USAR Pamphlet 37-1

Financial Administration

Defense Joint

Military Pay System –

Reserve Component

(DJMS-RC)

Procedures Manual

Department of the Army

United States Army Reserve Command

4710 Knox Street

Fort Bragg, North Carolina 28310-5010

7 May 2018

SUMMARY OF CHANGE

USAR Pamphlet 37-1

Defense Joint Military Pay System — Reserve Component (DJMS-RC) Procedures Manual

This major revision of USAR Pam 37-1 dated 7 May 2018—

Contains updated Enterprise E-mails for all correspondence

Changes O&F to GFC

Changes SRPC to RPAC

Adds information on Electronic Based Distributed Learning Courses

Eliminates requirement to notify the UPC of Soldiers claiming more the 10 federal tax exemptions

Adds certification requirements for HDIP orders

Adds requirement to submit all orders to start, recertify or terminate SDAP to the UPC

Clarifies SDAP entitlement for Soldiers mobilized or on TDY in excess of 90 days and not performing

special duties

Contains updated information for Deceased Soldiers’ accounts

Contains updated information for LES history request

Adds “Housing Master” data to appendix G

Adds Thrift Savings Plan, Roth Plan, and Contribution Totals to appendix H

Adds Tricare Select Reserve Dental Plan data to appendix I

Adds BAH DEP codes to appendix I

Contains updated ARIMS record numbers for items in appendix K

Deletes Student Loan Repayment Program (SLRP) Procedures. This information is available at the

Reserve Pay Supplemental Guidance at

https://xtranet/Organization/DCGUSARC/CoS/Coordinating/DCSG-8/pay/References/Forms/Refs.aspx

Deletes Health Professional Loan Repayment Program (HPLRP) Procedures. This information is available

at the Reserve Pay Supplemental Guidance at

https://xtranet/Organization/DCGUSARC/CoS/Coordinating/DCSG-8/pay/References/Forms/Refs.aspx

Adds new Appendix L with requirements to validate the Personnel/Pay Mismatch Report monthly

Adds requirement for a second-party review of ADARS/RADARS transactions prior to assigning a

transmittal letter

Updates Family Separation Allowance procedures for custodial parents

Deletes references to Direct Deposit waivers

Specifies that lump sum payments may be collected in full against outstanding debts for military pay

Specifies that TSP contributions may be reduced to allow collection of debts

Updates BAH guidance to incorporate creating DA Form 5960 in the RLAS RM module

Clarifies the difference between calculation of additional federal tax withholding and state tax withholding

Changes ARIMS file numbers and disposition

Adds new procedures for reconciling personnel / pay mismatches

ii USARC PAM 37-1 • 7 May 2018

Contents (Listed by paragraph number)

Chapter 1

General

Section I

Introduction

Purpose 1-1

References and forms

1-2

Explanation of abbreviations and terms 1-3

Policies 1-4

Section II Background

“Drilling Reservist” 1-5

Reserve training types 1-6

Defense Joint Military Pay System-Reserve Component (DJMS-RC) 1-7

Command pay managers (CPMs) 1-8

USAR Pay Centers (UPCs) 1-9

Single source data (SSD) 1-10

Document review and certification requirements 1-11

Chapter 2

Account Maintenance

Section I Basic

General 2-1

The UH022-2405 Master Military Pay Account History Report (MMPA) 2-2

USAR Form 26, Pay Document Transmittal Letter (TL) 2-3

Section II Accessions

Single Source Data (SSD) 2-4

SSD Exception 2-5

Acceptable documents for SSD exception 2-6

SSD accession process 2-7

Documents for manual accessions 2-8

Required accession data elements 2-9

Section III

myPay

myPay 2-10

Section IV

Mailing Address/Pay Options

General 2-11

Direct deposit 2-12

Held Pay 2-13

Section V

Waivers/Dual Compensation

Document preparation and distribution 2-14

Section VI

Servicemembers’, Combat and Family Group Life Insurance (SGLI, Combat SGLI, and FSGLI)

SGLI, Combat SGLI, and FSGLI 2-15

1

USAR PAM 37-1 • 7 May 2018 iii

Section VII

Promotions, Reductions, and Pay Grade Corrections

Promotions 2-16

Reductions and Erroneous Promotions 2-17

Pay grade corrections 2-18

Section VIII

Pay Entry Basic Date (PEBD)

Changes in PEBD 2-19

Section IX

Administrative Changes

Administrative procedures 2-20

Non-prior service indicator 2-21

Pay status and active duty codes 2-22

Section X

Organization Changes

Changes to organizational data 2-23

Section XI

Reassignment and Transfers

Required documentation 2-24

Verifying and updating account information 2-25

Section XII

Separations

Separation process 2-26

Bonus terminations 2-27

MMPA disposition after separation 2-28

Section XIII

Drill Limits/Authorizations

Drill limits 2-29

Non-prior service (NPS) drill limitations 2-30

Reinstatement of NPS drill limitations 2-31

Drill restrictions 2-32

Section XIV Taxes

Federal tax withholding 2-33

The IRS Form W-2 (Wage and Tax Statement) 2-34

State tax withholding 2-35

Section XV

Extension, Reenlistment, and ETS Date Corrections

Extension, reenlistment, and ETS date corrections 2-36

Chapter 3

Inactive and Active Duty Pay Procedures

Section I

Inactive Duty Training (IDT)

Inactive Duty Training (IDT) payment procedures- Automated Drill Attendance Reporting System (ADARS) 3-1

IDT administrative procedures 3-2

Manual IDT reporting 3-3

Funeral Honors Duty (FHD) payments 3-4

iv USAR PAM 37-1 • 7 May 2018

Medical/Dental Readiness Periods 3-5

Electronic Based Distributed Learning Courses 3-6

Collection of erroneous BA payments 3-7

Disposition of attendance documents 3-8

Section II

Individual Active Duty

Certification requirements 3-9

Payment processing requirements 3-10

Section III

Unit Annual Training (AT)

Payroll preparation 3-11

Section IV

Active Duty Pay Adjustments

Collection of Overpayments 3-12

Underpayments 3-13

Section V

Initial Active Duty for Training (IADT)

Payment of IADT 3-14

Section VI Allowances

Mileage allowance 3-15

Basic Allowance for Subsistence (BAS) 3-16

Overseas Housing Allowance (OHA) 3-17

OCONUS Cost-of-Living Allowance (COLA) 3-18

CONUS COLA 3-19

Family Separation Allowance (FSA) 3-20

Section VII

Basic Allowance for Housing (BAH)

Basic Allowance for Housing (BAH) 3-21

Section VIII

Hazardous Duty Incentive and Special Pay Entitlements

Hazardous Duty Incentive Pay (HDIP) 3-22

Special pay 3-23

Section IX

Miscellaneous Allowances

Saved pay 3-24

Officers’ uniform allowances 3-25

Clothing monetary allowance - enlisted Soldiers 3-26

Section X Miscellaneous

Duplicate input 3-27

Payment verification procedures 3-28

Active duty without pay and allowances 3-29

Per Diem claims 3-30

Thrift Savings Plan (TSP) 3-31

Chapter 4

Reserve Pay Support and the Pay Inquiry Process

Reserve Pay Support - General 4-1

RD and GFC CPMs Responsibilities 4-2

USAR PAM 37-1 • 7 May 2018 v

Resolving pay inquiries - General 4-3

Responsibility for resolving pay inquiries 4-4

Processing pay inquiries 4-5

Presidential, Congressional, Inspector General pay inquiries 4-6

Chapter 5

Collections

Collections of military pay and allowances 5-1

Fines/forfeitures (Articles 15/Courts-Martial) 5-2

DD Form 362 and DD Form 200 5-3

Debts to Non-appropriated Fund (NAF) activities and other agencies 5-4

Notice of levy on wages, salary, and other income (IRS Form 668-W) 5-5

Court orders 5-6

Request for remission and waiver of debts 5-7

Proration requests 5-8

Debt payment by personal check 5-9

Debts for Soldiers who have transferred or separated 5-10

Lump sum payments for accrued leave and bonuses

5-11

Adjustment to TSP contributions to assist in debt collection 5-12

Chapter 6

Miscellaneous Actions

Transfers to AGR 6-1

Accrued leave 6-2

Disability severance pay (DSP) 6-3

Incapacitation (INCAP) pay/Active Duty Medical Extension (ADME) 6-4

Deceased Soldiers’ accounts 6-5

Out-of-Service claims 6-6

Non-receipt/returned payments (EFT/Checks) 6-7

Claims resulting from the correction of military records 6-8

Requesting an LES copy 6-9

Chapter 7

Mobilization

Section I

Conceptual Overview

General 7-1

Tasks and responsibilities 7-2

Section II

Mobilization Pay and Benefits

Mobilization pay and benefits information 7-3

Section III

Unit Commanders Pay Management Report (UH022-2004) for Mobilized Units

Unit commander's responsibility 7-4

Section IV

Demobilization

Demobilization tasks 7-5

Section V

Mobilization Stations (Power Projection Platforms)

Mobilization Stations 7-6

vi USAR PAM 37-1 • 7 May 2018

Appendixes

A. References

B. Military Pay Websites

C. Major Subordinate Command (MSC), Army National Guard (ARNG), and Army Site Identification (Site ID) Codes and

Addresses

D. Document Logic Chart

E. State Tax Codes and Postal Service State Abbreviations

F. Travel

G. The UH022-2405 Master Military Pay Account History Report (MMPA)

H. Leave and Earnings Statements (LESs)

I. Unit Commander‘s Pay Management Report (UCPMR) (UH022-2004)

J. Transaction Identification Numbers (TINs)

K. Unit File Maintenance

L. Personnel / Pay Mismatch Reports

Table List

Table 2-1: Pay status and active duty codes

Table 2-2: Fiscal year drill limits

Table 3-1: Dependency interpretations

Table 3-2: Reimbursement for travel

Table 3-3: Basic Allowance for Subsistence (BAS) entitlements - enlisted

Table 7-1: Power Projection Platforms (Mobilization Stations)

Table C-1: UPC Pay Team e-mail addresses

Table C-2: Army activities with Reserve pay input capability

Table C-3: Army National Guard Site IDs

Table H-1: LES fields 1-9

Table H-2: LES fields 10-22

Table H-3: LES fields 23-41

Table H-4: LES fields 42-60

Table H-5: LES fields 61-80

Table H-6: LES fields 81-83

Table J-1: TIN chart

Table J-2: TIN layouts

Figure List

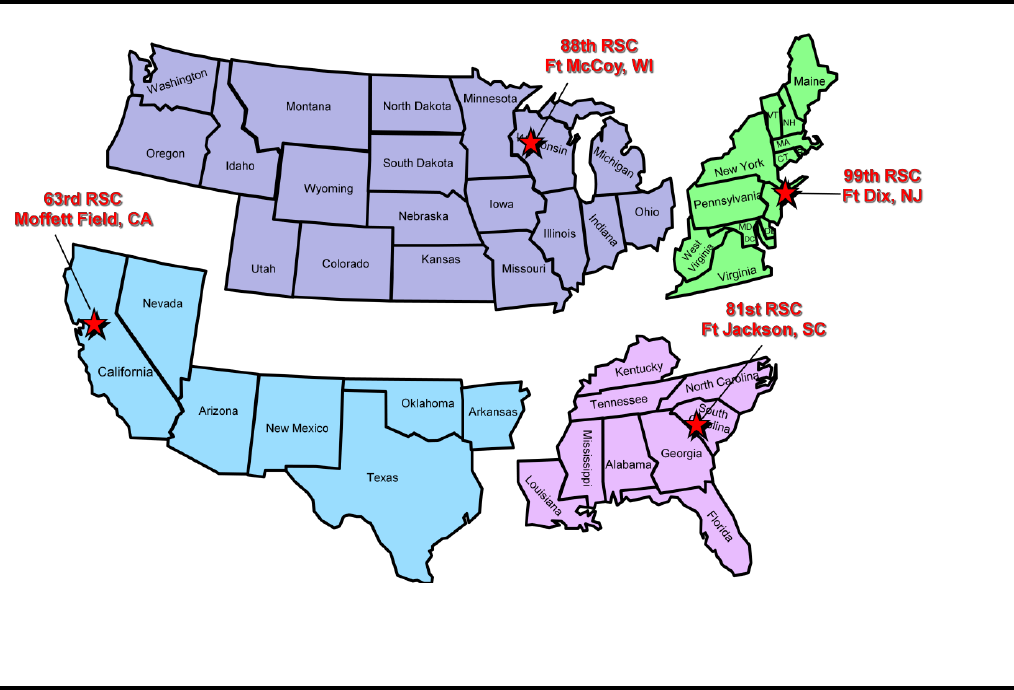

Figure 1-1: Data flows through the Reserve Pay Network

Figure 1-2: RD geographic areas of responsibility

Figure 3-1: Sample annotated ADARS IDT Attendance Roster

Figure 3-2: Sample permission to sign-in slip format

Figure 3-3: Sample appointment memorandum - monitor sign-in/out, review ADARS/RADARS transactions

Figure 3-4: Sample appointment memorandum- alternate certifying officer

Figure 4-1: Sample pay chain-of-command flyer for unit bulletin board

Figure 5-1: Example of a debt

Figure 7-1: Sample mobilization MMPA review checklist

Figure G-1: MMPA Reader‘s Guide – Section 1. “Administrative”

Figure G-2. MMPA Reader‘s Guide – Section 2. “Entitlement Data”

Figure G-3: MMPA Reader‘s Guide – Section 3. “Direct Deposit/Mobilization Data”

Figure G-4: MMPA Reader‘s Guide – Section 4. “Deductions”

Figure G-5: MMPA Reader‘s Guide – Section 5. “Housing Master”

Figure

G-6: MMPA Reader‘s Guide – Section 6. “Pay History”

Figure G-7: MMPA Reader‘s Guide – Section 7. “Calendar Data”

Figure G-8: MMPA Reader‘s Guide – Section 8. “Drill Master Data”

Figure G-9: MMPA Reader‘s Guide – Section 9. “Processed Transactions”

Figure G-10: MMPA Reader‘s Guide – Section 10. “Payment Record Data”

Figure I-1: Sample of UCPMR, Section 1

Figure I-2: Sample of UCPMR, Section 2

Figure I-3: Sample of UCPMR, Section 3

USAR PAM 37-1 • 7 May 2018 vii

Figure I-4: Sample of UCPMR, Section 4

Figure I-5: Sample of UCPMR, Section 5

Figure I-6: Sample of UCPMR, Section 6

Figure I-7: Sample of UCPMR, Section 7

Figure I-8: Sample UCPMR, Reconciliation Checklist

Figure L-1: Accessing the SELRES Pay/Per Data Discrepancy Issues – Subset Report

Figure L-2: Sample Reconciled SELRES Pay/Per Data Discrepancy Issues – Subset Report

Figure L-3: Personnel/Pay Mismatch Report Reconciliation Checklist

Glossary

USAR PAM 37-1 • 7 May 2018 1

Chapter 1

General

Section I

Introduction

1-1. Purpose

This pamphlet provides guidance to unit pay administrators (UPAs) and unit commanders on the automation and

documentation used to pay Soldiers and administer their pay accounts. The pay accounts reside in the Defense Joint Military

Pay System - RC (DJMS-RC). The Defense Finance and Accounting Service in Indianapolis

(DFAS-IN) maintains DJMS-RC.

1-2. References

a. Required and related publications and prescribed and referenced forms are in appendix A.

b. A listing of the United States Army Reserve (USAR) Forms prescribed in his pamphlet is in appendix A, section III.

They are available for download (and may be reproduced) from the United States Army Reserve Command (USARC)

SharePoint Publications website at https://arg1web/pubs/pubs/Pages/default.aspx.

(1) Instructions for use and completion are on the back of each form. Entries on forms can be electronic, typed or

printed legibly in ink.

(2) All information requested by the forms in this pamphlet is exempt from the requirements of Army

Regulation

(AR) 335-15. A requirement control symbol (RCS) is not required. See each form for the specific exemption.

(3) Enter the name and/or social security number (SSN) as shown on the current UH022-2405 Master Military Pay

Account History Report (MMPA) for the Soldier; even if it is incorrect (see para 2-9 and app G for information on the

MMPA). Use the correct SSN only after

it is

reflected on the MMPA.

1-3. Explanation of abbreviations and terms

Explanations of abbreviations and special terms used in this pamphlet are in the glossary.

1-4. Policies

The majority of policy related to USAR pay is contained in the Department of Defense (DoD) 7000.14-R, Financial

Management Regulation (DODFMR), Volume 7A

http://comptroller.defense.gov/Portals/45/documents/fmr/Volume_07a.pdf and the Joint Travel Regulation (JTR)

http://www.defensetravel.dod.mil/Docs/perdiem/JTR.pdf.

Section II

Background

1-5. “Drilling Reservists”

The Reserve Component (RC) is one component of the United States Army. The other component is the Active Component

(AC), sometimes called the “Regular Army”

.

The USAR and the Army National Guard make up the RC. Within the USAR

there are several categories of Soldiers. The primary focus of this pamphlet is on USAR Soldiers assigned to Troop Program

Units (TPUs). These Soldiers meet on scheduled dates with their units to train and accomplish basic administrative functions.

These TPUs

are very

similar to units in the active Army, except that their Soldiers are not on duty full-time unless called to

active duty for mobilization or support of a contingency operation.

1-6. Reserve training types

TPU training consists of two types: inactive duty training (IDT) and active duty (AD) training. There are also different types

of inactive and active duty training. The focus of this paragraph is on training performed as a unit.

a. The USAR refers to unit IDT as a battle assembly (BA). The BAs must be a minimum of 4 hours long. Soldiers may

perform a maximum of two BAs on the same day; this is known as a BA 2 (2 meaning two BAs). Most units perform a BA 4

each month that consists of a BA 2 on Saturday and a BA 2 on Sunday. Some units may schedule BAs throughout the month

(e.g., a BA every Tuesday night) in a way that meets the needs of the unit commander or the Army Reserve IAW AR 140-1,

Mission, Organization and Training. Soldiers receive 1 day of basic pay (BP) for each BA they perform.

b. Active duty performed as a unit is known as unit annual training (AT). Units normally perform 2 weeks of AT

each

year.

2 USAR PAM 37-1 • 7 May 2018

1-7. Defense Joint Military Pay System-Reserve Component (DJMS-RC)

a. Defense Finance and Accounting Service (DFAS) disburses all payments for IDT and active duty. The DJMS-RC

is the database application DFAS uses to administer USAR pay. It consists of pay records, known as master military pay

accounts (MMPAs), for each Soldier in DJMS-RC.

b. Figure 1-1 illustrates how data flows through the USAR pay network to initiate pay and update MMPAs. Pay data

flows from various sources into the USAR Pay Centers (UPCs) and DFAS for conversion to computer transactions that

update the MMPAs and DJMS-RC.

c. DJMS-RC updates occur daily, but only eight of these updates create payments. Updates that create pay are known as

"coded" updates. One of these coded updates generates mid-month payments for Soldiers who are mobilized or on active duty

for 30 or more days. Another coded update is the final update for the month and generates end of month (EOM) payments and

pay reports used by USARC G-8, the UPCs, Readiness Divisions (RDs), Geographical Functional Commands (GFCs) and units.

The final update normally occurs between the 20th and 23rd of the month.

d. DJMS-RC can store up to 12 months of pay information for each MMPA (current month and the 11 previous

months). The term for this storage period is "Immediate Access Storage (IAS)" or current record span.

e . USARC G-8 posts DJMS-RC update schedules at https://xtranet/Organization/DCGUSARC/CoS/Coordinating/DCSG-

8/pay/Pages/default.aspx. The DJMS-RC production schedule establishes DJMS-RC processing and payment dates. You can

determine when an action or payment should occur by comparing the date a transaction was processed in DJMS-RC against

the production schedule. To determine when a payment will occur select the current month production schedule. DJMS-RC

production months generally run from the 23rd of one month to the 22nd of the following month. Therefore, a transaction

processed on 25 May would fall under the Jun production schedule. The production schedule contains the following

information for use in determining the date an action will affect a Soldiers’ MMPA:

(1) Run Date. The date DJMS-RC was updated with new pay input.

(2) Type of update

(a) Daily – Daily updates process pay actions but do not create payment files

(b) CODE 1 – CODE 1 updates produce payment files for IDT, AT/ Active Duty for Training (ADT)/ Active Duty

Operational Support, Reserve Component (ADOS-RC) of less than 30 days and bonuses.

(c) CODE 2 Mid-Month (MM) – CODE 2 updates produce mid-month payment files for Soldiers paid twice-monthly

for long tours and the same payment types as a code 1.

(d) CODE 3 (EOM) – CODE 3 updates produce end-of-month payment files for Soldiers paid twice-monthly for long

tours and the same payment types as a code 1. CODE 3 also produces pay reports (Unit Commanders Pay Management Report

(UCPMR), etc.)

(3) Electronic Funds Transfer/Check (EFT/CHK) DATE – The date an Electronic Funds Transfer (EFT) should be

received by the financial institution or the date DFAS will mail a pay check.

(4) HIGH DATE PAID – The latest duty date included in payments generated by a CODE 1, 2 or 3 update. If the

HIGH DATE PAID is 25 May, payments for duty periods ending 25 May or earlier will be paid on this update.

(5) Effective Release (EFT REL) DATE – The date Department of Treasury will send a direct deposit to the financial

institution.

1-8. Command pay managers (CPMs)

The four RDs have full-time personnel known as command pay managers (CPMs) within their Resource Management Office

(RMO) to provide reserve pay support to UPAs and Soldiers. RDs provide support to all units in their geographic area of

responsibility (GAOR) regardless of the unit‘s chain of command. See figure 1-2 for a depiction of the RD GAORs. CPMs

provide reserve pay inquiry, training, unit pay operations reviews, and Soldier Readiness Processing support. Units must use

their pay chain of command, starting with the appropriate CPM (command pay manager), to resolve pay issues. CPM contact

information is at https://xtranet/Organization/DCGUSARC/CoS/Coordinating/DCSG-8/pay/Contacts/Forms/AllItems.aspx. See

para 4-4 for information on the pay chain of command.

1-9. USAR Pay Centers (UPCs)

The UPCs provide pay support to all TPU Soldiers. The UPC at Fort McCoy, WI supports TPUs in the Continental United

States (CONUS), Puerto Rico and Europe. The UPC at Fort McCoy also processes all Student Loan Repayment Program

(SLRP), Health Professionals Loan Repayment Program (HPLRP), and Incapacitation payment claims, as well as operating

the Ombudsman Pay team. The UPC at Fort McCoy has teams that support specific GFC commands. The 9th UPC at Fort

Shafter, HI supports TPUs in Hawaii, the Pacific, and Southeast Asia. Each UPC provides a full range of military pay

services, except travel voucher processing and those functions centralized at the UPC at Fort McCoy. The UPCs are not

staffed for answering pay inquiries; contact your CPM concerning these inquiries.

1-10. Single source data (SSD)

SSD is the term used to refer to data sent from the Total Army Personnel Data Base-Reserves (TAPDB-R) to DJMS-RC. Units

use the personnel module of the Regional Level Application Software (RLAS) to send updates to TAPDB-R. Chapter 2

discusses the specific data that TAPDB-R provides to DJMS-RC.

USAR PAM 37-1 • 7 May 2018 3

1-11. Document review and certification requirements

a. Some documents related to payment of USAR Soldiers require the signature of an individual authorized to certify or

review the document. Signatures for certification must be wet or secured digital. Other forms of signature, including

signature stamps, are not valid for documents that create entitlement to pay. The unit commander designates who has

certification or review authorization. UPAs may not certify their entitlement to pay. Documents requiring review are:

(1) USAR Form 26, Pay Document Transmittal Letter (TL). The UPA and other designated individuals may

sign as the reviewer. Prepare an additional duty appointment, in accordance with (IAW) AR 25-50, Preparing and

Managing Correspondence for those individual(s) authorized to sign the USAR Form 26.

(2) Automated Drill Attendance Reporting System ADARS and Reserve Active Duty Automated Reporting System

RADARS actions require review by a second party to ensure the pay information input by the UPA is accurate. The second

party, either the unit commander, or an alternate reviewing official, conducts the review by comparing the supporting

documents (IDT Attendance Roster, DA Form 1380 Record of Individual Performance of Reserve Duty Training, or active

duty orders) to the data input by the UPA prior to assigning the TL number. Prepare an additional duty appointment, IAW

AR 25-50, to designate an alternate reviewing official for reviewing ADARS and RADARS actions.

b. Documents requiring certification are:

(1) Unit AT Annexes. Only the commander or an alternate certifying officer may sign the Certificate of

Accuracy/Attendance on unit AT annexes. Prepare an additional duty appointment, IAW AR 25-50, to designate

the alternate certifying officer. Do not designate the UPA or anyone else with access to the Reserve Duty

Automated Reporting System (RADARS) as an alternate certifying officer.

(2) Unit Record of IDT Attendance Roster from the ADARS module of RLAS. Only the commander, first sergeant

(1SG), or senior Non-Commissioned Officers (NCOs) designated on an additional duty appointment can certify the IDT

Attendance Roster. Do not designate the UPA or anyone who has access to ADARS as an alternate certifying officer for the

IDT Attendance Roster.

(3) DA Form 1380. Any officer with knowledge of duty performance may sign block 11 of the DA Form 1380. Any

NCO or civilian with knowledge of duty performance may sign block 11 of the DA Form 1380 if they are authorized signature

authority IAW AR 25-50. Soldiers may not certify their own duty performance. The DA Form 1380 must contain the Soldier‘s

SSN.

(4) DA Form 5960, Authorization to Start, Stop or Change Basic Allowance for Quarters (BAH) and/or Variable

Housing Allowance (VHA). This form is used to substantiate entitlement to basic allowance for housing (BAH) and must be

created in the Resource Management module of the RLAS. Do not use any other means for creating the DA Form 5960. ALL

Soldiers must have a DA Form 5960 in RLAS and a certified copy in the Interactive Personnel Electronic Records Management

System iPERMS. Only the commander or the first commissioned officer in the Soldier’s chain of command may certify or

recertify the DA Form 5960. UPAs are prohibited from certifying or recertifying DA 5960s. Prepare an additional duty

appointment to designate officers authorized to certify or recertify DA 5960s. Units and Reserve Personnel Action Centers

(RPACs) will include a certified DA Form 5960 when submitting active duty orders to the USAR Pay Center (UPC) for duty of

30 or more days at a location not listed in table C-2 or orders for 1-29 days published by Human Resources Command (HRC).

(5) Unit Commander’s Pay Management Report. Only the commander or an alternate certifying officer can sign the

UCPMR attesting to its accuracy. The commander or alternate certifying officer must sign no later than the G-8 suspense date

for the current report. The UPA or alternate UPA may not sign the UCPMR. Prepare an additional duty appointment to

designate an alternate certifying officer for signing the UCPMR.

(6) Personnel/Pay Mismatch Report. Only the commander or an alternate certifying officer can sign the

Personnel/Pay mismatch report attesting to its accuracy. The commander or alternate certifying officer must sign NLT the G-

8 suspense date for the current report. The UPA or alternate UPA may not sign the Personnel/Pay mismatch report. Prepare

an additional duty appointment to designate an alternate certifying officer for signing the Personnel/Pay mismatch report.

c. A copy of each additional duty appointment must be maintained IAW

AR 25-400-2, Army Records Information

Management System (ARIMS) IAW appendix K

.

4 USAR PAM 37-1 • 7 May 2018

AR Pay

Process

USARC

R

L

A

S

RLAS input

to

TAPDB-R

Pay

reports

Payment

HRC

TAPDB-R

SSD transactions

i

n

p

u

t

UPC

DJMS-RC

Input

DFAS

Inquiry/Training/Quality

Assurance (QA)/

Soldier

Readiness Processing

(SRP)

Pay

Documents

RLAS input/pay

reports

RD/GFC

UNITS

MEPS

Figure 1-1. Data flows through the Reserve Pay Network

USAR PAM 37-1 • 7 May 2018 5

Figure 1-2. RD geographic areas of responsibility

6 USAR PAM 37-1 • 7 May 2018

Chapter 2

Account Maintenance

Section I

Basic

2-1. General

A Soldier must have an MMPA established in DJMS-RC before he/she can receive pay. Personnel data from TAPDB-R

flows to DJMS-RC and establishes the MMPA. The UPA must review the MMPA for each newly assigned Soldier and

submit appropriate documentation to complete or correct the pay account. Submit corrections through the personnel

module in RLAS or to the UPC, depending on the data requiring correction.

2-2. The UH022-2405 Master Military Pay Account History Report (MMPA)

a. The MMPA is a report of the Soldier’s DJMS-RC pay account. DFAS generates the reports by unit identification code

(UIC) monthly and USARC G-8 posts them to RLAS around the beginning of the next month. Units can access current and

previous reports if they have RLAS Resource Management (RM) Reports permissions for the UIC. Units should contact their

RD CPM if they do not have reports for their UIC in RLAS. Appendix G explains each data field on the MMPA.

b. Units should review all elements of the MMPA for all newly assigned Soldiers and submit corrective actions through

SSD or to the UPC as applicable.

c. Verification of a complete accession for a newly assigned Soldier can be quickly accomplished by reviewing the GAIN

field in Section 1 of the MMPA. When there are three “Gs” posted in this field, the accession is complete and the Soldier's

MMPA can issue pay. If there are not three “Gs” the MMPA cannot issue pay.

[NOTE: See data item description in figure G-1, Section 1, GAIN, for an explanation of the pay data represented by each "G.”]

2-3. USAR Form 26 Pay Document Transmittal Letter (TL)

Unless otherwise specified, submit all pay claims and documents supporting changes to Soldiers’ pay accounts to the UPC

within 72 hours of receipt. Use USAR Form 26 as the cover document for submission. Instructions on completing the USAR

Form 26 are on the reverse side of the form. Refer to appendix C, paragraph C-2, for UPC Pay Team mailing and e-mail

addresses. When scanning TLs to the UPC include the TL number in the subject line of the e-mail.

Section II

Accessions

2-4. Single Source Data (SSD)

SSD is the acronym for the automated process that provides TAPDB-R data on accessions, transfers, separations, enlisted

advancements and enlisted promotions, ETS date changes, name changes, and social security number (SSN) corrections to

DJMS-RC. A change to SSD data elements in TAPDB-R resulting from RLAS input or other sources should result in a

change to the same data in DJMS-RC within 15 business days. Do not send these actions to the UPC; see paragraph 2-5 for

exceptions to SSD processing rules.

2-5. SSD exceptions

Submit actions normally processed in DJMS-RC by the SSD process to the UPC in the following instances:

a. When an SSD action processes in TAPDB-R, but not in DJMS-RC. SSD actions normally update DJMS-RC within 15

days of a new Soldier appearing in RLAS or the unit making input to RLAS. Submit corrections to the UPC along with one

of the documents listed in paragraph 2-6.

b. When an SSD action does not process in TAPDB-R and an emergency requires processing through the UPC rather than

waiting for TAPDB-R to send the SSD action to DJMS-RC. These exceptions require approval from the UPC or USARC G-8.

The unit must submit the request through their pay chain of command.

2-6. Acceptable documents for SSD exceptions

The following are acceptable documents, along with required pay documentation, to support submitting an SSD exception to the

UPC to update a Soldier’s pay account. These documents demonstrate an action processed in TAPDB-R and posted to RLAS but

did not process in DJMS-RC.

a. DJMS-RC USAR Personnel/Pay Mismatch Report (UH022-2026) or SELRES Pay/Per Data Discrepancy Issues – Subset

Report. The reports list discrepancies between DJMS-RC and TAPDB-R/RLAS data. Use of the UH022-2026 report was

discontinued by USARC in Dec 16. Use the SELRES Pay/Per Data Discrepancy Issues – Subset Report from the Command

Strength Management Module (CSMM) to identify discrepancies between DJMS-RC and TAPDB-R/RLAS data. Use this report

to support SSD exceptions sent to the UPC for accessions, transfers, separations, enlisted advancements/promotions and name

changes that the report shows as processed in TAPDB-R/RLAS but not in DJMS-RC.

b. Personnel Qualification Record (PQR). Use RLAS to print the PQR. Select TAPDB-R as the data source for the

PQR. Use this report to support SSD exceptions for accessions, name changes, SSN changes, promotions, etc., when the

USAR PAM 37-1 • 7 May 2018 7

PQR shows the new data and DJMS-RC does not. The losing unit cannot use the PQR to document transfer to a new unit

or separation since they do not have visibility of the Soldier in RLAS.

c. Unit Manning Report (UMR). Use RLAS to print the UMR. Select TAPDB-R as the data source for the UMR.

Use this

report to support SSD exceptions for accessions, transfers, and separations when the UMR shows the new data and DJMS-RC

does not.

[NOTE: Units should contact their CPM if unable to locate a document substantiating enlistment, transfer, or separation of a

Soldier.]

2-7. SSD accession process

Soldiers enlisting through the Military Entrance Processing Stations (MEPS), assigned to the unit from an Army Transfer Point,

or accessed from the Individual Ready Reserve (IRR), have their MMPA established by the SSD feed from TAPDB-R. Units

should only submit accessions when the SSD process fails and exception processing (para 2-5) is required. The unit is

responsible for submitting to the UPC any additional documentation necessary to complete or correct the MMPA

[NOTE: Soldiers assigned to the IRR and participating in IDT assemblies for points only are not be accessed to DJMS-RC.]

2-8. Documents for manual accessions

a. A manual accession is required when a unit does not receive an MMPA for a new Soldier within a reasonable time

frame. The SSD actions normally update DJMS-RC within 15 days of processing in TAPDB-R. The unit should receive an

MMPA at the end of the month for new Soldiers assigned prior to the 8th of the month. If the MMPA is not received, contact

your CPM to determine if a manual accession is required. Paragraph 2-10 of this chapter discusses the MMPA. The report is

a printout of the Soldiers’ MMPA and is accessible from the RM Reports module of RLAS.

b. The remainder of this section addresses the documents required for each MMPA data element when submission of an

accession is necessary because an SSD failed to establish the pay account. Procedure D-1 describes the required substantiating

documents. Follow normal maintenance procedures outlined in this chapter after the MMPA is established to change the data

elements in paragraph 2-9.

2-9. Required accession data elements

Certain MMPA data elements must be complete and accurate for the Soldier to receive pay. These data elements are:

a. Name and Social Security Number (SSN).

(1) It is critical that these items are correct. See section IX of this chapter for procedures on correcting errors in name

and SSN after the MMPA is established.

(2) Source documents: DD Form 4 Enlistment/Reenlistment Document Armed Forces of the United States, DD Form

1966 Record of Military Processing – Armed Forces of the United States, Human Resources Command (HRC) assignment orders

or DD Form 214, Certificate of Release or Discharge from Active Duty or copy of SSN card for verification.

[NOTE: See figure G-1, MMPA, Section 1 - NAME, SSN.]

b. Pay grade.

(1) DJMS-RC uses 0 (zero) to indicate officers, 2 to indicate warrant officers and 3 to indicate enlisted Soldiers.

(a) Officer grades are 01 through 010; warrant officer grades are 21 through 25; and enlisted grades are 31 through

39. For example, a MAJ’s pay grade is 04, a CW2 is 22, and an SSG is 36.

(b) Source documents: DD Form 4 and DD Form 1966, HRC assignment orders, DD Form 214 or DA Form 71, Oath of

Office – Military Personnel.

(2) 2LTs through CPTs with over 4 years of active enlisted and/or warrant service (or combination), or more than 1460

enlisted retirement points are entitled to a higher rate of pay.

(a) This higher rate of pay is not established by SSD. See paragraph 2-18 for information on establishing credit for prior

enlisted or warrant service.

(b) Source documents for establishing previous enlisted or warrant active service are DD Form 214, National Guard

Bureau (NGB) Form 22, Leave and Earnings Statements (LESs) for payment of AT/ADT/Active Duty for Operational Support

(ADOS), or DA Form 5016, Chronological Statement of Retirement Points.

[NOTE: See figure G-1, MMPA, Section 1 – PAY GRADE, 04E.]

c. Pay entry basic date (PEBD) - Referred to as Pay Date in DJMS-RC.

(1) A Soldier’s pay rate is determined both by pay grade and by years of service. A sergeant with 8 years of service will

earn more than a sergeant with 6 years of service. When the PEBD is unknown, it will default to the date of assignment. See

section VIII of this chapter for information on changing PEBDs.

(2) Source document: DD Form 4, DD Form 1966 (item 20C) for enlistees, HRC assignment orders, DD Form 214 or

DA Form 71.

[NOTE: See figure G-1, MMPA, Section 1 – PAY DATE.]

d. Sex code.

(1) The sex code determines the rate of clothing replacement allowance payable when a Soldier is on active duty for

more than 6 months.

(2) Source document: DD Form 1966 or assignment orders from HRC.

8 USAR PAM 37-1 • 7 May 2018

[NOTE: See figure G-1, MMPA, Section 1 – SEX.]

e. Address data.

(1) The Soldier’s mailing address is normally established using the Soldier’s address on the accession documents.

DJMS-RC will not issue a payment for an MMPA account without a mailing address. All duty performance data (drills,

active duty payments) for accounts without a mailing address will recycle up to eight paying updates (approximately 4

weeks). If the mailing address is still missing at the end of that period, the performance data will reject and the UPC will

notify the unit of the rejected data.

(2) Source document: DD Form 1966 or HRC assignment orders.

[NOTE: See figure G-1, Section 1, MMPA, – ADRS-2, ADRS-3, ADRS-4, ADRS-5, ADRS-EFF-DT.]

f. Pay status codes.

(1) The pay status codes indicate a Soldier’s eligibility to receive pay for attending drills. For prior service Soldiers, and

Soldiers assigned from the IRR, another RC unit, or from the AC, the pay status code will be “A.” For non-prior service (NPS)

enlistees, code “A” is established along with an NPS indicator. The NPS indicator is “6” for NPS Soldiers and blank for all

others.

(2) Source document: DD Form 1966, page 1 (block 19) for enlistees.

[NOTE: See figure G-1, Section 2, MMPA, – PAY STATUS.]

g. Federal tax withholding exemptions.

(1) The number of exemptions claimed by a Soldier on Internal Revenue Service (IRS) Form W-4 Employees

Withholding Allowance Certificate determines the rate at which federal taxes are withheld from pay. If a W-4 is not submitted for

a newly assessed Soldier, the rate of tax withholding defaults to the highest rate, single with zero exemptions. Do not use the rate

of tax withholding for determining whether the Soldier has dependents.

(2) Soldiers may elect to have additional federal income tax withheld. The amount of additional withholding must be

indicated on the IRS Form W-4. Additional withholding may be requested in increments of $1.00 (minimum) up to $84.00

(maximum) for each day of base pay (e.g., Soldier requests $2.00 additional federal income tax withholding and performs a BA

2 resulting in $4.00 additional withholding for the two periods of base pay; therefore, $28.00 would be withheld for a 14-day

AT period).

(3) Source document: IRS Form W-4.

[NOTE: See figure G-4, Section 4, MMPA – FITW-MAR-STATUS and FITW-EXEMPT-OPT.]

h. State tax withholding exemptions.

(1) The number of exemptions claimed by a Soldier on a State Form W-4 (or IRS Form W-4 annotated “STATE TAX”

on top when a State W-4 is not available) determines the rate at which state taxes are withheld from pay. The state exemptions

do not have to be the same as the federal exemptions. If a State W-4 is not submitted, the state exemptions will be the same as

the federal exemptions.

(2) Soldiers may elect to have additional state income tax withheld. The amount of additional withholding must be

indicated on the State W-4 Form. Unlike additional federal tax withholding, additional state tax withholding is applied to

payments of basic pay, special pays, and incentive pays. Additional withholding may be requested in increments of $1.00 (minimum)

up to $84.00 (maximum) for each day of basic, special or incentive pay (e.g., Soldier requests $10.00 additional state income

tax withholding and performs a 14-day AT period during which he received SDAP for the whole period. $140.00 would be

withheld for the 14 days of basic pay and $140 for the 14 days of SDAP).

(3) Source document: State Form W-4 or IRS Form W-4 annotated “STATE TAX.”

[NOTE: See figure G-3, Section 3, MMPA – SITW-MAR-STATUS, SITW-EXEMPTIONS/OPTIONAL.]

i. State of legal residence.

(1) State of legal residence is normally established using the Soldier’s mailing address on the accession documents.

Submit a DD Form 2058, State of Legal Residence Certificate with the accession if the Soldier wants to elect a different state. (2)

Source document: DD Form 2058.

[NOTE: See figure G-4, Section 4, MMPA – FITW-W2-STATE.]

j. Date of assignment.

(1) The effective date of assignment, (known in DJMS-RC as the date of gain (DOG)), is on the assignment order. For

enlistments, the effective date of assignment is the date of enlistment on the DD Form 4.

(2) Source document: DD Form 4 or assignment orders.

[NOTE: See figure G-1, Section 1, MMPA – DOG.]

k. Personnel Accounting Symbol (PAS).

(1) This eight-digit code is comprised of the two-digit Site ID (see app C) and the six-digit unit identification code

(UIC) from which the leading “W” is dropped and a 0 (zero) is added to the end (e.g., the PAS for UIC: WXYAAA, serviced by

Site ID V1, is V1XYAAA0).

(2) Source document: DD Form 1966, page 1 (block 19) or assignment orders.

[NOTE: See figure G-1, Section 1, MMPA, – PAS.]

l. Expiration term of service (ETS) date (Enlisted Soldiers only).

(1) Soldiers without prior service who enlist in the Army Reserve incur a statutory military service obligation of eight years.

Soldiers commonly enlist for 6 years in a unit and 2 years in a control group of the IRR (“6x2” enlistment). The term of their

TPU commitment is shown on DA Form 3540, Certificate and Acknowledgement of US Army Reserve Service Requirements

USAR PAM 37-1 • 7 May 2018 9

and Methods of Fulfillment. The ETS date established on DJMS-RC is the end of the 8-year enlistment; therefore, a Soldier on a

6x2 enlistment may require separation from DJMS-RC at the end of their sixth year.

(2) Source document: DD Form 4 (with DA Form 3540 for NPS), DD Form 214, or assignment orders.

[NOTE: See figure G-1, Section 1, MMPA – ETS.]

m. Benefit and waiver status.

(1) A Soldier is not entitled to IDT or active duty pay for the same dates that they are receiving military retirement or VA

benefits. Ask all newly assigned Soldiers whether they are receiving military retirement or VA benefits.

(2) See paragraph 2-14 for processing instructions for Soldiers receiving VA benefits or military retirement pay.

(3) Source document: VA Form 21-8951-2, Notice of Waiver of VA Comp or Pension to Receive Military Pay

and Allowances.

[NOTE: See figure G-6, Section 6, MMPA, – WAIVER.]

n. Servicemembers’ Group Life Insurance (SGLI) election.

(1) By law, all Soldiers are automatically enrolled for $400,000 of SGLI coverage. All new Soldiers must complete a

SGLV Form 8286. For Soldiers who elect less than full coverage, the form must be submitted to the UPC to correct the

MMPA. Refer to paragraph 2-15 for instructions on changing an SGLI election.

(2) Source document: SGLV Form 8286.

[NOTE: See figure G-3, Section 3, MMPA, – SGLI-CURRENT.]

o. Incentive pays.

(1) Submit a copy of the incentive pay order if the Soldier is eligible to receive flight pay, jump pay, or demolition

pay.

(2) Source document: Incentive pay orders

[NOTE: See figure G-2, Section 2, MMPA, – IP-TYPE/DATES.]

p. Leave Information. DJMS-RC tracks leave accrued, used, sold, and excess leave. Leave days paid during prior

periods of military service must be reported to DJMS-RC to update the Soldier's MMPA.

(1) Since 10 February 1976, Soldiers are limited to a maximum payment of 60 days accrued leave during their career.

Leave accrued during contingency operations (e.g., Desert Storm, Enduring Freedom, Iraqi Freedom, etc.) is exempt from the 60-

day limitation on accrued leave payments Effective 1 October 2001, the 60-day leave payment limitation does not apply to leave

accrued by an RC Soldier while serving on active duty tours of 31 to 365 days in duration.

(2) The Leave Final Indicator (FI-IND) field identifies verification of prior leave days sold. If the FI-IND contains an

“X,” there has been verification of prior leave days sold. If the FI-IND is blank, the number of prior leave days requires

verification before DJMS-RC will permit payment of accrued leave. Soldiers with a blank FI-IND field are also found in section 6

of the UH022-2405, Unit Commander’s Pay Management Report (UCPMR).

(3) No action is required for Soldiers with an “X” in the FI_IND field unless the Soldier is entitled to payment of accrued

leave. In these cases, include a USAR Form 24, Individual Claim for Active Duty Pay, Allowances, and Adjustments with blocks

14 and 16 completed with the payment request. In block 16, state the number of days leave paid previously. Attach a copy of any

supporting documents showing the previous leave payment (DD Form 214, DD Form 215 Correction to DD Form 214,

Certificate of Release or Discharge from Active Duty, military pay vouchers, LESs, or prior MMPAs). When the FI-IND field is

updated to “X,” the LV-PAID field of the MMPA will reflect the number of days leave previously paid. See paragraph 6-2b for

procedures for requesting payment of accrued leave.

[NOTE: See figure G-6, Section 6, MMPA - FI-IND, LV-PAID.]

Section III

myPay

2-10. myPay

a. myPay allows Soldiers to make changes to their MMPA on-line and view or print various pay documents. myPay is

accessible from the DFAS website at https://mypay.dfas.mil/mypay.aspx. All newly accessed Soldiers are mailed a Personal

Identification Number (PIN) and an information letter for accessing myPay. The PIN must be changed the first time the

Soldier accesses myPay. Changes made in myPay generally update a Soldier’s MMPA within 24 hours.

b. Soldiers can use myPay to change their mailing address, direct deposit, federal and state tax information, print LESs and

IRS Form W-2s Wage and Tax Statement, enroll in Thrift Savings Plan (TSP), and view travel payments. Additional

capability is planned for future updates to myPay. Soldiers must use caution when entering information in myPay. Accuracy

is especially critical for direct deposit changes. The UPC notifies the unit of any rejected myPay transactions.

c. A warning remark will print on the Soldier’s leave and earnings statement (LES) and in section 8 of the MMPA when a

change is made to the Soldier’s PIN through myPay. Transactions in Section 8 of the MMPA that begin with a “$” were

generated by myPay input.

d. Soldiers who do not receive a PIN within 2 months of assignment should request one from the myPay website.

e. Soldiers who use myPay will not receive a hardcopy LES or W-2 form. Soldiers must use myPay and select the option to

receive a hardcopy of their LES if they wish to receive LESs by mail. Selecting this option also results receipt of the W-2 by

mail. Hardcopy LESs and W-2s are discouraged as they create avoidable costs for the Army and put Soldier’s personally

identifiable information (PII) at risk.

10 USAR PAM 37-1 • 7 May 2018

f. Restricted Access Personal Identification Number (RAPIN). The RAPIN allows Soldiers to provide a spouse or trusted

individual with a view only myPay PIN. This option is especially beneficial for deployed Soldiers.

(1) Soldiers can set the RAPIN by accessing myPay and selecting the "Personal Settings" page.

(2) Select “Restricted Access PIN.”

(3) Enter a RAPIN and provide it to the spouse/trusted individual.

(4) Spouses/trusted individuals use the RAPIN by signing in to myPay with the member's SSN and their RAPIN. The

spouse/trusted individual can view and print LESs and W-2s, but they cannot make pay changes.

g. Soldiers can record a personal e-mail address in myPay to receive notification of pay changes and other items of interest.

Soldiers can establish their personal e-mail address by selecting "E-mail address" from the myPay main menu.

Section IV

Mailing Address/Pay Options

2-11. General

LESs and W-2 forms for those Soldiers who elect to receive hard copies of these documents are sent to the mailing address

on the MMPA. Hardcopy LESs and W-2s are discouraged as they create avoidable costs for the Army and put Soldier’s

personally identifiable information (PII) at risk. Soldiers should use myPay to change their mailing address. When myPay is not

available, the unit can change the mailing address by submitting a USAR Form 22, Adjustment Certification Worksheet with

block 4 completed.

[NOTE: See figure G-1, Section 1, MMPA ADRS-2, ADRS-3, ADARS-4, ADARS-5, ADRS-EFF-DT]

2-12. Direct deposit

a. Direct deposit (also known as Sure Pay or electronic funds transfer (EFT)) transfers Soldier's military payments to their

financial institution electronically. The Department of the Treasury requires the use of direct deposit for payments to

Department of Defense uniformed Servicemembers and civilian employees.

b. Soldiers should use myPay to initiate or change their direct deposit information. When myPay is not available, submit

an Standard Form (SF) 1199A, Direct Deposit Sign-Up Form, (Authorization for Deposit of Federal Recurring Payments)

completed by the Soldier’s financial institution to the UPC. Alternately, Soldiers can bypass the financial institution by

attaching a copy of a voided check to the SF 1199A. Deposit slips are not acceptable, as they do not contain all the information

needed to initiate direct deposit. Soldiers electing direct deposit to a savings account must submit an SF 1199A competed by

the financial institution. Other types of direct deposit forms can be used in addition to the SF 1199A; include a “voided” check

for verification of the routing and checking account numbers.

[NOTE: See figure G-3, Section 3, MMPA – DIRECT DEPOSIT-STAT-CODE, DIRECT-DEP-EFF-DATE,

ACCT-POLICY-NBR, RTN]

2-13. Held pay

a. DFAS places a Soldier’s pay account in a held pay status (HPS) when a bank returns an EFT due to an incorrect

or

closed

account, or when a check is returned as undeliverable. HPS causes suspension of all future payments. DJMS-RC will

release HPS funds to the Soldier when the MMPA is updated with new direct deposit or address information.

b. DFAS places an HPS remark on the Soldier’s LES and the Soldier appears in the held pay portion of Section 6 of the

Unit Commander’s Pay Management Report. Units should contact Soldiers who are in HPS and assist them in updating their

pay option to release their HPS funds. Soldiers in HPS due to erroneous EFT information can correct the information in myPay

or provide an SF1199A to the unit for forwarding to the UPC

(1) When updating an address in myPay ensure that both street address lines are exactly the same. The address lines

hold 25 characters each; therefore, the street address must be abbreviated as much as possible to fit.

(2) Do not fill in the city and state; complete the zip code box and the city and state will automatically populate.

c. Soldiers with funds in HPS beyond 90 days will have their funds transferred to the Treasury on the 91st day. When this

occurs, the Soldier’s LES will contain a remark showing the date of the transfer. Units must coordinate with the Pay

Management Division (DFAS-IN), to recover HPS funds from the Treasury. E-mail a copy of the LES (or MMPA) containing

the remark that the Soldier had held pay funds sent to the Treasury to usarmy.usarc.usarc-hq.[email protected].

Include a DD Form 2660, Statement of Claimant Requesting Replacement Check, with the required blocks completed:

(1) Blocks 1- 4 - self explanatory

(2) Block 5 - must contain account number, routing number, and account type i.e. checking/savings, must match EFT

information on the Soldiers pay account

(3) Block 6 – if a check was mailed, the address to where the check was mailed

(4) Block 7 – Soldiers current mailing address, must match the mailing address on the Soldiers pay account

(5) Block 8 – check appropriate box

(6) Block 9 – date the funds were sent to the US Treasury (see 2-13e if Soldier does not have an LES with the remarks

indicating return of HPS funds to the Treasury)

(7) Blocks 10-11 – check appropriate box

(8) Blocks 12-13 – Soldier must hand sign and date the form. Digital signature is not authorized

USAR PAM 37-1 • 7 May 2018 11

(9) Block 17 - Must indicate “US Treasury Release of Funds”

d. Direct Deposit is mandatory; Soldiers may not elect check to address. The Soldier will not receive an LES or other

document when the held pay funds are released from the Department of Treasury.

e. Soldiers who have been separated from the USAR for more than 12 months must complete a DD Form 827, Application

for Arrears in Pay to request return of held pay funds from the Treasury. Attach the LES containing the remark that the Soldier

had held pay funds sent to the Treasury and mail the DD Form 827 to DFAS-IN, ATTN: COR/CLAIMS, 8899 E 56th St,

Indianapolis, IN 46249. The customer service number is (317) 212-6167.

f. Occasionally, remarks indicating return of HPS funds to the Treasury do not print on the Soldier’s LES. When this

happens, include the LES showing the first time the Soldier had funds placed in HPS when requesting return of the funds from

the Treasury. This will help identify when the funds should have transferred to the Treasury.

g. It is possible to have multiple transfers of HPS funds to the Treasury since each transfer starts a new 90 day period.

[Example: a Soldier enters HPS status in Jun 2013 and has HPS funds returned to the Treasury in Sep 2013. If the Soldier

does not update his /her EFT information, any new funds placed in HPS in Sep 2013 will be returned in Dec 2013. When

requesting to recover funds from the Treasury in these cases, include a copy of the LES or MMPA for each transfer to the

Treasury.]

h. Soldiers will normally receive a direct deposit of their recovered HPS funds within 10 days of submitting the request to the

Pay Management Division (DFAS-IN). Payments via check will take several days longer. The deposit or check will not appear

on the Soldier’s LES or MMPA since it comes from the Treasury.

[NOTE: See figure G-3, Section 3, MMPA – DIR-DEP-WAV-DT.]

Section V

Waivers/Dual Compensation

2-14. Document preparation and distribution

a. Soldiers receiving disability compensation from the Veterans Administration (VA) must complete a VA 21-8951-2 at

the beginning of each FY and elect to receive disability compensation or their military pay for duty performed during the

upcoming FY. The UPA must submit the VA 21-8951-2 to the UPC to record the Soldier’s election on his/her MMPA. The

Soldier must submit the form to the VA. Discuss the financial impacts of waiving military pay when a Soldier makes this

election to ensure the Soldier understands their election. See paragraph 2-14 d for more information.

b. At the end of each fiscal year (FY), Soldiers in receipt of VA disability compensation who received military pay during the

FY will receive a VA 21-8951 from the VA. The VA 21-8951 is the same form as the VA 21-8951-2 except that it will include

the number of days of duty the Soldier performed during the FY. The Soldier must make an election on the form to waive

disability compensation or their military pay for the duty days performed and return the form to the VA. Failure to return the form may

result in reduction of disability compensation for the new FY.

c. Soldiers electing to waive their disability compensation will have their disability compensation reduced for the next year

by the number of duty days performed during the previous FY. This option is almost always the best financially for the Soldier

as disability compensation is normally less than military pay. See paragraph 2-14 d for an explanation of the financial impact of

waiving military pay rather than disability compensation.

d. Soldiers electing to receive disability compensation in lieu of military pay should not receive any military pay and

allowances for duty they perform during the FY. This includes, but is not limited to; BAs, AT, ADT, ADOS-RC, and mobilization

pay. Soldiers who fail to complete a VA 21-8951-2 at the beginning of the FY and later waive military pay on the VA 21-8951

received from the VA at the end of the FY will have their military pay collected. The VA will notify the UPC to collect any

military pay received while the Soldier elected to receive disability compensation in lieu of military pay. Soldiers who elect to

waive military pay should be counseled that in almost all situations, the Soldier will receive more money by waiving their disability

compensation than waiving their military pay. The following example shows the financial impacts for a SSG over 14 years of

service with a 40% disability rating who chooses to waive her military pay. Her disability compensation is $699.36 a month or

$23.31 per day. Her Basic Pay is $122.48 daily. The difference between her daily Basic Pay and DC rate is $99.17. By waiving her

military pay she loses $122.48 for each drill period. If she waived her DC, she would only lose $23.31 of her VA compensation

for the next year for each drill period performed. Over 48 drills she would lose $5,879.04 by waiving her military pay (48 drills x

$122.48) but only $1,118.88 (48 x $23.31) if she waived her DC. She would lose even more for each day of active duty by

waiving military pay because of the additional entitlements for BAH and BAS. Ensure that Soldiers understand the financial

impact of waiving military pay.

[NOTE: See figure G-6, Section 6, MMPA – WAIVER.]

Section VI

Servicemembers’, Combat, and Family Group Life Insurance (SGLI, CSGLI, and FSGLI)

2-15. SGLI, CSGLI, and FSGLI

a. SGLI required forms and collection process.

(1) SGLI deductions occur from the Soldier’s first payment each month. Soldiers without income for the month will incur

12 USAR PAM 37-1 • 7 May 2018

an SGLI debt.

(2) A new SGLV Form 8286 is required to decrease the level of SGLI coverage.

(3) A new SGLV Form 8286 is required to reinstate or increase current SGLI coverage. If Soldier answers “YES” to any

of questions 4a – 4g, the completed form should be sent to the Office of Servicemembers’ Group Life Insurance, PO Box 41618

Philadelphia, PA 19176-9913, for approval prior to submitting it to the UPC

(4) If SGLI premiums are deducted erroneously after a Soldier cancelled or elected a lower level of coverage, complete USAR

Form 22, check block 19 and provide a brief explanation of the problem in block 20. Attach a copy of the SGLV Form 8286 and

forward on a USAR Form 26 to the UPC.

(5) Timely submission of SGLI coverage elections is imperative. Coverage elections that are more than 3 months old (from

the date signed to the date submitted to the UPC) require RD or GFC approval for reimbursement of premiums.

(6) SGLI coverage continues while a Soldier is awaiting separation orders and not performing duty. Soldiers may stop

SGLI to avoid incurring a debt by completing a SGLV Form 8286 and having the unit submit it to the UPC. The SGLV Form

8286 must include the statement, “I do not want insurance at this time.” Advise Soldiers that SGLI coverage will stop on the

date the

Soldier makes the election.

[NOTE: See figure G-3, Section 3, MMPA – SGLI-CURRENT.]

b. Combat Servicemembers’ Group Life Insurance Allowance.

(1) The Combat SGLI (CSGLI) allowance is paid to Soldiers who were in the Theater of Operations for Operation Enduring

Freedom at any time during a month.

(2) The monthly allowance payable is equal to the Soldier’s monthly SGLI premium, not to exceed $400,000, plus the

monthly premium of $1.00 for Traumatic Injury Protection under the SGLI (T-SGLI) program. [Example: Soldier pays

$28.00 for $400,000 of SGLI, and $1.00 for T-SGLI. The Soldier is entitled to $29.00 for his/her CSGLI allowance.]

(3) The first $3.25 of CSGLI allowance is tax free. The remainder of the CSGLI allowance is taxable. However, since

the CSGLI allowance is part of the earnings received while in a qualified hazardous duty area or designated combat zone tax

exclusion (CZTE) zone, it is excluded from taxable income. An exception to this exclusion is officers whose monthly

taxable income exceeds the maximum monthly enlisted rate (plus imminent danger pay/hostile fire pay (IDP)/HFP) for that

month.

(4) The CSGLI allowance is paid during the month following the deduction of the SGLI premium CSGLI reimbursement

terminates the month after the Soldier departs the Theater of Operations.

c. Family Servicemembers’ Group Life Insurance (FSGLI).

(1) FSGLI is life insurance for dependents of active duty and TPU Soldiers.

(2) A Soldier’s spouse is covered automatically for $100,000, or the amount of the Soldier’s SGLI coverage,

whichever is less. FSGLI premiums for spousal coverage are dependent on the spouse’s age.

(3) Collection of FSGLI premiums begins automatically upon enrollment of dependents in Defense Eligibility

Enrollment Reporting System (DEERS) and is retroactive to when the Soldier last entered the military or the date the Soldier

acquired a dependent, whichever is later. Late enrollment of dependents in DEERS will cause collection of several months of

FSGLI premiums. FSGLI premiums carry forward as a debt for months that a Soldier does not receive pay.

(4) Soldiers not desiring FSGLI coverage must decline FSGLI on an SGLV Form 8286A and provide the form to

DEERS for processing in the Defense Manpower Data Center (DMDC) portal in DEERS. Soldiers cannot decline

coverage until after enrolling their dependents in DEERS and cannot backdate their declination.

(5) Soldiers with less than maximum FSGLI coverage will have their coverage increased to $100,000 upon mobilization.

Soldiers wishing to retain the lower level of coverage must complete an SGLV Form 8286A electing lower coverage and provide

it to DEERS for processing in the DMDC portal in DEERS.

(6) FSGLI declinations must be processed through the Defense Manpower Data Center (DMDC) portal in DEERS to stop

FSGLI premium deductions. The UPC cannot start, change, or stop FSGLI deductions. Each RD G1 should have a representative

that has access to DMDC to change or terminate FSGLI enrollment.

(7) Soldiers who had FSGLI deductions after declining coverage can apply for premium refunds by sending the

following documents via e-mail to usarmy.usarc.usarc-hq.mbx.ardebtmngt@mail.mil or faxing them to (317) 212-

2140:

(a) SGLV Form 8286A. The form must be signed, witnessed and dated. Back dating of signatures is not authorized.

(b) Screen print from the DMDC FSGLI Portal showing input to terminate the Soldier’s FSGLI.

(c) A memorandum from the unit stating when the FSGLI termination was input, why the termination was processed late,

and the origin of the SGLV Form 8286A (e.g. obtained from Soldier, unit file or iPERMS).

Section VII

Promotions, Reductions, and Pay Grade Corrections

2-16 Promotions

a. The UPC receives enlisted advancement and promotion data from RLAS and passes it to DJMS-RC weekly.

These actions should appear in DJMS-RC within 15 days of processing in RLAS. Units should not submit enlisted

advancement or promotion documents to the UPC unless the promotion does not appear on the Soldier’s MMPA. Follow

SSD exception procedures (paras 2-4 and 2-5) when submitting promotions to the UPC.

USAR PAM 37-1 • 7 May 2018 13

b. The UPC does not receive officer promotion data from RLAS. Units must submit officer promotion orders to the UPC.

c. DJMS-RC will automatically adjust base pay, BAH-RC, and some special and incentive pays for periods within IAS

(see para 1-8d). Submit adjustments to the UPC for duty outside IAS and any adjustments that do not occur automatically

with the promotion.

[NOTE: See figure G-1, Section 1, MMPA – GRADE, EDG.]

2-17. Reductions and Erroneous Promotions

a. Reductions

(1) With the exception of Reserve Officers' Training Corps (ROTC) Cadets, and Article 15 reductions, format 306 orders

are required for reductions to E5 – E8. Submit a copy of the reduction order to the UPC for processing.

(2) Erroneous advancements to E2-E4 require a DA 4187 returning the Soldier to the former grade and effective date

of grade. Submit a copy of the DA 4187 to the UPC for processing.

(3) Reductions for disenrollment from ROTC require a DA Form 4187, Personnel Action. Submit a copy of the DA Form 4187

to the UPC for processing.

(4) For reductions imposed under Article 15, submit a copy of the DA Form 2627, Record of Proceedings under

Article 15, UCMJ to the UPC for processing.

b. Erroneous Promotions

(1) Reductions to E5-E8 and all warrant and officer grades resulting from an erroneous promotion order require

revocation of the promotion order. Submit a copy of the revocation order to the UPC for processing.

(2) Use USAR Form 22 to correct the pay grade of Soldier’s advanced or promoted erroneously without a DA Form 4187

or promotion order (e.g. input or system error). Check block 13 of the USAR 22 and include an explanation in block 20 that the

Soldier was advanced or promoted erroneously due to an input or other error. Also explain that the promotion was not

documented on a promotion order or DA Form 4187.

c. A reduction in pay grade will adjust the Soldier’s pay account automatically for any duty periods inside IAS. The

UPC will make adjustments for periods outside of IAS.

[NOTE: See figure G-1, Section 1, MMPA – GRADE, EDG.]

2-18. Pay grade corrections

a. If the Soldier's MMPA was established with an incorrect pay grade, submit a USAR Form 22 and appropriate

document(s) supporting the Soldier’s correct pay grade to the UPC. Ensure that RLAS is also corrected.

b. Officers with over 4 years active duty as an enlisted or warrant officer, or more than 1460 enlisted or warrant officer

retirement points, are entitled to a higher rate of pay until reaching the rank of major. The O4E data item in Section 1 of the

MMPA will show “Y” if the officer is receiving pay at the O4E rate. If it does not show “Y”, submit a USAR Form 22 with

document(s) verifying more than 4 years active duty as an enlisted/warrant officer or more than 1460 enlisted/warrant officer

retirement points. The UPC will make adjustments for any inactive or active duty periods.

[NOTE: See figure G-1, Section 1, MMPA – GRADE, EDG, 04E.]

Section VIII

Pay Entry Basic Date (PEBD)

2-19. Changes in PEBD

a. A Soldier’s rate of pay is determined by his/her pay grade and years of creditable service. For instance, a sergeant with

8 years of service will earn more than a sergeant with 6 years of service. A Soldier's years of creditable service is computed

from the PEBD. The PEBD is referred to as the “Pay Date” on the MMPA. Creditable service is determined IAW chapter 1 of

the DODFMR, Volume 7A. For non-prior service Soldiers—

(1) Time spent in the Delayed Entry Program (DEP) (currently known as the Future Soldiers Program) prior to 1 January

1985 is creditable service. From 1 January 1985 to 28 November 1989, DEP time prior to active duty or service in a Reserve

Component is not creditable.

(2) After 28 November 1989, DEP for the Army Reserve and National Guard is creditable if the Soldier performs at

least one IDT period prior to basic combat training (BCT). Soldiers who do not perform IDT prior to BCT should have a

PEBD of the first day of BCT.

(3) All non-prior service Soldiers incur a service obligation when they enlist. Any Soldiers entering the Army after May

1984 incurs an 8-year service obligation. Soldiers who complete their active duty or TPU obligation and transfer to the IRR

continue to accrue creditable service until discharged. This credit accrues even if the Soldier does not earn enough retirement

points for a good year.

b. UPAs must verify the PEBD of all non-prior service Soldiers upon completion of BCT. If the Soldier’s PEBD is the date

of enlistment and the Soldier did not perform IDT prior to BCT, submit a USAR Form 22 and a copy of DD Form 220, Active

Duty Report or DD Form 214 to the UPC to adjust the PEBD to the first day of BCT.

c. Prior service Soldiers may be assigned with an incorrect PEBD that does not reflect some or all of their prior creditable

service. In these cases, request a change to the PEBD by submitting a USAR Form 22, a completed PEBD calculator

worksheet and documents to support the Soldier’s prior creditable service to the UPC. The PEBD calculator worksheet is

14 USAR PAM 37-1 • 7 May 2018

available at https://xtranet/Organization/DCGUSARC/CoS/Coordinating/DCSG-8/pay/References/Forms/Refs.aspx.

Appropriate documents include DD Form 4, DD Form 214, DD Form

215, NGB

Form 22 Report of Separation and Record of

Service and 22A Correction to NGB Form 22, DA Form 4836 Oath of Extension of Enlistment or Reenlistment, assignment,

transfer or separation orders, and other documents that record periods of service. While the DA Form 5016 is not a valid

document for creditable service, it should be included as a cross-check to ensure accounting of all periods of prior service.

Soldiers may print their DA 5016 from the HRC web site at https://www.hrcapps.army.mil/portal/.

d. Computation of the PEBD. The UPC verifies the PEBD using the documents provided by the unit. Creditable service

cannot be granted for periods that are not documented. Specific rules for computing the PEBD are in chapter 1 of the

DODFMR, Volume 7A. In general, these are the rules for computing pay dates for Soldiers with periods of prior service.

(1) If a period of service ended on the last day of the month and that day is not the 30th, change the ending date in

your computation to 30 (because the Army pays on a 30-day month).

(2) If service ends on 28 February of a leap year, leave it 28 February.

(3) If, after computing the pay date, the PEBD falls on 29 February of a leap year, use that date. In non-leap years,

increase the PEBD to 1 March.

e. The following are examples of how to compute a Soldier’s pay date:

(1) A prior service enlistee in your unit spent 6 years on active duty in the Army, and 2 years in the IRR. He received a

discharge after completing his 8-year military obligation and had no other military duty until joining your unit. [NOTE: The

term “enlistment date” also refers to officers’ appointment dates and constructive service credit for medical and dental

officers (see DODFMR, Volume 7A, chap 1).]

Regular Army 98-07-11 to 03-07-10

IRR 03-07-11 to 06-07-10

(a) Since there is not a break in service, simply subtract the beginning date of service from the ending date

to determine total prior service.

Period: YY MM

DD End Date: 06 07 10

(-) Start Date: 98 07 11

Subtotal: 07 11

29* (+) 1 inclusive day: 01

(=) Net Service: 07 11 30

Total Prior Service: 8 years

(b) If this Soldier enlisted in your unit on 8 February 2007, you would have to compute an adjusted pay date to account

for the break in service. To compute the adjusted date, subtract his/her total prior service from the current

enlistment

date.*

Final Calculation: YY MM DD

Last date entered service:

07

02

08

*(-) Total Creditable Service:

08

00

00

(=) PEBD:

99

02

08

[NOTE: Convert 1 year to 12 months and add to the month's column, and convert 1 month to 30 days and add to the day's

column, to subtract months and days.]

(2) In this example the Soldier has more than one period of creditable service. You must add each period to

determine total creditable service. The Soldier served on active duty for 4 years, then spent 4 years in a control group before

discharge at the end of an 8-year military service obligation (MSO). One year later, the Soldier enlisted in the Army

National Guard (ARNG) for 3 years and is now enlisting into your unit on 24 May 2006. The PEBD computation would be:

Period 1:

End Date:

YY

00

MM

09

DD

03

(includes 6 years AD

and 2 years IRR)

(-) Start Date:

92

09

04

Subtotal:

07

11

29

(+) 1 inclusive day:

01

(=) Net Service:

07

11

30

USAR PAM 37-1 • 7 May 2018 15

Period 2:

End Date:

YY

04

MM

04

DD

17

(-) Start Date:

01

04

18

Subtotal:

02

11

29

(+) 1 inclusive day:

01

(=) Net Service:

02

11

30

Add Periods:

YY MM DD

Period 1:

07

11 30

Period

2:

02

11

30

Total New Prior Service: 09 22 60

Total Prior Service: 11 years

Final Calculation:

YY MM DD

Last date entered service: 06 05 24

(-)

Total

Creditable

service:

11

00

00

(=) PEBD: 95 05 24

Section IX

Administrative Changes

2-20. Administrative procedures

Use the following procedures to correct/update a Soldier’s MMPA. Refer to appendix D, procedure D-2, for required forms and

supporting documents.

a. Social security number (SSN) change. Contact your CPM prior to taking any actions for Soldiers who have received

payment under an incorrect SSN. The CPM coordinates with the UPC to transfer the Soldiers wage and tax information to the

correct SSN.

(1) If the SSN is incorrect in personnel and pay, correct the Soldier’s SSN in the personnel module of RLAS to generate an

SSD transaction to update the MMPA. Do not attempt to create a new record with the correct SSN.

(2) If the SSN is correct in the personnel module of RLAS, but incorrect on the MMPA, submit USAR Form 22 to the

UPC with one of the documents in procedure D-2, rule 2, indicating the correct SSN and one of the SSD exception documents

listed in paragraph 2-6.

[NOTE: See figure G-1, Section 1, MMPA – SSN.]

b. Name.

(1) If the name is incorrect in personnel and pay, correct the Soldier’s name in the personnel module of RLAS to generate

an SSD transaction to update the MMPA.

(2) If the name is correct in the personnel module of RLAS but incorrect on the MMPA, submit USAR Form 22 to the

UPC with one of the documents in procedure D-2, rule 4 indicating the correct name and one of the SSD exception documents

listed in paragraph 2-6.

[NOTE: See figure G-1, Section 1, MMPA – NAME.]

c. Sex code change. Submit USAR Form 22 indicating the correct sex code to the UPC.

[NOTE: See figure G-1, Section 1, MMPA – SEX.]

d. Date of Gain (DOG) change. Check block 7 of USAR Form 22, enter new date of gain in block 20, and submit to the

UPC with one of the documents in procedure D-2, rule 6 indicating the correct DOG.

[NOTE: See figure G-1, Section 1, MMPA – DOG.]

e. Officer Service Date (OSD)/Aviation Service Date (ASD) change. Check block 19 of USAR Form 22, place the

OSD/ASD dates in block 20 and submit to the UPC with one of the documents in procedure D-2, rule 7.

[NOTE: See figure G-2, Section 2, MMPA – OSD-ASD.]

f. Program element code (PEC), personnel accounting symbol (PAS), or state pay group mobilization augmentee (ST

PGMA) Code changes.

(1) PEC. Submit a USAR Form 22 with the correct PEC to the UPC.

16 USAR PAM 37-1 • 7 May 2018

(2) PAS. PAS codes (UIC portion) are updated through SSD. If the UIC is correct in RLAS but the UIC portion of the

PAS is incorrect on the MMPA, submit a USAR Form 22 with the correct PAS in block 8 to the UPC. The UIC portion of the