2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

Paul A. Buse, CPCU, ARM

Real Insurance Solutions Consulting

May 2022

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 1 of 84

2021 Texas P&C Marketplace Summary

Premiums – Distribution – Line of Business Trends

Source: © A.M. Best Company — Used by Permission; US Census Bureau

You are being provided this summary of the Texas property and casualty (P-C

) insurance

marketplace as a benefit of your membership in the Independent Insurance Agents of Texas.

What follows is a graphic and numeric presentation of the Texas P-C industry data from an

independent agent’s perspective. This summary emphasizes direct premiums, direct losses and the

associated direct underwriting results before reinsurance. As independent agents, this is the

marketplace experience for the business we place (or compete against) for our clients in Texas.

Included in this summary is data from nearly 3,000 insurers that are domiciled in the United States.

Then, if they have written premiums in Texas, their data is included in this summary.

The summary starts with a

direct premium listing of all 32 lines of business reported by P-C insurers,

for all distribution styles in Texas. The presentation of data then focuses on the 26 lines of business

independent agents work with most. For these agent-focused lines of business, data is provided on

loss ratios, growth rates, penetration rates by the various distribution styles and commission rates. In

addition, and important to independent agents, a breakout of surplus lines activity is provided to

show trends, and utilization rates. United States national data is provided for comparison purposes.

For those readers interested in the details, a separate page is provided for each of the 26 lines of

business independent agents work with most. Five-year premiums are provided, loss and combined

ratios, penetration rates by distribution style and information on the numbers and largest insurers.

The lines of business are provided in alphabetical order, and the applicable line of business detail

page number is shown in the Table of Contents. On the product details pages, any line of business in

the Top 10 is highlighted with a small pie chart in the upper right-hand corner which shows its relative

position in the ranking of premiums written by independent agents, in Texas.

Last, appendices are provided for information on approaches taken to presenting the industry data,

definitions and additional information that may further interest the reader.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 2 of 84

Contents

2021 Texas P&C Marketplace Summary .................................................................................................................................................. 1

Premiums: All P-C Lines of Business – All Distribution Styles ................................................................................................. 3

Premiums: Top Agent Lines of Business ................................................................................................................................................. 5

Loss Ratios: Agent-Focused Lines of Business .................................................................................................................................. 7

Premium Growth Rates: Agent-Focused Lines of Business .................................................................................................... 9

Penetration: Top Agent-Focused Lines of Business .................................................................................................................... 11

Commissions: Top Agent-Focused Lines of Business ................................................................................................................13

Surplus Lines: Top Lines, Premiums and Utilization Rate ........................................................................................................ 14

Texas Lines of Business: Product Details ............................................................................................................................................. 16

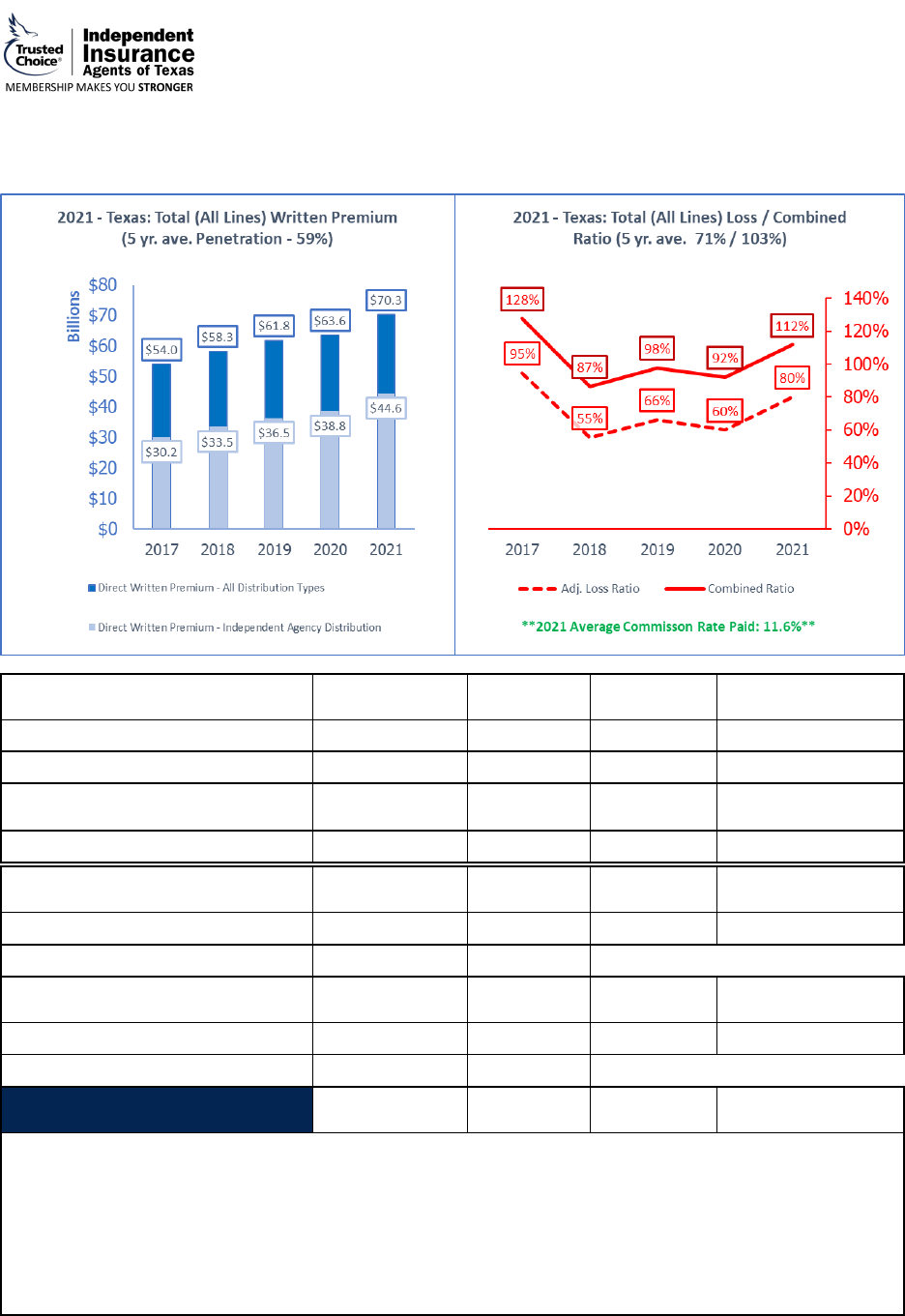

Total All P&C Lines of Business ....................................................................................................................................................................17

Aircraft (all perils) ................................................................................................................................................................................................... 19

Commercial Auto .................................................................................................................................................................................................... 21

All Private Passenger Auto ............................................................................................................................................................................. 23

Allied Perils Only .................................................................................................................................................................................................... 25

Boiler & Machinery ................................................................................................................................................................................................ 27

Burglary & Theft ...................................................................................................................................................................................................... 29

Commercial Multi-Peril ......................................................................................................................................................................................31

Earthquake ................................................................................................................................................................................................................. 33

Excess Workers’ Comp ..................................................................................................................................................................................... 35

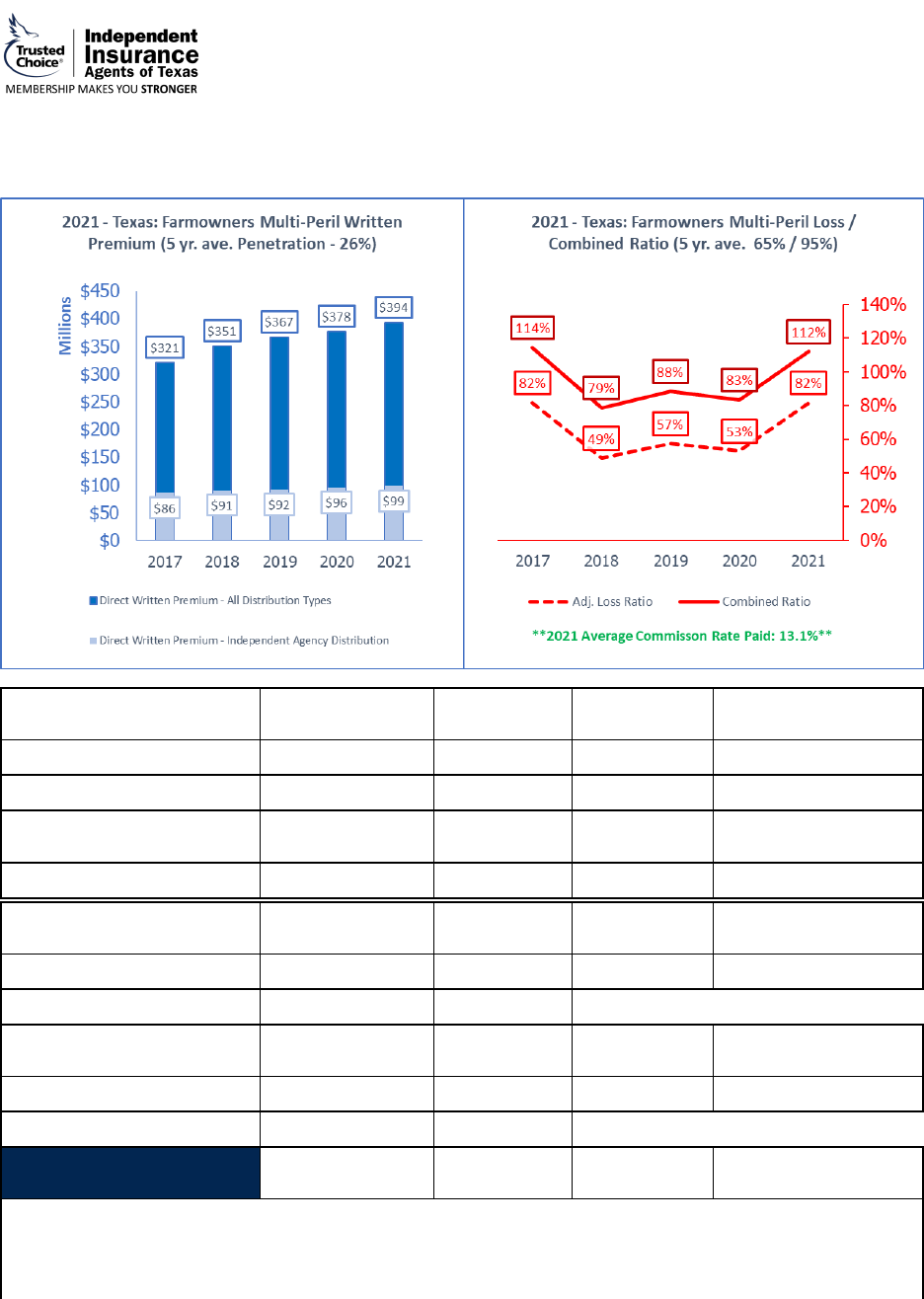

Farmowners Multi-Peril ..................................................................................................................................................................................... 37

Federal Flood ........................................................................................................................................................................................................... 39

Fire Peril Only ........................................................................................................................................................................................................... 43

Homeowners ............................................................................................................................................................................................................ 45

Inland Marine ............................................................................................................................................................................................................ 47

International ............................................................................................................................................................................................................... 49

Medical Malpractice ............................................................................................................................................................................................ 51

Multi-Peril Crop ....................................................................................................................................................................................................... 53

Ocean Marine............................................................................................................................................................................................................ 55

Other Liability (Claims-made) ....................................................................................................................................................................... 57

Other Liability (Occurrence) ........................................................................................................................................................................... 59

Private Crop ............................................................................................................................................................................................................... 61

Private Flood ............................................................................................................................................................................................................. 63

Products Liability .................................................................................................................................................................................................... 65

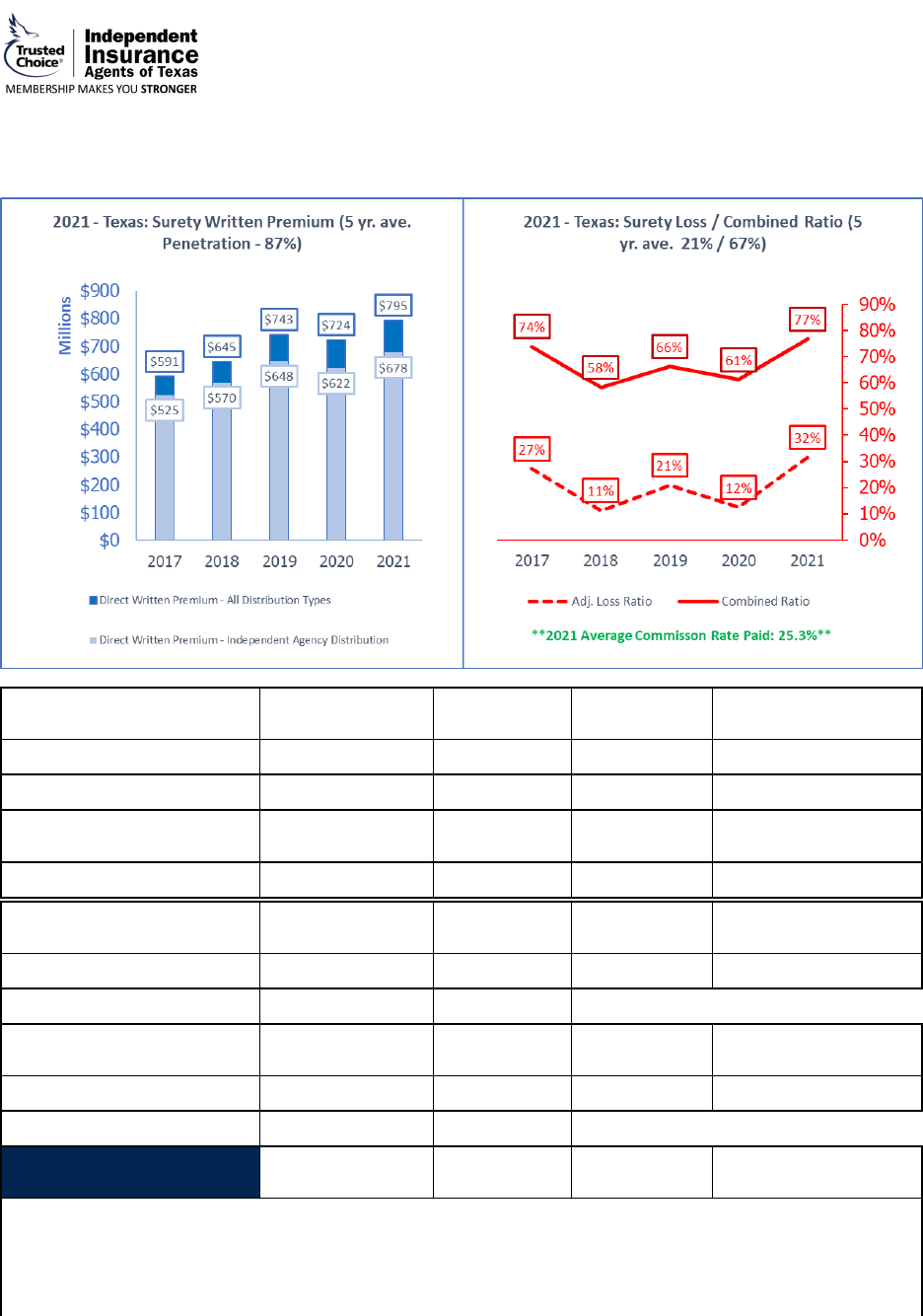

Surety ............................................................................................................................................................................................................................. 67

Workers Compensation ................................................................................................................................................................................... 69

Appendix #1: All Lines of Business-Additional Details ................................................................................................................71

Appendix #2: Distribution Style Classifications ................................................................................................................................ 73

Appendix #3: NAIC Line of Business Definitions ............................................................................................................................. 79

Appendix #4: Product Details Explanation .......................................................................................................................................... 82

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 3 of 84

Premiums: All P-C Lines of Business – All Distribution Styles

Source: © A.M. Best Company — used by permission.

Notes or Comments: The above chart shows all 32 lines of business that P-C insurers are required to

report on in their annual statement. The lines of business are listed in alphabetical order. The 26

agent-focused lines of business are emphasized above with an asterisk (*). These are the lines of

business that are included whenever a total is provided for Total (IA-Focused Lines) in the remainder

of this 2021 Texas P-C Marketplace Summary. The lines of business that are not included in Total (IA-

Focused Lines) are Accident & Health, Aggregate Write-ins, Credit, Financial Guaranty, Mortgage

Guaranty, and Warranty. These 6 lines of business are about 2.5% of all premiums in 2021.

Additional data on all 32 lines of business is provided in Appendix #1: All Lines of Business-Additional

Details.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 4 of 84

Texas Total Premiums Perspective

The previous page showed total premiums and premiums by line of business. To add perspective to

that, below are some standardized measures of total premiums for Texas compared to other states,

from data similar to the above.

In the below table, Total (All Lines) includes premiums for all 32 lines of business shown above,

including Credit. The combined premiums for Personal Lines is All Private Passenger Auto,

Homeowners Multi-Peril and Farmowners Multi-Peril. Commercial Lines is all other lines of business

except All Private Passenger Auto, Homeowners Multi-Peril, Farm owners Multi-Peril and Credit.

United

States

Smallest/Lowest

State

Largest/Highest

State Texas (Rank)

Total (All Lines)

Premiums

$785

Billion

$1.4 Billion

(Vermont-#51)

$97.3 Billion

(California-#1)

$70.3 Billion

(#2)

Total (All Lines) Per

Capita Premium

$2,369 $1,674 (Ohio-#51)

$3,839 (North

Dakota-#1)

$2,411 (#21)

Personal Lines Per

Capita Premium

$1,163

$835 (District of

Columbia-#51)

$1,621 (Florida-#1) $1,230 (#17)

Commercial Lines Per

Capita Premium

$1,186

$730 (West

Virginia-#51)

$2,647 (North

Dakota-#1)

$1,163 (#23)

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 5 of 84

Premiums: Top Agent Lines of Business

Source: © A.M. Best Company — used by permission.

Notes or Comments: The above pie charts show which lines of business are the most important to

independent agents based on direct written premium. The top 10 lines of business are shown in

each pie chart, with premium from all other lines of business combined in the “All Other” pie section.

The upper left pie chart shows the premiums for the top lines of business in order of premiums

written by independent agents in Texas. The upper right pie chart shows the same lines of business

but with all distribution styles included in premium totals for each line of business. The bottom two

pie charts are the same approach, but based on total United States independent agent distribution

and premiums.

In Appendix #2: Distribution Style Classifications, background is given on the classification of insurers

into distribution styles based on insurer reported marketing types.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 6 of 84

Top Line of Business Perspective

The United States overall, and most states individually, see Private Passenger Auto as the largest

premium line of business through independent agents. This is case in about 80% of the states, but

there are exceptions. Those exceptions are a handful of Midwest states, which have Multi-Peril Crop

as their highest premium line of business, followed by several states with Other Liability (Occurrence)

or Other Liability (Claims-Made), a few states with Workers’ Compensation, and finally one state with

Homeowners Multi-Peril.

There are consistencies in the highest premium generating lines of business. To get a sense for that,

in the table below are the lines that are present in at least one state’s Top 10, along with the percent

of states where that line of business is in the top 10. The percentages are approximate, as small

changes in premiums can result in variances, particularly in the last of the lines listed.

Line of Business

States With Product in Top 10

All Commercial Auto

100%

All Private Passenger Auto

100%

Commercial Multiple Peril

100%

Inland Marine

100%

Other Liability (Occurrence)

100%

Homeowners Multi-Peril

80% to 95%

Other Liability (Claims-made)

80% to 95%

Workers' Compensation

80% to 95%

Fire

80% to 95%

Multi-Peril Crop

45%

Allied Lines

35%

Medical Professional Liability

10%

Surety

10%

Farmowners Multi-Peril

10%

Accident & Health Lines

5%

Private Crop

5%

Earthquake

5%

Aircraft (all perils)

2%

Ocean Marine

2%

Warranty

2%

Source: © A.M. Best Company — used by permission

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 7 of 84

Loss Ratios: Agent-Focused Lines of Business

Source: © A.M. Best Company — used by permission. (International not shown as less than five years

data is available)

=

+

± ℎ

−

Notes or Comments: The above bar chart shows loss ratios for the 26 lines of business focused on

by independent agents. Loss ratios are calculated as “adjusted calendar year loss ratios” (see

algebraic formula above). For each line of business, the losses used in the ratio of losses to earned

premiums equals the paid losses that year, plus any estimates of future losses that will be paid from

claims that year (new reserves), plus any changes in reserves from previous years made that year

(prior reserves). The "adjusted" part is if dividends are paid out under a line of business, the loss ratio

is adjusted for that cost. When dividends paid out is a minor factor, the adjusted loss ratio and

unadjusted loss ratio are nearly the same. However, where dividends are a factor, it is important to

include them in the calculation whenever loss ratios of different lines of business are compared.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 8 of 84

Texas Loss Ratio Perspective

As can be seen in the above, loss ratios can vary in the short run from the long run. Loss ratios can

also vary by state. For added perspective on Texas’s loss ratios, below is a table of the 2021 Texas

loss ratios contrasted with the United States average loss ratios.

2021 Texas Loss Ratio

2021 United States Loss Ratio

Aircraft (all perils)

75% 54%

All Commercial Auto

80%

64%

All Private Passenger Auto

74%

69%

Allied Perils Only

144%

79%

Boiler & Machinery

157%

38%

Burglary & Theft

52%

52%

Commercial Multi-Peril

115%

61%

Earthquake

9%

3%

Excess Workers' Comp

115%

41%

Farm owners Multi-Peril

82%

65%

Federal Flood

5% 48%

Fidelity

32%

28%

Fire

103%

68%

Homeowners Multi-Peril

105%

69%

Inland Marine

59%

49%

Medical Malpractice

31%

55%

Multiperil Crop

94%

76%

Ocean Marine

46%

54%

Other Liability (Claims-made)

58%

56%

Other Liability (Occurrence)

64%

61%

Private Crop

110%

89%

Private Flood

8%

46%

Products Liability

46%

52%

Surety

32%

16%

Workers' Compensation (*)

43%

51%

Total (All Lines)

80%

63%

Source: © A.M. Best Company — used by permission (*Individual state experience for workers’

compensation in North Dakota, Ohio, Washington and Wyoming is not used for highlights as these are

monopolistic fund states and premiums are small and loss ratios can vary widely. Also International is

not shown due to limited data.)

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 9 of 84

Premium Growth Rates: Agent-Focused Lines of Business

Source: © A.M. Best Company — used by permission. (International not shown, as less than 5 years data

is available)

Notes or Co

mments: The above bar chart shows the percentage change in direct written premiums

for the 26 lines of business focused on by independent agents. The 1-year percentage is the

percentage change in premiums from 2020 to 2021. The 5-year growth rate is the constant

percentage from the first year to the last year to exactly equal the direct written premium in 2021,

when applied for the 4 previous annual periods on a compounded basis. The Total (IA-Focused

Lines) shown last is the average growth rates for the 26 lines of business focused on by independent

agents.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 10 of 84

Texas Growth Rate Perspective

Premium growth rates can vary considerably by line of business. They can also vary considerably by

state. To provide perspective on Texas growth rates, below is the 1-year growth rates by line of

business in Texas contrasted with average growth rates in United States.

Texas 1-Year Growth

United States 1-Year Growth

Aircraft (all perils) 15% 14%

All Commercial Auto

21%

17%

All Private Passenger Auto

5%

5%

Allied Perils Only

14%

12%

Boiler & Machinery

10%

11%

Burglary & Theft

6%

7%

Commercial Multi-Peril

12%

8%

Earthquake

6%

11%

Excess Workers' Comp

-22%

2%

Farmowners Multi-Peril

4%

5%

Federal Flood 6% 1%

Fidelity

4%

7%

Fire Peril Only

16%

13%

Homeowners Multi-Peril

10%

8%

Inland Marine

13%

15%

Medical Malpractice

14%

10%

Multi-Peril Crop

30%

37%

Ocean Marine

21%

13%

Other Liability (Claims-made)

26%

31%

Other Liability (Occurrence)

20%

16%

Private Crop

33%

14%

Private Flood

60%

45%

Products Liability

1%

4%

Surety

10%

7%

Workers' Compensation

0%

3%

Total (IA-Focused Lines)

11%

10%

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 11 of 84

Penetration: Top Agent-Focused Lines of Business

Source: © A.M. Best Company — used by permission.

=

Notes or Comments: The clustered bar chart above shows independent agent penetration trends

for the top lines of business. Shown are the top 10 lines of business in order of direct written

premium written through independent agents. The percentages above are calculated based on

premiums through independent agents, divided by all premiums for each line of business. The 1-

year and 5-year average penetration is available for the 26 lines of business focused on by

independent agents in the Lines of Business: Product Details section later in this Summary. The trend

for all 26 lines of business focused on by independent agents is provided last.

Information on classification of insurers into distribution styles is in Appendix #2: Distribution Style

Classifications.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 12 of 84

Texas Penetration Rate Perspective

Independent agent penetrations vary by line of business but also by state. To give perspective on

Texas’s penetrations rates, below is a table of the line of business penetration rates in Texas

contrasted with the average penetration in all the United States.

Texas Penetration

United States Average

Aircraft (all perils)

98%

95%

All Commercial Auto

87%

85%

All Private Passenger Auto

39%

32%

Allied Perils Only

84%

86%

Boiler & Machinery

93%

93%

Burglary & Theft

92%

96%

Commercial Multi-Peril

84%

84%

Earthquake

93%

87%

Excess Workers' Comp

99%

94%

Farm owners Multi-Peril

25%

40%

Federal Flood

67%

78%

Fidelity

90%

91%

Fire Peril Only

91%

88%

Homeowners Multi-Peril

48%

49%

Inland Marine

83%

77%

Medical Malpractice

85%

75%

Multi-Peril Crop

96%

96%

Ocean Marine

94%

96%

Other Liability (Claims-made)

93%

92%

Other Liability (Occurrence)

88%

86%

Private Crop

99%

96%

Private Flood

83%

84%

Products Liability

94%

94%

Surety

85%

86%

Workers' Compensation

94%

90%

Total (IA-Focused Lines)

64%

62%

Source: © A.M. Best Company — used by permission. (International not shown less than 5 years data is

available)

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 13 of 84

Commissions: Top Agent-Focused Lines of Business

Source: © A.M. Best Company — used by permission.

% =

Notes or Comments: The above bar chart shows the commission rate paid by all insurers for 26

independent agent-focused lines of business in alphabetical order. Shown last, Total (All Lines) is the

average commission paid on all lines of business.

The formula shows how comm

ission percentages are calculated, where the Commission % equals

the line of business direct and contingent commissions divided by the line of business written

premium.

Commission rates are based on a page in insurer annual reports called “Exhibit of Premiums and

Losses (Statutory Page 14)” or the “State’s Page”. On this State’s Page insurers are required to break-

out all lines of business by state and provide data on each line of business for direct written

premiums, direct earned premiums, direct incurred losses, and commissions and brokerage

expenses. The reader should note that the insurer annual report’s instructions tell insurers to include

contingent commissions.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 14 of 84

Surplus Lines: Top Lines, Premiums and Utilization Rate

Source: © A.M. Best Company — used by permission

Notes or Comments:

In all the preceding charts and tables, surplus lines premiums are combined with admitted insurance

premiums. In the above pie and bar charts, the surplus lines premiums are shown separately. The

pie chart shows the lines of business where surplus lines has the most premiums in Texas. Also

provided are total direct written premiums in surplus lines, and the percentage those total direct

written premiums are to all direct written premiums.

Readers should note the pie chart and bar chart/line chart above are premiums for insurers

domiciled in one of the 51 states or Washington, DC and writing surplus lines insurance. The

premiums of these insurers are identified by their licensed status. Also, the above data does not

include alien insurers (that is, insurers not domiciled in one of the 51 states). If alien premiums were

included, it would increase the amount of surplus lines premiums by approximately an additional

10%. An example of an alien surplus lines insurer is Lloyds of London. Alien insurer data is not

included, as it is not tracked as consistently across states nor in the same time-frame.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 15 of 84

Texas Surplus Lines Perspective

The need for surplus lines varies widely by line of business and from state-to-state. Below are the

line of business utilization rates for Texas contrasted with the average utilization with those lines of

business in the United States.

Line of Business

Texas Surplus Lines

Usage Rate

United States Surplus Lines

Usage Rate

Aircraft(all perils)

0.3%

2.1%

All Commercial Auto

9.2%

6.3%

All Private Passenger Auto

0.0%

0.2%

Allied Perils Only

36.0%

29.8%

Boiler & Machinery

8.7%

7.4%

Burglary & Theft

13.4%

19.8%

Commercial Multi-Peril

18.9% 8.7%

Earthquake

56.8%

44.5%

Excess Workers' Comp

13.3%

0.5%

Farmowners Multi-Peril

0.1%

0.4%

Federal Flood

0.5%

2.4%

Fidelity

2.8%

2.2%

Financial Guaranty

0.0%

0.0%

Fire Peril Only

35.3%

33.1%

Homeowners Multi-Peril

1.1%

2.3%

Inland Marine

5.1%

6.1%

International

100.0% 90.8%

Medical Malpractice

40.5%

24.4%

Multi-Peril Crop

0.0%

0.0%

Ocean Marine

2.4%

3.3%

Other Liability (Claims-made)

32.6%

34.9%

Other Liability (Occurrence)

39.7%

29.6%

Private Crop

0.0%

0.1%

Private Flood

47.5%

41.0%

Products Liability

49.3%

45.4%

Surety

0.9%

0.5%

Workers' Compensation

0.0% 0.5%

Total (All Lines)

9.8%

8.3%

Source: © A.M. Best Company — used by permission

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 16 of 84

Texas Lines of Business: Product Details

The following pages provide more in-depth detail on the 26 lines of business that independent

agents in Texas focus on. The first line of business provided is a summary for all lines combined, the

Total All P-C Lines of Business page. Then, the 26 lines of business detail pages are presented in

alphabetical order.

The details provided for each major line of business in Texas are:

• A summary bar chart of 5-years data on premiums for all distribution types (dark blue), and

premiums written through independent agents (light blue). For the premium chart the

classification of premiums through independent agents is based on a categorization of

agents by distribution style. The categorization approach is explained in Appendix #2:

Distribution Style Classifications.

• 5-year average line charts, showing the Loss ratio (dashed red line) and combined ratio (solid

red line) are provided.

• The direct written premium for independent agents, exclusive-captive agents, and direct

agents is provided with the percentage of the total. Surplus Lines premiums through any

distribution style is provided with its corresponding percentage of all premiums.

• The number of active insurers is provided with the number of independent agents, exclusive-

captive agent and direct insurers provided for each line of business. The number of active

surplus lines insurers is also provided.

• 1-year and 5-year growth rates are provided for independent agent, exclusive-captive and

direct insurers. The percentage premiums through insurers licensed as surplus lines is also

provided.

• Top Insurers: The top 5 insurer groups in each line of business is provided with that group’s

premiums, 1-year loss ratio, and 1-year growth rate. Groups of insurers sometimes are made

up of multiple policy-issuing insurers in a particular group but it can also be only one policy-

issuing insurer in that group. After the top groups, listed are the top policy-issuing insurers

distributing insurance through independent agents, captive-exclusive agents, direct insurers,

surplus lines insurers and the top risk retention group (if any) for the line of business. For each

policy-issuing insurer the premium for the insurer in that line of business is shown with the 1-

year loss ratio and 1-year growth rate.

As you scroll through the following lines of business pages take notice if a small pie chart thumbnail

is presented at the upper-right. If there is a pie chart present, that means the product is in the top 10

lines of business for independent agents in Texas. The broken-out pie slice in that small pie chart

represents the position of that line of business, and its rank-order based on independent agent

premium volume. The rank-order is based on direct written premium and corresponds to the pie

chart slice highlighted on Page 4 of this 2021 Texas P-C Marketplace Summary. If a line of business is

in the top 10 for a state but not a line of business generally focused on by independent agents it has

been added.

For further clarification on lines of business, Appendix #3: NAIC Line of Business Definitions is provided

for the reader. And, a visual guide to the data and calculations in the product details is provided in

Appendix #4: Product Details Explanation.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 17 of 84

Total All P&C Lines of Business

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$70,294,561,000

$44,607,214,000

$14,699,921,000

$9,627,505,000

$6,871,859,000

Loss Ratio and Combined Ratio Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

63%

21%

14%

9.8%

Active Affiliated and Unaffiliated Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

1,049

760

62

134

145

1-Year / 5-Year Premium Growth: All Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

11% / 7%

15% / 10%

5% / 1%

3% / 3%

26% / 18%

Top 5 Groups or Unaffiliated Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

State Farm Group (G)

$6,046,496,000

78%

7%

N/A

Progressive Insurance Group (G)

$5,526,220,000

72%

18%

N/A

Allstate Insurance Group (G)

$4,667,987,000

83%

2%

N/A

Berkshire Hathaway Insurance Group (G)

$4,334,053,000

79%

15%

N/A

Liberty Mutual Insurance Companies (G)

$3,832,271,000

78%

9%

N/A

Total or Average

$70,268,515,000

80%

11%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 18 of 84

Top 10 Pure Independent Agent-Broker Policy-

Issuing Insurers

Liberty County Mutual Insurance Company $1,055,376,000 61% 3%

Liberty Mutual Insurance

Companies

Allstate Vehicle and Property Ins Co

$1,044,787,000

107%

15%

Allstate Insurance Group

Texas Mutual Insurance Company

$923,449,000

48%

0%

...

Continental Casualty Company

$764,478,000

71%

5%

CNA Insurance Companies

National Union Fire Ins Co Pittsburgh PA

$534,666,000

35%

30%

American International Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Consumers County Mutual Insurance Co

$517,162,000

64%

6%

...

Home State County Mutual Insurance Co

$438,396,000

74%

16%

Home State Insurance Group

Redpoint County Mutual Insurance Company

$383,961,000

72%

39%

...

Top 3 Captive-Exclusive Policy-Issuing Insurers

State Farm Mutual Automobile Ins Co

$3,364,776,000

79%

5%

State Farm Group

State Farm Lloyds

$2,344,454,000

79%

11%

State Farm Group

Allstate Fire and Casualty Insurance Co

$2,199,057,000

79%

4%

Allstate Insurance Group

Top 3 Direct Policy-Issuing Insurers

GEICO County Mutual Insurance Company $2,525,107,000 86% 7%

Berkshire Hathaway Insurance

Group

United Services Automobile Association

$1,155,253,000

104%

2%

USAA Group

USAA Casualty Insurance Company

$1,014,404,000

90%

3%

USAA Group

Top 3 Surplus Lines Policy Issuing Insurers

National Fire & Marine Insurance Co $307,374,000 68% 24%

Berkshire Hathaway Insurance

Group

Lexington Insurance Company

$279,333,000

139%

30%

American International Group

Scottsdale Insurance Company

$276,018,000

72%

14%

Nationwide Group

Top Individual RRG

Attorneys' Liab Assr Society Ltd., A RRG

$21,702,000

-10%

-3%

...

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 19 of 84

Aircraft (all perils)

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$254,888,000

$249,447,000

$2,739,000

$2,701,000

$656,000

Loss Ratio and Combined Ratio Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

98%

1%

1%

0.3%

Active Affiliated and Unaffiliated Insurers

IA+MGA+IA-Mixed Insurers

Exclusive Insurers

Direct Insurers

Surplus Lines Insurers

32

29

1

1

4

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr: Exclusive 1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

15% / 10%

17% / 11%

15% / 18%

-57% / -25%

-91% / -51%

Top 5 Groups or Unaffiliated Single(s) 2021 DPW 2021 Adj. Loss Ratio

2020-2021 Growth

Rate Group Name or ALL L.O.B. DPW

Starr International Group (G)

$48,429,000

79%

22%

N/A

Allianz US PC Insurance Companies (G)

$33,612,000

62%

53%

N/A

American International Group (G)

$28,491,000

35%

19%

N/A

Chubb INA Group (G)

$21,664,000

4%

30%

N/A

Sompo Holdings US Group (G)

$20,152,000

134%

7%

N/A

Total or Average

$254,887,000

74%

15%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 20 of 84

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Starr Indemnity & Liability Company

$47,991,000

83%

46%

Starr International Group

Allianz Global Risks US Insurance Co $33,612,000 62% 53%

Allianz US PC Insurance

Companies

National Union Fire Ins Co Pittsburgh PA

$27,575,000

44%

17%

American International Group

Endurance American Insurance Company

$20,152,000

134%

7%

Sompo Holdings US Group

ACE American Insurance Company

$19,900,000

0%

30%

Chubb INA Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

U.S. Specialty Insurance Company

$6,407,000

31%

7%

Tokio Marine US PC Group

Harco National Insurance Company

$3,376,000

15%

43%

IAT Insurance Group

Houston Casualty Company

$915,000

10%

351%

Tokio Marine US PC Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

American National Property & Casualty Co $2,739,000 33% 15%

American National Prop & Cas

Group

Top 3 Direct Policy-Issuing Insurers

Avemco Insurance Company

$2,783,000

50%

19%

Tokio Marine US PC Group

Top 3 Surplus Lines Policy Issuing Insurers

Starr Surplus Lines Insurance Company

$438,000

-100%

-93%

Starr International Group

National Fire & Marine Insurance Co $209,000 -5% 41%

Berkshire Hathaway Insurance

Group

Prime Insurance Company

$8,000

0%

Prime Insurance Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 21 of 84

Commercial Auto

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$5,884,764,000

$5,094,004,000

$434,191,000

$287,146,000

$543,026,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

87%

7%

5%

9.2%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

413

333

28

35

72

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

21% / 14%

23% / 16%

16% / 7%

4% / 6%

43% / 35%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Progressive Insurance Group (G)

$1,310,589,000

78%

48%

N/A

Berkshire Hathaway Insurance

Group (G) $287,268,000 60% 59% N/A

Liberty Mutual Insurance Companies

(G) $274,128,000 69% 7% N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 22 of 84

Travelers Group (G)

$243,135,000

63%

0%

N/A

Old Republic Insurance Group (G)

$186,068,000

70%

0%

N/A

Total or Average

$5,883,769,000

79%

21%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

United Wisconsin Insurance

Company $107,458,000 103% 5% AF Group

National Liability & Fire Insurance Co $102,190,000 46% 38%

Berkshire Hathaway

Insurance Group

National Union Fire Ins Co Pittsburgh

PA $94,636,000 86% 35% American International Group

Infinity County Mutual Insurance Co

$90,400,000

69%

37%

Kemper PC Companies

State Automobile Mutual Insurance

Co $85,210,000 79% 86%

Liberty Mutual Insurance

Companies

Top 3 MGA/Wholesale Policy-Issuing Insurers

Trisura Specialty Insurance

Company $145,328,000 67% 9% Trisura US Insurance Group

Clear Blue Insurance Company

$111,503,000

72%

7%

Clear Blue Insurance Group

United Specialty Insurance Company

$87,392,000

35%

131%

Markel Corporation Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

State Farm Mutual Automobile Ins

Co $113,492,000 78% 17% State Farm Group

Sentry Select Insurance Company

$60,175,000

71%

35%

Sentry Insurance Group

Allstate County Mutual Insurance

Company $50,145,000 83% 5% Allstate Insurance Group

Top 3 Direct Policy-Issuing Insurers

Liberty Mutual Fire Insurance

Company $87,441,000 72% -7%

Liberty Mutual Insurance

Companies

Motors Insurance Corporation

$41,320,000

24%

-28%

Ally Insurance Group

Nationwide Agribusiness Insurance

Co $21,948,000 93% 2% Nationwide Group

Top 3 Surplus Lines Policy Issuing Insurers

Trisura Specialty Insurance

Company $145,328,000 67% 9% Trisura US Insurance Group

United Specialty Insurance Company

$87,392,000

35%

131%

Markel Corporation Group

National Fire & Marine Insurance Co $38,112,000 50% 52%

Berkshire Hathaway

Insurance Group

Top Individual RRG

Alpine Transportation Ins RRG, Inc.

$11,577,000

79%

-19%

...

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 23 of 84

All Private Passenger Auto

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$23,624,573,000

$9,299,684,000

$8,139,356,000

$5,801,600,000

$34,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

39%

34%

25%

0.0%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

174

115

22

35

1

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

5% / 3%

11% / 7%

2% / 0%

1% / 3%

-97% / -64%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Progressive Insurance Group (G)

$3,795,014,000

69%

11%

N/A

State Farm Group (G)

$3,357,022,000

78%

4%

N/A

Berkshire Hathaway Insurance

Group (G) $3,254,007,000 81% 11% N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 24 of 84

Allstate Insurance Group (G)

$2,750,562,000

74%

-1%

N/A

USAA Group (G)

$1,995,113,000

83%

-1%

N/A

Total or Average

$23,624,568,000

74%

5%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Liberty County Mutual Insurance

Company $1,055,376,000 61% 3%

Liberty Mutual Insurance

Companies

Foremost County Mutual Insurance

Company $290,185,000 64% 5% Farmers Insurance Group

Infinity County Mutual Insurance Co

$258,827,000

84%

20%

Kemper PC Companies

American Access Casualty Company

$229,900,000

90%

6%

Kemper PC Companies

Germania Select Insurance

Company $212,421,000 70% 12% Germania Mutual Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Consumers County Mutual Insurance

Co $517,161,000 64% 6% ...

Home State County Mutual

Insurance Co $426,518,000 73% 17% Home State Insurance Group

Redpoint County Mutual Insurance

Company $341,358,000 76% 48% ...

Top 3 Captive-Exclusive Policy-Issuing Insurers

State Farm Mutual Automobile Ins

Co $3,155,335,000 79% 4% State Farm Group

Allstate Fire and Casualty Insurance

Co $2,102,374,000 79% 4% Allstate Insurance Group

Farmers Texas County Mutual

Insurance Co $1,361,407,000 62% 2% Farmers Insurance Group

Top 3 Direct Policy-Issuing Insurers

GEICO County Mutual Insurance

Company $2,524,458,000 86% 7%

Berkshire Hathaway

Insurance Group

United Services Automobile

Association $626,448,000 89% -2% USAA Group

USAA Casualty Insurance Company

$583,828,000

81%

-1%

USAA Group

Top 3 Surplus Lines Policy Issuing Insurers

Fortegra Specialty Insurance

Company $35,000 50%

Fortegra P&C Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 25 of 84

Allied Perils Only

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$2,259,480,000

$1,902,051,000

$124,892,000

$177,395,000

$813,045,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

84%

6%

8%

36.0%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

320

266

20

20

78

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

14% / 15%

16% / 18%

9% / 4%

3% / 3%

22% / 21%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Travelers Group (G)

$129,818,000

220%

23%

N/A

Liberty Mutual Insurance Companies

(G) $126,918,000 39% 27% N/A

FM Global Group (G)

$126,691,000

224%

19%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 26 of 84

Chubb INA Group (G)

$125,178,000

121%

39%

N/A

Zurich Insurance US PC Group (G)

$124,443,000

281%

16%

N/A

Total or Average

$2,258,663,000

144%

14%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Foremost Lloyds of Texas

$90,620,000

71%

20%

Farmers Insurance Group

Travelers Lloyds Insurance

Company $86,829,000 243% 24% Travelers Group

Westchester Surplus Lines

Insurance Co $80,083,000 133% 14% Chubb INA Group

Landmark American Insurance

Company $67,314,000 177% 21% Alleghany Corporation Group

National Fire & Marine Insurance Co $60,723,000 78% 34%

Berkshire Hathaway

Insurance Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Ranchers & Farmers Mutual

Insurance Co $26,025,000 64% -8% ...

GuideOne National Insurance

Company $25,145,000 78% 72%

GuideOne Insurance

Companies

Transverse Specialty Insurance

Company $22,871,000 71% 6810% Transverse Insurance Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Texas Farm Bureau Underwriters

$40,152,000

80%

14%

Texas Farm Bureau Group

Fire Insurance Exchange

$24,272,000

84%

-10%

Farmers Insurance Group

Federated Mutual Insurance

Company $15,904,000 85% 17% Federated Mutual Group

Top 3 Direct Policy-Issuing Insurers

American Security Insurance

Company $71,921,000 80% 10% Assurant P&C Group

United Services Automobile

Association $32,911,000 115% -5% USAA Group

Westport Insurance Corporation

$25,760,000

174%

-1%

Swiss Reinsurance Group

Top 3 Surplus Lines Policy Issuing Insurers

Westchester Surplus Lines

Insurance Co $80,083,000 133% 14% Chubb INA Group

Landmark American Insurance

Company $67,314,000 177% 21% Alleghany Corporation Group

National Fire & Marine Insurance Co $60,723,000 78% 34%

Berkshire Hathaway

Insurance Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 27 of 84

Boiler & Machinery

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$175,830,000

$162,969,000

$3,879,000

$8,634,000

$15,366,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct

Penetration

Surplus Lines Utilization

100%

93%

2%

5%

8.7%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive

Insurers

Direct Insurers Surplus Lines Insurers

196

172

10

8

46

1-Year / 5-Year Premium Growth:

All Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

10% / 10%

9% / 10%

18% / 8%

24% / 9%

18% / 15%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021

Growth Rate Group Name or ALL L.O.B. DPW

FM Global Group (G)

$56,950,000

349%

-6%

N/A

American International Group (G)

$21,482,000

120%

25%

N/A

Zurich Insurance US PC Group (G)

$14,886,000

5%

88%

N/A

Travelers Group (G)

$13,760,000

18%

2%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 28 of 84

Chubb INA Group (G)

$9,716,000

99%

13%

N/A

Total or Average

$175,827,000

157%

10%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

National Union Fire Ins Co

Pittsburgh PA $15,532,000 149% 24% American International Group

Travelers Property Casualty Co of

Amer $9,903,000 15% -3% Travelers Group

Hartford Steam Boiler Inspec & Ins $4,979,000 36% 54%

Munich-American Holding Corp

Companies

Federal Insurance Company

$4,936,000

34%

6%

Chubb INA Group

XL Insurance America, Inc.

$4,702,000

-33%

-14%

XL Reinsurance America Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Colony Insurance Company

$164,000

-100%

26%

Argo Group

Benchmark Insurance Company

$144,000

0%

106%

Benchmark Insurance Group

Houston Casualty Company

$117,000

160%

-26%

Tokio Marine US PC Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Federated Mutual Insurance

Company $1,856,000 21% 24% Federated Mutual Group

Nationwide Mutual Insurance

Company $501,000 36% 12% Nationwide Group

Allstate Insurance Company

$450,000

30%

-7%

Allstate Insurance Group

Top 3 Direct Policy-Issuing Insurers

Liberty Mutual Fire Insurance

Company $4,288,000 47% 26%

Liberty Mutual Insurance

Companies

Westport Insurance Corporation

$2,510,000

14%

4%

Swiss Reinsurance Group

Nationwide Agribusiness Insurance

Co $696,000 44% 181% Nationwide Group

Top 3 Surplus Lines Policy Issuing Insurers

Interstate Fire & Casualty Company $2,675,000 506% 53%

Allianz US PC Insurance

Companies

Lexington Insurance Company

$2,628,000

9%

20%

American International Group

AIG Specialty Insurance Company

$1,530,000

17%

15%

American International Group

Top Individual RRG

ARISE Boiler Inspection & Insurance

RRG $53,000 1% 10% ...

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 29 of 84

Burglary & Theft

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$51,462,000

$47,543,000

$3,881,000

$20,000

$6,889,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

92%

8%

0%

13.4%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

132

119

7

4

21

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

6% / 18%

6% / 22%

-4% / -4%

82% / -10%

141% / 41%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Ranchers & Farmers Mutual

Insurance Co $12,754,000 62% -8% N/A

Zurich Insurance US PC Group (G)

$5,280,000

20%

93%

N/A

Travelers Group (G)

$4,749,000

121%

-38%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 30 of 84

Hiscox Insurance Company Inc.

$3,958,000

128%

21%

N/A

Kemper PC Companies (G)

$3,771,000

3%

-3%

N/A

Total or Average

$51,474,000

52%

6%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Travelers Casualty and Surety Co of

Amer $4,676,000 123% -38% Travelers Group

Steadfast Insurance Company $4,468,000 31% 185%

Zurich Insurance US PC

Group

Beazley Insurance Company, Inc. $3,440,000 101% 21%

Beazley USA Insurance

Group

XL Specialty Insurance Company $3,410,000 50% 47%

XL Reinsurance America

Group

Federal Insurance Company

$2,500,000

-12%

3%

Chubb INA Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Ranchers & Farmers Mutual

Insurance Co $12,754,000 62% -8% ...

U.S. Specialty Insurance Company

$671,000

-100%

-1%

Tokio Marine US PC Group

Harco National Insurance Company

$45,000

918%

-15%

IAT Insurance Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Capitol County Mutual Fire Insurance

Co $3,771,000 3% -3% Kemper PC Companies

Federated Mutual Insurance

Company $50,000 46% -21% Federated Mutual Group

Sentry Select Insurance Company

$23,000

575%

-15%

Sentry Insurance Group

Top 3 Direct Policy-Issuing Insurers

Federated Rural Electric Ins

Exchange $15,000 0% 67% ...

Crestbrook Insurance Company

$2,000

8%

Nationwide Group

Top 3 Surplus Lines Policy Issuing Insurers

Steadfast Insurance Company $4,468,000 31% 185%

Zurich Insurance US PC

Group

National Fire & Marine Insurance Co $702,000 12% 159%

Berkshire Hathaway

Insurance Group

Columbia Casualty Company

$360,000

48%

65%

CNA Insurance Companies

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 31 of 84

Commercial Multi-Peril

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$3,699,096,000

$3,101,841,000

$457,196,000

$117,991,000

$699,545,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

84%

12%

3%

18.9%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

326

280

21

18

69

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

12% / 8%

13% / 9%

13% / 5%

21% / 7%

11% / 15%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Travelers Group (G)

$286,549,000

113%

13%

N/A

Hartford Insurance Group (G)

$273,915,000

113%

11%

N/A

Chubb INA Group (G)

$252,669,000

110%

28%

N/A

Nationwide Group (G)

$239,957,000

135%

17%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 32 of 84

Liberty Mutual Insurance Companies

(G) $235,893,000 89% 11% N/A

Total or Average

$3,699,097,000

115%

12%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Philadelphia Indemnity Insurance

Company $127,972,000 136% 8% Tokio Marine US PC Group

ACE American Insurance Company

$126,145,000

115%

44%

Chubb INA Group

Ohio Security Insurance Company $103,604,000 66% 5%

Liberty Mutual Insurance

Companies

Third Coast Insurance Company

$103,015,000

239%

-17%

AF Group

Hartford Fire Insurance Company

$65,000,000

127%

6%

Hartford Insurance Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Independent Specialty Insurance

Company $44,487,000 41% 87% Markel Corporation Group

United Specialty Insurance Company

$28,128,000

162%

-342%

Markel Corporation Group

Western World Insurance Company

$19,420,000

87%

-3%

American International Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

State Farm Lloyds

$125,799,000

106%

14%

State Farm Group

Allstate Indemnity Company

$97,612,000

91%

8%

Allstate Insurance Group

Mid-Century Insurance Company

$75,990,000

157%

22%

Farmers Insurance Group

Top 3 Direct Policy-Issuing Insurers

Allied Insurance Company of

America $28,153,000 122% 57% Nationwide Group

Liberty Surplus Insurance

Corporation $23,368,000 79% 7%

Liberty Mutual Insurance

Companies

National General Insurance

Company $19,123,000 48% 25% Allstate Insurance Group

Top 3 Surplus Lines Policy Issuing Insurers

Third Coast Insurance Company

$103,015,000

239%

-17%

AF Group

Scottsdale Insurance Company

$64,825,000

75%

24%

Nationwide Group

Steadfast Insurance Company $52,775,000 127% 6%

Zurich Insurance US PC

Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 33 of 84

Earthquake

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$50,991,000

$47,449,000

$960,000

$2,534,000

$28,955,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

93%

2%

5%

56.8%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

150

125

11

12

41

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

6% / 18%

6% / 20%

-10% / 2%

12% / -2%

0% / 18%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

American International Group (G)

$5,522,000

-17%

25%

N/A

Allianz US PC Insurance Companies

(G) $5,277,000 3% 87% N/A

Chubb INA Group (G)

$5,242,000

0%

23%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 34 of 84

Sompo Holdings US Group (G)

$5,200,000

-5%

-29%

N/A

Berkshire Hathaway Insurance

Group (G) $3,918,000 1% 28% N/A

Total or Average

$50,998,000

9%

6%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Endurance American Specialty Ins

Co $5,182,000 -5% -28% Sompo Holdings US Group

Lexington Insurance Company

$3,970,000

-22%

34%

American International Group

Allianz Global Risks US Insurance Co $3,726,000 4% 48%

Allianz US PC Insurance

Companies

National Fire & Marine Insurance Co $3,415,000 0% 40%

Berkshire Hathaway

Insurance Group

Westchester Surplus Lines

Insurance Co $3,071,000 1% 21% Chubb INA Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Houston Casualty Company

$1,455,000

155%

-9%

Tokio Marine US PC Group

Evanston Insurance Company

$1,439,000

27%

-37%

Markel Corporation Group

Hallmark Specialty Insurance

Company $673,000 -60% -19% Hallmark Insurance Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

State Farm Lloyds

$726,000

0%

9%

State Farm Group

Federated Service Insurance

Company $80,000 0% -36% Federated Mutual Group

Texas Farmers Insurance Company

$62,000

0%

-3%

Farmers Insurance Group

Top 3 Direct Policy-Issuing Insurers

United Services Automobile

Association $781,000 1% 7% USAA Group

Liberty Mutual Fire Insurance

Company $501,000 0% 44%

Liberty Mutual Insurance

Companies

USAA Casualty Insurance Company

$410,000

0%

7%

USAA Group

Top 3 Surplus Lines Policy Issuing Insurers

Endurance American Specialty Ins

Co $5,182,000 -5% -28% Sompo Holdings US Group

Lexington Insurance Company

$3,970,000

-22%

34%

American International Group

National Fire & Marine Insurance Co $3,415,000 0% 40%

Berkshire Hathaway

Insurance Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 35 of 84

Excess Workers’ Comp

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$32,131,000

$31,709,000

$0

$422,000

$4,284,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

99%

0%

1%

13.3%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

13

12

0

1

2

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

-22% / -5%

-25% / -5%

#DIV/0!

-147% / -24%

-6% / -19%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Tokio Marine US PC Group (G)

$14,209,000

102%

4%

N/A

W. R. Berkley Insurance Group (G)

$11,264,000

62%

22%

N/A

Chubb INA Group (G)

$7,388,000

137%

-17%

N/A

AmeriTrust Group (G)

$1,901,000

88%

8%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 36 of 84

Zurich Insurance US PC Group (G)

$1,186,000

-27%

234%

N/A

Total or Average

$32,131,000

128%

-22%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Safety National Casualty Corporation

$14,209,000

102%

4%

Tokio Marine US PC Group

Midwest Employers Casualty

Company $11,264,000 62% 22%

W. R. Berkley Insurance

Group

Illinois Union Insurance Company

$3,884,000

117%

-8%

Chubb INA Group

ACE American Insurance Company

$3,504,000

156%

-25%

Chubb INA Group

Star Insurance Company

$1,901,000

88%

8%

AmeriTrust Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

State National Insurance Company,

Inc. $3,000 1000% -91% Markel Corporation Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Top 3 Direct Policy-Issuing Insurers

Liberty Mutual Fire Insurance

Company $452,000 56%

Liberty Mutual Insurance

Companies

Top 3 Surplus Lines Policy Issuing Insurers

Illinois Union Insurance Company

$3,884,000

117%

-8%

Chubb INA Group

Steadfast Insurance Company $417,000 -60% 97%

Zurich Insurance US PC

Group

Accelerant Specialty Insurance

Company $0 0%

Accelerant US Holdings

Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 37 of 84

Farmowners Multi-Peril

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$393,575,000

$98,718,000

$265,628,000

$29,151,000

$273,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

25%

67%

7%

0.1%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive Insurers Direct Insurers Surplus Lines Insurers

33

28

2

2

2

1-Year / 5-Year Premium Growth: All

Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

4% / 5%

2% / 3%

4% / 5%

16% / 14%

-92% / -16%

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate

Group Name or ALL L.O.B.

DPW

Texas Farm Bureau Group (G)

$224,218,000

88%

4%

N/A

State Farm Group (G)

$41,410,000

68%

4%

N/A

Travelers Group (G)

$39,715,000

58%

3%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 38 of 84

Liberty Mutual Insurance Companies

(G) $33,944,000 79% 39% N/A

Nationwide Group (G)

$29,477,000

88%

15%

N/A

Total or Average

$393,574,000

82%

4%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

Indemnity Insurance Co of North

America $19,348,000 72% 54% Chubb INA Group

State Automobile Mutual Insurance

Co $16,503,000 93% 36%

Liberty Mutual Insurance

Companies

Charter Oak Fire Insurance Company

$8,847,000

37%

2%

Travelers Group

West American Insurance Company $8,614,000 45% 2247%

Liberty Mutual Insurance

Companies

Travelers Property Casualty Co of

Amer $7,269,000 70% 9% Travelers Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Markel Insurance Company

$2,621,000

138%

24%

Markel Corporation Group

Accelerant Specialty Insurance

Company $10,000 32%

Accelerant US Holdings

Group

Accelerant National Insurance

Company $0 0%

Accelerant US Holdings

Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Texas Farm Bureau Underwriters

$224,218,000

88%

4%

Texas Farm Bureau Group

State Farm Lloyds

$41,410,000

68%

4%

State Farm Group

Top 3 Direct Policy-Issuing Insurers

Nationwide Agribusiness Insurance

Co $28,935,000 88% 16% Nationwide Group

Liberty Mutual Insurance Company $216,000 47% 315%

Liberty Mutual Insurance

Companies

Top 3 Surplus Lines Policy Issuing Insurers

Scottsdale Insurance Company

$542,000

98%

-15%

Nationwide Group

Accelerant Specialty Insurance

Company $10,000 32%

Accelerant US Holdings

Group

Acceptance Indemnity Insurance

Company $0 0%

IAT Insurance Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 39 of 84

Federal Flood

ALL Direct Written Premium (DPW) Ind. Agent DPW

Exclusive Agents

DPW

Direct DPW Surplus Lines DPW

$419,942,000

$279,338,000

$101,395,000

$39,209,000

$1,975,000

Loss Ratio and Combined Ratio

Accuracy

IA+MGA+IA-Mixed

Penetration

Exclusive

Penetration

Direct Penetration Surplus Lines Utilization

100%

67%

24%

9%

0.5%

Active Affiliated and Unaffiliated

Insurers

IA+MGA+IA-Mixed

Insurers

Exclusive

Insurers

Direct Insurers Surplus Lines Insurers

29

22

4

3

2

1-Year / 5-Year Premium Growth:

All Premium

1-yr / 5-yr: IA+MGA+IA-

Mixed

1-yr / 5-yr:

Exclusive

1-yr / 5-yr: Direct 1-yr / 5-yr: Surplus Lines

6% / 8%

7% / 9%

3% / 5%

8% / 6%

#DIV/0!

Top 5 Groups or Unaffiliated

Single(s) 2021 DPW

2021 Adj. Loss

Ratio

2020-2021 Growth

Rate Group Name or ALL L.O.B. DPW

Wright National Flood Insurance

Company $122,466,000 7% 5% N/A

Assurant P&C Group (G)

$60,176,000

9%

4%

N/A

Allstate Insurance Group (G)

$55,127,000

-2%

5%

N/A

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 40 of 84

Farmers Insurance Group (G)

$52,501,000

4%

3%

N/A

USAA Group (G)

$29,210,000

-3%

9%

N/A

Total or Average

$419,945,000

5%

6%

N/A

Top 10 Pure Independent Agent-Broker Policy-Issuing Insurers

American Bankers Insurance Co of

Florida $60,176,000 9% 4% Assurant P&C Group

ASI Lloyds

$27,267,000

10%

8%

Progressive Insurance Group

Hartford Insurance Co of the

Midwest $21,238,000 8% 5% Hartford Insurance Group

Selective Insurance Co of the

Southeast $10,133,000 1% 13% Selective Insurance Group

Integon National Insurance

Company $7,356,000 11% 14% Allstate Insurance Group

Top 3 MGA/Wholesale Policy-Issuing Insurers

Wright National Flood Insurance

Company $122,466,000 7% 5% ...

Universal North America Insurance

Co $3,543,000 43% 15%

Universal Insurance Group of

Puerto Rico

Occidental Fire and Casualty Co of

NC $2,730,000 0% 19% IAT Insurance Group

Top 3 Captive-Exclusive Policy-Issuing Insurers

Texas Farmers Insurance Company

$49,029,000

3%

2%

Farmers Insurance Group

Allstate Insurance Company

$47,771,000

-4%

4%

Allstate Insurance Group

American National Property &

Casualty Co $3,228,000 10% 6%

American National Prop & Cas

Group

Top 3 Direct Policy-Issuing Insurers

USAA General Indemnity Company

$29,210,000

-3%

9%

USAA Group

Liberty Mutual Fire Insurance

Company $5,421,000 12% 1%

Liberty Mutual Insurance

Companies

Homesite Lloyd's of Texas $4,578,000 21% 10%

American Family Insurance

Group

Top 3 Surplus Lines Policy Issuing Insurers

Trisura Specialty Insurance

Company $1,964,000 1% 151% Trisura US Insurance Group

Transverse Specialty Insurance

Company $55,000 19%

Transverse Insurance Group

Top Individual RRG

Source: © A.M. Best Company — used by permission.

2021 Texas P&C Marketplace Report

Independent Insurance Agents of Texas

May 2022

Page 41 of 84

Fidelity

ALL Direct Written Premium (DPW) Ind. Agent DPW