Entering

transactions

such

as

adjustments,

entity

changes,

etc.

Entering

collection

information

for

storage

and

processing

in

the

system.

Automatically

generating

notices,

collection

documents

and

other

outputs.

14-1

Section 14 - Integrated Data Retrieval System (IDRS)

1 Nature of Changes

Description Page No.

Category Codes 14-6

Activity Codes 14-20

2 Summary of IDRS

Reference Handbooks 2.3 and 2.4

The Integrated Data Retrieval System (IDRS) is a system which enables employees in the Campuses and the Area

Offices to have instantaneous visual access to certain taxpayer accounts.

Some capabilities of the system include:

Researching account information and requesting returns.

Several different files compose the IDRS data base. Some of them are:

A. UDIT INFORMATION MANAGEMENT SYSTEM (AIMS)—This file is a computer system designed to give

Examination Division information about the returns open to Examination.

B. DOPTION TAXPAYER IDENTIFICATION NUMBER (ATIN) - This file contains W-7A application information

regarding pending adoptions. A temporary number is assigned to the child so that adoptive parents can claim

dependency exemption and child care credit. All update processing will take place at the Austin Campus.

Command Code ATINQ is available for universal access inquiries at all Campuses. (IRM Handbook 2.3 Chapter

79)

C. CENTRALIZED AUTHORIZATION FILE (CAF) RESEARCH—The Centralized Authorization File contains

information regarding the type of authorization that taxpayers have given representatives for various modules

within their accounts. This information is used to direct refunds and/or copies of notices and correspondence to

representatives when this has been authorized. It can also be used to determine whether an individual claiming to

be a representative (Rep) of a taxpayer is, in fact, authorized to represent or act in the taxpayer’s behalf, or to

receive the information requested. The command codes available for research are: (a) CC CFINK IRM Handbook

2.3 Chapter 31, and (b) CC RPINK IRM 2.3 Chapter 31.

Note: The service center CAF databases were consolidated in July 2001. Then the CAF was converted to

DB2 format in March 2003. There is only one CAF, maintained on the master file IBM. All command

code inquiries and updates process against that file.

D. DISHONORED CHECK FILE (DCF)—This file contains a record of the dishonored checks returned to the

Campus by banks. The record will remain on the file until research positively identifies the tax module which was

credited when the check was originally received. Once identified, an entry is made to the file which will cause a

debit transaction to be generated and sent to the master file. A notice will also be generated to notify the taxpayer.

Reference IRM 2.4 Chapter 25

E. EXCESS COLLECTION FILE (XSF)—This file contains two accounts, non-revenue receipt credits in Account

6800 (Excess Collections) and Account 9999 (Revenue Clearance Accountability). Each record within the file

Any line marked with # is for official use only

ITIF—Individual

Master

File

BTIF—Business

Master

File

ZTIF—Individual

Retirement

Account,

Employer

Pension

Plan,

and

Non-Master

File.

Entity

changes

may

be

made

using

CCs

ENREQ,

INCHG,

IRCHG,

BNCHG,

,

BRCHG,

EOREQ,

and

E

O

C

HG.

-

See

IRM

2.3

Chapter

9

for

the

instructions.

14-2

contains the control number, amount, source of the credit, IRS received date, status code, other available

payment and follow up information. This file may be accessed with CC XSINQ. (IRM 2.3.49).

F.

Name Search Facility (NSF) - The NSF provides a way for IRS employees to access a Taxpayer

Identification Number (TIN) with the selected taxpayer’s name and address, or vice-versa. NSF data is

stored in a DB2 data base on the IBM, which is accessed by NSF command codes NAMES, NAMEE,

NAMEI, NAMEB, FINDS, FINDE and TPIIP.

G. IRS INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER (ITIN) - This file contains W-7 application information.

The ITIN is a permanent number assigned to those individuals who do not qualify for Social Security numbers

(SSN) but require a number for tax purposes. All update processing will take place at the Austin Campus.

H. NATIONAL ACCOUNT PROFILE (NAP)—The National Account Profile is maintained at the Martinsburg

Computing Center. The Campuses and Area Offices have direct access to the NAP using CC INOLE.

I. PREPARER TAX IDENTIFICATION NUMBER (PTIN) - This file contains W-7P application information. The PTIN

is a 9-character number assigned to tax return Preparers who choose to use the PTIN in lieu of their individual

Social Security Number on those returns they prepare. All update processing will take place at the Brookhaven

Campus. Command Code PTINQ is available for universal access inquires at all Post of Duties.

J. REPORTING AGENTS FILE (RAF) RESEARCH—The Reporting Agents File contains information regarding the

type of authorization that taxpayers have given to their reporting agent for the employment tax/payment modules

and/or the FTD payment modules in their account. This authorization allows the reporting agent to file the

taxpayer’s Form 940 or Form 941 on magnetic tape or make magnetic tape or electronically or make magnetic

tape or electronic submission of federal tax deposits. The information from the authorization is used to direct

copies of notices and correspondence to reporting agents if authorized. It can also be used to determine whether

an individual claiming to be a reporting agent for a taxpayer is, in fact, authorized to receive the information

requested.

K. TAXPAYER INFORMATION FILE (TIF)—The TIF provides tax account information for taxpayers selected for

IDRS. The TIF is divided into three sub-groups as follows:

L. UNIDENTIFIED REMITTANCE FILE (URF)—This file contains an information record of each remittance which is

received but cannot be positively identified. This file aids in resolving payment tracers.

3 IDRS Security System

A. Security Procedures

General

The IDRS Security System is designed to provide protection for both the taxpayer and the IDRS user employee.

The taxpayer must be protected from unauthorized disclosure of information concerning his/her account and

unauthorized changes to it. The IDRS user employee must be protected from other personnel using his/her

identification to access or make changes to an account.

IRM 1.3, Disclosure of Official Information Handbook contains guidelines governing the release of data included

on tax returns and other information contained in Service files.

Protection of Taxpayer Accounts

Employees should exercise special precautions to identify the taxpayer or his/her authorized representative when

answering inquiries about a refund, notice, adjustment or delinquent account.

When responding to telephone inquiries and walk-in taxpayers about a tax account, the employee handling the

Any line marked with # is for official use only

Document Locator Number (DLN), date or amount on notice or other document received.

Type

of

notice

or

other

communication

received.

Employees

must

never

use

another

employee’s

password.

the

input

of

a

command

code

without

an

entry

code

or

an

invalid

entry

code.

14-3

inquiry should obtain:

Taxpayer’s name, address.

Taxpayer Identification Number (SSN or EIN).

Date and/or amount of refund, adjustment, payment or return.

If a caller is unable to furnish enough information to establish that he/she actually is the taxpayer, the employee

should request that the caller find out the information and call back. If the caller states he/she does not have the

information and cannot obtain it, the employee should advise the caller to write.

Employees should not provide Taxpayer Identification Numbers over the telephone. Tele-Tin employees will

follow their IRM guidelines.

Information concerning taxpayers will not be provided to third parties without written authorization from the

taxpayer, even though the third party requesting the information has possession of a copy of the bill or notice in

question.

Written authorization from the taxpayer is not restricted to a power of attorney or to any specific form. The

authorization must bear the taxpayer’s signature. If there is serious doubt whether the signature on the

authorization is the taxpayer’s, offer to mail the information to the taxpayer’s address of record.

Authorized Access

IDRS users are authorized to access only those accounts required to accomplish their official duties. IRM 0735.1,

Handbook for the Rules of Conduct, states that instances of employee’s accessing their own (or spouse’s)

account or the account of another employee (or spouse) via IDRS will be treated as administrative offenses. In

addition, IDRS users must not access the account of a friend or relative, or any account in which they have a

personal or financial interest.

Passwords

Each

IDRS

user

employee

will

be

furnished

a

password

on

a

periodic

basis.

The

employee

is

responsible

for

protecting

his/her passwor

d.

The

password

must

not

be

revealed

to

anyone,

regardless

of

his/her pos

ition

in

or

outside

the

Internal

Revenue

Service.

Note: Any time a password is compromised, or even if an employee suspects that it has been, he/she will notify

the System Security Supervisor to obtain another password.

B. Security Violations

The following are examples of security violations:

the input of incorrect CC SINON information.

the

input

of

a

command

that

is

not

in

the

Employee

Profile.

All security violations will be recorded in the security files by terminal and, if possible, by employee number.

A terminal will lock out after three (3) consecutive violations. In the event of a security lockout, the # screen of the

affected terminal will display the message “SECURITY LOCK ON THIS TERMINAL”# The operator must

immediately notify his/her supervisor who will initiate action to unlock the # terminal.

C. Security Reminders

Employees should always clear the screen when the terminal operation is completed.

Employees should be sure to retrieve all prints. If someone leaves a print in the printer, it should be placed in

classified waste if the originator cannot be determined.

Any line marked with # is for official use only

14-4

IDRS terminals are programmed for real-time usage and are systematically deactivated at the end of each work

day.

Note: The preceding rules must be followed carefully to protect the security and integrity of the IDRS.

The SFDIS Command Code with definer (values: P=Production, T=Training) is used to pull up the list of Command Codes

in an employee’s profile.

4 IDRS Message File

IDRS Message file is available to all IDRS users via command code MESSG followed by the users entry code. This multi-

page file contains up to date information on a variety of topics for example; command code availability, command code

changes, MFTRA print status, ACTRA display status and system Files availability. An index of MESSG topics will be

displayed. All IDRS users should make a point of checking the MESSG File every morning.

5 Selection Criteria for IDRS

Data is extracted for IDRS when the entity or tax module meets extraction criteria prescribed in IRM Handbook 2.9.

Updated records are extracted for each module whenever Master File activity occurs in the account, such as merges,

unpostables, notices, Tax Code postings (including adjustments and examinations), certain freezes, and status changes.

The files are constantly updated from various sources until the record is removed from IDRS.

6 Retention Criteria for IDRS

Retention on the TIF is governed by the principle that a module should be retained as long as any one specified criteria is

met, such as dummy modules less than 3 cycles old, accounts in TDA/BAL DUE status, accounts in TDI/DEL RET status,

modules containing any open pending transactions, and modules with open control bases. If a module no longer meets

any retention criteria it is dropped from the file and a generated transaction is sent to MCC to inform the Master File that

the module is no longer on that Campuses IDRS file. Specific retention criteria is included in IRM Handbook 2.9.

7 Pending Transaction Identification Codes/IDRS Merge Related Transaction Codes

A. Pending Transaction Identification Codes

Code Definition

AP —A pending tax module transaction prior to PN status. This transaction will not have a complete DLN and

may be reviewed by Quality Review.

CU —A corrected unpostable transaction

*DC —A transaction deleted by ERS or Campus Reject Processing.

*DI —A delinquent or entity transaction which appears on IDRS, but does not post to the Master File.

*DJ —A transaction deleted through normal weekly update.

*DN —A transaction deleted by IDRS daily TIF batch processing. This pending transaction status normally

occurs under the following conditions:

1. A transaction on the TIF other than a Unn or Nu did not match an incoming IDRS daily update

on money amount. The transaction on the TIF changes to DN and the input transaction is separately

appended.

2. An entity transaction on the TIF other than a Unnn or Nu failed to match an incoming IDRS

daily update transaction on size (transaction length). The transaction on the TIF changes to DN and

the incoming transaction is appended separately.

Any line marked with # is for official use only

14-5

Code Definition

*DP —A transaction deleted by CC DELET, or has been a TP on TIF for 4 cycles or an age-pending routine

change or a TP transaction failed to match daily update on money amount.

*DQ —A transaction deleted by Quality Review.

DR —Retained for research.

*DU —A deleted unpostable transaction.

*DW —A transaction deleted via optional age routine in the weekend IDRS computer batch processing (weekly

updates).

EP —A pending entity module transaction prior to PN status. This transaction will not have a complete DLN

and may be reviewed by Quality Review.

ERS —A RS transaction appended to the entity is identified as ERS when it is displayed with a tax module.

Limited to TCs 903 and 904.

NU —A nullified unpostable transaction.

PN —A pending transaction that has passed all IDRS validity checks and has a complete DLN. All NMF

transactions posted after establishment of module remain as PN.

RJ —A reject transaction. RJ transactions are appended to the entity. They are displayed on the tax module if

the MFT, Plan Number and Tax Period are for the displayed tax module.

Rnnn —A transaction has been delayed beyond the scheduled cycle. It is extracted from the resequencing file

at MCC. Includes all TC 904s and TC 903s (Refer to 8A-35 for numeric code definitions).

TP —A payment received in the Campus input to IDRS from the Remittance Processing System (RPS) with

the cycle of input. It will not be included on a master file transaction tape until passing all validity and

consistency checks and updated to “PN” status with the expected MCC posting cycle.

Unnn —An open unpostable transaction (nnn - the numeric unpostable code).

*The pending transaction codes identified above with the asterisk will not be included in the IDRS balance.

B. Merge Related Transaction Codes

These differ slightly from those for the corresponding Master File transactions. The TC 003 and 026 are

generated during IDRS processing, therefore they are not the actual MF transactions, but do reflect MF status.

TC Description Definition

003 BMF Partial Merge Appears on the old EIN and contains a cross reference number. It

indicates that a merge was attempted but was not able to become a

complete merge because of modules in both involved accounts which are

for the same MFT and tax period. The TC 003 will appear in “DI” pending

status in the entity module.

004 BMF Partial Merge Appears on the new EIN and contains a cross reference TIN. The TC 004

will appear in “DI” pending status in the entity.

006 A Merge/Merge Fail. A TC 006 without a cross reference TIN indicates an unsuccessful

merge. A TC 006 (preceded by a TC 005) with a cross-reference TIN

indicates a successful merge from the cross-reference TIN.

008 IMF/BMF Complete Merge Appears on the new TIN to reflect a successful merge and contains a

cross reference TIN. The TC 008 will appear in “DI” pending status in the

entity.

026 IMF/BMF Complete Merge Appears on the old TIN to reflect a successful merge and contains a

cross reference to the new TIN. It will appear in the entity module only in

“DI” pending status.

C. Transaction Information Codes

BMF:

Code

A

Condition

FTD (Federal Tax Deposit) Credit

IMF:

Code

G

Condition

Amended (G Code) Return

computer transferred from a prior

module

C Consolidated FTD (TC 650) will X Indicates DLN (location) or

consist of the number of payments Administrative file or refile DLN

consolidated.

Any line marked with # is for official use only

14-6

BMF: IMF:

Code Condition Code Condition

F Final Return #

#

G Amended Return #

#

F Final Return

L Rejected Forms 7004/2758

P FTD (TC 650) credit computer

transferred to a subsequent module

X Return refiled under DLN indicated

T Treasury - U.S. DLN (Doc Code

97)

W Form 7004, changed Entity Fiscal

Month

2 Form 7004, 990C filed

4 Form 7004, 990T Resident Corp.

5 Form 7004, 990T Non-resident

Corp.

6 Form 7004, 1120F, Non-resident

Corp.

7 1120F Resident Corp.

8 Form 1066 Filer

8 Case History Status Codes

The following status codes are used when controlling a case. These status codes should not be confused with Master File

Status codes or with freeze codes.

A

B

Assigned—Actively being worked

Background—Non-workable case being monitored

S

M

Suspense—Short term delay

Other—Long term delay

C Closed Z Used to Close IRP Cases

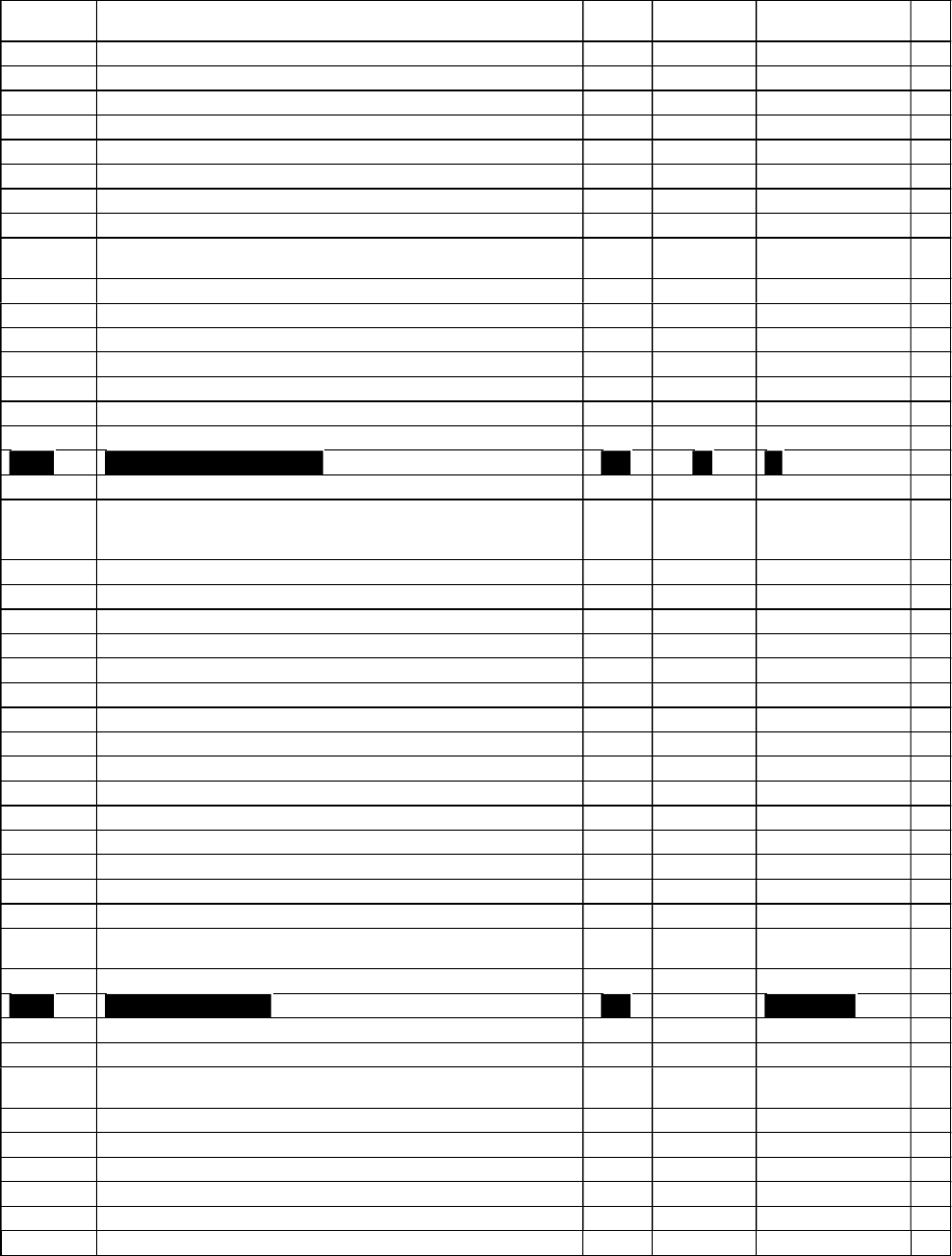

9 Category Codes

The category codes are a 4 digit code to denote the type or source of an adjustment or correspondence case. For

purposes of understanding the meaning of some of the column headings in the table below, the definitions are as follows:

“Age” refers to the number of days given before a case defaults; “Recap Category” refers to the area assigned to work the

case. A current list of the category codes and their definitions is given below:

Category

Codes

Definition Age Recap Recap Category

–Xnn Expired or Potentially Expired Assessment Statute Case.

Further descriptions are as follows:

099 STATUTE

–X01 Debit Balance – No Return 099 STATUTE

–X02 Erroneous Credit Freeze 099 STATUTE

–X03 Amended Return – No Original 099 STATUTE

–X04 Duplicate Return 099 STATUTE

–X05 Audit hold code 099 STATUTE

–X06 Claim Pending 099 STATUTE

–X07 ADP Credit to NMF Liability 099 STATUTE

–X08 Manual Refund 099 STATUTE

–X09 Additional Liability Pending 099 STATUTE

–X10 Refund – Repayment, Canceled or Deleted 099 STATUTE

–X11 Advance Payment 099 STATUTE

Any line marked with # is for official use only

14-7

Category

Codes

Definition Age Recap Recap Category

–X12 Credit Balance – No Return 099 STATUTE

–X13 Expired Installment 099 STATUTE

–X14 Barred Refund (STEX) 099 STATUTE

–X15 Erroneous Refund 099 STATUTE

–X16 Excess ES Credits 099 STATUTE

–X17 Reserved 099 STATUTE

–X18 TC59X w/Credit Balance – No Return 099 STATUTE

–X19 Offer in Compromise 099 STATUTE

–X20 Subsequent Payment 099 STATUTE

–X21 Account Reactivation 099 STATUTE

–X22 Original – No Amended Return 099 STATUTE

–X23 CSED TC470 (Claim Pending) 099 STATUTE

–X24 Math Error Protest 099 STATUTE

–X25 Additional Liability Pending 099 STATUTE

–X26 Reserved for Future Use 099 STATUTE

–X27 Reserved for Future Use 099 STATUTE

–X28 Unreversed TC 480 099 STATUTE

–XSF Statute Cases - Credit Systemically Transferred to XSF 099 STATUTE

100P 100-Percent Penalty Two Year Refund Hold 060 INTERGEN

1081 Reclamation credit received from FMS 030 REFINQ

1184 Paper TFS 1184 sent to RFC 090 REFINQ

1664 Undelivered Refund Check-NMF 045 UNDELRERF

170E CP 170-Duplicate Filing - Filing Condition & prompt

Assessment

075 11 INTERGEN

170X CP 170-Duplicate Filing - Filing Condition & prompt

Assessment

075 11 INTERGEN

185E CP185 TC690 Penalty Payment, Module in Credit Balance 075 11 INTERGEN

185X CP185 TC690 Penalty Payment, Module in Credit balance 075 11 INTERGEN

186E CP188 Transcript 075 11 INTERGEN

186X CP188 Transcript 075 11 INTERGEN

190E Amended Return Posted No Original on Record, within 4

cycles

045 05 NTERGEN

190X Amended Return Posted No Original on Record, within 4

cycles

045 05 NTERGEN

191E CP 191 Extension 075 11 INTERGEN

191I CP 191 Installment 075 11 INTERGEN

195E Other Adjustments (no category) 075 11 INTERGEN

195X Other Adjustments (no category) 075 11 INTERGEN

250E Other Adjustments (no category) 075 11 INTERGEN

270X Other Adjustments (no category) 075 11 INTERGEN

2287 Dishonored Check Case 045 ADJSTMTS

3858 TFS 1133 and check photocopy sent to taxpayer 045 REFINQ

3859 TFS 3859 Received from FMS Adjudication Division 014 REFINQ

3864 TFS 3864 Follow up sent to FMS 030 REFINQ

3870 Identify Form 3870 worked in CAWR and FUTA programs 045 24 TPI

3911 Lost/Stolen Refunds 030 REFINQ

3913 Refund Check Returned-TC841 to Post 045 RETDREF

##

##

840- IDRS Generated Refund (CC RFUND) 045 CORRESP

841P TC 841 Posted and P Freeze Set 014 RETDREF

Any line marked with # is for official use only

14-8

Category

Codes

Definition Age Recap Recap Category

#

941C Any Form 941C received at Ogden or Cincinnati worked in

Accounts Management

045 29 AMADJUST

941X Any 941X received at Ogden or Cincinnati worked in Accts

Management

045 02 AMADJUST

943X Any 943X received at Ogden or Cincinnati worked in Accts

Management

045 02 AMADJUST

944X Any 944X received at Ogden or Cincinnati worked in Accts

Management

045 02 AMADJUST

945X Any 945X received at Ogden or Cincinnati worked in Accts

Management

045 02 AMADJUST

ACA0 ACA-Correspondence 045 08 DEFAULTS

ACA-Correspondence 45 045 08 DEFAULTS

ACA-Correspondence - 498OH 045 08 DEFAULTS

ACA-1040X; ACA-1040X - 45R 045 08 DEFAULTS

ACA-1040X-CATA 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA1 ACA-Correspondence 045 08 DEFAULTS

ACA-Correspondence 45 045 08 DEFAULTS

ACA-Correspondence - 498OH 045 08 DEFAULTS

ACA-1040X; ACA-1040X - 45R 045 08 DEFAULTS

ACA-1040X-CATA 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA2 ACA-Correspondence 045 08 DEFAULTS

ACA-Correspondence 45 045 08 DEFAULTS

ACA-Correspondence - 498OH 045 08 DEFAULTS

ACA-1040X; ACA-1040X - 45R 045 08 DEFAULTS

ACA-1040X-CATA 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA3 ACA-Correspondence 045 08 DEFAULTS

ACA-Correspondence 45 045 08 DEFAULTS

ACA-Correspondence - 498OH 045 08 DEFAULTS

ACA-1040X; ACA-1040X - 45R 045 08 DEFAULTS

ACA-1040X-CATA 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA4 ACA-Correspondence 045 08 DEFAULTS

ACA-Correspondence 45 045 08 DEFAULTS

ACA-Correspondence - 498OH 045 08 DEFAULTS

ACA-1040X; ACA-1040X - 45R 045 08 DEFAULTS

ACA-1040X-CATA 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA5 ACA-Correspondence 045 08 DEFAULTS

ACA-Corr - Math Error 045 08 DEFAULTS

ACA-Corr - 45R 045 08 DEFAULTS

ACA-Corr - Other 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA -F-1120X 045 08 DEFAULTS

ACA-Amended (generic form type) 045 08 DEFAULTS

ACA6 ACA-Correspondence 045 08 DEFAULTS

ACA-Corr - Math Error 045 08 DEFAULTS

Any line marked with # is for official use only

14-9

Category

Codes

Definition Age Recap Recap Category

ACA-Corr - 45R 045 08 DEFAULTS

ACA-Corr - Other 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA -F-1120X 045 08 DEFAULTS

ACA7 ACA-Correspondence 045 08 DEFAULTS

ACA-Corr - Math Error 045 08 DEFAULTS

ACA-Corr - 45R 045 08 DEFAULTS

ACA-Corr - Other 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA -F-1120X 045 08 DEFAULTS

ACA8 ACA-Correspondence 045 08 DEFAULTS

ACA-Corr - Math Error 045 08 DEFAULTS

ACA-Corr - 45R 045 08 DEFAULTS

ACA-Corr - Other 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA -F-1120X 045 08 DEFAULTS

ACA9 ACA-Correspondence 045 08 DEFAULTS

ACA-Corr - Math Error 045 08 DEFAULTS

ACA-Corr - 45R 045 08 DEFAULTS

ACA-Corr - Other 045 08 DEFAULTS

ACA - Spanish 045 08 DEFAULTS

ACA -F-1120X 045 08 DEFAULTS

ACAC ACA-Correspondence 045 08 DEFAULTS

ACA – Spanish 045 08 DEFAULTS

ACAX ACA-Amended 045 08 DEFAULTS

ACA-1040X - 45R 045 08 DEFAULTS

ACA -F-1120X 045 08

DEFAULTS

ACEO Adjustment Customer Experienced Improvement (all other) 045 5 CLAIM

ACEX Adjustment Customer Experienced Improvement (all other) 045 5 CLAIM

ACKN Claim or Photocopy Request Processed by RCF to CP&R 030 REFINQ

ACTC

CC CHKCL input for ACTC 090 29 AMADJUST

AKPF Alaska Permanent Fund Dividend Levy Program 120 06 COLL

AM-X Expired or Potentially Expired Assessment Statute 099 STATUTE

AMnn Accounts Maintenance Research, Further Descriptions are

as follows:

120 AMRESRCH

AM01 Debit Balance - No return 120 AMRESRCH

AM02 Erroneous Credit Freeze 120 AMRESRCH

AM03 Amended Return - No Original 120 AMRESRCH

AM04 Duplicate return 120 AMRESRCH

AM05 Audit Hold Codes 120 AMRESRCH

AM06 Claim Pending 120 AMRESRCH

AM07 AADP Credit to NMF Liability 120 AMRESRCH

AM08 Manual Refund 120 AMRESRCH

AM09 Additionally Liability Pending 120 AMRESRCH

AM10 Refund - Repayments, Cancelled or Delayed 120 AMRESRCH

AM11 Advanced Payment 120 AMRESRCH

AM12 Credit Balance - No return 120 AMRESRCH

AM13 Expired Installment 045 AMRESRCH

AM14 Barred Refund (STEX) 099 AMRESRCH

AM15 Erroneous Refund 045 AMRESRCH

Any line marked with # is for official use only

14-10

Category

Codes

Definition Age Recap Recap Category

AM16 Excess ES Credits (IMF) or FTD Credit module (BMF) 120 AMRESRCH

AM17 TDI/DEL RET Refund Freeze 010 COLL

AM18 TC59X w/Credit Balance - No Return 099 AMRESRCH

AM19 Offer in Compromise 099 AMRESRCH

AM20 Subsequent Payment 120 AMRESRCH

AM21 Account Reactivation 120 AMRESRCH

AM22 Original -No amended return 120 AMRESRCH

AM23 CSED TC 470 (Claim Pending) 045 AMRESRCH

AM24 Math error protest 075 AMRESRCH

AM25 Additional Liability Pending (URP) 045 AMRESRCH

AM26 TC 59X w/Credit Balance - No return 120 AMRESRCH

AM27 URP - Zero Debit Balance 045 AMRESRCH

AM28 Unreversed TC 480 045 AMRESRCH

AMCZ Accounts Maintenance Combat Zone 180 AMRESRCH

AMRH Accounts Maintenance Research 120 AMRESRCH

APPZ Appeals Case 005 33 APPEALS

ARDI Accounts Receivable Dollar Inventory 045 COLL

ASFR Automated Substitute for Return 045 02 COLL

ASIA Assessed Installment Agreement 030 COLL

ASTA Alternative Strategy for Tax Administration 120 COLL

ATAO 911 Hardship (effective July 1990) 020 DEFAULTS

ATFR Automated Trust Fund Recovery 045 COLL

ATLA Additional Tax Liability Assessment 075 INTERGEN

AUDE Duplicate Filing Audit (CPs 93, 293) 045 05 CLAIM

AUDT Special Audit 045 ADJSTMTS

AUDX Duplicate Filing Audit (CPs 93, 293) 045 05 CLAIM

B249 249C Installment Bill 045 08 DEFAULTS

BA14 Barred Refund (STEX) 099 23 STATUTE

BARD Barred Assessment 099 STATUTE

BDUP BMF Duplicate Files For (non-employment tax forms) All

BMF Form 706, 709 and 94X series returns identified as

amended, revised or corrected that by-pass processing.

045 CLAIM

BEIC Non-Select BCSC EITC

045 24 TPI

BID1 BMF Identity Theft case involving Employment Forms 94X.

Code for receipt of all taxpayer-initiated Forms

14039/14039B, internally-identified identity theft inquiries

and BMF ID theft referrals (Form 14566) .

180 BMF ID THEFT

BID2 BMF Identity Theft case involving Forms 1120. Code for

receipt of all taxpayer-initiated Forms 14039/14039B,

internally-identified identity theft inquiries and BMF ID theft

referrals (Form 14566) .

180 BMF ID THEFT

BID3 BMF Identity Theft case involving all other BMF related

Forms. Code for receipt of all taxpayer-initiated Forms

14039/14039B, internally-identified identity theft inquiries

and BMF ID theft referrals (Form 14566) .

180 BMF ID THEFT

BMFO BMF Other Correspondence (non-employment tax forms) 045 TPI

BNF- BMF- Nonfiler related inventory 045 10 INRETURN

BNFC BMF- Nonfiler Correspondence relate inventory 045 10 INRETURN

BNFR BMF-Nonfiler Reconsideration Related inventory 045 10 INRETURN

BRRQ BMF Other (non-employment tax forms) non-TPI issues 075 INTERGEN

BUR- BUR related inventory on MFT 30 accounts 045 10 INRETURN

BUR0 CP2030 based inventory 045 10 INRETURN

Any line marked with # is for official use only

14-11

Category

Codes

Definition Age Recap Recap Category

BUR1 CP2531 related inventory 045 10 INRETURN

BURC BUR closing actions including assessments 045 10 INRETURN

BURR BUR reconsideration related inventory 045 10 INRETURN

BURS BUR Statutory Notice related inventory 045 10 INRETURN

BWH- Backup Withholding 045 COLL

C174 Unexplained exempt remuneration listed on Form 940 075 INTERGEN

C175 Unexplained adjustment on Forms 941,945,942,943 075 INTERGEN

C186 CP 186 Transcript 075 INTERGEN

C190 Amended Return Posted No Original on Record Within Four

Cycles

045 CLAIM

C194 CP 194 (Potential FTD Penalty) 075 INTERGEN

C234 CP 234 Potential ES Penalty Transcript Notice—BMF 075 INTERGEN

C294 Possible 15% FTD Penalty 075 INTERGEN

C36F Domestic 36F 075 05 CLAIM

C36P Domestic CP36 045 01 ACCOUNTS

C874 Unexplained exempt remuneration listed on Form 940PR 075 INTERGEN

C875 Unexplained adjustment on Forms 941PR and 943PR 075 INTERGEN

#

CATA 1040X CATA 45 02 ADJSTMTS

CAWR Combined Annual Wage Reporting—CAWR cases where

correspondence has been issued and no previous CCA

record has been generated.

045 CORRESP

CCO1 Collection Contracted Out 060 DEFAULTS

CDPF Collection Due Process Front End Case 060 COLL

CERT Certified Transcript 045 CORRESP

CFTE Credit for the Elderly 120 INTERGEN

CFWD Net Operating Loss Carryforward - Domestic 045 5 CLAIM

CISA Assessed CIS 045 06 COLL

CISP Pre-Assessed CIS0 045 06 COLL

CLAM Claim Cases 030 CLAIM

COCZ Collection Combat Zone 180 COLL

COLL Collection Related Questions 045 COLL

COPY Taxpayer Request for Copy of Return 060 CORRESP

CP04 Combat Zone Letters 070 06 COLL

CP29 Amended Return Posted, No Original 045 CLAIM

CP40 Potential ES Penalty Transcript Notice—IMF 075 INTERGEN

CP44 Notice of Available Credit 045 ACCOUNTS

CP46 CP 46 Paper transcript (Notice of Manual Refund on L or W

Coded Return)

120 03 AMRSRCH

CP86 CP 86 Transcripts 075 INTERGEN

#

CRMR Criminal Restitution Mirroring Review 180 08 DEFAULTS

CRTS Correspondence Response Time Study 045 ADJSTMTS

CT1X Any CT1X received at Ogden or Cincinnati worked in Accts

Management

045 02 ADJSTMTS

CZ01 Combat Zone 045 AMRSRCH

DATC Deferred Adverse Tax Consequence 075 INTERGEN

DAUD Duplicate Filing Audit 045 CLAIM

DDIA Direct Debit Installment Agreement 060 30 CUSTSRVC

DDIP Direct Debit Installment Pre-Assessed (Agreement) 060 30 CUSTSRVC

DFRL 1993 Deferral of Taxes Processing in 1995 and 1996 030 INTERGEN

Any line marked with # is for official use only

14-12

Category

Codes

Definition Age Recap Recap Category

DFRX Deferral Cleanup 045 INTERGEN

DIAG TDI/DEL RET DIAG-Q Transcripts 045 06 COLL

DMFC Debtor Master File Claim 045 CLAIM

DMFE Injured Spouse Claim – Efile 045 05 CLAIM

DMFN Injured Spouse Claim – No Debt 045 01 ACCTS

DMFT Injured Spouse Claim – Tax Debt 045 01 ACCTS

DSTR Disaster Case 045 CLAIM

DUPA Duplicate Assignment 045 ADJSTMTS

DUPE Duplicate Return for Estate and Gift Tax 045 29 AMADJUST

DUPF Duplicate Filing (CP 36,193,436) 045 CLAIM

DUPR Duplicate Refunds 045 REFINQ

DUPX Duplicate Return for Excise Tax 045 29 AMADJUST

E190 Amended Return Posted for Estate and Gift Tax 045 29 AMADJUST

#

#

#

#

#

#

#

#

#

#

EARC Electronic Account Resolution Control 045 07 CORRESP

#

ECFD Net Operating Loss Carryforward - Exempt Organization 045 5 CLAIM

EDUP Exempt Organization (EO) Duplicated Filed Returns 045 31 OAMC

EICN Earned Income Credit Notice (CP32) 045 TPI

ENCC Energy Credit Carryover Transcript 075 INTERGEN

ENTC Entity Change Case 075 INTERGEN

EOAM Exempt Organization(EO) Accounts Maintenance

Transcripts

075 31 OAMC

#

EOCP EO CP Notices 045 31 OAMC

EOCU Miscellaneous EOCU Fallout 045 31 OAMC

EOPC EO Photo Copy 060 35 RAIVIS

EPAM Form 5330 AMRH Transcript 075 31 OAMC

EPBS Form 5330 – Reprocessing of Returns/Payment processed

incorrectly by IRS

045 31 OAMC

EPCD Form 5330 – Credit/Debit Listing 030 31 OAMC

EPDP Form 5330 – Amended/Dup Returns & CP193 045 31 OAMC

ER51 Error—Doc Code 51 075 INTERGEN

ERAB Erroneous Abatement 099 STATUTE

#

#

#

ERRF Erroneous Refund 045 CORRESP

#

ESTA Potential Expired Statute Case—Campus 045 EXPDSTAT

ESTB Potential Expired Statute Case—Area Office 045 EXPDSTAT

Any line marked with # is for official use only

14-13

Category

Codes

Definition Age Recap Recap Category

ETAD Employment Tax Adjustment-DCC Program. 075 INTERGEN

ETAP Employment Tax Adjustment Program 075 INTERGEN

ETC- Employee Tax Compliance Program 030 PRIVACT

#

EXES EXEC-TC 840 transcript ( J-/-X Freeze) 120 03 AMRESRCH

EXOR Exempt Organization 045 ADJSTMTS

F709 F709XTNSN Transcripts 075 EXAMS

FACO Field Assistance Collection (used with E-4442 system and

mirrors what is already established for CAS)

030 32 WIFA

FAOT Field Assistance Other (used with E-4442 system and

mirrors what is already established for CAS)

030 32 WIFA

FARA Field Assistance Referral ACA 45 08 DEFAULTS

FARE Field Assistance Refund (used with E-4442 system and

mirrors what is already established for CAS)

030 32 WIFA

FTHB First - Time Home Buyer Credit - Claims 045 02 ADJSTMTS

FTHC First-Time Home Buyer Credit - Correspondence 045 02 ADJSTMTS

FUTA Federal Unemployment Tax Act 090 DEFAULTS

GAIN Gain on Sale of Residence 120 INTERGEN

GRVW Accounts Management – Global Review Reserved for AM

IPSU

180 02 ADJSTMTS

HCTC Health Coverage Tax Credit 030 CUSTSRVC

I174 Unexplained Exempt Remuneration Listed on Form 940—

International

099 INTL-CP

I175 Unexplained Adjustment on Forms 941/E/SS/942/943—

International

099 INTL-CP

I190 Amended Return Posted—BMF—No original—International 099 INTLCLAM

I234 Potential ES Penalty Transcript Notice—BMF—International 099 INTL-CP

I36F International 36F 045 05 CLAIM

I36P International CP36 045 01 ACCOUNTS

I840 IDRS Generated Refund—International 060 INTLCORR

I874 Form 940—International 099 INTL-CP

I875 Unexplained Adjustment on Forms 941PR/942PR/943PR—

International

099 INTL-CP

IAC1 ACA International correspondence 45 08 DEFAULTS

IAC2 ACA International correspondence 45 08 DEFAULTS

IAC3 ACA International 1040X 45 08 DEFAULTS

IAC4 ACA International 1040X 45 08 DEFAULTS

IATL Additional Tax Liability Assessment—International 099 INTL-CP

ICFD Net Operating Loss Carryforward - International 060 13 INTLCLAM

IDI1

IDT referral to IDTVA

045 IDTVA

IDI2

Received and Assigned

045 IDTVA

IDI3

Acknowledgement/First Read Completed

045 IDTVA

IDI4

Additional documentation required

045 IDTVA

IDI5 DITA referral 045 IDTVA

IDI6

Bypass DIF Score Referral

045 IDTVAe

IDI7

TAS/ITAR/Fast Track

045 IDTVAe

IDI8

Module Count

045 IDTVA

IDI9

IDTVA Internal Transfer

045 IDTVA

IDII RPM 365 02 ADJSTMTS

IDPA Duplicate Filing Audit CP93, 293—International 099 INTLCLAM

IDPF Duplicate Filing Audit CP36, 193—International 099 INTLCLAM

Any line marked with # is for official use only

14-14

Category

Codes

Definition Age Recap Recap Category

IDS- Inventory Dollar System 045 COLL

#

#

#

#

#

IDST Disaster Case—International 099 INTLCLAM

IDT1 Accounts Management – Tax Related IDT – Taxpayer Self-

Identified

180 02 ADJSTMTS

IDT2 Self Identified– Tax Related (AM IPSU only) - (loose or

incidental form 14039)

120 02 ADJSTMTS

IDT3 Accounts Management – Tax Related IDT – IRS Internally

Identified

180 02 ADJSTMTS

IDT4 Accounts Management – Loose Form 14039 and Non-Tax

Related IDT

045 02 ADJSTMTS

IDT5 TP Responses to (miscellaneous) IDT Correspondence and

Data Loss notifications/letters

045 02 ADJSTMTS

IDT6 Electronic Fraud Detection System (EFDS) cases (AM only) 180 02 ADJSTMTS

IDT7 Accounts Management – Reserved for AM IPSU 180 02 ADJSTMTS

IDT8 CP05A and Deceased Taxpayer cases (AM only) 180 02 ADJSTMTS

IDT9 Accounts Management – Cases with Form 14103,

Identity Theft Assistance Request (ITAR), referrals from

Andover or Fresno IPSU.

180 02 ADJSTMTS

IDTX Accounts Management – Tax Related – Monitoring only –

Reserved for AM IPSU

365 11 ADJSTMTS

IDUP Unnumbered Intl Return 045 13 INTLCLAM

IEIN Application for EIN - IRC Section 965 (Beginning July 2018)

Age 45 days Recap (no entry) Recap Category TPI

030 29 AMADJUST

IENC Entity Control Case—International 099 INTL-CP

IERF Erroneous Refund Case—International 099 INTLCORR

IETP Employment Tax Adjustment—International 099 INTL-CP

IFUT Federal Unemployment Tax—International 120 INTL-CP

IIAC Interest Abatement Claim—International 099 INTLCLAM

IIEQ Internal Examination Question—International 099 INTLTPRQ

IIRQ Internal Request for Adjustment—International 099 INTL-CP

IJCC Joint Committee Case—International 099 INTLCLAM

IN29 Amended Return Posted—IMF—No original—International 099 INTLCLAM

IN32 Earned Income Credit Notice (CP32)—International 099 INTLTPRQ

IN40 Potential ES Penalty Transcripts Notice—IMF—International 099 INTL-CP

INEQ Internal Examination Question (3870) 045 ADJSTMTS

INMF NMF Return Adjustments—International 099 INTLTPRQ

INSP Primary Taxpayer Filed a Request for Innocent Spouse

Relief

060 CLAIM

INSS Secondary Taxpayer Filed a Request for Innocent Spouse

Relief

060 CLAIM

INTC Claim for abatement of Interest 045 CLAIM

INTT Complex Interest Cases 045 TPI

INUP Nullified Unpostable—International 099 INTL-CP

IOTH “Other Adjustment” (no Category)—International 099 INTL-CP

IOUR Output Review—International 010 INTL-CP

IPRP Problem Resolution Case—International 030 INTLTPRQ

IPTC ACA-International Corr 45 08 DEFAULTS

IPTX ACA-International 1040X (form 1040X) 45 08 DEFAULTS

Any line marked with # is for official use only

14-15

Category

Codes

Definition Age Recap Recap Category

IPYT IMF and BMF Payment Tracer—International 099 INTLTPRQ

IRA- Individual Retirement Annuity Cases 045 ANNUITY

IRAF Individual Retirement Annuity Cases 030 ADJSTMTS

IRNT Restricted Interest Carryback Claim—International 060 RINTTENT

IRP- Information Reports Processing 045 INRETURN

IRRQ Internal Request, e.g. 3465 075 INTERGEN

IRTL IRS Telephone Inquiry, or other (Taxpayer Assistance) 045 CORRESP

ISPJ Other Special Project Cases—International 180 INTLSPJT

ISSA SSA Adjustments,SSA-7000,OAO-10,SS-13 and other SSA

Cases—International

099 INTLCORR

ITAR Accounts Management – Identity Theft Assistance Request

– Reserved for AM IPSU

180 02 ADJSTMTS

ITCB Tentative Carryback Application—International 060 RINTTENT

ITCC International and Possession Technical Request or

Correspondence

099 INTLCORR

ITIN Individual Tax Identification Number 075 05 CLAIM

ITLR Telephone Inquiry or other Taxpayer Assistance—

International

099 INTLTPRQ

ITRQ (TPRQ) Taxpayer Request—International 1040X or 1120X-

International

099 INTLTPRQ

IXRT 1040X or 1120X-international 060 INTLCLAM

JCCC Joint Committee Case 045 CLAIM

KATX Disaster – Hurricane Katrina 045 34 DSTR

KITA Killed In Terrorist, Killed In Action & 911 Rescue Workers

Claims

045 AMADJUST

L249 249C Reply 045 08 DEFAULTS

LBSR Lockbox Special Research 090 INTERGEN

LEVY Levy payment 014 COLL

LGCP Large Corp 045 AMRESRCH

LGGE Government Entity Large Case (01402) 045 TRDSBSE

LGSB Small Business Large Case (01401) 045 TRDSBSE

LSFM Loose Form 045 24 TPI

LTXn (n=1-9)—Lifetime Exclusion 120 INTERGEN

MATH Correspondence Math Error 045 24 TPI

MCSD MULTICSED transcript 090 COLL

MDEF Military Deferment 030 06 COLL

MFCO MF Clean-up Collection Cases 045 COLL

MFRP MF Clean-up Non-collection Cases 045 INTERGEN

MISC Miscellaneous Correspondence 045 TPI

MLBD Multi-lingual Bal Due 030 06 COLL

MLRD Multi-lingual Return Delinquency 030 06 COLL

MULT Multiple Spouse 060 ADJSTMTS

#

MXSP Duplicate Filing 180 02 ADJSTMTS

#

#

#

#

#

#

#

Any line marked with # is for official use only

14-16

Category

Codes

Definition Age Recap Recap Category

#

#

#

NATF Non-Atfr Transcript 45 11 INTERGEN

#

NLUN Nullified Unpostable 045 TPI

NLWH No Longer Works Here 060 06 COLL

NMnn (nn 01-29) No Merge 075 INTERGEN

NM01 ADJSTMTS Nomrg-400 type NMRG CONTROL-

CATEGORY

075 INTERGEN

NM02 ADJSTMTS Nomrg-VEST type NMRG CONTROL-

CATEGORY

075 INTERGEN

NM03 ADJSTMTS Nomrg-XXSSN type NMRG CONTROL-

CATEGORY

075 INTERGENT

NM04 REFDELET Nomrg-914 type NMRG CONTROL-

CATEGORY

045 ADJSTMTS

NM05 REFDELET Nomrg-916 type NMRG 045 ADJSTMTS

NM06 REFDELET Nomrg-918 type NMRG 045 ADJSTMTS

NM07 COLL Nomrg-TDA/BAL DUE type NMRG 099 ADJSTMTS

NM08 ADJSTMTS Nomrg-DUP type NMRG 075 INTERGEN

NM09 ADJSTMTS Nomrg-576 type NMRG 075 INTERGEN

NM10 ADJSTMTS Nomrg-930 type NMRG 075 INTERGEN

NM11 DEFAULTS Nomrg-424 type NMRG 075 INTERGEN

NM12 DEFAULTS Nomrg-940 type NMRG 045 ADJSTMTS

NM13 COLL Nomrg-520 type NMRG 045 ADJSTMTS

NM14 ADJSTMTS Nomrg-RPS type NMRG 075 INTERGEN

NM15 CORRESP Nomrg-CAF type NMRG 020 ADJSTMTS

NM16 ADJSTMTS Nomrg-RECR type NMRG 075 INTERGEN

NM17 COLL Nomrg-PDT type NMRG 045 ADJSTMTS

NM18 ADJSTMTS Nomrg-LTEX type NMRG 075 INTERGEN

NM19 ADJSTMTS Nomrg-TAXI type NMRG 075 INTERGEN

NM20 COLL Nomrg-CPNL type NMRG 099 ADJSTMTS

NM21 DEFAULTS Nomrg-ATS type NMRG 045 ADJSTMTS

NM22 ENTITY Nomrg-CONS type NMRG CATEGORY 020 ADJSTMTS

NM23 ENTITY Nomrg-STAT type NMRG CATEGORY 020 ADJSTMTS

NM24 ENTITY Nomrg-GEN type NMRG CATEGORY 020 ADJSTMTS

NM25 ENTITY Nomrg-AF type NMRG CATEGORY 020 ADJSTMTS

NM26 ENTITY Nomrg-FYM type NMRG CATEGORY 020 ADJSTMTS

NM27 ENTITY Nomrg-NOUS type NMRG CATEGORY 020 ADJSTMTS

NM28 ENTITY Nomrg-SS type NMRG CATEGORY 020 ADJSTMTS

NM29 ENTITY Nomrg–NC type NMRG CATEGORY 020 ADJSTMTS

NMRG No Merge Transcripts 150 INTERGEN

#

#

#

#

NRPY No Reply—CAWR cases (no SSA IND = 2 cases) are

systemically closed as a No Reply on CAP.

045 07 CORRESP

#

#

NYCX New York City 1040X - IRC Section 965 (Beginning July

2018) Age 045 Recap 05 Recap Category Claim

045 05 CLAIM

Any line marked with # is for official use only

14-17

Category

Codes

Definition Age Recap Recap Category

OECD Form 1042/1042S OECD - Exchange of Information Project

- International

180 INTLSPJT

OICC OIC Correspondence 030 06 COLL

OIO- Office of International Operations 045 OIO

OOPS Claim Processing Interrupted, Remedial Action Required 014 REFINQ

OPA- Online Payment Application 060 06 COLL

ORCR Original CR 180 08 DEFAULTS

OTHE Other Adjustments (no category) 075 INTERGEN

OURV Output Review 010 INTERGEN

P810 Form 1042/1042S, Correspondence Listing of

Underwithheld Withholding Agents—International

180 INTLSPJT

PAID Check Negotiated, Claims Package or Check-Photocopy to

follow

030 REFINQ

PAYT Payment Tracer 045 TPI

PDIA Payroll Deduction Installment Agreement 030 06 COLL

#

PHZ1 Taxpayer Correspondence Initial Scan 045 24 TPI

PHZ2 Unresolved Taxpayer Correspondence from Initial Scan 045 29 TPI

PLTY Correspondence Penalty 045 24 TPI

PMTE Payment After Expired CSED 045 COLL

PPCC Practitioner Priority Case Collection 045 AMRESRCH

PPCM Practitioner Priority Case Messages 045 AMRESRCH

PPCO Practitioner Priority Case Other 045 AMRESRCH

PPCP Practitioner Priority Case Program Accounts 045 CORRESP

PPCR Practitioner Priority Refunds 045 AMRESRCH

PPEI Practitioner Priority Electronic Request 045 PPSERVIC

PPPI Practitioner Priority Phone Inquiry 045 PPSERVIC

PPRQ Practitioner Paper Request 045 PPSERVIC

PREA Pre-assessed Installment Agreements 060 COLL

PRNQ Privacy Act Inquiry 030 PRIVACT

PRPD Problem Resolution Program—DO Initiated 030 TPI

PRPS Problem Resolution Program—SC Initiated 045 TPI

PSUB Parent/Subsidiary 045 ACCOUNTS

PTCA ACA-1040X – CATA 45 08 DEFAULTS

PTCC ACA-Correspondence 45 08 DEFAULTS

ACA - Spanish 45 08 DEFAULTS

PTCX ACA-1040X 45 08 DEFAULTS

PYMT Correspondence Payment Inquiry 045 24 TPI

Q-FR Notice Review of Q Freeze Cases 045 REFDELET

QRPA Questionable Refund Program Adjustments 045 29 AMADJUST

RCTF CHKCL Claim input 030 REFINQ

REBV Internal Transcript — REBATEREV 075 ADJSTMTS

RECL Claim Denied or Reclamation 180 REFINQ

RECN Reconsideration Cases 030 05 CLAIM

REF- Refund Hold For return delinquency cases 060 COLL

REFC REFCANCL17 180 02 ADJUSTMTS

REFI REFCANCL18 180

02 ADJUSTMTS

REFM Refund MFT 31 060 ADJUSTMTS

REFQ REFCALCL19 180 02 ADJUSTMTS

RFCK CHKCL photocopy or status request input 030 REFINQ

RFDL Refund Delete Case 045 REFDELET

Any line marked with # is for official use only

14-18

Category

Codes

Definition Age Recap Recap Category

RFIQ Refund Inquiry 045 REFINQ

RINT Restricted Interest 045 RINTTENT

#

RSED Refund Statue Exp Date 099 STAYUTE

RTCK Returned Check 045 CORRESP

SC0E Reserved 045 29 AMADJUST

SC0P Reserved 045 19 AMADJUST

SC1E Form 8849, Schedule 1 E-file 045 29 AMADJUST

SC1P Form 8849, Schedule 1 Paper 045 29 AMADJUST

SC2E Form 8849, Schedule 2 E-file 020 29 AMADJUST

SC2P Form 8849, Schedule 2 Paper 045 29 AMADJUST

SC3E Form 8849, Schedule 3 E-file 020 29 AMADJUST

SC3P Form 8849, Schedule 3 Paper 045 29 AMADJUST

SC4E Form 8849, Schedule 4 E-file 045 29 AMADJUST

SC4P Form 8849, Schedule 4 Paper 045 29 AMADJUST

SC5E Form 8849, Schedule 5 E-file 045 29 AMADJUST

SC5P Form 8849, Schedule 5 Paper 045 29 AMADJUST

SC6E Form 8849, Schedule 6 E-file 045 29 AMADJUST

SC6P Form 8849, Schedule 6 Paper 045 29 AMADJUST

SC7E Reserved 045 29 AMADJUST

SC7P Reserved 045 29 AMADJUST

SC8E Form 8849, Schedule 8 E-file 020 29 AMADJUST

SC8P Form 8849, Schedule 8 Paper 045 29 AMADJUST

SC9E Reserved 045 29 AMADJUST

SC9P Reserved 045 29 AMADJUST

SCRM Scrambled SSN Case 150 CLAIM

SCTR Substantiated Credit Transcripts 045 ACCOUNTS

SFAR ASFR Reconsideration 060 COLL

SFR- Substitute for Returns 045 INRETURN

SFRC ASFR correspondence 030 06 COLL

SFRH Refund Hold 030 06 COLL

SFRI ASFR Refund Hold 030 06 COLL

SFRR ASFR Returns 045 06 COLL

SFRT ASFR telephone calls 030 06 COLL

SIXD 6020(b)-DCC 075 INTERGEN

SPAC Spanish Adjustments Correspondence 045 24 TPI

SPC1 Reserved for special assignment 045 DEFAULTS

SPC2 Reserved for special assignment 045 DEFAULTS

SPC3 Reserved for special assignment 045 DEFAULTS

SPC4 Reserved for special assignment 045 DEFAULTS

SPC8 Combat Injured Veterans Claims 045 AMADJUST

SRWC Spanish Referral Written Collection 045 24 TPI

SRWO Spanish Referral Written Other 045 24 TPI

SRWR Spanish Referral Written Refund 045 24 TPI

SSA- CAWR SSA IND = 2 cases where correspondence has been

issued and no previous CCA record has been generated.

OR CAP system systemically closed an SSA IND = 2 case

as a no reply. OAO10, SS-13, OALETR, OAR7000, other

SSA

045 CORRESP

SSA2 Scrambled SSN 2-Year File 730 24 TPI

STnn (nn=01-29) Statute 099 STATUTE

Any line marked with # is for official use only

14-19

Category

Codes

Definition Age Recap Recap Category

ST01 Debit Balance – No Return 099 STATUTE

ST02 Erroneous Credit Freeze 099 STATUTE

ST03 Amended Return – No Original 099 STATUTE

ST04 Duplicate Return 099 STATUTE

ST05 Audit Hold Codes 099 STATUTE

ST06 Unreversed TC 470 (Claim Pending) 099 STATUTE

ST07 ADP Credit to NMF Liability 099 STATUTE

ST08 Manual Refund 099 STATUTE

ST09 Additional Liability Pending 099 STATUTE

ST10 Refund – Repayment, Cancelled or Deleted 099 STATUTE

ST11 Advance Payment 099 STATUTE

ST12 Credit Balance – No Return 099 STATUTE

ST13 Expired Installment 099 STATUTE

ST14 Barred Refund (STEX) 099 STATUTE

ST15 Erroneous Refund 099 STATUTE

ST16 Excess ES Credits 099 STATUTE

ST17 Reserved 099 STATUTE

ST18 TC 59X with Credit Balance – No Return 099 STATUTE

ST19 Offer in Compromise 099 STATUTE

ST20 Subsequent Payment 099 STATUTE

ST21 Account Reactivation 099 STATUTE

ST22 Original – No Amended Return 099 STATUTE

ST23 CSED TC 470 (Claim Pending) 099 STATUTE

ST24 Math Error Protest 099 STATUTE

ST25 Additional Liability Pending 099 STATUTE

ST26 Reserved for Future Use 099 STATUTE

ST27 Reserved for Future Use 099 STATUTE

ST28 Unreversed TC 480 099 STATUTE

ST29 Refund Statute Expiration Date — Follow-up for Statutes

Area

099 STATUTE

ST30 Refund Statute Expiration — Follow-up for Exam Area

Offices

030 STATUTE

ST32 Status 32-Check outstanding 045 REFINQ

STAT Statute Cases 099 STATUTE

STEX Statute Case 099 STATUTE

SWRC Spanish Refund Written Collection 030 TPI

SWRO Spanish Refund Written Other 030 TPI

SWRR Spanish Refund Written Refund 030 TPI

TBCD TEB Credit/Debit Listing 075 31 OAMC

TBCL Tax Exempt Bond Claim Processing 045 31 OAMC

TBCP TEB CP 142/143 Notice Replies 030 31 OAMC

TBFR TEB First Read 045 31 OAMC

TDI/DEL

RET-

Campus TDI/DEL RET Cases 045 CORRESP

TDI/DEL

RETa

Campus TDI/DEL RET Cases (a=A-Z) 045 CORRESP

TDUP TEB DUP Files for Tax Exempt Bonds 045 31 OAMC

TECC Technical Case, Congressional 045 CORRESP

TECL Technical Case, Letter 045 CORRESP

TECT Technical Case, Telephone or other 045 CORRESP

TEGE TEGE CAS – Customer Account Services 031 06 COLL

Any line marked with # is for official use only

14-20

Category

Codes

Definition Age Recap Recap Category

TENT Tentative Carryback 045 RINTTENT

TETR Telephone Excise Tax Rebate 045 05 CLAIM

TFCR Miscellaneous Trust Fund Credit Transcripts 099 06 COLL

TFRP Trust Fund Recovery Penalty 075 COLL

TINP No TIN Penalty 045 INRETURN

TOAD Completed TFS 1133 Sent to FMS Adjudication Dir. 090 REFINQ

TPAR Taxpayer Service, Impact on Accounts Receivable 075 DEFAULTS

TPCI Taxpayer Correspondence Inquiry 045 TPI

TPLR Late Reply—CAWR and SSA IND = 2 cases where a late

reply is received (after closed on CAP system).

045 07 CORRESP

TPPI Taxpayer Personal or Phone Inquiry 045 TPI

TR46 TRNS 46 automated transcript 120 03 AMERSRCH

TPRQ Taxpayer Request, e.g. 3870 045 TPI

TPRR CAWR taxpayer reply received and/or when case is

reassigned (case is open on CAP).

030 TPI

#

TWRA Telephone Written Referral (ACA) 030 TPI

TWRC Telephone Written Referral (Collection Issue) 030 TPI

TWRO Telephone Written Referral (Other) 030 TPI

TWRR Telephone Written Referral (Refund Issue) 030 TPI

#

UDRF Undelivered Refund Check—IMF and BMF 045 UNDELREF

UNDL Undeliverables—CAWR and SSA IND = 2 cases that are

updated for an undeliverable received for correspondence

previously issued (for open cases only).

045 07 CORRESP

#

URP- CP-2000 Notice of Proposed Change 075 INRETURN

URP1 CP-2501 Inquiry Notice 060 INRETURN

URPS Statutory Notice of Deficiency 120 INRETURN

VERF Verified Payment Transcripts 120 AMRESRCH

WHCC WHC Correspondence 030 06 COLL

WHCP WHC Phone Calls 030 06 COLL

WHCR WHC Referrals 030 06 COLL

WHCS WHC Special Projects 060 06 COLL

WHCT WHC Transcripts 045 06 COLL

WPT- Windfall Profit Tax 045 CLAIM

X190 Amended Return Posted for Excise Tax 045 29 AMADJUST

XHRG 1040X – Hurricane Relief Grant 120 05 CLAIM

XRET 1040X, 1120X 045 CLAIM

10 Activity Codes

These codes are used in the case control and history section. They are used when controlling a case or to describe an

action taken. It should be noted that each Campus has its own Activity Codes and these will vary from center to center.

The respective Campus bulletins and Regional Commissioner memorandums should be consulted in regards to

explanations of Activity Codes.

Only activity codes generated by adjustment control card input or on-line transaction input, or activity codes specified in

ADP Handbooks are listed below.

Code Definition

Any line marked with # is for official use only

14-21

Code Definition

1 ADJUSTMENT—Accounts Maintenance case sent to Adjustments

2 AMFOLLUPn—Accounts Maintenance follow-up number n.

3 CASETOCn—Related case closed for association with Cn case.

4 CREDTRANS—Credit transferred by DRT24 or DRT48 input; generated when case control was not

previously established.

5 CRTOSPnnnn—Credit transferred to spouse’s tax period.

6 CnERRCLSD—Control base number n was closed prematurely. Current control base is a continuation of Cn.

7 DOnn2990—Miscellaneous Investigation (Form 2990) initiated to Area office nn, Field Branch.

8 ENMODCNTRL—Case controlled on ENMOD-overflow on TXMOD

9 ENTC—Input with an entity history item in order to hold entity posted transactions on IDRS for research

purposes for seven weeks.

10 ERRORCASE—Case established in error, closed.

11 FOLLOWUP—Follow-up or second inquiry correspondence associated with established case.

12 FRERELINP—Freeze release input.

13 FRFRELVER—Freeze release verified.

14 IDRSREFUND—IDRS Generated Refund requested by CC RFUND

15 INCRADDLW2—To increase tax due to additional W-2 filed.

16 LETERvvvvv—Specified RSC, C, or other letter sent.

17 LEVYa—LEVYE, LEVYR, or LEVYD input establishes a history item on the entity module.

18 MULTIPLE—Case was identified as “multiple” or a “duplicate” before the Campus adjustment control file was

converted to IDRS’ generated during conversion.

19 FODAUDIT—Return being audited at FOD (formerly OIO)

20 OVERSIZE—Account is too large to be brought into IDRS.

21 POAONFILE—Power of attorney on file

22 POTDUPLIC—Potential duplicate case

23 STAUPnnvvv—Module status changed by STAUP to status requested.

24 TELREPLY—Telephone reply to taxpayer

25 TNSFRCASE—Transferring a open control base from one employee to another.

26 TPnnn-nnnn—Taxpayer’s phone number.

27 nnnnnnnnnn—Adjustment control number; generated when case control is established by tape input.

28 ZEROSPACCT—Spouse’s account backed out in full.

29 34-CR TRAN—Credit transferred by FRM34 input, generated when case control was not previously

established.

30 54-TAX-ADJ—DP tax adjustment input by ADJ54; generated when no other action code was specified.

31 CANTPAY—Taxpayer referred to nearest IRS Office in response to claim of inability to pay tax or request for

time to pay.

32 3911 TORDCC—Generated when check claim data input-etc.

33 IAaaa—An IAORG, IAREV, IADFL, input established or updated the Installment Agreement data in the

accounts entity module.

34 UnnnCnnnn—Generated for nullified unpostable condition (where nnn equals the cycle)

35 RELIHOLD – Return held in suspense until clarification received. Return contains religious or conscience-

based objection or taxpayer identifies as Amish/Mennonite/Form 4029 attached, AND dependents do not

have a SSN, AND taxpayer claiming CTC, ACTC, or ODC.

11 North American Industry Classification System Codes (NAICS)

The North American Industry Classification System Code, formerly called Principal Industry Activity Code (PIA) will be self

coded by the taxpayer on line B of Schedule C. The PBA identifies the nature of the taxpayers business and will appear on

IDRS tax modules, IDRS module transcripts, and CC RTVUE. Additional references for these codes are included in

Section 13, Subsection 9 of this book. or IRM 3.12.217-1.

Any line marked with # is for official use only

14-22

12 Microfilm

All microfilm was not converted to Microfilm Replacement System. The unconverted microfilm will continue to be

researched in the microfilm units.

Three types of microfilm information are available:

A. CURRENT MICROFILM+m-

These microfilms contain data which cannot be found by using MRS. They are updated periodically and include

the following:

(a)Partnership Name Directory-can be used to determine the EIN and Name Control of partnership entities. Once

these have been determined, the DLN and return can be obtained through existing procedures.

(b)EPMF National Alpha Register-is produced annually and contains a nationwide listing (in alphabetical order) of

all the active entities on the EPMF.

(c)Federal Tax Deposit Registers-The Federal Tax Deposit (FTD) transactions (Doc. Code 97) received at MCC

are listed on microfilm FTD Registers. For each Campus, the FTD Registers list only the FTD transactions

received from that Campus. Three registers are produced for each scheduled production period. Each register

contains the same information but in a different sort sequence. The three registers are:

1) EIN Register listed by EIN

2) Amount Register listed by the payment amount

3) Each FTD payment is accompanied by an FTD coupon which is microfilmed upon receipt in the Campus.

This microfilm register is the third FTD register maintained in the Research function. Images of FTD coupon

are retained on this microfilm register in sequence by microfilm serial number within a weekly cycle.

B. RETENTION REGISTER

These microfilms contain modules which are no longer carried on the Individual and Business Master Files. The

Retention Registers require index information to be accessed; this information is found on the Reference

Registers for prior to cycle 198401 located in the Microfilm Unit or in the retention register data section of certain

types of MRS transcripts.

(a)Retention Register (IMF/BMF)-The first IMF Retention Register was produced in January 1969 during the 1968

year-end conversion computer processing. The first BMF Retention Register was produced one year later. The

format is identical to the Accounts Register except for the title and certain entity information. It contains all entity

and tax modules removed from the Master File. The basic criteria for removal of a tax module are an assessed

module balance of zero and the last transaction (including the return) has been posted 51 or more months, or

the assessed module balance is credit and the last transaction (including the return) has been posted 60 or

more months. When the last tax module is removed from the account, the entity module is also removed from

the Master File to the Retention File. The Reference Register shows a “2222’ as the period, and “R’ in the

Status Indicator position and the cycle of removal. Each tax module is also shown with the reference to the

cycle of removal.

(b)IMF/BMF will be researched using the DO and year. Some of the BMF MFT’s placed on retention in cycle

197901 or earlier will be found by researching the Residual Master File (RMF) Retention Register Microfilm. No

transactions can post to the tax period once the module has been removed.

Note: No new Retention Registers were produced for calendar years 1982 and 1983 due to the time period of

inactivity extending to at least 52 months before dropping to the Retention Register. Production began again in

1984.

B. Archival Microfilm

These microfilms contain information which predates MRS.

Any line marked with # is for official use only

14-23

13 Universal Access

Universal Access is part of the TSM effort to provide users the most current taxpayer data by providing on-line updates of

taxpayer data from CFOL, the ability to view other SC TIP accounts, and the creation of a National Account Index (NAI) to

keep track of the location of IDRS accounts.

Simply defined, Universal Access is part of the TSM effort to provide the user of an IDRS research command code with

the ability to access and review TIF data on a remote Campuses TIF data base.

It is also the ability to Download or Refresh an account on the local IDRS TIF with data from CFOL.

It includes the creation of a National Account Index (NAI) to keep track of the SC location of IDRS accounts.

A. Universal Access Command Codes

The following command codes have Universal Access capability:

ACTON CHKCL ESTABS IAPND INTST PIFTD REINF

AISDL DMSDL FFINQ IAGRE LETER PIFTF REMFE

AMDIS DMSUL FTDPN IAORG LPAGE PIVAR RFINK

ATINQ ENMOD FTPIN IAREV MESSG PLINF RFRTM

KAFRM ERINV IADIS ICOMP PICRD PLINQ RPINK

STAUP

SUMDL

SUMRY

TDI/DEL

RETNQ

TXMOD

UPCAS

UPDIS

UPTIN

URINQ

USIGNR

VPARS

VPMSG

VRIAG

VRIAO

VRIAR

VRINT

XSINQ

CFINK ERSDL IADFL ITDLN PIEST PTINQ SCFTR UNLCE USIGNT VRSTA

B. National Account Index (NAI)

The NAI is an index of tax module and entity information that can be found on the IDRS nationwide.

When

the

inquiry

command

code

(mentioned

above) f

ails

to

find

the

requested

information

on

the

local

TIF

it

will

then

“default”

to

access

the

NAI.

If

the

requested

information

cannot

be

found

on

the

NAI,

the

CFOL

files

will

be

accessed

to

find

the

requested

information.

If

a

tax

module

or

entity

module

exists

on

the

NAI,

the

requesting

input

screen

will

be

displayed

as

the

new

input

display

screen

with

the

addition

of

the

remote

Campus

abbreviations

and

location

codes

on

lines

22

and

23.

If

a

tax

module

or

entity

is

not

on

the

NAI

but

can

be

found

on

CFOL

and

is

online,

then

a

MFREQ

input

screen

will

be

displayed.

MFREQ

will

immediately

bring

the

entity/tax

module

on

line

to

the

originating

Campus.

If

a

tax

module

or

entity

information

is

on

the

master

file,

but

is

not

on

line

for

BMF,

then

a

BMFOLM s

creen

with

the

message

NO

DATA

FOUND

AT

LOCAL

SITE

-

NAI

-

INPUT

REQUEST

FOR

CFOL

DATA

on

line

23

will

be

displayed

to

request

that

the

data

be

placed

on

line

the

next

day.

The

following

collection

update

command

codes

can

also

be

used

at

remote

sites:

LEVYD,

LEVYE,

LEVYR,

LEVYS,

TDI/DEL

RETAD,

TSIGN,

TELEA,

TELEC,

TELED

and

TELER.

C. NAI/IDRS Timing

Lag time will exist between the time that MF, CFOL and NAI are updated to the time that the TIF is updated.

There is also a lag between the time TIF retention drops an account locally and the time NAI is updated with this

information.

This lag time could give the appearance that something exists on a SC TIF when in reality it doesn’t.

In these cases the remote access command code would give back a “NO DATA FOUND” message.

When data does not exist on the local TIF but exists on CFOL CC MFREQ may be used to download the account

information from CFOL to TIF.

When data exits on TIF but is not as current as CFOL a refresh update or reconciliation of the account may be performed

using a new command code called RECON.

Any line marked with # is for official use only

14-24

Account currency will be determined by comparing the Last MF Extract Cycle of the TIF account to that of the CFOL.

If they are equal no update will take place but an appropriate message will be returned.

If CFOL is more current, then the TIF account will be refreshed with the more current CFOL data.

Entity only or single module Download requests are input.

D. TC902’s

Every time that an account is downloaded or reconciled using CC MFREQ or RECON a TC902 will be generated to MF.

This TC902 will let MF know that the account is now resident on IDRS and where. It will also cause MF to reanalyze the

module and send a current update back to IDRS.

A mini-weekend analysis will also be performed for each account downloaded or updated through CC MFREQ or RECON.

E. 10 days to 10 seconds

This whole process should accomplish in ten seconds what current MFREQ TC902 processing does in ten days.

F. Profile Restrictions

The remote access command codes would be used prior to making taxpayer contact or after the taxpayer has initiated

contact to determine the current overall status of the account.

Once account research is completed the MFREQ/RECON command codes would be used to establish or update a local

account prior to making or inputting an account adjustment.

MFREQ/RECON should not be used to download data for the sole purpose of researching. Remote access or CFOL

command codes should be used for this purpose.

Note: Download capability from CFOL will not be available during Dead Cycles (cycles 1 through 4).Initially only IMF

and BMF will be available for CFOL download. EPMF will be available at a later date. NMF accounts will not

have update capability because they have no associated Master File or CFOL.

G. Direct Remote Access

IDRS users will have the option of directly routing a command code request to a remote Campus by manually inputting the

CC information followed by the routing symbol (@) and the two digit Campus location code and transmitting.

This will provide file research functionality with files that are physically located in remote centers.

No adjustment, credit transfer or transaction type input command code will be allowed as this functionality is currently

available locally. This service will effectively consolidate Security Processing at the local level and provide a National

Password for IDRS users.

Users will have to determine beforehand which SC location they want to route to. How this determination is made will be

dependent on each individual case and what data is needed.

H. IDRS Command Codes Job Aid

Many screen displays and field definitions for command codes reside in this helpful tool located at the SERP web site on

the intranet. The web address is:

http://serp.enterprise.irs.gov/databases/irm-sup.dr/job_aid.dr/command-code.dr/idrs_command_codes_job_aid.htm

Because command code information can be obtained from the address mentioned above, this document will no longer be

providing the screen displays with field definitions.

User Notes

Any line marked with # is for official use only