Score Complete

Customer Handbook

Prepared by:

Larry Macdonald, Sr. Product Manager

10-Jun-2014

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 2

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Table of Contents

Introducing Score Complete ........................................................................................................................................... 3

1. Modeling Concepts ................................................................................................................................................ 3

1.1 Population of Interest / Minimum Scoring Criteria ........................................................................................ 4

1.2 Response Variable ....................................................................................................................................... 5

1.3 Available Data / Independent Variables ........................................................................................................ 6

2. The Score Complete Model ................................................................................................................................... 7

2.1 Segmentation ............................................................................................................................................... 7

2.2 Modeling Technique ..................................................................................................................................... 8

2.3 Scaling .......................................................................................................................................................... 9

2.4 Attributes .................................................................................................................................................... 11

2.5 Account Management and Scorecard Migration ......................................................................................... 12

3. Output ................................................................................................................................................................. 14

4. Using Score Complete – Alone or With Another Score ....................................................................................... 15

5. Evaluating a Model .............................................................................................................................................. 15

5.1 Score Complete Development Data ........................................................................................................... 18

Summary ...................................................................................................................................................................... 20

Additional Reading ....................................................................................................................................................... 20

Appendix – Reason Codes, Scorecard Indicator, Reject Codes .................................................................................. 21

Reason Codes ......................................................................................................................................................... 21

Reject Codes ........................................................................................................................................................... 23

Score Card Indicators .............................................................................................................................................. 23

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 3

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Introducing Score Complete

Risk managers have a difficult task. Their companies are in the business of lending money or granting credit to

ordinary Canadians who need credit cards for everyday purchases, loans to buy goods and services, lines of credit to

optimize and bring flexibility to credit management, and mortgages so they will have a place to live. Unfortunately, it

is not profitable for these companies if their customers don’t pay them back. A credit file, supplemented with a credit

score, gives a risk manager the ability to assess the likelihood that a customer will meet their financial obligations – to

make regular payments on the credit that they use.

Credit scores are systematic and predictive, enabling the application of consistent business rules. Low risk

customers may receive better product offerings, better terms, or higher limits, while high risk customers may be

required to provide securitization or may not be offered credit at all.

Most Canadian consumers regularly pay their bills and have established good credit histories. These are profitable

consumers for the lending institutions in the financial industry. Unfortunately, the consumers who are non-payers

cause significant losses for the lenders, resulting in increased interest rates for all. Identifying these consumers and

mitigating their losses in a timely manner makes the entire lending practice more efficient for the lender and borrower

alike.

Score Complete is our most accurate solution in the prediction of consumer delinquency risk. Consumers or

applicants with low scores have a high probability of going 90 days past due or worse on their debt obligations over

the next 12 months. But Score Complete attempts to do something that no other score in the market does. It tries to

score every Canadian consumer file or application for credit.

Score Complete uses such credit file characteristics as missed payments, utilization and balances, inquiries, public

records, and the ages and types of credit products, to assess delinquency risk. For files with limited credit

information and for applicants without credit files, aggregated credit data from the consumer’s neighbourhood is used

to augment the limited information available to assess credit risk.

1. Modeling Concepts

It is a relatively simple task to determine a consumer’s behaviour when there is a long history with a lot of accounts

and activity. One can assume that prior patterns will repeat. Someone who has paid their bills regularly for a number

of years may be expected to continue to do so. When there is less information available, other considerations must

be taken into account. Deriving the relationship between the information in a person’s credit file and the future

behaviour is a statistical exercise, creating the proper weighting for each factor, by determining the characteristics

that distinguish the good payers from those who go delinquent. These relationships among the various factors may

shift over time, due to different market conditions, so using a score that is up to date is key.

Score Complete is a predictive model offered by Equifax that risk managers use to help them determine which

customers or applicants are creditworthy; that have credit characteristics that are associated with good payers.

In order to build a model, three key components are required: population, outcome, and data. The population is the

collection of records used to build the model, and should be representative of the population where the model will be

used. The outcome is the value to be modelled, and represents the unknown quantity that the model predicts. The

data are the known attributes that are available at the time and used in the calculations.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 4

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

1.1 Population of Interest / Minimum Scoring Criteria

There are two considerations necessary to define a population for a credit model. The first is to decide on the target

population where the model is of interest. For a delinquency model, the ideal population may be any Canadian

consumer or applicant for credit. Assessing the risk of every prospect or existing customer is the best case.

The second consideration is available information. It may be difficult or impossible to make an accurate assessment

of risk given the sparcity of data in some cases. Among the common limitations:

Credit File Not Found. Sometimes an applicant does not have a credit file. This includes young

Canadians who apply for credit for the first time, or new immigrants. Some people may go for many years

without building a credit history, preferring to pay cash for everything so as not to owe any money, or they

use their family’s credit (parents or spouse) for their own needs. A change in their family status, such as

death or divorce, forces them to establish their own credit. Additionally, a credit file may not be found in

cases where there are mismatches between the information in the credit file and the application. This could

be due to typographical errors, information variants such as different name versions like Robert and Bob,

revised information that hasn’t been updated on the credit file like new address or change of name, or

format errors, such as having the input data in the wrong fields, or supplying an address out of the country.

Death Notice on File. Although the estate of a deceased individual may be responsible for the financial

commitments in some cases, the information in the credit file may not be predictive of the future

performance of the account.

Inactivity. If a credit file has not been updated for a period of time, the information that it contains may be

stale. In many cases, it may be more accurate for an institution to make lending decisions based on other

information, such as income statements or wealth (including property equity), by providing collateral or

security, or having a co-signer.

The combination of the target population and the available information to generate a score is known as the minimum

scoring criteria.

For Score Complete, consideration was given to whether the credit file, by itself, contained enough information to

calculate the credit score. It was determined that the criteria for this was to include all Canadian consumers with

credit activity within the last 24 months and at least one valid trade line

1

. Activity is defined as a trade line updated

(based on the date reported) or a hard inquiry

2

.

For consumers with credit files that did not meet these criteria, aggregated credit data was used to augment the

amount of available information about the consumer. If either a credit file is found, or aggregated credit data is found,

Score Complete estimates the risk and calculates a score. Score Complete calculates and returns a score even

when a credit file is not found.

1

Trade lines are the accounts or credit products that financial institutions report to the credit bureau. They are the credit cards,

loans, lines of credit, mortgages, etc. that show what responsibilities and history the consumers have with various reporting

institutions.

2

Inquiries are posted whenever somebody views or receives information contained in the credit report. Hard inquiries indicate

that a consumer has applied for credit and granted permission for someone to see their credit report for the purpose of

adjudicating that credit. Soft inquiries are posted whenever a company refreshes information about their customers, but are not

motivated by consumer activity. Soft inquiries are only visible to the consumer, and do not affect any credit scores.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 5

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

For credit files with death notices, the minimum possible score of 300 is returned. Many algorithms default to a no

score result with a death notice. Since a no score implies that the institution must investigate further in order to

assess the applicant, Score Complete suggests that no further investigation is required.

There are only two cases where Score Complete will not return a valid score. If there is no credit file, and there is no

aggregated credit data from the address, there is no information available to the score. The other case is if a file has

been flagged by Equifax as a manual file, or file under review. Manual files are rare; almost all instances of failure for

Score Complete will be due to problems with the input address.

1.2 Response Variable

Credit scoring is done to help risk managers understand how likely it is that their customers are going to make the

required payments on their credit products (loans, credit cards, lines of credit, mortgages, etc.). The model requires

taking a representative sample from the target population from a recent archive period (known as the observation

point), and then defining and calculating the response variable; consumer credit files are observed at a more recent

period (12 months after the observation period for Score

Complete; this is called the performance window) to

determine whether there has been negative behaviour.

For Score Complete, this response variable is defined as

a serious delinquency (90 days or worse) or write-off of a

trade line, or presence of a derogatory public record

such as a bankruptcy, within the performance window.

For the development of Score Complete, three different

time intervals were used to account for seasonality.

Approximately 2 million records without death notices

were chosen from time periods (observation and

performance) spaced 12 months apart:

June 2010 and June 2011

September 2010 and September 2011

December 2010 and December 2011

In addition, approximately 900,000 files were used for consumers who opened a new account between July 2010 and

March 2011, and did not meet the criteria to score based solely on the credit file, in order to build the additional

scorecards.

Special emphasis was placed on detecting characteristics of consumers at origination who opened accounts that

went delinquent in the first year. Since Score Complete is particularly strong at predicting this behavior, it is an

excellent score for risk managers to use at perhaps the most critical point of the consumer’s life cycle – the point at

which the consumer becomes a customer of the risk manager’s lending institution.

While Score Complete was developed as a score that predicts 90-day or worse delinquency of a consumer of any

trade within 12 months, it is also very predictive of other similar outcomes, such as delinquency within 24 months

rather than 12, or 60-day delinquencies rather than 90-days. Score Complete can be used to predict the likelihood of

Special emphasis was placed on detecting

characteristics of consumers at origination who

opened accounts that went delinquent in the first

year. Since Score Complete is particularly strong

at predicting this behavior, it is an excellent score

for risk managers to use at perhaps the most

critical point of the consumer’s life cycle – the

point at which the consumer becomes a

customer of the risk manager’s lending

institution.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 6

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

a consumer going delinquent on any individual account when being assessed for account management purposes, as

well as predicting delinquency for a new account during acquisition / adjudication.

1.3 Available Data / Independent Variables

A model estimates an unknown quantity by developing the relationship between the known attributes and the

required outcome (the performance as defined in the previous section). The known attributes have to be available at

the time that the unknown quantity is to be estimated. The statistical term for these attributes is independent

variables. For Score Complete, the attributes come from the credit file in most cases. When the credit file is not

robust enough to return a score reliably, additional attributes are available from the aggregated data available within

Neighbourhood View

3

.

The credit file attributes are the Equifax Canada Risk Modelling Segments (RMS), consisting of over 400 proprietary

credit file attributes covering a wide spectrum of credit file characteristics including delinquency, utilization and

balances, inquiries, public records, and the make-up of the wallet. These segments include many industry-specific

attributes as well as some that are aggregated for all trades or inquiries.

In order for Score Complete to accurately predict a delinquency rate for consumers with very limited credit file

information, or no credit file at all, an additional data source must be used. Using the information that is there along

with additional information that is relevant to the consumer and predictive of his behavior allows Score Complete to

be a complete score for the Canadian credit-seeking population.

Augmenting the credit file in cases where there may not be enough information to calculate a reliable score is

aggregated credit data from Neighbourhood View. Neighbourhood View is a tool originally designed for marketers

who are looking for consumers that have desirable credit characteristics and are more likely to have a desire to

consumer the company’s products. Neighbourhood View is aggregated credit data, where the credit histories of

consumers in each neighbourhood are combined to give a profile.

Information aggregated to a neighbourhood is representative, in a majority of cases, of the individuals within the

neighbourhood. The average credit profile of a neighbourhood would be consistent with the credit profile of most of

the residents in that neighbourhood. This consistency is enhanced by the fact that the consumer and all members of

the same household contribute data to the neighbourhood. Therefore, it is reasonable that the aggregate information

of the neighbourhood makes a good proxy for individual data, when individual data cannot be obtained.

The neighbourhood in which a person lives may be a defining characteristic. Whether they live in a rich or poor

neighbourhood, a house, apartment, or condominium, a rural or urban community, these characteristics are shared

with their closest neighbours. Knowing whether the other residents in a neighbourhood pay their bills on time or not,

carry high or balances on their accounts, and whether or not they use different credit products reflects on the

individuals for which little information is known. This aggregated data is helpful in predicting whether a consumer is

likely to pay regularly their own bills on time.

With Score Complete, neighbourhoods are geographically defined at the Street Level. While privacy legislation

prevents aggregating fewer than 15 credit files together, postal codes are sometimes very large, and one may wish to

3

When files have a lot of information, predicting behavior is easy. With less information, a good model can provide an excellent

estimate. When the credit file has very little information, other sources are required in order to build a model that distinguishes

the consumers who are good payers from those who will go delinquent.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 7

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

split a large postal code into smaller segments. This is what Street Level does. The credit files in each postal code

are sorted by street, house (civic) number, and apartment (or suite) number. Along each street, credit files are

counted by address until at least 15 credit files are found. Additional credit files may be included if they match the

address of the 15

th

file. This segment is called a subdivision. Then the process continues from the next address. In

this manner, large postal codes are segmented into a number of smaller subdivisions with at least 15 credit files, so

these subdivisions are much more granular; perhaps only 7 or 8 households are used to define them. Consumers

are aggregated with fewer neighbours, and likely those who are in closer proximity, and therefore likely share more

common characteristics than those in a larger area. In addition, since fewer consumers are aggregated together, an

individual’s information contributes a larger proportion of data to the subdivision, making the subdivision data a much

better proxy for the individual than the postal code as a whole.

2. The Score Complete Model

The Score Complete model returns a three-digit numerical score that corresponds to the delinquency risk for the

individual consumer with the given credit file and address information. Consumers with high credit scores are less

likely to have serious delinquencies than consumers with low scores. This section discusses properties of the score:

how it is built and how the results can be interpreted.

2.1 Segmentation

The predictability of a model is often greatly enhanced by segmenting the population into a number of subgroups,

and creating a different predictive formula in each segment.

Different formulas may be needed because there may be

differences in the availability of data for certain parts of the

population. For example, there is no need to have

attributes for public records in all formulas if there are

different segments for consumers with and without public

records. Another reason is that different business

decisions may apply, such as if companies have different

strategies for consumers who are new to credit. A third

reason for segmentation is that there may be certain

subgroups of the population for which there is a different

relationship between the modeling attributes and the

outcome.

Score Complete uses a segmentation scheme based on

delinquency and public records, the age of the oldest trade, and the number of trades on file. A total of eleven

segments are defined, of which eight are based entirely on credit file attributes, and three that are augmented with

Neighbourhood View data. A different formula is to be applied to each, so that the attributes can predict the outcome

over each segment. These distinct formulas are called scorecards. Since there is a direct relationship between the

segment and scorecard, the two terms are commonly used interchangeably.

Some credit files have robust data, with a long credit history and a large number of trades, and the future

performance of the consumer can be accurately assessed with great confidence. On the other hand, when the open

date of the oldest trade is recent and/or the number of trades is few, the consumer doesn’t have a robust credit

Consumers with good but short payment

histories may be considered low risk for

continuing payment and obligations with the

credit that they already have, but may not be

as low risk for new credit granted.

Identifying the segment for these consumers

will help a risk manager deal with these two

different cases.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 8

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

history and there isn’t a lot of information that can be used in identifying if these consumers are good credit risks.

These files are often called thin files. Consumers with good but short payment histories may be considered low risk

for continuing payment and obligations with the credit that they already have, but may not be as low risk for new

credit granted. Identifying the segment for these consumers will help a risk manager deal with these two different

cases.

In cases where aggregated data is used to augment the credit file, or is the only source of data when no file is found,

it may be good practice to be cautious in granting credit. While these consumers live in areas which suggest that

they may be good credit risks (and this has been demonstrated statistically), it may be wise to limit the exposure of

credit to consumers who have not personally demonstrated the responsibility of managing their own credit.

Applicants from the augmented scorecards can easily be identified and treated appropriately. This may depend on

the financial product. The applicant may be approved for a cell phone based on his or her address, or a credit card

with a moderate credit limit, but perhaps not for a large auto loan or a mortgage without a co-signer.

2.2 Modeling Technique

Eight of the eleven segments were built with individual credit file attributes (the RMS segments). The response for

each of these segments was a 90-day delinquency or worse (including derogatory public record) within the 12-month

performance window.

Within each segment, a logistic regression model was developed. Logistic regression is a modeling technique

designed to model the relationship between a binary

4

outcome and the explanatory variables. For each variable, a

weight is assigned, multiplying the weight by the value, or by giving a set number of points for each possible value of

the variable.

In addition to the logistic regression models, there are two neural networks. Neural networks are statistical models

that look at combinations of variables, and these combination variables are used to build the model. Neural networks

can be highly predictive when the event that is being predicted is a rare event or when the amount of available

information is limited.

With Score Complete, five of the eight segments enhance the predictability of the logistic regression models by

combining the logistic regression result with the result of the neural networks. The two results are blended using a

methodology called score fusion, transforming them into one estimate of the likelihood of serious delinquency. The

results were fused in such a way as to maintain the logistic regression as the primary driver of the score.

After score fusion, the formulas applied to each credit file have derived a probability of delinquency. These formulas

have been proven accurate, in the development dataset, by taking all of the records with similar probabilities and

calculating the observed bad rates and comparing them to the expected bad rate.

Three additional scorecards were used to create the score in cases where there was limited credit file information.

Recall from Section 1.1, all Canadian consumers with credit activity within the last 24 months and at least one valid

trade line will score based on their own credit file information. Consumers who do not qualify are most likely new

applicants for credit, and the response used in the development of these scorecards was a 90-day delinquency or

4

Binary outcomes are those that can take two values. These are often denoted by “yes” and “no,” or “true” and “false”, or in this

case, “good” or bad.” They are represented in code as 0 and 1.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 9

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

worse (including derogatory public record) within the 12-month performance window for any new account opened

within the first quarter of the performance window; trade lines which already existed on the file were not used in the

performance definition. In other words, the additional scorecards were built purely as an origination model.

Separate logistic regression scorecards were built for the consumers with limited credit file information and

consumers without any credit file at all

5

. Consumers who have a credit file, but the credit file has been created within

30 days and there is no trade on file, are somewhat similar to consumers who do not have a credit file at all. In order

to prevent a wild swing in score based on migration from the “no file” scorecard to the “thin file” scorecard,

interpolation between the two scorecards was done, based on the age of the file. This “hybrid” calculation is

presented as the eleventh scorecard.

Example: A consumer has a credit file that was created on March 1. At the time of an inquiry on March 1, without a

credit file, this consumer (applicant) would have to be scored based on his address and the aggregated data from

Neighbourhood View from his subdivision. He would be scored on the “No credit file found” scorecard, with a score

of 640. The inquiry opens a thin file. With his next inquiry, since he has a credit file, he can be scored on the “Thin

file augmented with aggregated data” scorecard. Using his address and thin file (with an inquiry on it), the calculation

of his Score Complete would be 670 on the “Thin file augmented with aggregated credit data” scorecard. This

consumer does not score 670 immediately after his file is created. His risk profile hasn’t changed very much, so his

score should not jump 30 points immediately. Instead, his score will increase by interpolation; 30 points in 30 days

means a point per day. His score on March 18, for example, would be calculated as:

Score Complete = No-Hit Score + (No-Score Score – No-Hit Score) x (Current Date – File Creation Date) / 30

= 640 + (670 – 640) x (18 – 1) / 30

= 640 + 30 x 17 / 30

= 657

This interpolation only applies for consumers with no trades on file, and with files created within 30 days. After 30

days, this consumer will be scored solely on the “Thin file augmented with aggregated data” scorecard.

2.3 Scaling

Score Complete uses a 300 to 900 scale rather than a probability estimate, where a high score indicates a low

delinquency risk. This is a convention that is standard to credit scoring. Most credit scores, regardless of bureau or

country or score version, follow the same scale. It is not necessary that the scores do this, but professionals who

work with different institutions that use different credit bureaus or scores, have gained experience in interpreting a

score value, and redeveloped versions and other scores tend to follow the same convention.

The key is that scores should separate and rank order delinquency risk. This means that there should be a

relationship between the score and the delinquency rate. Consumers with low scores have a high delinquency rate,

while consumers with higher scores should have a lower delinquency rate. The relationship should be consistent,

5

It may not be obvious how there can be records in the data where there is no credit file. The development data was selected by

finding all trade lines opened between July 2010 and March 2011. The performance of these accounts was determined at the

end of each of the three performance windows (June, September, and December 2011), giving each trade between 9 and 11

months of history. The observation dates of June, September, and December 2010 were used to pull information at origination.

If a consumer opened a new account in July 2010, they may not have had a file in June 2010. This consumer’s score would be

based on the address, and Neighbourhood View Street Level data from June 2010.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 10

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

and there should be a large difference in delinquency rates between consumers with the best and worst Score

Complete.

Score Range

Interpretation

300-499

Very serious issues, difficult to get any credit

500-574

High risk customer, may be required to provide securitization. May be eligible in the Telco industry.

575-649

Above average risk profile. May be granted credit with high interest or low limits.

650-749

Fairly safe credit risk for most institutions

750-900

Safe credit risk, generally approved easily

Scores below 300 or above 900 are not possible with Score Complete at Equifax Canada.

This interpretation should be treated as a guideline only. Companies should validate scores on their own portfolio

with their own definition of negative performance, in order that their risk managers can customize and optimize their

strategy for their own business needs.

Over time, changes in lending policies, reporting policies, lending institutions, consumer behaviour, and the economy

can change the relationship between scores and the expected bad rate. Score Complete will continue to perform in

the future and continue to rank order delinquencies, but the bad rate at various scores may shift if the data or the

economy changes significantly. Risk managers should monitor their portfolios regularly and determine if decisions

should be implemented at a different score range or cut-off than has been used previously.

The eight scorecards built with credit file information only, using the definition of a 90-day delinquency on any trade in

wallet were scaled identically; the same probability of delinquency in each scorecard was mapped to the same Score

Complete result on the 300 to 900 scale.

The additional scorecards were built with a different performance definition: 90-day delinquency on new trades. To

map to the same 300 to 900 scale and indicate the same degree of risk, two steps were taken.

First, new accounts opened between July 2010 and March 2011 for consumers for the development of the original

eight scorecards were analysed, and the relationship between the Score Complete result of these consumers to the

delinquency rate of these new accounts was determined. This was done to determine the relationship between the

Score Complete calculated from the original eight scorecards with the performance definition applied to the

augmented ones.

Second, an adjustment was made to the delinquency rate observed on the new open accounts used in the

development of the augmented scorecards. The reason this was necessary is because the development data

included all accounts for consumers who opened a new account, but is meant to apply to anyone who applies to

open a new account. Consumers who were approved for accounts are likely to have qualified after some additional

investigation by the lender, under criteria not accounted for in the data. It is likely that they are lower risks than

average, and the delinquency rates observed was lower than would be expected on a typical application. The

population used to build the model was not exactly representative of the population for which the model should apply,

and this correction was made to account for that difference.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 11

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

This adjusted delinquency rate was mapped to the delinquency of new accounts from the eight original scorecards

and the associated Score Complete. In this way, the final Score Complete result, 300 to 900, indicates the same

amount of risk regardless of which of the scorecards was used in the calculation.

Consumers with death notices on the file get a 300 score, the lowest possible score. The 300 score is reserved for

files with death notices. Instead of returning no score, which implies that the lender should undergo an investigation

of other sources to determine whether or not to approve credit, a death notice on file with a 300 score indicates that

no further investigation is needed. The only way to get a 300 score is with a death notice. All other cases will be 301

or higher.

2.4 Attributes

The credit file attributes that are included in the final Score Complete model are those credit file characteristics that

are found to be predictive of future delinquencies. These tend to be the same characteristics that risk managers

consider when they look at a credit file. They can be classified into a number of categories:

Payment history. If you are trying to determine whether a consumer will be able to make regular payments in the

future, the strongest predictor is to see if they have missed payments in the past. The number of accounts currently

past due, the rating of the most seriously delinquent trade, the number of accounts past due previously, and the

length of time since prior delinquency are considered here.

Utilization and balances. It is intuitively obvious that is it easier for consumers to pay their bills when they do not

owe a lot of money and the required payments are small. In addition, carrying balances on revolving accounts

suggests the inability to pay them off in full, which makes it more likely that the consumer will have problems

continuing to pay their bills. Low utilization indicates a difference between the credit limit and the balance,

sometimes called “open to buy.” A large amount open to buy gives consumers flexibility, a way to pay bills for a short

time that can’t be covered by income, by tapping into their lines of credit. A small amount of open to buy reduces the

incentive to make a payment on a credit card or line of credit since they won’t be able to use much of it anyway. And

once the credit cards are maxed out and the lines of credit are used up, they may not be able to cover their

payments. Bankruptcy may become their only option.

Credit history. A consumer who has managed credit for many years is considered lower risk than someone new to

credit. Over a long period of time, many people have significant life events, including moving, changing or losing job,

marriage or divorce, having children, and serious illness or injury. Those who have experienced these events in the

past and continued to pay their bills have a strong likelihood to continue doing so. They have shown responsibility

and consistency over a long period of time and can be considered a good credit risk.

On the other hand, young Canadians or new residents, new to credit, who have managed a first credit card with a

small credit limit have not demonstrated a history of managing large amounts of debt and haven’t proven the ability to

make regular payments over several years (such as a mortgage or auto loan). They are less likely to have dealt with

significant life events, and if one occurs, they have not demonstrated the ability to deal with it and maintain their

financial responsibilities.

Also in this category is the number and type of accounts. Consumers with many different accounts may be of higher

risk, and the properties of some trades indicate a higher risk than they do in other industries. For example, high

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 12

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

utilization in a line of credit may be a risk factor, while high utilization of a loan just means that it is a new account and

the consumer hasn’t had a chance to pay off much of the balance.

The presence of many new accounts may also be an indication of higher risk. For one thing, consumers in financial

difficulty often try to open new accounts in order to extend their “open to buy” and continue to pay their bills through

the tough times. Additionally, a number of new accounts may indicate that something has changed, and this brings

uncertainly to the risk prediction, which in turn means higher risk to the lender.

Public records. Those who have a prior history of bankruptcy, or have had collection issues or other derogatory

public records may be considered risky. The presence of these events, though relatively rare, has a significant

negative impact on a credit score.

Inquiries. Consumers who are going through financial difficulties, whether through job loss, family or health

situations, or general financial woes, often look for additional credit products to provide additional open to buy. They

may apply for a loan to pay down the credit card they have maxed out, and try to get a new credit card. The inquiry

may be the leading indicator, the first sign of danger that appears on the credit file. Of course not every inquiry is a

sign of financial difficulty, and only a number of inquiries, in combination with other warning signals should lead to a

significant decline in a credit score.

Consumers sometimes shop around when they are looking for certain products, and multiple inquiries over a short

period of time can be considered as shopping for one product. Three mortgage inquiries in a week rarely means that

a consumer is trying to buy three houses, while three credit card inquiries may mean that they are going to have

three new credit cards. Mortgage inquiries, auto finance inquiries, and Telco inquiries are deduped, meaning that

multiple inquiries within 30 days count as one inquiry in the calculation of the score. In addition, inquiries within the

first 30 days do not count in the score calculation, allowing consumers a chance to shop at different places without

there being an advantage to the first lender that pulls a file that receives a score with no inquiries counting.

The Neighbourhood View data elements that are used in Score Complete mimic the attributes for the individual.

Attributes such as the average number of delinquent accounts, the number and recency of public records, inquiries,

and high utilization are used, and have the same directional impact as they do at the individual level, although they

are weighted differently, and appropriately, for estimating risk.

In the case where a score can be generated from the credit file information only, Telco trades are not used in the

formulas. These scorecards use products including credit cards, loans, lines of credit, and mortgages from industries

which include banks, credit unions, and finance companies. The additional scorecards use the Telco trades, any

other trades in the file, inquiries, public records, and the aggregated data from the neighbourhood.

2.5 Account Management and Scorecard Migration

Score Complete is always calculated with the most up-to-date data available. Companies that want to monitor the

behaviour of their consumers often refresh the scores of their portfolio on a regular basis, and store the historical

scores in their databases. They may want to take action when consumers score differently.

When consumers are scored at different times, the information in the credit file will have changes, as new inquiries

and trades are added to the files and existing trades are updated. Even if there hasn’t been an update in the

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 13

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

information, the data in the credit file ages. Increasing the length of time since the oldest trade has been opened is a

positive factor, and negative behavior, such as missed payments and public records, move further into the past.

When Score Complete calculates a new score, it is based entirely on the current snapshot of the credit file (or the

archive snapshot for scores on a historical file). The consumer may score on the same scorecard, or may have

migrated to a different one.

When a consumer is scored on the same scorecard at two different points in time, the difference in the scores can be

attributed to changes in the attributes used by that scorecard. If the consumer’s attributes are similar from month to

month (no new trades, few inquiries, no large change in balances), the score will change very little. When attributes

change in a positive way (by paying down balances and keeping current on accounts and having delinquencies move

further into the past), the score will increase in a predictable manner.

When a consumer’s score is refreshed, and the consumer changes from one scorecard to another, the attributes

used in calculating the score change as well. Using different attributes with different weights sometimes causes a

change in the score that cannot be attributed to a single change in behavior. Moving from a thin file to thick (or to

very thick), from young to old, or from the augmented scorecard to the regular one may cause score changes that

can’t be explained by looking at individual attributes. Of course, moving from the Clean to Delinquent scorecards will

usually result in a much lower score.

Along with the score, companies may want to store the scorecard indicator in their databases. The scorecard

indicator is returned as Score Complete’s fourth reason code. When comparing the latest refresh to the saved

historical data, they would be able to determine consumers who have significant changes in score. They can further

understand these differences by comparing scorecard indicators. When the score change is based on scores from

the same scorecard, it can be said that there has been improvement in the underlying attributes. The consumer has

made positive changes in the characteristics of the credit file, and the score directly reflects that.

However, if the scorecard has changed, it is more complicated. There are two considerations. Sometimes a

consumer will migrate from a clean scorecard (92 to 95) to a delinquent one (96 to 99) – see table below. This is a

fundamental change in the file, and will usually be accompanied by a score decrease. However, changes between

thin and thick, or moving to the mature scorecards mean that different elements of the credit files are used in

evaluating risk, and so an increase or decrease in score is not necessarily attributed to improving or declining

attributes; it may simply be that the consumer has better or worse characteristics on the attributes considered more

important to the current segment than on the other scorecard. And movement from the augmented scorecards (89 to

91) to the established ones (92 to 99) indicates that the weight given to the neighbourhood transfers to the credit file

itself. It is expected in these cases that the score may change as consumers attain more robust credit files, and are

scored on different criteria. However, the scores should be correlated. For a population of consumers with scores

based on thin files and neighbourhood data, high scores imply that the risk is low. Low risk implies that consumers

are likely to make their payments on their new accounts. This positive behavior will lead them to have good credit

scores when they migrate to the traditional scorecards, and these high scores also predict the same expectation of

low risk.

Scorecard

Description

89

No credit file found

90

No trade on file and file age < 30 days

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 14

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Scorecard

Description

91

Thin file augmented with aggregated credit data

92

Clean, mature and very thick

93

Clean, mature and thick

94

Clean and thick

95

Clean and thin

96

Prior delinquency thick

97

Prior delinquency thin

98

Delinquent thick

99

Delinquent thin

3. Output

While the score is the most important output from the scoring module, several other pieces of information are

generated and returned with the output.

The first is a product identifier, “SC”, which identifies the score as being a Score Complete. Following the three-digit

score between 300 and 900 are four reason codes that help explain why a consumer file has the score that it does.

Reason codes correspond to the attributes that have values that lower the score, such as delinquent accounts, high

balances or utilization, or excessive inquiries. The first three reason codes correspond to the three attributes from

the credit file whose values impact the score by the largest amount. The fourth reason code denotes the scorecard,

or subpopulation, indicator.

The identification of the subpopulation used in the score may be a strong

indication of the score. For example, the subpopulations defined by

delinquency or public records tend to score lower than the subpopulations

without them. In addition, the scorecard indicator highlights files with limited

credit information, and the scorecards which are augmented with information

from the credit files in the neighbourhood. In many cases, these “thin files”

may be low risk for the accounts that they already have, but would be high

risk if they were given a new and large loan, line of credit, or mortgage. Risk

managers can use the scorecard indicator to automate different credit

policies for consumers belonging to different subpopulations.

There are only two cases where Score Complete will not return a valid score.

If there is no credit file, and there is no aggregated credit data from the address, there is no information available to

the score. The other is if a file has been flagged by Equifax as a manual file, or file under review

6

. Reject codes are

returned to account for these two cases.

See Appendix for a complete list of reason and reject codes for Score Complete.

6

This is a very rare occurrence. In one recent month, less than one inquiry in 500,000 resulted in a manual file.

Score Complete: 657

57 Too many auto inquiries

83 Too many derogatory public

records in neighbourhood

35 High credit open telco trades is

too high

91 Thin file augmented with

aggregated credit data

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 15

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

4. Using Score Complete – Alone or With Another Score

Score Complete is designed to score any credit file or application. It assesses the delinquency risk, either at

origination or in batch for account management purposes, and returns a three-digit score which rank-orders

delinquency risk. Score Complete returns a score virtually every time, unless there is problem with the input address,

such as a format error (address elements are in the wrong fields, or the address is out of country) or an address in a

new postal code that has just been created. Score complete rank-orders delinquency risk for all files, and can be

used by itself as a complete delinquency score.

Some companies already use a delinquency score, such as BEACON, Equifax Risk Score (ERS), or Consumer Risk

Predictor (CRP). These scores assess delinquency risk, but have minimum scoring criteria that do not score certain

credit files, and they certainly do not return a score when no credit file is found. These companies may want to

continue to use their choice of score, but have a waterfall process that uses Score Complete in cases where their

primary score fails to return a score. This can be done.

To do this, the primary score must be activated for the inquiry, as well as Score Complete as a child score. If the

primary score succeeds in scoring the file, the score identifier, three-digit score, and four reason codes are returned,

as well as a blank reject code. The Score Complete algorithm does not run, and no result is returned.

If the primary score fails, the score identifier is still returned, along with a 0 score that indicates no score can be

calculated. The reason codes will be blank. The reject code will be filled in, corresponding to the code for that

particular score (reject codes do vary between the different generic scoring models).

Then the Score Complete algorithm runs, and generates a score. The SC score identifier, the three-digit score, and

four reason codes are returned. The fourth reason code is the scorecard indicator. In the case of no data, neither a

credit file nor aggregate data is available, the reject code will be returned.

Score Complete’s 300 to 900 score range is similar to the range used by most versions of most of the generic

delinquency scores available from Equifax. It may be appropriate in some cases to use the same strategies with a

Score Complete result in the second bureau segment as would be used with a score in the primary segment,

although companies would be wise to test this assumption on their own before relying on that assumption.

5. Evaluating a Model

What do we mean when we say that a model works? It means that a model can be used in predicting the unknown

quantity that it is supposed to predict. There are a number of different ways to determine this. Formal methodologies

include creating tables and graphs and calculating statistics.

Credit scores, especially with scaling, work if the scores separate and rank order credit risk. A population that is

representative of the target population that has values for the required quantity are used to show how well the score

predicts the outcome.

First, records are segmented by score. This may be done by fixed score ranges, like 20-point score bands, or by

score distribution, such as deciles. The keys to looking at data expressed this way:

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 16

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Separation. Files with low scores should have a high percentage of records with the negative occurrence

that was measured, while low risk scores should have a low percentage of bad outcomes. The more

separation there is, the better the score is performing. It is better if the bad rate is 50% in the high risk

section and 2% in the low risk, than if the differences vary between 15% and 10%.

Rank ordering. As scores improve, the bad rate should improve in an orderly and predictable fashion.

Score Complete scores increase when the risk decreases, so the observed bad rate should also decrease

as scores increase.

Here is an example illustrating how scores separate and rank order risk:

In this example, the records are grouped in deciles, 10% in each row of the table. Within the entire population, only

3.6% of the records were classified with negative performance (792K out of 22M), having a 90+ day delinquency or

bankruptcy within the performance window.

The lowest scores, 300 to 650, correspond to the 2.2M consumers (10% of the total) with the highest risk. They had

a 21.8% bad rate, which is 6 times higher than the overall bad rate. The highest scores, 844 to 900, had a very low

bad rate of 0.4%. The bad rates rank order through the score ranges, decreasing with every decile.

Bad rates are often shown graphically. This is a plot of the column represented in the table above by the red up

arrow:

Consumers Cumulative % Consumers Cumulative % Bad Rate Goods to Bad

300 to 650 2,209,742 10.0% 482,191 60.9% 21.8% 3.6

650 to 701 2,209,742 20.0% 130,614 77.3% 5.9% 15.9

701 to 730 2,209,742 30.0% 61,770 85.1% 2.8% 34.8

730 to 752 2,209,742 40.0% 35,120 89.6% 1.6% 61.9

752 to 772 2,209,742 50.0% 23,335 92.5% 1.1% 93.7

772 to 790 2,209,743 60.0% 16,740 94.6% 0.8% 131.0

790 to 809 2,209,742 70.0% 13,264 96.3% 0.6% 165.6

809 to 825 2,209,742 80.0% 10,570 97.6% 0.5% 208.1

825 to 844 2,209,742 90.0% 9,950 98.9% 0.5% 221.1

844 to 900 2,209,742 100.0% 8,807 100.0% 0.4% 249.9

Scorables 22,097,421 792,361 3.6% 26.9

All Accounts

Negative Performance

Delinquency 90+ or bankruptcy

21.8%

5.9%

2.8%

1.6%

1.1%

0.8%

0.6%

0.5%

0.5%

0.4%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

300 to 650 650 to 701 701 to 730 730 to 752 752 to 772 772 to 790 790 to 809 809 to 825 825 to 844 844 to 900

Separate and rank

order

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 17

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Companies will often set a score cut-off, with strategies to take adverse action to consumers with low scores, or will

decline applicants with low scores that fall below the cut-off that has been set. Since they want to limit declines or

adverse action to a small percentage of their consumers or applicants, it is crucial that most of the consumers who

will, in the future, exhibit bad behaviour have scores that are below the cut-off now. Some good customers

7

have low

scores for various reasons, and companies do not want to strain many of these relationships and lose good business.

In the table above, of the 792,361 consumers with serious delinquency or bankruptcy, 482,191 scored in the bottom

10%. This represented 60.9% of all bads. It is often a key measure of the predictability of a credit score to determine

the percentage of bad records identified in the highest risk scores, and the higher the better. This is the column in

the table above highlighted by the purple down arrow.

Graphically, this is called a lift chart:

The better a score works, the higher the line will be in the lift chart. One way to measure how well the score works is

called the Kolmogorov-Smirnov statistic, or K-S. The K-S looks at the lift chart, and calculates the percentage of

good and bad records (represented by the blue line, below) scoring below each available score value. The maximum

difference is the K-S

8

:

7

Good means that they will be good customers in the future; they will meet their financial obligations, and not be classified as

bad according to the definition that is used to test the score.

8

Other metrics, such as the Gini and AUROC, measure the lift of a model differently, but K-S is often the standard metric in

credit risk scoring.

0%

61%

77%

85%

90%

93%

95%

96%

98%

99%

100%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

300 650 701 730 752 772 790 809 825 844 900

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 18

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Here, 77% of the bads (red line) score at 701 or below, but only 18% of the goods. The 59% difference is the largest

difference at any point on the graph, so it is the K-S value. The higher the K-S, the better

9

.

5.1 Score Complete Development Data

Score Complete is built in two pieces, the traditional credit score that is based on predicting delinquency from records

with robust information, and a separate component for the no-hits and thin files. Traditional credit scores have been

developed and redeveloped for many years by different modellers, and these scores have been accepted as valuable

and predictive.

The concept of scoring every application, including no-hits and thin files may need some additional support. The

results below are based on the data from the validation dataset from the score development data

10

. A bias

correction, as described in section 2.3 to adjust the delinquency rate prior to the model scaling, is incorporated here

as well.

The scorecards based on no-hits and thin files, applied to consumers who opened a new account between July 2010

and March 2011, show significant separation in the prediction of 90-day delinquencies:

9

What is a good K-S? It depends greatly on the use of the model and the available data. Sometimes a very small amount of lift

can have tremendous benefit. One of the values of K-S is as a comparison tool between different models on the same data, as

an evaluation of the models. Another is to evaluate how well a model performs over time as things change.

10

Traditionally, when statisticians create a model, they separate the initial dataset into two parts, often with approximately the

same number of records in each. The training dataset is the one used to build the model, and create the weights for each

attribute. The formulas are optimized on the training dataset. The validation dataset is used to show that the formulas work on

different data. It is fair to use the validation dataset to make inferences on how well the model would work in independent

analyses.

0%

61%

77%

85%

90%

93%

95%

96%

98%

99%

100%

0%

8%

18%

28%

38%

48%

59%

69%

79%

90%

100%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

300 650 701 730 752 772 790 809 825 844 900

59%

K-S

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 19

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

The K-S is 37.2%. Given that there is limited, if any, credit file information, and the outcome is based on opening

new accounts rather than managing existing ones, this K-S is very good.

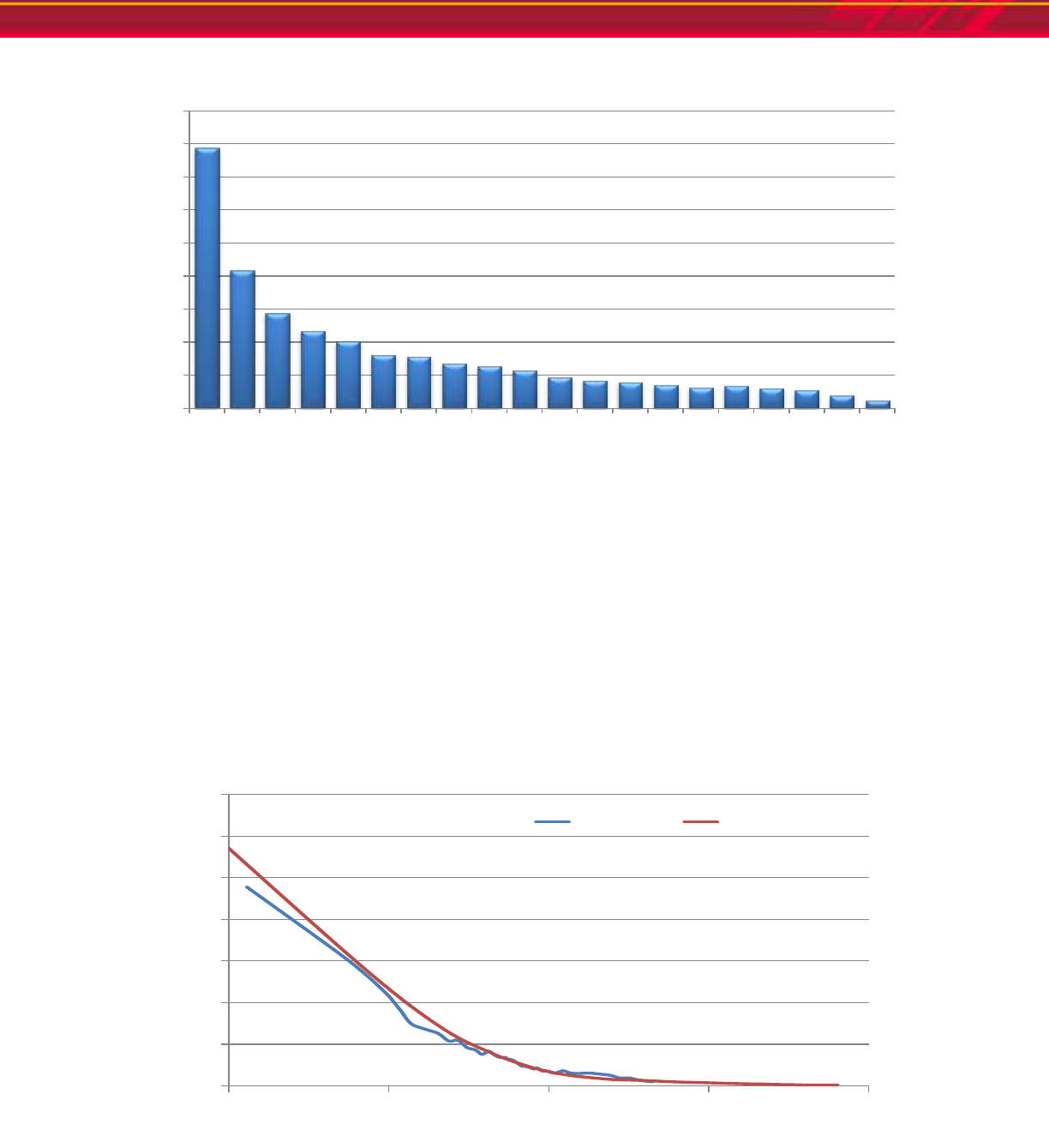

While the traditional scorecards were developed with a negative performance definition of a 90-day delinquency or

worse on any trade, not just new ones, the new accounts for consumers on these scorecards were analysed to

estimate the relationship between the score and the probability of delinquency on a new account. As the following

chart demonstrates, the bad rate by score range for the traditional scorecards and the augmented ones indicates the

same expectation of a 90+ day delinquency on a new account.

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

301

to

588

588

to

610

610

to

627

627

to

640

640

to

651

651

to

660

660

to

668

668

to

674

674

to

677

677

to

682

682

to

686

686

to

692

692

to

697

697

to

701

701

to

706

706

to

717

717

to

729

729

to

741

741

to

752

752

to

900

0%

10%

20%

30%

40%

50%

60%

70%

500 600 700 800 900

Bad Rate

Score Complete

Calibration of New Scorecards

(Accounts Opened First Quarter, 12 month performance)

Augmented Original

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 20

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

These two charts show that the Score Complete augmented scorecards act the same as the original ones. They

separate the high risk applications from the low risk applications and return a score that is consistent with the

expectation of delinquency. Risk managers may be comfortable using the result of the Score Complete model to

help assess the likelihood that a given applicant will make regular payments on their financial obligations, and will be

pleased that so many applications are assessed where traditional credit scores fail.

Summary

Canadian consumers need credit cards for everyday purchases, loans to buy goods and services, lines of credit to

optimize and bring flexibility to credit management, and mortgages so they will have a place to live. To finance these

things, banks and other lending or credit granting institutions provide these credit products, but need to ensure that

they can do so profitably. They send their data to Equifax, and Equifax builds credit files that contain the credit

history of over 24 million active credit holders.

The information in these credit files allows risk managers the opportunity to evaluate the likelihood that the consumer

or applicant is in a good financial position and will be able to repay the loan, or make regular payments on the

revolving credit. A credit score, like Score, assists this process. Score Complete weighs the elements of the credit

file properly, and provides consistency to the decision making process, allowing the risk manager the ability to

optimize strategies to be as profitable and successful as possible.

The fact that Score Complete succeeds in returning a score on virtually every request makes it an outstanding risk

management tool for any lender.

Additional Reading

The original eight scorecards used when a file is robust are the same as the Equifax Risk Score (ERS 2.0), with the

only exception being that ERS 2.0 scores of 300 are bumped to 301 to free up the 300 score to account for death

notices (Death notice files do not score with ERS 2.0). The reason is referred to the Equifax Risk Score 2.0

Handbook.

As the additional scorecards are somewhat based on Neighbourhood View, for a further understanding of that

product, please see the Neighbourhood View Handbook.

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 21

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Appendix – Reason Codes, Scorecard Indicator, Reject Codes

Reason Codes

Reason

Code

Description

1

Average trade age too young

2

Too many trades currently 90+ DPD

3

Too many trades 60+DPD within the last 2 years

4

Too many trades opened within last 2 Years were 90+DPD

5

Too few satisfactory trades

6

Too few open trades

7

Too many trades past due

8

Too few trades on file

9

Length of time trades established

10

Percentage of trades satisfactory too low

11

Current delinquency

12

Delinquency on file

13

Too few auto trades

14

Too few satisfactory auto trades

15

Too many auto inquiries

16

Too few bank instalment trades

17

Too few satisfactory bank instalment trades

18

High ratio of balance to high credit on bank instalment trades

19

Current delinquency on bank instalment trades

20

Delinquency on bank instalment trades

21

Too many bank inquiries

22

Too few bank revolving trades

23

Too few bank revolving trades older than 6 months

24

Length of time bank revolving trades established

25

Too few satisfactory bank revolving trades

26

High ratio of balance to high credit on bank revolving trades

27

Current delinquency on bank revolving trades

28

Delinquency on bank revolving trades

29

Too many collection inquiries

30

Recent collection inquiry

31

High balance on collection items

32

Too many collection items within the last 3 years

33

Too few satisfactory credit union trades

34

Too many finance instalment trades

35

High credit open telco trades is too high

36

High ratio of balance to high credit on finance instalment trades

37

Too many personal finance inquiries in the last year

38

Too many personal finance inquiries

39

Too many finance revolving trades

40

High ratio of balance to high credit on finance revolving trades

41

Delinquency on instalment trades

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 22

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Reason

Code

Description

42

Too many national credit card inquiries

43

Average national credit card trade too young

44

High balance on national credit cards

45

Too many national credit cards

46

Too recent age of oldest trade in neighbourhood

47

Too many national credit cards with high utilization

48

Too many national credit cards with high utilization

49

Too many national credit cards with high utilization

50

High ratio of balance to high credit on national credit cards

51

High ratio of balance to high credit on new national credit cards

52

Current delinquency on National Card Trades

53

Delinquency on National Card Trades

54

Too many other inquiries

55

Recent public record

56

Public records within the last year

57

Public records within the last 3 years

58

High ratio of balance to high credit on personal finance trades

59

Too many revolving trades with balances

60

Too few revolving trades with $0 balance

61

Length of time revolving trades established

62

Too many revolving trades with high utilization

63

Too many revolving trades with high utilization

64

High ratio of balance to high credit on revolving trades

65

High ratio of balance to high credit on new revolving trades

66

Too many retail trades with balances

67

High ratio of balance to high credit on retail trades

68

High ratio of balance to high credit on sales finance trades

69

Current delinquency on sales finance trades

70

Too many telco inquiries in the last year

71

Too many telco inquiries

72

Too many inquiries in the last year

73

Too many recent auto, sales finance, national cards or other inquiries

74

Too many inquiries in the last 3 months

75

Too many inquiries

76

Too many auto, sales finance, national cards or other inquiries

77

Recent inquiry

78

Too many revolving trades with high utilization

79

Too many department stores inquiries on file

80

Current maximum rate in neighbourhood too high

81

Too few open trades in neighbourhood

82

Too many delinquent trades in neighbourhood

83

Too many derogatory public records in neighbourhood

84

Too many inquiries in neighbourhood

85

High utilization on open revolving trades in neighbourhood

86

Too few satisfactory trades in neighbourhood

Confidential and Proprietary

©2014 Equifax Canada Co. All rights reserved. Page | 23

Equifax®, Score Complete™ and Neighbourhood View™ are registered trademarks of Equifax Canada Co.

Reason

Code

Description

87

Too low high credit on open trades in neighbourhood

88

Death notice on file

Reject Codes

Reject Code

Description

G

No credit file or neighbourhood data available

F

Score Complete not available, file under review

Score Card Indicators

Scorecard

Description

89

No credit file found

90

No trade on file and file age < 30 days

91

Thin file augmented with aggregated credit data

92

Clean, mature and very thick

93

Clean, mature and thick

94

Clean and thick

95

Clean and thin

96

Prior delinquency thick

97

Prior delinquency thin

98

Delinquent thick

99

Delinquent thin