Q2-22

Investor Update

August2, 2022

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 2

This presentation contains non-GAAP measures relating to our performance. These measures may exclude certain expenses, gains and losses that may not be indicative of our core operating results and

business outlook, and, in each case, may be different from the non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any

comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally

accepted accounting principles. You can find the reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures in the Supplemental Information at the end of this

presentation.

As previously disclosed, beginning with the first quarter of 2020, we modified the presentation of our non-GAAP results to exclude the impact of all gains and losses on our strategic investments. In addition,

beginning with the fourth quarter of 2020, we have reclassified certain cash flows related to customer balances from cash flows from operating activities to cash flows from investing activities or financing

activities within the consolidated statements of cash flows. Prior period amounts have been reclassified to conform to the current period presentation.

All growth rates represent year-over-year comparisons, except as otherwise noted. FX-Neutral (which we also refer to as FXN or currency-neutral) results are calculated by translating the current period’s local

currency results by the prior period’s exchange rate. FX-Neutral growth rates are calculated by comparing the current period's FX-Neutral results with the prior period's results, excluding the impact from

currency hedging activities.

This presentation contains forward-looking statements relating to, among other things, the future results of operations, financial condition, expectations and plans of PayPal Holdings, Inc. and its consolidated

subsidiaries that reflect PayPal’s current projections and forecasts. Forward-looking statements can be identified by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,”

“estimate,” “intend,” “strategy,” “future,” ”opportunity,” “plan,” “project,” “forecast” and other similar expressions. Forward-looking statements may include, but are not limited to, statements regarding our

guidance and projected financial results for third quarter and full year 2022; anticipated cost savings and operating margin expansion; our capital return program; the impact and timing of product launches and

acquisitions; and the projected future growth of PayPal’s businesses. Forward-looking statements are based upon various estimates and assumptions, as well as information known to PayPal as of the date of

this presentation and are inherently subject to numerous risks and uncertainties. Our actual results could differ materially from those estimated or implied by forward-looking statements. Factors that could

cause or contribute to such differences include, but are not limited to: our ability to compete in markets that are highly competitive and subject to rapid technological change, and to develop and deliver new

or enhanced products and services on a timely basis; cyberattacks and security vulnerabilities, and associated impacts; the effect of global and regional political, economic, market and trade conditions,

supply chain issues and related events that affect payments or commerce activity, including inflation and rising interest rates; the impact of natural disasters or other business interruptions on our business and

financial condition, as well as our customers, suppliers, vendors and other business partners; the continuing effects of the COVID-19 pandemic and the proliferation of variants; the impact of the Russia-Ukraine

conflict; the stability, security and performance of our payments platform; the effect of extensive government regulation and oversight related to our business, products and services in a variety of areas,

including, but not limited to, laws covering payments, lending and consumer protection; the impact of complex and changing laws and regulations worldwide, including, but not limited to, laws covering

privacy, data protection, and cybersecurity, which expose us to potential liabilities, increased costs, and other adverse effects on our business; the impact of payment card, bank, or other network rules or

practices; changes in how consumers fund transactions; our ability to effectively detect and prevent the use of our services for fraud, abusive behaviors, illegal activities, or improper purposes; our ability to

manage regulatory and litigation risks, and the outcome of legal and regulatory proceedings; our ability to manage relationships with third parties and their ability to meet their obligations to us; damage to our

reputation or brands; fluctuations in foreign currency exchange rates; changes in tax rates and exposure to additional tax liabilities; changes to our capital allocation, management of operating cash or

incurrence of indebtedness; our ability to timely develop and upgrade our technology systems, infrastructure and customer service capabilities; the impact of proposed or completed acquisitions, divestitures,

strategic investments, or entries into new businesses or markets; and our ability to attract, hire, and retain talented employees. The forward-looking statements in this presentation do not include the potential

impact of any acquisitions or divestitures that may be announced and/or contemplated after the date of this presentation.

More information about factors that could adversely affect PayPal's results of operations, financial condition and prospects or that could cause actual results to differ from those expressed or implied in forward-

looking statements is included under the captions “Risk Factors”, “Legal Proceedings,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in PayPal’s most recent

annual report on Form 10-K, and its subsequent quarterly reports on Form 10-Q, copies of which may be obtained by visiting PayPal's Investor Relations website at https://investor.pypl.com or the SEC's website

at www.sec.gov. All information in this presentation is as of August2, 2022. For the reasons discussed above, you should not place undue reliance on the forward-looking statements in this presentation. PayPal

assumes no obligation to update such forward-looking statements.

Non-GAAP Financial Measures; Forward-Looking Statements

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 3

Solid second quarter, with two points of sequential revenue acceleration and 22% growth in free cash flow

Non-GAAP operating margin and expenses, non-GAAP EPS, and free cash flow are non-GAAP financial measures. Please see the Supplemental Information for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

(1) All references to eBay in this presentation refer to eBay Marketplaces on our payments platform (2) Daily active accounts represents the average number of active accounts that have completed a transaction using our core PayPal payments products and services,

including person-to-person payments transfers and checkout transactions, on a given day during the designated period (3) Foreign currency-neutral

Highlights

Q2 results & metrics • TPV growth: 3-year spot CAGR of 25%, and 28% ex-eBay

(1)

• Revenue growth: 3-year spot CAGR of 16%, and 22% ex-eBay

• PayPal core daily active accounts

(2)

up >40% relative to pre-pandemic period (Q2-19)

• Non-GAAP EPS of $0.93, ~$0.07 stronger than guidance

• $1.3B in free cash flow (FCF), 22% growth and 19% of revenue

Management updates • Blake Jorgensen appointed Chief Financial Officer (CFO)

• Conducting search for new Chief Product Officer (CPO) following Mark Britto’s plan to retire at end of year

Productivity initiatives • FY-22 guidance incorporates $900M of cost savings, with annualized benefit of at least $1.3B in FY-23

• Plan to deliver operating margin expansion in FY-23

Capital return program • New $15 billion share repurchase authorization

• FY-22 share repurchases expected to reach ~$4.0B

• Commitment to work with Elliott Investment Management L.P. on a comprehensive evaluation of capital

return alternatives

Full year outlook • Expect ex-eBay revenue growth of ~14.5% FXN

(3)

, FCF >$5.0B, and ~10M NNAs

• Raising non-GAAP EPS guidance range; targeting non-GAAP operating margin expansion in Q4

• Revenue growth expected to accelerate each quarter; targeting 14% FXN growth in Q4

Leadership, resiliency, and shareholder value initiatives

Raising FY-22 non-GAAP EPS guidance; targeting non-GAAP operating margin expansion in Q4

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 4

48.7

Payment transactions per active

account (TPA)

12% increase y/y

PayPal core daily active accounts are

>40% higher relative to pre-pandemic

period (Q2-19)

Customer Engagement

$340B

9% spot and 13% FXN y/y growth

11% spot and 15% FXN y/y growth

ex-eBay

3-year spot CAGR of 25%

3-year ex-eBay spot CAGR of 28%

Total Payment VolumeActive Accounts

0.4M

Net new active accounts (NNAs)

$1.3B

22% increase y/y

19% of revenue

Free Cash Flow

$0.93

19% decrease y/y

Includes ~$0.11 per share headwind from

lower eBay transaction margin dollars and

lapping ~$0.11 benefit from credit loss

reserve releases in Q2-21

3-year transaction margin dollar CAGR of

12%

Non-GAAP EPS

$6.8B

9% spot and 10% FXN y/y growth

14% spot y/y growth ex-eBay

3-year spot CAGR of 16%

3-year ex-eBay spot CAGR of 22%

Revenue

429M

Includes 35M active merchant

accounts

6% increase y/y

Three-year CAGRs highlight solid performance

Second Quarter 2022 Summary

Non-GAAP earnings per share and free cash flow are non-GAAP financial measures. Please see the Supplemental Information for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 5

181M 305M 426M

Active Accounts

28.1 40.6 45.4

$9.2B $17.8B $25.4B

Net Revenue

$1.8B $3.4B $5.4B

Free Cash Flow

(1)

2015 2019 2021

5.1B 12.4B 19.3B

Transactions

$288B $712B $1.25T

Total Payment

Volume (TPV)

Transactions per

Account (TPA)

PayPal delivers results at massive scale

Building an

enduring

platform

Supporting

customers

through the

pandemic

Combining

trust and

innovation

(1) Free cash flow is a non-GAAP financial measure. Please see the Reconciliation of Operating Cash Flow to Free Cash Flow within Supplemental Information for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 6

Business Credit Card

3/2 Cobrand Credit Card

Savings

Paidy

Shopping Hub

Happy Returns

Global Pay Later

Crypto

Venmo Business Profiles

Venmo Credit Card

Venmo DD & Check Capture

Digital Wallet

QR Code

Honey

Bill Pay

Consumer Debit Card

Check Capture

Zettle

Venmo Checkout

Venmo Debit Card

Hyperwallet

Business Loans & Loan Builder

Xoom

Presentment Currencies

Multicurrency Withdrawals

Working Capital

Venmo P2P

Braintree

Prepaid Card

Cash-In

Direct Deposit

Donate / Fundraise

Subscriptions and Recurring Pmts

PayPal Credit

Card Processing Risk Mgmt

PayPal Payouts

PayPal Mobile

Shipping

Consumer Credit Card

Merchant Debit Card

Disputes and Resolutions

Invoicing

Checkout

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

PayPal has remained at the forefront of the digital payment revolution for more

than 20 years

By leveraging technology to make financial services and commerce more

convenient, affordable, and secure, the PayPal platform is empowering nearly

430 million consumer and merchant accounts in more than 200 markets to join

and thrive in the global economy

2019-20222015-2018

Consumer Debit Card

Check Capture

Zettle

Venmo Checkout

Venmo Debit Card

Hyperwallet

Business Loans & Loan Builder

Xoom

Presentment Currencies

Multicurrency Withdrawals

Working Capital

Venmo P2P

Braintree

Prepaid Card

Cash-In

Direct Deposit

Donate / Fundraise

Subscriptions and Recurring Pmts

PayPal Credit

Card Processing Risk Mgmt

PayPal Payouts

PayPal Mobile

Shipping

Consumer Credit Card

Merchant Debit Card

Disputes and Resolutions

Invoicing

Checkout

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

2010-2014

Working Capital

Venmo P2P

Braintree

Prepaid Card

Cash-In

Direct Deposit

Donate / Fundraise

Subscriptions and Recurring Pmts

PayPal Credit

Card Processing Risk Mgmt

PayPal Payouts

PayPal Mobile

Shipping

Consumer Credit Card

Merchant Debit Card

Disputes and Resolutions

Invoicing

Checkout

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

2006-2009

PayPal Credit

Card Processing Risk Mgmt

PayPal Payouts

PayPal Mobile

Shipping

Consumer Credit Card

Merchant Debit Card

Disputes and Resolutions

Invoicing

Checkout

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

2002-2005

Shipping

Consumer Credit Card

Merchant Debit Card

Disputes and Resolutions

Invoicing

Checkout

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

1998-2001

PayPal Balance

Add from Bank

Withdraw to Bank

PayPal P2P

Consumer

Merchant

Consumer + Merchant

PayPal’s evolution into today’s global payments leader

Enhancing value proposition of two-sided platform

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 7

Merchants

Winning Checkout

Consumers

Winning Digital Wallet

Partners

Increasing Digital Transactions

(1) Last twelve months transactions and TPV (Q3-21 to Q2-22)

Drive

Conversion

Attract

Customers

Social

Full Stack

Solution

Drive

Conversion

Speed

Trust

Choice

Utility

Social

PayPal is driving a digital payments paradigm for merchants,

consumers, and partners

20.9B

Secure Transactions

(1)

$1.31T

TPV

(1)

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 8

Leadership, Resiliency, and Shareholder Value Initiatives

Board of Directors and Management aligned to strengthen PayPal’s position

• Investor Day to be held in early 2023 to share financial and strategic update and provide details related to the review of capital return

alternatives

• Entering into an Information Sharing Agreement with Elliott to continue collaboration across a range of value-creation opportunities

Management

updates

Efficiency

opportunities &

growth initiatives

Invigorated capital

return program

• Appointing Blake Jorgensen as CFO, effective August 3

◦ Blake has extensive experience driving operational excellence and shareholder value, having served as

CFO at industry-leading companies including Electronic Arts Inc., Levi Strauss & Co., and Yahoo! Inc.

• Conducting search for a new Chief Product Officer following Mark Britto's plan to retire at the end of the year

• FY-22 financial outlook incorporates ~$900 million of savings across transactional and non-transactional

operating expenses

• On an annualized basis, these FY-22 savings, in conjunction with additional initiatives, are expected to generate

savings of at least ~$1.3 billion in FY-23

• Expect to reinvest a portion of the gross savings into high-conviction growth opportunities and to drive

operating margin expansion in FY-23

• Includes a new $15 billion share repurchase authorization and a comprehensive evaluation of capital return

alternatives

◦ Returned $2.25 billion to shareholders in the form of share repurchases in the first half of 2022, representing

~95% of free cash flow generated in the period

• FY-22 share repurchases expected to reach ~$4 billion

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 9

Expanding support for SMBs around the world

New and enhanced products to drive growth and resiliency for SMBs

PayPal Business Cashback

Mastercard

®

Credit Card

U.S.

Tap to Pay with Zettle

Netherlands, Sweden, & UK

PayPal Working Capital

France & Netherlands

Unlimited 2%

cash back on

purchases

No annual fee &

free employee

cards

Fraud liability

protection

Enhanced

benefits from

Mastercard

(1)

The PayPal Business Cashback Mastercard is issued by WebBank pursuant to a license by Mastercard International and serviced by Concerto Card Company. Mastercard is a registered trademark.

(1) 2-year Extended Warranty on Purchases, cell phone protection, Mastercard ID Theft Protection

TM

, and more from Mastercard

Leveraging near-field

communication (NFC), Tap to Pay

enables individual sellers and small

businesses to accept contactless

payments using the Zettle Go app

by tapping a customer’s card or

payment device to

the back of an

Android phone

with no

additional

hardware

or fees

PayPal Working Capital (PayPal

Funding Pro) expanded to France

and the Netherlands, providing

SMBs with simple and flexible

funding in minutes. Since PayPal

Working Capital launched in 2013,

PayPal has provided SMBs access to

more than $25.6B in capital through

over 1.3M loans in the U.S., Australia,

UK and Germany

GOAL 9:

Industry, Innovation and

Infrastructure

Target 9.3: Increase the access of small-scale industrial

and other enterprises to financial services and their

integration into value chains and markets

Empowering SMBs is a priority ESG topic for PayPal and is central to

PayPal’s mission to democratize financial services. PayPal supports

SMBs globally through access to capital and tools to drive growth

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 10

Leaning into engagement, with room to grow in core markets

PayPal consumer penetration across core developed markets remains below 50%

(1)

(1) PayPal consumer penetration % calculation is based on the number of unique PayPal consumer users that have conducted at least one transaction in the past 12 months divided by the adult population (ages 18+) in each country, according to UN World Population

Prospects 2022 data; penetration analysis is based on PayPal only and does not include other products/services (e.g., Venmo)

(2) Average PayPal consumer penetration % in France, Italy, and Spain

Note: Order based on adult population in each country (largest to smallest, with France, Italy, and Spain representing the average adult population)

39%

19%

42%

44%

35%

50%

100%

26%

(2)

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 11

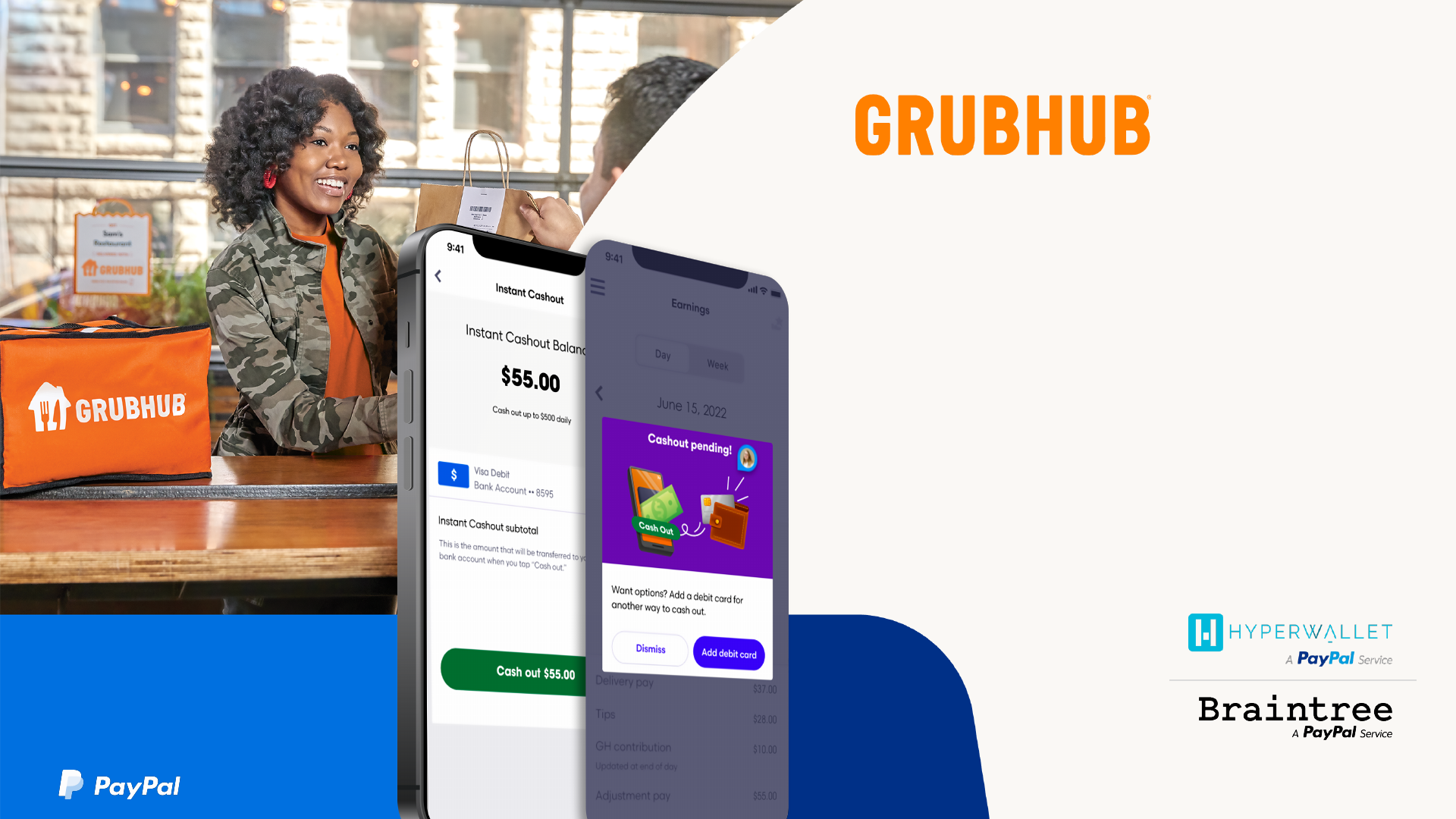

Supporting choice and flexibility for

Grubhub’s customers and drivers

PayPal and Grubhub have nurtured a strong relationship over the last 10

years that has resulted in millions of customers opting to use PayPal or

Venmo at checkout to order the food they love.

Currently, 95% of Grubhub transactions are processed by Braintree.

Braintree facilitates high authorization rates and low risk of losses for the

company, providing both speed and security for Grubhub and its

customers.

For Grubhub’s drivers, cashing out is one of the most important features

– and now, drivers can immediately access their earnings with the

launch of Instant Cashout via Direct to Debit, enabled by Hyperwallet

from PayPal and Visa Direct. With the support of PayPal’s Hyperwallet,

Grubhub is increasing financial stability and flexibility for its drivers by

offering real-time payouts of their tips and earnings.

©2022 PayPal Holdings, Inc.

Business

Update

Q2-22

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 13

285

311

310

340

323

340

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

50% 40% 26% 23% 13% 9%

46% 36% 24% 23% 15% 13%

Q2-22 Total Payment Volume (TPV)

3-year CAGR of 25% at spot and 28% ex-eBay

• TPV increased 9% on a spot basis and 13% FXN

to $340 billion

◦ 3-year CAGR of 25% at spot, with volume

processed in the quarter nearly doubling

from Q2-19 to Q2-22

• Excluding eBay, TPV increased 11% on a spot

basis and 15% FXN, on top of 48% spot and 43%

FXN growth in Q2-21; 3-year CAGR of 28% at

spot

• P2P volume, which includes PayPal, Venmo, and

Xoom, increased 3% to $93B, on top of 41%

growth in Q2-21, and represented 27% of TPV; 3-

year CAGR of 26% at spot

• Venmo volume increased 6% to $61B, on top of

58% growth in Q2-21; 3-year CAGR of 36% at

spot

◦ Venmo commerce volume grew >250% in

Q2-22

(1)

Total Payment Volume (TPV) ($B)

Y/Y Growth

FXN Y/Y Growth

(1) Venmo TPV is primarily comprised of P2P activity. Commerce volume includes business profiles, goods & services transactions, and Pay with Venmo.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 14

• CBT TPV was $45billion, down 6% FXN, driven

by softness in U.S.-China, UK-EU and UK-China

corridors, partly offset by intra-European

corridors

◦ On a 3-year CAGR basis, CBT TPV grew 14%

at spot

◦ Excluding eBay, cross-border TPV increased

2% FXN, on top of 28% growth in Q2-21, and

16% on a 3-year CAGR basis at spot

◦ CBT TPV represented 13% of TPV in Q2-22,

compared to 16% in Q2-21

◦ Cross-border trade is primarily comprised of

e-commerce goods-related activity and has

limited exposure to the recovery of travel

Cross-Border Trade TPV ($B)

Note: In a typical purchase transaction, cross border TPV is counted in the region where the merchant is located. For example, in the case of a U.S. seller and a German buyer, the TPV is counted in the U.S.

48

51

47

49

44

45

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

51% 38% 19% 5% (7%) (12%)

44% 30% 17% 7% (4%) (6%)

17% 16% 15% 14% 14% 13%

41% 28% 19% 14% 4% 2%

Q2-22 TPV: Cross-Border Trade (CBT)

3-year CAGR of 14% at spot and 16% ex-eBay

Y/Y Growth

FXN Y/Y Growth

Share of Total TPV

Ex-eBay FXN

Y/Y Growth

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 15

• Ended the quarter with 429 million active

accounts, up 6%, including 35 million merchant

accounts

• Added 0.4 million net new active accounts in

Q2-22, primarily driven by Venmo. Includes

impact from pull back on incentive-driven

campaigns, leading to minimally engaged users

naturally rolling off

• Processed 5.5 billion payment transactions, up

16%, despite 43% decline in eBay transactions.

Ex-eBay, transactions grew 20%. On a 3-year

CAGR basis, transactions grew 23% and 28% ex-

eBay

• 12% growth in TPA was driven by strong

transaction growth from Braintree. Growth in

PayPal transactions ex-eBay also helped to offset

decline in eBay transactions

• PayPal core daily active accounts increased

>40% relative to Q2-19 and ~13% on a 3-year

CAGR basis, demonstrating elevated activity and

engagement relative to pre-pandemic period

Active Accounts (M) and TPA

21% 16% 15% 13% 9% 6%

7% 11% 10% 11% 11% 12%

34% 27% 22% 21% 18% 16%

Q2-22 Customer Engagement

Transactions per active account (TPA) reached 48.7, growing 12%

Y/Y Growth

Active Accounts

TPA

Transactions

392

403

416

426

429 429

42.2

43.5

44.2

45.4

47.0

48.7

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 16

• Total revenue grew 9% at spot and 16% on a 3-year

CAGR basis

◦ Ex-eBay revenue grew 14%, and 22% on a 3-

year CAGR basis

◦ Transaction revenue grew 8%, driven primarily

by Braintree. Ex-eBay transaction revenue grew

13%

◦ Other Value Added Services (OVAS) revenue

increased 21%

• Total take rate was flat year over year. Benefits from

FX hedge gains, P2P mix and Venmo helped offset

pressure from lower FX fees and eBay volume/yield

(3bps drag)

◦ eBay volumes declined 39% and eBay take rate

in Q2-22 was 2.13% vs. 3.22% in Q2-21

• Hedging gains, recognized in international

transaction revenue, were $107 million in Q2-22

versus hedging losses of $89 million in Q2-21

• Exiting Q2, at exchange rates as of June30, 2022,

we estimate that our derivative positions will result in

the recognition of $372 million of hedging gains in

international transaction revenue over the next 12

months

31% 19% 13% 13% 7%

9%

29% 17% 13% 13% 8% 10%

6.033

6.238

6.182

6.918

6.483

6.806

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Q2-22 Revenue

3-year CAGR of 16% at spot and 22% excluding eBay

Total Revenue ($B)

Y/Y Growth

FXN Y/Y Growth

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 17

Total Expenses

($M)

Volume-based

Expenses

(1)

($M)

Non-transaction

Related Expenses

(2)

($M)

GAAP and Non-GAAP Operating Margin

4,584

5,504

Q2-21 Q2-22

2,693

3,492

Q2-21 Q2-22

1,891

2,012

Q2-21 Q2-22

Y/Y Growth

21.4% 20.1% 18.0% 29.7% 26.7% 6.4%

% of Revenue

73.5% 80.9% 43.2% 51.3% 30.3% 29.6%

8.6%

18.1%

17.9%

15.7%

17.3%

18.1%

16.9%

15.2%

11.0%

11.2%

19.7%

28.2%

27.2%

24.7%

27.7%

26.5%

23.8%

21.8%

20.7%

19.1%

Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Non-GAAP Operating Margin

GAAP Operating Margin

Q2-22 Non-GAAP Expense Detail

Non-GAAP operating margin of 19.1%

Non-GAAP operating margin and expenses presented on a non-GAAP basis are non-GAAP financial measures. Please see the Supplemental Information for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

(1) Volume-based expenses include transaction expense and transaction and credit losses.

(2) Non-transaction related expenses include customer support & operations, sales & marketing, technology & development, and general & administrative.

• Volume-based expenses grew 29.7%, resulting from increased funding costs driven by volume and funding mix (unbranded processing

growth), and lapping the release of $156 million dollars of credit reserves in Q2-21

• Non-transaction related expenses grew 6.4%, representing 29.6% of revenue, an improvement of ~80bps from Q2-21, driven by an increased

focus on cost control with leverage across sales and marketing and customer support and operations, partially offsetting deleverage on

technology and development spend

• Non-GAAP operating margin of 19.1%, contracting ~740bps vs. non-GAAP operating margin performance in Q2-21 of 26.5%, driven primarily by

higher transaction expense rate from volume mix (unbranded processing growth) as well as lapping the release of credit reserves in Q2-21 and

increased investment in technology and development

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 18

• Non-GAAP EPS declined $0.22 relative to Q2-21,

which includes impacts from:

◦ ~$0.11 headwind from lower eBay transaction

margin dollars

◦ Lapping ~$0.11 benefit from release of credit loss

reserves in Q2-21

• In addition to the eBay (~$0.11) and lapping (~$0.11)

headwinds, Q2-22 GAAP EPS of ($0.29) also includes

a negative impact of ~$0.37 associated with a

discrete tax charge related to acquired intellectual

property and a net negative impact of ~$0.65 related

to PayPal’s strategic investment portfolio

◦ In Q2-22, GAAP EPS includes a net loss of

~$0.45 related to strategic investments

◦ In Q2-21, GAAP EPS included a net gain of

~$0.20 related to strategic investments

Non-GAAP EPS

$0.66

$1.07 $1.07

$1.08

$1.22

$1.15

$1.11

$1.11

$0.88

$0.93

Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Q2-22 EPS

Non-GAAP EPS of $0.93, down 19% y/y and 3-year CAGR of 9%

Non-GAAP EPS is a non-GAAP financial measure. Please see the Supplemental Information for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 19

• Free Cash Flow (FCF) of $1.3billion, increasing

22%, driven by higher cash earnings and

favorable changes in working capital relative to

Q2-21

• In Q2-22, for every $1 of revenue, PayPal

generated 19 cents of FCF

• $15.6 billion in cash and cash equivalents ($4.6B),

short-term ($4.7B) and long-term investments

($6.3B)

• Long-term debt of ~$10.2 billion, and short-term

debt of ~$400 million as of June30, 2022

◦ Long-term debt includes $3.0 billion of

issuance in May 2022. Approximately $1.6

billion in proceeds used to redeem

maturities coming due in September 2022

and June 2023

Free Cash Flow

($M)

Free cash flow is a non-GAAP financial measure. Please see the Supplemental Information for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

1,537

1,059

1,286

1,550

1,051

1,291

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

25% 17% 21% 22% 16% 19%

4% 4% 4% 3% 3% 3%

Q2-22 Free Cash Flow

FCF of $1.3 billion, 22% increase

% of

Revenue

FCF

Capex

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 20

Capital Allocation ($B)

• Generated ~$26 billion in FCF since becoming an independent company in July 2015

• In Q2-22, returned $750 million in capital to stockholders by repurchasing ~8 million shares at an average price of $98.71 per share

• Since separation, allocated $14.2 billion to share repurchases and $12.9 billion to acquisitions and investments

• PayPal Board of Directors recently approved a new $15 billion share repurchase authorization, which combined with $2.8 billion

remaining on the 2018 authorization, brings PayPal’s aggregate outstanding authorization to nearly $18 billion

0.4

2.8

1.3

3.8

3.1

0.21.0

1.0

3.5

1.4

1.6

3.4

2.3

0.7

0.7

0.8

0.7

0.9

0.9

0.4

Acquisitions & Strategic Investments Stock Repurchases Capex

2016 2017 2018 2019 2020 2021 2022 YTD

Q2-22 Capital Allocation

Free cash flow is a non-GAAP financial measure. Please see the Supplemental Information for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 21

Net Revenue ($B)

~$27.85

Net Revenue Growth

(FXN)

~11%

Non-GAAP EPS

~$3.87-$3.97

Free Cash Flow ($B)

>$5.0

• GAAP EPS: ~$1.52-$1.62

• Non-GAAP effective tax rate: ~16%-18%

• Capex: ~3% of revenue

FY-22 Guidance

Raising expected non-GAAP EPS to ~$3.87-$3.97

• TPV: Expect TPV growth of ~12% at spot and ~16% FXN

• Revenue: Expect revenue growth of ~10% at spot and ~11% FXN, the

low end of the prior currency-neutral guidance

◦ Revenue growth expected to accelerate each quarter, targeting

~14% FXN growth in Q4

◦ Includes an expected eBay revenue decline of ~$750M (H1-22

decline of ~$625M, with ~$125M expected in H2-22)

◦ Excluding eBay, revenue expected to grow ~13.5% at spot and

~14.5% FXN

• Non-GAAP Operating Margin: Expect op margin of at least ~20%, with

the high end of the non-GAAP EPS range contemplating 20.5% and

expansion in Q4-22

◦ Outlook incorporates ~$900M of savings across transactional and

non-transactional operating expenses

• Non-GAAP EPS: Raising expected range to ~$3.87-$3.97, compared to

$4.60 in FY-21

◦ In FY-21, GAAP and non-GAAP EPS included a benefit of ~$0.21

from the release of credit loss reserves

• NNAs: Expect to add ~10 million NNAs

• Share Repurchases: Expected to reach ~$4.0B

Non-GAAP EPS, non-GAAP operating margin and free cash flow are non-GAAP financial measures. Please see the Supplemental Information for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 22

Net Revenue ($B)

~$6.80

Net Revenue Growth

(FXN)

~12%

Non-GAAP EPS

~$0.94-$0.96

Q3-22 Guidance

• Revenue: Expect revenue growth of ~10% at spot and ~12% FXN to

~$6.80B

◦ Excluding eBay, revenue expected to grow ~12% at spot and

~13.5% FXN

◦ Includes 150 bps headwind from revenue attributable to the

Paycheck Protection Program recognized in Q3-21

(1)

• EPS: Expect GAAP EPS in the range of ~$0.61-$0.63, compared to

$0.92 in the prior year period, and non-GAAP EPS in the range of

~$0.94-$0.96, compared to $1.11 in the prior year period

◦ In the third quarter of 2021, GAAP EPS included a net gain of

~$0.13 relating to PayPal’s strategic investment portfolio

◦ In the third quarter of 2021, GAAP EPS and non-GAAP EPS

included ~$0.04 from release of credit loss reserves

◦ GAAP EPS guidance does not include any expectation of net

realized and unrealized gains and losses on PayPal’s strategic

investment portfolio

Revenue growth expected to accelerate to ~12% FXN

Non-GAAP EPS is a non-GAAP financial measure. Please see the Supplemental Information for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

(1) In Q3-21, Other Value Added Services benefited from revenue associated with U.S. Small Business Association Paycheck Protection Program (PPP) loan forgiveness and extinguishment of a portion of servicing obligations with respect to PPP loans

Supplemental

Information

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 24

• 45% of active accounts were outside the

U.S. as of June30, 2022

• Average Payment Volume (APV) was $62,

down 6% y/y, driven primarily by higher

Braintree mix

• Total take rate was flat year over year.

Benefits from FX hedge gains, P2P mix and

Venmo helped offset pressure from lower

FX fees and lower eBay volume/yield (3bps

drag)

◦ Relative to Q1-22, Braintree accounted for

less pressure primarily due to volume mix

and OVAS was a larger benefit

◦ eBay volumes declined 39% and eBay

take rate in Q2-22 was 2.13% vs. 3.22% in

Q2-21

• Transaction expense rate increase of ~8bps

year over year driven primarily by volume

mix (e.g., unbranded share gain) and funding

mix effects

(1) Definitions included in Supplemental Information.

*

(in millions, except %) Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Active Accounts 392 403 416 426 429 429

Y/Y Growth 21% 16% 15% 13% 9% 6%

Net New Active Acounts 14.5 11.4 13.3 9.8 2.4 0.4

Number of Payment Transactions 4,371 4,735 4,900 5,343 5,161 5,513

Y/Y Growth 34% 27% 22% 21% 18% 16%

Total Payment Volume $285,447 $310,992 $309,910 $339,530 $322,981 $339,791

Y/Y Growth 50% 40% 26% 23% 13% 9%

FXN Y/Y Growth 46% 36% 24% 23% 15% 13%

US TPV

$171,124 $188,506 $192,428 $211,323 $207,845 $219,307

Y/Y Growth

46% 42% 29% 30% 21% 16%

International TPV $114,323 $122,486 $117,482 $128,207 $115,136 $120,484

Y/Y Growth

56% 38% 21% 12% 1%

(2)%

FXN Y/Y Growth

45% 26% 18% 14% 5%

8%

Total Take Rate

2.11% 2.01% 1.99% 2.04% 2.01% 2.00%

Transaction Take Rate

1.97% 1.86% 1.81% 1.88% 1.86% 1.85%

Transaction Expense Rate 0.80% 0.81% 0.83% 0.87% 0.87% 0.90%

Transaction and Credit Loss Rate 0.10% 0.05% 0.09% 0.10% 0.11% 0.13%

Transaction Margin 57.8% 56.8% 54.2% 52.3% 50.9% 48.7%

Q2-22 PayPal Metrics

(1)

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 25

Q2-22 Financial Detail

(1) Non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, non-GAAP EPS, and free cash flow are non-GAAP financial measures. Please see the Supplemental Information for a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measures.

*

(in millions, except %) Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Transaction Revenue

$5,621 $5,797 $5,607 $6,377 $5,998 $6,272

Y/Y Growth

33% 17% 10% 12% 7% 8%

Other Value Added Services (OVAS)

$412 $441 $575 $541 $485 $534

Y/Y Growth

2% 40% 50% 25% 18% 21%

Total Revenue

$6,033 $6,238 $6,182 $6,918 $6,483 $6,806

Y/Y Growth

31% 19% 13% 13% 7% 9%

FXN Y/Y Growth

29% 17% 13% 13% 8% 10%

US Revenue Y/Y Growth 24%

23% 23% 27% 20% 18%

International Revenue FXN Y/Y Growth

35% 10% 2% (1%) (5%) 1%

% International

49% 48% 44% 44% 43% 43%

Volume-based expenses $2,548 $2,693 $2,832 $3,302 $3,186 $3,492

Non-transaction related expenses $1,812 $1,891 $1,880 $2,109 $1,954 $2,012

Total Operating Expenses

(1)

$4,360 $4,584 $4,712 $5,411 $5,140 $5,504

Y/Y Growth 18% 21% 19% 17% 18% 20%

Non-GAAP Op. Income

(1)

$1,673 $1,654 $1,470 $1,507 $1,343 $1,302

Non-GAAP Op. Margin %

(1)

28% 27% 24% 22% 21% 19%

Non-GAAP EPS

(1)

$1.22 $1.15 $1.11 $1.11 $0.88 $0.93

Y/Y Growth 84% 8% 4% 4% (28)% (19)%

CAPEX

$221 $247 $227 $213 $191 $175

Free Cash Flow

(1)

$1,537 $1,059 $1,286 $1,550 $1,051 $1,291

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 26

(in millions, except %)

Q1-21 Q2-21 Q3-21 Q4-21 Q1-22 Q2-22

Hedging Impacts

(1)

Favorable (unfavorable) impact to net revenues (exclusive of

hedging impact)

$ 190 $ 237 $ 61 $ (48) $ (123) $ (242)

Hedging impact

(59) (89) (44) 2 47 107

Favorable (unfavorable) impact to net revenues

131 148 17 (46) (76) (135)

Favorable (unfavorable) impact to operating expense

(73) (101) (29) 22 57 131

Net favorable (unfavorable) impact to operating income

$ 58 $ 47 $ (12) $ (24) $ (19) $ (4)

Credit net charge-offs, reserve builds (releases) and credit

losses

Net charge-offs

(2)

$ 76 $ 52 $ 38 $ 53 $ 52 $ 60

Reserve build (release)

(3)

(84) (156) (63) (9) (5) 8

Credit Losses

$ (8) $ (104) $ (25) $ 44 $ 47 $ 68

(1) Foreign currency movements relative to the US dollar. We calculate the year-over-year impact of foreign currency movements on our business using prior period foreign currency exchange rates applied to

current period transactional currency amounts.

(2) Net charge-offs includes the principal charge-offs partially offset by recoveries for consumer and merchant receivables.

(3) Reserve build (release) represents change in allowance for principal receivables excluding foreign currency remeasurement.

Q2-22 Hedging impacts and credit reserve builds and releases

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 27

Reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses

Three Months Ended

Year Ended December 31,

(In Millions/Unaudited) Note

June 30,

2022

March 31,

2022

December 31,

2021

September 30,

2021

June 30,

2021

March 31,

2021

December 31,

2020

September 30,

2020

June 30,

2020

March 31,

2020

2021 2020 2019

GAAP operating expenses:

Transaction expense

$ 3,044

$ 2,817

$ 2,952

$ 2,564

$ 2,524

$ 2,275

$ 2,330

$ 2,022

$ 1,843

$ 1,739

$ 10,315

$ 7,934

$ 6,790

Transaction and credit losses

448

369

350

268

169

273

366

344

440

591

1,060

1,741

1,380

Customer support and

operations

536 534 532 504 521 518 507 449 423 399 2,075 1,778 1,615

Sales and marketing

595

594

666

549

628

602

605

471

414

371

2,445

1,861

1,401

Technology and development

815

815

796

755

746

741

732

674

631

605

3,038

2,642

2,085

General administrative

514

607

570

498

522

524

569

503

512

486

2,114

2,070

1,711

Restructuring and other changes 90 36 2 1 1 58 44 19 47 29 62 139 71

Total operating expenses

$ 6,042

$ 5,772

$ 5,868

$ 5,139

$ 5,111

$ 4,991

$ 5,153

$ 4,482

$ 4,310

$ 4,220

$ 21,109

$ 18,165

$ 15,053

Non-GAAP operating expense

adjustments:

Customer support and operations

(a)

(67)

(73)

(58)

(56)

(77)

(72)

(71)

(63)

(64)

(52)

(263)

(250)

(198)

(b)

—

(6)

(2)

(1)

(3)

(16)

(1)

—

(1)

(7)

(22)

(9)

(9)

Sales and marketing

(a)

(42)

(45)

(41)

(38)

(48)

(48)

(41)

(45)

(47)

(39)

(175)

(172)

(127)

(b) (1) (5) (1) (2) (5) (13) (1) (1) (3) (7) (21) (12) (12)

(c)

(53)

(53)

(51)

(39)

(39)

(38)

(40)

(43)

(44)

(43)

(167)

(170)

(135)

Technology and development

(a)

(129)

(136)

(112)

(117)

(147)

(139)

(145)

(138)

(133)

(113)

(515)

(529)

(420)

(b)

(1)

(12)

(2)

—

(5)

(34)

(2)

(1)

(1)

(17)

(41)

(21)

(17)

(c) (59) (57) (58) (64) (63) (61) (61) (63) (64) (64) (246) (252) (75)

General administrative

(a)

(88)

(188)

(120)

(100)

(129)

(119)

(130)

(127)

(116)

(87)

(468)

(460)

(305)

(b)

(1)

(14)

(3)

(2)

(3)

(26)

(4)

(1)

—

(14)

(34)

(19)

(16)

(c) (7) (7) (7) (7) (7) (7) (7) (7) (7) (7) (28) (28) (1)

(e)

—

—

—

—

—

—

—

—

—

(20)

—

(20)

(3)

(g)

—

—

—

—

—

—

—

—

(7)

(11)

—

(18)

(23)

Restructuring and other charges

(d)

(71)

(20)

—

—

5

(32)

(35)

(19)

(26)

(29)

(27)

(109)

(78)

(f) — — — — — — — — — — — — 7

(h)

(19)

(16)

(2)

(1)

(6)

(26)

(9)

—

(21)

—

(35)

(30)

—

Total operating expenses

$ (538)

$ (632)

$ (457)

$ (427)

$ (527)

$ (631)

$ (547)

$ (508)

$ (534)

$ (510)

$ (2,042)

$ (2,099)

$ (1,412)

Non-GAAP operating expenses:

Transaction expense

3,044

2,817

2,952

2,564

2,524

2,275

2,330

2,022

1,843

1,739

$ 10,315

$ 7,934

$ 6,790

Transaction and credit losses

448

369

350

268

169

273

366

344

440

591

1,060

1,741

1,380

Customer support and

operations

469 455 472 447 441 430 435 386 358 340 1,790 1,519 1,408

Sales and marketing 499 491 573 470 536 503 523 382 320 282 2,082 1,507 1,127

Technology and development

626

610

624

574

531

507

524

472

433

411

2,236

1,840

1,573

General and administrative

418

398

440

389

383

372

428

368

382

347

1,584

1,525

1,363

Total operating expenses

$ 5,504

$ 5,140

$ 5,411

$ 4,712

$ 4,584

$ 4,360

$ 4,606

$ 3,974

$ 3,776

$ 3,710

$ 19,067

$ 16,066

$ 13,641

(a) Stock-based compensation expense.

(b) Employer payroll taxes on stock-

based compensation.

(c) Amortization and impairment of

acquired intangible assets.

(d) Restructuring.

(e) Acquisition related transaction

expense.

(f) Net gain related to the sale of our U.S.

Consumer Credit receivables

portfolio.

(g) Award for a legal proceeding and

expenses related to pre-acquisition

contingencies of an acquired

company.

(h) Asset impairment charges for right-of-

use lease assets and related leasehold

improvements in conjunction with

exiting certain leased properties,

charges associated with early lease

termination, and a charge associated

with exiting a leased property.

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 28

Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin

Three Months Ended Year Ended December 31,

(In Millions, Except Percentages/Unaudited)

June 30,

2022

March 31,

2022

December 31,

2021

September 30,

2021

June 30,

2021

March 31,

2021

December 31,

2020

September 30,

2020

June 30,

2020

March 31,

2020

2021 2020 2019

GAAP net revenues $ 6,806 $ 6,483 $ 6,918 $ 6,182 $ 6,238 $ 6,033 $ 6,116 $ 5,459 $ 5,261 $ 4,618 $ 25,371 $ 21,454 $ 17,772

GAAP operating income 764 711 1,050 1,043 1,127 1,042 963 977 951 398 4,262 3,289 2,719

Stock-based compensation expense and

related employer payroll taxes 329 479 339 316 417 467 395 376 365 336 1,539 1,472 1,104

Amortization of acquired intangible assets 119 117 116 110 109 106 108 113 115 114 441 450 211

Restructuring 71 20 — — (5) 32 35 19 26 29 27 109 78

Other 19 16 2 1 6 26 9 — 28 11 35 48 16

Acquisition related transaction expense — — — — — — — — — 20 — 20 3

Total non-GAAP operating income adjustments 538 632 457 427 527 631 547 508 534 510 2,042 2,099 1,412

Non-GAAP operating income $ 1,302 $ 1,343 $ 1,507 $ 1,470 $ 1,654 $ 1,673 $ 1,510 $ 1,485 $ 1,485 $ 908 $ 6,304 $ 5,388 $ 4,131

GAAP operating margin 11.2 % 11.0 % 15.2 % 16.9 % 18.1 % 17.3 % 15.7 % 17.9 % 18.1 % 8.6 % 16.8 % 15.3 % 15.3 %

Non-GAAP operating margin 19.1 % 20.7 % 21.8 % 23.8 % 26.5 % 27.7 % 24.7 % 27.2 % 28.2 % 19.7 % 24.8 % 25.1 % 23.2 %

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 29

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Net Income, GAAP Diluted EPS to

Non-GAAP Diluted EPS, and GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate

Three Months Ended Year Ended December 31,

(In Millions, Except Percentages and Per Share

Amount/Unaudited)

June 30,

2022

March 31,

2022

December 31,

2021

September 30,

2021

June 30,

2021

March 31,

2021

December 31,

2020

September 30,

2020

June 30,

2020

March 31,

2020

2021 2020 2019

GAAP income before income taxes $ 49 $ 629 $ 706 $ 1,165 $ 1,356 $ 872 $ 1,859 $ 1,144 $ 1,799 $ 263 $ 4,099 $ 5,065 $ 2,998

GAAP income tax expense (benefit) 390 120 (95) 78 172 (225) 292 123 269 179 (70) 863 539

GAAP net income (loss) (341) 509 801 1,087 1,184 1,097 1,567 1,021 1,530 84 4,169 4,202 2,459

Non-GAAP adjustments to net income:

Non-GAAP operating income adjustments (see

table above)

538 632 457 427 527 631 547 508 534 510 2,042 2,099 1,412

(Gains) losses on strategic investments 672 (14) 290 (173) (283) 120 (941) (209) (888) 124 (46) (1,914) (208)

Other certain significant gains, losses, or charges 431 — — 43 (7) — — — (17) 259 36 242 230

Tax effect of non-GAAP adjustments (221) (95) (229) (65) (59) (393) 108 (45) 104 (191) (746) (24) (371)

Non-GAAP net income $ 1,079 $ 1,032 $ 1,319 $ 1,319 $ 1,362 $ 1,455 $ 1,281 $ 1,275 $ 1,263 $ 786 $ 5,455 $ 4,605 $ 3,522

Shares used in diluted share calculation:

GAAP 1,158 1,172 1,183 1,187 1,186 1,190 1,191 1,190 1,184 1,185 1,186 1,187 1,188

Non-GAAP 1,160 1,172 1,183 1,187 1,186 1,190 1,191 1,190 1,184 1,185

1,186 1,187 1,188

Net income (loss) per diluted share:

GAAP $ (0.29) $ 0.43 $ 0.68 $ 0.92 $ 1.00 $ 0.92 $ 1.32 $ 0.86 $ 1.29 $ 0.07 $ 3.52 $ 3.54 $ 2.07

Non-GAAP $ 0.93 $ 0.88 $ 1.11 $ 1.11 $ 1.15 $ 1.22 $ 1.08 $ 1.07 $ 1.07 $ 0.66 $ 4.60 $ 3.88 $ 2.96

GAAP effective tax rate 796 % 19 % (13) % 7 % 13 % (26) % 16 % 11 % 15 % 68 % (2) % 17 % 18 %

Tax effect of non-GAAP adjustments to net income (782) % (2) % 22 % — % 2 % 36 % (3) % 1 % (2) % (56) % 13 % (5) % (2) %

Non-GAAP effective tax rate 14 % 17 % 9 % 7 % 15 % 10 % 13 % 12 % 13 % 12 % 11 % 12 % 16 %

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 30

Reconciliation of Operating Cash Flow to Free Cash Flow

Three Months Ended Year Ended December 31,

(In Millions/Unaudited)

June 30,

2022

March 31,

2022

December 31,

2021

September 30,

2021

June 30,

2021

March 31,

2021

December 31,

2020

September 30,

2020

June 30,

2020

March 31,

2020

2021 2020 2019 2015

Net cash provided by operating

activities

$ 1,466 $ 1,242 $ 1,763 $ 1,513 $ 1,306 $ 1,758 $ 1,347 $ 1,314 $ 1,772 $ 1,421 $ 6,340 $ 5,854 $ 4,071 $ 2,546

Less: Purchases of property and

equipment

(175) (191) (213) (227) (247) (221) (226) (241) (193) (206) (908) (866) (704) (722)

Free cash flow 1,291 1,051 1,550 1,286 1,059 1,537 1,121 1,073 1,579 1,215 5,432 4,988 3,367 1,824

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 31

Q3-22 and FY-22 GAAP and Non-GAAP Guidance

Three Months Ending

September 30, 2022

GAAP

Non-GAAP

(a)

Revenue Growth Rate (Spot) ~10% ~10%

Revenue Growth Rate (FXN) N/A ~12%

Diluted EPS $ ~$0.61-$0.63 ~$0.94-$0.96

Twelve Months Ending

December 31, 2022

GAAP

Non-GAAP

(b)

Revenue Growth Rate (Spot) ~10% ~10%

Revenue Growth Rate (FXN) N/A ~11%

Diluted EPS $ ~$1.52-$1.62 ~$3.87-$3.97

(a) Estimated non-GAAP amounts for the three

months ended September 30, 2022, reflect

adjustments of approximately $450 million,

primarily representing estimated stock-

based compensation expense and related

payroll taxes of approximately $320 million

(b) Estimated non-GAAP amounts for the

twelve months ended December 31, 2022,

reflect adjustments of approximately $2.1

billion, primarily representing estimated

stock-based compensation expense and

related payroll taxes of approximately $1.5

billion

©2022 PayPal Holdings, Inc.

Q2-22 Investor Update • 32

Definitions

Our key metrics are calculated using internal company data based on the activity we measure on our platform and may be compiled from multiple systems, including

systems that are organically developed or acquired through business combinations. While the measurement of our key metrics is based on what we believe to be

reasonable methodologies and estimates, there are inherent challenges and limitations in measuring our key metrics globally at our scale. The methodologies used to

calculate our key metrics require judgment.

We regularly review our processes for calculating these key metrics, and from time to time we may make adjustments to improve their accuracy or relevance. For

example, we continuously apply models, processes and practices designed to detect and prevent fraudulent account creation on our platforms, and work to improve

and enhance those capabilities. When we detect a significant volume of illegitimate activity, we generally remove the activity identified from our key metrics.

Although such adjustments may impact key metrics reported in prior periods, we generally do not update previously reported key metrics to reflect these subsequent

adjustments unless the retrospective impact of process improvements or enhancements is determined by management to be material.

Active Accounts: An active account is an account registered directly with PayPal or a platform access partner that has completed a transaction on our platform, not

including gateway-exclusive transactions, within the past 12 months. A platform access partner is a third party whose customers are provided access to PayPal’s

platform or services through such third party’s login credentials, including entities that utilize Hyperwallet’s payout capabilities. A user may register on our platform to

access different products and may register more than one account to access a product. Accordingly, a user may have more than one active account. The number of

active accounts provides management with additional perspective on the overall scale of our platform, but may not have a direct relationship to our operating results.

Daily Active Accounts: Daily Active Accounts “DAA” represent the number of Active Accounts that have completed a transaction using our core PayPal payments

products and services, including person-to-person payments transfers and checkout transactions, on a given day. DAA is presented as the average daily active

accounts during the designated period.

Number of Payment Transactions: Number of payment transactions are the total number of payments, net of payment reversals, successfully completed on our

payments platform or enabled by PayPal via a partner payment solution, not including gateway-exclusive transactions.

Number of Payment Transactions per Active Account: Number of payment transactions per active account or “TPA” reflects the total number of payment

transactions within the previous 12-month period, divided by active accounts at the end of the period. The number of payment transactions per active account

provides management with insight into the average number of times an account engages in payments activity on our payments platform in a given period.

Total Payment Volume: Total Payment Volume or “TPV” is the value of payments, net of payment reversals, successfully completed on our payments platform, or

enabled by PayPal via a partner payment solution, not including gateway-exclusive transactions.

Total Take Rate: Total take rate is total revenue divided by TPV.

Transaction Take Rate: Transaction take rate is transaction revenue divided by TPV.

Transaction Expense Rate: Transaction expense rate is transaction expense divided by TPV.

Transaction and Credit Loss Rate: Transaction and credit loss rate is transaction and credit losses divided by TPV.

Transaction Margin: Transaction margin is total revenue less transaction expense and transaction and credit losses, divided by total revenue.