Policy Governance

Manual

Revised January 2023

i

POLICY GOVERNANCE MANUAL

INTRODUCTION AND OVERVIEW

This manual describes the governance process and standards for Community Associations Institute. CAI

governance is based on the Policy Governance Model® developed by John and Miriam Carver, which has

been adapted and refined by the CAI Board of Trustees to meet its unique organizational circumstances

and requirements.

Overview of Policy Governance

A policy is a value or perspective, as well as a guiding principle. CAI’s Policy Governance Manual has

been developed and adopted by the Board of Trustees, and all Board members must be familiar with the

governance structure and policies.

Under Policy Governance, there are four general categories of policies.

1. Ends—The Ends Statements are the Board’s articulation of organizational purpose. They are

intentionally broad and open-ended in nature and provide the primary benchmark against which

organizational success is determined.

2. Executive Limitations and Expectations—Executive Limitations and Expectations are the boards

specific directions to the Chief Executive Officer regarding what actions he must and must not

take in achieving the Board’s Ends. They can be stated as limitations, the CEO must not, or as

expectations, the CEO shall. Executive Limitations and Expectations form the boundaries within

which the CEO is permitted to function.

Ends along with Executive Limitations and Expectations are the Board’s sole

instructions to the staff, via the CEO. The Board will evaluate, over the course of

each fiscal year, the CEO’s performance against these policies. By definition,

performance against the Ends and Executive Limitations and Expectations is

equivalent to organizational performance and success.

3. Governance Process—Governance Process policies define the purpose of the Board of Trustees,

its governing style, values, and processes, and mechanisms for ongoing Board self-evaluation.

4. Board-CEO Relationship—The Board’s sole employee is the CEO. Board-CEO Relationship

policies document communication, accountability, and evaluation processes for the CEO.

Policy Design

Policies are layered in their design and development. The first policy in each of the four categories is the

Board’s most broad statement in that area. Subsequent polices provide further description, explanation,

and interpretation of Board guidance. The benefit of this design is that even if a particular issue is not

specifically addressed, the broadest policy level will provide guidance to the Board and CEO.

Board Member Responsibilities

Each member of the CAI Board of Trustees should be familiar with the overall framework of Policy

Governance and have a strong understanding of CAI’s Policy Governance Manual. Regular reports

submitted by the CEO are the principle mechanism for the Board to evaluate progress toward Ends,

compliance with Executive Limitations and Expectations, and evaluate the CEO annually. Thoughtful

review and consideration of these reports is a critical element of the Board’s oversight and leadership

roles.

ii

Table of Contents

SECTION PAGE

Introduction and Overview i

Ends Statements (Results) 1

Executive Limitations and Expectations 3

ELE #1. General Executive Constraint 4

ELE #2. Staff and Volunteer Treatment 5

ELE #3. Fiscal Planning and Budgeting 6

ELE #4. Communication and Support to the Board 7

ELE #5. Asset Protection 8

ELE #6. Compensation and Benefits 9

ELE #7. Emergency Executive Succession 10

ELE #8. Chapter Relations 11

Governance Process 12

GP #1. Global Governance Process 13

GP #2. Governing Style 14

GP #3. CAI Board Job Description 15

GP #4. President's Role 16

GP #5. Committee and Task Force Principles 17

GP #6. CAI Trustee and Membership Representation Groups Code of Conduct 18

GP #7. Governance Investment 19

GP #8. Handling of Operational Complaints 20

GP #9. Handling Apparent Policy Violations 21

Board-CEO Relationship 23

BCR #1. Global Board CEO Relationship 24

BCR #2. Unity of Control 25

BCR #3. Accountability of CEO 26

BCR #4. Delegation to the CEO 27

BCR #5. Monitoring Executive Performance 28

Appendix A: Investment Policy 2

Appendix B: Conflict of Interest Policy Form, Disclosure 35

Statement, and Clarification Document

Appendix C: Monitoring Reports Schedule 39

- 1 -

Ends Statements

(Results)

- 2 -

Ends Statements

(Results)

Revised January 2023

The Community Associations Institute exists to support and enable our members’ success and

to create conditions favorable to the well-being of community associations and the

advancement of community association governance, management, and quality of life. CAI

fosters a culture of discovery, innovation, diverse perspectives, and inclusive opportunities to

strengthen communities.

As a result of CAI efforts…

E-1. Positive Image

Community Associations and their volunteer leaders, managers, and business partners

are valued.

E-2. Advocacy

The business environment is favorable to community associations.

2.1 Laws and regulations provide fairness, flexibility, and support for Community

Associations.

2.2 Members are effective advocates for the CAI mission and their own interests at

the local, state, federal and international levels.

E-3. Leadership Skills

Members have the knowledge, skills, and competencies necessary to effectively govern,

manage and serve their Community Associations.

E-4. Professional Opportunities

Members develop personal and professional relationships, cultivate a network of

support and advance professional opportunity through collegial interaction.

- 3 -

Policy Type:

Executive Limitations &

Expectations

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 4 -

ELE #1. Policy Title: General Executive Constraint

The CEO shall not cause or allow any practice, activity, decision or organizational circumstance

which is either illegal, immoral, imprudent, or in violation of commonly accepted business and

professional ethics.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 5 -

ELE #2. Policy Title: Staff and Volunteer Treatment

The CEO may not cause or allow conditions that are unfair, undignified, inconsistent or unduly

unsafe.

The CEO shall:

1. Operate within written personnel procedures that clarify personnel rules for staff,

provide for a grievance process, and protect against wrongful conditions.

2. Ensure that staff is aware of the policies.

3. Ensure that staff is treated in compliance with personnel policies.

4. Ensure that sufficient staff are recruited, trained and supported.

5. Advise or inform the Board of Trustees of major pending staff issues that could result

in legal action or claims.

6. Provide staff with a workable mechanism for official communications.

The CEO shall:

1. Ensure that sufficient volunteers are recruited, trained and supported.

2. Advise or inform the Board of Trustees of major pending volunteer issues that could

result in legal action or claims.

3. Provide volunteers with a workable mechanism for official communications.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 6 -

ELE #3. Policy Title: Fiscal Planning and Budgeting

The CEO shall exercise prudent fiscal management and show an acceptable level of foresight,

expending funds in accordance with the Ends policies.

The CEO shall ensure fiscal planning and budgeting that:

1. Contains sufficient information to enable accurate projection of revenues and expenses.

Such information must be adequate for audit trails and must disclose planning

assumptions.

2. Results in the presentation of a comprehensive budget for Board approval within Ends

guidelines.

3. Ensures that cash and investments stay above ten percent (10%) of the general fund

budget.

4. Provides sufficient funding for an annual external audit.

5. Provides sufficient funding for Board activities, governance, and development, including

travel and training.

The CEO may not:

6. Expend more funds than are available.

7. Borrow money without prior Board approval.

8. Use any reserves for other than Board-approved purposes.

9. Conduct inter-fund transfers in amounts that would violate the operating reserve policies

of the Board.

10. Allow cash to drop below the amount needed to settle payroll and debts in a timely

manner.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 7 -

ELE #4. Policy Title: Communication and Support to the Board

The CEO shall keep the Board informed in a timely, complete, and accurate manner.

The CEO shall:

1. Inform the Board of any existing or imminent, significant non-compliance with any

policy of the Board, or any other matter that could have a material effect on CAI.

2. Provide the Board with required monitoring data (see policy on Monitoring Executive

Performance) in a timely, accurate and understandable fashion, directly addressing the

Board policies being monitored.

3. Provide the Board with sufficient alternative points of view from members, staff and

external sources on issues and options as needed for the Board to make fully informed

decisions.

4. Provide the Board with regular and timely minutes.

5. Provide the Board with appropriate additional financial analysis to supplement regular

monthly financial statements (e.g., annual international revenue and expenses).

The CEO shall not:

6. Deal with the Board other than as a whole, except for fulfilling appropriate individual

requests for information, or for communicating with the Board officers, Committees and

Task Forces duly charged by the Board.

7. Undermine the Board by violating confidences or by pitting member against member.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 8 -

ELE #5. Policy Title: Asset Protection

The CEO will ensure that all assets are adequately protected, properly maintained,

appropriately used and not placed at an undue risk.

The CEO shall:

1. Maintain adequate insurance coverage for the organization including the following

categories: Employee Dishonesty/Crime Coverage, Directors and Officer's Liability,

Property Insurance, Comprehensive General Liability, Cyber Liability and Data Breach

Response Services, Employment Practices Liability, Key Employee coverage, and

Workers Compensation.

2. Comprehensive General Liability insurance policies shall cover Board members,

volunteers, staff and the organization.

3. Protect the organization's intellectual property in the U.S. and abroad.

4. Be prepared to deal with disasters, including having a disaster recovery plan.

The CEO shall not:

5. Subject facilities, equipment and infrastructure to improper wear and tear or insufficient

maintenance.

6. Unnecessarily expose CAI, its Board, volunteers or staff to claims of liability.

7. Engage in any purchase wherein normally prudent protection has not been given against

conflict of interest or engage in purchasing practices in violation of law or Board policies

or other organizational documents.

8. Invest or hold funds in violation of CAI's Investment Policy.

9. Acquire/purchase or dispose of real property without prior Board approval.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 9 -

ELE #6. Policy Title: Compensation and Benefits

The CEO shall provide compensation and benefits that enhance recruitment and retention and

does not jeopardize CAI's fiscal integrity or public image.

The CEO shall:

1. Establish compensation and benefits that are commensurate with the geographic

and/or professional market for the skills employed.

2. Provide some basic level of benefits to all regular full-time employees, though

differential benefits to encourage longevity in key employees are not prohibited

The CEO shall not:

3 Change his or her own compensation and benefits.

4. Promise or imply permanent or guaranteed employment.

5. Create employment obligations over a longer term than revenues can be safely

projected.

6. Establish deferred or long-term compensation and benefits that cause unfunded

liabilities to occur or commit to benefits that incur unpredictable future costs.

7. Allow any employee to lose benefits already accrued from any foregoing deferred

compensation plan.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 10 -

ELE #7. Policy Title: Emergency Executive Succession

The CEO shall have at least two staff members at a level of Vice President or higher,

knowledgeable with the Board and CEO issues and processes to enable them to take over with

reasonable proficiency as an interim successor.

POLICY TYPE:

EXECUTIVE LIMITATIONS & EXPECTATIONS

- 11 -

ELE #8. Policy Title: Chapter Relations

The CEO shall not operate with a poor working relationship between the national organization

and its chapters.

- 12 -

Policy Type:

Governance Process

POLICY TYPE:

GOVERNANCE PROCESS

- 13 -

GP #1. Policy Title: Global Governance Process

The purpose of the Board is to:

1. Represent the interests of the membership. The Board will proactively pursue members'

input.

2. Determine the overall value of CAI membership, keeping a long-term, strategic

perspective (the Ends policies).

3. Ensure that the operating organization continually strives to meet the Ends in

conformance with the Executive Limitations and Expectations.

POLICY TYPE:

GOVERNANCE PROCESS

- 14 -

GP #2. Policy Title: Governing Style

The Community Associations Institute Board will govern with an outward vision,

encouragement of diversity in viewpoints, strategic leadership, clear distinction of Board and

staff roles, collective decisions, the future, and proactivity.

More specifically, the Board will:

1. Operate in all ways mindful of its fiduciary obligations.

2. Enforce upon itself and its members whatever discipline is needed to govern with

excellence. Discipline will apply to matters such as policymaking principles, respect of

clarified roles and self-policing of any tendency to stray from governance adopted in

Board policies. Board Members are expected to prepare for meetings and maintain

regular attendance. Continuing Board development will include orientation of new

members in the governance process, participation in relevant continuing education, and

periodic Board discussion of process improvement.

3. Provide inspiration, direction, and control to the CEO through establishment of broad

organizational values (Ends) and perspectives, rather than micromanagement.

4. Focus chiefly on intended long term impacts (Ends), not on the administrative means of

attainment.

5. Be an initiator of policy, not merely a reactor to staff initiatives. The Board, not the staff,

will be responsible for Board performance as specified in the policy entitled Board Job

Products.

6. Use the strengths of individual members to enhance the ability of the Board as a body to

make wise policy.

7. Regularly monitor and discuss the Board's own process and performance.

8. Ensure the continuity of its governance capability through education and training.

9. Be responsible for the competent, conscientious and effective accomplishment of its

obligations as a body. It will allow no Board Member or committee of the Board to

usurp this role or hinder this commitment.

10. Be expected to express their points of view and meaningful debate is encouraged.

However, each Board Member must respect the majority decision, and support all

decisions with one voice.

11. Treat everyone in a courteous, dignified and fair manner.

POLICY TYPE:

GOVERNANCE PROCESS

- 15 -

GP #3. Policy Title: CAI Board Job Description

The job of the Board is to make certain contributions that lead the Board toward the desired

performance and assure that it occurs. The Board's specific contributions are unique to its

trusteeship role and necessary for proper governance and management.

Consequently, the "products" or job contributions of the Board shall be:

1. The link between the organization and its membership.

2. Written governing policies that, at the broadest levels, address:

a. Ends (Results): Organizational products, impacts, benefits, outcomes (what good, for

which people, at what cost?)

b. Executive Limitations and Expectations: Constraints on executive authority, which

establish the prudence and ethical boundaries within which all executive activity and

decisions must take place.

c. Governance Process: Specification of how the Board conceives, carries out and

monitors its own task.

d. Board-CEO Relationship: How power is delegated and its proper use monitored.

3. The assurance of performance of CEO against policies in 2a. and 2b.

POLICY TYPE:

GOVERNANCE PROCESS

- 16 -

GP #4. Policy Title: President's Role

The job "product" of the President is, primarily, ensuring the integrity of the Board's process

and, secondarily, occasional representation of CAI to its membership and to outside parties.

1. The job output of the President is that the Board operates consistently with its own

rules and those legitimately imposed upon it.

a. Meeting discussion content will only be those issues that, according to Board policy,

clearly belong to the Board to decide, not the CEO.

b. Deliberation will be timely, fair, orderly and thorough, but also efficient, limited to

time and to the point.

c. The rules of Parliamentary Procedure are observed, except where the Board has

suspended them.

2. The authority of the President consists only in making decisions on behalf of the Board

that fall within and are consistent with any reasonable interpretation of Board policies

on the Governance Process and on the Board-CEO Relationship, except where the Board

specifically delegates portions of this authority to others.

a. The President is empowered to chair Board meetings with all the commonly

accepted power of that position (e.g., ruling, recognizing).

b. The President has no authority to make interpretations about the policies created by

the Board within Ends and Executive Limitations and Expectations policy areas.

c. The President shall communicate with the CEO, President-Elect, and Immediate Past

President no less than twice per month.

d. The President shall promote and foster professionalism, meeting preparation, and

respectful dialogue among all Trustees and the Membership Representation Groups.

3. The President is responsible for ensuring that the Board's annual agenda includes

facilitating discussion among the Trustees in order to conduct an evaluation of the CEO's

performance.

POLICY TYPE:

GOVERNANCE PROCESS

- 17 -

GP #5. Policy Title: Committee and Task Force Principles

The Board may establish committees to help carry out its responsibilities. To preserve the unity

of the Board, committees will be used sparingly, only when other methods have been deemed

inadequate. Committees will be used so as to minimally interfere with the wholeness of the

Board's job, and so as never to interfere with delegation from Board to CEO.

1. Board committees may not speak or act for the Board except when formally given such

authority for specific and time-limited purposes. Expectations and authority will be

carefully stated in order not to conflict with the authority delegated to the CEO.

2. Board committees are to help the Board do its job, not to help the staff do its job.

Committees ordinarily will assist the Board by preparing policy alternatives and

implications for Board deliberation. Board committees are not created by the Board to

advise staff.

3. Board committees are to avoid over-identification with a part of CAI rather than the

whole. Therefore, if a Board committee has helped the Board create policy in a given

topic, it will not be used to monitor CEO performance on that same topic.

4. Board committees may not exercise authority over staff. In keeping with the Board's

broader focus, Board committees will normally not have direct dealings with current

staff operations. Because the CEO works for the full Board, he or she will not be

required to obtain approval of a CAI Board committee before taking any executive

action.

5. This policy applies only to committees formed by Board action, whether or not the

committees include non-Board Members. It does not apply to committees formed under

the authority of the CEO.

6. Committee Members shall not take any special advantage of services or opportunities

for personal gain that are not available to all CAI members. They shall refrain from

accepting any gifts or promises of future benefits that might compromise or give the

appearance of compromising their independence of judgment or action.

7. Committee Members shall neither disclose the content of confidential discussions and

information, nor use such information to advance personal, financial or other private

interests.

8. Special committees, including task forces, shall serve until the work assigned has been

completed or until authoritatively dissolved.

POLICY TYPE:

GOVERNANCE PROCESS

- 18 -

GP #6. Policy Title: CAI Trustee and Membership

Representation Groups Code of Conduct

Individual trustees and members of the Membership Representation Groups are expected to

act in an ethical and businesslike manner. They must:

1. Represent the interests of the organization above conflicting or competing

organizations. This accountability supersedes any conflicting loyalty to any Chapter,

advocacy or interest groups, or membership on other boards or staffs. This

accountability supersedes the personal interest of any Trustee or member of a

Membership Representation Group acting as an individual consumer or provider of the

organization's services.

2. Disclose and, to the extent possible, avoid any conflict of interest or nepotism conflicts

in accordance with laws and/or the CAI's Conflict of Interest Policy.

a. If the conflict may result in personal financial gain to the Trustee or member of the

Membership Representation Group, they will refrain from participating in discussion

and voting.

3. Not attempt to exercise individual authority over the organization except as explicitly

set forth in Board policies.

a. Interactions with the public, press, or any external entity, the CEO, staff, or

committee reporting to the staff, must recognize the lack of authority of any

individual or group except as noted above.

4. Base decisions on the merits and substance of the matter at hand. They shall not pursue

inappropriate personal agendas, practice deception or break the trust of other Trustees

or Membership Representation Groups.

5. Not take any special advantage of services or opportunities for personal gain that are

not available to all CAI members. They shall refrain from accepting any gifts or promises

of future benefits that might compromise or give the appearance of compromising their

independence of judgment or action.

6. Neither disclose the content of confidential discussions and information, nor use such

information to advance personal, financial or other private interests.

7. Recognize and respect all points of views, even those from representatives of competing

organizations.

POLICY TYPE:

GOVERNANCE PROCESS

- 19 -

GP #7. Policy Title: Governance Investment

The Board will invest in its own governance capacity and the governance capacity of the

Membership Representation Groups.

Governance capacity includes skills, methods, and supports that are sufficient to ensure

governing with excellence. Costs will be prudently incurred, though not at the expense of

endangering the development and maintenance of superior capability. The areas of investment

are:

1. Training and retraining to orient new Board members and Membership Representation

Group members, as well as to maintain and increase existing Board and Membership

Representation Groups member skills and understandings.

2. Outside monitoring assistance (e.g., external financial audit) so the Board can exercise

confident control over organizational performance.

3. Outreach mechanisms as needed to ensure the Board's, and the Membership

Representation Groups' ability to listen to member viewpoints and values.

POLICY TYPE:

GOVERNANCE PROCESS

- 20 -

GP #8. Policy Title: Handling of Operational Complaints

To ensure that the Board fulfills its accountability to the ownership, but does not interfere in

matters it has delegated to the CEO, the following process shall be followed in the case of a

Board Member receiving a complaint from a member, regarding an operational matter.

1. The Board Member shall inquire if the concern has been addressed with a staff member

at the CAI headquarters office. If not, the member shall be advised to present the

concern to CAI, and the Board Member shall take no further action.

2. The Board Member shall not offer any evaluative comments or solutions.

3. If the concern has been presented to CAI, and the member feels the concern has not

been adequately addressed by CAI staff, the Board Member shall explain that the Board

has delegated certain responsibilities to the CEO, and that the Board holds the CEO

accountable. The member should be advised that the CEO will be asked to ensure that

the matter is looked into and that the CEO or their designee will respond directly to the

member.

4. The Board Member shall inform the CEO (or individual designated by the CEO) of the

complaint, and request that it be reviewed, if and as appropriate.

5. The Board Member shall encourage the member to contact him or her again if they

have not received a response within a reasonable time period.

POLICY TYPE:

GOVERNANCE PROCESS

- 21 -

GP #9. Policy Title: Handling Apparent Policy Violations

If there is a reasonable appearance of policy violation, even though a particular policy is not

scheduled for monitoring, the Board may choose to request a special monitoring report. The

Board may also use the occasion of a concern to re-evaluate the adequacy of its policy to

address the issue raised.

1. Conditions which may trigger a request for special monitoring may include:

• Board Member has been contacted regarding a complaint by a member of the

ownership or a customer which appears unresolved by staff and/or the CEO.

• If a member advises a Board Member following that an Operational Complaint remains

unresolved after following the procedures in GP #8, Handling of Operational Complaints,

and the Board Member believes there may be a potential policy violation.

• One or more Board Members receive complaints or become aware of a pattern of

similar instances that taken together raise questions of general policy violation.

• A single incident or complaint is of a nature that regardless of how it is resolved, there is

a serious question of policy violation.

2. If any of the above conditions exist:

• The Board Member shall inform the President of the situation.

• If the alleged situation presents a material level of risk to the organization, the President

shall call a special meeting of the Board as soon as practicable and the Board shall

determine if (a) it needs to seek legal counsel, and/or (b) engage an external, qualified,

independent third party

• If the alleged situation does not present a sufficient level of risk for the above process,

the President shall request the CEO to provide to the Board his or her interpretation of

the policy, or the relevant parts of the policy, along with rationale for why the

interpretation should be considered reasonable.

• The Board shall determine whether the CEO’s interpretation falls within any reasonable

interpretation of the policy, or whether to request an opinion regarding reasonableness

from a qualified, external, disinterested third party.

• The Board shall determine whether to request evidence of compliance with the

interpretation from the CEO or a qualified, external, disinterested third party.

• The Board as a whole shall determine whether the CEO’s interpretation falls within any

reasonable interpretation of the policy.

3. If the CEO’s interpretation is assessed by the Board to be reasonable and there is evidence

of compliance with that interpretation, the matter shall be dropped at the Board level. (The

CEO will handle the issue directly with the complainant.)

POLICY TYPE:

GOVERNANCE PROCESS

- 22 -

4. If the CEO’s interpretation is assessed by the Board as not being a reasonable interpretation

of the policy, or there is a clear violation of a reasonable interpretation, the Board shall

determine the degree of seriousness of the issue and deal with the CEO regarding

performance.

5. If the incident(s) in question do(es) not appear to be a potential violation of policy:

• The Board member should consider if he or she believes the policy should be amended

to prevent a future occurrence of a similar situation.

• If the Board member considers that a policy amendment should be made, the Board

member should ask the President to put the item on the next agenda.

• The Board shall determine whether or not the policy should be amended, making the

reported event explicitly unacceptable in the future.

- 23 -

Policy Type:

Board-CEO Relationship

POLICY TYPE:

BOARD-CEO RELATIONSHIP

- 24 -

BCR #1. Policy Title: Global Board-CEO Relationship

The Board's sole official connection to the operational organization, its achievements, and

conduct will be through a chief executive officer (CEO).

In order to delegate effectively, the Board recognizes that its only employee is the CEO, and

that it will delegate only to the CEO. The Board will hold the CEO accountable for all

organizational achievements and conduct.

POLICY TYPE:

BOARD-CEO RELATIONSHIP

- 25 -

BCR #2. Policy Title: Unity of Control

Only officially passed motions of the Board are binding on the CEO.

1. Decisions or instructions of individual Board members, officers, Membership

Representation Groups, or committees are not binding on the CEO.

2. In the case of Board members, committees or Membership Representation Groups

requesting information or assistance without Board authorization, the CEO can refuse

such requests that require, in the CEO's opinion, a material amount of staff time or

funds, or are disruptive.

POLICY TYPE:

BOARD-CEO RELATIONSHIP

- 26 -

BCR #3. Policy Title: Accountability of the CEO

The CEO is the Board's only link to operational achievements and conduct, so that all authority

and accountability of staff, as far as the Board is concerned, is considered the authority and

accountability of the CEO.

1. The Board shall not give instructions to persons who report directly or indirectly to the

CEO.

2. The Board shall not evaluate, either formally or informally, any staff other than the CEO.

3. The Board shall view CEO performance as identical to organizational performance, so

that organizational accomplishment of Board-stated Ends and compliance with

Executive Limitations and Expectations will be viewed as successful CEO performance.

POLICY TYPE:

BOARD-CEO RELATIONSHIP

- 27 -

BCR #4. Policy Title: Delegation to the CEO

The Board's job is generally confined to establishing the broadest policies; implementation and

subsidiary policy development is delegated to the CEO.

The Board will instruct the CEO through written policies that:

1. Prescribe the organizational Ends to be achieved and

2. Describe organizational situations and actions to be avoided (Executive Limitations and

Expectations) allowing the CEO to use any reasonable interpretation of these policies.

a. Ends direct the CEO to achieve certain results; Executive Limitations and

Expectations policies constrain the CEO to act within acceptable boundaries of

prudence and ethics. With respect to ends and executive means, the CEO is

delegated all authority allowed by the Bylaws and is authorized to establish all

further policies, make all decisions, take all actions and develop all activities as long

as they are consistent with any reasonable interpretation of the Board's policies.

b. The Board may change its policies, thereby shifting the boundary between Board

and CEO domains. Consequently, the Board may change the latitude of choice given

to the CEO, but as long as any particular delegation is in place, the Board and its

members will respect and support the CEO's choices. The Board will not allow the

impression that the CEO has violated policy when in fact, a policy change has

occurred. This does not prevent the Board from obtaining information in the

delegated areas. Changes in policy may only be applied proactively, never

retroactively.

c. No Board member, member of a Membership Representation Group, or committee

has authority over the CEO. Information may be requested by these individuals or

groups, but if such request, in the CEO's judgment, requires a material amount of

resources or is detrimental to other necessities, it may be refused.

d. As long as the CEO uses any reasonable interpretation of the Board's Ends and

Executive Limitations and Expectations policies, the CEO is authorized to establish all

further policies, make all decisions, take all actions, establish all practices and

develop all activities. Such decisions of the CEO shall have full force and authority as

if decided by the Board.

POLICY TYPE:

BOARD-CEO RELATIONSHIP

- 28 -

BCR #5. Policy Title: Monitoring Executive Performance

Monitoring executive performance is synonymous with monitoring organizational performance

against Board policies on Ends and on Executive Limitations and Expectations. Any evaluation of

CEO performance, formal or informal, may be derived only from these monitoring data.

1. Monitoring is an important means to determine the degree to which Board policies are

being fulfilled. Information that does not do this will not be considered to be

monitoring. Monitoring will be as systematic as possible, using a minimum of Board time

so that meetings can be used to create the future rather than review the past.

2. A given policy may be monitored in one or more of three ways:

a. Internal Report: Disclosure of compliance information to the Board from the CEO.

b. External Report: Discovery of compliance information by a disinterested external

auditor, inspector or judge who is selected by and reports directly to the Board. Such

reports must assess executive performance only against policies of the Board, not

against those of the external party unless the Board has previously indicated that

party's opinion to be the standard.

c. Direct Board inspection: Upon being duly charged by the Board, this is discovery of

compliance information by a Board member, a committee or the Board as a whole.

This is a Board inspection of documents, activities or circumstances directed by the

Board, which allows a "prudent person" test of policy compliance.

3. Upon the choice of the Board, any policy can be monitored by any method at any time.

For regular monitoring, however, each Ends and Executive Limitations and Expectations

policy will be classified by the Board according to frequency and method.

4. The Board may monitor CEO performance with respect to these expectations at any

time, but the Board intends to monitor on a routine basis.

a. The Board will determine the frequency and method of monitoring the policies that

instruct the CEO (Ends and Executive Limitations and Expectations) and will normally

use a routine schedule. (Appendix C)

5. The CAI Board will conduct an annual, formal evaluation of CEO performance, and such

evaluation will be based only on the accumulation of previous monitoring reports

received year to date.

6. The President, President-elect, and Immediate Past President will ensure that the Board

considers the annual evaluation of the CEO when setting compensation.

- 29 -

Investment Policy Statement

Approved by the CAI Board of Trustees October 2005

Revised January2009

Revised March 2011

Revised April 2013

Introduction

This statement of investment policy has been adopted by the Board of Trustees of the Community

Associations Institute (CAI) to provide guidelines for the investment of funds held by the Institute.

For the purposes of managing investment risk and to optimize investment returns within acceptable risk

parameters, the funds held will be divided into three separate investment pools. The process for

determining the dollar amount in each pool is set forth in the "Procedures" section of this document.

The three investment pools shall be called the "Operating Fund," the "Short-Term Fund" and the "Long-

Term Fund." These short- and long-term pools of funds are designed to generate operating income and

to fund reserves. The Chief Financial Officer shall review and recommend the amount that will be

budgeted on an annual basis for interest income, subject to review and approval of the Board of

Trustees in the normal budget preparation and review process.

Procedures

1. The following procedures will be followed to ensure the investment policy statement is consistent

with the current mission of CAI and accurately reflects the current financial condition:

A. This investment policy shall be reviewed bi-annually by the CFO in conjunction with the

investment advisor, and any recommended changes will be presented to the Board of Trustees

for approval.

2. The following procedures will be used to determine the dollar amounts to be placed in the Short-

Term Fund and the Long-Term Fund. Dollars not specifically designated for the Short-Term or Long-

Term Funds will be restricted to investments designated in the "Investment Guidelines" for the

Operating Fund.

A. The CFO, in consultation with the investment advisor, will recommend the dollar amounts to be

placed in the Short-Term and Long-Term Funds.

B. The Chief Executive Officer will have final approval of the dollar amounts placed in each fund

(operating, short term, long term) for CAI.

C. Allocation of the dollar amounts to each fund and actual investments will be limited by any

relevant criteria contained in CAI’s Executive Limitations Document.

3. The services of an investment consultant will be sought to manage portions of CAI funds. The

following procedure shall be followed to engage a new or replace a current investment consultant.

A. The CFO and CEO will recommend the hiring or replacing of an investment consultant to the

Board of Trustees.

Appendix A

- 30 -

B. The Board of Trustees will review the candidate(s) and have final approval.

4. The procedures for changing an investment manager and/or mutual funds will be as follows:

A. The investment consultant will recommend the selection of and the changing of an investment

manager and/or mutual fund to the CFO and CEO who will review the recommendation and

have final approval.

CAI OPERATING FUND

Purpose

The purpose of the Operating Fund is to provide sufficient cash to meet the current financial obligations

of CAI in a timely manner.

Investment Objectives

The investment objectives of the Operating Fund are:

1. Preservation of capital

2. Liquidity

3. To optimize the investment return within the constraints of the policy

Investment Guidelines

ALLOWABLE INVESTMENTS

The CFO shall be authorized to invest the CAI Operating Fund as follows:

1. Checking accounts in U.S. federally insured banks and savings and loans not to exceed federally

insured amounts

2. Money market funds that invest in U.S. Government backed securities

M

ATURITY

The maturities on investments for the Operating Fund shall be limited to one year or less.

R

EPORTING

The CFO shall prepare the following reports for presentation on a quarterly basis to the Board of

Trustees:

1. Schedule of investments

2. Interest income year to date

3. Current yield

CAI SHORT-TERM FUND

Purpose

The purpose of the Short-Term Fund is to meet the expenses occurring as the result of unanticipated

activities, to improve the return on funds held for expenditure over the next one to two years, and to

manage investment risk.

Investment Objectives

The investment objectives of the Short-Term Fund are:

1. Preservation of capital

2. Liquidity

3. To optimize the investment return within the constraints of the policy

- 31 -

Investment Guidelines

ALLOWABLE INVESTMENTS

The CFO shall be authorized to invest the CAI Short-Term Fund as follows:

1. Money market funds that invest in government-backed securities;

2. U.S. Federally insured certificates of deposit not to exceed the current Federal insurance

amount (currently $250,000) per institution

3. Direct obligations of the U.S. Government, its agencies and instrumentalities

4. Commercial paper rated A-1/P-1 by Standard & Poor's and Moody's

5. Corporate notes with a minimum rating of investment grade by one rating service

M

ATURITY

The Short-Term Fund shall have an average maturity of two years or less.

D

IVERSIFICATION

No more than 5% at cost of the Short-Term Fund may be in the securities of any one issuer with the

exception of obligations of the U.S. Government, its agencies and instrumentalities; repurchase

agreements collateralized by obligations of the U.S. Government, its agencies and instrumentalities;

mutual funds and federally insured certificates of deposit.

R

EPORTING

The CFO shall prepare the following reports for presentation on a quarterly basis to the Board of

Trustees:

1. Schedule of investments,

2. Interest income year to date, and

3. Current yield.

CAI LONG-TERM FUND

Purpose

The purpose of the CAI Long-Term Fund is to enhance the purchasing power of funds held for future

expenditure including initiating new programs within CAI, ownership of a building for CAI staff, and

replacement of furniture and equipment for CAI.

Investment Objectives

The objectives of the portfolio represent a long-term goal of maximizing returns without exposure to

undue risk, as defined herein. It is understood that fluctuating rates of return are characteristic of the

securities markets. The primary concern should be long-term appreciation of the assets and consistency

of total return on the portfolio. Recognizing that short-term market fluctuations may cause variations in

the account performance, the portfolio is expected to achieve the following objectives over a three-year

moving time period:

1. The account's total expected return will exceed the increase in the Consumer Price Index by 4%

annually. On a quarter to quarter basis, the actual returns will fluctuate and can be expected to

exceed the target about half the time.

2. The account's total expected return will exceed the increase in the Treasury Bill Index by a

minimum of 4% annually. On a quarter to quarter basis, the actual returns will fluctuate and can

be expected to exceed the target about half the time.

Understanding that a long-term positive correlation exists between performance volatility (risk) and

statistical returns in the securities markets, we have established the following short-term objective:

- 32 -

The portfolio should be invested to minimize the probability of low negative total returns, defined as a

one-year return worse than negative -20%. It is anticipated that a loss greater than this will occur no

more than one out of twenty years.

Investment Guidelines

The investment policies and restrictions presented in this statement serve as a framework to achieve

the investment objectives at the level of risk deemed acceptable. These policies and restrictions are

designed to minimize interference with efforts to attain overall objectives, and to minimize the

probability of excluding appropriate investment opportunities.

P

ROHIBITED INVESTMENTS

The following investments and investment activities are prohibited except to the extent that mutual

funds used by CAI within the Absolute Return portion of the portfolio may use these investments for the

purposes of managing portfolio risk:

1. Private placements

2. Letter stock

3. Derivatives. However, to the extent that mutual funds are used by CAI the mutual funds may

buy or sell derivatives for the purposes of managing portfolio risk

4. Commodities or commodity contracts

5. Short sales

6. Margin transactions

7. Any speculative investment activities

8. Investments categorized as low grade at the time of acquisition

9. Any investment prohibited by CAI’s Executive Limitations Document and not specifically listed

above

D

IVERSIFICATION

Diversification is expected to be achieved through the Long-Term Fund Target Asset Mix.

L

ONG-TERM FUND TARGET ASSET MIX

The long-term component of the Reserve Fund shall be divided between an Absolute Return investment

strategy and an Asset Allocation 50% of the portfolio shall be comprised of the Absolute Return strategy

and 50% devoted to the Asset Allocation strategy.

The Absolute Return investment strategy shall have a goal to achieve positive returns during all market

environments consistent with the goals of the long-term fund. Recognizing this goal cannot be achieved

over every time period, the Absolute Return Investment Strategy shall attempt to achieve this objective

over three-year periods.

The Asset Allocation investment strategy shall be comprised of the asset classes listed in the table

below. The target weight is the desired weight for each asset class. The minimum weights and maximum

weights are to allow for normal market fluctuations. It shall be the responsibility of the investment

consultant to remain within the range specified for each asset class. The investment consultant should

re-balance the portfolio on an as needed basis to maintain the target weights and will alert the CFO

when this occurs.

- 33 -

ASSET CLASS

MINIMUM

WEIGHT

TARGET

WEIGHT

MAXIMUM

WEIGHT

EQUITY

U.S. Large Capitalization Stocks 30% 35% 40%

U.S. Mid Capitalization Stocks 05% 10% 15%

U.S. Small Capitalization Stocks 05% 10% 15%

International Stocks 00% 05% 10%

TOTAL EQUITY

60%

FIXED INCOME

U.S. Government/Corporate

Intermediate Bonds

20% 25% 30%

International Bonds 00% 05% 10%

High Yield Corporate Bonds 05% 10% 15%

TOTAL FIXED INCOME

40%

EQUITIES

The equity asset classes should be maintained at risk levels roughly equivalent to the sectors of the

market represented, with the objective of exceeding a nationally recognized index measuring the

performance of the designated sector over a three-year moving time period net of fees and

commissions. Mutual funds conforming to the policy guidelines may be used to implement the

investment program.

The following definitions shall apply for the purposes of this policy:

U.S. Large Capitalization Stocks: A portfolio of stocks comprised primarily of U.S. based

companies, with the average of the stocks held having a

market value exceeding $5.0 billion and primary shares of

which are traded on a major U.S. exchange.

U.S. Mid Capitalization Stocks: A portfolio of stocks comprised primarily of U.S. based

companies, with the average of the stocks held having a

market value between $1.0 and $5.0 billion and primary

shares of which are traded on a major U.S. exchange.

U.S. Small Capitalization Stocks: A portfolio of stocks comprised primarily of U.S. based

companies with the average of the stocks having a market

value less than $1 billion.

International Stocks: A portfolio comprised primarily of stocks of non-U.S. based

companies, the primary shares of which are traded on

exchanges outside the U.S. American Depository Receipts

are considered International Stocks.

F

IXED INCOME

Investments in fixed income securities will be managed actively to pursue opportunities presented by

changes in interest rates, credit ratings, and maturity premiums. Mutual funds conforming to the policy

guidelines may be used to implement the investment program. The Following definitions shall apply for

the purposes of this policy:

- 34 -

U.S. Government/Corporate A portfolio consisting primarily of fixed income securities

Intermediate Bonds: denominated in U.S. dollars issued by the U.S. Government

or U.S. corporations having a weighted average maturity of

less than 10 years.

High Yield Corporate Bonds: A portfolio consisting primarily of bonds issued by U.S.

corporations and the majority of the bonds are rated below

BBB/Baa.

International Bonds: A portfolio consisting primarily of fixed income securities

denominated in currencies other than U.S. dollars. Issuers

may be both governments and corporations.

Performance Reporting

The Long-Term Fund will be evaluated quarterly on a total return basis. Returns will be compared to:

1. Consumer Price Index plus 4%

2. Three-month Treasury Bill Index plus 4%

3. Nationally recognized indices measuring the performance of the classes specified in the target

asset mix

Comparisons will show results for the latest quarter, year to date and since inception. The report will be

prepared by the Investment Consultant and will be presented to the CFO on a quarterly basis who will

distribute appropriately to Board members.

- 35 -

Conflict of Interest Policy

Adopted by Board of Trustees January 2010

Revision Approved January 2017

In compliance with provisions of the Sarbanes-Oxley Act, the CAI Board of Trustees has adopted this Conflict

of Interest Policy. All officers, trustees, membership representation groups (MRGs) members, and employed

senior management are required to submit this form annually and as needed should a potential conflict of

interest arise. This policy: (1) defines conflicts of interest; (2) identifies classes of individuals within the

organization covered by this policy; (3) facilitates disclosure of information that may help identify conflicts of

interest; and (4) specifies procedures to be followed in managing conflicts of interest.

1. Definition of conflicts of interest. A conflict of interest arises when a person in a position of authority

over the organization may benefit, financially or otherwise, from a decision he or she could make in that

capacity, including indirect benefits such as to family members or businesses with which the person is

closely associated. This policy is focused upon material interest of, or benefit to, such persons.

2. Individuals covered. Persons covered by this policy are the organization’s officers, trustees, MRG

members and employed senior management.

3. Facilitation of disclosure. Persons covered by this policy will annually disclose or update to the President

of the Board of Trustees on a form provided by the organization their interests that could give rise to

conflicts of interest, such as a list of family members, substantial business or investment holdings, and

other transactions or affiliations with businesses and other organizations or those of family members.

4. Procedures to manage conflicts. For each interest disclosed to the President of the Board of Trustees,

the President will determine whether to: (a) take no action; (b) assure full disclosure to the Board of

Trustees and other individuals covered by this policy; (c) ask the person to recuse from participation in

related discussions or decisions within the organization; or (d) ask the person to resign from his or her

position in the organization or, if the person refuses to resign, become subject to possible removal in

accordance with CAI’s removal procedures. The organization’s chief employed executive and chief

employed finance executive will monitor proposed or ongoing transactions for conflicts of interest and

disclose them to the President of the Board of Trustees in order to deal with potential or actual conflicts,

whether discovered before or after the transaction has occurred.

Conflict of Interest Acknowledgement

I have read the Conflict of Interest Policy set forth above and agree to comply fully with its terms and conditions

at all times during my service as a member of the CAI Board of Trustees, Business Partners Council,

Community Association Mangers Council, Homeowner Leaders Council, or employed senior management. If at

any time following the submission of this form I become aware of any actual or potential conflicts of interest, or

if the information provided with this form becomes inaccurate or incomplete, I will promptly notify the President

of the CAI Board of Trustees in writing.

____ I have no conflicts as described in this policy.

____ I have no conflicts as described in this policy, except for those noted on the attached

Conflict of Interest Disclosure Statement.

Signature Name (please print)

Date

Appendix B

- 36 -

Conflict of Interest Disclosure Statement

The Conflict of Interest Disclosure Statement is designed to help members of the Board of Trustees and

Membership Representation Groups (MRGs) meet their continuing responsibility to disclose potential conflicts of

interest. All Trustees and MRG members agree to abide by the Conflict of Interest Policy adopted by the CAI Board

of Trustees. You are required to submit a completed and signed Conflict of Interest Disclosure Statement if you

have a potential conflict of interest as defined in the CAI Conflict of Interest Policy or if you answered “yes” to any of

the questions on the CAI Conflict of Interest Disclosure Questionnaire (Trustees only).

1. In the space below, please list all organizations, associations or businesses in which: (1) you have a substantial

financial interest, or (2) you are a member, hold a position as a trustee, director, general manager, principal

officer, or employee, if these organizations, associations or businesses engage in business transactions with or

compete in any way with Community Associations Institute. Enter “N/A” if you have no organizations to report.

Name of Organization/Association/Business Nature of Your Interest in the Organization/Association/Business

(Attach additional sheets if necessary.)

2. In the space below, please provide a description of any and all business transactions of CAI during the past

fiscal year in which (1) you have a substantial financial interest, or (2) that involve an organization, association,

or business in which you have a substantial financial interest or (3) that involved an organization, association,

or business in which you hold a position as trustee, director, general manager, principal officer, or staff. Include

a brief description of each transaction, and a description of your interest in the transaction. Enter “N/A” if you

have no transactions to report.

(Attach additional sheets if necessary.)

3. In the space below, list any family members that are CAI officers, trustees or employed senior management.

Enter “N/A” if you have no family relationships to report.

(Attach additional sheets if necessary.)

4. In the space below, list any CAI officers, trustees or employed senior management with whom you have a

business relationship. Enter “N/A” if you have no business relationships to report.

(Attach additional sheets if necessary.)

I certify that the above information is correct to the best of my knowledge.

Signature Date

Name (please print) CAI Title

- 37 -

Conflict of Interest Policy

Clarification Document

Adopted by Board of Trustees January 2017

PURPOSE

The purpose of CAI’s Conflict of Interest Policy (“Policy”) is to ensure that the trustees, officers, members of

the Business Partners Council, Community Association Managers Council, and Homeowner Leaders Council,

and key employees (“Leaders”) of Community Associations Institute (“Association”) act in the best interests of

the Association and protect the interests of the Association.

The policy:

1. Defines conflicts of interest

2. Identifies classes of individuals within the organization covered by the policy

3. Facilitates disclosure of information that may help identify conflicts of interest

4. Specifies procedures to be followed in managing conflicts of interest

The policy is intended to supplement, but not replace, any applicable state and federal laws governing conflict

of interest applicable to nonprofit organizations.

PROCEDURES

Duty to Disclose/Facilitation of Disclosure. Persons covered by this policy will annually disclose or update to

the President of the Board of Trustees on a form provided by the Association their interests that could give rise

to conflicts of interest, such as a list of family members, substantial business, or investment holdings, and

other transactions or affiliations with businesses and other organizations or those of family members.

Relationships of a confidential nature or within professions regulated by privacy laws, such as that between an

attorney/client or banker/client, are exempt from disclosure.

If at any time following the annual disclosure a person becomes aware of any actual or potential conflicts of

interest, or if the information provided with this form becomes inaccurate or incomplete, he or she will

promptly notify the President of the CAI Board of Trustees in writing.

Determining Whether a Conflict of Interest Exists.

For each interest disclosed to the President of the Board of Trustees, the President will determine one of the

following actions:

1. Take no action

2. Assure full disclosure to the Board of Trustees and other individuals covered by this policy

3. Ask the person to recuse from participation in related discussions or decisions within the organization

4. Ask the person to resign from his or her position in the organization or, if the person refuses to resign,

become subject to possible removal in accordance with CAI’s removal procedures.

Procedures to Manage Conflicts. The organization’s chief employed executive and chief employed finance

executive will monitor proposed or ongoing transactions for conflicts of interest and disclose them to the

President of the Board of Trustees in order to deal with potential or actual conflicts, whether discovered

before or after the transaction has occurred.

- 38 -

DEFINITIONS AND EXAMPLES

Benefits. Benefits could include, but are not limited to, financial, personal, political, or promotional gain.

Competing Organization. Organizations, associations or businesses in which: (1) a Leader has a substantial financial interest, or

(2) a Leader is a member, holds a position as a trustee, director, general manager, principal officer, or employee, if these

organizations, associations, or businesses engage in business transactions with or compete in any way with the Association.

“Competing” can mean:

1. Competing for dollars

2. Competing for members

3. Competing legislatively or regulatorily

4. Competing for primary interests

“Engage in Business Transactions” means as a customer, business partner, advisor, or in a leadership position(s).

Examples. O

rganizations that serve the real estate industry and could be perceived as competitors include, but are not

limited to:

• A

rizona Association of Community Managers (AACM)

• Alliance of Community Association Managers Chief Executive Officers (ACAM-CEO)

• Building Owners and Managers Association (BOMA)

• California Association of Community Managers (CACM)

• Executive Council of Homeowners (ECHO)

• Institute of Real Estate Management (IREM)

• National Association of Realtors (NAR)

• Large Management Company or Business Partner events that provide education to community association board

members or managers on par with CAI’s curriculum

Examples. T

he following organizations are not competing organizations:

• Foundation for Community Association Research (FCAR)

• Community Association Managers International Certification Board (CAMICB)

• Any CAI Chapter

Conflict of Interest. A conflict of interest arises when a person in a position of authority over the organization may benefit

personally from a decision he or she could make in that capacity, including indirect benefits such as to family members or

businesses with which the person is closely associated. CAI’s Conflict of Interest Policy is focused upon material interest of, or

benefit to, such persons.

A conflict of interest is present when, in the judgment of the President of the Board of Trustees, a Leader’s stake in the

transaction is such that it reduces the likelihood that a Leader’s influence can be exercised impartially in the best interests of the

Association.

Any potential (real or perceived) conflict of interest must be disclosed. To avoid a conflict of interest, some activities should be

avoided. Some examples include:

Disclose

Avoid

Financial interest or contractual relationship

Serving on a board or in similar leadership role for a competing

organization

Serving on a committee(s) for a competing organization

Using CAI’s intellectual property for activities with a competing

organization

Serving in a strategy or policy creating role with a competing organization,

especially when in conflict with CAI’s adopted policies

Relationships of a confidential nature or those regulated by privacy laws, such as that between an attorney/client or

banker/client, are exempt from disclosure.

Family. Includes an individual’s spouse, ancestors, children, grandchildren, great grandchildren, siblings (whether by whole- or

half-blood), and the spouses of children, grandchildren, great grandchildren, and siblings.

Interest. Any commitment, investment, relationship, obligation, or involvement, financial or otherwise, direct or indirect, that

may influence a person’s judgment. An interest is not necessarily a conflict of interest. A person who has an interest may have a

conflict of interest only if the President of the Board of Trustees decides that a conflict of interest exists.

Transaction. Any transaction, agreement, or arrangement between a Leader and the Association, or between the Association

and any third party where a Leader has an interest in the transaction or any party to it.

- 39 -

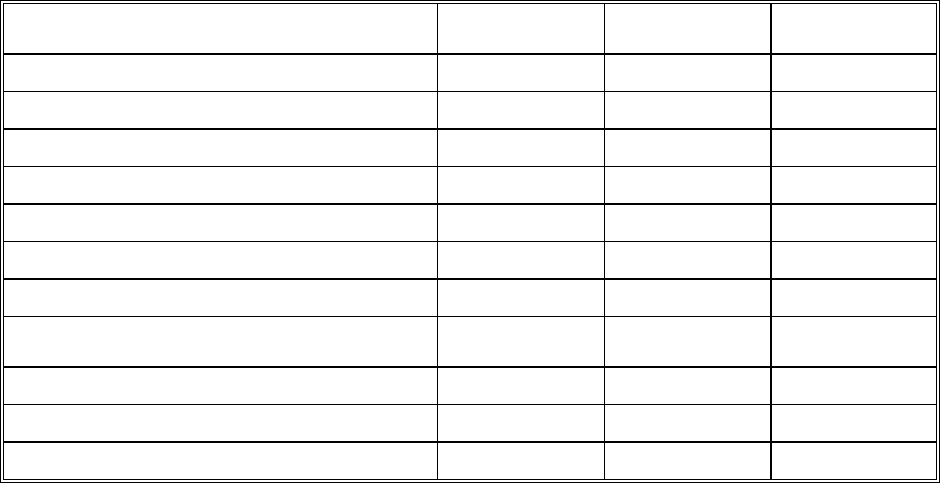

Monitoring Reports Schedule

Ends Reports

First Quarter: October 31

Second Quarter: January 31

Third Quarter: April 30

Fourth Quarter: August 15

Executive Limitations and Expectations Monitoring Reports

Policy Frequency Due Date

1. General Executive Constraint

Annually

4

th

quarter: August 15

2. Staff and Volunteer Treatment

Annually

4

th

quarter: August 15

3. Fiscal Planning and Budgeting

Quarterly*

1

st

quarter: October 31

2

nd

quarter: January 31

3

rd

quarter: April 30

4

th

quarter: August 15

4. Communication and Support to the Board

Quarterly

1

st

quarter: October 31

2

nd

quarter: January 31

3

rd

quarter: April 30

4

th

quarter: August 15

5. Asset Protection

Annually

4

th

quarter: August 15

6. Compensation and Benefits

Annually

4

th

quarter: August 15

7. Emergency Executive Succession

Annually

4

th

quarter: August 15

8. Chapter Relations

Quarterly

1

st

quarter: October 31

2

nd

quarter: January 31

3

rd

quarter: April 30

4

th

quarter: August 15

If a CAI event or meeting conflicts with a report due date, the CEO receives an automatic 15-day

extension to distribute the report to the Board of Trustees.

*In addition to monthly financial statements.

Appendix C

- 40 -

Adopted May 2004

Revised May 2005

Revised November 2005

Revised March 2006

Revised February 2007

Revised May 2011

Revised June 2014

Revised August 2014

Revised December 2016

Revised March 2017

Revised November 2018

Revised January 2019

Revised January 2021