Syracuse University Syracuse University

SURFACE SURFACE

Syracuse University Honors Program Capstone

Projects

Syracuse University Honors Program Capstone

Projects

Spring 5-1-2019

The Golden Ticket: How Blockchain Technology can be The Golden Ticket: How Blockchain Technology can be

Implemented into Event Ticketing Implemented into Event Ticketing

Jack Singer

Follow this and additional works at: https://surface.syr.edu/honors_capstone

Part of the Databases and Information Systems Commons, Information Security Commons, and the

Technology and Innovation Commons

Recommended Citation Recommended Citation

Singer, Jack, "The Golden Ticket: How Blockchain Technology can be Implemented into Event Ticketing"

(2019).

Syracuse University Honors Program Capstone Projects

. 1090.

https://surface.syr.edu/honors_capstone/1090

This Honors Capstone Project is brought to you for free and open access by the Syracuse University Honors Program

Capstone Projects at SURFACE. It has been accepted for inclusion in Syracuse University Honors Program Capstone

Projects by an authorized administrator of SURFACE. For more information, please contact surface@syr.edu.

i

The Golden Ticket:

How Blockchain Technology can be Implemented into Event Ticketing

A Capstone Project Submitted in Partial Fulfillment of the

Requirements of the Renée Crown University Honors Program at

Syracuse University

Jack H. Singer

Candidate for Bachelor of Science Degree

and Renée Crown University Honors

Spring 2019

Honors Capstone Project in Your Major

Capstone Project Advisor: _______________________

Jeffrey Rubin

Capstone Project Reader: _______________________

Alexander Corsello

Honors Director: _______________________

Kate Hanson PhD, Deputy Director

ii

Jack Henry Singer, May 1

st

, 2019

iii

Abstract

When the group/individual named Satoshi Nakamoto first conceptualized blockchain in 2008, it

served as the underlying foundation to the cryptocurrency Bitcoin. In the years following,

cryptocurrencies alike experiences massive gains in profitability; however, after the bubble had burst

organizations began to look at the technology from a more academic standpoint. It was quickly found

out that there is a massive application for blockchain in almost all sectors of industry from bulk stores

(Walmart) to banking (IBM). This paper will explore how blockchain technology can be implemented into

event ticketing, more specifically concerts. The current landscape of the industry is under scrutiny as

previous events led to a gap in trust and security between consumers and businesses. The ticketing

sector is being exposed to the advantages of integrating the emerging and evolving technology as more

companies begin to take interest in how blockchain can improve business. The willingness of ticketing

corporations to adopt the technology will help mend relationships with consumers, provide more

protection, and provide a more secure and engaging experience for consumers.

iv

Executive Summary

This project, since the inception of it, has taken on many different forms and was stretched in

many different directions. After finding an intellectually stimulating, current, and important technology

that could be implemented into event ticketing, I began forming what topics I wanted to cover. The

Golden Ticket will give an in depth analysis of blockchain, how it works, how it can be applied to

ticketing, and the current landscape in ticketing. (Un)Fortunately, the past two or so years have been

filled with a shift of power and focus in the ticketing industry. Ticketmaster was accused of skeptical

business practices, Ticketfly had one of the largest data breaches on record, the use of bots (automated

purchasing software) has increased, and there was seemingly a large gap in trust between these

companies and consumers. The project culminated with a sample code of what a blockchain ticketing

interface could look like. This portion is where the technology meets the music.

There is an argument to be made for the adoption of blockchain technology in modern day

event ticketing. Consumers can now download their ticket to their smart phone to gain access to events

of different sizes. From baseball games to a concert at the Brooklyn Bowl patrons can simply store their

ticket in their mobile device. This new aspect to ticketing has led to some people forging QR codes for

tickets. As the industry advances and becomes more technology driven, there will always be people who

will try to work around the system. The research provided ranges from Federal Government standards

on anti-trust laws, to ticket sales data recorded by Pollstar, to investigative reports. This myriad of

information has further ameliorated the reason as to why there should be more secure measures for

ticketing across all venues and entertainment.

For the technology aspect of the project, source material from Syracuse University’s IST 400:

Blockchain Management course, third party solidity coding labs, and consulting with blockchain experts

aided in the creation of the ticket interface. There was a large period of trial and error to make sure the

v

code ran as intended with no errors or redundancies. Having met with a few different blockchain coding

experts, the end result ended up being more simple than initially anticipated.

In the wake of Ticketmaster’s reselling tickets practice, Live Nation being accused of pulling

show’s because vendors don’t want to use their ticketing software, and the Ticketfly data breach there

has been an expanding gap of trust and security. There is seemingly no end to the amount of live

entertainment events annually, and they are getting larger and more global. While this is going on, a

technology that is centered around data integrity and decentralization has become an increasingly hot

topic. Other business titans such as Walmart, IBM, and American Express are beginning to implement

blockchain into their operation practices Although there are many positive externalities to blockchain,

this could be an item of “low hanging fruit” or something that a company can take on and immediately

begin to see benefits.

vi

Table of Contents

Abstract……………………………………….……………….………….. iii

Executive Summary………………………….……………….…………... iv

Acknowledgements ………….…………………………………………… vii

Advice to Future Honors Students …………..………………………….. viii

Chapter 1: Introduction ……………………………………………… 1

Chapter 2 The Landscape: ……………………………………………… 5

Chapter 3: Interviews ……………………………………………… 8

Chapter 4: Feasibility ……………………………………………… 16

Chapter 5: Coding ……………………………………………… 21

Works Cited.………………………………………………………………. 23

vii

Acknowledgements

I would like to thank my mother, father, and sister for being the best support team I could have

ever imagined. I wouldn’t have what I have today if it were not for you three. I would like to thank my

capstone advisor Jeff Rubin for lighting a flame beneath me and getting me going and my project

Alexander Corsello for believing in me and being and giving me the encouragement to wrap this all up. I

would like to acknowledge Anmol Handa for taking the time out of his schedule to work with me on the

ins and outs of coding solidity, you were a life saver. Lastly, I’d like to thank every single band I have ever

seen live, although none of them will read this, they showed me what I want to do with my life.

viii

Advice to Future Honors Students

Push yourself, keep cool, and you’ll get it done. I promise.

Rock and Roll,

Jack H. Singer

1

Chapter 1

Introduction

Annually, there is a plethora of live events for people of all ages to attend. Legacy acts

such as The Rolling Stones, Dead & Company, and Elton John are headlining world-wide arena

tours. In the same vein, there is a new dawn of musicians on the rise who relentless tour across

the world playing clubs (250-1,000 capacity), theaters (1,001 - 2,500), and concert halls (2,501 -

4,000). Each major city has several venues of all different sizes and crowds who are eager to

attend such events and an equal amount of performers who want to put on a show. With these

two forces working in tandem with one another, an immense amount of tickets are being moved.

In a handful of instances, the demand vastly exceeds the supply and fans can be left empty

handed, in this event they may go to a secondary (possibly tertiary) markets or vendors and pay a

significant surge price. This price could be anywhere from a 50% to 500% gauge and none of

those profits are seen by the proprietary ticketing company, managers, agencies, and promoters.

Along with this is the risk of purchasing a fraudulent ticket which is a seriously unfortunate

event where people take advantage of consumer’s desire to be a part of a specific event.

According to Pollstar Magazine, a music industry focused periodical, the average cost of an

event ticket has increased to $46.69 (4.2% higher than last year) (Valenti, 2018). While this

number may not seem extreme, the annual rise in price is deterring fans from seeing their

2

favorite artists. Since the 1990s artists have noticed that those in the best seats in the house

procured their admission from scalpers and paid significantly higher prices. This caused artists to

begin price tiers to see more profit generated from ticket sales in hopes to curb ticket scalping.

The current landscape of

ticketing is dominated by a few

major players such as

Ticketmaster and Ticketfly.

These are two major vendors

who in the past five years have

been in the news for rather

unfortunate happenings such as

collusion and data breaches. Ticketfly in the summer of 2018 was subject to a massive data

breach; it was reported that approximately 26 million people’s accounts were compromised.

Fortunately for Ticketfly, no pertinent data was taken such as credit card information and social

security numbers, however, “names, addresses, emails, and phone numbers” were leaked

(Schatz, 2018). As the realm of the internet, for the most part, remains unregulated and sans

legislature protecting individual privacy (domestic, not foreign) is a huge concern for many users

of the internet. Over the past year, Ticketmaster has been scrutinized. First, in 2010 the ticketing

juggernaut was merged with the promotion company Live Nation. For many independently

owned venues and smaller ticketing platforms this is viewed as a vertical monopoly; while the

department of justice initially thought that the merger would actually boost competition and

possibly decrease overall ticket prices, the two entities have only amassed more power.

Ticketmaster is now the soul ticket provider for “80 of the top 100 arenas” according to a New

3

York Times Article referencing pollstar data (Sisario, 2018). The company sells millions of

tickets annually for the years biggest artists in the largest arenas across the world. Ticket prices

and the accompanying fees have only increased and there is lack of competition in the market.

Along with providing for venues, Live Nation also manages several hundred artists some of

whom are the highest grossing annually. It has been reported that Live Nation has supposedly

pressured venues into using their subsidiary platform Ticketmaster or else they would cancel

concerts. More recently, it was discovered that Ticketmaster has been colluding with scalpers

and turning a blind eye to people who have several hundred Ticketmaster accounts and are

buying up swaths of tickets to then resell. The scalpers then move their tickets on a Ticketmaster

product called TradeDesk; here they are able to collect the fees associated with the resale ticket.

According to the Canadian Broadcasting Corporation, Ticketmaster for the upcoming Bruno

Mars tour, was able to possibly “collect up to $658,000” (CBS, 2018). Ticketmaster has since

denied these accusations.

Now more than ever there is an expanding gap of security and trust between ticketing

companies and their consumers. On one front, user information may not be protected with the

utmost integrity and their privacy is at risk. On the other front, consumers are being subjected to

high prices from ticketing and promotion conglomerates. There is no end to live music in sight

and the ticketing field needs to be subject to a more watchful eye. According to Moore’s Law the

number of transistors that can fit onto a circuit doubles every year. This gives technology the

capacity to become stronger, more agile, and faster every two years. There have been several

technologies implemented into the event ticketing space such as mobile ticketing, storing

admission stubs into virtual wallets, and creating a queue to purchase tickets online. More

broadly, several new technologies have been integrated with the events themselves such as VR

4

concerts, coordinated house RFID light wristbands, and social promotion. There is a huge space

for technology in ticketing; in the wake of the crypto-currency bubble, there has been a lot of

speculation about the application of blockchain technology into businesses. Large companies

such as Walmart have integrated the technology to help better track inventory and product

information. There is an application for blockchain in the ticketing industry, security of

information and data would increase, there would be proportionately more trust in these ticketing

companies that no grey-area business is taking place. There are currently a few blockchain

ticketing companies in the field such as Blockparty, Aventus, and Upgraded . With the right

focus, blockchain could be a powerful tool in the event ticketing realm that could give consumers

a fair opportunity to purchase tickets and empower them to continue to cultivate the live music

sector.

Chapter 2

The Landscape

5

Although the Live Nation and Ticketmaster merger was dubious at first, skeptics would be

proved to be well founded in their assumptions. When news of the merger broke, a great amount of the

entertainment industry voiced their concerns. Prior to the execution of the deal Ticketmaster was forced

to license its ticketing software to Live Nation’s competitor AEG and after five years they could purchase

the software, create their own, or partner with a competitor. The ticketing company was as well forced

to sell Paciolan, which is now owned by Learfield Communications. Other terms included that

Ticketmaster has been “barred from retaliating against venue owners who use a competing ticketing

service.” (Pelofsky, 2010). Despite some people’s reluctancy, the merger passed and Live Nation and

Ticketmaster would assume dominance in the event ticketing industry for the foreseeable future. The

Federal Trade Commission (FTC) states in their ‘Guide to AntiTrust Laws’ ‘Mergers’ section that some

mergers may “lead to higher prices, fewer or lower-quality goods and services, or less innovation.” This

is an externality that has plagued event ticketing since the merger in 2010. Ticket prices are increasing,

competition is falling behind, and innovation is few and far between.

In July of 2018 a ticketing convention was held in the Caesar’s Palace Hotel in Las

Vegas, NV. At this convention, reporters from the Toronto Star had gone undercover as ticket

scalpers to the event and spoke with Ticketmaster representatives; when the reporters approached

the Ticketmaster resale booth, they were told by a sales executive that, “I have brokers that have

literally a couple hundred Ticketmaster accounts.” (Cribb, 2018). This statement goes directly

against the company’s own rules and regulations of buying over the amount of allocated tickets

per customer. Each event has a maximum amount of tickets one consumer can purchase at a

given time. Ticketmaster and TradeDesk, although the same company, did not communicate or

interact in any sense, the sales person went so far as to refer to the relationship as ‘church and

state’ (Cribb, 2018). This practice of allowing scalpers to have several accounts gave

Ticketmaster a secondary source of revenue. On top of the fees and commission they take from

6

on-sale tickets, they were making more money from the fees of their ‘verified resale’ tickets.

This practice, while not illegal, is making consumers feel duped and forced into purchasing after

market tickets at higher prices. Ticketmaster since the 2010 merger has been, and will continue

to, cultivating power and can do whatever they please so long as demand exceeds the supply. If

they do not choose to stop their own antics, the only entity that would prohibit such activity

would be the government.

In October of 2018 the FTC announced a public ticketing workshop. Ticketmaster issued

a statement, as all eyes were on them in the wake of the event announcement, saying that “...this

is not a probe.” (Brooks, 2018). This news follows all of the controversy surrounding the

ticketing giant as people on all sides of the industry have expressed concern. The Federal Trade

Commission said the following about the March, 29th, 2019 workshop, “The online event ticket

industry has been a frequent topic of consumer and competitor complaints, and FTC staff is

seeking public input in advance of the workshop, including possible discussion topics and

potential participants.” The goal of the event is to bring in consumer advocates, company

executives, and government officials and educate them on the ethics and current issues in the

market.

Beyond the obstacles that Ticketmaster is creating, other ticketing companies, while not

at fault for suspect practices, have been suffering and consumer security and trust is being

diminished. Ticketfly is another first party ticketing vendor that is owned by Eventbrite. In June

of 2018 news had surfaced that the company had suffered a massive data breach and all

operations were immediately suspended until the company addressed the problem. They reported

that they became aware of unauthorized access to the platform on May 30th, 2018. Following

this the company had stopped all operations and swiftly addressed the problem; credit and debit

7

card information and other financial credentials was not accessed by the hacker. The only things

that were leaked were names, addresses, emails, and phone numbers were taken. The scope of

the impact was approximately 27 million accounts and the company reassessed their security

protocol as well as made all users reset their passwords as an extra measure

(support.ticketfly.com, 2018). This incident was listed by Fox Business magazine as one of the

biggest data breaches of the year along with Facebook, Equifax, and Under Armour.

Despite no payment information being taken, this data breached scared consumers.

Privacy is increasingly a popular topic as more and more companies suffer from data breaches or

are treating the information without the utmost integrity. These events in the ticketing market has

whittled away at the consumer’s trust and security with these companies. Ticketmaster has made

claims that they are going to address any problems the company has with reselling tickets. They

have as well acquired a blockchain company called Upgrade; their service provides another layer

of security as tickets are turned into interactive digital assets and encrypt the ticket barcode. This

is not a marketplace to purchase the tickets, although you can seamlessly transfer the ticket

rights, it is simply an extra measure to help Ticketmaster prevent fraudulent sales and activity.

8

Chapter 3

Interviews

In the past five years blockchain has captivated the interest of millions of people across the

globe. Cryptocurrencies reached all time highs (but have since decreased), and the frenzy around

blockchain continued as people saw applications for the underlying technology. Primarily, blockchain

has a decentralized property which means that no central body or organization has control over the

network. This structure provides for ample security, user privacy, and increased trust. Blockchain is

comprised of a block and chain. Each block is where information is stored and each block is connected

via a chain. These groups create a connected system that allow for transactions to be made on the

system through a unique token or crypto currency. Any time that an author makes a change, all the

other machines on the chain are updated with the new information as well. There are two different

means of tracking who has dont work on a specific block; these protocols are proof of work and proof of

stake. Proof of work is when a person solves a complex algorithm and a reward is given to them (also

called mining). Proof of stake is when a person on a chain is deemed the creator of a block based on

their wealth. Blockchain is as well immutable or once a change is made it cannot be undone, only

another transaction can be executed that results in the previous one being a zero sum. Also, old versions

of a file cannot be deleted which keeps a record of changes made (this helps prevent fraud) it is referred

to by Richie Etwaru as the rings of a tree, “Each ring is an immutable record of the tree’s growth during

one year. Once a ring is grown by a tree, it cannot be altered.” (Etwaru, 125). This technology can bring a

much needed boost in data security, consumer trust, and equality to the event ticketing landscape.

9

One of the biggest features of the blockchain fabric are smart contracts. For businesses,

this provides a rules of engagement for users on the chain. The white paper for Ethereum

describes them as, “...systems which automatically move digital assets according to arbitrary pre-

specified rules.” (Ethereum, 2014). This contract allows users to move an object, in this case a

ticket, from one person to another only if certain rules and requirements are met. Innately, smart

contracts are designed for security on the network and provide users with confidence no one is

up to anything malicious on the chain.

With all of the recent news about Ticketmaster and the Ticketfly data breach people

looking to buy tickets for an event are right in not trusting the current landscape of the ticketing

industry. Recently, Upgraded, a blockchain ticketing platform was purchased but Ticketmaster.

The app allows users to purchase a ticket to a concert or sporting event and covers the tickets

barcode until the event’s doors open and the user is within range of the venue. The app also

allows users to sell their ticket on a secondary market or transfer the stub to a friend who will

have immediate use on their mobile device. Now that big companies are starting to adapt the

technology there will most likely be an increase in others adopting the technology. There is a

place for this technology to make a substantial difference. With blockchain fraudulent tickets

would be few and far between, customer information is secure, and most importantly everyone

would have an even playing field with regards to on-sale.

In the summer of 2018, amidst extensive research on my thesis, I had the opportunity to

be an intern in the Artist Development & Touring department at Atlantic Records. On a daily

basis I would have to synthesize radio data, organize artist itineraries, book hotels/travel, create

budgets, and keep track of artist touring. A big part of my job was tickets and making sure they

are the right price, taking care of company ticket buys, and handling on-sale. I was fortunate

10

enough to work for Harlan Frey, the Senior Vice President of Artist Development and Touring

When I had mentioned my project to him he was open to sitting down with me to talk about

technology in the ticketing sector as well as some of the woes of the business. When we spoke

about fake tickets and unfair practices Harlan had the following to say:

“The more demand, the hotter the show, the higher chance there is a fake ticket

market. It is hurtful to the fan community because it makes for distrust between

the artist and the fan...The more it hits me is in the scalping market and those who

utilize tech to get tickets at face value and sell them for three or four times the

amount. In those cases, managers, agents, and promoters do not see the money.

Every artist has their own view on how tickets to be sold. So do agents and

managers. Some want tix in the hands of fans and some just want to sell-out the

show no matter the cost. If that means brokers and bots create the perception of

‘heat’ some managers and artists are ok with that.” (Frey, 2018)

Harlan firmly believes that there will be something to more firmly control the fake ticket market.

If that product cannot completely get rid of fake tickets then it surely will control it as more and

more unique identifiers come up. The verified fan presale is a good measure to ensure that fans

are getting tickets and scalpers are not buying mass quantities and reselling them. This helps

bridge the trust gap as it incentivises people to subscribe to their favorite artists and have an

unobstructed chance at purchasing tickets. Harlan believes that at some point the fake ticket

market will be eliminated or greatly lessened, he said:

“I do not know when that is coming but I also never thought in a million years

streaming would be where it is today and piracy would be all but eliminated.

11

Maybe it will never be fully eliminated but at least it will be under control.”

(Frey, 2018)

With company executives understanding that there is an issue with event ticketing, there will be

more notice placed on making sure fans are able to purchase tickets in a safe, secure, and

legitimate environment.

On the other side of the conversation, there is equally as much optimism about the

emergence of blockchain in ticketing. I was fortunate enough to have gotten in contact with

Jason Berger, the founder of 1800-All- Show. While working at Ticketmaster in the late 80’s,

Jason realized that there is an un-catered market: tickets to exclusive or “hot” events. All show

primarily works with events in the northeast market and provides tickets on the secondary market

for, more often than not, a more competitive price than other sources. Over the past two decades,

Mr. Berger has taken it upon himself to deliver a top quality service and continue to adapt to new

technology trends; for one, his service is tapped into the inventories of other markets such as

Stubhub, Vividseats, and Seatgeek to name a few. When discussing how he uses technology to

his advantage, he said, “We do a lot of backend tech to help facilitate the delivery of tickets.

Tech for us really helps execute sales and delivery. We work with companies who have online

marketplaces…” (Berger, 2019). Mr. Berger’s services watch over the values of tickets for

events and when a customer is ready to purchase, they always look for the cheapest, legitimate

option with the best seats available. This is a different approach than what most do; a bulk of

scalpers simply buy as many tickets as possible (most likely using a bot or some regulated

means) and then flood the market for a large markup. Through his use of technology Jason is

able to procure tickets for any event for a lower markup than other mediums of exchange:

12

“We share technology that all the major exchanges and brokers share. We get

real time feeds of their inventory. It benefits the consumer by this: we could

provide tickets from all resellers for lower prices. They charge at least 27-30%

mark up where as our markup is 20%.” (Berger, 2019)

Unlike other markets, All Shows has a live pricing system so they are able to get the customer

the best deal possible.

Although Mr. Berger’s company is not a blockchain centric company, he is well versed in

the technology as he has been watching its rise in popularity. When prompted with, “Do you

think blockchain has a practical application within the ticketing sector?” he responded with:

“Yes, very much so. It can help in a lot of areas; it will definitely help

prevent buyer fraud (people using fake or stolen credit cards), it would

help in terms of knowing the consumer who is buying it, being able to

verify a fan is getting a ticket.” (Berger, 2019)

I found his response, although concise, interesting in two different ways. He notes what would be

one of the primary functions of blockchain in ticketing, preventing buyer fraud. Blockchain will

help make sure that the people buying the tickets are fans who want to attend the event, not

malicious resellers who are looking to make a dollar off of exploiting other people’s wants and

interests. However, his second statement is one that is a big bonus for businesses; knowing who

the customer on the other end of the ticket sale will help collect valuable data. Despite people

yearning for privacy on social media and other platforms, knowing age demographics,

geographical location, time spent getting the ticket (add to cart to checkout), gender, and

customer history can help businesses (agencies, management, record labels, venues) better

13

understand the consumers. This will also help provide access to future events to consumers

through email notifications, artist presales, venue presales, and other fan oriented programs.

The final interview I conducted was with Keith White, Chief Technology Officer at

Paciolan. Currently, Paciolan is one of the biggest ticketing enterprises in the United States

offering primary ticketing for sporting events and concerts. Wasting no time, we spoke about

emerging tech in the sector and discussed the potential use of biometric means to protect

customer’s tickets. Fingerprint ID and face scanning is technology that is standard in most cell

phones and laptops. Mr. White said, “This will also help with security in the sense that they will

know who is in the venue. Fingerprints and face scans will be pivotal.” (White, 2019). Above

just being a measure for customers, the security aspect of this technology will help venues know

who exactly is in their space. Unfortunately, events such as the Route 91 Harvest Festival

shooting (Las Vegas, NV), The Eagles of Death Metal terrorist attack at the Bataclan (France),

and the suicide bombing at the Manchester Arena during an Ariana Grande Concert occurred and

the need for bolstered security at high capacity events has become larger. With regards to fake

ticketing, Keith does not see an end coming to the fraudulent market, “Think of it as currency,

even as it is now you can counterfeit it but it has become difficult to do so...But like currency, as

long as there is value to something people will try to fake.” (White, 2019). The analogy he made

sums up how fake ticketing will continue despite whatever measures are made to prevent the

manufacturing of forged tickets.

Most of our interview time was spent talking about how technology will change the

ticketing landscape. Not just today, but as time progresses and more advanced means of

production come forth ticketing will be a dynamic, ever changing field. Before getting into

blockchain, we spoke about bots and their impact on how consumer’s purchase access to events.

14

“ Are bots increasing, yes! That game has been going on for decades. As we get

more sophisticated they get more sophisticated. I worked at ticketmaster for 7

years, I know all the folks are trying to fight it. We have all gotten better but to be

honest I do not see an end game there. I think that it is going to be an ongoing

effort to combat this. People have tried legislature, technology, business

engagement, presale registration. There are ways to cut it down but there will be

no end.” (White, 2019)

Mr. White brings up a great point. Akin to ticketing always becoming more advanced because of

technology, so will bots. The ability for companies such as Ticketmaster, Paciolan, Ticketfly,

and other first party vendors to determine that a fan, and not a bot or scalper, is buying the tickets

is getting more difficult. Everytime a ticket is purchased there is always a captcha which bots can

now get around, sometimes faster than humans. The automated aspect of bots is able to input

addresses and credit card information at lightning speeds. However, there are automation

extensions that consumers can use to compete with bots (similar to Mr. Berger’s approach).

We then proceeded to speak about blockchain integration and consumer trust with

ticketing companies. The past 3 years have been filled with ticketing mishaps like the Ticketfly

data breach, the surfacing of TradeDesk, and the ever increasing rise in cost of the average event

ticket. One of the biggest qualities of blockchain is instilling trust between the business and the

consumer: ‘

“Eb and flow. There was a period of time where there was a big dis trust.

Ticketing companies have now shifted to be more fan friendly; but again you're

dealing with a scarce commodity. If you have a hot ticket there are only so many

of those and the demand will outweigh supply. Overall its peaks and valleys, if

15

anything I have probably seen it get a little bit better. Companies are now trying

to direct fans, if fallen short of their goal, to legitimate market places to buy

tickets.” (White, 2019)

Blockchain has yet to truly become the standard in the ticketing sector so looking at platforms

such as Blockparty, Aventus, and Upgraded can only do so much with regards to understanding

the trust gap. However, there is slowly a shift toward this infrastructure because companies

tr3uly do want fans to have adequate access to events. Bridging the trust gap will be a great step

forward in how ticketing businesses interact with their consumers as well as how tickets are

released publically. As Mr. White states, there will always be people who unfortunately are not

able to get admission. There is a finite amount of space at each event but it is important that no

one consumer is at an advantage. Blockchain would provide equity for consumers and clarity for

the businesses.

16

Chapter 4

Feasability

While there are blockchain mediums to procure event tickets, they lack the inventory

(events) and ubiquity that other ticketing companies possess. What has made Ticketmaster and

other first party vendors so powerful are the consumers. There are few outlets for people to have

the same access to events as other parties with the added bonus of extra security. People often

find themselves waking up early to buy tickets, and moments after the public on sale the event is

sold out. In 2016, President Obama passed a law banning the use of bots to purchase tickets for

events over 200 capacity; currently, the FTC and state governments are supposed to enforce the

law which as well prohibits the sale of tickets purchased by bots across state lines (seemingly

something that is often violated). This is all encompassed in the Better Online Ticket Sales

(BOTS) Act of 2016 (congress.gov, 2016). This is a problem that sites like stubhub, vividseats,

and seatgeek (second party) do not experience as they are not the proprietary source for

admission to events.

As of now there are only a handful of blockchain oriented ticketing platforms such as

Aventus and Blockparty. On Aventus, a consumer cannot even purchase an event ticket yet, and

for Blockparty there are only a handful of events, mostly festivals. Ticketmaster purchased a

company called Upgraded. Although this is not a purchasing platform, it is a blockchain driven

17

mobile ticketing wallet. This is a big step forward as the public will become more aware of the

technology, how it functions, and other companies may begin to follow suit.

In the months of September to December of 2018 I took IST 400, Blockchain

Management at Syracuse University. Eager to dive deeper into the idea of merging the up and

coming technology with the ticketing landscape led me to create an in depth, mock blockchain

ticketing company. When the project was in its nascent stages there were a lot of details to look

into and decisions to be made. The first aspect to review was the current playing field, who the

biggest players are, and how high (or low) is the barrier to entry. Currently Ticketmaster makes

up 80% of the market share for event ticketing (Cohan, 2017). So, for a competitor to try to enter

the first party ticket sales market is extremely high. Even though consumers often pay exuberant

service fees, TicketMaster and Ticketfly have become household names in this space. The added

confusion (for some) of what blockchain is and how it works also does not help up and coming

enterprises.

Bearing this in mind, the second aspect to be reviewed, in great detail, is what type of

infrastructure would this lie upon. Currently, there are two major means: Ethereum and the

Hyperledger fabric.

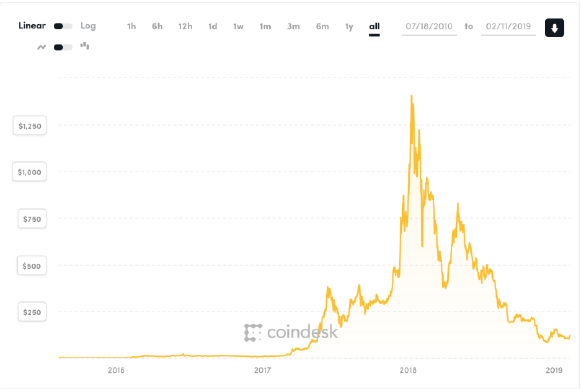

Ethereum is more known among the public because of the crypto currency involved,

Ether. During the crypto bubble, Ether hit an all time high of approximately $1,350 in January of

2018. A little over a year later, the value of the coin is at $120 (2/11/19). Despite a massive

decrease in value, the previously record high numbers gave way to public awareness of the

18

underlying technology that

supported the currency. Ethereum,

as a technology was designed with

consumer purchasing in mind.

Programs are written in a specific

language was built around smart

contracts, solidity. The program is

also fully transparent which is one

of the major tenets of which blockchain is built around (along with decentralization and

immutability). Seemingly, this is one of the better, if not the best option, for a first party,

blockchain ticketing company to use. According to the projects website:

“This enables developers to create markets, store registries of debts or promises,

move funds in accordance with instructions given long in the past (like a will or a

futures contract) and many other things that have not been invented yet, all

without a middleman or counterparty risk.” (ethereum.org)

Ethereum has seemingly no ceiling for the opportunities that can arise, it is as well built with

businesses and consumers in mind.

The other fabric to choose to use as an operating platform is Hyperledger. This is an

extremely powerful resource for companies where information has to be private or a supply

chain must be tracked. A lot of companies who use the network specialize in internet of things

(IOT), medical records, and financial endeavours. The open source network is great for

collecting data, watching over network activity, and security. Similar to Ethereum, Hyperledger

has its own form of smart contracts called chaincodes which serve the same function (set of rules

19

for business to follow). The hyperledger team’s goal for the technology is to “Provide neutral,

open, and community-driven infrastructure supported by technical and business governance.”

(hyperledger.org/about). This statement is interesting in that they use the word ‘governance’

which seemingly detracts from what blockchain is, decentralized.

The two foundations are both great and provide specialized service. However, they both

have their drawbacks. Ethereum has a scalability problem, something that a first party ticketing

company would need. As more and more transactions occur on the network, the time it takes to

execute will increase. Although there is no exact amount of transactions per second, people

speculate that Ethereum can only process somewhere between 15-30 transactions per second.

Ticketmaster has to deal with hundreds, sometimes even thousands of transactions per second

which is no simple feat to accomplish. However, the creator of Ethereum, Vitalik Buterin

explained that:

“with second-layer solutions such as Sharding and Plasma, the Ethereum network

will eventually be able to process 1 million transactions per second and

potentially more than 100 million transactions per second.” (Young, 2018)

This is big news for the technology as more transactions per second could potentially increase

the amount of buying platforms (such as ticketing) that use Ethereum.

Hyperledger also has some technical issues that would make it difficult for use in

ticketing. Primarily it is a completely private network within a business, everyone on the network

had to have been permissioned prior and this obfuscates transparency. Hyperledger is also not

decentralized. The project is over sought by The Linux Foundation; this goes against the

traditional pillar of blockchain being decentralized as there is once central body that governs.

The system also does not support the use of a cryptocurrency and is mostly a collaboration tool

20

that creates blockchain frameworks. A lot of companies such as American Express, Deutsche

Bank, Cisco, and IBM use the service for overseeing aspects of the supply chain and tracking

records.

Ethereum would be a more suitable platform because it is specifically designed for

transactions. With the advent of mobile ticketing, and an ever increasing amount of live events

annually, tickets are exchanged more than ever. This constant movement from the first party, to

the consumer, to potentially a secondary market or transferred would be best supported on a

system the is smart contract centric and transparent. There would then be an increased amount of

trust as consumers would then be able to verify transactions and authenticity. Despite the current

issues regarding scalability, if Mr. Buterin’s comments come to fruition the issue of slow

transaction times and the amount of ‘gas’ (added money to expedite transaction process) would

be all but nothing.

21

Chapter 5

Coding

Pictured above is a rudimentary blockchain ticket that can be created and sent to a user. The

user can then change of the ownership of the ticket if they so choose to. Using the platform Remix, I

created two different smart contracts; on contract is the logic functions for the ticket, and the other is

for a recipient.

In order to begin to code, the version of solidity in which someone is coding must be stated.

Some programs have unique functions or different methods of achieving a similar goal. Once the version

is established the first contract can be created. A smart contract is a list of standards that need to be

22

met in order to execute. Within the contract are functions and modifiers which validates the candidate

for the transaction at hand. Lines 4-9 are the variables that are established prior to the functions such as

event which are message the contract sends out to the user, uint or unsigned integer which represents a

numerical value (ether/wei or barcode), bool or boolean value is a simple true or false value, and lastly

address is a location in the transaction. After the values are established, the functions can start being

created. The function in lines 11-13 generates a random, unique number with up to 256 integers. This is

a private function that only the owner of the contract can see. Lines 15-20 state that the current owner

of the ticket is the sender (person who created contract), the specific ticket I.D. is created, isPurchased

(bool value) is required to be true, and if the recipient of the ticket does not have the right amount of

Ether to purchase the ticket they are not allowed to purchase. In this case, the value of the ticket was

set at $50, approximately the average cost of a ticket. Lines 22-25 begin to undergo the process of

changing the ownership of the ticket. Once the financial aspect meets the requirements of the contract,

ownership is given to the purchaser and they now have the rights to the ticket I.D.. The following

modifier, in lines 27-30, ensures that the msg.sender (or owner of the contract) is the original owner.

The final functions, lines 32-35 and 37-40 respectively, approve the ticket ownership to be transferred

and triggers an event for the user. The latter function confirms the purchase was made and ownership

was transferred.

Although brief, the last function sets up a ‘person’ contract. This interacts with the ‘Ticket’

contract so there can be an exchange of an item. This function is for the demo specifically as I wanted to

have the items engage with the contract. On the left hand side of the picture there is a box that reads

“Deploy” and “At Address”. While the contracts did deploy, I did not have the ‘gas’ or extra money

added to expedite the transaction.

23

Chapter 6

Conclusion

This technology is here to stay. As time moves on, according to Mohr’s Law, technology will only

become more powerful and be able to handle more processes and transactions at once. With companies

of a myriad of varieties developing their own blockchains the use and feasibility for its application in

ticketing grows. Ticketmaster took the first major step for ticketing and blockchain; the big ticketing

companies understand that there is, to a degree, some sort of a problem and blockchain can be a low

hanging fruit. That is, it is something companies can adopt immediately, not be too difficult to grow

accustom to, and see results. Through all of the research gathered, and time spent coding, a first party,

blockchain oriented ticketing company is feasible. Not only is it something that can be accomplished,

consumers may feel more inclined to use such a service as they want their information secured and an

even chance at procuring access to an event.

Further research for the application is needed, but the technology needs to develop further.

Ethereum, which is a popular foundation for blockchain, can only handle 15 transactions per second

whereas other payment methods can process several thousand transactions. That is the more

transactions being processed, the slower the underlying technology will run. This is due in part to the

technology being in its nascent stages; however, with time it will only be able to handle more requests

per Vitalik Buterin. Once at the level required to fully execute an operation on a massive scale, there

should be critical research done on how it improved company operating procedures, were customers

retained, and if there was an influx of new customers because of the improved security.

24

After having been shut out of multiple concert on-sales and purchasing fake tickets on two

separate occasions I felt as though there is a problem in event ticketing. People’s claims of skeptical

activity after the Ticketmaster and Live Nation merger, the Ticketmaster/Trade desk news, and the

Ticketfly data breach all cemented my visceral feeling as though there is a gap in trust and security in

between businesses and consumers in the ticketing industry. After revising my project a multitude of

times, I had finally concluded that there is space for blockchain technology in ticketing. It would

decimate or possibly even eliminate fake tickets and provide all consumers the same access to events by

protecting against the use of automated purchasing software.

25

Works Cited

“About – Hyperledger.” Hyperledger, www.hyperledger.org/about.

Brooks, Dave. “Ticketmaster Says It 'Welcomes' Federal Trade Commission Workshop on Ticketing.”

Billboard, 4 Oct. 2018, www.billboard.com/articles/business/8478325/tickemaster-federal-trade-

commission-workshop-ticketing-ftc-statement.

Brooks, Dave. “Undercover Video Forces Ticketmaster to Answer Uncomfortable Questions About Its

Resale Business.” Billboard, 21 Sept. 2018,

www.billboard.com/articles/business/8476349/undercover-video-forces-ticketmaster-answer-

uncomfortable-questions-resale-business.

Buterin, Vitalik. Ethereum White Paper.

cryptorating.eu/whitepapers/Ethereum/Ethereum_white_paper.pdf.

CBS News. “Ticketmaster Is Colluding with Ticket Scalpers and Taking a Cut, Undercover Report

Finds.” CBS News, CBS Interactive, 20 Sept. 2018, www.cbsnews.com/news/ticketmaster-

undercover-report-reveals-company-profiting-from-resold-tickets/.

Cohan, Peter. “Amazon Seeks To Snag $5 Billion Market From Ticketmaster.” Forbes, Forbes Magazine,

11 Aug. 2017, www.forbes.com/sites/petercohan/2017/08/11/amazon-seeks-to-snag-5-billion-

market-from-ticketmaster/#94825473042f.

Cribb, Robert, and Marco Chown Oved. “We Went Undercover as Ticket Scalpers - and Ticketmaster

Offered to Help Us Do Business.” Thestar.com, 19 Sept. 2018,

www.thestar.com/news/investigations/2018/09/19/we-went-undercover-as-ticket-scalpers-and-

ticketmaster-offered-to-help-us-do-business.html.

Dobrev, Staffo. “How To Find Cheap Concert Ticket Prices Across the U.S.” Wanderu, 2018.

“Ethereum Project.” Ethereum Project, www.ethereum.org/.

26

“Mergers.” Federal Trade Commission, 15 Dec. 2017, www.ftc.gov/tips-advice/competition-

guidance/guide-antitrust-laws/mergers.

Moran, Jerry. “Actions - S.3183 - 114th Congress (2015-2016): BOTS Act of 2016.” Congress.gov, 14

Dec. 2016, www.congress.gov/bill/114th-congress/senate-bill/3183/actions.

Pelofsky, Jeremy. “Live Nation, Ticketmaster Merge; Agree to U.S. Terms.” Reuters, Thomson Reuters,

26 Jan. 2010, www.reuters.com/article/us-ticketmaster-livenation/live-nation-ticketmaster-merge-

agree-to-u-s-terms-idUSTRE60O4E520100126.

Peoples, Glenn. “Millennials and Boomers Love Experiences, But Who Attends More Concerts?”

Billboard, 24 Aug. 2015, www.billboard.com/articles/business/6671232/millennials-and-

boomers-love-experiences-but-who-attends-more-concerts.

Schatz, Lake. “Ticketfly Breach Exposed Data of 26 Million Customers: Report.” Consequence of Sound,

5 June 2018, consequenceofsound.net/2018/06/ticketfly-hacker-data-breach/.

Singer, Jack H. “Jason Berger Interview.” 4 Jan. 2019.

Singer, Jack H. “Keith White Interview.” 18 Jan. 2019.

Singer, Jack H. “Harlan Frey Interview.” 30 July 2018.

Sisario, Ben, and Graham Bowley. “Live Nation Rules Music Ticketing, Some Say With Threats.” The

New York Times, The New York Times, 1 Apr. 2018,

www.nytimes.com/2018/04/01/arts/music/live-nation-ticketmaster.html.

Ticketfly Attendee Support, support.ticketfly.com/s/article/41507.

“Vitalik Buterin: Ethereum Would Eventually Achieve 1 Million Transactions Per Second.” CCN, 3 June

2018, www.ccn.com/vitalik-buterin-ethereum-will-eventually-achieve-1-million-transactions-per-

second.