MLN901344 April 2023

Page 1 of 34

Booklet

Physician Fee Schedule Look-Up Tool overview

Substantive content changes are in dark red.

CPT codes, descriptions, and other data only are copyright 2022 American Medical Association. All Rights Reserved.

Applicable FARS/HHSARS apply. Fee schedules, relative value units, conversion factors and/or related components are

not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly

or indirectly practice medicine or dispense medical services. The AMA assumes no liability for data contained or not

contained herein.

How to Use the PFS Look-Up Tool

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 2 of 34

Table of Contents

What’s Changed? .....................................................................................................................................3

What is the PFS Look-Up Tool?

...............................................................................................................4

Why Would a Health Care Provider or Supplier Use the PFS Look-Up Tool?

.......................................... 4

Background

...................................................................................................................................................5

PFS Payment Rates .................................................................................................................................6

Relative Value Units (RVUs)

.....................................................................................................................6

Geographic Practice Cost Indices (GPCIs)

..............................................................................................6

Conversion Factor (CF)

............................................................................................................................6

How Up to Date is the PFS?

.....................................................................................................................7

Searching the PFS

........................................................................................................................................7

Pricing Information Search .......................................................................................................................9

Pricing Search Using a List of Evaluation and Management Codes

......................................................12

Pricing Search Using a Code with an Applicable Professional or

Technical Component

.............................................................................................................................15

Payment Policy Indicators Search

..........................................................................................................16

Payment Policy Indicators Search Using a Code with an Applicable Professional or

Technical Component

.............................................................................................................................16

Payment Policy Indicators Search Using a Surgical Code

..................................................................... 18

Relative Value Unit (RVU) & Geographic Practice Cost Index (GPCI) Search

....................................... 20

Conclusion

.................................................................................................................................................. 23

Appendix

.....................................................................................................................................................23

Status Indicators .....................................................................................................................................23

Physician Fee Schedule (PFS) Quick Reference Search Guide.............................................................32

Resources

...................................................................................................................................................34

MLN901344 April 2023Page 3 of 34

MLN BookletHow to Use the PFS Look-Up Tool

To Learn More…

If you nd this How to booklet helpful, then you may review the other booklets in this series. To nd these

booklets, go to the MLN Publications webpage, and search “how to.”

This booklet explains the Physician Fee Schedule (PFS) Look-Up Tool. You’ll learn how to search:

● Pricing amounts

● Payment policy indicators

● Relative Value Units (RVUs)

● Geographic practice cost indices (GPCIs)

● The national payment amount

● A specic Medicare Administrative Contractor (MAC)

● A specic MAC locality

What’s Changed?

• Updated instructions and screenshot for searching the PFS, pages 7-9

• Added new screenshots and prices for the instructions for the various searches, pages 9-23

• Added 2023 Conversion Factor, page 21

• Added 2023 Practice Expense (PE) RVUs, page 21

• Added 2023 GPCI WORK, GPCI PE, and GPCI Malpractice (MP) values for Northern California,

page 23

• Changed the referral to MLN Matters Article in the callout box to MM9647, page 28

• Updated percentage of the MPPR reduction to the professional component for certain diagnostic

imaging services to 5%, page 28

• Updated the instructions in the PFS Quick Reference Search Guide, pages 32-34

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 4 of 34

What is the PFS Look-Up Tool?

The CMS PFS Look-Up Tool gives Medicare payment

information on more than 10,000 services, including:

● Pricing

● Associated RVUs

● Payment policies

The tool doesn’t display carrier priced codes or

Medicare Part B non-payable codes.

Why Would a Health Care Provider or

Supplier Use the PFS Look-Up Tool?

The PFS is the primary method of payment for

enrolled health care providers. Specically, Medicare

uses the PFS when paying the following services:

● Professional services of physicians and other

enrolled health care providers in private practice

● Services covered incident to physicians’ services

(Other than certain drugs covered as incident to

services)

● Diagnostic tests (Other than clinical laboratory

tests)

● Radiology services

Medicare also pays suppliers like mammography

centers, according to the PFS. Medicare pays

institutional providers like hospitals, comprehensive

outpatient rehabilitation facilities (CORFs), and skilled

nursing facilities (SNFs) for services under the PFS,

depending on the kind of institution and service.

For example, Medicare pays hospital outpatient

departments for screening mammographies and

outpatient rehabilitation services under the PFS.

The PFS Look-Up Tool helps providers and suppliers

nd Medicare payment amounts for each code so

they can calculate the patient coinsurance amount.

The PFS gives the limiting charge for nonparticipating

providers and suppliers who treat Medicare patients.

Participating Medicare Providers and

Suppliers enroll in Medicare and sign the

Form CMS-460, Medicare Participating

Physician or Supplier Agreement, agreeing

to charge no more than Medicare-approved

amounts and deductibles and coinsurance

amounts. Participating providers and suppliers

send in assigned claims.

Providers and suppliers send in Assigned

Claims on behalf of the patient. Medicare

issues payment to the sender.

Nonparticipating Providers and Suppliers

who enroll in Medicare but decide not to sign

the Form CMS-460 accept assignment on a

case-by-case basis.

Medicare reduces the Medicare-approved

amounts for nonparticipants by 5% for services

paid under the PFS. Also, Medicare limits what

you or the supplier may charge the patient

(Limiting Charge) when you choose not to

accept assignment on the claim.

Limiting Charge equals 115% of the

nonparticipating fee schedule amount and

is the most the nonparticipant may charge

a patient on an unassigned claim. The

nonparticipating fee schedule amount is equal

to 95% of the PFS.

Nonparticipating providers or suppliers who

don’t accept the assignment on the claim,

send in Unassigned Claims. Medicare issues

payment to the patient. Use the PFS Look-

Up Tool to learn if payment policies such as

payment of assistant at surgery services,

applicability of certain modiers, and physician

supervision of diagnostic services affect

HCPCS codes.

MLN901344 April 2023Page 5 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Using the PFS is an excellent way to check if the

following payment polices affect HCPCS codes:

● Payment of assistant at surgery services

● Applicability of certain modiers

● Physician supervision of diagnostic services

Find a full list of HCPCS codes on the PFS Relative Value Files webpage.

Background

Medicare Part B pays for physician services based on the Medicare PFS, which lists the more than 10,000

unique codes and their payment rates. Physicians’ services include:

● Ofce visits

● Surgical procedures

● Anesthesia services

● A range of other diagnostic and therapeutic services

Physicians provide services in all settings, including:

Tip

• Find more information about these and other payment policies in the CMS manuals

• Search the Medicare National Correct Coding Initiative (NCCI) Edits webpage to nd NCCI code pair

edits and medically unlikely edits (MUEs)

• Search the Medicare Coverage Database (MCD) to review national and local coverage determinations

• Visit the Medicare Learning Network® (MLN) Publications webpage to review other booklets in the How

to series:

◦ How to Use the Medicare National Correct Coding Initiative (NCCI) Tools

◦ How to Use the Medicare Coverage Database

Tip

Print out the PFS Quick Reference Search Guide

on page 32 of this booklet for a step-by-step

summary of how to use the PFS Look-Up Tool.

● Physicians’ ofces

● Hospitals

● Ambulatory Surgical Centers

● SNFs and other post-acute care settings

● Hospices

● Outpatient dialysis facilities

● Clinical laboratories

● Patients’ homes

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 6 of 34

PFS Payment Rates

Medicare uses the PFS payment rates formula to decide a service’s payment rate. There’s a description for

each part below the formula.

Medicare PFS Payment Rates Formula

Relative Value Units (RVUs)

The PFS uses 3 separate RVUs to calculate a payment:

1. The Work RVU shows the Medicare PFS service’s relative time and intensity

2. The Practice Expense (PE) RVU shows the costs of supporting a practice (like renting ofce space,

buying supplies and equipment, and staff costs)

3. The Malpractice (MP) RVU shows the costs of malpractice insurance

Geographic Practice Cost Indices (GPCIs)

Medicare adjusts each of the 3 RVUs to account for geographic variations in the costs of practicing medicine in

different areas of the country. Each kind of RVU has a related GPCI adjustment.

Conversion Factor (CF)

To decide the payment rate for a service, CMS systems multiply the sum of the geographically adjusted RVUs

by a CF in dollars. The statute species the formula Medicare uses to update the CF every year.

Medicare uses a fee schedule, a complete listing of fees, to pay doctors or other providers and suppliers. We

use this comprehensive listing of fee maximums to pay a physician or other providers and suppliers on a Fee-

for-Service (FFS) basis. Medicare bases payment on whichever is less, the charge or PFS amount. CMS also

develops fee schedules for ambulance services, clinical laboratory services, and DMEPOS.

Payment

Work RVU x

Work GPCI

PE RVU x

PE GPCI

MP RVU x

MP GPCI

CF

Figure 1: Arithmetic graphic of the parts added and multiplied together to show how Medicare decides

the PFS payment rate for services

MLN901344 April 2023Page 7 of 34

MLN BookletHow to Use the PFS Look-Up Tool

For most codes, Medicare pays 80% of the allowed amount and the patient pays 20%. Examples of reductions

from the published PFS amount include:

● Assistants at surgery get 16% of the PFS rate

● Medicare pays nurse practitioners, physician assistants, and clinical nurse specialists 85%

● Medicare pays physical and occupational therapy assistants 85%

● Medicare pays registered dietitians or nutrition providers for medical nutrition therapy services 85%

● Clinical social workers get 75%

How Up to Date is the PFS?

CMS updates the PFS quarterly. The Data Updated statement on the PFS Overview page shows the date of

the latest update.

Searching the PFS

The Overview page of the PFS Look-Up Tool tells you the information you can search for with the tool. The site

allows you to search:

● Pricing amounts

● Various payment policy indicators

● Relative Value Units

● Geographic Practice Cost Indices

You have 2 ways to manage your search results once completed:

1. Download CSV

2. Copy link

You’ll see these buttons below your search results table.

To download an Excel le of your search results:

● Click the Download CSV button

● A box will pop up at the top right of your screen asking if you want to open the le

● If you click on the Open button, you’ll get your search results in an Excel spreadsheet

Tip

See Sections 110.2 and 120 of the Medicare Claims Processing Manual, Chapter 12, for more information.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 8 of 34

To save a le with your search results:

● Click on the folder icon to the right of the Open button

● Choose where you’d like to save your le on your computer

To delete your search results:

● Click on the trash can icon to the right of the folder icon

To copy a link to your search results:

● Click on the Copy link button below your search results table

● You’ll see a green check box to the right of the button and a message that says Link copied to clipboard

● Right click and select paste to paste the link in an email, a browser search bar, or to any document

you choose

To start a search from the Overview page of the PFS Look-Up Tool:

● Click on the Begin Search button

● Accept to show you’ve read and agree to the licensing agreement

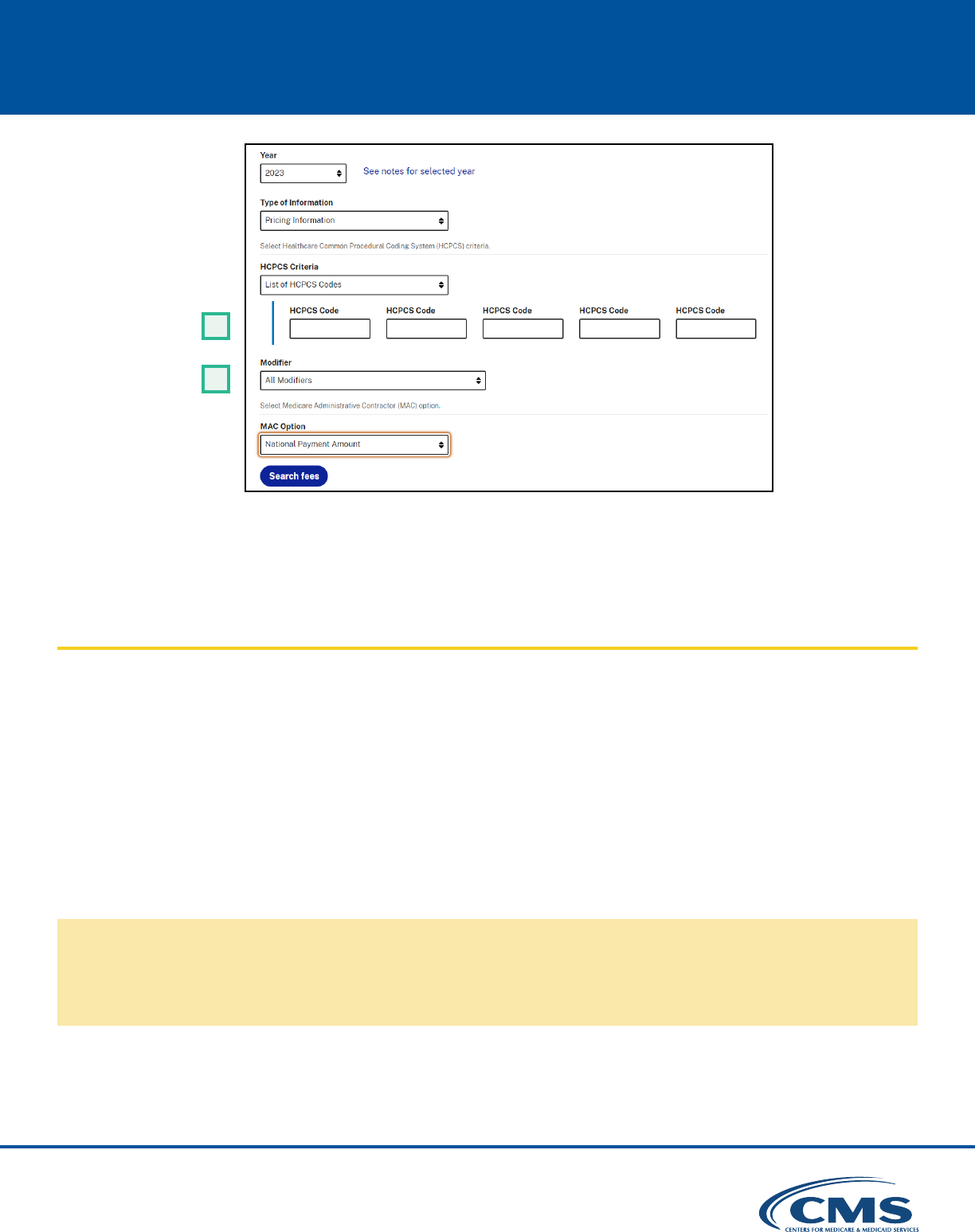

The Search the Physician Fee Schedule webpage appears. Figure 2 shows part of this screen. To start your

search, choose the following criteria:

Figure 2: Search Criteria

1

2

MLN901344 April 2023Page 9 of 34

MLN BookletHow to Use the PFS Look-Up Tool

1

Choose the year from the dropdown menu.

2

Then, choose the Type of Information for the search from the following choices:

● Pricing Information - Search the maximum fee schedule amount by HCPCS code

● Payment Policy Indicators - This choice gives information such as global surgery days, multiple

surgery indicators, and applicability of professional and technical components

● Relative Value Units (RVUs) - For those interested in how the PFS tool calculates the payment

amount, this choice gives RVU information for work, practice expense, and malpractice costs

● Geographic Practice Cost Index (GPCI) – Medicare set up a GPCI for every Medicare payment

locality for each of the 3 parts of a procedure’s RVU

● All - This choice gives data for each of the above types of information

The rest of the search limits and choices shown change based on the Type of Information chosen for the

search. We’ll show the next steps of this search doing a Pricing Information Search and review the other

choices of searches.

Pricing Information Search

1

Choose Pricing Information for the Type of Information

2

Choose 1 of the following HCPCS Criteria:

● Single HCPCS Code

• Enter 1 procedure code

● List of HCPCS Codes

• Enter up to 5 codes

● Range of HCPCS Codes

• Enter a starting and ending procedure code to

dene the range

• You can search for up to 300 codes at a time

Tip

The downside to choosing All is if you choose to print the results, you’ll print more than what you need and

spend a little more time arranging the printing. Also, if you select 1 of the choices and then change your

mind, you can easily switch from viewing only the default columns to all columns once your search results

appear.

Tip

The PFS includes Level I CPT and

Level II HCPCS codes.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 10 of 34

3

Choose 1 of the following choices for the Medicare Administrative Contractor (MAC) criteria:

● National Payment Amount

This choice searches for information for only the

national payment amount. A MAC locality code of

0000000 shows for the national payment amount.

● Specic MAC

Providers use a MAC locality code to search for

information showing a specic geographic area.

If you choose this alternative, choose an area from the

dropdown menu at the bottom of the page.

A few of these areas, such as 01112, have multiple

listings. To learn what these numbers mean, reset the

search to Specic Locality.

● Specic Locality

This search allows you to drill down to specic cities (for example, 0111205 - San Francisco) if

payment varies within a MAC for specic localities. Notice the number for San Francisco starts with

the Northern California number followed with a 05.

● All MACs

This choice searches for information for the entire nation. The results include the national payment

amount and all MAC localities. This choice is helpful for states with multiple payment localities

because it groups all localities together for a MAC. Medicare payment may vary within 1 MAC. But

this choice doesn’t give locality names. You must know the MAC locality codes, like those given in

the Specic Locality choice.

Figure 3: Pricing Information Search

1

2

Tip

MACs have more than 1 of these

locality codes. For example, the

JE MAC includes 01182-Southern

California; 01112-Northern California;

01212-Hawaii, Guam, American

Samoa, and the Northern Mariana

Islands; and 01312-Nevada.

MLN901344 April 2023Page 11 of 34

MLN BookletHow to Use the PFS Look-Up Tool

4

Enter the HCPCS code(s) for the search.

5

Choose 1 of the following Modier alternatives from the dropdown menu:

● Global (Diagnostic Service) or Physicians Professional

Service where the Professional or Technical concept

doesn’t apply

● 26 Professional Component

● 53 Procedures which the physician ended before

completion

● TC Technical Component

● All Modiers

Figure 4: Pricing Information Search

3

Tip

If you don’t know which modier to

choose, choose All Modiers. This

choice brings up all the modiers listed

above, not all modiers in the AMA or

HCPCS code books.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 12 of 34

Click Search fees after you choose the criteria to start your pricing search.

Pricing Search Using a List of Evaluation and Management Codes

We’ll start with an example of a pricing search using a list of Evaluation and Management (E/M) codes. We’ll

then show how search results vary when using a code with a professional or technical component.

Figure 5 shows the top part of the Search Results page after choosing or inputting the following information in

this order:

● 2023 Pricing Information

● List of HCPCS Codes

● 99214 and 99215 as a list of HCPCS Codes

● All Modiers

● 11202 South Carolina as the Specic MAC

Tip

To change the search criteria, type in a new code or other factor at the top of the page and then click on

Search fees.

Figure 5: Pricing Information Search

5

4

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN901344 April 2023Page 13 of 34

MLN BookletHow to Use the PFS Look-Up Tool

See the results from our search below. The PFS Look-Up Tool explains each code under the Short

Description column.

In Figure 6, let’s review the pricing information given starting with the column on the left:

1

HCPCS Code – The PFS Look-Up Tool displays 99214 and 99215 on separate rows with the pricing

information shown to the right.

2

Modier - There’s nothing displayed in this column. This eld stays blank for services other than those

codes with a professional or technical component (or both), with 1 exception: When allowed, CPT

modier 53 appears in this column.

3

Short Description – This column shows a short description of the code and time a physician would

spend during an exam.

4

Proc Stat - This column includes the Procedure Status Code. A is listed in this column for Active Code.

This means the physician fee schedule pays this code separately, if covered.

5

MAC Locality - In Figure 6, the search shows 1120201. In this example, 1120201 is South Carolina, and

01 as the last 2 digits means that all of South Carolina’s pricing is statewide. If you use Northern

California as an example, the Look-Up Tool shows several rows because pricing in California varies in

several localities.

6

Non-Facility Price - Figure 6 displays $121.88 for 99214 and $171.09 for 99215. This column includes

the fee schedule amount when you do a procedure in a non-facility setting like the ofce. (Non-facility

fees apply to therapy procedures regardless of whether the physician provides them in facility or non-

facility settings.)

4 5 6 7 8 9 10321

Figure 6: Pricing Search Results for List of E/M Codes

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 14 of 34

Occasionally, Medicare pays institutions like hospitals under the PFS. When this occurs, Medicare pays them

at the non-facility (higher) rate. Although the terminology might seem confusing at rst, the higher payment

makes sense because the facility handles the cost of supplying the staff and supplies.

7

Facility Price - $93.88 shows for 99214 and

$137.85 for 99215. This is the fee schedule

amount when a physician provides this service

in a facility setting, like a hospital or ambulatory

surgical center (ASC).

8

Non-Facility Limiting Charge - $133.16 shows

for 99214 and $186.91 for 99215.

This is the most the providers listed below may

charge a patient for the service:

● Nonparticipating health care providers

● Providers who don’t accept assignment

● Providers who do the service in an

ofce setting

On page 4 of this booklet, we explain that Medicare reduces the Medicare-approved amounts 5% for

nonparticipating providers and suppliers. In other words, the amounts in this column add up to 115% of 95% of

the amounts in column 5.

9

Facility Limiting Charge – Figure 6 shows $102.57 for 99214 and $150.61 for 99215.

● This is the most the providers listed below may charge a patient for the service:

• Nonparticipating health care providers

• Providers who don’t accept assignment

• Providers who do the service in a facility setting

10

Conv Fact - This column displays the Conversion Factor for this code. We’ll explain this later when we

discuss RVUs.

Site of Service Differential

Under the PFS, some procedures have

a separate Medicare fee schedule for a

physician’s professional services when

provided in a facility (like a hospital) or a

non-facility. Generally, Medicare pays more

for procedures done in an ofce because

you must supply clinical staff, supplies, and

equipment. View this differential in the Non-

Facility Price and Facility Price columns.

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN901344 April 2023Page 15 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Pricing Search Using a Code with an Applicable Professional or

Technical Component

Figure 7 below shows other pricing information that displays for codes providers may bill globally or with a

professional or technical component. Use the following information for this example:

● 2023

● Pricing Information

● 76706 as the Single HCPCS Code

● 11202 South Carolina as the Specic MAC

● All Modiers

1

In Figure 7, the rst row is blank in the modier column. When a provider doesn’t use a modier with this

code, it means this provider did both the technical and professional components of the procedure. The

Non-Facility Price pricing amount is $100.23, NA for the Facility Price and $109.50 for the Non-

Facility Limiting Charge. When you add the amounts for the professional component (modier 26) and

the technical component (TC), in the Non-Facility Limiting Charge column, they equal the amount

in row 1.

Under the Facility Limiting Charge, the search results show NA.

2

The second row gives information for CPT code 76706 submitted with modier 26, which providers use

when they perform only the professional component of the procedure. The search results display $25.51

for the Non-Facility Price and Facility Price and $27.87 for the Non-Facility Limiting Charge and

$27.87 under the Facility Limiting Charge.

1

2

3

Figure 7: Pricing Search Showing Modiers 26 and TC

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 16 of 34

3

The third row displays the results if you bill CPT code 76706 with HCPCS Level II modier TC, Technical

Component. TC means the provider billed for performing the ultrasound only, not for the interpretation.

The search results display $74.72 under the Non-Facility Price, NA under the Facility Price, and

$81.63 under Non-Facility Limiting Charge.

Under the Facility Limiting Charge, the search results show NA.

Payment Policy Indicators Search

Let’s use the Payment Policy Indicators Search to review the other information available in the PFS

Look-Up Tool.

The Payment Policy Indicators include:

● Professional or technical modiers if they apply

● The number of post-operative days included in a procedure

● Whether Medicare pays a code

● The level of physician supervision needed

● Whether you bill the service as a bilateral procedure

Payment Policy Indicators Search Using a Code with an Applicable Professional

or Technical Component

In Figure 8, we’ll search using a code with related professional or technical modiers and then, in Figures 9-1

and 9-2, we’ll discuss the information given when you use a surgical code.

Figure 8 shows a part of the Search results after choosing the following criteria:

● 2023

● Payment Policy Indicators

● Single HCPCS Code 76706

● All Modiers

We used the same code, 76706, as we just did in a pricing search to compare the information given.

Tip

You don’t have to include a location or choose a MAC for the payment policy search because the policies

shown are national. Learn more about these policies in the Medicare Claims Processing Manual, Chapter

23. Remember that MACs may have other local policies that you’ll need to research on their websites or in

the Medicare Coverage Database.

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN901344 April 2023Page 17 of 34

MLN BookletHow to Use the PFS Look-Up Tool

1

Modier – As in our pricing search for this code, the screen displays 3 rows, showing that providers can

report code 76706, abdominal aorta ultrasound, with no modier, modier 26, or a TC modier.

All the other columns in this example display the same information for each row under the

column heading.

2

Proc Stat – This column, which shows Procedure Status Indicator, shows an A, meaning an active code

in the Pricing Search.

3

PCTC – This column shows the Professional Component and Technical Component Indicators. In our

example, 1 shows, which means the code is a diagnostic test or radiology service. You can use Modiers

26 and TC when sending in this code on a claim.

4

Global – XXX shows in this example, which means the global surgery concept isn’t applicable to

this code.

5

MULT SURG – This column displays zeros, which means no payment adjustment rules for multiple

procedures apply.

1 2 3 4 5 6

Figure 8: Payment Policy Indicators Search Results

Tip

For the technical component of certain diagnostic imaging procedures, Medicare bases payment on the

lower of the Outpatient Prospective Payment System (OPPS) cap or fee schedule amount. The PFS

search results don’t show payment adjustments. The PFS Look-Up Tool displays full payments as well

as OPPS payments. Also, the PFS Look-Up Tool can’t display multiple procedures payment reductions

(MPPRs) since too many combinations of HCPCS codes exist. For more information about MPPR, refer to

the MLN Matters® Articles List.

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 18 of 34

6

BILT SURG – This column displays zeros, which means the 150% payment adjustment for bilateral

procedure doesn’t apply. The PFS bases RVUs on the procedure done as a bilateral procedure. If you

report the procedure with modier 50 or report it twice on the same day (for example, with RT and LT

modiers with a 2 in the units eld), Medicare bases payment for both sides on the lower of:

● The total actual charges for both sides

● 100% of the fee schedule amount for a single code

All the other columns include the gure 0 or letters XXX showing that these indicators don’t apply, or

Medicare doesn’t allow them for code 76706. Let’s now do a search using a surgical code to see what

information shows in these columns.

Payment Policy Indicators Search Using a Surgical Code

Figure 9-1 below shows the PFS search results when searching for CPT code 47480, Incision of gallbladder.

Understanding information shown in these search results helps you understand policies such as bundled

procedures or whether you need a CPT modier with a code to get paid. This includes modiers for assistant

surgeons, bilateral surgery, and multiple procedures.

1

Modier – The Modier column has no information listed.

2

Short Description – This column shows a short description of the code.

3

Proc Stat – This column displays an A showing this code is active.

4

PCTC – This column displays a 0. The 0 indicator refers to codes that describe physician services.

Examples include visits, consultations, and surgical procedures. The concept of PC and TC don’t apply

since the PFS doesn’t split physician services into professional and technical components.

5

Global – This eld gives the time frames that apply to payment for each surgical procedure or another

indicator that says whether it applies to the global concept of the service.

Figure 9.1: Payment Policy Indicators Search Using a Surgical Code

1 2 3 4 5 6 7 8

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN901344 April 2023Page 19 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Figure 9-1 lists 090 which means code 47480 is major

surgery with a 1-day preoperative period and 90-day

postoperative period included in the fee schedule

payment amount.

6

MULT SURG – This column shows which

payment adjustment rule for multiple

procedures (including certain physical therapy

procedures) applies to the service. In Figure

9-1, a 2 shows that standard payment

adjustment rules for multiple procedures apply.

Payment is based on the lower of the billed

amount, or:

● 100% of the fee schedule amount for the

highest valued procedure

● 50% of the fee schedule amount for the

second through the fth highest valued

procedures

The Medicare system reviews other procedures and considers them for payment.

7

BILT SURG – This eld gives an indicator for bilateral services subject to a payment adjustment. CMS

denes Bilateral surgeries as procedures done on both sides of the body during the same operative

session or on the same day. In Figure 9-1, we see 0, which means the 150% payment adjustment for

bilateral procedures doesn’t apply. If you report this procedure with modier 50 or with modiers RT and

LT, Medicare bases payment for the 2 sides on the lower of:

● The total actual charge for both sides

● 100% of the fee schedule amount for a single code

8

ASST SURG – This column shows whether the PFS pays assistants at surgery. Figure 9-1 shows a 2,

which means payment restriction for assistants at surgery doesn’t apply to this procedure.

For a complete listing of indicators, refer to the

Medicare Claims Processing Manual, Chapter

23. Review the Addendum in Chapter 23,

Section 50.6 for the latest information or refer

to the Appendix in the back of this booklet.

Because Medicare only updates Chapter 23

every year, it’s important to also review MLN

Matters® articles and other information

from CMS.

For Medicare Physician Fee Schedule

Database (MPFSDB) le layout information

for years before 2018, choose the Historical

MPFSDB Layouts link from the Downloads

section of the Physician Fee Schedule

webpage

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 20 of 34

9

CO SURG – This eld in Figure 9-2 includes an indicator 1, which means the PFS pays co-surgeons

(each of a different specialty). Medicare needs supporting documentation to prove the medical necessity

of 2 surgeons for this procedure.

10

Team SURG – This eld in Figure 9-2 shows indicator 0, meaning Medicare rules don’t allow a team of

surgeons (more than 2 surgeons of different specialties) for this procedure.

11

PHYS SUPV – Health care providers must do diagnostic tests, with certain exceptions, under the

supervision of a physician. This eld shows the level of supervision needed. In this example, 09 means

that this concept doesn’t apply.

Relative Value Unit (RVU) & Geographic Practice Cost Index (GPCI) Search

Before starting an RVU or GPCI search, it’s important to understand the denition of RVUs and GPCIs. The

PFS bases the pricing for each code on the following 3 parts:

1.) RVU – RVUs show the resources needed

to provide a physician fee schedule service.

The PFS uses 3 separate RVUs to calculate

payment under:

● Work RVUs show the time and intensity

associated with providing a service and

equal about 50% of the total payment

● Practice Expense (PE) RVUs show costs

like renting ofce space, buying supplies

and equipment, and staff

● Malpractice (MP) RVUs show the relative

costs of purchasing malpractice insurance

2.) GPCI – To calculate the payment for every provider’s service, the Medicare system adjusts parts of the

fee schedule (physician work, PE, and MP RVUs) with a GPCI. The GPCIs show the costs of physician

work, practice expense, and malpractice expense in a specic area compared to the national average

costs for each part.

Tip

If you search for code 99215 instead of 99214,

you’ll see a 2.80 in the Work RVU column, showing

a higher relative value. Look back at the pricing

search we did earlier in this booklet with these 2

codes. You’ll see that the payment for 99215 is

higher than for 99214. This helps you understand

the impact of RVUs on the fee schedule amount.

Figure 9.2: Payment Policy Indicators Search Using a Surgical Code

9 10 11

CPT only copyright 2022 American Medical Association. All rights reserved.

MLN901344 April 2023Page 21 of 34

MLN BookletHow to Use the PFS Look-Up Tool

3.) Conversion Factor (CF) – Typically, CMS updates the CF each year. Until 2015, CMS used the

Medicare Economic Index (MEI) adjusted up or down to calculate the annual update, depending on how

actual expenditures compared to a target rate called the sustainable growth rate (SGR). The Medicare

Access and CHIP Reauthorization Act of 2015 (MACRA) repealed the SGR update formula for payments

under the PFS. Effective January 1, 2023, the Physician Fee Schedule update factor is 0.00% and the

CF is 33.0607. The application of the CF converts RVUs to dollar amounts.

Find more information about RVUs and GPCIs in the annual Medicare Physician Fee Schedule Final Rule.

We’ll rst show an RVU search and then show a GPCI search.

RVU Search

Using the PFS Look-Up Tool, we chose:

● 2023

● Relative Value Units for the Type of Information

● 99214 for the Single HCPCS Code

● All Modiers

Figure 10 shows a part of the screen displayed after making these choices. This gure shows the following 5

columns (from the many columns displayed on the website) that interest most providers:

The PFS Look-Up Tool shows the following Practice Expense (PE) RVUs displayed in 5 columns:

1

1.73 under Transitioned Non-FAC PE RVU

2

1.73 under Fully Implemented Non-FAC PE RVU

Figure 10: RVU Search

1

2

3

4

5

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 22 of 34

3

0.82 under Transitioned Facility PE RVU

4

0.82 under Fully Implemented Facility PE RVU

5

MP RVU (Malpractice RVU) has a value of 0.14 in this example.

In Figure 10, the Work RVU column is 1.92.

Chapter 23 of the Medicare Claims Processing Manual includes information on the other columns displayed in

an RVU search.

GPCI Search

Finally, let’s do a GPCI search for 2023. Remember, we don’t enter a HCPCS code here because the same

GPCI applies for all codes in an area. We’ll decide whether we want a GPCI for:

● National Payment Amount

● Specic MAC

● Specic Locality

● All MACs

Figure 11 shows the screen for GPCIs when choosing All MACs.

Tip

To see how MP RVUs vary, enter a different code in an RVU search and compare to this result for 99214.

Figure 11: GPCI Search

MLN901344 April 2023Page 23 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Remember that MAC Locality 0000000 is national (see Figure 11). The value of 1.000 shows in each of the 3

GPCI columns: GPCI WORK, GPCI PE, and GPCI MP. For specic localities, any values higher or lower than

1.000 mean higher or lower geographic classication values than the national average.

For our example, location 0111205 shows a value of 1.082, 1.374, and 0.452 in these 3 separate columns.

Conclusion

In this booklet, we’ve shown several searches using the PFS Look-Up Tool. For more information, see the

Resources section on page 33.

Print out the Physician Fee Schedule (PFS) Quick Reference Search Guide on page 32 of this booklet for a

step-by-step summary of how to use the PFS Look-Up Tool.

Appendix

This information is from the Medicare Claims Processing Manual, Chapter 23. For Medicare Physician Fee

Schedule Database (MPFSDB) le layout information for years before 2018, choose the Historical MPFSDB

Layouts link from the Downloads section of the Physician Fee Schedule webpage.

Status Indicators

A = Active code. Medicare pays these codes separately under the physician fee schedule (PFS), if covered.

Codes with this status include RVUs and payment amounts. The presence of an A indicator doesn’t mean that

Medicare has made a national coverage determination about the service. A/B MACs (B) stay responsible for

coverage decisions in the absence of a national Medicare policy.

B = The PFS always bundles payment for covered services into payment for other services not specied.

No RVUs or payment amounts exist for these codes and Medicare never makes separate payment. When

Medicare covers these services, we include payment for them in the payment for the services to which they’re

incident. An example is a telephone call from a hospital nurse about the care of a patient.

C = A/B MACs (B) price the code. A/B MACs (B) set up RVUs and payment amounts for these services,

generally on an individual case-by-case basis following review of documentation such as an operative report.

Tip

Because Medicare only updates Chapter 23 every year, it’s important to also review MLN Matters® articles

and other information from CMS.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 24 of 34

E = Excluded from physician fee schedule by regulation. CMS excludes these codes for items or services

from the fee schedule payment by regulation. The PFSDB Status Indicators table doesn’t show any RVUs or

payment amounts and makes no payment under the fee schedule for these codes. Payment for them, when

covered, continues under reasonable charge procedures.

I = Not valid for Medicare purposes. Medicare uses another code for reporting of, and payment for, these

services. This code isn’t subject to a 90-day grace period.

J = Anesthesia services (no relative value units or payment amounts for anesthesia codes on the database,

only used to help with the identication of anesthesia services.)

L = Local codes. A/B MACs (B) will apply this status to all local codes in effect on January 1, 1998, or those

later approved by central ofce for use. A/B MACs (B) will complete the RVUs and payment amounts for |

these codes.

M = Measurement codes. Used for reporting purposes only.

N = Non-covered service. Medicare carries these codes on the HCPCS tape as noncovered services.

P = Bundled and excluded codes. No RVUs exist for these services. Medicare doesn’t make separate payment

for them under the fee schedule. If we cover the item or service as incident to a physician service and you

provide it on the same day as a physician service, we bundle payment for it into the payment for the physician

service to which it’s incident. An example is an elastic bandage a physician provided incident to a physician

service. If Medicare covers the item or service as other than incident to a physician service, we exclude it from

the fee schedule (for example, colostomy supplies) and pay it under the other payment provision of the Social

Security Act.

Q = Therapy functional information code. Used for reporting purposes only. This indicator is no longer effective

starting with the 2020 fee schedule as of January 1, 2020.

R = Restricted coverage. Special coverage instructions apply.

T = RVUs and payment amounts exist for these services. Medicare only pays these codes if no other services

are payable under the physician fee schedule (PFS) billed on the same date by the same provider. If Medicare

pays the same provider for any other services billed on the same date under the PFS, we bundle these

services into the physician services.

X = Statutory exclusion. These codes stand for an item or service that isn’t in the legal denition of physician

services for fee schedule payment purposes. The PFSDB Status Indicators table shows no RVUs or payment

amounts for these codes and makes no payment under the PFS. Examples: Medicare excludes ambulance

services and clinical diagnostic laboratory services.

MLN901344 April 2023Page 25 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Global Surgery

This eld gives the postoperative timeframes that apply to payment for each surgical procedure or another

indicator that describes how the global concept applies to the service.

000 = Medicare includes endoscopic or minor procedure with related preoperative and postoperative relative

values on the day of the procedure only in the fee schedule payment amount. Medicare doesn’t generally pay

evaluation and management (E/M) services on the day of the procedure.

010 = Medicare includes minor procedure with preoperative relative values on the day of the procedure and

postoperative relative values during a 10-day postoperative period in the fee schedule amount. Medicare

doesn’t generally pay E/M services on the day of the procedure and during this 10-day postoperative period.

090 = Medicare includes major surgery with a 1-day preoperative period and 90-day postoperative period

included in the fee schedule payment amount.

MMM = Maternity codes; usual global period doesn’t apply.

XXX = Global concept doesn’t apply.

YYY = A/B MAC decides whether global concept applies and establishes postoperative period at time

of pricing.

ZZZ = Code related to another service. Medicare always includes it in the global period of the other service.

Note: Physician work is associated with intra-service time and sometimes the post service time.

Preoperative Percentage (Modier 56)

This eld has the percentage (shown in decimal format) for the preoperative part of the global package. For

example, 10% shows as 010000. The total of the preoperative percentage, intraoperative percentage, and the

postoperative percentage elds will usually equal 1. Any variance is slight and results from rounding.

Intraoperative Percentage (Modier 54)

This eld has the percentage (shown in decimal format) for the intraoperative part of the global package

including postoperative work in the hospital. For example, 63% shows as 063000. The total of the preoperative

percentage, intraoperative percentage, and the postoperative percentage elds will usually equal 1. Any

variance is slight and results from rounding.

Postoperative Percentage (Modier 55)

This eld has the percentage (shown in decimal format) for the postoperative part of the global package that’s

provided in the ofce after discharge from the hospital. For example, 17% shows as 017000. The total of the

preoperative percentage, intraoperative percentage, and the postoperative percentage elds will usually equal

1. Any variance is slight and results from rounding.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 26 of 34

Professional Component (PC) or Technical Component (TC) Indicator

0 = Physician service codes. This indicator describes physician service codes. Examples include visits,

consultations, and surgical procedures. The concept of PC or TC doesn’t apply since Medicare doesn’t

split physician services into professional and technical components. You can’t use Modiers 26 and TC with

these codes. The total Relative Value Units (RVUs) include values for physician work, practice expense, and

malpractice expense. Medicare includes physician service codes with no work RVUs.

1 = Diagnostic tests or radiology services. This indicator describes diagnostic tests codes (for example,

pulmonary function tests or therapeutic radiology procedures such as radiation therapy). These codes

generally have both a professional and technical component. You can use Modiers 26 and TC with these

codes. The total RVUs for codes reported with a 26 modier include values for physician work, practice

expense, and malpractice expense. The total RVUs for codes reported with a TC modier include values for

practice expense and malpractice expense only. The total RVUs for codes reported without a modier equals

the sum of RVUs for both the professional and technical component.

2 = Professional component only codes. This indicator identies stand-alone codes that describe the physician

work part of chosen diagnostic tests for which there’s an associated code that describes the technical

component of the diagnostic test only and another associated code that describes the global test. An example

of a professional component only code is 93010, Electrocardiogram, interpretation, and report. You can’t use

modiers 26 and TC with these codes. The total RVUs for professional component only codes include values

for physician work, practice expense, and malpractice expense.

3 = Technical component only codes. This indicator describes stand-alone codes that describe the technical

component (like staff and equipment costs) of chosen diagnostic tests for which there’s an associated code

that describes the professional component of the diagnostic tests only. An example of a technical component

code is 93005, Electrocardiogram, tracing only, without interpretation and report. It also describes codes that

Medicare covers only as diagnostic tests and don’t have a related professional code. You can’t use Modiers

26 and TC with these codes. The total RVUs for technical component only codes include values for practice

expense and malpractice expense only.

4 = Global test only codes. This indicator describes stand-alone codes that have associated codes naming:

● The professional component of the test only

● The technical component of the test only

You can’t use modiers 26 and TC with these codes. The total RVUs for global procedure only codes include

values for physician work, practice expense, and malpractice expense. The total RVUs for global procedure

only codes equal the sum of the total RVUs for the professional and technical components only codes together.

5 = Incident to codes. This indicator describes codes for services covered incident to a physician’s service

when auxiliary personnel the physician employs and who work under their direct supervision provides them.

MACs may not make payment for these services when auxiliary personnel provide them to hospital inpatients

or patients in a hospital outpatient department. You can’t use modiers 26 and TC with these codes.

MLN901344 April 2023Page 27 of 34

MLN BookletHow to Use the PFS Look-Up Tool

6 = Laboratory physician interpretation codes. This indicator describes clinical laboratory codes for

interpretations by laboratory physicians. Medicare pays separately for these services. Medicare pays the

laboratory physician for doing the tests under the lab fee schedule. You can’t use modier TC with these

codes. The total RVUs for laboratory physician interpretation codes include values for physician, work, practice

expense, and malpractice expense.

7 = Private practice therapist’s service. Medicare may not make payment if an independently practicing

physical therapist or occupational therapist provided the service to a hospital outpatient or inpatient.

8 = Physician interpretation codes. This indicator describes the professional component of clinical laboratory

codes. Medicare may make separate payment only if the physician interprets an abnormal smear for a hospital

inpatient. This applies only to code 85060. Medicare doesn’t recognize TC billing because we make payment

for the underlying clinical laboratory test to the hospital, generally through the Prospective Payment System

(PPS) rate. Medicare doesn’t make payment for code 85060 provided to hospital outpatients or non-hospital

patients. Medicare pays the physician interpretation through the clinical laboratory fee schedule (CLFS)

payment for the clinical laboratory test.

9 = Concept of a professional or technical component doesn’t apply.

Multiple Procedure (CPT Modier 51)

This indicator shows which payment adjustment rule for multiple procedures applies to the service.

0 = No payment adjustment rules for multiple procedures apply. If you report the procedure on the same day as

another procedure, payment is based on the lower of:

● The actual charge

● The fee schedule amount for the procedure

1 = Standard payment adjustment rules in effect before January 1, 1996, for multiple procedures apply. In the

1996 MPFSDB, this indicator only applied to codes with procedure status of D. If a procedure is reported on

the same day as another procedure with an indicator of 1, 2, or 3, Medicare ranks the procedures by the fee

schedule amount and applies the correct reduction to this code (100%, 50%, 25%, 25%, 25%, and by report).

MACs base payment on the lower of:

● The actual charge

● The fee schedule amount reduced by the right percentage

2 = Standard payment adjustment rules for multiple procedures apply. If you report the procedure on the same

day as another procedure with an indicator of 1, 2, or 3, MACs rank the procedures by fee schedule amount

and apply the reduction to this code (100%, 50%, 50%, 50%, 50%, and by report). MACs base payment on the

lower of:

● The actual charge

● The fee schedule amount reduced by the correct percentage

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 28 of 34

3 = Special rules for multiple endoscopic procedures apply if you bill the procedure with another endoscopy in

the same family (that is, another endoscopy that has the same base procedure). You show the base procedure

for each code with this indicator in the endoscopic base code eld. The multiple endoscopy rules apply to

a family before ranking the family with other procedures done on the same day (for example, if you report

multiple endoscopies in the same family on the same day as endoscopies in another family or on the same day

as a non-endoscopic procedure). If you report an endoscopic procedure with only its base procedure, Medicare

doesn’t pay the base procedure separately. We include payment for the base procedure in the payment for the

other endoscopy.

4 = Diagnostic imaging services subject to the MPPR. TC of diagnostic imaging services subject to a 50%

reduction of the second and subsequent imaging services furnished by the same physician (or by multiple

physicians in the same group practice, for example, same group National Provider Identier [NPI]) to the same

patient on the same day, effective for services July 1, 2010, and after. PC of diagnostic imaging services are

subject to a 5% payment reduction of the second and subsequent imaging services effective January 1, 2017.

Medicare doesn’t include multiple procedure indicator 5 in this le, since the indicator stands for the therapy

multiple procedure payment reduction which never applies to professional service revenue codes. Medicare

doesn’t include multiple procedure indicators 6 and 7 in this le, since in these cases the reduction only applies

to technical component services. On CAH claims, Medicare pays technical components on a cost basis, and

they aren’t subject to the reductions.

9 = Concept doesn’t apply.

The payment Indicator le doesn’t include codes with RVUs equal to zero. These codes may have multiple

procedure indicators not shown.

Bilateral Surgery Indicator (CPT Modier 50)

This eld gives an indicator for services subject to a payment adjustment.

0 = 150% payment adjustment for bilateral procedures doesn’t apply. The bilateral adjustment isn’t right for

codes in this category because of:

● Physiology or anatomy

● The code descriptor specically states that it’s a unilateral procedure and there’s an existing code for the

bilateral procedure

1 = 150% payment adjustment for bilateral procedures applies. If you bill a code with the bilateral modier,

Medicare bases payment for these codes (when reported as bilateral procedures) on the lower of:

● The total actual charge for both sides

● 150% of the fee schedule amount for a single code

Tip

Refer to MLN Matters® Article MM9647 about the 5% reduction to the PC for certain diagnostic imaging

procedures.

MLN901344 April 2023Page 29 of 34

MLN BookletHow to Use the PFS Look-Up Tool

If you report a code as a bilateral procedure with other procedure codes on the same day, Medicare applies the

bilateral adjustment before applying any applicable multiple procedure rules.

2 = 150% payment adjustment for bilateral procedure doesn’t apply. Medicare bases RVUs on the procedure

providers do as a bilateral procedure. Medicare bases RVUs on a bilateral procedure because:

● The code descriptor specically states that the procedure is bilateral

● The code descriptor states that the procedure may be performed either unilaterally or bilaterally

● You usually do the procedure as a bilateral procedure

3 = The usual payment adjustment for bilateral procedures doesn’t apply. Services in this category are

generally radiology procedures or other diagnostic tests which aren’t subject to the special payment rules for

other bilateral procedures. If you bill the procedure with modier 50, Medicare bases payment on the lessor of:

● The actual charge for each side

● 100% of the fee schedule amount for each side

If you report a procedure as a bilateral procedure and with other procedure codes on the same day, the fee

schedule amount for a bilateral procedure is determined before applying any applicable multiple

procedure rules.

Services in this category are generally radiology procedures or other diagnostic tests which aren’t subject to

the special payment rules for other bilateral procedures.

9 = Concept doesn’t apply.

Assistant at Surgery (Modiers AS, 80, 81 and 82)

This eld gives an indicator for services where Medicare never pays an assistant at surgery.

0 = Payment restriction for assistants at surgery applies to this procedure unless you send in supporting

documentation to prove medical necessity.

1 = Statutory payment restriction for assistants at surgery applies to this procedure. Medicare may not pay

assistants at surgery.

2 = Payment restriction for assistants at surgery don’t apply to this procedure. Medicare may not pay assistants

at surgery.

9 = Concept doesn’t apply.

Co-Surgeons (Modier 62)

This eld gives an indicator for services for which Medicare may pay 2 surgeons, each in a different specialty.

0 = Co-surgeons not allowed for this procedure.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 30 of 34

1 = Co-surgeons could be paid. Medicare requires supporting documentation to prove medical necessity of 2

surgeons for the procedure.

2 = Co-surgeons allowed. Medicare doesn’t require documentation if you meet the 2 specialty requirements.

9 = Concept doesn’t apply.

Team Surgeons (Modier 66)

This eld gives an indicator for services for which Medicare may pay team surgeons.

0 = Team surgeons not allowed for this procedure.

1 = Team surgeons could be paid. Medicare requires supporting documentation to prove medical necessity of a

team. Paid by report.

2 = Team surgeons allowed. Pay by report.

9 = Concept doesn’t apply.

Endoscopic Base Codes

This eld shows an endoscopic base code for each code with a multiple surgery indicator of 3.

Diagnostic Imaging Family Indicator

88 = Subject to the reduction for diagnostic imaging (effective for services January 1, 2011, and after).

99 = Concept doesn’t apply.

Physician Supervision of Diagnostic Procedures

Medicare uses this eld in post payment review.

01 = Procedure must be furnished under the general supervision of a physician.

02 = Procedure must be furnished under the direct supervision of a physician.

03 = Procedure must be furnished under the personal supervision of a physician. A registered radiologist

assistant (RRA) who’s certied and registered by The American Registry of Radiologic Technologists (ARRT)

or a radiology practitioner assistant (RPA) certied by the Certication Board for Radiology Practitioner

Assistants (CBRPA), can do diagnostic imaging procedures under direct supervision. State law must authorize

the RRA or RPA to provide the procedure.

04 = Physician supervision policy doesn’t apply when a qualied, independent psychologist or a clinical

psychologist furnishes a procedure. Otherwise, a physician must generally supervise the procedure.

MLN901344 April 2023Page 31 of 34

MLN BookletHow to Use the PFS Look-Up Tool

05 = Not subject to supervision when a qualied audiologist, physician, or nonphysician practitioner furnishes

the procedure personally. A physician must directly supervise those parts of the test that a qualied technician

may provide when proper.

06 = A physician or physical therapist (PT) certied by the American Board of Physical Therapy Specialties

(ABPTS) as a qualied electrophysiological clinical specialist and allowed to provide the procedure under

state law, must personally do the procedure. A PT with ABPTS certication may also do the procedure without

physician supervision.

21 = Procedure may be furnished by a technician with certication under general supervision of a physician.

Otherwise, a physician must directly supervise the procedure. A PT with ABPTS certication may also do the

procedure without physician supervision.

22 = May be furnished by a technician with on-line real-time contact with a physician.

66 = May be personally furnished by a physician or by a PT with ABPTS certication and certication in this

specic procedure.

6A = Supervision standards for level 66 apply. Also, the PT with ABPTS certication may personally supervise

another PT, but only the PT with ABPTS certication may bill.

77 = Procedure must be furnished by a PT with ABPTS certication (TC & PC) or by a PT without certication

under direct supervision of a physician (TC & PC), or by a technician with certication under general

supervision of a physician (TC only; PC always physician).

7A = Supervision standards for level 77 apply. Also, the PT with ABPTS certication may personally supervise

another PT, but only the PT with ABPTS certication may bill.

09 = Concept doesn’t apply.

Diagnostic Imaging Family Indicator

For services effective January 1, 2011, and after, family indicators 01 - 11 won’t populate.

01 = Family 1 Ultrasound (Chest/Abdomen/Pelvis – Non-Obstetrical)

02 = Family 2 CT and CTA (Chest/Thorax/Abd/Pelvis)

03 = Family 3 CT and CTA (Head/Brain/Orbit/Maxillofacial/Neck)

04 = Family 4 MRI and MRA (Chest/Abd/Pelvis)

05 = Family 5 MRI and MRA (Head/Brain/Neck)

06 = Family 6 MRI and MRA (Spine)

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 32 of 34

07 = Family 7 CT (Spine)

08 = Family 8 MRI and MRA (Lower Extremities)

09 = Family 9 CT and CTA (Lower Extremities)

10 = Family 10 Mr and MRI (Upper Extremities and Joints)

11 = Family 11 CT and CTA (Upper Extremities)

88 = Subject to the reduction of the TC diagnostic imaging (effective for services January 1, 2011, and after).

Subject to the reduction of the PC diagnostic imaging (effective for services January 1, 2012, and after)

99 = Concept doesn’t apply.

Physician Fee Schedule (PFS) Quick Reference Search

Guide

Search the Physician Fee Schedule and follow the steps below to complete the search process.

Step 1: Begin Search

Click Begin Search

Step 2: Year

Choose the PFS year for your search

Step 3: Type of Information

Choose 1 of the following 5 types of information related to your search:

● Pricing Information

● Payment Policy Indicators

● Relative Value Units (RVUs)

● Geographic Practice Cost Index (GPCI)

● All

Tip

If you choose Payment Policy Indicators from

the Type of Information dropdown menu, no

MAC drop down menu appears.

MLN901344 April 2023Page 33 of 34

MLN BookletHow to Use the PFS Look-Up Tool

Step 4: HCPCS Criteria

Choose 1 of the following 3 alternatives (This step won’t appear if you chose the GPCI Type of Information in

step 2 above):

● Single HCPCS Code – Click on Single HCPCS Code and type the code in the HCPCS Code eld that l

appears at the bottom of the page

● List of HCPCS Codes – Click on List of HCPCS Codes and enter up to 5 codes in the HCPCS Code

elds that appear at the bottom of the page

● Range of HCPCS Codes – Click on Range of HCPCS Codes and enter starting and ending procedure

codes for the code range in the HCPCS Code elds that appear at the bottom of the page

Then, choose a modier value from the Modier dropdown menu at the bottom of the page.

Step 5: Medicare Administrative Contractor (MAC)

Choose 1 of the following 4 alternatives (This step only appears if you choose Pricing Information, GPCI, or All

for the Type of Information in step 2):

● National Payment Amount – Shown with a MAC locality code of 0000000.

● Specic MAC – Click Specic MAC, then start typing the name of the region or state you’d like. Once you

start typing, MAC regions will appear below the box. Choose your MAC from the list that appears below

the box.

● Specic Locality – Click Specic Locality, then start typing the name of the region or state you’d like.

Once you start typing, MAC localities will appear below the box. Choose your locality from the list that

appears below the box.

● All MACs – Displays information for the entire nation. Results include the national payment amount, as

well as all MAC localities.

Step 6: Click Search Fees to see your search results

Tip

We recommend using a small range of codes. It takes longer for a larger range to populate.

MLN BookletHow to Use the PFS Look-Up Tool

MLN901344 April 2023Page 34 of 34

Resources

● PFS Federal Regulation Notices

● Physician Fee Schedule

● CMS Forms List

● How to Use the Medicare Coverage Database educational tool

● How to Use the Medicare National Correct Coding Initiative (NCCI) Tools booklet

● Medicare Benet Policy Manual, Chapter 15

● Medicare Claims Processing Manual, Chapter 4

Medicare Learning Network® Content Disclaimer and Department of Health & Human Services Disclosure

The Medicare Learning Network®, MLN Connects®, and MLN Matters® are registered trademarks of the U.S.

Department of Health & Human Services (HHS).

Please note that this display tool is created and maintained as a helpful aid for physicians and nonpractitioners

looking for a quick look-up and reference to the Physician Fee Schedule (PFS) payment rates. Users of

this display tool should note that the Centers for Medicare & Medicaid Services (CMS) make no warranties,

expressed or implied, regarding errors or omissions and assume no legal liability or responsibility for loss

or damage resulting from the use of information contained within. For the ofcial and denitive CMS PFS

payment les, please contact the local Medicare Administrative Contractor (MAC) in your payment jurisdiction.