≥

User Guide

superior solutions thr

ough bett

er understanding

Libraries

pg 21 - Search

pg 21 - Saving a Standard Search

pg 22

- Saving a User-Defined Report/Ranking/

Matrix or Drill-down report

pg 23 - Report Wizard

pg 24

- Steps to create a report using Report Wizard

pg 25 - Sharing Reports

Appendix A: Key Search Fields

pg 26 - Key Search Fields for ECM Analysis

Appendix B: Field Glossary

pg 27

- Field Glossary

Help and Support

pg 38 - ECM Analytics Help and Support

pg 38 - Calling the ECM Analytics Hotline

Getting Started

pg 3 - Designer

pg 3 - Portal

pg 3

- DealCal

pg 3 - News&Alerts

pg 3 - Dealogic ScoreCard

pg 3

- CapitalMap

pg 4 - MyReports

pg 4 - LookUp Search

DealCal pg 5

Deal Profile pg 6

News&Alerts pg 7

ScoreCard

pg 8 - Selecting parameters

pg 9 - Drilling down to underlying data

pg 9 - Copy a ranking into Excel

CapitalMap pg 10

MarketMatrix pg 11

LookUp pg 12

MyReports pg 13

Designer

pg 14 - Launching through Portal via modify buttons

pg 15 - Launching Designer as a standalone

pg 15 - Standard Search

pg 16 - Option 1: Tranche Report/User-Defined

pg 17 - Option 2: Ranking Table

pg 18 - Use Dates

pg 18 - Customise Ranking Drill-Down

pg 19 - Option 3: Matrix

pg 20 - Exporting to Excel

≥

Contents

New York: (+1) 212 577 4400 email: usinfo@dealogic.com London: (+44) 20 7379 5650 email: [email protected]

Hong Kong: (+852) 2804 1223 email: [email protected]om Tokyo: (+813) 5157 1527 email: jpinf[email protected]

≥ www.dealogic.com

superior solutions through better understanding

≥

Getting Started

ECM Analytics (v.5.06) User Guide 3

Dealogic www.dealogic.com

ECM Anal

ytics is a competitive benchmarking system covering the Global Equity Capital Markets. Reporting packages

include Bookrunner and company rankings by Industry and Region, deal lists and profiles of individual transactions.

Custom reports can be saved in shared libraries set up specifically for defined user groups, which can be generated with

up-to-date data from anywhere in the world using only a web browser. Output can be printed or copied/exported to Excel.

The platf

orm is comprised of two primary components, the Designer and the Portal.

Designer

Designer is a l

ocally installed desktop application that enables a user to create, edit and save reports in personal libraries

or to share to other users or groups. Designer is used to specify search parameters, including but not limited to:

- Date ranges

- Pr

oducts and sub-products

- Regions and countries

- Indus

tries and sectors

- Deal v

alue ranges

- Specific manager involvement

Portal

The Portal is a password protected website with several primary pages:

DealCal

- Calendar of filed, expected, withdrawn/postponed and completed deals with drill-downs to individual profiles

- Monthly, Weekly and Daily views

- Filter preferences include dates, banks, deal status, deal type, deal execution, regions, deal size and target market

News&Alerts

- ECM Squawk of breaking market information

- ECM Alerts of all deals that have been revised, filed, priced and withdrawn

- Daily ECM NewsSheets topical to the activity of the market

Dealogic ScoreCard

- Rankings by time period f

or Bookrunner or Indus

try based on v

olume

- Detail includes number of deals, aggregate deal volume, percentage share, aftermarket performance information

- Yearly, quarterly, monthly, weekly and year-to-date views

- Drill-do

wn hyperlinks pr

oduc

e underl

ying deal lists for rankings

- Modify buttons allow users to further customize queries using the Designer

CapitalMap

- Snapshot of ECM activity by geogr

aphic

al region/nation

- Analysis selection includes deal type, volume, number of deals, year-to-date, last-year-to-date and last year

- Modify buttons allow users to further customize queries using the Designer

≥

Getting Started

ECM Analytics (v.5.06) User Guide 4

MyReports

- Access to a library of saved reports that can be accessed on an individual, group or firm wide basis

- Ability to share reports with designated individuals or groups

- Reports created through the Designer can be easily posted to MyReports and executed on a recurring basis

LookUp Search

- Company: List all deals for a given company or company parent

- Bank: ECM bank profile by deal type, recently completed deals and deals in the backlog

- Industry: ECM industry profile by deal type, recently completed deals and deals in the backlog for any Dealogic

General Industry Group (GIG)

- Deal number: Go directly to full profile of deal with a specific deal number

Dealogic www.dealogic.com

≥

DealCal

ECM Analytics (v.5.06) User Guide 5

Dealogic www.dealogic.com

When opening the ECM Anal

ytics platform the first page you come to is DealCal. Showing the ticker, Deal Type and

Bookrunner Parent Code for any deals on a global basis that have been filed/announced, expected to price, priced revised

or withdrawn over the specified time period.

It is possible to modify the time period to the specific dates or number of weeks that you require. You can choose to view

the data on a Monthly, Weekly or Daily basis.

There is also a ticker look-up function on every page in the Portal, by entering the ticker and clicking go you will be taken

to a page with all the deals under that ticker. (Please see the LookUp page for more extensive searching features).

Y

ou can also Filter the information that appears on your DealCal page by setting your preferences.

Click on the preferences option and you will go to the Edit DealCal Preferences page. Here you can select what you would

lik

e t

o see on the c

alendar based on a Specific Bank and their role, Status, Deal Type, Deal Execution, Share Type, Region,

Target Market, Deal Size and Industry.

Onc

e y

ou hav

e edit

ed y

our Pr

ef

er

ences you have the option to save them to a Library. These Libraries can then be accessed

quickly by clicking on the Filter button on the main DealCal page.

≥

Deal Profile

ECM Analytics (v.5.06) User Guide 6

Dealogic www.dealogic.com

By clicking on any of the tick

ers on the DealCal page you can drill down to see the Deal Profile of the underlying deal.

The Deal Profile provides an in-depth look at individual transactions, including structure, individual tranche details,

pricing, syndicate group and disclosed gross fees. Click on the hyperlinked company to access detailed information on any

transaction underlying a search.

Also on the full pr

ofile you have access to source documentation via the EdgarDesk Link. The Ticker Search links into

Yahoo Finance ticker information, and Web Search pulls up a Google search on the company name.

≥

News&Alerts

ECM Analytics (v.5.06) User Guide 7

Dealogic www.dealogic.com

The Ne

ws&Alerts page consists of ECM Squawk – a brief statement on pertinent issues, ECM Alerts – Further information

on deals that have filed/announced, priced or revised, providing further information than on the calendar, and the

NewsSheet.

A NewsSheet is posted daily, giving a brief synopsis topical to the market, and providing regular standardized tables and

breakdowns.

≥

ScoreCard

ECM Analytics (v.5.06) User Guide 8

Dealogic www.dealogic.com

Illus

trates Bookrunner or Industry volume rankings at ECM level or Deal Type level over pre-defined periods. Displays

deal volume, number of deals, % market share, aftermarket performance for the selected time period.

Tip:

Dealogic’s Official Ranking Criteria is also available at the top of the ScoreCard page.

Selecting Parameters

Users can navigate between ECM deal types (ECM, Stock, IPO, Follow-on and Convertible) and time periods.

The tables will automatically regenerate upon making a selection.

≥

ScoreCard

ECM Analytics (v.5.06) User Guide 9

Dealogic www.dealogic.com

Drilling down to underlying data

To view a banks deal list and apportioned credit for each deal, click on the respective row to drill down to the underlying

data, once you have the list of underlying deals it is then possible to drill down into the full profile.

Copy a ranking into Excel

Any ranking table on the ScoreCard (and any ranking or table within the Portal that has a copy button) can be copied into

Excel by pressing the Copy button and then pasting the data into Excel.

≥

CapitalMap

ECM Analytics (v.5.06) User Guide 10

Dealogic www.dealogic.com

The Capit

alMap gives a snapshot of the regional breakdown by volume and activity. The top deals across all regions are

also shown.

As with the previous pages it is possible to drill down and see the data underlying the tables.

At the bottom of the page in the Analysis Selection it is possible to modify the data for the whole page to display the time

period, deal type or the number of deals or v

olume as required.

ECM Analytics (v.5.06) User Guide 11

The Mark

etMatrix shows the top three banks from the Global ECM Bookrunner Ranking table and shows a breakdown of

their apportioned value across Region and Deal Type.

Dealogic www.dealogic.com

≥

MarketMatrix

ECM Analytics (v.5.06) User Guide 12

LookUp

The LookUp page is a quick reference page that allows you to search for a specific Issuer, Bank, Industry, Deal or Region.

Dealogic www.dealogic.com

≥

LookUp

The MyReports page is wher

e you can access a library of reports. These are either reports saved to your personal log-in

or saved under a shared library. Reports created from the Designer can easily be posted to the MyReports page and

executed on a recurring basis.

It is also possible to share existing reports with other users under the same Client ID.

T

o run the reports select the report from the list on the left, this displays the criteria for the selected report on the right.

You then have the option to either Modify or run the report.

Modifying the report (see the Designer Section) launches the Designer with the set criteria allowing you to modify the

sear

ch or the report as required.

Running the report; hitting the Run button allows the search and report to run without launching the Designer. Once the

report has run you again have the option to Modify, or you can Copy and Paste to Excel. The About option at the top of the

report allows you to view the search and report criteria.

ECM Analytics (v.5.06) User Guide 13

Dealogic www.dealogic.com

≥

MyReports

≥

Designer

ECM Analytics (v.5.06) User Guide 14

Dealogic www.dealogic.com

The Designer is a t

ool that enables you to modify parameters of the ScoreCard and CapitalMap or devise a new stand alone

search. Access to the designer allows users to perform custom analysis, which can be saved in libraries and shared with

other users.

Users can access the Designer from the Portal in one of two ways: clicking on a modify button associated with an existing

ranking/deal list or launching from the toolbar at the top of the page.

Lauching through Portal via Modify buttons

A key advantage to launching the Designer via the modify button is that the standard report parameters are already

configured to the tables on the ScoreCard. This allows the replication and modification of the report.

Hitting the modify button launches the screen below. Select “finish” to replicate the ScoreCard tables or to modify select

“Back” twice until you reach the Standard Search screen where you can amend the search according to desired parameters.

≥

Designer

ECM Analytics (v.5.06) User Guide 15

Dealogic www.dealogic.com

Launching Designer as a standalone

An alternative to launching the Designer from a Modify button is to launch the Designer from the toolbar icon, or the icon

on the MyReports page.

Standard Search

After launching the Designer either through the Modify button (as explained above) or the Designer icon you will get to the

Standard Search page.

Standard Search – used to isolate a dataset of deals with a common set of properties.

• Select the Deal or Tranche button to specify the basis of your search. This selection determines whether a ranking reports

the number of deals or the number of tranches.

• Select a field from the field dropdown box by typing part of the name or by scrolling through the list.

• Choose the appropriate condition for your search e.g. equals, not equal to etc. (These conditions will alter the way that

a chosen field will act within the search).

• Enter a value into the Value Box. Coded fields such as nationalities, banks, deal type etc. have a list of possible variables

which can be accessed by clicking on the value box next to the desired code or by pressing F9.

Tip:

Searches can be saved in a shared or personal library for easy future access.

When running the Standard Search, you can display your results in a Tranche Report (User-Defined), Ranking Table or

a Matrix.

Tip:

When searching on Deal Value the field is in dollars/Euros, either enter in the full amount or “m” following the value

in millions i.e. 20m.

≥

Designer

ECM Analytics (v.5.06) User Guide 16

Dealogic www.dealogic.com

Option 1: Tranche Report/User-Defined

Enabl

es you to produce customized reports by choosing specific fields and sorting options. There are three ways of

selecting the Report Function:

• Click on the Report Fields button to ensure that it is selected.

• Locate the required field by scrolling through the list or by typing part of the field name to limit the choices.

• Click on the desired field to be reported. Other fields can be selected in a similar fashion. Use the Up and Down buttons

to adjust the postion of the field.

• Click on Sort Order and select the desired fields to sort the report.

• Select either ascending or descending under Field Attributes.

• Save the User-Defined Report in a shared or personal library, if desired.

Tip:

Use the check boxes under Field Attributes to provide totals and averages for numeric fields. Also select denominations

from the drop down menu to the right.

Note:

If tranche-level fields are displayed, the report will display separate tranches on separate rows. If no tranche-level

fields are selected, the report will display each deal on a single row.

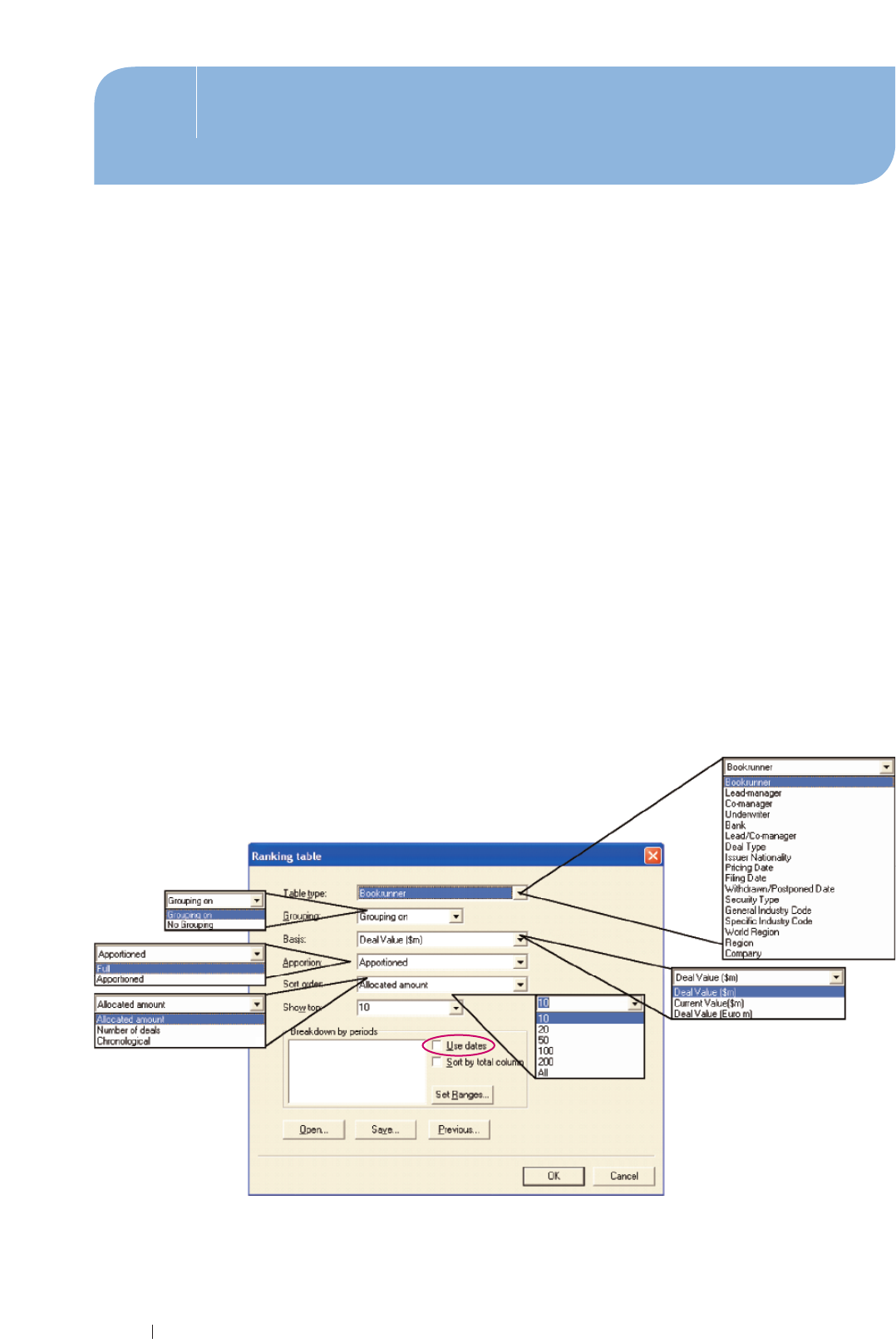

Option 2: Ranking Table

A r

anking table consolidates deal information to rank banks, issuers, industries, regions etc. Rankings are based upon

deal volume and deal activity from a dataset generated by the previous search.

• Bookrunner Ranking Tables, according to standard Dealogic methodology, should be run on:

- Bookrunner (also applies to other manager tables – Lead-manager, Co-manager, Underwriter, Lead/Co-manager.

- Gr

ouping On, consolidates bank subsidiaries to the bank parent.

- From Basis select Deal Value to capture deal volume (this can be in either Euro’s or $).

- Apportion: Gives two options one being Apportioned where the credit is equally split between all the bookrunner

on a tr

anche by tranche basis (Dealogics standard methodology). The second option is Full, where entire tranche

credit is given to each bookrunner.

- Sort order allows you to sort rank based on amount or number of deals. (If ranking by a Date field, you will also

have the option to sort Chronologically).

- Show top allows you to designate the number of banks that will be displayed in the ranking.

• Volume rankings can be viewed in one of several ways:

- Company

- Product Type

- Deal Type

- Issuer Nationality [single unique Nationality for each deal]

- Pricing Date

- Filing Date

- Withdrawn/Postponed Date

- Security Type

- General Industry Group (GIG) [single unique GIG for each deal]

- Specific Industry Group (SIG) [single unique SIG for each deal]

- World Region [single unique nationality for each deal]

- Region [single unique nationality for each deal]

≥

Designer

ECM Analytics (v.5.06) User Guide 17

Dealogic www.dealogic.com

≥

Designer

ECM Analytics (v.5.06) User Guide 18

Dealogic www.dealogic.com

Use Dates

Option that allows you to see rankings across multiple

time periods. Upon checking the Use Dates box, an options

window will appear. Specify the period length, number of

periods, and the most recent period for your ranking. You

can also modify the range to report on calendar year or on

a rolling basis.

Customize Ranking Drill-Down

This allows you to configure a drill-down report, selecting the data items to display and the criteria by which to sort

the deals.

Steps:

• Highlight the desired bank row or rows and right-click on the mouse.

• Select “configure drill down report” option.

• Locate the fields you require from the Field Selector, either by scrolling through the list or by typing part of the field

name to limit the list.

• Select the fields you wish to report on.

• Sort the report by clicking on the Sort Order tab. You can sort up to three different parameters, select the fields by which

you would like to sort and their order.

• Click OK for the report to execute.

≥

Designer

ECM Analytics (v.5.06) User Guide 19

Dealogic www.dealogic.com

Option 3: Matrix

The Matrix pr

ovides a statistical breakdown of a dataset according to two user-selected fields. Two fields must be chosen.

One will be reported on the X-axis (across the top of the report) while the other will be reported on the Y-axis (down the

side of the report). For example, Pricing Date by Year may be reported on the Y-axis while Deal Type is reported on the X-

axis. In this way a r

eport can be built based on any two fields relating to the respective axis. With the Display Items you

can customize your report further with what information you wish to view, you can choose from Amount, Percentage,

Average and Count.

ECM Analytics (v.5.06) User Guide 20

Exporting to Excel

There are three ways to export any User-Defined Report,

Ranking or Matrix to Excel from the Designer.

- Right click on the report and select Copy All or go to

Edit/Copy All, then pas

t into an Excel spreadsheet.

- From the Edit menu you can also Copy Selection based on

any r

ows highlighted in your current report or table.

- You can export to Excel by pressing the Excel button from

the tool bar. The advantage of exporting to Excel rather

than copying the table is that you can retain the formatting

as you see it on your screen. Also the criteria will be

available on the second tab in the same worksheet.

Dealogic www.dealogic.com

≥

Designer

ECM Analytics (v.5.06) User Guide 21

Cus

tom reports can be saved in individual or shared libraries and dynamically generated with up-to-date data using a web

browser. Output can be printed or copied/exported to Excel.

- A library of saved reports can be accessed on an individual, group or firm-wide basis.

- Allows user to share reports with designated individuals or groups. Reports created through the Designer can be

easily saved to MyReports via the Report Wizard, allowing them to be run on a recurring basis.

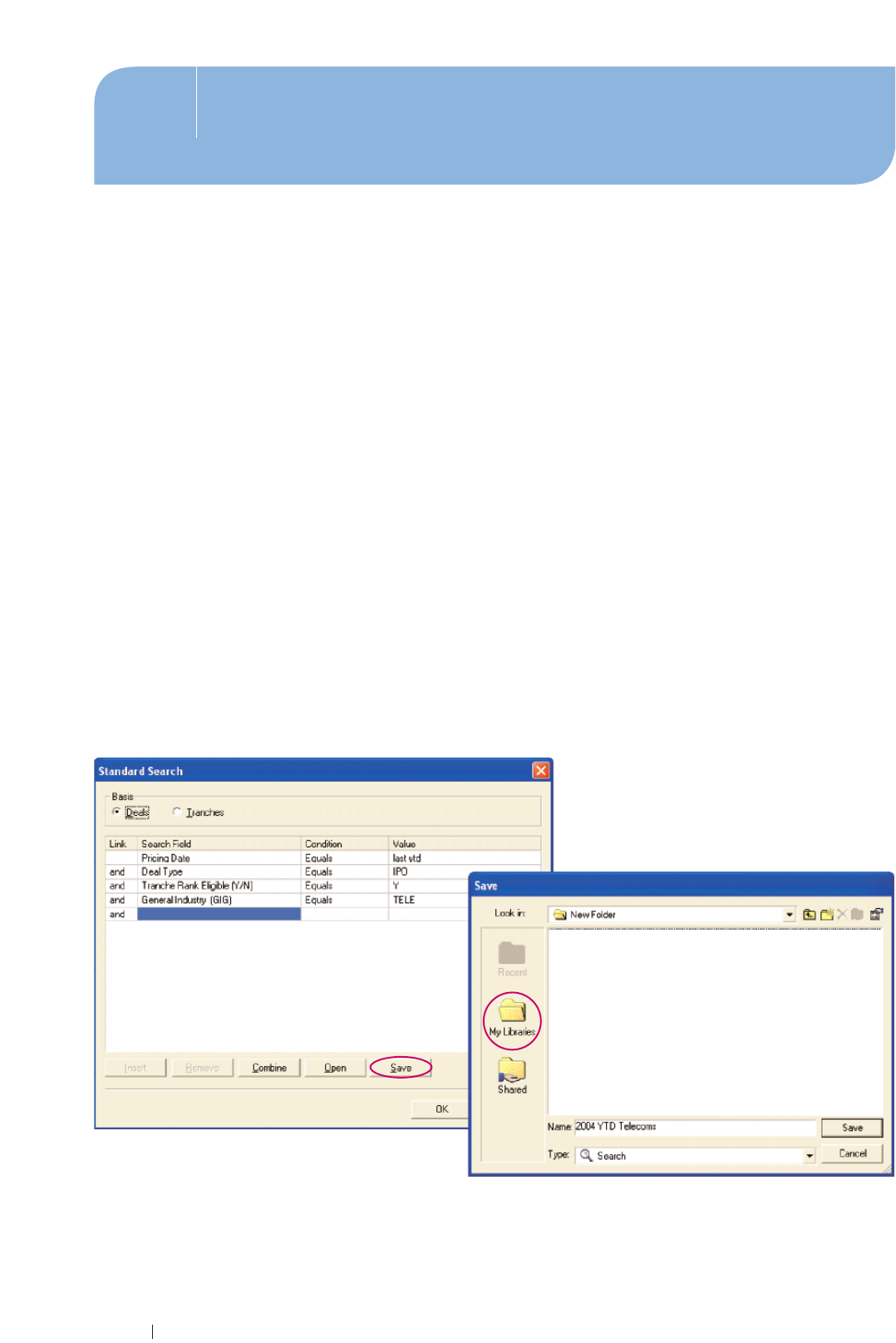

Search

At any stage after setting search parameters in your Standard Search and running either a Ranking or User-Defined

Report, you can save one or each of these actions in your libraries for future reference.

This is especially useful when your analysis does not conform to any one of the searches on ScoreCard or frequently

used reports.

Saving a Standard Search

Steps:

• Modify search from ScoreCard – add in any extra criteria to your search or launch the Designer individually from the

Designer icon and create your search.

• Save your Search by hitting the Save button, which pulls up a window that allows you to save your report in My Libraries,

it is also possible to create folders in your libraries if required.

• Reports saved in the My Libraries folder can only be accessed with your login; reports saved in the Shared folder can be

accessed by other users under the same Client ID.

• Name your search and click the Save button when complete.

• Retreive this search by clicking the Open tab on the Standard Search screen, this allows you to access all saved reports.

Dealogic www.dealogic.com

≥

Libraries

ECM Analytics (v.5.06) User Guide 22

Saving a User-Defined Report/Ranking/Matrix or Drill-down report

Steps:

• Save by hitting the Save button once you have selected fields and sort priorities for your report. You will then see a list

of your folders and those that are shared with other users.

• Save report in desired folder.

• Retrieve this report at a later stage by clicking the Open Reports tab to access all saved reports.

Note:

When searches and reports are saved at each individual step these do not show on the MyReports section of the

Portal, in order to save a report under MyReports you have to use the Report Wizard.

Dealogic www.dealogic.com

≥

Libraries

ECM Analytics (v.5.06) User Guide 23

Report Wizard

Another means of retrieving any of your saved Searches is by clicking on the Wizard button on the toolbar or selecting the

Report Wizard from the Report Menu. Also as previously mentioned, modifying any report on the Portal will automatically

transfer you to the Wizard.

• The Report Wizard tool is used to save Searches and Reports together in the My Libraries folder, to produce reports,

which can then be automated at the click of a button.

• It is the tool that allows users to save reports for easy access on the MyReports section of the Portal.

• Within My Libraries, click on the folder icon to add folders, New Folders can be renamed.

• The Recent folder stores the recently run searches and reports.

Dealogic www.dealogic.com

≥

Libraries

ECM Analytics (v.5.06) User Guide 24

Steps to create a report using Report Wizard

• Step 1: Click on Report Wizard icon or select Wizard from Report menu.

• Step 2: Click on Next and define your standard search (either create a new report or open a report from your libraries

by clicking the Open button and selecting the search), click next.

• Step 3: Select either a Tranche Report or a Ranking Table or Matrix, click next.

• Step 4: Make the desired selections for the report or ranking (either create from new, or use existing libraries), click next.

• Step 5: Click Save button and save report to library or click Finish to execute the report, or Cancel.

Dealogic www.dealogic.com

≥

Libraries

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

ECM Analytics (v.5.06) User Guide 25

Sharing Reports

Once a you have created a report on MyReports it is possible to then share this with and individual or a group.

Steps to share a report:

• Step 1: Either return to the Report Wizard and click on Library, or go to File/Open on the toolbar, or the blue folder on

the t

oolbar.

• Step 2: Highlight the report and click the share folder icon with a hand underneath.

• Step 3: You will then be given a list of current users. Highlight the user you wish to share the report with and click the

singl

e arrow button to share. To share with the entire list click the double arrow button.

• Step 4: Click on the Shared folder to view any reports, which have been shared with you from another user. This report

will also appear on you’re MyReports page, and any reports you have shared will appear on the MyReports page of the

user you have shared with.

Dealogic www.dealogic.com

≥

Libraries

Step 2

Step 3

Step 4

ECM Analytics (v.5.06) User Guide 26

Key Search Fields for ECM Analysis

1. Tranche Rank Eligible Y/N: All Dealogic standard reports use tranche rank eligible. This excludes the following:

- Closed End Funds

- Spot Secondary

- Best Efforts

- Chinese A-shares

- Pre-arranged placements

- Accelerated Bookbuilds/Bought deals with undisclosed selling shareholders

2. Deal types: ECM breakdown into 4 top level product types

- IPO

- FO

- CONV

- SHELF

3. Pricing Date: Searches on specific dates or time periods. With the added functionality of options for this week, this ytd,

last ytd etc that will, when saved in a search on the MyReports page will update accordingly.

4. Deal World Region: Allows top level breakdown of Global ECM into 3 regions (based on nationality of the issuer)

- EMEA

- Asia Pacific

- Americas

5. Deal Region: Allows more granular world breakdown into 11 regions (based on nationality of the issuer).

6. US Marketed Y/N: Includes all deals totally or partially marketed in the US including SEC Registered and 144a (Akin to

EquiDesk data).

7. Current Value: The expected amount to be raised on a transaction. This is the value that should be used in Backlog

Rankings.

Dealogic www.dealogic.com

≥

Appendix A: Key Search Fields

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 27

Dates

Announcement Date Date registration information is announced

Filing Date Date security was filed with the SEC

Initial T

erms Date Date security's initial terms were filed with the SEC

Revision Date Date the latest material revision was filed with the SEC

Latest Filing Date Latest of filing date, initial terms date or material revision date

Expected Date Expected pricing date

Pricing Date Date the security is priced

T

rade Date Offer date of an issue

First Trade Date Security's first day of trading on the stock exchange

Settlement Date Date an executed transaction must be settled

Withdrawn/Postponed Date Date on which a prospective offering is withdrawn from the market or the intended

is

suance cancelled

Regis

tration/Revision Date Latest revision filed with the SEC

Prospectus Off Date For SEC registered deals, date by which point final prospectus must be delivered to investors.

180 days from Trade Date

# Days Announcement to Offer Number of days from original SEC filing date to pricing date

# Days Since Filed Number of days since the filing date

# Days Since Filed Initial Terms Number of days since the issuer filed initial terms with the SEC

# Days Since IPO Number of days since IPO priced

# Days Since Last Issue Number of days since the last issue priced

# Days Since Revised Number of days since the issue was last revised with the SEC

# Days Since Shelf Filed Number of days since shelf was filed with the SEC

Share Price Fields

Offer Price Offer price in currency of issue

Offer Price (US$) The price at which each security will be offered in US$

Last Trade before Filing Last common stock price before filing date

Last Trade before Offer Last common stock price before offer date

Last Trade before Revision Last common stock price before revision date

Ask before Offer The quoted ask price prior to offer

Bid before Offer Quoted Bid on NASDAQ at last market close prior to pricing

Filing Range Original pricing range

Filing Range Low Low end of pricing range when issue is filed

Filing Range High High end of pricing range when issue is filed

Initial Mid Point Range Average price based on the filing range

Revised Range Revised price range

Revised Range Low Low end of pricing range in the latest revision statement

Re

vised Range High

High end of pricing r

ange in the lat

es

t r

e

vision statement

Revised Mid Point Range Midpoint of revised price range

Current Range Pricing range in most recent registration statement

Curr

ent Mid P

oint Range

Midpoint of current price range

Current Range Low Low end of pricing range in the latest revision statement

Current Range High High end of pricing range in the latest revision statement

Revision Direction Indicates what amount the revision specifies as compared to the original filing

Above/Below/In Range Level of offer price compared to initial range

Last Trade Indicates the closing price of the security of the previous trading day.

F

or is

sues no l

onger tr

ading indic

at

es the last reported price

Last Trade Date Last trade date of the security in the market exchange

% Change Price Initial/Offer Percentage change from initial price to the offer price

Pr

emium/Disc

ount(Stock) Percentage change from last trade before offer price to offer price.

A negative value indicates a discount.

% Change Price Offer/Open Change in security price from offer price to the first trade date opening price

% Change Price Offer/1 Day Change in security price from offer date to 1 day later

% Change Price Offer/1 Month Change in security price from offer date to 1 month later

% Change Price Offer/1 Week Change in security price from offer date to 1 week later

% Change Pric

e Off

er/2 W

eeks

Change in security pric

e fr

om offer date to 2 weeks later

% Change Price Offer/3 Months Change in security price from offer date to 3 months later

% Change Price Off

er/6 Months

Change in security price from offer price to 6 months later

% Change Price Offer/1 Yr Change in security price from offer price to 1 year later

% Change Price Offer/Last Quarter Change in security price from offer date to the last quarter

% Change Price Offer/Last Year End Change in security price from offer price to the last year

% Change Price Offer/Current Change in security price from offer price to current

% Change Price 1 Day/Current Change in security price from one day after the offer to the last closing price

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 28

52 Week High Date Date that 52 week high occurred

52 Week High Price Highest common stock price in the past 52 weeks

52 Week Low Date Date that 52 week low occurred

52 W

eek Low Price Lowest common stock price in the past 52 weeks

Opening Trade Security's open price for the first day of trading

Closing Price - 1 Day Security's closing price one day after the offer

Closing Price - 1 Month Security's closing price 1 month after the offer

Closing Price - 1 Week Security's closing price 1 week after the offer

Cl

osing Price - 2 Weeks Security's closing price 2 weeks after the offer

Closing Price - 3 Months Security's closing price 3 month after the offer

Closing Price - 6 Months The price for a given security after 6 month

Closing Price - 1 Yr The price for a given security after 1 year

Cl

osing Price - Last Quarter Closing Price of security at the end of the quarter

Cl

osing Price - Last Year End The price for a given security at the end of last year

Split Adjusted Offer Price Offer price adjusted for stock splits

Split Factor Cumulative factor of all stock splits since the date of the offerings

Split Date Date the stock split occurred

Split History History of stock splits for security

Fees

Gross Fee $ per share Gross spread fee expressed in dollars per security

Gross Fee % (Disc) Gross spread fee (disclosed) as a percentage of the offer price

Underwriting Fee $ The portion of gross fee paid to underwriters (lead and co-managers)

Management Fees ($) Portion of the gross spread paid to investment managers

Selling Concession $ Amount paid to the underwriters for selling the securities

Reallowance $ Portion of the selling concession which is passed on to another securities dealer

Accounting Fees ($) Fees and expenses as declared in SEC filing

Bluesky Fees ($) Fees and Expense related to Blue-sky laws

Legal Fees ($) Legal fees associated with the sale of the security

Market Listing Fees ($) Fees associated with listing the issue on the market exchange

Miscellaneous Fees ($) Other fees associated with the issue

NASD Filing Fees ($) Fee associated with filing issue with the NASD

Printing Fees ($) Fee charged by financial printer for red herring and prospectus printing

SEC Registration Fee ($) Fee associated with registering issue with the SEC

Issuer Fields

Issuer Name or code of the issuer

Is

suer Name

F

ull name of the is

suer

Issuer URL Home page URL of issuer

NAICS North American Industry Classification System code

SIC

St

andar

d Industrial Classification (SIC) code

General Industry (GIG) General industry code of the firm's primary business

Specific Industry (SIG) Specific industry code of the firm's primary business

Issuer Business Description Business description for the issuer

Issuer Type Classifies the issuer further, i.e. financial, government, industrial etc.

Issuer City City in which the issuer is located

Is

suer St

at

e

St

at

e (symbol) in which the issuer is located

Issuer Nationality Nationality of the issuer

Deal Nationality Nationality where the majority of the issuer's business takes place

Deal Subr

egion

Full name of sub-region where the major part of an issuer's business takes place

(i.e. Eastern Europe)

Deal Region Full name of region where the major part of an issuer's business takes place

Deal World Region Full name of world region where the major part of an issuer's business takes place

Issuer Parent Parent company of the issuer

Issuer Parent Nationality The nationality of parent company to issuer

Shar

es Outs

t

anding

Number of outs

t

anding shares after the offer

Market Value ($) / (Euro) Indicates the issuer's market capitalization upon completion of the offer

Financials Date

Dat

e of the financial statements that appear on the deal profile

Revenue ($) Issuer revenue for the fiscal year displayed in the deal profile

Operating Income ($) Issuer operating income for the fiscal year displayed in the deal profile

Net Income ($) Issuer net income for the fiscal year displayed in the deal profile

EPS (FD) Earnings per share (net income divided by shares outstanding)

Total Assets ($) Issuer's total assets for prior 12 months (specified date in profile)

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 29

Total Liabilities Issuer's total liabilities for prior 12 months (specified date in profile)

Stockholders Equity ($) Stockholders equity for prior 12 months (specified date in profile)

Market to Sales Ratio of a firm's market value to revenue

Debt t

o Equity Ratio of a firm's total debt to its shareholders' equity

P/E Ratio Price to earnings ratio from the end of the last fiscal year

Dilution Change in EPS that will result from the issuance of new shares

Ticker Symbol Ticker symbol of security

Exchange Name of the market exchange on which the issue is listed

Ex

change Nationality Nationality of the market exchange on which the issue is listed

Exchange Previously Traded Exchange in which the security previously was traded

Quote Type Specific underlying exchange or type of listing (OTC, Pink Sheets, Nat'l Mkt)

IPO Exchange Exchange in which the IPO is listed

IPO Quot

e Type Specific underlying exchange or type of listing for an IPO (OTC, Pink Sheets, Nat'l Mkt)

IPO Tick

er Symbol Ticker symbol of a company that makes its first share offering to the public, if available

Guarantor An institution guaranteeing the payment of a the security in the event of default by the issuer

Guarantor Nationality The nationality of the institution guaranteeing the payment of a the security in the event of

default by the issuer

REIT (Y/N) Indicates if the issuer is a Real Estate Investment Trust

REIT Subsector Type of real estate a REIT corporation invests in

Underlying Asset General Industry (GIG) General industry code of a security's underlying asset's primary business

Underlying Asset Specific Industry (SIG) Specific industry code of a security's underlying asset's primary business

Underlying Asset Parent Nationality The nationality of parent company to Security's underlying asset

Issuer Delisted (Y/N) Indicates if the issuer has been delisted from an exchange market

Issuer Delisted Date Date the issuer was delisted

Deal Fields

Deal Type Type of offering

Deal Type of Security Type of security being sold in the offering

Deal Subtype Subtype offering category (i.e. IPO -Fixed Pricing, FO - Bought Deals)

IPO - Fixed Pricing Indicates the IPO is fix Price

IPO - Open Pricing Indicates the IPO is Open Price

FO - Accelerated Bookbuild Indicates the offering was structured as an Accelerated Bookbuild

FO - Accelerated Bookbuild (Rump placement) Indicates the offering is a rump placement (shares not taken by existing shareholders in

a rights issue)

FO - Bought Deal Indicates the offering was structured as a Bought Deal/Block Trade

FO - Cash Placing Indicates the offering was structured as a cash placing

FO - Fully Marketed Indicates the offering was structured as fully marketed follow-on

FO - PIPE Indicates the offering is a PIPE

(priv

at

e inv

es

t

or

s under Reg D in the US inv

esting in public companies )

FO - Guaranteed Preferential Allocation Indicates the offering was structured as a Guaranteed Preferential Allocation

FO - Registered Direct Indicates the offering was structured as an offering of registered securities by an issuer to

a limit

ed number of ac

cr

edited investors

FO - Rights Offer Indicates whether or not issuer offers existing shareholder the right to buy more shares at

a discount to the trading price of their existing shares

FO - Top-up Placement Indicates whether the security is a top-up placement (Transaction normally marketed in

Hong Kong and Asia, where a group existing shareholders offer shares to another group

of existing shareholders)

CONV - Debt

Indic

at

es whether the c

onv

ertibl

e bond's instrument are shares

CONV - Preferred Indicates whether the convertible bond's instrument are preferred shares

CONV - PIPE Indicates whether the security is a PIPE (privately issued securities that are sold to

ac

cr

edited investors under regulation D (US regulation) by public companies

PIPO Indicates whether the offering is a pre-IPO

SEC Registered (Y/N) Indicates if the issue is registered with the SEC

SEC File Form Type of Securities and Exchange Commission filing

Registration # Number assigned to the offering by the SEC

# of Tranches Number of tranches involved in the offering

% of Company Sold

% of c

ompany's s

t

ak

es, which hav

e been offered in the deal

BCC/SPAC (Y/N) Indicates whether the issuer is a Blank Check Company or Special Purpose Acquisition Vehicle

BDC (Y/N)

Indic

at

es whether the issuer is a Business Development Company

Bearer/Registered Whether the shares are held in Bearer or Registered form

Best Efforts (Y/N) Non-underwritten offering

Bought Deal (Y/N) Indicates if issue is a bought deal

Canadian Income Trust Indicates whether issuer is a Canadian Income Trust

Carve Out (Y/N) Parent company selling a minority share of a child while retaining a stake

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 30

Carve Out Parent Name of the company that incorporated a child company

Chinese A-shares (Y/N) Share available only to Chinese Nationals and QIFF investors

Company Acquired (Y/N) Indicates if the company has been acquired

Cumulativ

e (Y/N) Arrangement in which a payment due is carried over to the following period

Deal Status Current status of deal

Deal US Marketed (Y/N) Sold to US investors either SEC registered or 144A

Demutualization (Y/N) A groupe mutuelle that becomes public so policyholders become shareholders

Domestic Deal (non-US) Y/N Identifies a deal that has raised capital just in the domestic market

Domes

tic Tranche Identify the tranche to a security, which has raised capital in the local market in the native

currency via a syndicate based in the home country

First Follow-On (Y/N) Issuers first follow-on following an IPO

Initially Postponed (Y/N) Indicates if the issuer had postponed its pricing date

Initiall

y Postponed Date Date at which the issuer postponed its pricing date

Int

ernational Tranche (Y/N) Identifies the tranche which has raised capital in the international market

Internet Related (Y/N) Indicates if the issuer's primary business is internet-related

Legal Text Specific rules governing the sale of the security

Lock-up Expiration Date Expiration date of the lock-up period, in case of multiple lock-up periods the shortest period

Lock-up Provision Period of time following an IPO where options cannot be sold

Lock-up Shares Shares that cannot be sold within a determined time period

MLP (Y/N) Indicates whether issuer is a Master Limited Partnership

Original Exchange Move Date Date of transfer of the issuer's listing

Overnight Y/N Indicates if the deal is an overnight offering (includes ABBs and Block Trades))

Pipe (Y/N) Indicates if the issue is a PIPE

PIPO (Y/N) Pre-IPO offering of an issuer expected to subsequently complete an IPO

POWL (Y/N) Public Offering Without Listing. For Japanese deals which are marketed in Japan but

not listed in Japan

Price before Offer (General) Last common stock price before the offer date

Pricing Fixed/Open Indicate if a security's price is open or fixed

Privatization Y/N A state/government owned entity, which does an equity offering

Quiet Period End Date The period during which the issuer cannot comment publicly on the offering

Rank Eligible (Y/N) Filter searches so anything that is not eligible according to Dealogic criteria will be excluded

Red Chip (Y/N) Companies incorporated and listed in Hong Kong whose main business is in mainland China

Registered Direct (Y/N) Indicates whether offering is a SEC registered direct private placement

Retail/Institutional Target investor base

Retail Tranche (Y/N) Identifies the tranche to a security, which has been offered to retail investors

Rights Offer Y/N Indicates if the deal is a rights offer (includes rump placement)

Rule 144a (Y/N) Indicates whether the deal is marketed within the United States only to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933

Rule 415 (Y/N) Indicates if the offering is under the SEC rule allowing for shelf registrations to be issued

in the futur

e

Rump Placement (Y/N) Placement of shares left over from existing shareholders on a rights issue

S Corporation (Y/N) Indicates if issuer is a small corporation which has the benefits of incorporation but taxed

as a partner

ship

Selling Shareholder Name of selling shareholder(s)

Selling Shareholder Nationality Nationality of selling shareholder(s)

Shares of Beneficial Interest (Y/N) Identifies transaction as consisting of shares of beneficial interest

Shelf Date Date the shelf was registered with the SEC

Shelf Takedown (Y/N) Indicates if the security is being issued from a shelf registration

Shelf V

alue $

V

alue of the shelf r

egis

tr

ation

Simultaneous Offering (Y/N) Indicates whether the issuer is simultaneously offering a different security

Spin Off (Y/N) Sale or distribution of a minority stake in an existing business/division by the parent

c

ompany f

or an IPO or rights offering

Sponsor Related (Y/N) Sponsor backed deals

Spot Secondary (Y/N) Follow on which does not require SEC registration

Syndicated (Y/N) Transaction syndicated amongst an underwriting group

Syndicated Loan (Y/N) Banks had a prior lending relationship with the Issuer

Target Market The market (country) that the issue is offered to

T

ar

get Mark

et Description

Nationality, wher

e the security has been off

ered to (for a specific tranche)

Top-Up Placement (Y/N) Indicates whether the security is a top-up placement (Transaction normally marketed in

Hong Kong and Asia, wher

e a gr

oup e

xisting shareholders offer shares to another group

of e

xisting shareholders)

Tracking Stock (Y/N) Stock which pays a dividend based on the performance of a part of a company

Type of Derivative Indicates the specific type of derivative

Unit Trust (Y/N) Indicates whether issuer is a Unit Trust

US IPO (Y/N) Indicates whether the offering is the first time an issuer has made a public offering in the US

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 31

US Sales Indicates how issue is sold into the US

Use of Proceeds Use of the capital raised through issuing the security

Use of Proceeds Note General description to what how the funds raised in the issue will be used

V

enture Capital (Y/N) Venture-backed transaction

Withdrawn/Postponed Indicates if the offering has been withdrawn or postponed

Withdrawn/Postponed Comment Reason behind withdrawing or postponing a deal

CUSIP # Cusip number of issue

ISIN International Security Identification Number

Deal Synopsis

Brief synopsis of deal

Dealogic Deal Note Supplementary deal information in text format

ECM Deal # Unique numeric identifier for a deal

Last Date Updated Date the deal information was last updated

T

ranche Reference # Unique identification number for individual tranches

Amount Fields

Deal Value $ Total amount offered including overallotment in all tranches accounting for rank eligibility

Deal Value $ Current Total current amount expected to be offered including overallotment (if exercised) in all

tranches in dollars accounting for rank eligibility

Deal Value $ Excl Ovl Total amount offered in all tranches excluding overallotment accounting for rank eligibility

Deal Value $ Initial Total amount filed in all tranches accounting for rank eligibility

Deal Value $ Revised Total amount offered in last revision statement to the original filing accounting for

rank eligibility

Pro-Forma Value $ Displays Deal Value $ for priced deals and Deal Value $ Current for expected deals

% Change Value Initial/Offer Change in the offer's value from initial announcement to offer date

Ovl Value $ Overallotment in all tranches

Ovl Authorized (Shares) Number of overallotment shares authorized to be sold during the offering

Ovl Exercised (Shares) Number of overallotment shares that are offered

Total Value $ Incl Non-Deal Deal value including overallotment for all tranches regardless of rank eligibility

Total Value $ Incl Non-Deal Excl Ovl Deal value including all tranches regardless of rank eligibility

Total Value $ Incl Non-Deal Initial Deal value including overallotment for all tranches regardless of rank eligibility at time of

announcement/filing

Total Value $ Incl Non-Deal Initial Excl Ovl Deal value including all tranches regardless of rank eligibility at time of announcement/filing

Currency Representing the currency that the issue is traded in

Deal Value (Local Currency) Total amount offered including overallotment (if exercised) in all tranches in local currency

of the issuer

Total Value inc Non-Deal (Local Currency) Total amount offered including overallotment (if exercised) in all tranches regardless of

rank eligibility in local currency of the issuer

Exch. Rate ($) The local currency's exchange range vs US Dollars

Ex

ch. Rat

e (Eur

o)

The l

oc

al curr

ency's exchange range vs Euro

Deal Value Euro Total amount offered including overallotment (if exercised) in all tranches in Euros

Total Value inc Non-Deal Euro Total amount offered including overallotment (if exercised) and all non-eligible tranches

in Eur

os

Gross Fee Euro (All) Total gross spread fee in Euros for the offering

Gross Fee Euro (Disc) Total gross spread fee (modeled and disclosed) in Euros for the offering

Ovl Value Euro Value for Overallotment in Euros

Shar

e Fields

Shares Current Number of shares currently expected to be offered

Shares Initial Number of shares initially announced or filed

Shar

es Initial Ex

cl Ovl Number of shares initially announced or filed excluding overallotment shares

Shares Offered Number of shares offered

Shares Offered Excl Ovl Number of shares offered excluding overallotment shares

Shares Revised Number of shares after revision

Shares Revised Excl Ovl Number of shares after revision excluding overallotment shares

Total Shares Incl Non-Deal Total number of shares offered regardless of rank eligibility

T

ot

al Shar

es Incl Non-Deal Ex

cl Ovl

T

otal number of shares offered excluding overallotment shares regardless of rank eligibility

Total Shares Incl Non-Deal by Issr Number of primary shares offered regardless of rank eligibility

Total Shares Incl Non-Deal by Shhldr Number of secondary shares offered regardless of rank eligibility

Total Shares Incl Non-Deal Initial Total number of shares initially filed or announced regardless of rank eligibility

Total Shares Incl Non-Deal Initial Excl Ovl Total number of shares initially filed or announced excluding overallotment shares

regardless of rank eligibility

Total Shares Incl Non-Deal Initial by Issr Number of primary shares initially filed or announced regardless of rank eligibility

Total Shares Incl Non-Deal Initial by Shhldr Number of secondary shares initially filed or announced regardless of rank eligibility

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 32

Total Shares Incl Non-Deal Revised Total number of shares filed according to latest amendment regardless of rank eligibility

Total Shares Incl Non-Deal Revised Excl Ovl Total number of shares filed according to latest amendment excluding overallotment

shares regardless of rank eligibility

T

otal Shares Incl Non-Deal Revised by Issr Number of primary shares filed according to latest amendment regardless of rank eligibility

Total Shares Incl Non-Deal Revised by Shhldr Number of secondary shares filed according to latest amendment regardless of

rank eligibility

ADS Factor Number of shares to convert ordinary shares into ADS or GDS

ADS Outstanding Number of ADS or GDS outstanding

ADS Off

ered Number of American Depositary Shares or Global Depositary Shares offered

ADS Offered Excl Ovl Number of American Depositary Shares or Global Depositary Shares offered excluding

overallotment

ADS Initial Number of American Depositary Shares or Global Depositary Shares offered initially

ADS Initial Ex

cl Ovl Number of American Depositary Shares or Global Depositary Shares offered initially

e

xcluding overallotment

ADS Revised Revised number of American Depositary Shares or Global Depositary Shares

ADS Revised Excl Ovl Revised number of American Depositary Shares or Global Depositary Shares excluding

overallotment

Total ADS Total number of American Depository Shares or Global Depositary Shares

Total ADS Excl Ovl Total number of American Depository Shares or Global Depositary Shares excluding

overallotment

Total ADS Excl Ovl Initial Total number of American Depository Shares or Global Depositary Shares excluding

overallotment initially offered

Total ADS Excl Ovl Revised Revised number of total American Depository Shares or Global Depositary Shares

excluding overallotment

Total ADS Initial Total of American Depository Shares or Global Depositary Shares initially offered

Total ADS Ovl Authorized Number of ADS or GDS authorized as overallotment

Total ADS Ovl Exercised Number of ADS or GDS exercised as overallotment

Total ADS Revised Revised number of American Depository Shares or Global Depositary Shares

Shares by Shareholder as % Percentage number of secondary (existing) shares from total shares offered

Shares by Issuer as % Percentage number of primary (new) shares from total shares offered

% Change Shares Initial/Current Change in number of shares from initial announcement to current

Bank Fields

Bank Parent Name of the parent company of all banks on an issue

Bookrunner Parent Name of bookrunner's parent company

Bookrunner Subsidiary Name of bookrunner's subsidiary company

Lead-Manager Parent Parent company to the Lead Manager

Non-Book Lead Manager Parent Parents to the managers, who are not bookrunners to the deal

Co-Manager P

ar

ent

P

ar

ent c

ompany t

o the Co-Manager

Underwriter Parent The Parent of the underwriter to the deal

Underwriter Subsidiary Name of the underwriter to the deal

Gl

obal Co-or

dinat

or Name of the global co-ordinator involved in the deal

Global Co-ordinator Parent Parent company to the global co-ordinator of a security

# Banks No. of banks involved in the deal

# Bookrunners Total number of bookrunners on an issue

# Lead Managers No. of lead managers involved in the deal

# Non-Book Lead Managers Number of lead managers, who are not bookrunners on the deal

# Co-Manager

s

No. of c

o-manager

s inv

ol

ved in the deal

# Managers No. of managers involved in the deal

# Underwriters No. of underwriters involved in the deal

# Gl

obal Co-or

dinators No. of global co-ordinators involved in the deal

Bank in any role The specified bank's role in the deal(s)

Stabilization Agent Bank in charge of the stabilization of the shares

POWL Manager Manager of the POWL offering

Financial Sponsor Name of the financial Sponsor involved in a deal

Issuer Attorney Name of the issuer's Lawyer/Attorney

Manager Att

orne

y

Name of the Manager's Lawy

er/Att

orne

y

Auditor Name of issuer's auditor

Convertible Fields

Coupon The interest rate on a fixed income security expressed as a percentage of par

Conversion Price Price per common share at which a security is converted

Premium (Conv) For convertible offerings, indicates the percentage between market price & conversion price

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics (v.5.06) User Guide 33

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

Conv Debt File Price % File price of a convertible debt instrument

Convertible Debt Offer Price % Offer price of a convertible debt instrument

Issue Price Price placed on a new bond expressed as percent of principal amount

Conv

ertible Note Specific rules governing the sale of the security

Convertible Preferred File Price Price of underlying common shares at time of Convertible Preferred filing

Convertible Rank Indicates if the issue is senior or subordinated

Maturity Date The date on which a debt becomes due for payment

Original Talk Coupon % The original price talk coupon

Original T

alk Premium % The original price talk premium

Current Talk Coupon Initial range of the coupon

Current Talk Premium Initial range of the premium

Revised Coupon Coupon in the last revision statement

Re

vised Premium Premium in the last revision statement

Yield (Annual)

The annual dividend a security will earn with the yield expressed as a percentage of the

amount paid for a security

Yield (Semi-Annual) The semi-annual dividend a security will earn with the yield expressed as a percentage

of the amount paid for a security

Common Price at Announcement Common stock price at filing date

Common Price at Offer Common stock price at offer date

Common Price at Revision Common stock price at revision date

Reference Price For non-US deals. Common stock price used to calculate conversion premium

Assets Per Bond For convertibles and equity-related bonds, the number of shares or other assets into which

one bond is convertible or exercisable

Call Frequency The frequency at which the call option can be exercised

Call Provision Clause granting the issuer the right to retire an issue prior to maturity

Common Dividend Dividend of underlying common stock

Common Yield Yield of common stock

Conversion Period The period of time at which a security can be converted into equity or a different type

of security

Convertible Rank Indicates if the convertible is senior or subordinated

Coupon Frequency Frequency of the coupon period

Denomination The denominations of a bond, which are available for purchase

Exchangeable (Y/N) Indicates whether convertible securities are exchangeable into the common stock of

another corporation

First Call Date The first date on which the issuer can redeem the bonds before their maturity,

at a specified price

First Call Price The price at which a call may be first exercised

First Coupon Payment Date First date the coupon will be paid

First Put Date The first date on which the investor can sell securities back to the issuer at a

pr

e-det

ermined pric

e

Governing Laws For convertibles. Region of governing laws.

Mandatory Convertible (Y/N) Indicates if convertible has to be mandatory converted at maturity

Put F

r

equency

This is the frequency at which the put option can be exercised

Put Price The price at which a security may be sold back to the issuer on the indicated put dates

Redemption Price The price at which bonds will be redeemed at maturity

Reference Price Price of the underlying asset used as reference to price security

Years to Break Even Years over which the conversion premium will be recouped

Years to Maturity Years until the issuer will redeem the issue by paying the principal

Underl

ying As

set P

ar

ent

P

arent company to the underlying asset for the security

Underlying Asset Security's underlying asset

Underlying Asset Nationality Nationality for Security's underlying asset

High Yield / Inv

es

tment Grade Indicates if the convertible is high yield or investment grade

S & P Rating Issuer's S&P's bond rating

Moody's Rating Issuer's Moody's bond rating

Effective Rating (Launch) Average rating based on Issuer's S&P and Moody's bond rating

Cr

os

s Sys

t

em Links

LoanWare Reference # Identification number for deal in Dealogic LoanWare/Loan Analytics database

M&A Desk Referenc

e # Identification number for deal in Dealogic M&A Desk database

Tranche BondWare Deal # BondWare deal number

Tranche EquiDesk Deal # EquiDesk deal number

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 34

Tranche Fields

Head Tranche Gross Fee $ (Disc) Gross spread amount of head tranche given by bookrunner

Tranche # Tranche number

T

ranche # Banks Number of banks assigned to a particular tranche

Tranche # Bookrunners Number of bookrunners assigned to a particular tranche

Tranche # Co-Managers Number of co-managers assigned to a particular tranche

Tranche # Global Co-ordinators Number of global coordinators participating in a deal

Tranche # Lead Managers Number of lead managers assigned to a particular tranche

T

ranche # Managers Number of underwriters assigned to a particular tranche

Tranche # Non-Book Lead Managers Number of non-bookrunner lead managers assigned to a particular tranche

Tranche # Underwriters Number of underwriters assigned to a particular tranche

Tranche % Change Price 1 Day/Current Change in security price from 1 day post offer to the last closing price

T

ranche % Change Price Initial/Current Change in security price from initial price to the last closing price

T

ranche % Change Price Initial/Offer Change in security price from initial price to the offer price

Tranche % Change Price Offer/1 Day Change in security price from offer date to the next day

Tranche % Change Price Offer/1 Month Change in security price from offer date to 1 month later

Tranche % Change Price Offer/1 Week Change in security price from offer date to 1 week later

Tranche % Change Price Offer/1 Yr Change in security price from offer price to 1 year later (for a specific tranche)

Tranche % Change Price Offer/2 Weeks Change in security price from offer date to 2 weeks later

Tranche % Change Price Offer/3 Months Change in security price from offer date to 3 months later

Tranche % Change Price Offer/6 Months Change in security price from offer price to 6 months later (for a specific tranche)

Tranche % Change Price Offer/Current Change in security price from offer price to the last closing price

Tranche % Change Price Offer/Last Quarter Change in security price from offer date to end of last quarter

Tranche % Change Price Offer/Last Year End Change in security price from offer price to last year (for a specific tranche)

Tranche % Change Price Offer/Open Change in security price from offer price to open price (for a specific tranche)

Tranche % Change Shares Initial/Offer Change in number of shares from initial announcement to the offer

Tranche % Change Value Initial/Offer Change in the offer's value from initial announcement to offer date

Tranche Adjusted Offer Price (Local) Offer price, after stock split effects, in tranche's local currency

Tranche ADS Excl Ovl Number of ADS offered in a tranch excluding overallotment

Tranche ADS Initial Excl Ovl Number of ADS initially announced in a tranch excluding overallotment

Tranche ADS Ovl Authorized Number of ADS authorized in overallotment

Tranche ADS Ovl Exercised Number of ADS exercised in overallotment

Tranche ADS Revised Excl Ovl Number of revised ADS in a tranch excluding overallotment

Tranche Bank Parent Parent to the banks assigned to a particular tranche

Tranche Bank Parent Name Parent to the banks assigned to a particular tranche

Tranche Bank Subsidiary Subsidiary name of a Bank (not Parent Name)

Tranche Bank Subsidiary Name Subsidiary name of a Bank (not Parent Name)

Tranche Bank Subsidiary Row ID Unique numeric identifier for a bank

Tranche Bookrunner Parent Name of the Bookrunner's parent company

T

r

anche Bookrunner P

ar

ent Name

Name of the Bookrunner's par

ent c

ompany

Tranche Bookrunner Participation Number of shares received by each bookrunner

Tranche Bookrunner Participation % % of shares received by each bookrunner vs total shares (for a specific tranche)

T

r

anche Bookrunner Subsidiary

Name of bookrunner's subsidiary company (for a specific tranche)

Tranche Bookrunner Subsidiary Name Name of bookrunner's subsidiary company (for a specific tranche)

Tranche Closing Price - 1 Day The price for a given security after 1 day (for a specific tranche)

Tranche Closing Price - 1 Month The price for a given security after 1 month (for a specific tranche)

Tranche Closing Price - 1 Week The price for a given security after 1 week (for a specific tranche)

Tranche Closing Price - 2 Weeks The price for a given security after 2 weeks (for a specific tranche)

T

r

anche Cl

osing Pric

e - 3 Months

The pric

e for a given security after 3 months (for a specific tranche)

Tranche Closing Price - 6 Months The price for a given security after 6 month (for a specific tranche)

Tranche Closing Price - Last Quarter The price for a given security at the end of the last quarter

T

r

anche Closing Price - Last Year End Security's closing price for last year (for a specific tranche)

Tranche Co-Manager Parent Name of co-managers' parent (for a specific tranche)

Tranche Co-Manager Parent Name Name of co-managers' parent (for a specific tranche)

Tranche Co-Manager Participation Number of shares received by each co-manager

Tranche Co-Manager Participation Number of shares received by each co-manager

Tranche Co-Manager Participation % % of shares received by each co-manager vs total shares (for a specific tranche)

T

r

anche Co-Manager Subsidiary

Name of the Co-Manager(s)

Tranche Co-Manager Subsidiary Name Name of the Co-Manager(s)

Tranche Currency Code Code representing the currency that the issue is traded in

Tranche Current Mid Point Range Midpoint of current range

Tranche Current Range Current price range (for a specific tranche)

Tranche Current Range High High point of current range

Tranche Current Range Low Low point of current range

Tranche Estimated Expenses $ % of Underwriting Fee lost to stabilization and underwriting expenses (estimated)

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 35

Dealogic www.dealogic.com

≥

Appendix B: Field Glossary

Tranche Exch. Rate ($) The local currency's exchange range vs US Dollars (for a specific tranche)

Tranche Exch. Rate (Euro) Exchange Rate to Euro

Tranche Filing Range Initial filing range for a security

T

ranche Filing Range High Initial filing top range for a security

Tranche Filing Range Low Initial filing low range for a security

Tranche Fund (Y/N) Investment Fund (Closed End Fund, Open End Fund)

Tranche Gross Fee $ (Disc) Disclosed gross spread amount with Overallotment per tranche as given by bookrunner,

or estimated by Dealogic if empty

T

ranche Gross Spread % (Disc) Disclosed gross spread percent per tranche as given by bookrunner, or estimated by

Dealogic if empty

Tranche Initial Mid Point Range The initial mid point range for an issue

Tranche Instrument Type Tranche type of instrument (i.e. ADS, ordinary shares, common stock, …)

T

ranche Last Trade Price at which the issue last traded on that tranche's market exchange

T

ranche Last Trade Date Last trade date of the security in the market exchange (for a specific tranche)

Tranche Lead Manager Parent Parent Name to the lead manager(s) associated with a deal

Tranche Lead Manager Participation Number of shares received by each lead manager

Tranche Lead Manager Participation Number of shares received by each lead manager

Tranche Lead Manager Participation % % of shares received by each lead-manager vs total shares (for a specific tranche)

Tranche Lead Manager Subsidiary Lead manager(s) associated with a deal

Tranche Lead/Co Manager Parent Parent to lead and co-manager(s) associated with a deal (for a specific tranche)

Tranche Lead/Co Manager Subsidiary Lead and co-manager(s) associated with a deal (for a specific tranche)

Tranche Non-Book Lead Manager Parent Parents to the managers, who are not bookrunners to the deal (for a specific tranche)

Tranche Non-Book Lead Participation Number of shares received by managers who are not bookrunners to the deal

(for a specific tranche)

Tranche Non-Book Lead Participation % % of shares received by each manager, who is not bookrunner vs total shares

(for a specific tranche)

Tranche Offer Price Offer price for a tranche

Tranche Offer Price (US$) Tranche offer price in US Dollars

Tranche Opening Trade Security's open price on the first day of trading (for a specific tranche)

Tranche Overnight (Y/N) Indicates if the tranche was an overnight transaction

Tranche Ovl Authorized $ Overallotment amount authorized per tranche

Tranche Ovl Exercised $ Overallotment amount exercised per tranche

Tranche Retail/Institutional Indicates if the tranche was marketed to retail or institutional investors

Tranche Revised Mid Point Range The mid-point amount for the revised price range (for a specific tranche)

Tranche Revised Premium Premium in the last revision statement (for a specific tranche)

Tranche Revised Range Revised price range (for a specific tranche)

Tranche Revised Range High The maximum offer in the revised price range (for a specific tranche)

Tranche Revised Range Low The maximum offer in the revised price range (for a specific tranche)

Tranche Revision Date Indicates the date, when the change to the price range happens (for a specific tranche)

T

r

anche Re

vision Dir

ection

Indic

at

es the direction of the change to the price range (for a specific tranche)

Tranche Rights Offer (Y/N) Indicates whether or not issuer offers existing shareholder the right to buy more shares at

a discount to the trading price of their existing shares

T

r

anche Rul

e 144a (Y/N) Indicates whether the deal is marketed within the United States only to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933

Tranche Shares Initial Excl Ovl Shares filed per tranche in original filing

Tranche Shares Offered Excl Ovl Shares offered per tranche

Tranche Shares Revised Excl Ovl Shares filed per tranche in last revision statement to original filing

Tranche Target Market Nationality, where the security has been offered to

T

r

anche Tick

er Symbol

Tick

er symbol f

or tranche offering

Tranche Total Bookrunner Participation % % of shares received by all bookrunners vs total shares (for a specific tranche)

Tranche Total Co-Manager Participation % % of shares received by all co-managers vs total shares (for a specific tranche)

T

r

anche Total Lead Manager Participation % % of shares received by all lead-managers vs total shares (for a specific tranche)

Tranche Total Manager Participation % % of shares received by all managers vs total shares (for a specific tranche)

Tranche Total Non-Book Lead Participation % % of shares received by all managers, who are not bookrunners vs total shares

(for a specific tranche)

Tranche Total Underwriter Participation % % of shares received by all underwriters vs total shares (for a specific tranche)

Tranche Type of Security Type of security being sold in the tranche

T

r

anche Underwrit

er P

ar

ent

Parent company of the security's underwriter

Tranche Underwriter Parent Name The Parent of the underwriter to the deal (for a specific tranche)

Tranche Underwrit

er Participation Number of shares received by each underwriter

Tranche Underwriter Participation Number of shares received by each underwriter

Tranche Underwriter Participation % % of shares received by each underwriter vs total shares (for a specific tranche)

Tranche Underwriter Subsidiary Security's underwriter (for a specific tranche)

Tranche Underwriter Subsidiary Name Full name of the underwriter

Tranche US Marketed (Y/N) Indicates if the tranche is marketed in the US

ECM Analytics Field Name Explanation

ECM Analytics (v.5.06) User Guide 36

Tranche Value $ Amount offered including overallotment in each tranche

Tranche Value $ Apportioned Apportioned amount offered including overallotment (if exercised) to the tranche's bookrunner(s)

Tranche Value $ Current Current amount offered including overallotment in each tranche

T

ranche Value $ Estimated Pre-offer estimate of tranche size

Tranche Value $ Excl Ovl Amount offered in each tranche

Tranche Value $ Initial Excl Ovl Amount filed in each tranche

Tranche Value $ Revised Excl Ovl Amount filed in latest revision statement for each tranche

Tranche Value (Local Currency) Total amount offered including overallotment (if exercised) in a tranche in local currency

of the is

suer

% Change Index

AMEX/1 Day % Ch

The percentage change in the AMEX from the trade date of the offering to the close of the

fir

st day of trade

AMEX/1 Month % Ch The percentage change in the AMEX from the trade date of the offering to the close one

month from the trade date

AMEX/1 Week % Ch The percentage change in the AMEX from the trade date of the offering to the close one

week from the trade date

Amex/1 Yr % ch The percentage change in the AMEX from the trade date of the offering to the close one year

from the trade date

AMEX/2 Week % Ch The percentage change in the AMEX from the trade date of the offering to the close two

weeks from the trade date

AMEX/3 Months % Ch The percentage change in the AMEX from the trade date of the offering to the close three

months from the trade date

AMEX/6 Months %Ch The percentage change in the AMEX from the trade date of the offering to the close six

months from the trade date

AMEX/Last Quarter % Ch The percentage change in the AMEX from the trade date of the offering to the close on the

last day of the last quarter

AMEX/Last Year End % Ch The percentage change in the AMEX from the trade date of the offering to the close on the

last day of trade of the last full year

AMEX/Off Curr % Ch The percentage change in the AMEX from the trade date of the offering to the close on the

last day of trade

DOW/1 Day % Ch The percentage change in the Dow from the trade date of the offering to the close of the

first day of trade

DOW/1 Month % Ch The percentage change in the Dow from the trade date of the offering to the close one

month from the trade date

DOW/1 Week % Ch The percentage change in the Dow from the trade date of the offering to the close one week

from the trade date

DOW/1 Yr % Ch The percentage change in the Dow from the trade date of the offering to the close one year

fr

om the tr

ade dat

e

DOW/2 Week % Ch The percentage change in the Dow from the trade date of the offering to the close two

weeks from the trade date

DO

W/3 Months % Ch

The per

centage change in the Dow from the trade date of the offering to the close

three months from the trade date

DOW/6 Months % Ch The percentage change in the Dow from the trade date of the offering to the close six

months from the trade date

DOW/Last Quarter % Ch The percentage change in the Dow from the trade date of the offering to the close on the

last day of the last quarter

DO

W/Las

t Y

ear End % Ch

The per

c

entage change in the Dow from the trade date of the offering to the close on

the last day of trade of the last full year

DOW/Off Curr % Ch The percentage change in the Dow from the trade date of the offering to the close on

the las

t day of tr

ade