J.P. Morgan Wealth Management

408(b)(2) Fee Disclosure Statement for Retirement Plans

covered under the Employee Retirement Income Security Act of 1974 (ERISA)

Dated July 2024

INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY,

JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS

OF THE PRINCIPAL AMOUNT INVESTED

Page | 2

CONTENTS

GENERAL/BACKGROUND ......................................................................................................................................................................................... 3

SERVICES PROVIDED ................................................................................................................................................................................................ 3

Brokerage Accounts .............................................................................................................................................................................. 3

Investment Advisory Accounts .............................................................................................................................................................. 3

COMPENSATION ...................................................................................................................................................................................................... 3

FIDUCIARY/INVESTMENT ADVISORY STATUS ........................................................................................................................................................... 4

Status Under ERISA ............................................................................................................................................................................... 4

Status Under The Investment Advisers Act of 1940 and State Law ........................................................................................................ 4

CHANGES ................................................................................................................................................................................................................. 4

CONTACTS ............................................................................................................................................................................................................... 4

FEE DISCLOSURES ..................................................................................................................................................................................................... 5

Brokerage Accounts .............................................................................................................................................................................. 5

Investment Advisory Accounts .............................................................................................................................................................. 7

Miscellaneous Account and Administrative Fees ................................................................................................................................... 8

OTHER IMPORTANT INFORMATION ......................................................................................................................................................................... 9

DISCLOSURE ARRANGEMENTS WITH PAYERS OF INDIRECT COMPENSATION............................................................................................................ 9

Compensation JPMS Receives From Mutual Fund Companies ............................................................................................................... 9

Distribution And/Or Service 12b-1 (Service/12b-1) Fees .............................................................................................................. 9

Administrative Servicing/Recordkeeping Fees ............................................................................................................................. 9

Compensation JPMS Receives From Money Market Fund Companies ................................................................................................... 9

12b-1 Distribution Fees ................................................................................................................................................................ 9

Servicing And Administrative Fees ............................................................................................................................................. 10

Revenue Sharing ........................................................................................................................................................................ 10

Waivers ............................................................................................................................................................................................... 10

Compensation JPMS Receives From Alternative Investments .............................................................................................................. 11

FLOAT .................................................................................................................................................................................................................... 11

NONMONETARY COMPENSATION & SUBSIDES ...................................................................................................................................................... 11

EXTERNAL SOURCES ............................................................................................................................................................................................... 12

NO TAX/LEGAL ADVICE .......................................................................................................................................................................................... 12

PRODUCT EXPENSES .............................................................................................................................................................................................. 12

AFFILIATED PRODUCTS ........................................................................................................................................................................................... 12

RECORDKEEPING AND BROKERAGE SERVICES ........................................................................................................................................................ 12

COMPENSATION FOR TERMINATION OF CONTRACT OR ARRANGEMENT ............................................................................................................... 13

ORDER FLOW, ECNS, TRADING CENTERS ................................................................................................................................................................ 13

REQUESTS FOR ADDITIONAL INFORMATION .......................................................................................................................................................... 13

NO OFFER OR SOLICITATION .................................................................................................................................................................................. 14

APPENDIX A - COMMISSIONS ................................................................................................................................................................................. 15

APPENDIX B - CHANGES AND UPDATES .................................................................................................................................................................. 16

Page | 3

GENERAL/BACKGROUND

This Disclosure Statement contains information about the services that J.P. Morgan Securities LLC (“JPMS”) offers to your retirement

plan, as well as the compensation JPMS and its affiliates reasonably expect to receive with regard to those services. The information

is being provided to you, as a retirement plan fiduciary, in connection with the Department of Labor’s regulation (the “Regulation”)

under section 408(b)(2) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and is intended to assist

you in determining the reasonableness of your plan’s contracts or arrangements with JPMS, including the reasonableness of JPMS’s

compensation, and potential conflicts of interest. Please carefully review this information.

SERVICES PROVIDED

Disclosures contained herein apply to the “covered services” provided by JPMS and/or JPMorgan Chase Bank, N.A. (“JPMCB NA”), as

applicable, which are affiliates of JPMorgan Chase & Co. (We refer to JPMS, JPMCB NA, J.P. Morgan Chase & Co. and their affiliates

collectively as “J.P. Morgan.”) Such services are fully described in the agreements entered into and other related documentation you

receive at the time you open the plan’s account(s) (and any amendments you may receive thereafter), as referenced below. Of

course, you may request another copy of these agreements (and amendments) at any time.

Brokerage Accounts

JPMS provides brokerage services (in both “Self-Directed Investing” and “Full Service” brokerage accounts) to retirement plans as

described in the J.P. Morgan Self-Directed Investing Disclosures & Brokerage Account Agreement (for Self-Directed Investing

accounts) or in the J.P. Morgan Securities Customer Agreement (for Full Service brokerage accounts), as applicable, and handles the

brokerage and related functions for your account. This may include but is not limited to holding securities and cash, executing,

clearing and settling transactions, collecting and processing dividends, issuing buy and sell confirmations and client statements and

looking after the various details incidental to the clearing and carrying of brokerage accounts. Unless you have specified otherwise,

JPMS will act as custodian of the property in these brokerage accounts. For additional information regarding the services JPMS

provides with respect to brokerage accounts, please refer to your account agreement or other applicable service-related documents,

any of which may be amended from time to time. You may request additional copies of these agreements or other documents at

any time.

Under certain limited situations specific to Alternative Investments, JPMS provides custody services through JPMCB NA, as described

in the Custody Agreement, sometimes referred to as “Accounts And Services Relating To Assets Held By JPMorgan Chase Bank, N.A.

And Affiliated Banks,” which is part of the Combined Terms and Conditions. Pursuant to that agreement, such services generally

include recording, on our books, the plan’s interest in property that JPMCB NA holds directly or indirectly for the account as

custodial agent. JPMCB NA may also make purchases, sales, and deliveries in accordance with instructions given by the plan sponsor.

Investment Advisory Accounts

JPMS offers a number of non-discretionary and discretionary investment advisory programs (“Programs”) to its retirement plan

clients, including the Strategic Investment Services Program (“STRATIS”), the Investment Counseling Service Program (“ICS”), the

Unified Managed Account Program (“UMA”), the Portfolio Advisor Program (“PA”), the Portfolio Manager Program (“PM”), the J.P.

Morgan Core Advisory Portfolio Program (“JPMCAP”), and the Customized Bond Portfolios Program (“CBP”). Full details of the

services that JPMS provides in connection with the Programs, and the fees associated with the Programs, are provided in the client

agreement and Form ADV Disclosure Brochure (“Program Brochure”). Current copies of the Program Brochure are available free of

charge online at https://www.jpmorgan.com/wealth-management/wealth-partners/securities/adv

or from your J.P. Morgan Wealth

Advisors and J.P. Morgan Wealth Partners (collectively, “advisors”).

Information regarding the specific fees payable by your plan to JPMS for these services is available on your account statements. Your

advisor can provide your plan’s specific Program fee information or a copy of the client agreement at any time.

COMPENSATION

Under the Regulation, we are required to disclose so-called “direct compensation” JPMS or its affiliates receives from your plan. We

are also required to disclose “indirect compensation,” which is generally defined to include compensation JPMS or its affiliates

receive from any source other than your covered plan or the plan sponsor. For example, JPMS or its affiliates may earn indirect

compensation from clients’ investments in mutual funds, or through arrangements with investment managers and other service

Page | 4

providers (including investment managers and service providers that are affiliated with JPMS). JPMS may receive such indirect

compensation in connection with the applicable services described herein and in the plan’s account agreements, as indicated above.

The sections below describe the compensation that may be earned in connection with various services and investments that JPMS

may make available to retirement plan clients through brokerage and investment advisory accounts.

FIDUCIARY/INVESTMENT ADVISORY STATUS

Status Under ERISA

JPMS provides services as a fiduciary under ERISA in each of the Programs, as described in the relevant investment advisory program

documents that clients receive before opening an investment advisory account with JPMS (as amended from time to time). Similarly,

whether or not any third-party portfolio managers (which may include affiliates of JPMS) available in the STRATIS, ICS, UMA, PA, PM,

JPMCAP and CBP programs are providing any services as a fiduciary under ERISA is described in the relevant program client

agreement (as amended) and/or your direct agreement with such manager (if applicable). Pursuant to certain arrangements

between JPMS and any third-party portfolio managers (which may include affiliates of JPMS), such portfolio managers may also be

required to notify you directly if they are providing services to your plan as an ERISA fiduciary.

Furthermore, when we provide “investment advice” to you regarding your qualified retirement plan account(s) (within the

meaning of ERISA) outside of the investment advisory programs referenced above, we are fiduciaries under that law governing

such accounts. The way we make money creates some conflicts with your interests, so when providing such investment advice,

including rollover and transfer recommendations for your plan account(s) and investment recommendations for your Full

Service brokerage plan account(s), we operate under a special rule requiring us to act in your best interest and not put our

interest ahead of yours. Under this special rule’s provisions, we must:

• Meet a professional standard of care when making investment recommendations (give prudent advice) to you;

• Never put our financial interests ahead of yours when making investment recommendations (give loyal advice) to you;

• Avoid misleading statements about conflicts of interest, fees, and investments;

• Follow policies and procedures designed to ensure that we give advice that is in your best interest;

• Charge no more than what is reasonable for our services;

• Give you basic information about conflicts of interest.

On the other hand, JPMS does not act as a discretionary manager or provide investment advice (within the meaning of ERISA) in

connection with its provision of Self-Directed Investing brokerage services. Therefore, JPMS is not considered a fiduciary under ERISA

when providing such services.

Status Under the Investment Advisers Act of 1940 and State Law

JPMS is dually registered with the U.S. Securities and Exchange Commission as a broker-dealer and investment adviser. Accordingly,

JPMS acts as an investment adviser registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), in

connection with the investment advisory services it provides in its Programs (described above), but not with respect to any of the

services it provides to brokerage accounts. Similarly, all of the third-party portfolio managers (which may include affiliates of JPMS)

available in the STRATIS, ICS, UMA, PA, PM, JPMCAP and CBP programs act as investment advisers registered under the Advisers Act

in connection with the portfolio management services they provide in such programs.

CHANGES

You should expect to receive periodic notices or other communications regarding changes, if any, to the compensation and service

information described herein. Please visit the J.P. Morgan Securities Retirement Disclosures website at

https://www.jpmorgan.com/securities/legal/mutual-fund-disclosures

on a regular basis in order to view any recent changes.

CONTACTS

Please contact your advisor or other J.P. Morgan Representative to request additional information.

Page | 5

FEE DISCLOSURES

Brokerage Accounts

Unless otherwise indicated, all compensation is earned by JPMS.

To view the “direct compensation” JPMS receives on certain products or services that are available to you through:

• Self-Directed Investing accounts go to the following link: Fee and Commission Schedule

.

• Full Service brokerage accounts, please see the following table.

These disclosures reflect standard charges associated with certain products or services that may be made available to you through

your brokerage account. Note that fees and charges may vary from one account to another based on a variety of factors. All such

fees and charges are deducted from your account and are subject to change periodically.

To view the “indirect compensation” JPMS receives on certain products or services that are available to you through your brokerage

account, please see “Other Important Information,” below.

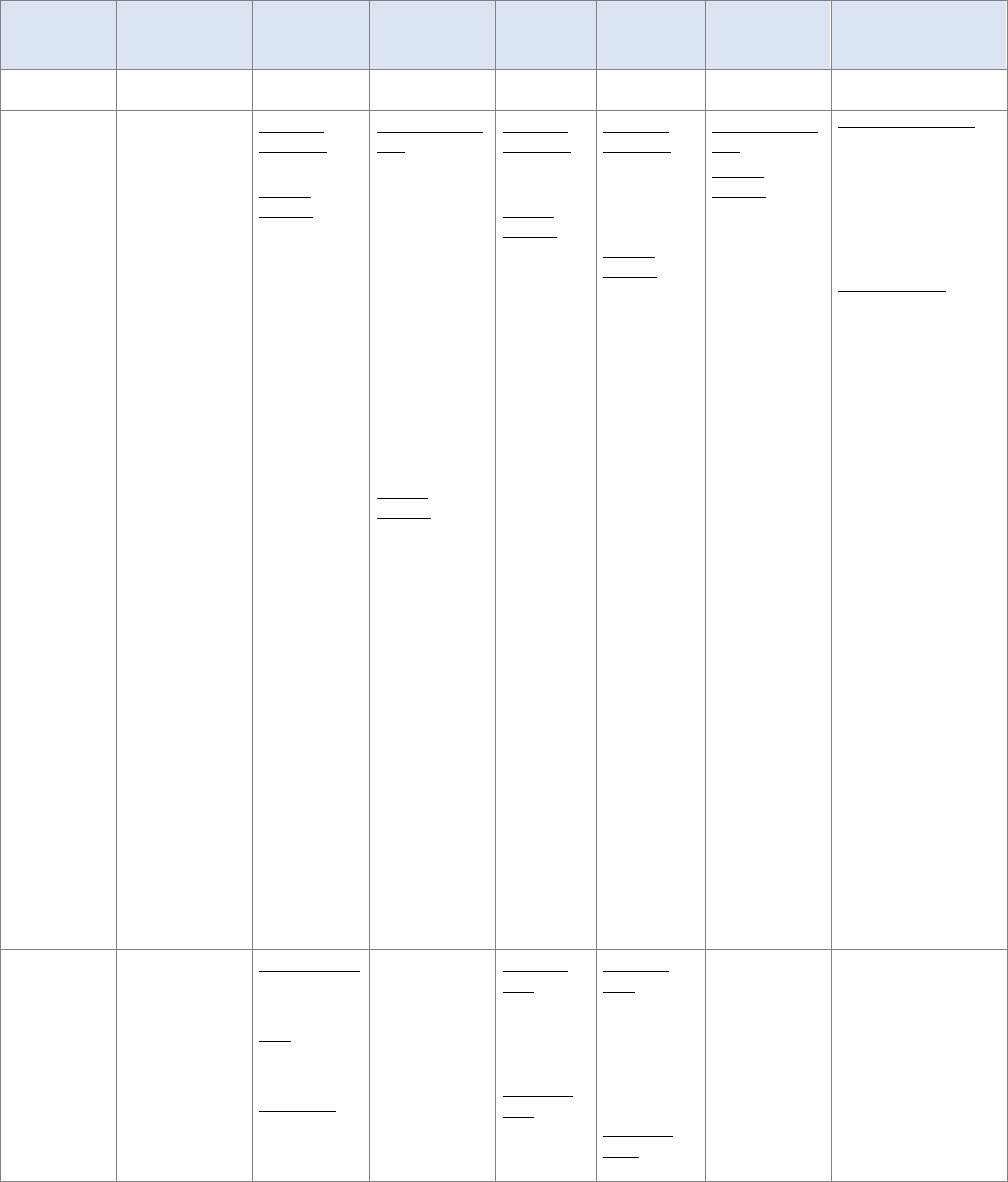

Service/

Product

Compensation

Description

Compensation

Type

Amount / Rate

Manner of

Receipt

Timing of

Payment

Payer (of

Indirect

Compensation)

Additional Disclosures

Trading

Stocks,

Exchange

Traded Funds,

Fixed Income,

Options

Commissions

(Full Service Only)

Direct See Appendix A

for Standard

Commission

Schedules

Deducted

from account

Time of

transaction

N/A Commissions reflected in

Appendix A represent the

standard rates charged to

brokerage accounts.

Please refer to your trade

confirmations or contact

your advisor for

information on the

specific rates payable at

any given point in time.

Mutual Funds –

Load Waived

(see below for

money market

funds (including

sweep funds or

direct money

market mutual

funds

purchases))

- 12b-1 Distribution

Fee

- Servicing and

Administrative Fees

Indirect See “Other

Important

Information”

below

See “Other

Important

Information”

below

12b-1

Distribution

Fee: Paid

monthly or

quarterly

Servicing and

Administrative

Fees: Paid

monthly or

quarterly

Fund distributor,

fund adviser or

other fund affiliate

See “Other Important

Information” below.

For detailed disclosures

about JPMS’s

compensation on mutual

funds, please visit the J.P.

Morgan Securities

Retirement Plan

Disclosures for Plan

Sponsors website at

https://www.jpmorgan.co

m/wealth-

management/wealth-

partners/legal/mutual-

fund-disclosures and click

on the link to the Mutual

Fund Compensation

Disclosures.

Money Market

Mutual Funds

(including

sweep funds or

direct money

market mutual

funds

purchases)

- 12b-1 Distribution

Fee

- Servicing and

Administrative Fees

- Revenue Sharing

Indirect See “Other

Important

Information”

below

See “Other

Important

Information”

below

12b-1

Distribution

Fee: Paid

monthly or

quarterly

Servicing and

Administrative

Fees: Paid

monthly or

quarterly

Revenue

Sharing: Paid

Fund distributor,

fund adviser or

other fund

affiliate

Page | 6

Service/

Product

Compensation

Description

Compensation

Type

Amount / Rate Manner of

Receipt

Timing of

Payment

Payer (of

Indirect

Compensation)

Additional Disclosures

monthly or

quarterly

Structured

Products

(Full Service

Only)

Placement agent

fees (commissions);

Hedging revenue

Placement

Agent Fees:

Direct

Hedging

Revenue:

Indirect

Placement Agent

Fees: The

maximum fee is

1% with a one

year tenor, and

0.50% for each

additional year

(pro-rated for

periods of less

than a year),

calculated with

reference to the

price of the note.

Generally, this fee

is capped at a

maximum of 3%.

See “Additional

Disclosures”

Hedging

Revenue: The

terms of

(including the

revenue

associated with)

hedging

transactions are

negotiated

separately from

the Structured

Product by a J.P.

Morgan team

distinct from the

Placement Agent.

See “Additional

Disclosures”

Placement

Agent Fees:

Deducted

from account

Hedging

Revenue:

Embedded in

the terms of

the hedging

transaction.

See

“Additional

Disclosures”

Placement

Agent Fees:

Upfront

payment at

time of

investment

Hedging

Revenue:

Dependent on

terms of

hedging

transaction.

See “Additional

Disclosures”

Placement Ag

ent

Fees: N/A

Hedging

Revenue: Issuer

of the Structured

Product or an

affiliate of the

issuer. See

“Additional

Disclosures”

Placement Agent Fees:

For specific compensation

earned by JPMS or its

affiliate for the sale and

distribution of Structured

Products, please refer to

your term sheet, or

contact your advisor.

Hedging Revenue: For

certain Structured

Products issued by third

parties, JPMS or its

affiliate may cause the

issuer to conduct up to

50% of its hedging

activities in respect of

such Structured Product

with JPMS or its affiliate –

a practice known as “split

hedging”.

For expected hedging

revenue associated with

“split hedging”, a

reasonable methodology

to calculate the revenue

JPMS or its affiliate would

receive is as follows:

[Par Value of Notional

Invested minus

Distribution Fees minus

Estimated Value]

multiplied by 50% of the

Notional Invested.

The actual revenue JPMS

or its affiliate receives

from the split hedge may

be different from the

formula above due to

differences in each

issuer’s calculation of

estimated value, internal

model differences, and

credit related charges on a

deal by deal basis.

Alternative

Investments

Hedge Funds,

Private Equity

Funds and Real

Estate Funds

Placement Fees;

Origination Fees;

Withdrawal

Reductions (certain

hedge funds); Co-

Investment Access

Fees (certain

private equity and

real estate funds)

Placement Fees:

Indirect

Origination

Fees:

Direct

Co-Investment

Access Fees:

Direct

See “Other

Important

Information”

below

Placement

Fees: Paid to

JPMS by

investment

manager or

fund

Origination

Fees:

Deducted

from account

Placement

Fees:

Generally,

upfront

payment and

quarterly

payments

thereafter

Origination

Fees: Upfront

payment at

See “Additional

Disclosures”

JPMS does not generally

offer private equity funds,

real estate funds, or

hedge funds to ERISA plan

clients, though certain

plan clients as of July 1,

2012 may continue to

hold prior investments.

For such clients, and to

the extent JPMS

otherwise determines to

Page | 7

Service/

Product

Compensation

Description

Compensation

Type

Amount / Rate Manner of

Receipt

Timing of

Payment

Payer (of

Indirect

Compensation)

Additional Disclosures

Co-

Investment

Access Fees:

Where

applicable,

deducted

from account

time of

investment

Co-Investment

Access Fees: At

time of co-

investment

offer such funds to other

ERISA plan clients in the

future, it is anticipated

that a description of the

specific compensation

received by JPMS in

connection with a client’s

investment in a pooled

alternative investment

vehicle (generally, hedge

funds, private equity

funds and real estate

funds), will be located

within the private

placement memorandum,

subscription agreement

and/or supplemental

disclosure notice or

similar letter associated

with such vehicle (or, in

the case of a Co-

Investment Access Fee,

the supplemental letter

associated with such

investment). Plan

investors will be provided

such documents (and,

therefore, the requisite

compensation

information) reasonably in

advance of entering into

such investments.

Float Interest earned on

uninvested cash

Indirect See “Other

Important

Information”

below

See “Other

Important

Information”

below

See “Other

Important

Information”

below

See “Other

Important

Information”

below

See “Other Important

Information” below.

Investment Advisory Accounts

Unless otherwise indicated, all investment advisory services are provided by, and all compensation described below is earned by,

JPMS. When opening an investment advisory account, you will receive a client agreement and Form ADV Disclosure Brochure, which

fully describe the nature of JPMS’s services and the fees charged in the Programs for investment advisory services.

JPMS charges an annual asset-based investment advisory fee for the Programs; the maximum fee charged is 2.00%, except that the

maximum fee charged by JPMS for assets invested in the CBP is 0.70%.

Additional fees are charged by Model Portfolio Providers and Portfolio Managers. Portfolio Manager fees range from approximately

0.00% to 1.00% and Model Portfolio Providers fees range from 0.11% to 0.425%.

Current copies of the Program Brochure are available free of charge online at

https://www.jpmorgan.com/wealth-

management/wealth-partners/securities/adv or from your advisor.

Page | 8

Miscellaneous Account and Administrative Fees

The following table lists miscellaneous account and administrative charges associated with your account. All compensation

described below is earned by JPMS. All such fees and charges are subject to change periodically. However, please note that the

Service/Product Trading fees do not apply with respect to Investment Advisory Accounts. Miscellaneous account and administrative

fees for Self-Directed Investing accounts can be found at the following link: Fee and Commission Schedule

Service/ Product Description

Compensatio

n Type

Amount/ Rate

Manner

of

Receipt

Timing of

Payment

Payer (of

Indirect

Compensation)

Additional Disclosures

Trading

Options

Transactions

Transaction

Fee

1

Direct $0.02685 per

contract

Deducted

from

account

Time of

Transaction

N/A

This fee is intended to offset fees

assessed to JPMS by the various

options exchanges. The amount

collected may be more or less than

the amount ultimately paid to the

various regulatory bodies. In the

event of the former, no

reimbursement will be distributed

back to your plan and, in the event

of the latter, there will be no

additional charge made to your

plan.

Trading

Listed Equities and

Options (sells only)

Transaction

Fee

1

Direct $0.000005 of

principal/trade

Deducted

from

account

Time of

Transaction

N/A

This fee is intended to offset fees

charged by various regulatory

bodies. The amount collected may

be more or less than the amount

ultimately paid to the various

regulatory bodies. In the event of

the former, no reimbursement will

be distributed back to your plan

and, in the event of the latter,

there will be no additional charge

made to your plan.

Account Services ACAT

(deliveries

only)

Direct $95 per account Deducted

from

account

Time of

Transaction

N/A

Third-Party

Wire Transfer

Direct $20 per wire Deducted

from

account

Time of

Transaction

N/A

Trade

Confirmations

Direct $5 per

transaction

2

Deducted

from

account

Time of

Transaction

N/A

Retirement

Account

Transfer and

Termination

Direct $95 per wire Deducted

from

account

Time of

Transaction

N/A

Prototype Plan

Account

Money Purchase

Plan or

Profit Sharing Plan

- Distribution

Processing

-1099-R

Reporting

Direct $35 annual fee

$50 termination

fee

3

Deducted

from

account

Each Year

Upon account

termination

N/A

Prototype Plan

Account

Individual (k) Plan

- Distribution

Processing

Direct $50 termination

fee

3

Deducted

from

account

Upon account

termination

N/A Additional details, including fees

payable to the third-party record

keeper in connection with these

Page | 9

Service/ Product

Description

Compensatio

n Type

Amount/ Rate

Manner

of

Receipt

Timing of

Payment

Payer (of

Indirect

Compensation)

Additional Disclosures

services, are contained in the “JP

Morgan Individual(k) Plan

Establishment Kit” that plan clients

receive prior to establishing their

prototype plan.

1. Fee charged only to accounts which do not generate $500 in annual fees and/or commissions, or maintain average equity in the household in excess of

$100,000.

2. The fee is not charged to those who have enabled electronic trade confirmations. Access your account at chase.com or via the Chase Mobile app for information

and instructions on how to go paperless or speak to your advisor.

3. Prototype plan account termination fee applies to all prototype plan types, including Individual(k) Plans. Other fees may be payable to the third-party

recordkeeper with regard to the Individual(k) plan and are contained in the "JP Morgan Individual(k) Plan Establishment Kit" that plan clients receive prior to

establishing the prototype plan.

OTHER IMPORTANT INFORMATION

DISCLOSURE ARRANGEMENTS WITH PAYERS OF INDIRECT COMPENSATION

Compensation JPMS Receives from Mutual Fund Companies

Distribution and/or Service 12b-1 (Service/12b-1) Fees

JPMS receives Service/12b-1 fees from some of the mutual fund companies on its brokerage platform. Like other fees and expenses

in a mutual fund, these fees will reduce investment returns. The exact amount of such fees paid out varies among funds and share

classes but is disclosed in the applicable fund prospectus. The typical ranges of Service/12b-1 fees in mutual funds on the platform

are as follows: A shares: 0.00%–0.50% (most frequently 0.25%); C shares: 0.00%–1.00% (most frequently 1.00%).

Administrative Servicing/Recordkeeping Fees

Mutual funds or their fund affiliates may pay us fees for providing certain administrative services, which may include maintaining

and updating separate records for each client, preparing and delivering client statements, tax reporting, proxy voting and

solicitation, processing purchase and redemption orders, processing dividends, distributing prospectuses and other fund reports,

and responding to client inquiries. The fees for these services are typically called “administrative servicing fees,” or “recordkeeping

fees.” These fees may also be referred to as “shareholder servicing fees.” The fees may be based on the number of fund positions

held by JPMS clients (generally in the range of $0–$20 per position) or based on assets, expressed as a percentage (generally in the

range of 0%–0.25%). These fees generally are paid from investor assets in mutual funds, but in some cases are subsidized in part by

affiliates or the distributor of the mutual funds (such affiliate payments may be referred to as “revenue sharing”).

The fee ranges quoted in this “Compensation JPMS Receives from Mutual Fund Companies” section are generally for the funds

approved for purchase in Self-Directed Investing and Full Service brokerage accounts. Similar fees may be received by J.P. Morgan in

connection with other funds that are not approved, but held upon client request, and applicable rates may differ. For detailed

disclosures about JPMS’s compensation on mutual funds, please visit the J.P. Morgan Securities Retirement Plan Disclosures for Plan

Sponsors website at https://www.jpmorgan.com/wealth-management/wealth-partners/legal/mutual-fund-disclosures

and click on

the link to the Mutual Fund Compensation Disclosures.

Compensation JPMS Receives from Money Market Fund Companies

12b-1 Distribution Fees

JPMS may receive 12b-1 distribution fees from the money market funds approved for purchase in Self-Directed Investing and Full

Service brokerage accounts. Like other fees and expenses in a money market fund, 12b-1 distribution fees will reduce investment

returns. The exact amount of such fees paid out varies among funds and share classes but is disclosed in the applicable fund

Page | 10

prospectus. The typical range of 12b-1 distribution fees for approved money market funds is 0% - 0.35%.

Servicing and Administrative Fees

Money market funds or their fund affiliates may pay JPMS fees for providing certain shareholder services, administrative services,

and/or recordkeeping. Shareholder services may include responding to investor inquiries and providing investors information about

their investments. Administrative services and/or recordkeeping may include maintaining and updating separate records for each

client, preparing and delivering client statements, tax reporting, proxy voting and solicitation, processing purchase and redemption

orders, processing dividends, distributing prospectuses and other fund reports, and responding to client inquiries regarding

administrative services and/or recordkeeping. Such fees may be based on the number of positions held by J.P. Morgan clients or

based on assets, expressed as a percentage. Depending upon the share class and specific arrangements with fund families, as

compensation for these shareholder services, administrative services, and/or recordkeeping, JPMS may receive fees payable by fund

companies for these services that may be bundled into one fee, typically between 0% and 0.80% for approved money market funds,

which may include up to a 0.25% service fee whether paid from a 12b-1 plan or outside of a 12b-1 plan. These fees generally are

paid from investor assets in money market funds, but in some cases are subsidized in part by affiliates or the distributor of the funds

(such affiliate payments may be referred to as “revenue sharing”).

The fee ranges quoted in this “Compensation JPMS Receives from Money Market Fund Companies” section are generally for the

funds approved for purchase in Self-Directed Investing and Full Service brokerage accounts. Similar fees may be received by J.P.

Morgan in connection with other funds that are not approved, but held upon client request, and applicable rates may differ. For

detailed disclosures about JPMS’s compensation on money market funds, please visit the J.P. Morgan Securities Retirement Plan

Disclosures for Plan Sponsors website at

https://www.jpmorgan.com/wealth-management/wealth-partners/legal/mutual-fund-

disclosures and click on the link to the Mutual Fund Compensation Disclosures.

Revenue Sharing

Separate from the 12b-1 distribution fees and servicing and administrative fees noted above and described in the fund’s prospectus,

money market fund sponsors or distributors may make additional payments JPMS or its affiliates in certain sales channels for

providing additional marketing, sales and/or support services. These payments are typically called revenue sharing and are paid from

the entity’s revenues or profits, not from the fund’s assets, but the entity’s revenues or profits may reflect fees paid to them by the

fund. JPMS may receive a payment as a percentage per year of the amount held in these money market funds. Percentage payments

generally range from 0% to 0.19% for approved money market funds.

JPMS may allow representatives of all its approved money market funds, including the J.P. Morgan Money Market Funds, access to

its advisors for educational and promotional purposes, subject to conditions imposed by JPMS. Some funds allocate more resources

for these purposes, which could cause advisors to become more familiar with those funds and focus on them when meeting with

clients. Funds or their affiliates may pay for sales meetings, seminars and conferences JPMS holds in conducting its business, subject

to conditions imposed by JPMS. The extent to which a fund is willing to pay for these activities is solely determined by the fund’s

advisers or affiliates, not by JPMS.

The level of payments to JPMS varies in any given year. Payments for sales of one fund’s shares may be more or less than the

payments JPMS receives from other funds’ advisers, distributors or other entities, and in certain instances, the payments could be

significant. While any such payments will not change the net asset value or price of a fund’s shares, the payments create a conflict of

interest, as there may be an incentive to promote and recommend those funds whose sponsors make significant payments.

Waivers

Please note that the actual amount received by JPMS may be subject to periodic waivers by fund families and such waivers may

significantly reduce the actual amount received by JPMS. Additionally, in some cases, the expense ratio of a mutual fund will be

voluntarily limited by the manager through a fee waiver. Fee waivers allow the fund to set a maximum level on the amount charged

to shareholders. Accordingly, the 12b-1 fees and other compensation described herein and in the “Mutual Fund Compensation

Disclosures” reflect amounts payable to JPMS prior to any waivers or expense caps imposed on the funds, which could, in practice,

result in lower payments to JPMS as compared to the amounts disclosed herein and can be found on the tool located on the J.P.

Page | 11

Morgan Securities Retirement Plan Disclosures for Plan Sponsors website at https://www.jpmorgan.com/wealth-

management/wealth-partners/legal/mutual-fund-disclosures

Compensation JPMS Receives from Alternative Investments

In certain limited situations, JPMS (or a predecessor) has agreed to assist the investment managers of alternative investment funds

by introducing potential investors in the fund. If the fund accepted a subscription from an investor introduced by JPMS (or such

predecessor), such investment manager or, in some cases, the fund pays JPMS a fee, sometimes known as a placement fee or

“revenue sharing” payment.

FLOAT

JPMCB NA or its affiliates may retain, as compensation for the performance of services, your account’s proportionate share of any

interest earned on aggregate cash balances held by J.P. Morgan with respect to “assets awaiting investment or other processing.”

This amount, known as “float,” is earned by J.P. Morgan through investment in a number of short-term investment products and

strategies, including, without limitation, loans to customers and investment securities, with the amount of such earnings retained by

J.P. Morgan, due to the short-term nature of the investments, being generally at the prevailing Federal Funds interest rate (a publicly

available average rate of all Federal Funds transactions entered into by traders in the Federal Funds market on a given date), less

Federal Deposit Insurance Corporation insurance and other associated costs, if any. “Assets awaiting investment or other

processing” for these purposes include, to the extent applicable, new deposits to the account, including interest and dividends, as

well as any uninvested assets held in the account caused by an instruction to purchase and sell securities. J.P. Morgan will generally

earn float until such time as such funds may be automatically swept into a sweep vehicle, or otherwise reinvested. “Assets awaiting

investment or other processing” may also arise when JPMCB NA facilitates a distribution from the account. Thus, pursuant to JPMCB

NA’s standard processes for check disbursement, cash is generally debited from the account on the date on the face of the check

(also called the payable date). Such cash is deposited in a noninterest-bearing omnibus deposit account at JPMCB NA, where it

remains until the earlier of the date the check is presented for payment or the date payment on the check is stopped at the client’s

instruction (in which case the underlying funds are returned to the account). JPMCB NA derives earnings (float) from the use of

funds that may be held in this manner, as described above.

NONMONETARY COMPENSATION & SUBSIDIES

Third-party providers (such as investment managers and recordkeepers), including companies that sponsor investment options

made available to qualified retirement plans through JPMS, may participate in JPMS-sponsored internal training and education

conferences and meetings, and may make payments to, or for the benefit of, JPMS or its advisors to reimburse for certain expenses

incurred for these events. Providers may also sponsor their own educational conferences or due diligence meetings and pay certain

expenses of advisors attending these events. JPMS’s policies require that the training or educational portion of these conferences

comprises substantially all of the event and such conferences and meetings are subject to review and approval. Further, JPMS may

provide sponsorship opportunities and access to our branch offices and advisors to such providers for educational, marketing and

other promotional efforts. Any payments made by providers could lead advisors to focus on products managed by these providers

when recommending products to clients instead of those from other providers that do not commit similar resources to educational,

marketing and other promotional efforts.

J.P. Morgan has implemented policies and procedures intended to ensure that J.P. Morgan and its employees avoid actual or

perceived conflicts of interest when giving or receiving nonmonetary compensation from relevant parties, and comply with all

applicable laws and regulations. To that end, the J.P. Morgan Code of Conduct and other gift-related policies generally restrict or

prohibit acceptance of any gifts, entertainment or other nonmonetary compensation in connection with the services we provide to

any particular client, including any particular plan, or in return for any business of the firm. Exceptions may be made, including for

certain non-cash gifts or promotional items valued at $100 or less. J.P. Morgan’s Code of Conduct and other gift-related policies set

conditions for each of these types of payments, and do not permit any gifts or promotional items unless it is clear that the gift-giving

person is not trying to influence or reward the JPMS employee inappropriately in connection with any business decision or

transaction and the gift is unsolicited.

Providers participating in JPMS programs or otherwise utilized by the firm are not required to make any of these types of payments.

Page | 12

JPMS believes that, under any reasonable method of allocation, the gifts and other nonmonetary compensation or subsidies that may

be attributable to any particular plan are typically of insubstantial value (as any such gifts and other nonmonetary compensation or

subsidies are most often attributable to JPMS’s or J.P. Morgan’s “book of business” as a whole) and, therefore, will generally be

exempt from reporting on the Schedule C for the plan’s Form 5500. Similarly, JPMS does not reasonably anticipate receiving any such

gifts and other nonmonetary compensation or subsidies associated with the services it

provides to any plan in excess of $250 and,

accordingly, does not believe it has reportable nonmonetary compensation for purposes of ERISA section 408(b)(2).

EXTERNAL SOURCES

Certain compensation formulas and other information in this report and the “Mutual Fund Compensation Disclosures” tool located

on the J.P. Morgan Securities Retirement Disclosures website at

https://www.jpmorgan.com/wealth-management/wealth-

partners/legal/mutual-fund-disclosures were obtained from third-party sources that we believe, in good faith and with reasonable

diligence, to be reputable and reliable. Accuracy, completeness and timeliness of data from such sources cannot be guaranteed.

NO TAX/LEGAL ADVICE

J.P. Morgan does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is

not intended to provide, and should not be relied on for, tax, legal or accounting advice. You are urged to consult your tax, legal and

accounting advisers before opening an account and to understand the tax, ERISA and related consequences of any investments

made under the plan.

PRODUCT EXPENSES

This Disclosure Statement solely covers compensation received by JPMS and its affiliates. Please remember that certain investment

products (such as mutual funds and alternative investments) may have various internal fees, such as management fees, and other

expenses, which are paid by managers or issuers of such products or by the vehicle itself, but which ultimately are borne by the plan

as investor. The compensation described in this Disclosure Statement may, in some cases, also be reflected as a component of such

internal fees and expenses. The prospectus, descriptive brochure, offering memorandum or similar documents for such products

describe these internal fees and expenses in detail. Prospectuses for mutual funds or other registered funds managed by J.P. Morgan

or its affiliates and other fund information may be obtained by calling your J.P. Morgan representative or J.P. Morgan Distribution

Services, Inc. at (800) 480-4111. You may also view and order materials online at www.jpmorganfunds.com

.

AFFILIATED PRODUCTS

Certain sponsors and managers of mutual funds and collective investment vehicles may be affiliated with JPMS. JPMS affiliates may

receive investment management fees for managing an affiliated mutual fund, ETF or other vehicle and/or other forms of

compensation in connection with the operation thereof -- such as shareholder servicing, custody, fund accounting, administration,

distribution, securities lending and other services -- which may not be covered under the Regulation (and, therefore, are not

described in this Disclosure Statement). The prospectus, descriptive brochure, offering memorandum or similar documents for such

products describe these fees and other compensation in detail. The plan will receive no offset against fees by reason of such

additional compensation, except as may be required by applicable law.

RECORDKEEPING AND BROKERAGE SERVICES

For purposes of the Regulation, participant-directed brokerage accounts opened by JPMS are considered brokerage windows, self-

directed brokerage accounts, or similar plan arrangements. JPMS does not offer a platform or similar mechanism through which a

plan may specify – and no investments available within JPMS brokerage accounts shall be considered - “designated investment

alternatives” into which participants and beneficiaries may direct the investment of assets held in, or contributed to, their individual

accounts, even in such situations where the plan sponsor has attempted to restrict the investments into which such participants may

allocate plan assets.

Page | 13

If your plan is an individual account plan (as defined in section 3(34) of ERISA) that permits participants to direct the investment of

their accounts into one or more “designated investment alternatives”(e.g., recordkept through a third-party recordkeeper’s platform

or similar mechanism), in addition to the information set forth in this Disclosure Statement regarding compensation received and

services performed by JPMS, the regulation requires disclosure of certain information with respect to each such designated

investment alternative. Please contact your plan's recordkeeper to ensure you receive such information, which includes: (i) a

description of any compensation that will be charged directly against an investment, such as commissions, sales loads, sales charges,

deferred sales charges, redemption fees, surrender charges, exchange fees, account fees, and purchase fees, and that is not included

in the annual operating expenses of the investment contract, product, or entity; (ii) the total annual operating expenses of the

designated investment alternative; and (iii) certain other information or data about the designated investment alternative that is

required for the covered plan administrator to comply with the disclosure obligations described in 29 CFR 2550.404a–5(d)(1)

(commonly known as the “participant disclosure regulations”).

COMPENSATION FOR TERMINATION OF CONTRACT OR ARRANGEMENT

Unless otherwise specified herein or in your account agreement (or, as appropriate, the prospectus, descriptive brochure, offering

memorandum or similar documents for the products in which the plan invests), you may generally terminate JPMS’s services at any

time without penalty and no compensation is payable in connection with the termination of your plan’s arrangement with JPMS,

except for any accrued but unpaid fees. In addition, as investment advisory fees are generally billed and payable in advance, if the

plan’s investment advisory agreement is terminated prior to the last day of the quarter, a pro rata portion, based on the number of

days remaining in the quarter after the termination date, of the quarterly fee paid in advance will be refunded to the plan. To the

extent such fees are billed and payable in arrears, there would be no prepaid amounts to be refunded upon termination of the

arrangement.

ORDER FLOW, ECNS, TRADING CENTERS

JPMS does not receive payment for order flow from market makers for client orders in equity securities. JPMS receives rebates from

and pays fees to some registered securities exchanges for providing or taking liquidity on those exchanges, according to those

exchanges’ published fee schedules approved by the SEC. Alternative trading systems also charge fees and, in some cases, pay

rebates for the provision or removal of liquidity. In addition, JPMS receives marketing fees from options exchanges under marketing

fee programs sponsored by some exchanges. Under some circumstances, the amount received by JPMS from a trading center over a

period of time may exceed the amount that JPMS is charged by a trading center. These practices are one of many factors that may

impact routing decisions and do not alter JPMS’s policy to route client orders in securities to the trading centers where it believes

clients will receive the best execution, taking into account, among other factors, price, transaction cost, volatility, reliability, market

depth, and speed.

Affiliates of JPMS have ownership interests in some trading centers. Accordingly, JPMS stands to share in any profits that these

trading centers earn from the execution of JPMS client orders on those trading centers. Additional information on the material

aspects of JPMS’s relationships with the primary trading centers to which JPMS routes, including descriptions of arrangements for

payment for order flow and profit-sharing relationships, is available in JPMS’s SEC Rule 606 reports at

https://www.jpmorgan.com/disclosures/sec-order-execution

.

An up-to-date list of all trading centers through which JPMS might trade and in which J.P. Morgan has an ownership interest can be

found at https://www.jpmorgansecurities.com/pages/am/securities/legal/ecn

. Such trading centers (and the extent of J.P. Morgan’s

ownership interest in any trading center) may change from time to time.

REQUESTS FOR ADDITIONAL INFORMATION

Please contact your advisor or other J.P. Morgan Representative to request any other information relating to the compensation

JPMS received in connection with your plan’s contract or arrangement that you may need in order to comply with the reporting and

disclosure requirements of Title I of ERISA and the regulations, forms and schedules issued thereunder (including any information

required for you to file Schedule C of Form 5500, where applicable). Wherever possible, such request should be furnished well in

advance of the date upon which you must comply with the applicable reporting or disclosure requirement.

Page | 14

NO OFFER OR SOLICITATION

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. In addition, this

document is not itself an agreement for services, it is not intended to replace or amend any agreement or other contract that JPMS

may have with or in respect of a plan, nor is it any guarantee with respect to the pricing of any of our services. In the event of any

discrepancy between the information contained in these materials, on the one hand, and the terms which govern our contractual

relationships with respect to direct relationships with a plan on the other, the latter will govern.

Page | 15

APPENDIX A – COMMISSIONS

The following standard commission schedules for Full Service brokerage accounts (not Self-Directed Investing accounts) detail how

“full rate” commissions are calculated for Stocks, Exchange Traded Funds (ETFs), Options and Fixed Income agency transactions. All

fees and charges, including the following commission rates, are subject to change periodically.

Please refer to your confirm or contact your advisor for the actual commission amount payable by the plan at any given point in time

or with respect to a specific trade.

Stocks and Exchange Traded Funds

1% of Principal

Minimum commission of $25

Stocks and Exchange Traded Funds via Chase.com

$0 per trade

Options

Premium Price

Fee per contract

$0.01-$0.49

$1.00

$0.50-$0.99

$2.00

$1.00 and over

$4.00

Minimum commission of $25.00

Fixed Income*

Asset Class

Maximum Mark-Up ($/Bond)

High Grade

20.00

High Yield

25.00

Treasury Bills

1.00

Treasury Notes/Bonds

6.25

Municipal Bonds

25.00

*JPMS or an affiliate may act as principal on certain transactions. In such cases, JPMS or an affiliate receives an additional payment

by adding a mark-up to purchases, and deducting a mark-down from sales. This mark-up or mark-down will be reflected in the price

when JPMS or an affiliate acts as principal.

Page | 16

APPENDIX B – CHANGES AND UPDATES

Under the Regulation, JPMS, as a covered service provider, is required to disclose any changes to the service and compensation

information provided in this document. The purpose of this Appendix B is to provide you with a summary of the recent applicable

changes that were made to this document since the last restatement date.

Effective

Date

Section

Location

Description

March

2023

Appendix B

– Changes and Updates

N/A

March 2023

reflects when the document was restated

and Appendix

B – Changes and Updates reflects any

future

change(s).

August 2023

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 7

The Option Transaction Fee is now $

0.02885 instead of

$0.02905

August 2023

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 7

The Option Transaction Fee is now $

0.03005 instead of

$0.

02885

September

2023

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 7

The Option

Transaction Fee is now $0.03025 instead of

$0.

03005

September

2023

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 7

The Option Transaction Fee is now $

0.03175 instead of

$0.03025

October 2023

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 7

The Option Transaction Fee is now $

0.01925 instead of

$

0.03175

November

2023

Fee Disclosures

– Structured Notes

Page 6

Language updated to reflect the most recent offering

November

2023

Fee

Disclosures – Miscellaneous Account and Administrative Fees

Page 8

Retirement Account Transfer and Termination

fees

added

November

2023

Services Provided

- Investment Advisory Accounts

Page 3

Program name updated from

J.P. Morgan Core

Advisory

Program (“JPMCAP”) to J.P. Morgan Core

Advisory Portfolio Program (“JPMCAP”)

January 2024

Fee Disclosures

– Miscellaneous Account and Administrative Fees

Page 8

The Option Transaction Fee is now $

0.02685 instead of

$0.01925

June 2024

Fiduciary/Investment Advisory Status

– Status Under ERISA

Page 4

General language update

June 2024

Structured Notes (Full Service Only)

- Placement Agent Fees

Page 7

Maximum capped fee is updated from 3% to 5%

June 2024

Fiduciary/Investment Advisory Status

– Status Under ERISA - Updated

Page 4

The

update has been reversed to the prior month’s

language

.

June 2024

Structured Notes (Full Service Only)

- Placement Agent Fees

Page 7

The

update has been reversed to the prior month’s

language.

©2024 JPMorgan Chase & Co. All rights reserved. All product names, company names, and logos mentioned herein are trademarks

or registered trademarks of their respective owners.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB”) offer investment products, which may include bank-managed

accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and

advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. JPMCB and JPMS are

affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY,

JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF

THE PRINCIPAL AMOUNT INVESTED