NREL is a national laboratory of the U.S. Department of Energy

Office of Energy Efficiency & Renewable Energy

Operated by the Alliance for Sustainable Energy, LLC

This report is available at no cost from the National Renewable Energy

Laboratory (NREL) at www.nrel.gov/publications.

Contract No. DE-AC36-08GO28308

Technical Report

NREL/TP-6A20-76881

July 2020

Current and Future Costs of Renewable

Energy Project Finance Across

Technologies

David Feldman

,

1

Mark Bolinger,

2

and Paul Schwabe

1

1

National Renewable Energy Laboratory

2

Lawrence Berkeley National Laboratory

NREL is a national laboratory of the U.S. Department of Energy

Office of Energy Efficiency & Renewable Energy

Operated by the Alliance for Sustainable Energy, LLC

This report is available at no cost from the National Renewable Energy

Laboratory (NREL) at www.nrel.gov/publications.

Contract No. DE-AC36-08GO28308

National Renewable Energy Laboratory

15013 Denver West Parkway

Golden, CO 80401

303-275-3000 • www.nrel.gov

Technical Report

NREL/TP-6A20-76881

July 2020

Current and Future Costs of Renewable

Energy Project Finance Across

Technologies

David Feldman,

1

Mark Bolinger,

2

and Paul Schwabe

1

1 National Renewable Energy Laboratory

2 Lawrence Berkeley National Laboratory

Suggested Citation

Feldman, David, Mark Bolinger, and Paul Schwabe. 2020. Current and Future Costs of

Renewable Energy Project Finance Across Technologies. Golden, CO: National

Renewable Energy Laboratory. NREL/TP-6A20-76881.

https://www.nrel.gov/docs/fy20osti/76881.pdf

.

NOTICE

This work was authored in part by the National Renewable Energy Laboratory, operated by Alliance for Sustainable

Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308. Funding

provided by U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Office of Strategic

Programs and Solar Energy Technologies Office. The views expressed herein do not necessarily represent the

views of the DOE or the U.S. Government.

This report is available at no cost from the National Renewable

Energy Laboratory (NREL) at www.nrel.gov/publications

.

U.S. Department of Energy (DOE) reports produced after 1991

and a growing number of pre-1991 documents are available

free via www.OSTI.gov

.

Cover Photos by Dennis Schroeder: (clockwise, left to right) NREL 51934, NREL 45897, NREL 42160, NREL 45891, NREL 48097,

NREL 46526.

NREL prints on paper that contains recycled content.

iii

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Acknowledgments

This work was authored by the National Renewable Energy Laboratory, operated by Alliance

for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No.

DE-AC36-08GO28308. Funding provided by U.S. Department of Energy Office of Energy

Efficiency and Renewable Energy Office of Strategic Programs and Solar Energy Technologies

Office.

The authors would like to thank the following individuals for their thoughtful reviews and

comments on this work: Paul Donohoo-Vallett (DOE), Rebecca Jones Albertus (DOE), Doug

Arent (NREL), Jay Bartlett (Resources for the Future), Philipp Beiter (NREL), Dan Bilello

(NREL), Elaine Hale (NREL), Parthiv Kurup (NREL), Robert Margolis (NREL), Mike Meshek

(NREL), Gian Porro (NREL), Edward Settle (NREL), Rocio Uria Martinez (Oak Ridge National

Laboratory), Laura Vimmerstedt (NREL), and Ryan Wiser (Lawrence Berkeley National

Laboratory).

iv

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

List of Acronyms

ATB Annual Technology Baseline

BNEF BloombergNEF

CSP concentrating solar power

DOE U.S. Department of Energy

DSCR debt service coverage ratio

EEI Edison Electric Institute

EIA US. Energy Information Administration

FRED Federal Reserve Economic Data

GW gigawatt

IOU investor-owned utility

IPP independent power producer

IRR internal rate of return

ITC investment tax credit

LADWP Department of Water and Power

LCOE levelized cost of electricity

LIBOR London Inter-Bank Offered Rate

MACRS modified accelerated cost recovery system

NREL National Renewable Energy Laboratory

OPPD Omaha Public Power District

POU publicly owned utility

PPA power purchase agreement

PSEG Public Service Enterprise Group

PTC production tax credit

ROE return on equity

RoR rate of return

SoBRA Solar Rate Base Adjustment

SMUD Sacramento Municipal Utility District

SOFR Secured Overnight Financing Rate

WACC weighted average cost of capital

v

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Executive Summary

This report documents a consistent set of technology-specific U.S. financing cost benchmarks

for renewable and conventional energy technologies. The benchmarks are intended for use in

the National Renewable Energy Laboratory’s Annual Technology Baseline (ATB), a cross-

technology modeling and analysis framework of current and projected future cost of electric

generation and storage technologies.

1

Renewable energy technologies covered in the ATB

include land-based wind, offshore wind, utility-scale solar photovoltaic (PV), distributed PV,

concentrating solar power (CSP), geothermal, and hydropower; conventional technologies

covered include natural gas, coal, nuclear, and biopower.

2

Because ATB develops independent

projections of the change in renewable energy costs and characteristics of new generating assets

over time—while relying on other sources for conventional electric generation technologies—we

focus our analysis reported here primarily on these renewable energy technologies, estimating

both current and future financing costs to 2030. We also benchmark financing costs for new

natural gas generation facilities, as they represent the vast majority of all recently installed

conventional electricity generation.

3

In all cases, the goal is to portray consistent, representative

financial transactions and financing terms.

While there is a wide variety of financial ownership structures and individual project

characteristics for U.S. electric generation assets, we benchmark current finance costs for assets

owned by independent power producers (IPPs) because this ownership status represents most

new electric generation assets in the United States, particularly for renewable energy plants. IPPs

use tax equity arrangements as the primary financial arrangement for most U.S. renewable

energy assets, without the need for external financial partnerships. We benchmark IPPs primarily

to simplify the complexity of formulating a common set of financial assumptions for a variety of

technologies over time and to reflect that federal renewable tax credits are phasing down over the

next few years.

4

We also estimate future changes to finance costs from the planned expiration of

tax credits and a likely increase in interest rates from current historical lows, as both are assessed

to be fairly certain and easy to quantify. Lastly, we benchmark financial costs for renewable

energy assets assuming these projects sell their electricity through long-term power contracts, or

1

The financing cost benchmarks are used in ATB to calculate levelized cost of energy for each technology over time

and can be more generally used in other analyses that require current or future financing inputs for various

technologies.

2

While biopower can be considered a renewable energy technology, NREL does not perform research in that area;

biopower is treated in the ATB similar to conventional electric generation technologies.

3

Feldman and Margolis (2020) report that from 2010 to 2019, 79% of conventional U.S. electric generation

technology capacity additions (including biomass) were natural gas facilities.

4

Other reasons for not modeling tax equity transactions include that not all owners of electric generating assets enter

into tax equity arrangements, and that far fewer will do so in the future given the current phasedown of federal tax

credits. In addition, despite tax equity having a relatively low internal rate of return (IRR) of 6%–8% according

to Norton Rose Fulbright (2020a) compared to the cost of equity estimated in this report ranging from 7.5% to 10%,

the costs and complexity of tax equity transactions make them more inefficient and also mask the transparency

required for cross-technology comparisons over time, given different emphasis on different metrics. For example, a

tax equity provider may be more interested in its return on investment (ROI)—that is, the total amount of return it

receives in excess of its initial investment, regardless of time—than its rate of return (RoR) or internal rate of return

(IRR; i.e., the annualized return of an investment over a period of time). For example, investors in a solar project

may receive a considerable portion of their initial investment back in the first year in the form of tax credits and

depreciation expense benefits, and nearly all their return in the first five years of an investment, so that the IRR

does not properly convey the amount of money made on a transaction to the same degree as ROI.

vi

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

power purchase agreements (PPAs); IPP financing structures in the United States are currently

based primarily on projects obtaining these contracts before receiving construction funding.

Natural gas plants are typically not able to obtain contracts of such a long duration, and so we

benchmark natural gas plants assuming quasi-merchant electricity sales. However, there are

many other factors that could affect financing costs that are less certain to occur and are more

difficult to quantify in terms of their impact; we discuss these additional factors in the report, but

we do not incorporate them into future estimates of financing costs.

We collect data from a variety of sources that have exposure to different renewable and

conventional energy technology financings, both in the United States and abroad. Sources

include confidential industry interviews with renewable energy project developers, owners,

financiers, consultant, and analysts; IPP public filings; public and privately reported project-level

financial data; and government-reported interest-rate data. The vast majority of all research was

performed before the novel coronavirus pandemic and therefore the benchmarks do not capture

any change, now or in the future, caused by it. Table ES-1 (next page) summarizes the identified

financial assumptions by technology during a project’s operation for an IPP-owned electric

generation asset, incorporating our current benchmarks with future changes in financing costs

discussed above. The electricity sales are categorized as power purchase agreements (PPAs) or

quasi-merchant.

We combine these assumptions

5

with the 2020 ATB project cost, operation and maintenance

cost, capacity factor, tax rate, and lifetime assumptions and calculate a projected weighted

average cost of capital (WACC) for the different technologies, as summarized in Figure ES-1

(page viii).

6

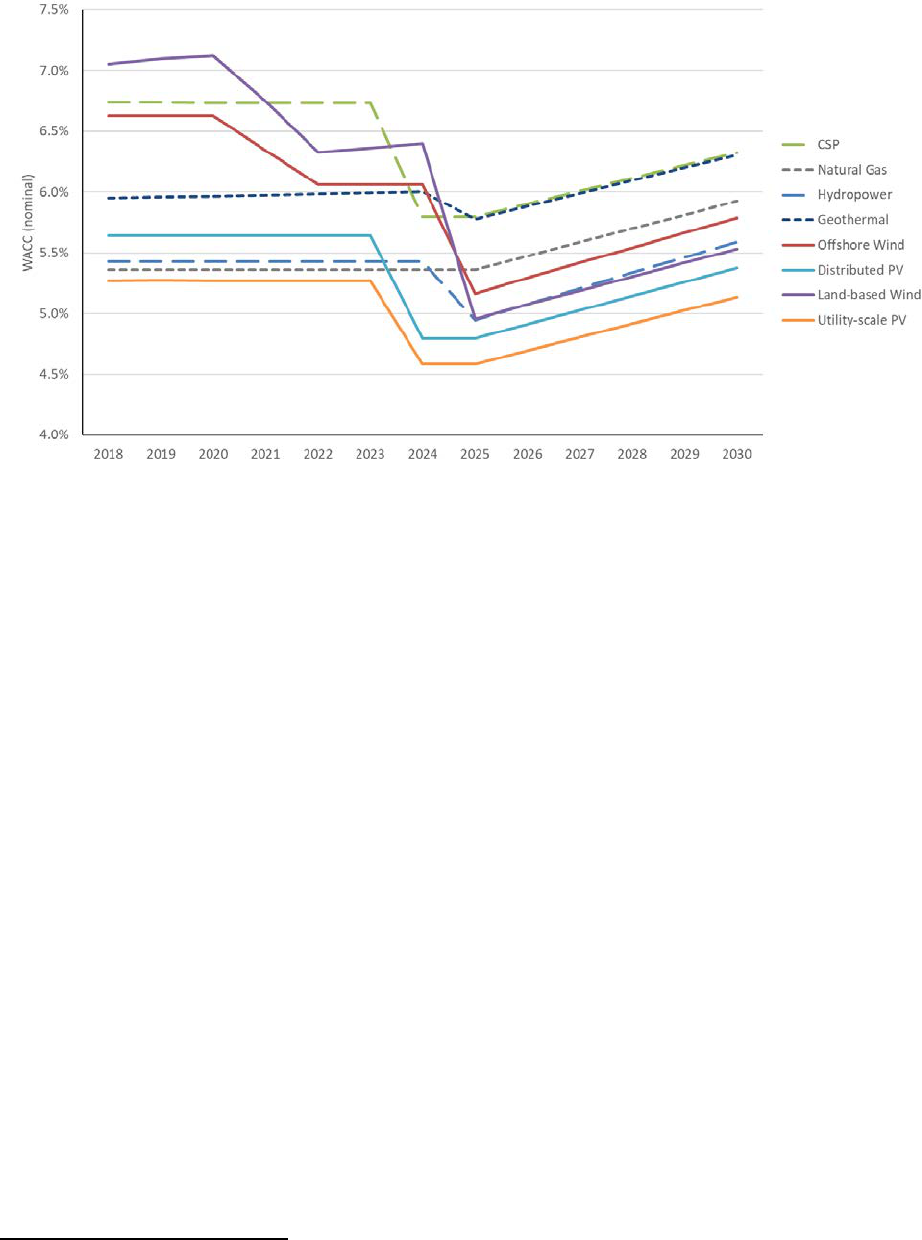

Under these assumptions, the initial financing term WACC on technologies with tax credits

decreases as these credits phase out. The after-tax benefit that tax credits provide will—all else

being equal—be replaced by a greater amount of cash revenue (e.g., via higher PPA prices),

which in turn will allow greater leverage. And because debt is typically less costly than equity,

this shift in capital structure toward more debt will lower overall financing costs (i.e., WACC),

thereby partially mitigating the loss of tax benefits. WACC subsequently increases from 2025 to

2030 as interest rates rise. We project an increase consistent with the Congressional Budget

Office (CBO) estimate of the increase in 10-year Treasury bond yields from 2019 (2.1%) to 2030

(3.1%, or a 100 basis point increase) in all-in construction and term debt interest rates by 2030

(CBO 2020). WACC also varies by technology; we estimate that solar PV and wind electricity

generation assets have lower cost of capital, owing to lower equity return expectations and

higher leverage. It is also important to keep in mind that while financing costs can vary by

technology, they currently also vary greatly (1) by project ownership (independent power

producer versus investor-owned utility versus publicly owned utility) and (2) based on the

individual characteristics of a project, its owner, and when and where it is built.

5

We choose 2025 as the starting point for the interest rate increase to simplify calculations and assumptions, given

that 2025 is when all tax credits will have expired or reverted to their lower value. This is a reasonable assumption

given the recent announcement that the Federal Reserve plans to keep interest rates near zero through 2022

(Timiraos 2020).

6

The 2020 ATB also has cases that reflect no consideration of tax credits and no change in interest rate. For these

cases, we ran separate leverage calculations, but input the same cost of equity and debt.

vii

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Table ES-1. Summary of Current and Future Financial Assumptions by Technology

Construction Operation

Technology

Electricity

Sales

After-

Tax

Levered

Equity

Returns

Debt

Interest

Rate:

2018/2030

Leverage

(i.e. debt

fraction)

After-

Tax

Levered

Equity

Returns

18-Year

Term Debt

Interest

Rate:

2018/2030

Leverage:

2018/2030

land-based

wind

power

purchase

agreement

(PPA)

11.0% 4.0%/5.0% 80% 9.0% 4.0%/5.0% 32%/66%

offshore

wind

PPA

12.0% 4.0%/5.0% 80% 10.0% 4.0%/5.0% 48%/67%

utility PV PPA 9.75% 4.0%/5.0% 80% 7.75% 4.0%/5.0% 52%/65%

residential

and

commercial

PV

PPA

10.75% 4.0%/5.0% 80% 8.75% 4.0%/5.0% 54%/67%

CSP PPA 12.0% 4.0%/5.0% 80% 10.0% 4.0%/5.0% 46%/58%

geothermal

PPA pre-

drilling:

15.0%

post-

drilling:

10.0%

4.0%/5.0%

pre-

drilling:

0%

post-

drilling:

75%

10.0% 4.0%/5.0% 58%/59%

hydropower PPA 12.0% 4.0%/5.0% 80% 10.0% 4.0%/5.0% 65%/70%

natural gas

quasi-

merchant

12.0% 5.0%/6.0% 80% 10.0%

5.0%/6.0%

73%

viii

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Figure ES-1. WACC of different technologies, 2018–2030

ix

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Table of Contents

1 Introduction ........................................................................................................................................... 1

2 IPP Ownership .................................................................................................................................... 11

2.1 Construction Financing ........................................................................................................... 11

2.2 Term Financing ....................................................................................................................... 12

2.2.1 Term Debt ...................................................................................................................... 12

2.2.2 Debt Service Coverage Ratio ......................................................................................... 15

2.2.3 Term Equity ................................................................................................................... 17

2.3 Summary of Current IPP costs ................................................................................................ 18

3 Utility Financing .................................................................................................................................. 20

3.1 IOU Financing ......................................................................................................................... 20

3.2 Publicly-Owned and Cooperative Utility Financing ............................................................... 22

3.3 Qualitative Comparison of IPPs, IOUs, POUs ........................................................................ 25

4 Future Financing................................................................................................................................. 27

4.1 Changes in Interest Rate .......................................................................................................... 27

4.2 Changes in Tax Credits ........................................................................................................... 28

4.3 Other Factors that May Influence Future Financing Costs ...................................................... 30

4.4 Summary of Financing Cost Changes Over Time ................................................................... 32

5 Conclusion .......................................................................................................................................... 36

References ................................................................................................................................................. 37

x

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

List of Figures

Figure ES-1. WACC of different technologies, 2018–2030 ...................................................................... viii

Figure 1. Financial risk by technology .......................................................................................................... 2

Figure 2. U.S. utilities by number of companies (left) and millions of customers (right), 2017 .................. 3

Figure 3. Percentage of new U.S. electric generation capacity owned, by company type, beginning service

from 2010 to 2018 .................................................................................................................... 4

Figure 4. Percentage of new U.S. hydropower capacity owned, by company type and system size,

beginning service from 2010 to 2018 ....................................................................................... 5

Figure 5. History of debt interest rates and components ............................................................................. 14

Figure 6. Empirical all-in term debt interest rates for loans initiated over time, by technology ................. 15

Figure 7. Empirical DSCR data at different probability of exceedance levels, by technology ................... 16

Figure 8. Empirical data and medians of the after-tax levered cost of equity, by technology .................... 17

Figure 9. IOU’s average ROE and investment grade corporate debt yield, 2010 to 2019 .......................... 21

Figure 10. Characteristics of municipal bonds ............................................................................................ 23

Figure 11. Comparison of 3% tax-exempt debt and equivalent taxable yields ........................................... 24

Figure 12. Revenue bond yields, 2017–2019 .............................................................................................. 25

Figure 13. Tax credit assumptions for electric generating assets, by online date ....................................... 28

Figure 14. Leverage assumed in LCOE modeling as tax credits phase down ............................................ 29

Figure 15. Leverage of global renewable energy projects, by technology ................................................. 29

Figure 16. WACC of different technologies, 2018–2030 ........................................................................... 35

List of Tables

Table ES-1. Summary of Current and Future Financial Assumptions by Technology ............................... vii

Table 1. Top Ten U.S. IPPs, by Technology Capacity (as of February 2020) .............................................. 6

Table 2. Summary of Current IPP Financial Assumptions ......................................................................... 18

Table 3. Capital Structure, Return, and WACC Estimates for IOUs, 2010–2019 ...................................... 22

Table 4. Comparison of 1%–5% Tax-Exempt Debt and Equivalent Taxable Yields ................................. 24

Table 5. Qualitative Comparison of Different Financing Approaches by IPPs, IOUs, and POUs ............. 26

Equation 1. WACC Formula ....................................................................................................................... 32

Table 6. Summary of Current and Future Financial Assumptions by Technology ..................................... 34

1

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

1 Introduction

The purpose of the analysis reported here is to develop a consistent set of technology-specific

U.S. financing cost benchmarks for the renewable and conventional energy technologies. The

benchmarks are intended for use in the National Renewable Energy Laboratory’s (NREL’s)

Annual Technology Baseline (ATB),

7

a cross-technology modeling and analysis framework of

current and projected future cost of electric generation and storage technologies.

8

Renewable

energy technologies covered in the ATB include land-based wind, offshore wind, utility-scale

solar photovoltaic (PV), distributed PV, concentrating solar power (CSP), geothermal, and

hydropower; conventional technologies in the ATB include natural gas, coal, nuclear, and

biopower.

9

Because the ATB’s develops independent projections of the change in renewable

energy costs and characteristics of new generating assets over time—while relying on other

sources for conventional electric generation technologies—we focus our analysis primarily on

these renewable energy technologies, estimating both current and future financing costs to 2030.

We also benchmark financing costs for new natural gas generation facilities, as they represent

the vast majority of all recently installed conventional electricity generation.

10

In all cases, the

goal is to portray consistent, representative financial transactions and financing terms.

Various factors influence the financial costs associated with building, owning, and operating

an energy asset. Key factors include the amount of risk associated with achieving the investor’s

desired rate of return, the level of marketplace competition for available projects and sources

of capital (i.e., the balance of supply and demand),

11

and, to a lesser extent, the time and effort

required to arrange a financial transaction. Each technology has its own specific risk factors

during the construction and operation of plant, which may influence the underlying cost of

financing. These “technology risks” relate to the likelihood of completing construction

(including on-time and on-budget), and the likelihood of producing the expected amount of

electricity; such factors that might influence the latter include resource availability, equipment

failure, damage, underperformance, or operational failure. Figure 1, from Fitch Ratings (2015)

demonstrates the indicative risk to fully develop (i.e., “complete”) and operate different

renewable technologies. Solar PV has lower construction and operation risk, as it is modularly

built, involves few moving parts, and offers more predictable resource availability. Wind has

more moving parts, though is still somewhat modular in design, and so it has slightly higher

construction risk; however, because of more uncertainty in resource availability, it has more

operation risk. Geothermal, CSP, and hydropower plants require more engineering in design

7

https://atb.nrel.gov

8

The financing cost benchmarks are used in ATB to calculate levelized cost of energy for each technology over time

and can be more generally used in other analyses that require current or future financing inputs for various

technologies.

9

While biopower can be considered a renewable energy technology, NREL does not perform research in that area;

biopower is treated in the ATB similar to conventional electric generation technologies.

10

Feldman and Margolis (2020) report that from 2010 to 2019, 79% of conventional U.S. electric generation

technology capacity additions (including biomass) were natural gas facilities.

11

Lower perceived risk of cash flows to PV investors also affects the amount of marketplace competition because

it expands the number of investors willing to fund a project, thus increasing the supply of capital.

2

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

and operation, permitting requirements, are more site-specific, and in the case of geothermal

may have less certainty in resource availability.

Figure 1. Financial risk by technology

Source: Fitch Ratings 2015

Sizes of bubbles represents variation in risk.

Beyond technology risk, two other determinants of financing costs among energy projects are

project ownership and electricity sales agreement structure.

Project Ownership

In the United States, grid-tied energy generation assets are primarily owned by electric utilities

and independent power producers (IPPs). Electric utilities can be for-profit (i.e., investor-owned

utilities [IOUs], nonprofits [i.e., cooperatives], or publicly owned [POUs; i.e.; federal, state, or

municipally-owned]). Each owner type typically has different return expectations and faces

different rules and processes in terms of selling electricity and raising capital, which can

influence financing costs.

Additionally, some of these regulatory or organizational strategies may limit the number of

projects that can be owned by specific organizations (e.g., some co-ops may purchase the bulk of

their electricity generation from a third-party, and some public utility commissions discourage

utility ownership of electric generating assets in favor of a more market-based approach).

Ownership type also influences the ability to monetize tax benefits generated by projects. Certain

companies may be limited or even prohibited from using these tax benefits and may need

specific types of financial partners to invest in projects to take advantage of the benefits (i.e., tax

equity investors).

Additionally, though the overall price of electricity is not directly tied to the cost of capital,

it may be influenced by ownership in the case of utility-owned projects with tax attributes,

because of normalization requirements. Normalization accounting requirements diminish the

upfront stimulus of tax benefits by requiring utility owners to account for the benefits over the

High

3

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

life of the project. Conversely, IPPs are for-profit corporations, operating within a more market-

based competitive landscape.

Electricity Sales Agreements

IPPs generate revenue by making short-term electricity sales either through wholesale markets or

via long-term contracts (i.e., power purchase agreements, or PPAs). Long-term contracts (e.g.,

10–30 years) are typically far less risky, as the future sale price is known, as long as generation

requirements are met. However, even if selling into the wholesale market, project owners may

also protect against future price uncertainty through financial hedges, which come in several

forms including synthetic PPAs, bank hedges, and proxy revenue swaps (Bartlett 2019). The

longer the hedge or PPA contract, the more certainty in the electricity revenue over the life of

a project. Typically, PPAs with electric utilities have longer terms than financial hedges and

“avoided cost” PPA contracts mandated under the Public Utility Regulatory Policies Act.

Electric utilities typically generate revenue through the sale of electricity to their customers.

What they can charge, and the return they are allowed to achieve, are regulated and are often

dictated by the rate-making process (i.e., the process in which utilities set electricity rates

for customers).

Because of the impact that asset ownership and electricity sales agreements have on financial

costs, we assess which types are most common in the U.S. market through the U.S. Energy

Information Administration (EIA) Form 860 (EIA 2019a) and BloombergNEF’s (BNEF’s) U.S.

Power Plant Stack (BNEF 2020a). As shown in Figure 2, while there are far fewer IOUs than

publicly owned or cooperative utilities, IOUs service the vast majority of customers in the

United States.

Figure 2. U.S. utilities by number of companies (left) and millions of customers (right), 2017

Source: EIA 2019b

4

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Though IOUs represent the majority of U.S. customers, IPPs owned the majority of new U.S.

generating capacity from 2010 to 2018 and therefore represent the majority of recent financial

transactions (excluding refinancing existing electric generation assets and upgrading or

repowering), as shown in Figure 3.

Figure 3. Percentage of new U.S. electric generation capacity beginning service from 2010 to 2018

owned, by company type

Source: EIA 2019a

Additionally, the IPP ownership percentage is significantly higher for renewable energy assets

than fossil assets, with the exception of hydropower facilities. However, as shown in Figure 4,

there is significantly more IPP ownership for new hydropower plants with capacities below 150

MW. From 2010 to 2019, approximately half of all new hydropower installed in the United

States had capacities under 150 MW, with the other half coming from one plant.

12

12

Additionally, the ATB represents hydropower plants of sizes below 150 MW.

5

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Figure 4. Percentage of new U.S. hydropower capacity beginning service from 2010 to 2018

owned, by company type and system size,

Source: EIA 2019a

A significant portion of IPPs are either large companies focused in the energy space—often

an unregulated arm of a regulated utility company—or financial infrastructure investment

institutions, and they often own generating assets of different technologies. Many are also

publicly-traded companies, which typically have access to lower-cost financing than private

companies. Table 1 shows the top ten IPPs by technology capacity within the United States at

the end of February 2020.

6

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Table 1. Top Ten U.S. IPPs, by Technology Capacity (as of February 2020)

(P: energy company with shares traded on a stock exchange; Pr: private energy company; F: financier; D: developer)

Rank

Land-based

Wind

Offshore Wind Utility-scale

PV

CSP Geothermal Hydropower Natural Gas

1 NextEra (P)

14.4 gigawatts

(GW)

Ørsted (P)

30 MW

ConEd (P)

2.1 GW

NRG Energy

(P) 0.7 GW

Energy Capital

Partners (F)

1.7 GW

Brookfield (P)

1.7 GW

Energy Capital

Partners (F)

27.6 GW

2 Iberdrola (P)

7.1 GW

Vineyard Wind

(P)

NextEra (P)

2.0 GW

Atlantica Yield

(F)

0.3 GW

Ormat

Technologies

(D)

0.8 GW

Exelon (P)

1.6 GW

Vistra Energy

(P)

25.7 GW

3 EDP (P)

5.0 GW

Wind Energy

Systems

Technology (D)

Southern Co.

(P)

1.7 GW

NextEra (P)

0.3 GW

Berkshire

Hathaway/

MidAmerican

(P)

0.4 GW

Engie (P)

1.4 GW

NRG Energy

(P) 24.6 W

4 Invenergy (P)

3.4 GW

Fishermen's

Energy (D)

Berkshire

Hathaway/

MidAmerican

(P)

1.3 GW

Energy Capital

Partners (F)

0.2 GW

AltaRock

Energy (D)

0.1 GW

ArcLight

Capital

Partners (F)

0.6 GW

LS Power (Pr)

12.8 GW

5 Enel (P)

3.2 GW

Equinor (D) Dominion

Energy (P)

1.3 GW

US

Renewables

Group (F)

0.1 GW

AES Corp. (P)

0.1 GW

LS Power (P)

0.5 GW

Exelon (P)

9.2 GW

6 Global

Infrastructure

Partners (F)

2.7 GW

— Capital

Dynamics (F)

1.0 GW

Acciona (P)

0.1 GW

EnergySource

(D)

0.1 GW

Emera (P)

0.3 GW

Riverstone (F)

9.0 GW

7 Electricite de

France (P)

2.6 GW

— Global

Infrastructure

Partners (F)

0.9 GW

— Enel (P)

0.1 GW

Riverstone

Holdings (F)

0.3 GW

Southern Co.

(P)

8.8 GW

7

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Rank

Land-based

Wind

Offshore Wind Utility-scale

PV

CSP Geothermal Hydropower Natural Gas

8 BlackRock (F)

2.4 GW

— AES Corp. and

AIM Co. (P)

0.8 GW

— — Enel (P)

0.2 GW

Public Service

Enterprise

Group, or

PSEG (P)

7.5 GW

9 RWE (P)

2.2 GW

— First Solar (D)

0.7 GW

— — JP Morgan (F)

0.2 GW

Tenaska (Pr)

7.2 GW

10 Pattern Energy

(D)

2.0 GW

— Canadian Solar

(D)

0.6 GW

— — Royal Dutch

Shell (P)

0.2 GW

ArcLight

Capital

Partners (F)

7.1 GW

Top-ten U.S.

IPP capacity

as a

percentage of

total U.S.

installed

capacity, by

technology

43% 100% 35% 100% 88% 7% 27%

As of the end of 2019, only one offshore wind facility, Block Island Wind Farm, had been installed; however, several were under active

development; The companies listed in italics are the owners of the offshore wind projects under active development.

Source: BNEF 2020a

8

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Even though many IPPs have large balance sheets, they often partner with additional equity

investors for certain projects, especially those with large tax benefits, such as those associated

with the federal investment tax credit (ITC) or production tax credit (PTC). Though many IPPs

can take advantage of some of (if not all) the tax benefits associated with projects, partnerships

may be more economical in many instances. These partnerships, also called tax equity

arrangements, offer lower-cost capital for a portion of the cost of eligible projects in exchange

for the associated tax benefits. However, tax equity participation also comes with the costs of

structuring, and arranging the complex financial arrangements, and removing them when they

are no longer needed. Norton Rose Fulbright (2020a) reported that approximately $12 billion in

tax equity was raised in both 2018 and 2019 for solar and wind projects, representing

approximately 40% and 55% of total project costs, respectively. Based on pricing data reported

by Lawrence Berkeley National Laboratory for solar (Barbose and Darghouth 2019; Bolinger,

Seel and Robson 2019) and wind (Wiser and Bolinger 2019), and on the notion that financial

closings can precede the commercial operation date of a plant by a year or more, we estimate that

these transactions contributed capital to the vast majority of solar and wind plants in 2018 and

2019.

IPP financing structures in the United States are also currently based primarily on having long-

term contracts. Bolinger, Seel and Robson (2019) report that from 2006 to 2019 there were only

a few IPP solar projects without a long-term contract (i.e., “merchant”); Wiser and Bolinger

(2019) report that 23% of wind projects installed in 2018 were merchant or quasi-merchant;

Uría-Martínez et al. (2020) reported that of the hydropower plants that received Federal Energy

Regulatory Commission licenses from 2007 to 2018 and are now operational or under

construction, none was reported as merchant;

13

and geothermal projects also primarily rely on

PPAs, with Hernandez, Richard, and Nathwani (2016) reporting data on approximately 1

gigawatt (GW) of geothermal PPAs. Natural gas plants are unable to get electricity price

contracts of the same length as renewable energy generation assets because of an inability (or

prohibitive cost) to lock in or hedge fuel prices for more than a few years. According to the EIA,

the average expiration date reported in 2019 for natural gas contracts for electricity generation

plants was October 2021—or a little over two years.

14

Renewable energy projects have little to

no fuel risks and are able to contract electricity for much longer periods —typically 10–30

years.

15

Though we focus on the risks associated with technology, ownership, and electricity sales, it is

important to note that there are a variety of other risks associated with projects, which are large

contributors to the wide variation in financing costs of individual projects. According to Feldman

et al. (2018) and Bartlett (2019), these risks include the:

• Political risk

• Regulatory uncertainty

• Development risk

13

An inability to obtain a PPA was cited as the primary reason for project cancellations.

14

The average expiration date for a coal contract in 2019 was July 2021.

15

Some renewable energy projects have recently contracted shorter-term contracts, increasing the percentage of cash

flow over the lifetime of a project that is uncontracted at the beginning of the contract (Norton Rose Fulbright

2019a).

9

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

• Government support (if any)

• Credit-worthiness of the project owner

• Credit-worthiness of the electricity offtaker

• Length of the contract (if any)

• Whether the electricity price is firm or changes with the market

• Supply and demand of competing electricity

• Underlying inflation rate

• Cost of the underlying base interest rate.

Additionally, financing costs can be influenced by economies of scale (e.g., some investment

sources have minimum investment thresholds), supply and demand of sources of financing, or

preexisting relationships between project developers and financiers. For these reasons, there is

a wide range in financing costs across the United States, even for the same types of project.

In summary, while there is a wide variety of financial ownership and electricity sales structures

and individual project characteristics for U.S. electric generation assets, most of them are owned

by IPPs, and a much higher percentage of renewable assets are owned by IPPs. While IPPs that

own conventional electric generating assets typically sell their power either into wholesale

markets or under short-term contracts, most renewable energy generation assets sell electricity

via long-term contracts. IPPs are typically large companies with big balance sheets (i.e., a

significant amount of assets [including cash] and equity, which can be used to directly fund

projects or raise more capital to fund projects) and access to low-cost capital, often through

public markets. However, the vast majority of renewable energy projects receiving tax credits

also receive a large percentage of funding (~40% for solar, 55% for wind) from tax equity

providers (Norton Rose Fulbright 2020a). Tax equity participation is likely to greatly diminish

as the tax credits phase out (or down), leaving ownership interest to come principally from large

IPPs that likely can raise more funding from debt providers than currently exists today. However,

electric utilities also own a significant share of new electric generating assets, including

renewable energy projects (although not as great a percentage as older, larger plants), and in the

case of hydropower, are the principal form of asset ownership. Utilities sell this power to their

customers via a regulated process, and they receive a regulated return. Looking into the future,

when all tax credits will have expired or reverted to their lower value, utility ownership of

renewable assets may increase as utilities are no longer hampered by normalization accounting

of tax benefits.

Based on this landscape, and on our emphasis on renewable energy, we focus most of our efforts

in benchmarking financing costs for a project owned by an IPP with sales governed by a long-

term electricity contract. For conventional technologies, we benchmark the financing costs of a

natural gas project owned by an IPP, without a long-term contract. While tax equity

arrangements are the primary financial arrangement for most U.S. renewable energy assets,

we benchmark the financing costs of an IPP that is able to use the tax benefits associated with tax

equity directly without the need for external financial partnerships. We do this for a variety of

reasons, but most notably to simplify the complexity of formulating a common set of financial

assumptions for a variety of technologies over time.

16

We also compare the financing costs of

16

Other reasons for not modeling tax equity transactions include that not all owners of electric generating assets

enter into tax equity arrangements, and far fewer will do so in the future given the current phasedown of federal tax

10

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

IPP ownership to the financing costs of IOUs and POUs. The vast majority of all research was

performed before the novel coronavirus pandemic and therefore the benchmarks do not capture

any change, now or in the future, caused by the pandemic.

credits. In addition, the costs and complexity of tax equity transactions make them relatively inefficient and also

mask the transparency required for cross-technology comparisons over time, given different emphasis on different

metrics. For example, a tax equity provider may be more interested in its return on investment (ROI)—that is, the

total amount of return it receives in excess of its initial investment, regardless of time—than its rate of return (RoR,

or IRR)—that is, the annualized return of an investment over a period of time. For example, an investors in a solar

project may receive a considerable portion of their initial investment back in the first year in the form of tax credits

and depreciation expense benefits, and nearly all their return in the first five years of an investment that the IRR

does not properly convey the amount of money made on a transaction to the same degree as ROI.

11

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

2 IPP Ownership

We collected data from a variety of sources that have exposure to different renewable and

conventional energy technology financings, both in the United States and abroad. Sources

include confidential industry interviews with renewable energy project developers, owners,

financiers, consultant, and analysts; IPP public filings; public and privately reported project-level

financial data; and government-reported interest-rate data. Doing so, we endeavored to

accurately represent typical financing costs for each technology as well as the differences, if any,

between technologies. Data points include:

• Construction financing

o After-tax cost of levered equity

17

during the construction of the asset

o Cost and amount of debt during the construction of the asset

• Term financing

o Required debt service coverage ratio (DSCR) that debt providers use to determine the

amount of debt (i.e., leverage) they would provide to a project during the operation of

the asset

o Cost-of-term debt—or a loan with a set payment schedule of interest and principal—

during the operation of the asset

o After-tax cost of levered equity during the operation of the asset.

2.1 Construction Financing

Based on confidential industry interviews, there is a premium of approximately 200 basis points

(2%) on the cost of equity during construction for each renewable energy project, relative to the

cost of equity during plant operation, to account for construction risk. The exception to this is the

construction financing costs for geothermal projects, where the cost of equity during construction

is separated into at least two stages. The first round of equity investment occurs pre-drilling of

site wells, where the resource potential is unknown and there is no long-term site control,

completed permit, or PPA in place. During this period, it is typically not possible to obtain

construction debt to finance development and pre-construction costs, and the cost of equity is

usually higher. Once the wells have been drilled and the geothermal resources found to be viable,

site control is in place, permits have been obtained, and a PPA has been contracted, the risk on

invested capital is greatly reduced, meaning the required equity return is lower and construction

debt can be obtained.

18

While all electric generation technologies have some form of initial

development risk before construction occurs in earnest, geothermal is somewhat unique in the

level of time, risk, and percentage of capital that must be expended before plant construction.

17

The after-tax cost of levered equity is the cash flows—after accounting for taxes—an investor requires to make

an equity investment in a project that is also funded through a loan (i.e., with leverage).

18

As mentioned before, finance varies significantly between projects. Ormat Technologies is a notable exception

to the geothermal construction financing described above. As one of the top two operators of geothermal projects

in the United States, Ormat Technologies finances the construction of its projects from a combination of short-term

corporate bonds, cash flow from operating projects, and lines of credit. Still, Ormat Technologies assesses a higher

cost of capital during construction than during plant operation.

12

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Interestingly, once a plant can proceed to construction, the cost of debt is relatively consistent

across technologies. According to Norton Rose Fulbright (2020a), interest during construction is

approximately 50 basis points lower than term debt. Though there is no operational cash flow on

which debt providers can depend on for payment, construction loans are significantly shorter in

nature than term loans, and construction debt is only provided to projects with guaranteed

financing once a project begins operation (and implements risk-limiting measures)—meaning the

risk is mostly tied to whether a project completes construction. Also, construction debt providers

do not fund the entire portion of construction costs, which motivates project owners to complete

construction or lose the funds they used during construction (typically 10%–25% and

representing the first dollars spent).

Because of the inherently greater construction risk associated with offshore wind, geothermal,

and hydropower technologies, we assume construction debt and term debt are priced the same

(i.e., are not 50 basis points lower than term debt).

2.2 Term Financing

2.2.1 Term Debt

Term debt—which is sourced primarily in the commercial bank market, but sometimes through

the bond market—makes up a significant portion of the capital stack for IPP project owners

using project finance. For deals involving third-party tax equity investors, term debt most often

takes the form of “back leverage,” by which the debt is secured not by the underlying project

assets but instead by the IPP-owner’s equity stake in the project company (i.e., back leverage is

secured and serviced only by the cash allocated by the project company—typically a special-

purpose LLC created solely to own the project—to the IPP sponsor over time). In contrast, under

the simplifying assumption of no third-party tax equity (i.e., that the IPP sponsor can make

efficient use of tax benefits on its own), term debt is typically secured by the project assets.

Historically, back leverage has been priced at a small premium to project-level debt (reflecting

the slightly inferior collateral position), but in recent years, increasing market liquidity (i.e., the

supply of capital outstripping demand) has all but erased this premium, and back leverage and

project-level debt are now widely considered to have essentially the same terms and conditions

(Norton Rose Fulbright 2020a).

The “all-in” or total interest rate charged on term debt is a function of three independent

components: the base rate, the bank spread, and the swap rate (Bolinger 2018). The base rate

is a short-term interest rate that can be thought of as a proxy for the bank’s cost of funds.

Historically, the three-month London Inter-Bank Offered Rate (LIBOR) has served as the base

rate for renewable energy projects using project finance in the United States. However, as a

result of a recent price-manipulation scandal involving LIBOR, the market is in the early stages

of a transition to a new base rate based on the Secured Overnight Financing Rate, or SOFR

(Norton Rose Fulbright 2020b).

13

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

The second component of all-in term debt interest rates, the bank spread, is simply the margin

that banks charge on top of the base rate (whether LIBOR or SOFR). The size of the bank spread

reflects several things, including the bank’s cost of funds (to the extent that the base rate is an

imperfect proxy for cost of funds), the risk of getting repaid (riskier projects typically have larger

bank spreads), market liquidity (more capital flowing typically means lower bank spreads, all

else equal), and profit margin. As such, the bank spread is the only interest rate component

whose magnitude is based, at least in part, on the underlying renewable energy asset being

financed—both the base rate and the swap rate (described below) are generic benchmarks that

are not at all tied to the underlying asset.

Adding the bank spread to the base rate yields a floating debt interest rate that will vary over

time as the base rate—a short-term interest rate—moves around, for example, with changes to

monetary policy (as shown in Figure 5, the three-month LIBOR has closely followed the

overnight federal funds rate over time). This floating interest rate is applicable mostly just for

short-term (e.g., six months to two years) construction debt, where the risk of significant changes

in the base rate are minor, given the short time frame.

For term debt of longer duration, however, most banks require borrowers to swap out the floating

interest rate for a fixed rate over the full term of the loan. This requires consideration of the third

component all-in interest rates—the fixed-for-floating swap rate (or just the “swap rate”) over

the applicable loan term. The swap rate is the fixed interest rate that banks demand be paid in

exchange for paying out the base rate (e.g., three-month LIBOR) over the life of a loan; as such,

it represents banks’ views on future movements in the base rate. Given that the borrower is

simultaneously paying the base rate (i.e., the first component of all-in interest rates) and also

being paid the base rate (as one-half of the swap transaction), the borrower’s base-rate exposure

cancels out altogether and the all-in fixed interest rate is comprised solely of the swap rate plus

the bank spread.

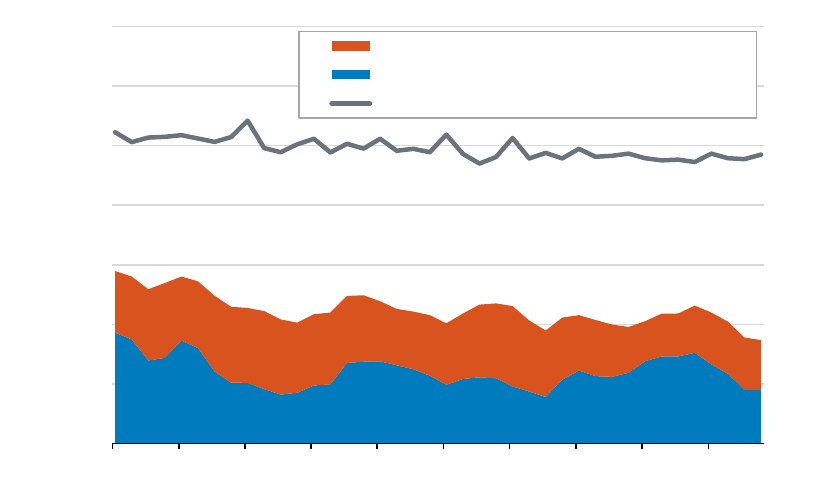

Figure 5 shows the daily history of all three underlying components, as well as the all-in floating

and fixed interest rates, going back to 2005. The overnight federal funds rate is included as well.

Though they do not always move in tandem, since early 2019, both the base rate and the 20-year

swap rate have moved lower, while bank spreads have—until very recently—held steady,

resulting in both floating and 20-year fixed interest rates below 4%. The recent market turmoil

caused by the novel coronavirus has pushed the base rate even lower (as the Federal Reserve has

cut the federal funds rate to 0%), though at the same time, bank spreads have moved higher by at

least 50 basis points, reflecting market uncertainty and liquidity concerns (Norton Rose Fulbright

2020c).

14

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Figure 5. History of debt interest rates and components

Sources: U.S. Federal Reserve Bank 2020; Intercontinental Exchange 2020; Norton Rose Fulbright 2020a

b.p: basis points

Whereas Figure 5 builds up a theoretical history of project finance interest rates from underlying

components, Figure 6 shows some empirical data points on debt interest rates from relatively

recent renewable energy project financings. Though there is clearly some spread depicted—

particularly in 2019, which is perhaps a function of the sharply declining interest rate

environment in that year, as shown in Figure 5—the empirical interest rates shown in Figure 6

are nevertheless roughly consistent with the trends shown above in Figure 5. Though all-in term

debt interest rates have fallen below 4% over the past year, our modeling analysis assumes a 4%

interest rate for all technologies, on the grounds that interest rates are unusually low at present

and that the inclusion of bank closing fees and necessary reserve accounts will likely push a sub-

4% rate up toward the 4% level regardless.

19

We also do not assume technology-specific interest

rates because we could not definitively differentiate each technology, given the limited data

spread. For example, land-based wind and utility-PV, which represent the majority of U.S. (and

global) renewable energy generation loans, overlap considerably in rates. In addition, our data set

appears to suggest geothermal projects tend to have higher rates and distributed PV have lower

rates; however, these technologies have much smaller sample sizes, there is still overlap with

other technologies, and there may be individual project-specific circumstances that push loans

higher or lower.

19

Various costs are associated with securing a loan. Banks often charge fees for arranging a loan, which may range

from 1% to 3% of the principal of the loan (Mendelsohn et al. 2012) estimated bank closing fees of 2.75%);

additionally, they may require that a borrower set aside cash up front into one or more accounts as a reserve to cover

unexpected fluctuations in cash flow. These arrangements effectively push the cost of a loan higher than the stated

interest on a loan.

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Jan-19

Jan-20

Fed Funds rate (with 25 b.p. target range since 2009)

20-year fixed interest rate (swap rate+bank spread)

Floating interest rate (LIBOR+bank spread)

20-year fixed-for-floating swap rate

Bank spread

3-month LIBOR

15

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Figure 6. Empirical all-in term debt interest rates for loans initiated over time, by technology

Each data point represents a collected value, which may include the capacity-weighted average rate for a company

or portfolio or an analyst estimated value.

Sources: Berkshire Hathaway Energy 2018; Terraform Power 2019, 2020; Brookfield Renewable Partners 2020;

Bank of America 2020; BNEF 2019; Guillet 2018; Norton Rose Fulbright 2020, 2019b, 2019c; Ormat

Technologies 2019, 2018

Table 2 (page 18) shows our construction and term debt interest rate assumptions for each

technology, in both 2018 and 2030. These assumptions are informed by a bottom-up buildup of

all-in interest rates from the underlying components described above (and shown in Figure 5),

Congressional Budget Office (CBO) interest rate projections (CBO 2020), as well as the

empirical interest rates shown in Figure 6. The modestly higher interest rates in 2030 are

consistent with CBO’s projection of a 100 basis point increase 10-year Treasury bond yields

from 2019 to 2030 (from 2.1% in 2019 to 3.1% in 2030), and reflect that interest rates are

currently at abnormally low levels and are therefore likely to increase in the future. For example,

at its June 2020 meeting, the Federal Reserve Bank’s Federal Open Market Committee projected

the overnight federal funds rate—a benchmark interest rate that is the Federal Reserve’s primary

monetary policy tool—will remain near 0% through 2022 but then increase to ~2.5% over the

longer run, five or six years from now (FOMC 2020). Though changes to the federal funds rate

do not flow through directly one-for-one to term debt interest rates (e.g., see Figure 5, above), in

general, tighter monetary policy (i.e., a higher federal funds rate) is associated with higher

interest rates across the board. This view is further supported by the U.S. Department of the

Treasury (Treasury) yield curve, which currently pegs the 10-year benchmark Treasury bond

yield at roughly 60 basis points above the one-month T-bill yield, implying a slight rise in

interest rates over the coming decade.

2.2.2 Debt Service Coverage Ratio

Though the all-in interest rate determines the cost of the loan, the size of the loan is governed by

the minimum debt service coverage ratio (DSCR) required by the lender. The DSCR is simply a

measure of the amount of net operating income that must be freely available over time to service

16

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

the loan; it both represents and dictates the size of the “cushion” required by the lender to ensure

the loan will be repaid—even under “worst-case” operating conditions.

The required DSCR is largely a function of the uncertainty surrounding future revenue generated

by the project. For renewable energy projects—which may have variable weather-dependent

output but often fixed-price PPAs in place—revenue uncertainty mostly boils down to resource

uncertainty (though it also depends on a host of other factors, including curtailment, availability,

and offtaker credit risk). As a result, lenders typically require a DSCR of 1.0 under a worst-case

or “P99” resource forecast (i.e., a long-term resource forecast that has a 99% probability of

exceedance). In other words, lenders typically require that even in the worst-case or most-

unlikely resource scenario, the project should still generate just enough net free cash to repay

the loan (i.e., a 1:1 ratio between of cash flow and debt service). In turn, this P99 DSCR of

1.0 translates into a P50 DSCR that is higher than 1.0, based on the gap (reflecting relative

uncertainties) between the P99 and P50 (i.e., median) resource projections. For solar PV projects,

P50 DSCRs of ~1.30 are common (Norton Rose Fulbright 2020a). For wind projects, P50

DSCRs tend to be higher (e.g., ~1.40) simply because wind resource projections are more

uncertain than solar resource projections (Norton Rose Fulbright 2020a).

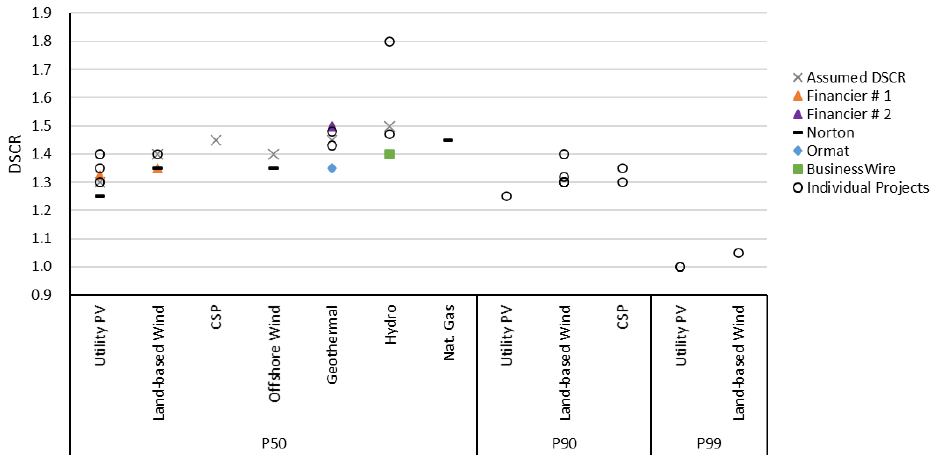

Figure 7 shows empirical DSCR data gathered from various sources (and at different levels of

probability of exceedance), while Table 2 (page 18) shows our benchmark P50 DSCR

assumptions for each technology based on the empirical data in Figure 7. While certain data

points in Figure 7 were gathered from sources with information on one technology’s DSCR,

most data points come from data sources covering multiple technologies (and therefore offer

a comparative perspective).

Figure 7. Empirical DSCR data at different probability of exceedance levels, by technology

Sources: Norton Rose Fulbright 2019c, 2020a; Financier 1 2020; Financier 2 2020; Ormat Technologies 2020;

BusinessWire 2015; Credit Agricole 2018a, 2019b; Fitch Ratings 2015

17

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

2.2.3 Term Equity

While financing for IPP-owned electric generation assets comes from various sources and can

involve multiple owners including tax equity, we focus our analysis on the after-tax equity return

requirements of assets solely owned by IPPs. These large companies typically have access to

significant capital through ongoing operations and public capital markets; however, because debt

is almost always less costly than equity,

20

equity investments in electric generating assets only

cover the portion of the project not funded through debt—thus, representing “levered” returns.

Figure 8 summarizes 31 separate data points gathered from 15 sources for the levered after-tax

cost of equity by technology type. In some instances, unlevered equity returns were provided,

which we convert to levered via a derivation of the weighted average cost of capital (WACC)

formula.

21

For example, we calculate a 7.5% unlevered rate of return to be equivalent to a 10.5%

levered rate of return.

Figure 8. Empirical data and medians of the after-tax levered cost of equity, by technology

Error bars represent estimates given with ranges.

Sources: Bank of America 2020; BNEF 2019; Financier 3 2020; Financier 4 2020; Financier 1 2020; Financier 5

2020; Financier 6 2020; Financier 7 2020; Financier 8 2020; Financier 9 2020; Financier 10 2020; Nextera Energy

2019; Norton Rose Fulbright 2020a;

Ørsted 2018; Ormat Technologies 2020

As shown in Figure 8, utility-scale PV requires the lowest after-tax levered rate of return, with

a median of 7.75%, and is followed by land-based wind at 9.00%. This would seem to follow

the premium in perceived risk between utility-scale PV, with fewer moving parts and lower

predicted resource variability than land-based wind. For example, Fitch Ratings (2020) stated,

“more than a decade of analysis shows that solar resources are consistently more stable and

predictable than wind, resulting in less volatile revenues and generally higher ratings.”

Given the limited data points for the other technologies (i.e., offshore wind, CSP, geothermal,

hydropower, and natural gas), their overlapping data points, and the premium assessed over wind

20

Debt investors lend money for a predetermined period of time and have a legal claim to any assets up to the

amount borrowed, plus the interest, and that right supersedes that of the equity investor. Because there is more

certainty and seniority to their cash flow than equity investors, debt is typically a less expensive form of capital

than equity.

21

levered cost of equity (i.e. WACC) = unlevered cost of equity / equity capital contribution – cost of debt * (1 – tax

rate) * debt capital contribution / equity capital contribution. A 4.0% cost of debt, a combined effective corporate tax

rate of 25.7%, and a debt contribution of 40% were assumed.

18

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

and PV by data sources that provided multiple values, we assume a 100 basis point premium

over land-based wind. This premium is slightly lower than the premium reported by individual

data sources when comparing these technologies to onshore wind (which ranged from 120 to 150

basis points); however, the 100 basis point premium provides values more consistent with their

median data points. We were unable to obtain specific returns for distributed PV, but Norton

Rose Fulbright (2020a) estimates that tax equity rates for distributed PV are approximately 100

basis points higher than utility-scale PV transactions; therefore, we assume a similar premium for

after-tax levered equity returns. Though they are not included in Figure 8, we were also able to

obtain data on equity rates where the PPA offtaker is a corporation or the owner uses a financial

hedge; the data sources indicate a rate of return between 10% and 12% for wind and utility-PV

projects (Financier 11 2020).

2.3 Summary of Current IPP costs

Table 2 summarizes our financial assumptions by technology during the project’s construction

and operation. As noted in the table and above, the electricity sales for natural gas plants are

assumed to come from short-term quasi-merchant plants, unlike the long-term PPA sales

assumed for the renewable energy technologies. This is likely a large contributor to the higher

cost of equity and DSCR shown in Table 2.

Table 2. Summary of Current IPP Financial Assumptions

Construction Operation

Technology

Electricity

Sales

After-Tax

Levered

Equity

Returns

Debt

Interest

Rate

Leverage

After-Tax

Levered

Equity

Returns

18-Year

Term

Debt

Interest

Rate

P50

DSCR

land-based

wind

PPA 11.0% 3.5% 80% 9.0% 4.0% 1.40

offshore wind

PPA

12.0% 4.0% 80% 10.0% 4.0% 1.40

utility PV PPA 9.75% 3.5% 80% 7.75% 4.0% 1.30

residential

and

commercial

PV

PPA

10.75% 3.5% 80% 8.75% 4.0% 1.30

CSP PPA 12.0% 3.5% 80% 10.0% 4.0% 1.45

geothermal

PPA

pre-drilling:

15.0%

post-

drilling:

10.0%

4.0%

pre-

drilling:

0%

post-

drilling:

75%

10.0%

4.0%

1.45

hydropower PPA 12.0% 4.0% 80% 10.0% 4.0% 1.50

natural gas

quasi-

merchant

12.0% 3.5% 80% 10.0% 5.0% 1.45

19

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

These financial assumptions are used as input values to calculate the WACC in the 2020 ATB.

WACC is used in the ATB as the discount rate input to the capital recovery factor for the

levelized cost of electricity (LCOE) formula. There is some incongruity to this method, in that

the variables shown in Table 2 are inputs to project finance cash flow models, and those models

differ from the simple LCOE formula used in ATB. Using these inputs to derive the WACC that

feeds into the LCOE formula might create slightly lower finance costs, and thus lower costs of

electricity, than are warranted. For example, the WACC (and LCOE) formula assumes a steady

debt-to-equity ratio over the project life; however, in project finance, principal is typically paid

down, creating more equity in a project over time. Feldman and Schwabe (2018) examine this

issue.

20

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

3 Utility Financing

This section illustrates financing practices for utility ownership of power generation assets.

Though the ATB uses data under an IPP model, it is also important to characterize and quantify

the cost of financing utility-owned projects because utilities currently own a significant amount

of U.S. electric generating assets, including renewable energy assets, as demonstrated in

Section 1, and utilities may own a larger share of renewable energy assets in the future.

We describe two primary ownership types prevalent in the U.S. marketplace: privately-owned

IOUs and POU organizations such as municipals, power authorities or districts and cooperative

utilities and other variations. Under the utility-ownership model, IOUs or POUs may own some

or all of the electric generation required to serve their customers, as well as the transmission and

distribution infrastructure. In contrast to IPPs, utility financing practices and costs (with some

notable exceptions; e.g., Florida’s Solar Rate Base Adjustment) do not differentiate financing

cost by generation technology type; rather, the main driver for costs are regulatory restrictions

and allowances, availability of capital, and credit rating for each type of utility.

3.1 IOU Financing

IOUs provide electricity services to 72% of utility customers in the United States, which

represents 220 million Americans (EIA 2019b; EEI 2019a). IOUs’ business strategy and

electricity rates are regulated at varying levels by state utility commissions. Like IPPs, IOUs are

for-profit corporations that are taxable at the federal level; they are eligible to receive federal tax

benefits afforded to qualifying renewable energy project owners, including the PTC, ITC, and

modified accelerated cost recovery system (MACRS) benefits. Of the 47 U.S. IOUs tracked by

the Edison Electric Institute in 2018, 42 had directly tradable stock and 5 operated as subsidiaries

of parent corporations or other business variations (EEI 2019).

In the IOU ownership-model, we assume investment in a power generation asset reflects the

capital structuring and cost of capital for the utility overall, as the IOU’s regulatory body permits

it to recover costs from all its capital investments, irrespective of technology, including electric

generation assets.

22

Estimating representative financing costs requires three input parameters

specific to IOUs: (1) the average return on equity (ROE), (2) the average cost of debt, and (3) the

composition of debt and equity in the IOU’s capitalization.

A utility’s ROE is largely determined by its regulator and typically results from a rate case. The

average awarded ROE for IOUs has trended downward since the late 1990s largely because of

steady decreases in the economy-wide benchmark interest rates (see Figure 9). According to EEI

(2019a), the averaged awarded ROE for tracked IOUs fell from 10.54% in 2009 to 9.70% in

2019.

We estimate the cost of debt for IOUs using the range of IOU’s bond credit ratings from the

Edison Electric Institute (EEI) and aggregated corporate bond yields (i.e., stated interest rates)

reported by the Federal Reserve. EEI reports that as of 2019, 43 of the 45 IOUs were rated as

22

As mentioned previously, there are notable exceptions to this assumption where a regulatory authority permits

a utility to achieve a specific return from a specific type of investment. For example, through the use of a Solar Rate

Base Adjustment, or SoBRA, by several Florida utilities, the public service commission can approve the addition of

solar projects of a utility rate base without a full rate case.

21

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

“investment grade,” with two utilities rated BBB- (the lowest investment-grade rating), another

two rated A or higher (the highest investment grade ratings), and the remaining 39 with an

average credit rating of BBB. To construct the cost of debt for IOUs, we average reported yields

for the lowest and highest rated investment grade corporate bonds. The resulting average

corporate yield for 2019 was 3.9%, as noted in Table 3, but by Q4 2019, it had dropped to 3.5%

(EEI 2020; FRED 2020a, 2020b). Figure 9 shows the ROE and average investment grade

corporate bond yields from 2010 to 2019. The 10-year Treasury bond rate is shown to illustrate

the spread of ROE and debt yield relative to the benchmark government interest rate.

Figure 9. IOU average ROE and investment grade corporate debt yield, 2010 to 2019

Sources: EEI 2020; FRED 2020a, 2020b

IOU capital structure held steady from 2010 to 2019. The average capital structure of IOUs over

that period ranged from 43% to 47% equity, with the corresponding 53%–57% made up of debt

(EEI 2019b). Unlike the IPPs, IOUs traditionally do not partner with third-party tax equity

providers and instead may use the tax credit in-house, which is known as “self-sheltering.”

From the estimates of ROE, corporate bond yields, and capital structure, we calculate the annual

WACC for the IOU ownership model. Table 3 presents the estimated WACC for IOUs from

2010 to 2020, which range from 5.8% to 6.4%. The WACC in Table 3 is an after-tax value, as

the interest payments on debt are tax deductible for IOUs.

0%

2%

4%

6%

8%

10%

12%

14%

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

IOU Cost of Capital

Corporate Debt Rate (Spread over Treasury)

10 Year Treasury (Benchmark Interest Rate)

Approved Return on Equity (ROE)

22

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

Table 3. Capital Structure, Return, and WACC Estimates for IOUs, 2010–2019

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Equity capitalization (%) 43.2 43.7 43.3 43.3 46.9 46.4 44.7 44.4 45.0 45.0

Debt capitalization (%) 56.7 56.3 56.8 56.7 53.1 53.6 55.4 55.6 55.0 55.0

Return on equity (%) 10.3 10.3 10.2 10.0 9.9 9.9 9.8 9.7 9.5 9.6

Debt interest rate (%) 5.5 5.2 4.3 4.7 4.5 4.4 4.2 4.1 4.4 3.9

Federal tax rate (%) 35 35 35 35 35 35 35 35 21 21

WACC (%) 6.5 6.4 6.0 6.1 6.2 6.1 5.9 5.8 6.2 6.0

3.2 Publicly-Owned and Cooperative Utility Financing

In addition to IOUs, EIA also classifies utilities as either public or cooperative. Public utilities

may include federal, state, or municipal electric service companies run by governmental entities.

Cooperative utilities are nonprofit organizations owned by their members. Although there are

important but subtle distinctions between public and cooperative utilities, we group these non-

IOUs together for the sake of simplicity as POUs.

POUs collectively serve more than 44 million customers and constitute the greatest number of

utilities by count in the United States. EIA (2019b) lists 812 cooperative utilities and 1,958