-emergency care when traveling outside the

U.S.

• Private-duty nursing

•

Routine eye care (adult)

•

Routine foot care

•

Weight loss programs

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

•

Acupuncture

• Bariatric surgery

• Chiropractic care

•

Hearing aids

• Infertility treatment

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those

agencies is: the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of Health and

Human Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Other coverage options may be available to you, too, including buying individual insurance

coverage through the Health Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318- 2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a

grievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also

provide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or

assistance, contact: Appeals Coordinator, c/o Community Care Plan 1643 Harrison Parkway, Suite 200, Bldg. H. Sunrise, Florida 33323.

Does this plan provide Minimum Essential Coverage? Yes

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid,

CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.

Does this plan meet the Minimum Value Standards? Yes

If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.

Language Access Services:

Spanish (Español): Para obtener asistencia en Español, llame al 954 622 3499.

PRA Disclosure Statement: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control

number. The valid OMB control number for this information collection is 0938-1146. The time required to complete this information collection is estimated to average 0.08 hours per response,

including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy

of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland

21244-1850.

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

Page 7 of 7

About these Coverage Examples:

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different

depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts

(deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion of costs you might

pay under different health plans. Please note these coverage examples are based on self-only coverage.

The plan’s overall deductible $100

Specialist copay $30

Hospital (facility) copay $0 for maternity

Other coinsurance 0%

This EXAMPLE event includes services like:

Specialist office visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests (ultrasounds and blood work)

Specialist visit (anesthesia)

Total Example Cost

$12,700

In this example, Peg would pay:

Cost Sharing

Deductibles

$100

Copayments

$400

Coinsurance

$0

What isn’t covered

Limits or exclusions

$60

The total Peg would pay is

$560

The plan’s overall deductible $100

Specialist copay $30

Hospital (facility) copay $150 per day

(5 day max)

Other coinsurance 0%

This EXAMPLE event includes services like:

Primary care physician office visits (including

disease education)

Diagnostic tests (blood work)

Prescription drugs

Durable medical equipment (glucose meter)

Total Example Cost

$5,600

In this example, Joe would pay:

Cost Sharing

Deductibles

$100

Copayments

$800

Coinsurance

$0

What isn’t covered

Limits or exclusions

$20

The total Joe would pay is

$920

The plan’s overall deductible $100

Specialist copay $30

Hospital (facility) copay $150 per day

(5 day max)

Other coinsurance 0%

This EXAMPLE event includes services like:

Emergency room care (including medical

supplies)

Diagnostic test (x-ray)

Durable medical equipment (crutches)

Rehabilitation services (physical therapy)

Total Example Cost

$2,800

In this example, Mia would pay:

Cost Sharing

Deductibles

$100

Copayments

$500

Coinsurance

$0

What isn’t covered

Limits or exclusions

$0

The total Mia would pay is

$640

The plan would be responsible for the other costs of these EXAMPLE covered services.

Peg is Having a Baby

(9 months of in-network pre-natal care and a

hospital delivery)

Managing Joe’s Type 2 Diabetes

(a year of routine in-network care of a well-

controlled condition)

Mia’s Simple Fracture

(in-network emergency room visit and follow up

care)