UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-5424

DELTA AIR LINES, INC.

(Exact name of registrant as specified in its charter)

Delaware 58-0218548

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

Post Office Box 20706

Atlanta, Georgia 30320-6001

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (404) 715-2600

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

Common Stock, par value $0.0001 per share DAL New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and

"emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☑

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included

in the filing reflect the correction of an error to previously issued financial statements o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2023 was

approximately $30.4 billion.

On January 31, 2024, there were outstanding 643,323,851 shares of the registrant's common stock.

This document is also available on our website at http://ir.delta.com/.

Documents Incorporated By Reference

Part III of this Form 10-K incorporates by reference certain information from the registrant's definitive Proxy Statement for its 2024 Annual

Meeting of Stockholders to be filed with the Securities and Exchange Commission.

Table of Contents

Page

Forward-Looking Statements 1

PART I

ITEM 1. BUSINESS 2

ITEM 1A. RISK FACTORS 17

Risk Factors Relating to Delta 17

Risk Factors Relating to the Airline Industry 23

ITEM 1B. UNRESOLVED STAFF COMMENTS 26

ITEM 1C. CYBERSECURITY 27

ITEM 2. PROPERTIES 29

Flight Equipment 29

Ground Facilities 30

ITEM 3. LEGAL PROCEEDINGS 31

ITEM 4. MINE SAFETY DISCLOSURES 31

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 32

ITEM 6. (RESERVED) 33

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS 34

Financial Highlights 34

Results of Operations 35

Non-Operating Results 38

Income Taxes 39

Refinery Segment 39

Financial Condition and Liquidity 41

Critical Accounting Estimates 45

Supplemental Information 50

Glossary of Defined Terms 53

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 54

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 55

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE 98

ITEM 9A. CONTROLS AND PROCEDURES 98

ITEM 9B. OTHER INFORMATION 100

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS 100

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 100

ITEM 11. EXECUTIVE COMPENSATION 100

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS 100

Unless otherwise indicated or the context otherwise requires, the terms "Delta," "we," "us," and "our" refer to Delta Air

Lines, Inc. and its subsidiaries.

FORWARD-LOOKING STATEMENTS

Statements in this Form 10-K (or otherwise made by us or on our behalf) that are not historical facts, including statements

about our estimates, expectations, beliefs, intentions, projections or strategies for the future, may be "forward-looking

statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially from historical experience or our present expectations. Known

material risk factors applicable to Delta are described in "Risk Factors Relating to Delta" and "Risk Factors Relating to the

Airline Industry" in "Item 1A. Risk Factors" of this Form 10-K, other than risks that could apply to any issuer or offering. All

forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any

forward-looking statements to reflect events or circumstances that may arise after the date of this report.

Delta Air Lines, Inc. | 2023 Form 10-K 1

Part I

ITEM 1. BUSINESS

General

As a global airline based in the United States, we connect customers across our expansive global network with a

commitment to industry-leading customer service, safety and innovation. In 2023, we served over 190 million customers.

Competitive Advantages and Brand Strength

The competitive advantages that support our trusted consumer brand include our people and culture, operational reliability,

global network, customer loyalty and financial foundation. In 2023, we continued to differentiate Delta from the industry by

strengthening our competitive advantages.

People and Culture

The Delta people and culture are our strongest competitive advantage. Our more than 100,000 employees provide world-

class travel experiences for our customers and best-in-class service, delivering customer satisfaction and brand preference. We

believe that Delta's brand transcends the industry, powered by our people's outstanding work and passion for serving our

customers. Delta is the world's No. 11 Most Admired Company as ranked by FORTUNE and is ranked No. 13 in the U.S. on

Glassdoor's Best Places to Work list.

Our industry-leading profit sharing program directly aligns our employees' interests with the company's long-term success

and for 2023, we are rewarding them with $1.4 billion in profit sharing payments. The company also maintains a Shared

Rewards program to incentivize operational performance, and our employees earned $53 million under this program in 2023.

Operational Reliability

We remain committed to industry-leading reliability and are consistently among the industry's best performers, delivering

the best on-time arrival among our network carrier peers in 2023. In recognition of our commitment to operational performance

and minimizing passenger disruption, we were honored for the third consecutive year with the Cirium Platinum Award for

global operational excellence in January 2024, and named the most on-time airline in North America. The Wall Street Journal

named us the top airline of 2023 among the nine major U.S. airlines in its annual airline scorecard for the third consecutive

year, leading the industry in on-time arrivals and involuntary denied boardings.

Global Network

We and our alliance partners collectively serve over 130 countries and territories and over 700 destinations around the

world. At the end of 2023, we offered more than 4,000 daily flights to more than 280 destinations on six continents.

Our domestic network is centered around core hubs in Atlanta, Minneapolis-St. Paul, Detroit and Salt Lake City. Core hubs

have strong local passenger share, a high penetration of customers loyal to Delta, a competitive cost position and strong

margins. Core hub positions complement coastal hub positions in Boston, Los Angeles, New York-LaGuardia, New York-JFK

and Seattle. Coastal hubs provide a strong presence in large revenue markets and enable growth in premium products and

international service.

In 2023, we focused on restoring our core hubs while solidifying positions in our coastal hubs. We expect to leverage our

coastal gateways and strategic relationships with international airline partners to further grow our international service.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 2

Internationally, we operate significant hubs in, or have market presence in the key cities of, Amsterdam, Bogota, Lima,

London-Heathrow, Mexico City, Paris-Charles de Gaulle, Santiago (Chile), Sao Paulo, Seoul-Incheon and Tokyo. Through

innovative alliances with Aeroméxico, LATAM Airlines Group S.A. ("LATAM"), Air France-KLM, China Eastern, Korean Air

and Virgin Atlantic, we seek to bring more choice to customers worldwide. Our strategic relationships with these international

airlines are an important part of our business as they improve our access to markets around the world and enable us to provide

customers a more seamless global travel experience across our alliance network. The most significant of these arrangements are

commercial joint ventures or cooperation agreements that include joint sales and marketing coordination, co-location of airport

facilities and other commercial cooperation arrangements. In some cases, we have reinforced strategic alliances through equity

investments where we have opportunity to create deep relationships and maximize commercial cooperation.

Our global network is supported by a fleet of 1,273 aircraft as of December 31, 2023 that are varied in size and capabilities,

giving us flexibility to adjust aircraft to the network. We are continuing to refresh our fleet by acquiring new and more fuel-

efficient aircraft with increased premium seating and cargo capacity to replace retiring aircraft. Simultaneously, we continue on

our multi-year journey of fleet simplification by replacing retiring aircraft with deliveries of next-generation aircraft. In 2023,

we took delivery of 43 aircraft, including new A321neos, A220-300s and A330-900s. Our new aircraft delivered since 2019 are

on average 28% more fuel efficient per seat mile than aircraft retired since 2019. In January 2024, we entered into a purchase

agreement with Airbus for 20 A350-1000 aircraft, with an option to purchase an additional 20 widebody aircraft. Deliveries of

these aircraft are scheduled to begin in 2026.

Customer Loyalty

With operational excellence, best-in-class service and commitment to our customers, we have continued to earn our

customers' trust and preference by delivering the "Delta Difference." We are elevating the customer experience by deploying

our newest aircraft, accelerating generational airport investments in key markets, including new facilities that opened at New

York-LaGuardia, Los Angeles and Salt Lake City, and investing in our digital transformation. We believe our continued

investment in customer service and experience, operations, product, airports and technology has shaped customer perception of

our brand leading to improvements in our domestic net promoter scores and increased customer loyalty compared to pre-

pandemic levels. In 2023, various outlets recognized Delta as a trusted consumer brand, including:

• Named the number one airline by corporate travel customers in the annual Business Travel News Airline Survey for

the 13

th

year in a row and the number one U.S. airline by Condé Nast Traveler readers.

• Ranked No. 12 in TIME magazine's World's Best Companies of 2023 based on revenue growth, employee satisfaction

and the company's sustainability profile.

• Earned the No. 1 spot on The Points Guy's list of best U.S. Airlines for the fifth year in a row, and USA Today readers

selected Delta as the Best Airline of 2023.

Our award-winning SkyMiles program, discussed in further detail below, is designed to attract lifetime members and to

grow customer loyalty by offering our customers a wide variety of benefits when traveling with us and our partners, and

personalizing our engagement with them. We aim to increase the value of our program for customers and to deepen customer

engagement with Delta through a growing ecosystem of partnerships with premier brands, extending the value of our SkyMiles

currency beyond flight and introducing new technology initiatives. We believe there is opportunity to continue this trend and

expect the increased value we provide customers to deliver high-margin revenue and resilient cash flows.

Financial Foundation

In 2023, we made significant progress restoring our financial foundation with strong profitability and $2 billion of free cash

flow for the year. Our financial results are discussed in more detail in "Item 7. Management's Discussion and Analysis," which

includes definitions and reconciliations of non-GAAP financial measures, including free cash flow, under the "Supplemental

Information" section.

Restoring the strength of our balance sheet and reducing debt is a key financial priority. During 2023, we repaid

approximately $4.1 billion in debt and finance lease obligations and the company remains committed to regaining investment

grade metrics.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 3

Over the last decade we have fundamentally transformed our business by investing in our people, our product and our

reliability to alter the commodity-like nature of air travel and improve our financial foundation. We have diversified our

business by growing high-margin revenue streams that leverage our competitive advantages, including:

• Our continued focus on our premium products (including Delta One

®

, First Class, Delta Premium Select and Delta

Comfort+

®

) and customer segmentation, which has reduced our reliance on the most price sensitive customer segment.

• Our partnership with American Express, which provides us a co-brand revenue stream tied to broader consumer

spending.

• Our Maintenance, Repair and Overhaul ("MRO") operation, where we believe that we remain well-positioned for

growth through contractual agreements with jet engine manufacturers, including three next generation engine

platforms.

• Our other complementary portfolio businesses, such as our cargo business and our travel-adjacent services, which

include trip insurance, car and hotel rentals.

Our premium yield growth has significantly outpaced main cabin, with record paid load factors in premium cabin in 2023,

as demand for premium products continues to grow. In 2023, we grew our mix of premium seats, including the continued

expansion of Delta Premium Select. The sale of premium products is facilitated through various distribution channels, with

62% of tickets sold through direct channels in 2023. These include digital channels, such as the Fly Delta app, which surpassed

one billion visits in 2023, delta.com and our reservations specialists. Indirect distribution channels include online travel

agencies and traditional "brick and mortar" agencies. We make fare and product information widely available across those

channels in an effort to ensure customers receive the best information and service options, further supporting the growth of

premium products.

SkyMiles Program

Our SkyMiles program provides members with the ability to earn mileage credits ("miles") when traveling on Delta, Delta

Connection and our partner airlines. Miles may also be earned by using certain services offered by program partners, such as

credit card, retail, ridesharing, car rental and hotel companies. To facilitate transactions with participating companies, we sell

miles to non-airline businesses and other airlines.

Miles may be used toward award redemptions such as flights and upgrades on Delta, our regional carriers and other

participating airlines as well as donations to specific charities and more. In 2023, 10% of revenue miles flown on Delta were

from award travel, as program members redeemed miles in the loyalty program for approximately 30 million award tickets. Our

most significant and valuable contract to sell miles relates to our co-brand credit card relationship with American Express. In

2023, remuneration from American Express totaled $6.8 billion, which we expect to increase by 10% in 2024 and grow to $10

billion over the long-term.

Innovative Investments in Technology

Our objective is to make technology a strategic differentiator. We continue to invest in technological improvements that

enhance the customer experience, support our operations and empower our people. These investments include innovations to

customer facing applications and improvements to infrastructure and technology architecture to unify and improve access to

data sources. We believe this digital transformation enhances interactions with our customers and allows our people to deliver

more personalized service, further enhancing the customer experience, strengthening our brand and driving revenue and

efficiency.

Through the development of innovative new technologies, we can better serve customers and give our employees the best

tools. For our customers, we are making investments in the digital platforms on the ground and in the air. We continue to

evolve the Fly Delta app into a digital travel concierge for our customers to offer convenient services on the day of travel and

deliver thoughtful notifications to make their travel journeys more seamless. On the ground, we are investing to create a

smoother, less stressful and increasingly contactless travel experience. Onboard the aircraft, we continue to invest in in-flight

entertainment and announced fast and free Wi-Fi for all customers through a free SkyMiles account on most domestic mainline

flights, with plans for full availability on international and regional aircraft. We also introduced Delta Sync, which will enable

the creation of more personalized experiences over the next several years and further elevate the consumer experience across

the travel journey, including partnerships with leading brands. For our employees, we are investing in applications that allow

our people to have more meaningful interactions with our customers.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 4

Commercial Arrangements with Other Airlines

Joint Venture/Cooperation Agreements. We have implemented four separate joint venture or joint cooperation agreements

with foreign carriers as described below. We have sought to reinforce a number of the agreements through equity investments

in those carriers. See Note 4 of the Notes to the Consolidated Financial Statements for additional information about our equity

investments.

Each of our joint venture or cooperation arrangements provides for joint commercial cooperation with the relevant partner

within the geographic scope of the arrangement, including the sharing of revenues and/or profits and losses generated by the

parties on the joint venture routes, as well as joint marketing and sales, coordinated pricing and revenue management, network

and schedule planning and other coordinated activities with respect to the parties' operations on joint venture routes. Our

implemented commercial joint ventures/cooperation agreements consist of the following:

• A combined joint venture with Air France, KLM and Virgin Atlantic with respect to transatlantic traffic flows. In

addition to the joint venture, we own a non-controlling 49% equity stake in Virgin Atlantic Limited, the parent

company of Virgin Atlantic Airways and a 3% ownership stake in the parent company of Air France and KLM.

• A joint cooperation agreement with Aeroméxico with respect to trans-border traffic flows between the U.S. and

Mexico. In addition to the joint cooperation agreement, we currently own an approximately 20% equity stake in Grupo

Aeroméxico, S.A.B. de C.V., the parent company of Aeroméxico.

• A joint venture agreement with LATAM with respect to traffic flows between North and South America, allowing our

passengers to access more than 300 destinations between the United States/Canada and South America (Brazil, Chile,

Colombia, Paraguay, Peru and Uruguay). We currently own an approximately 10% equity stake in LATAM.

• A joint venture with Korean Air with respect to traffic flows between the United States and certain countries in Asia.

In addition to the joint venture, we own just under 15% of the outstanding common stock of Hanjin-KAL, the largest

shareholder of Korean Air.

Each of our joint venture or joint cooperation agreements described above has been approved and granted antitrust immunity

from the U.S. Department of Transportation ("DOT"). The grant of antitrust immunity for our joint cooperation agreement with

Aeroméxico is subject to a pending renewal application with the DOT, which was tentatively dismissed pursuant to an Order to

Show Cause issued by the DOT on January 26, 2024. The existing immunity remains in effect pending final adjudication of the

renewal application, the timing and outcome of which cannot be predicted at this time.

Enhanced Commercial Agreements with China Eastern. We own a 2% equity interest in China Eastern, with whom we have

a strategic joint marketing and commercial cooperation arrangement covering traffic flows between China and the U.S., which

includes reciprocal codesharing, loyalty program participation, airport lounge access and joint sales cooperation.

SkyTeam. We are a member of the SkyTeam global airline alliance. The other members of SkyTeam are Aerolíneas

Argentinas, Aeroméxico, Air Europa (Spain), Air France, China Airlines, China Eastern, Czech Airlines, Garuda Indonesia,

ITA Airways (Italy), Kenya Airways, KLM, Korean Air, Middle East Airlines, Saudia, TAROM (Romania), Vietnam Airlines,

Virgin Atlantic and Xiamen Airlines (China). Through alliance arrangements with other SkyTeam carriers, we are able to link

our route network with those of the other member airlines, providing opportunities to increase connecting traffic while offering

enhanced customer service through reciprocal codesharing and loyalty program participation, airport lounge access and cargo

operations.

Other International Carriers. We also have marketing arrangements with other airlines to enhance our global network.

These arrangements may include codesharing, reciprocal loyalty program benefits, shared or reciprocal access to passenger

lounges, joint promotions, common use of airport gates and ticket counters, office co-location and other activities.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 5

Regional Carriers

We have air service agreements with domestic regional air carriers that feed traffic to our network by serving passengers

primarily in small and medium-sized cities in the domestic market. These arrangements enable us to better match capacity with

demand in these markets.

Through our regional carrier program, Delta Connection

®

, we have contractual arrangements with regional carriers to

operate aircraft using our "DL" designator code. We currently have contractual arrangements with:

• Endeavor Air, Inc., a wholly owned subsidiary of ours ("Endeavor").

• Republic Airways, Inc.

• SkyWest Airlines, Inc. ("SkyWest Airlines").

Our contractual agreements with regional carriers are primarily capacity purchase arrangements, under which we control the

scheduling, pricing, reservations, ticketing and seat inventories for the regional carriers' flights operating under our "DL"

designator code. We are entitled to all ticket, cargo, mail, in-flight and ancillary revenues associated with the flights under these

capacity purchase arrangements. We pay those airlines an amount, as defined in the applicable agreement, which is based on a

determination of their cost of operating those flights and other factors intended to approximate market rates for those services.

These capacity purchase agreements are long-term agreements, usually with initial terms of at least ten years, which grant us the

option to extend the initial term. Certain of these agreements provide us the right to terminate the entire agreement, or in some

cases remove some of the aircraft from the scope of the agreement, for convenience at certain future dates.

SkyWest Airlines operates some flights for us under a revenue proration agreement. This proration agreement establishes a

fixed dollar or percentage division of revenues for tickets sold to passengers traveling on connecting flight itineraries.

Cargo

Through our global network, our cargo operations are able to connect the world’s major freight gateways. We generate

cargo revenues in domestic and international markets through the use of cargo space on regularly scheduled passenger aircraft.

We are a member of SkyTeam Cargo, an international airline cargo alliance with eight other airlines that offer a network

spanning six continents, through which we provide global solutions to our customers by connecting our network with those

partners.

In 2023, cargo revenues decreased year over year, mostly resulting from lower yield due to decreased market demand and

increased industry capacity.

Other Complementary Businesses

We have various other businesses arising from our airline operations, including the following:

• In addition to providing maintenance and engineering support for our fleet of 1,273 mainline and regional aircraft, our

MRO operation, known as Delta TechOps, serves aviation and airline customers from around the world. With

agreements to service multiple next-generation aircraft engines, Delta TechOps is positioned as a leading global

service provider for state-of-the-art, more sustainable engines.

• Our vacation wholesale subsidiary, Delta Vacations, provides vacation packages to third-party consumers. Revenue

allocated to Delta Vacations excludes flight revenue associated with vacation packages.

In 2023, the aggregate revenue from our MRO operation and Delta Vacations was approximately $840 million.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 6

Environmental Sustainability

In 2023, we outlined our roadmap to a more sustainable future of travel that details our strategy for achieving net-zero

greenhouse gas emissions from our airline operations by 2050. As part of this roadmap, we announced short-, medium- and

long-term milestones which will help us measure and report progress towards our ultimate net-zero goal. In 2023, we made

progress toward achievement of our goals across three key areas:

What We Fly

• Fleet renewal: We continue to make our existing fleet more efficient as older aircraft are retired. Additions to our fleet

since 2019, including 43 new aircraft delivered in 2023, are on average 28% more fuel efficient per seat mile than

aircraft retired since 2019. We also completed the retirement of the CRJ-200 fleet in 2023, our least fuel-efficient

aircraft type, contributing to a fleet-wide fuel efficiency improvement of 5.5% compared to 2019.

• Pursuing future aviation technologies: Our sustainability strategy aims to introduce revolutionary aircraft into our

fleet. In 2023, we joined a coalition alongside Boeing and NASA to support the Sustainable Flight Demonstrator

program. We will serve as an adviser on a new aircraft design with a Transonic Truss-Braced Wing, which will be the

first ever experimental aircraft focused on sustainability. We sold two retired MD-90 aircraft to Boeing which will

become the test planes for the program. This innovative project supplements previously announced partnerships with

Airbus on their hydrogen-powered aircraft research as well as our investment in Joby Aviation, which aims to pioneer

home-to-airport transportation through electric, vertical takeoff and landing (eVTOL) technology.

• Fleet modification: Following the completed installation of split-scimitar winglets on the Boeing 737-900ER fleet, and

outfitting all Boeing 737-800 and 737-900ER aircraft with lighter-weight, radial landing gear tires in 2022, we began

installing split-scimitar winglets on the 737-800 fleet in 2023. When complete, this enhancement is expected to drive

approximately three million gallons of fuel savings annually. Additionally, we completed modifications and

certification test flights for a novel drag reduction system on the 737-800 fleet with Aero Design Labs, accelerating the

certification of this innovation.

How We Fly

• Aircraft operations: Teams across Delta have worked together to make an impact through enhanced landing

procedures, optimizations to flight routing and speed, and weight reduction initiatives. These cross-divisional efforts

coordinated through our Carbon Council have saved over 20 million gallons of jet fuel in 2022 and 2023.

• Waste reduction: Our Waste Council was established in 2023 and led the evaluation of test sites across our operation

aiming to capture more recyclable materials by changing processes and leveraging catering kitchens. We also launched

our paperless gates initiative in 2023, allowing gate agents to bypass the automatic printing of pre-departure and

departure documents on all flights. The effort eliminates printer malfunctions, cuts paper and printer maintenance costs

and saves an estimated 70 million pages per year – the equivalent to 4,000 trees.

• Ground operations: In 2023, we purchased more than 500 new electric ground support equipment ("GSE") for

utilization across our network, inclusive of baggage tractors, belt loaders, and aircraft tow tractors. The equipment

necessary to turn an aircraft (core GSE) at our hubs in Salt Lake City and Boston is nearly entirely powered with

electricity.

The Fuel We Use

• Continued investment in sustainable aviation fuel ("SAF"): With approximately 90% of our carbon emissions

coming from jet fuel, finding lower emissions fuel alternatives is critical to making progress toward net zero. SAF,

which can be channeled to airports through existing fuel infrastructure, is central to reducing the lifecycle emissions

from aviation fuel and is safe to use in current aircraft engines. Our Global Sustainability and Fuel teams have been

working over the past several years to catalyze investment and stimulate SAF production by signing offtake

agreements with various SAF producers. Under these agreements, we have contracted to purchase SAF when it is

available, subject to certain conditions. In 2023, we used over three million gallons of SAF onboard our aircraft, nearly

doubling our 2022 SAF utilization.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 7

• Building coalitions for the future: We continue to advocate for policy incentives to scale the SAF market. For

example, we are a founding member of Americans for Clean Aviation Fuels (ACAF), a diverse coalition of the largest

industrial sectors in America from farmers to fuel producers and aviation to agribusiness. This coalition is focused on

promoting the economic benefits of building a robust market for SAF and clean aviation fuels. We are also a founding

member of the Minnesota SAF Hub, a first-of-its-kind partnership among corporations seeking to collaborate on

scaling SAF production.

The global aviation industry is viewed as a "hard-to-abate" sector, meaning it is innately difficult to decarbonize. Achieving

our long-term goals will require substantial expansion of the SAF market, the adoption of new technologies, engagement from

both internal and external stakeholders, as well as partnerships across industries to increase production of alternative fuels and

help drive down costs.

Employee Matters

Human Capital and Commitment to Diversity, Equity and Inclusion

We believe that the Delta people and culture are our strongest competitive advantage, and the high-quality service that our

employees provide sets us apart from other airlines. As of December 31, 2023, we had approximately 103,000 full-time

employee equivalents, of which approximately 100,000 were based in the U.S.

Our principal human capital management objectives are to attract, retain and develop people who understand and are

committed to delivering the "Delta Difference" that is core to our brand. To support these objectives, we have put in place

programs that seek to:

• Reward our people through highly competitive total compensation designed to share Delta’s success with our

employees who make it possible and promote teamwork and collaboration across the business.

• Achieve high performance by fostering our people’s holistic wellbeing including physical, emotional, social and

financial wellbeing.

• Drive employees’ professional and community engagement.

• Prepare our employees for key roles and future leadership positions through a variety of training and development

programs.

• Enhance our culture through efforts aimed at making our workplace more engaging, equitable and inclusive.

The health and safety of our employees is foundational to achieving these objectives. Delta's Safety Management System is

central to promoting a positive safety culture, proactively managing safety risk, and making investments to ensure a safe

experience for our employees and customers.

Our commitment to diversity, equity and inclusion is critical to effective human capital management at Delta. As a global

airline, we are in the business of bringing people together, and we believe our business should reflect the diversity of our

customer base. To achieve this goal, we seek diverse talent internally and externally in an effort to achieve broader

representation throughout our organization. We also promote inclusion through education, training and development

opportunities as well as by leveraging insights from our ten employee resource groups, which we refer to as business resource

groups, totaling membership of more than 30,000 as of December 31, 2023.

We continued to invest in our leadership’s equity learning and understanding in 2023, with nearly 80% of officers

participating in our voluntary two-day racial equity workshop by the end of 2023. In 2023, we also introduced a new diversity,

equity and inclusion education program, building on foundational learnings through a multitude of different training offerings.

In addition, we are reviewing and revising systems, practices and policies in support of our commitment to diversity, equity

and inclusion and with a focus on achieving equitable outcomes. Two key areas on which we are focused are (1) reinforcement

of our diverse talent pipeline by, among other things, requiring hiring candidate slates and interview panels to reflect diversity,

and taking a proactive approach to build internal and external career pathways to certain roles by removing college degree

requirements and introducing a skills-first talent approach, and (2) closing diversity gaps in senior leadership positions by

increasing the representation of women, Black and Latin/Hispanic groups in those roles.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 8

We also believe that listening, engaging and connecting with employees furthers our human capital management objectives.

We have historically done so primarily through our open-door policy, digital communication across all levels of the company,

in-person events with senior management and company-wide and division-specific surveys to evaluate employee satisfaction.

Members of senior management participate in regular company-wide town hall discussions with our employees and our senior

executive leadership team regularly shares memos with all employees regarding our ongoing commitment to our people and our

culture. We have also continued to conduct periodic employee surveys to seek feedback on engagement levels in general, our

wellbeing programs, diversity, equity and inclusion efforts and our culture of safety.

Collective Bargaining

As of December 31, 2023, approximately 20% of our full-time equivalent employees were represented by unions.

Domestic airline employees represented by collective bargaining agreements by group

Employee Group

Approximate Number of

Employees Represented Union

Date on which Collective

Bargaining Agreement

Becomes Amendable

Delta Pilots

(1)

16,960 ALPA December 31, 2026

Delta Flight Superintendents (Dispatchers) 490 PAFCA November 1, 2024

Endeavor Pilots 1,530 ALPA January 1, 2029

Endeavor Flight Attendants 1,600 AFA March 31, 2027

(1)

Delta’s pilots ratified a new four-year Pilot Working Agreement in March 2023, effective January 1, 2023.

In addition to the domestic airline employee groups discussed above, approximately 200 refinery employees of our wholly

owned subsidiary, Monroe Energy, LLC ("Monroe") are represented by the United Steel Workers under an agreement that

expires on February 28, 2026. This agreement is governed by the National Labor Relations Act ("NLRA"), which generally

allows either party to engage in self-help upon the expiration of the agreement. Certain of our employees outside the U.S. are

represented by unions, work councils or other local representative groups.

Labor unions periodically engage in organizing efforts to represent various groups of our employees, including at our

operating subsidiaries, that are not represented for collective bargaining purposes.

Fuel

Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel. We purchase

most of our aircraft fuel under contracts that establish the price based on various market indices and therefore do not provide

material protection against price increases or assure the availability of our fuel supplies. We also purchase aircraft fuel on the

spot market, from offshore sources and under contracts that permit the refiners to set the price. We are currently able to obtain

adequate supplies of aircraft fuel, including fuel produced by Monroe or procured through the exchange of gasoline, diesel and

other refined petroleum products ("non-jet fuel products") the refinery produces, and crude oil for Monroe's operations.

The following table shows our aircraft fuel consumption and costs:

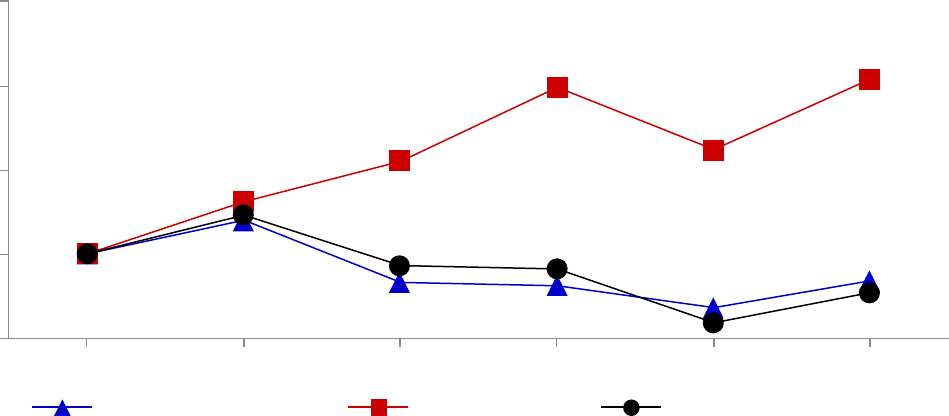

Fuel consumption and expense by year

Year

Gallons

Consumed

(1)

(in millions)

Cost

(1)(2)

(in millions)

Average Price

Per Gallon

(1)(2)

Percentage of

Total Operating

Expense

(1)(2)

2023 3,926 $ 11,069 $ 2.82 21 %

2022 3,412 $ 11,482 $ 3.36 24 %

2021 2,778 $ 5,633 $ 2.02 20 %

(1)

Includes the operations of our regional carriers operating under capacity purchase agreements.

(2)

Includes the impact of fuel hedge activity and refinery segment results.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 9

Monroe Energy

Our Monroe subsidiaries operate the Trainer refinery and related logistics assets located near Philadelphia, Pennsylvania.

The facilities include pipelines and terminal assets that allow the refinery to supply jet fuel to our airline operations throughout

the Northeastern U.S., including our New York hubs at LaGuardia and JFK. These companies are distinct from us, operating

under their own management teams and with their own boards. We own Monroe as part of our strategy to mitigate the cost of

the refining margin reflected in the price of jet fuel, as well as to maintain sufficiency of supply to our New York operations.

Refinery Operations. The facility is capable of refining approximately 200,000 barrels of crude oil per day and sources

domestic and foreign crude oil supply from a variety of providers. During 2023, Monroe successfully performed a planned

plant-wide maintenance turnaround ("turnaround"), which addressed all required inspections, allowed Monroe to clean and

repair all of the equipment, as well as enable the installation of a new Fluidized Catalyst Cracking Unit Reactor.

Strategic Agreements. Monroe has agreements in place to exchange the non-jet fuel products the refinery produces with

third parties for jet fuel consumed in our airline operations.

Environmental Sustainability. Delta is evaluating operational pathways for integrating Monroe into Delta's net zero future.

Monroe’s sustainability ambitions include being one of the most energy efficient refineries in the country with the lowest

energy intensity and greenhouse gas ("GHG") emissions on an absolute and per barrel basis. For example, Monroe is

implementing a plan to replace steam driven turbines that currently power pumps at the facility with more efficient and reliable

electric motors, which will reduce the amount of steam required from the facility’s natural gas-fired boilers. Monroe is also

recovering and utilizing methane, a potent GHG, instead of flaring it into the atmosphere. Finally, in support of Delta’s 10%

SAF goal, Monroe is evaluating the possibility of producing SAF and other renewable fuels at the Trainer refinery, although

additional analyses must be conducted to determine economic and operational viability of various SAF production pathways.

Monroe continues to evaluate the production of renewables, and in 2023 successfully produced a test quantity of renewable

diesel at the facility.

Fuel Hedging Program

Our derivative contracts to hedge the financial risk from changing fuel prices are related to Monroe’s inventory. We may

utilize different contract and commodity types in this program and frequently test their economic effectiveness against our

financial targets. We closely monitor the hedge portfolio and rebalance the portfolio based on market conditions, which may

result in locking in gains or losses on hedge contracts prior to their settlement dates.

Competition

The airline industry is highly competitive, marked by significant competition with respect to routes, fares, schedules (both

timing and frequency), operational reliability, services, products, customer service and loyalty programs. The industry has

evolved through mergers, new entries, both domestically and internationally, and changes in international alliances.

Consolidation in the airline industry, the presence of subsidized government-sponsored international carriers, changes in

international alliances and the creation of immunized joint ventures have altered, and will continue to alter, the competitive

landscape in the industry, resulting in the formation of airlines and alliances with significant financial resources, extensive

global networks and competitive cost structures.

Domestic

Our domestic operations are subject to significant competition from traditional network carriers, including American

Airlines and United Airlines, national point-to-point carriers, including Alaska Airlines, JetBlue Airways and Southwest

Airlines, and other discount or ultra-low-cost carriers, including Allegiant Air, Avelo Airlines, Breeze Airways, Frontier

Airlines and Spirit Airlines. Some of these carriers have business models primarily focused on maintaining low costs, with the

intention of providing service at lower fares to destinations served by Delta. In particular, we face significant competition at our

domestic hubs and key airports either directly at those airports or at the hubs of other airlines that are located in close proximity.

We also face competition in small- to medium-sized markets from regional jet operations of other carriers.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 10

International

Our international operations are subject to competition from both foreign and domestic carriers, including from point-to-

point carriers on certain international routes. Through alliance and other marketing and codesharing agreements with foreign

carriers, U.S. carriers have increased their ability to sell international transportation, such as services to and beyond traditional

European, Asian and Latin American gateway cities. Similarly, foreign carriers have obtained increased access to interior U.S.

passenger traffic beyond traditional U.S. gateway cities through these relationships.

In particular, several joint ventures among U.S. and foreign carriers, including several of our joint ventures as well as those

of our competitors, have received grants of antitrust immunity allowing the participating carriers to coordinate networks,

schedules, pricing, sales and inventory. In addition, alliances formed by domestic and foreign carriers, including SkyTeam, the

Star Alliance (among United Airlines, Lufthansa German Airlines, Air Canada and others) and the oneworld alliance (among

American Airlines, British Airways, Qantas and others) have enhanced competition in international markets.

Regulatory Matters

The DOT and the Federal Aviation Administration (the "FAA") exercise regulatory authority over air transportation in the

U.S. The DOT has authority to issue certificates of public convenience and necessity required for airlines to provide air

transportation. An air carrier that the DOT finds fit, willing and able to perform the proposed service is given authority to

operate domestic and international air transportation (including the carriage of passengers and cargo), as applicable. Since the

passage of the Airline Industry Deregulation Act in 1978, airlines have generally been free to launch or terminate service to U.S

airports without restriction, except with respect to certain slot-controlled and schedule-facilitated airports, as well as certain

constraints related to service to small communities governed by the "Essential Air Services" program.

The DOT has jurisdiction over certain economic and consumer protection matters, such as unfair or deceptive practices and

methods of competition, advertising, denied boarding compensation, baggage liability and disabled passenger transportation.

The DOT also has authority to review certain joint venture agreements between domestic and international carriers. The DOT

engages in regulation of economic matters such as transactions involving allocation of "slots" or similar regulatory mechanisms

which limit the rights of carriers to conduct operations at airports where such mechanisms are in place. The FAA has primary

responsibility for matters relating to the safety of air carrier flight operations, including airline operating certificates, control of

navigable air space, flight personnel, aircraft certification and maintenance and other matters affecting air safety.

Authority to operate international routes and international codesharing arrangements is regulated by the DOT and by the

governments of the foreign countries involved. International certificate authorities are also subject to the approval of the U.S.

President for conformance with national defense and foreign policy objectives.

The Transportation Security Administration ("TSA") and the U.S. Customs and Border Protection, each a division of the

Department of Homeland Security, are responsible for certain civil aviation security matters, including passenger and baggage

screening at U.S. airports and international passenger prescreening prior to entry into or departure from the U.S.

Airlines are also subject to various other federal, state, local and foreign laws and regulations. For example, the U.S.

Department of Justice has jurisdiction over some airline competition matters. The U.S. Postal Service has authority over certain

aspects of the transportation of mail. Labor relations in the airline industry, as discussed below, are generally governed by the

Railway Labor Act with oversight by the National Mediation Board ("NMB"). Environmental matters are regulated by various

federal, state, local and foreign governmental entities. Privacy of passenger and employee data is regulated by domestic and

foreign laws and regulations.

Fares and Rates

Airlines set ticket prices in all domestic and most international city-pairs with minimal governmental regulation, and the

industry is characterized by significant price competition. Certain international fares and rates are subject to the jurisdiction of

the DOT and the governments of the foreign countries involved. Many of our tickets are sold by travel agents, and fares are

subject to commissions, overrides and discounts paid to travel agents, brokers and wholesalers.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 11

Route Authority

Our flight operations are authorized by certificates of public convenience and necessity and also by exemptions and limited-

entry frequency awards issued by the DOT. The requisite approvals of other governments for international operations are

controlled by bilateral agreements (and a multilateral agreement in the case of the U.S. and the European Union ("EU")) with,

or permits or approvals issued by, foreign countries. Because international air transportation is governed by bilateral or other

agreements between the U.S. and the foreign country or countries involved, changes in U.S. or foreign government aviation

policies could result in the alteration or termination of such agreements, diminish the value of our international route authorities

or otherwise affect our international operations. Bilateral agreements between the U.S. and various foreign countries that we

serve are subject to renegotiation from time to time. The U.S. government has negotiated "Open Skies" agreements with many

countries, which allow unrestricted access between the U.S. and these foreign markets.

Certain of our international route authorities are subject to periodic renewal requirements. We request extension of these

authorities when and as appropriate. While the DOT usually renews temporary authorities on routes where the authorized

carrier is providing a reasonable level of service, there is no assurance this practice will continue in general or with respect to a

specific renewal. Dormant route authorities may not be renewed in some cases, especially where another U.S. carrier indicates a

willingness to provide service.

Airport Access

Operations at three major domestic airports and certain foreign airports that we serve are regulated by governmental entities

through allocations of "slots" or similar regulatory mechanisms. Each slot represents the authorization to land at or take off

from the particular airport during a specified time period.

In the U.S., the FAA currently regulates the allocation of slots, slot exemptions, operating authorizations or similar capacity

allocation mechanisms at Reagan National in Washington, D.C. and LaGuardia and JFK in the New York City area. Our

operations at these airports generally require the allocation of slots or analogous regulatory authorizations. Similarly, our

operations at London's Heathrow airport, Tokyo's Haneda airport and other international airports are regulated by local slot

coordinators pursuant to the International Air Transport Association's Worldwide Scheduling Guidelines and applicable local

law. We currently have sufficient slots or analogous authorizations to operate our existing flights, and we have generally been

able to obtain the rights to expand our operations and to change our schedules. There is no assurance, however, that we will be

able to do so in the future because, among other reasons, such allocations are subject to changes in governmental policies.

Airline Labor Regulation

In the U.S., airlines and labor unions are governed by the Railway Labor Act. Under the Railway Labor Act, a labor union

seeking to represent an unrepresented craft or class of employees is required to file with the NMB an application alleging a

representation dispute, along with authorization cards signed by at least 50% of the employees in that craft or class. The NMB

then investigates the dispute and, if it finds the labor union has obtained a sufficient number of authorization cards, conducts an

election to determine whether to certify the labor union as the collective bargaining representative of that craft or class. A labor

union will be certified as the representative of the employees in a craft or class if more than 50% of votes cast are for

representation. A certified labor union would then commence negotiations toward a collective bargaining agreement with the

employer.

Under the Railway Labor Act, a collective bargaining agreement between an airline and a labor union does not expire, but

instead becomes amendable as of a stated date. Either party may request that the NMB appoint a federal mediator to participate

in the negotiations for a new or amended agreement. If no agreement is reached in mediation, the NMB may determine, at any

time, that an impasse exists and offer binding arbitration. If either party rejects binding arbitration, a 30-day "cooling off"

period begins. At the end of this 30-day period, the parties may engage in "self-help," unless the U.S. President appoints a

Presidential Emergency Board ("PEB") to investigate and report on the dispute. The appointment of a PEB maintains the "status

quo" for an additional 60 days. If the parties do not reach agreement during this period, the parties may then engage in self-help.

Self-help includes, among other things, a strike by the union or the imposition of proposed changes to the collective bargaining

agreement by the airline. The U.S. Congress and the President have the authority to prevent self-help by enacting legislation

that, among other things, imposes a settlement on the parties.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 12

Environmental Regulation

Environmental Compliance Obligations. Our operations are subject to numerous international, federal, state and local laws

and regulations governing protection of the environment, including regulation of greenhouse gases and other air emissions,

noise reduction, water discharges, aircraft drinking water, storage and use of petroleum products and other regulated substances,

and the management and disposal of hazardous waste, substances and materials.

We are also subject to certain environmental laws and contractual obligations governing the management and release of

regulated substances, which may require the investigation and remediation of affected sites. Soil and/or ground water impacts

have been identified at certain of our current or former leaseholds at several domestic airports. To address these impacts, we

have a program in place to investigate and, if appropriate, remediate these sites. Although the ultimate outcome of these matters

cannot be predicted with certainty, we believe that the resolution of these matters will not have a material adverse effect on our

Consolidated Financial Statements.

In 2022, the U.S. Environmental Protection Agency (the "EPA") proposed regulations to define certain per- and

polyfluoroalkyl substances ("PFAS") as "hazardous substances" under the Comprehensive Environmental Response,

Compensation, and Liability Act ("CERCLA"), and the EPA has proposed to regulate certain PFAS as "hazardous constituents"

under the Resource Conservation and Recovery Act ("RCRA"). The EPA is also proposing to regulate PFAS under the Safe

Drinking Water Act. PFAS are used in a wide variety of consumer and industrial products, including the firefighting foams

used to extinguish fuel-based fires at airports and refineries. Numerous states have adopted regulations governing PFAS as

well, and some have adopted legislation prohibiting the manufacture, sale, distribution and/or use of firefighting foam

containing intentionally added PFAS. The EPA’s proposed rule under CERCLA, once finalized, could subject airports, airlines,

and refineries, among others, to potential liability for cleanup of historical PFAS contamination associated with use of PFAS-

containing firefighting foam, and some state laws require transition to alternative fire suppression systems. To address these

possibilities, Delta is developing plans to transition its aircraft maintenance hangars to systems that do not contain intentionally

added PFAS. The ultimate impact and associated cost to Delta of these legislative and regulatory developments cannot be

predicted at this time.

GHG Emissions. Aviation industry GHG emissions, particularly carbon emissions, and their impact on climate change have

become a focus in the international community and within the U.S. In 2016, the International Civil Aviation Organization

("ICAO") formally adopted a global, market-based emissions offset program known as the Carbon Offsetting and Reduction

Scheme for International Aviation ("CORSIA"). This program establishes a goal for the aviation industry to achieve carbon-

neutral growth in international aviation beginning in 2021. Any growth above the baseline would need to be addressed using

either eligible carbon offsets or a lower carbon fuel. ICAO set the baseline for establishing airlines’ obligations under CORSIA

for 2021 to 2023 based on 2019 travel, and in 2022 set a new, more stringent CORSIA baseline of 85% of 2019, which will

apply from 2024 through 2035.

The pilot phase of the CORSIA program ran from 2021 through 2023, and is being followed by a first phase of the program

beginning in 2024 and a second phase beginning in 2027. Countries can voluntarily participate in the pilot and first phase, and

the United States agreed to participate in these voluntary phases. Participation in the second phase is mandatory for certain

countries, including the United States. The U.S. government has not yet enacted legislation to mandate that U.S. operators

participate in CORSIA. Nonetheless, we have voluntarily submitted verified emissions reports on our annual international

emissions. While airlines had no offsetting obligations during the pilot phase of CORSIA as a result of the impact of the

COVID-19 pandemic on international travel, we expect that international airline emissions will likely exceed the new baseline

during the next phase (2024 – 2026). Because certain CORSIA program details remain to be developed and could potentially be

affected by political developments in participating countries or the results of the initial phases of the program, the impact of

CORSIA cannot be predicted at this time. However, CORSIA is expected to increase operating costs for airlines that operate

internationally.

Additionally, the EU requires its member states to implement regulations to include aviation in its Emissions Trading

Scheme ("ETS"). Under these regulations, any airline with flights originating or landing in the European Economic Area

("EEA") is subject to the ETS and, beginning in 2012, was required to purchase emissions allowances if the airline exceeds the

number of free allowances allocated to it under the ETS. The scope of the ETS was narrowed so that it currently applies only to

flights within the EEA through 2023 to align with the pilot phase of CORSIA. In 2023, the EU adopted new legislation

extending this narrow scope of the EU ETS until 2027 but requires a review of CORSIA’s effectiveness in 2026, which could

potentially lead to expansion of the EU ETS to include all flights departing the EU and EEA. As a result of the United

Kingdom’s ("UK") withdrawal from the EU, UK flights are no longer part of the EU ETS and are instead regulated under a

separate UK ETS scheme. UK ETS is applicable to UK domestic flights and flights from the UK to EEA countries.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 13

In 2017, ICAO also adopted aircraft certification standards to reduce carbon dioxide ("CO

2

") emissions from new aircraft.

The new aircraft certification standards applied to new fleet types in 2020 and will apply to in-production aircraft no later than

2028. These standards will not apply to existing in-service aircraft. In 2021, the EPA finalized GHG emission standards for new

aircraft engines designed to implement the ICAO standards on the same timeframe contemplated by ICAO, and these standards

have been upheld in response to legal challenges. Like the ICAO standards, the final EPA standards would not apply to engines

on in-service aircraft.

The airline industry may face additional regulation of aircraft emissions in the U.S. and abroad and become subject to

further taxes, charges or additional requirements to obtain permits or purchase allowances or emission credits for GHG

emissions in various jurisdictions. For example, in 2023, the EU adopted legislation that will impose a SAF mandate on fuel

supplied at EU airports. The mandate requires that, of the jet fuel supplied in the EU, 2% must be SAF beginning in 2025, and

the percentage increases incrementally over time to 70% in 2050. This mandate is expected to increase the cost of SAF in the

EU. Additional regulation could result in taxation, regulatory or permitting requirements from multiple jurisdictions for the

same operations and significant costs for us and the airline industry. In addition to direct costs, such regulation could result in

increased fuel costs passed through from fuel suppliers affected by any such regulations. Certain airports have also adopted, and

others could in the future adopt, GHG emission or climate-related goals and requirements that could impact our operations or

require us to make changes or investments in our infrastructure. We are monitoring and evaluating the potential impact of such

developments.

Noise. The Airport Noise and Capacity Act of 1990 recognizes the rights of operators of airports with noise problems to

implement local noise abatement programs so long as such programs do not interfere unreasonably with interstate or foreign

commerce or the national air transportation system. This statute generally provides that local noise restrictions on Stage 3

aircraft first effective after October 1, 1990 require FAA approval. While we have had sufficient scheduling flexibility to

accommodate local noise restrictions in the past, our operations could be adversely impacted if locally imposed regulations

become more restrictive or widespread. In addition, foreign governments may enact or allow airports to enact similar

restrictions, which could adversely impact our international operations or require significant expenditures in order for our

aircraft to comply with the restrictions. For example, in 2022, to reduce noise, the Netherlands announced a multi-phase plan to

reduce the maximum number of flights authorized annually at Amsterdam’s Schiphol Airport. In 2023, airlines and airline

associations, including Delta and KLM, challenged the initial phase of the plan. The legal challenge resulted in a ruling against

the industry, but an appeal is currently pending before the Supreme Court of the Netherlands. The U.S., the European

Commission and other governments also raised legal concerns about the plan with the Dutch government. In November 2023,

the Netherlands suspended the initial phase of the plan; however, the government continues to support a second-phase plan to

reduce flights at Schiphol. The outcome cannot be determined at this time.

Refinery Matters. Monroe's operation of the Trainer refinery is subject to numerous environmental laws and extensive

regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention

measures and greenhouse gas and other air emissions.

Under the Energy Policy Act of 2005, as expanded by the Energy Independence and Security Act of 2007, the Renewable

Fuel Standard ("RFS") was created, setting up specific targets of renewable fuel to be used in the U.S. economy by mandating

the blending of renewable fuels into gasoline and on-road diesel ("Transportation Fuels"). Renewable Identification Numbers

("RINs") are assigned to renewable fuels produced by or imported into the U.S. that are blended into Transportation Fuels to

demonstrate compliance with this obligation. A refinery may meet its obligation under RFS by blending the necessary volumes

of renewable fuels with Transportation Fuels, by purchasing RINs in the open market or through a combination of blending and

purchasing RINs. Because Monroe is able to blend only a small amount of renewable fuels, it must purchase the majority of its

RINs requirement in the secondary market. Market prices for RINs have been volatile and marked by periods of sharp increases

and decreases primarily in response to speculation about what the EPA and/or the U.S. Congress will do with respect to

compliance obligations. In June 2023, the EPA finalized RFS volume requirements for 2023, 2024 and 2025. These volume

requirements are below projected production of Transportation Fuels, which has resulted in a decrease in the price of RINs.

Civil Reserve Air Fleet Program

We participate in the Civil Reserve Air Fleet program (the "CRAF Program"), which permits the U.S. military to use the

aircraft and crew resources of participating U.S. airlines during airlift emergencies, national emergencies or times of war. We

have agreed to make available under the CRAF Program a portion of our international aircraft during the contract period that

ends on September 30, 2024. The CRAF Program has only been activated three times since it was created in 1951, most

recently in 2021 to support the military’s effort to evacuate people from Afghanistan following the withdrawal of U.S. troops

from the country.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 14

Information About Our Executive Officers

Edward H. Bastian, Age 66: Chief Executive Officer of Delta since May 2016; President of Delta (September 2007 - May

2016); President of Delta and Chief Executive Officer Northwest Airlines, Inc. (October 2008 - December 2009); President and

Chief Financial Officer of Delta (September 2007 - October 2008); Executive Vice President and Chief Financial Officer of

Delta (July 2005 - September 2007); Chief Financial Officer of Acuity Brands (June 2005 - July 2005); Senior Vice President -

Finance and Controller of Delta (2000 - April 2005); Vice President and Controller of Delta (1998 - 2000).

Glen W. Hauenstein, Age 63: President of Delta since May 2016; Executive Vice President - Chief Revenue Officer of

Delta (August 2013 - May 2016); Executive Vice President - Network Planning and Revenue Management of Delta (April 2006

- July 2013); Executive Vice President and Chief of Network and Revenue Management of Delta (August 2005 - April 2006);

Vice General Director - Chief Commercial Officer and Chief Operating Officer of Alitalia (2003 - 2005); Senior Vice

President- Network of Continental Airlines (2003); Senior Vice President - Scheduling of Continental Airlines (2001 - 2003);

Vice President Scheduling of Continental Airlines (1998 - 2001).

Allison C. Ausband, Age 61: Executive Vice President - Chief Customer Experience Officer of Delta since June 2021;

Senior Vice President - In-Flight Service of Delta (September 2014 - May 2021); Vice President - Reservation Sales and

Customer Care of Delta (January 2010 - September 2014).

Alain Bellemare, Age 62: President - International of Delta since January 2021; Chief Executive Officer of Bombardier

(February 2015 - March 2020); President and Chief Executive Officer of United Technologies Corporation Propulsion &

Aerospace Systems (June 2011 - February 2015).

Peter W. Carter, Age 60: Executive Vice President - External Affairs of Delta since October 2022; Executive Vice

President - Chief Legal Officer of Delta (July 2015 - October 2022); Partner of Dorsey & Whitney LLP (1999 - 2015),

including co-chair of Securities Litigation and Enforcement practice group, chair of Policy Committee and chair of trial

department.

Daniel C. Janki, Age 55: Executive Vice President - Chief Financial Officer of Delta since July 2021; Senior Vice

President of General Electric Company (GE) and Chief Executive Officer of GE Power Portfolio (October 2020 - June 2021);

Senior Vice President, Business and Portfolio Transformation of GE (2018 - 2020); Senior Vice President, Treasurer and

Global Business Operations of GE (2014 - 2017); Senior Vice President, CEO of GE Energy Management (2012 - 2013).

John E. Laughter, Age 53: President - Delta TechOps and Chief of Operations since October 2023; Executive Vice

President - Chief of Operations of Delta (June 2021 - October 2023); Senior Vice President and Chief of Operations of Delta

(October 2020 - June 2021); Senior Vice President - Flight Operations of Delta (March 2020 - October 2020); Senior Vice

President - Corporate Safety, Security and Compliance of Delta (August 2013 - March 2020); Senior Vice President -

Maintenance Operations of Delta (March 2008 - July 2013); Vice President - Maintenance of Delta (December 2005 - March

2008).

Rahul Samant, Age 57: Executive Vice President - Chief Information Officer of Delta since January 2018; Senior Vice

President and Chief Information Officer of Delta (February 2016 - December 2017); Senior Vice President and Chief Digital

Officer of American International Group, Inc. (January 2015 - February 2016); Senior Vice President and Global Head,

Application Development and Management of American International Group, Inc. (September 2012 - December 2014);

Managing Director of Bank of America (1999 - September 2012).

Steven M. Sear, Age 58: Executive Vice President - Global Sales of Delta since February 2016; Senior Vice President -

Global Sales of Delta (December 2011 - February 2016); Vice President - Global Sales of Delta (October 2008 - December

2011); Vice President - Sales & Customer Care of Northwest Airlines, Inc. (June 2005 - October 2008).

Joanne D. Smith, Age 65: Executive Vice President and Chief People Officer of Delta since October 2014; Senior Vice

President - In-Flight Service of Delta (March 2007 - September 2014); Vice President - Marketing of Delta (November 2005 -

February 2007); President of Song (January 2005 - October 2005); Vice President - Marketing and Customer Service of Song

(November 2002 - December 2004).

Mike Spanos, Age 59: Chief Operating Officer of Delta since June 2023; President and Chief Executive Officer of Six

Flags Entertainment Corporation (November 2019 - November 2021); Chief Executive Officer, Asia, Middle East and North

Africa of PepsiCo, Inc. (January 2018 - November 2019); previously served in a variety of management roles of increasing

responsibility at PepsiCo, Inc. since 1993.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 15

Additional Information

Our company website is located at www.delta.com and our investor relations website is located at ir.delta.com. We make

available free of charge on our investor relations website our Annual Report on Form 10-K, our Quarterly Reports on Form 10-

Q, our Current Reports on Form 8-K and amendments to those reports as soon as reasonably practicable after these reports are

filed with or furnished to the Securities and Exchange Commission ("SEC"). Information on our website, including our investor

relations website, is not incorporated into this Form 10-K or our other securities filings and is not a part of those filings.

Item 1. Business

Delta Air Lines, Inc. | 2023 Form 10-K 16

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the following material risk factors

applicable to Delta. As described below, these risks could materially affect our business, financial condition or results of

operations in the future.

Risk Factors Relating to Delta

We are at risk of losses and adverse publicity stemming from a serious accident involving our aircraft or aircraft of our

airline partners.

An aircraft crash or other serious accident involving our aircraft or those of our airline partners could expose us to

significant liability. Although we believe that our insurance coverage is appropriate, we may be forced to bear substantial losses

from an accident in the event that the coverage was not sufficient.

In addition, any accident involving an aircraft that we operate or an aircraft that is operated by an airline that is one of our

regional carriers or codeshare, alliance or joint venture partners could create a negative public perception about safety and

reliability for aviation authorities and the public, which could harm our reputation, resulting in air travelers being reluctant to

fly on our aircraft and therefore harm our business.

Breaches or lapses in the security of the technology systems we use and rely on could compromise the data stored within

them and consequently expose us to liability, disruption to our operations and damage to our reputation, any or all of which

could have a material adverse effect on our business.

As a regular part of our ordinary business operations, we collect and store sensitive data, including information necessary for

our operations, personal information of our passengers and employees and information of our business partners. The secure

operation of our networks and systems, and those of our business partners and third-party service providers, on which this type

of information is stored, processed and maintained is critical to our business operations and strategy. These networks and

systems are subject to an increasing threat of continually evolving cybersecurity risks, which we must manage.

We expect unauthorized parties to continue attempting to gain access to our systems or information, or those of our business

partners and third-party service providers, including through fraud or other means of deception, or introduction of malicious

code, such as malware and ransomware. If successful, these actions could cause harm to our computer systems or compromise

data stored on our computer networks or those of our business partners and third-party service providers, potentially causing us