The Ohio State University – University Policies policies.osu.edu Page 1 of 15

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

Responsible Office University Advancement

POLICY

Issued: 06/10/2009

Revised: 04/18/2023

Generous donors support the students, faculty, staff, programs, and facilities that enable The Ohio State University to be a

flagship public research university, a leader in scholarship, and a change agent for improving lives around the world. The

university is committed to maintaining the highest levels of stewardship in handling gifts to and for its benefit. This policy

governs the types of gifts the university and The Ohio State University Foundation (foundation) may accept, as well as

how and by whom proposed gifts will be evaluated and processed.

Purpose of the Policy

To maintain the highest levels of stewardship, to ensure all gifts further the university’s and the foundation’s mission, and

to comply with state and federal laws and reporting requirements.

Table of Contents

POLICY ................................................................................................................................................................................. 1

Purpose of the Policy ........................................................................................................................................................ 1

Definitions ........................................................................................................................................................................ 1

Policy Details ................................................................................................................................................................... 3

PROCEDURE ....................................................................................................................................................................... 5

Responsibilities .............................................................................................................................................................. 12

Resources ........................................................................................................................................................................ 14

Contacts .......................................................................................................................................................................... 14

History ............................................................................................................................................................................ 15

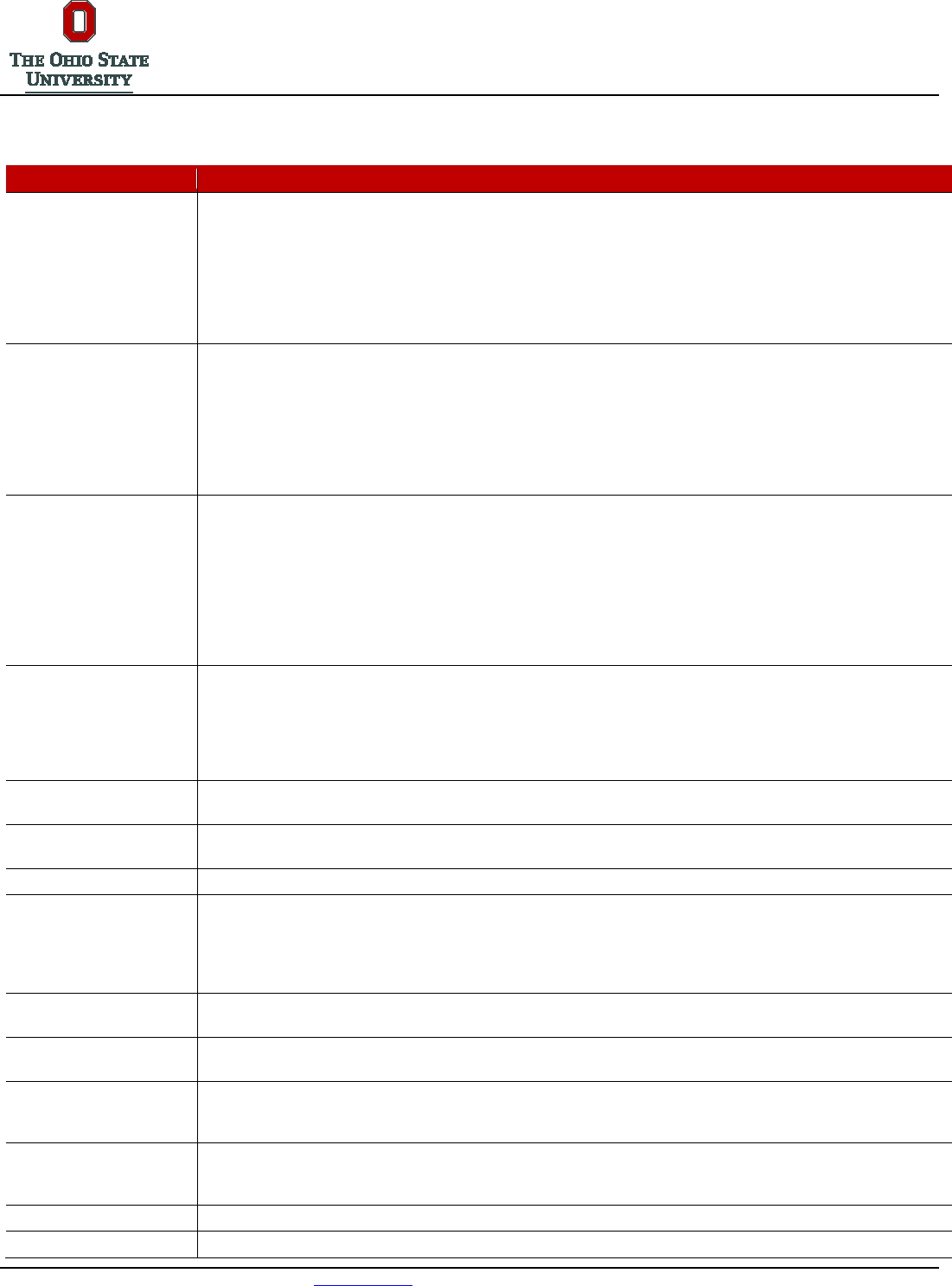

Definitions

Term

Definition

Contract

An agreement between the university or foundation and another party wherein the university or foundation

agrees to provide specific goods or services in exchange for compensation. Contracts are not gifts or

philanthropic grants.

Endowment funds

Funds that are invested and have been permanently restricted by the donor to be used in perpetuity, with

annual distributions to be used as prescribed by the donor.

Gift

An irrevocable transfer of personal property (e.g., cash, securities, books, equipment) or real property

(e.g., land, buildings) by a donor, either outright or through a planned/deferred gift vehicle, for the

charitable purpose designated by the donor and without expectation of a tangible or direct economic

benefit to the donor, with the exception of tax benefits and life income in the case of planned/deferred

gifts. A gift implies no responsibility to provide the donor with a product, service, technical or scientific

report, or intellectual property. This policy divides gifts into three types: complex gifts, outright gifts, and

planned/deferred gifts.

Complex gifts

Gifts that require special review and consideration before the university or foundation will agree to accept

such gifts.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 2 of 15

Term

Definition

Gift in Kind /

tangible

personal

property

Any gift of property that is not real property, including, but not limited to, animals, art, automobiles, books,

computers, food for an event, machinery, medical equipment, and intellectual property.

IRA charitable

rollover

A transfer of funds from a donor’s traditional or Roth IRA account directly to the foundation. Also referred

to as a “qualified charitable distribution.”

Real property

Any undeveloped or developed land as well as the property attached directly to such land, including both

residential and commercial property (e.g., family homes, condominiums, apartment or commercial

buildings, farms, and oil and gas interests).

Restricted

securities / Other

business

interests

Thinly traded, non-publicly traded, closely held, or unmarketable securities, or ownership interests in non-

corporate business entities, such as partnerships and limited liability companies.

Outright gifts

Gifts that do not require special handling by the university or the foundation and are processed by the

Advancement Records office without further consultation.

Cash

Banknotes, coins, checks, credit card payments, money orders, bank drafts, payroll deductions, electronic

funds or wire transfers, and any other ready money equivalent. Cash gifts do not include any form of

alternative currency (including cryptocurrency) that cannot be easily and immediately redeemed for cash.

Donor-Advised

Fund

A charitable giving vehicle maintained by a public charity that allows a donor to make a contribution to that

charity and receive an immediate tax deduction, and then recommend grants over time to any IRS-

qualified public charity, including the foundation.

Matching gift

A gift that is made contingent on another donor’s gift. Matching gifts are generally made by companies

that agree to match gifts made by that company’s employees, officers, and/or directors.

Philanthropic

grant

The voluntary transfer of money, services, or property from a donor organization to support a particular

university project that is generally an award received as the result of a written proposal. There is

oftentimes a requirement that an accounting and/or report will be provided to the donor at the end of the

project, but the donor has no expectation of receiving a direct economic benefit or the return of any goods

or services in exchange for a philanthropic grant. Philanthropic grants do not normally require a detailed

budget be provided to the grantor, include detailed terms and conditions governing the expenditure of the

granted funds, grant ownership or an exclusive license of intellectual property to the funder, or involve

highly regulated types of research such as research with human or animal subjects (grants with these

types of requirements are generally sponsored research project grants, not philanthropic grants). If

philanthropic grants involve regulated research, researchers must adhere to all federal and university

policies and procedures.

Publicly traded

securities

Any equity security traded on a national securities exchange.

Qualified

sponsorship

Any payment of money, transfer of property, or performance of services by a company (“sponsor”) where

there is no arrangement or expectation that the sponsor will receive any substantial return benefit, other

than the use or acknowledgement of the name or logo (or product lines) of the sponsor’s trade or

business. Sponsors may be corporations or other organizations that wish to sponsor a university event or

initiative, such as a speaker series.

Planned/deferred

gifts

Gifts that represent a donor’s present decision to make a future gift, as evidenced through a written gift

instrument.

Bequest

A gift from a donor’s estate that is made by including language in the donor’s will or living trust indicating

that the donor wishes to leave a portion of their estate to the university or the foundation. Bequests may

be made for a specific amount, a percentage of the donor’s estate, or for all or a portion of what is left

after other bequests have been made.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 3 of 15

Term

Definition

Charitable gift

annuity

A contract between a donor and the foundation, whereby the donor transfers cash or property to the

foundation in exchange for a partial tax deduction and a lifetime stream of income from the foundation.

Charitable lead

trust (CLT)

An irrevocable trust that provides an income stream for the foundation for a term of years or the life of one

or more individuals, with the remainder passing to a family member or other non-charitable beneficiary.

Charitable

remainder trust

(CRT)

An irrevocable trust that allows the donor and/or other beneficiaries to receive an income stream for a

period of years or the life of one or more individuals, with the remainder of the assets passing to the

university or foundation.

Life insurance

policies

Contracts with insurance companies that, in exchange for premium payments, provide a lump-sum

payment to named beneficiaries upon the insured’s death.

Pledge

A good faith commitment to make a gift to the university or foundation, as evidenced through a written gift

instrument.

Retirement plan

assets

Funds held in retirement savings accounts, such as 401(k), 403(b), IRA and other qualified retirement

plans.

Quasi-endowment

funds

Funds that have been restricted by the board of trustees to be invested in the long-term investment pool in

order to provide income over a long period of time.

Sponsored research

project

A type of research project that involves a reciprocal relationship between the grantor and the university or

foundation, with each party giving and receiving something of relatively equal value in the transaction.

Sponsored research projects include a statement of work to be performed by the university in exchange

for something of value, such as data, results, or intellectual property, and require a written sponsored

research agreement (e.g., a grant, contract, or cooperative agreement). Sponsored research projects are

handled by the Office of Sponsored Programs.

The Ohio State

University Foundation

(foundation)

An Ohio nonprofit corporation exempt under Section 501(c)(3) of the Internal Revenue Code and the

primary fundraising organization for the university.

Policy Details

I. Scope of Policy. This policy applies to gifts, including outright gifts, complex gifts, and planned/deferred gifts,

made to the university or foundation in furtherance of their shared charitable, educational, and scientific purposes.

The policy does not apply to sponsored research projects or contracts for goods or services. See the Guidelines

for Grants, Gifts and Contracts for further information on how to distinguish a philanthropic grant from a

sponsored research project or contract.

II. G

eneral Provisions

A. Donors will be encouraged to direct gifts to the foundation rather than the university, except for gifts of real

property or gifts in kind/tangible personal property to be used by the university in a manner related to

carrying out its purposes.

B. Endowment Funds. Gifts that meet minimum endowment funding levels may be endowed by the donor for

use in perpetuity.

C. Quasi-Endowment Funds. The board of trustees may establish quasi-endowment funds meeting minimum

endowment funding levels.

D. Naming Guidelines. Certain gifts may be recognized through the naming of academic entities and physical

spaces, subject to the Naming of University Spaces and Entities policy.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 4 of 15

E. Foreign Donors. The university and foundation comply with federal and state laws regarding review and

reporting requirements for gifts or grants from foreign sources, foreign governments, or foreign persons.

Federal regulations require universities that receive Title IV funding to report certain gifts or contracts from

foreign entities. Semi-annual reporting of foreign sources is coordinated by the Student Financial Aid office.

F. Donor Recognition. Appropriate recognition in any donor recognition societies, including, but not limited to,

President’s Club, Neil Legacy Society, and the Oval Society, may be extended to donors, unless declined in

writing by a donor. Any such recognition will be at the university’s discretion and subject to university policy

or guidelines.

G. Donor Confidentiality. The university and foundation are proud of the gifts they receive and often times will

share news of a gift in university publications and websites and other media sources, or will publicly

acknowledge a donor by name. Donors who wish their gifts to be anonymous or do not want any such

recognition must notify the university or foundation in writing and all such donor records will be kept

confidential to the extent allowed by law. Ohio law requires the university and foundation to release donors’

names as well as the date, amount, and terms of gifts if a public records request is received asking for such

information.

H. Donor Obligations. Neither the university nor the foundation will provide legal or tax advice to donors, nor

can the university or foundation guarantee whether any particular gift will be deductible for a particular

donor. Donors are encouraged to seek such advice from their own counsel and professional consultants so that

they are fully aware of all potential advantages or disadvantages of any particular gift as well as any

documentation or reporting obligations that may be required of the donor (e.g., qualified appraisal or IRS

Form 8283).

I. Donor Control. In order to ensure the deductibility of donors’ gifts as well as comply with laws and ethical

standards, gifts may not be controlled by a donor nor may a donor personally benefit from a gift, or have a

role in influencing expenditures. All expenditures are made in accordance with the Expenditures policy

.

Donors may restrict gifts for a particular use, college, or unit within the university, but may not control how

the gift is used.

J. F

ees. Subject to the discretion of the university’s board or trustees or the foundation’s board of directors, fees

may be assessed against gifts and grants.

III. Conflict of Interest. Gifts will not be accepted by the university or foundation if doing so would create a conflict

of interest under any applicable university or university-approved foundation policy, Ohio Ethics Law, or under

the Outside Activities and Conflicts policy and the Wexner Medical Center’s Vendor Interaction policy

.

IV. Outright Gifts. All outright gifts will be received and acknowledged by the foundation.

V. Complex Gifts. The university or foundation will generally only accept gifts if: (i) the time and cost of handling

the gift is not disproportionate to its expected value, (ii) the gift does not expose the university or foundation to

excessive liability, and (iii) the university’s or foundation’s prospects for realizing cash from the asset are not

distant or disproportionate to the current costs of holding the asset.

VI. Planned/Deferred Gifts. All planned/deferred gifts require confirmation of the gift through a gift agreement,

commitment form, or other documentation from the donor. The university and foundation may renounce or

disclaim a gift that flows through estate documents for any reason, including illiquidity, lack of marketability,

holding costs, liability exposure, and unacceptable gift restrictions.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 5 of 15

VII. Gift Receipts

A. Advancement Records will provide gift receipts when required, which will include, at a minimum, all

information required by the IRS in order for donors to claim a tax deduction for their gifts.

B. Neither the university nor the foundation will provide gift receipts for contributions of personal or volunteer

services, software licenses, partial interests in property (e.g., use of property or facilities, such as hotel rooms,

time shares, beach houses, and rounds of golf), free advertising or promotion of the foundation or university,

or pledges. However, the university may, at its discretion, provide certain recognition for such contributions.

PROCEDURE

Issued: 06/10/2009

Revised: 04/18/2023

I. Documentation. All gifts, including outright gifts, complex gifts, and planned/deferred gifts, must be documented

through a written gift instrument (e.g., gift agreement, memorandum of understanding, check, commitment form,

online form, or other written documentation) that includes: (i) a description of the gift; (ii) any donor restrictions

on the use of the funds; (iii) whether the funds are endowed or for current use; and (iv) any other information

necessary to fully document the donor’s wishes (e.g., whether the donor wishes to be acknowledged by name or

not). Documentation and acceptance procedures are detailed in the sections below.

II. Charitable Restrictions. Whether the funds are to be used at the discretion of a particular college or unit, or for

something more specific, the development officer must work closely with the donor to craft a clear statement

outlining how the donor’s gift may be used. Especially in regards to endowed funds, consideration must be paid to

the possibility of changed circumstances over time and flexibility should be built into any restrictions. Neither the

university nor the foundation will accept a gift that is restricted for any unlawful purpose or purpose that is

contrary to the policies of the university, or that allows the donor to derive personal benefit from the gift.

III. Endowment and Quasi-Endowment Funds

A. Endowment Funds. Endowment funds are invested in the university’s Long-Term Investment Pool and annual

distributions are made according to the Investment policy and Fund Transfers – General Ledger policy

, each

as amended from time to time. Exceptions to minimum endowment funding levels may be permitted for

certain estate gifts upon the recommendation of the Estate and Gift Planning office and ultimate discretion of

the senior vice president for advancement in consultation with the senior vice president for business and

finance.

B. Q

uasi-Endowment Funds. Quasi-endowment funds are invested in the Long-Term Investment Pool and

annual distributions are made according to the Investment policy. Unlike endowment funds, the board of

trustees may choose to release restrictions on quasi-endowment funds at its discretion, however, in order to

allow for stability and long-term planning in the Long-Term Investment Pool, quasi-endowment funds should

only be established when there is an expectation that the funds will remain in the Long-Term Investment Pool

for an extended period of time. The minimum investment period for funds transferred to the Long-Term

Investment Pool is governed by the

Fund Transfers – Unrestricted to Endowment policy. Quasi-e

ndowment

funds must be identified as such either in the fund name or description.

IV. A

cceptance Procedures for Outright Gifts

A. Cash

1. The Advancement Records office may receive cash gifts and will issue receipts to donors for such gifts

without further review or consultation. Cash gifts received in other departments must be directed to the

Advancement Records office.

2. Cash gifts are valued at their face value as of the date of the gift.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 6 of 15

B. Publicly traded securities

1. Development officers may provide donors with transfer instructions, or direct donors’ brokers to contact

the Advancement Records office for transfer instructions.

2. Publicly traded securities are valued at their fair market value on the date they are received in the

brokerage account specifically indicated on the transfer instructions (the “Valuation Date”). Publicly

traded securities transferred to any brokerage account other than the account specifically indicated on the

transfer instructions may be valued on such date for donor deductibility purposes, but will be valued for

donor recognition and endowment funding purposes only once they are transferred to the brokerage

account specifically indicated on the transfer instructions. The fair market value is the average of the

highest and lowest quoted selling price of the securities on the Valuation Date. If there were no sales on

the Valuation Date, the fair market value will be determined by taking the weighted average of the highest

and lowest sales on the nearest date before and the nearest date after the Valuation Date, within a

reasonable period.

3. The Advancement Records office may receive gifts of publicly traded securities and will issue receipts to

donors for such gifts without further review or consultation.

4. The Advancement Records office will notify the Treasurer’s Office of all gifts of publicly traded

securities, and transfer any stock certificates to the Treasurer’s Office as soon as practicable. The

Treasurer’s Office, on behalf of the foundation and at its sole discretion, will sell such gifts as soon as

practical, generally within one business day of receipt into the brokerage account specifically indicated on

the transfer instructions, taking into account liquidity, daily volume, and transaction processing.

C. Gifts from donor-advised funds

1. The Advancement Records office may receive donor-advised fund gifts without further review or

consultation. Donor receipts are not required. This includes gifts from The Ohio State University

Foundation Donor-Advised Fund, which is a fund held at The Columbus Foundation (TCF) for the

benefit of the foundation.

2. Gifts from donor-advised funds are valued at their face value as of the date of the gift.

3. Pursuant to IRS rules, the donor-advised fund advisor(s) may receive no more than an incidental benefit

from any donor-advised fund gift.

4. A donor’s intention to recommend gifts from a donor-advised fund should be documented with a

memorandum of understanding.

D. Qualified sponsorships

1. Qualified sponsorships will be evaluated on a case-by-case basis by the college or unit benefitting from

the gift, Gift Agreement Services, the Office of Legal Affairs (OLA), and the Advancement Corporate

Relations office.

2. A qualified sponsorship will be valued based on the underlying asset transferred (e.g., qualified

sponsorships satisfied through a transfer of cash will be valued according to Procedure IV.A. and

qualified sponsorships satisfied through a transfer of publicly traded securities will be valued according to

Procedure IV.B.). If any benefits are provided to the sponsor, other than qualified sponsorship

recognition, the value of the sponsorship amount will be reduced by the value of return benefits provided

to the sponsor.

3. Sponsor recognition may include use or acknowledgment of the sponsor’s name, logo, website, or product

lines, but may not include advertising (i.e., identifying the sponsor’s products or services through

messages that contain qualitative or comparative language, price information, or other indications of

savings or value, endorsements, or inducements to purchase, sell, or use the sponsor’s products or

services). If a sponsor wishes to purchase advertising, they must contact

Trademark and Licensing

Services.

4. Sponsorships may not be contingent upon the level of attendance at an event, broadcast ratings, or other

factors indicating the degree of public exposure to one or more events.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 7 of 15

E. Matching gifts

1. The Advancement Records office may receive and acknowledge matching gifts paid in cash or publicly

traded securities without further review or consultation, and may verify matching gift claims.

2. Matching gifts are valued based on the underlying asset transferred (e.g., matching gifts satisfied through

a transfer of cash will be valued according to Procedure IV.A. and matching gifts satisfied through a

transfer of publicly traded securities will be valued according to Procedure IV.B.).

3. Unless otherwise indicated by the matching donor, matching gifts will follow the designation of the

matched donor’s gift.

4. For company matched gifts, it is the responsibility of the individual donor to request a matching gift from

the company; such gifts are credited to the individual donors for recognition purposes, including meeting

minimum endowment funding levels.

V. Acceptance Procedures for Complex Gifts

A. Gifts in kind/tangible personal property

1. Gifts in kind will be evaluated on a case-by-case basis.

2. The university may accept a gift in kind only when it intends to retain and use the gift in furtherance of

the university’s charitable and educational purposes, provided the cost and risk of accepting the gift do

not outweigh the benefit of accepting the gift. The foundation may only accept a gift in kind when it is

something the university has determined it cannot use, but can be readily liquidated for the benefit of the

university.

3. For gifts to the university, the Advancement Records office, with approval of the development officer and

the head of the college or unit that will use the gift, may accept gifts in kind valued at less than $50,000.

Gifts in kind to the university valued at $50,000 or more must also be approved by the senior vice

president for business and finance, in consultation with the Treasurer’s Office, Estate and Gift Planning,

and OLA.

4. The foundation may accept a gift in kind only with the intent to sell it. Gift acceptance is at the discretion

of the president of the foundation in consultation with the Treasurer’s Office, Estate and Gift Planning,

and OLA, and the college or unit that will benefit from the gift. Required due diligence before accepting

such a gift includes, but is not limited to:

a. Review of a complete and current description of the property;

b. Determination of the marketability of the property;

c. Preparation and review of a financial plan detailing all costs associated with accepting and selling the

property; and

d. Review of any other information or documentation necessary for the foundation to make a fully

informed decision about the potential risks and benefits of accepting any particular item.

5. Certain gifts in kind will be subject to additional review and approval guidelines or policies or specific

documentation requirements (such as those for construction-related gifts in kind).

6. Donors who wish to claim a charitable deduction for any gift in kind with a fair market value of more

than $5,000 must secure a qualified appraisal at their expense. Gifts with a fair market value of $5,000 or

less, or gifts with a fair market value of more than $5,000 for which a donor does not wish to take a

deduction, may be valued based on the donor’s appraisal, the value declared by the donor (a copy of

either a paid bill of sale or invoice and a copy of a check or credit card statement showing payment is

recommended), or a value determined by a qualified expert on the faculty or staff of the university or

foundation. This value will be used for donor recognition purposes only; it will not be used for donor

deductibility or endowment funding purposes. If a gift-in-kind is donated in order to fund an endowment,

the gift-in-kind will be sold and the endowment will be established with the net proceeds of such sale

subject to the current endowment minimums. If an appraisal, or other documentation determined

acceptable by the university or foundation, is not provided, the gift will be recorded at $1.00, and the

value will be adjusted when the appraisal is provided or the property is sold.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 8 of 15

7. Donors should be advised of their responsibility to complete IRS Form 8283, Noncash Charitable

Contributions. Advancement Records will complete the donee acknowledgement section of a completed

IRS Form 8283.

8. Development officers should inform donors that the university or foundation may choose to sell or

dispose of the property, and that any sale or disposition occurring within three years of the date of the gift

will be reported to the IRS on Form 8282, Donee Information Return.

B. Real property

1. Gifts of real property will be evaluated for recommendation of acceptance on a case-by-case basis by the

Treasurer’s Office, Estate and Gift Planning office, and the OLA, with assistance from the Planning and

Real Estate (“PARE”) office when appropriate. In general, but at the ultimate discretion of the senior vice

president for business and finance, if real property is accepted with the intent to sell the property, it will

be received and acknowledged by the foundation upon the approval of the president of the foundation and

the senior vice president for business and finance. If real property is accepted with the intent to retain the

property for use by the university, it will be received and acknowledged by the university upon the

approval of the senior vice president for business and finance and subject to the

Board of Trustees Review

and Approval of Facilities Improvement Projects and Real Estate Transactions policy, which requires

prior approval of the board of trustees to accept any real property gifts to the university. Such board

approval will be sought only after all internal review, approvals, and documentation have been completed.

2. G

ifts of real property will only be considered if they have a value of at least $100,000. Donors must

secure a qualified appraisal at their expense. If an appraisal is not provided, the gift will be recorded at

$1.00 and the value for donor recognition purposes will be adjusted when the appraisal is provided or the

property is sold. If a gift of real property is donated to fund an endowment, the property will be sold and

the endowment will be established with the net proceeds of such sale. The university or foundation may

choose to secure an additional appraisal, but any such appraisal may not be used by the donor for

purposes of their tax returns or otherwise.

3. The development officer must contact the Estate and Gift Planning office as soon as reasonably possible

whenever there is a proposed gift of real property.

4. Estate and Gift Planning will work with the Treasurer’s Office, the college or unit benefitting from a gift

of real property, and OLA, with assistance from PARE when appropriate, to conduct the due diligence

necessary to determine whether or not to recommend that the property be accepted.

a. Required due diligence before accepting real property includes, but is not limited to:

i. A site visit;

ii. Determination of market value and marketability of the property;

iii. Review of environmental risks, including securing Phase I and Phase II Environmental Site

Assessments, as needed;

iv. Title search;

v. Survey;

vi. Appraisal;

vii. Review of all carrying costs associated with the property;

viii. Preparation and review of a financial plan detailing all costs associated with accepting and selling

the property (if being considered by the foundation) or accepting and retaining the property (if

being considered by the university); and

ix. Any other information or documentation necessary for the university or foundation to make a

fully informed decision about the potential risks and benefits of accepting any particular property.

b. The costs associated with completing the required due diligence, including the cost of securing a

survey or required environmental assessments, for example, will be paid by the donor or the college

or unit that will benefit from the acceptance of the property.

5. Bargain sales (i.e., purchasing an asset from a donor for less than fair market value) will only be

considered if the university intends to retain the property for its use. The university will not consider

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 9 of 15

bargain sales that would require the university to accept property subject to outstanding debt. The

foundation will not accept bargain sales.

6. Donors should be advised of their responsibility to complete IRS Form 8283, Noncash Charitable

Contributions. Advancement Records will complete the donee acknowledgement section of a completed

IRS Form 8283.

7. Development officers should inform donors that the university or foundation may choose to sell or

dispose of the property, and that any sale or disposition occurring within three years of the date of the gift

will be reported to the IRS on Form 8282, Donee Information Return.

C. Restricted securities and other business interests

1. Gifts of restricted securities and other business interests will be evaluated on a case-by-case basis by

the Estate and Gift Planning office, Treasurer’s Office, and OLA.

2. It is the donor’s responsibility to have the securities or other business interests valued by a qualified

independent appraiser, as required by the IRS.

3. Any such gifts will be received and acknowledged by the foundation, upon the approval of the president

of the foundation and the senior vice president for business and finance.

4. The development officer must contact the Estate and Gift Planning office as soon as reasonably possible

whenever there is a proposed gift of restricted securities or other business interests. The development

officer must secure from the donor:

a. Written description of the proposed gift;

b. Current appraisal of the fair market value of the proposed gift;

c. Any available information indicating the marketability of the proposed gift;

d. Audited financial statements and/or tax returns of the underlying corporation or other business entity;

e. Governing documents of the underlying business entity;

f. Any applicable shareholder or buy-sell agreements;

g. Description of any restrictions on transfer of interests; and

h. Any other information necessary to fully evaluate the gift.

5. The Estate and Gift Planning office will work with the Treasurer’s Office and OLA to conduct the

necessary due diligence to determine whether or not the foundation will accept a proposed gift of

restricted securities or other business interests and will weigh factors such as the administrative

obligations to be assumed by the foundation (e.g., monitoring a partnership for unrelated business

income), whether distributions will be sufficient to justify administrative costs or other expenses, whether

there are obligations to make capital contributions, whether the foundation could be held liable for the

debts of the business interest, whether it is adequately capitalized and insured, and any other factors

relevant to making a well-informed decision.

6. If a gift of restricted securities or other business interests is accepted, the Treasurer’s Office, on behalf of

the foundation, will attempt to sell the securities or other business interest as soon as practical.

7. If a qualified appraisal is not provided, the gift will be recorded at $1.00 and the value for donor

recognition purposes will be adjusted when the appraisal is provided or the restricted securities or other

business interest is sold. If a gift of restricted securities or other business interest is donated to fund an

endowment, the securities or business interests will be sold and the endowment will be established with

the net proceeds of such sale.

D. IRA charitable rollovers

1. IRA charitable rollovers will be received and acknowledged by the foundation.

2. Under current law, if a donor is age 70

½ or older on the date of the gift, the donor is permitted to

transfer up to $100,000 a year to the foundation without recognizing the distribution as taxable

income.

3. IRA charitable rollovers will be valued at their face value as of the date of transfer.

4. Development officers must notify the Estate and Gift Planning office of proposed IRA charitable

rollovers as soon as reasonably possible.

5. Donors may designate the area at the university that they wish the rollover to support.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 10 of 15

6. IRA charitable rollovers may not be directed to a donor-advised fund and may not be used to create any

life income gifts (e.g., charitable remainder trusts).

7. IRS rules prohibit donors from receiving any benefits in return for IRA charitable rollovers, including

membership in donor societies and any athletic ticket points, rights to purchase athletic tickets, or other

benefits.

8. Advancement Records will provide donors with a gift acknowledgment letter from the foundation that

states the gift qualifies as a qualified charitable distribution from an IRA and no tax deduction is

available.

VI. Acceptance Procedures for Planned/Deferred Gifts

A. Bequests

1. Donors may designate the university or foundation as the beneficiary of a bequest in their estate planning

documents, but are encouraged to name the foundation (as opposed to the university).

2. The development officer must work with the donor and Estate and Gift Planning office to develop a gift

agreement or other written documentation outlining the donor’s wishes for the future gift, and will contact

Estate and Gift Planning immediately for any unusual bequests of property, non-cash items, or issues

regarding trustees or executors.

3. Bequests will be valued based on the underlying gift type (e.g., cash, publicly traded securities, or real

property).

4. Estate and Gift Planning will provide suggested estate planning language for the donor and their advisors

to review and consider.

5. If possible, the development officer should obtain a copy of the portion of the donor’s estate planning

document naming the university or foundation as beneficiary.

6. Bequest distributions are handled by Estate and Gift Planning and any correspondence must be

immediately directed to that office.

B. Charitable gift annuities

1. Only the foundation may issue a charitable gift annuity.

2. Charitable gift annuities are valued at the present value of the remainder interest. A donor’s deduction

may, however, be reduced under the percentage limitation and reduction rules as described in Section 170

of the Internal Revenue Code.

3. Estate and Gift Planning is responsible for preparation of charitable gift annuity agreements and

associated gift agreements.

4. The minimum amount of a new gift annuity is $10,000 for most donors, and $5,000 for repeat donors and

retired faculty and staff.

5. Gift annuities funded by property other than cash or publicly traded securities are not recommended and

will be accepted only upon the approval of the Estate and Gift Planning office, Treasurer’s Office, and

OLA.

6. State registration requirements must be adhered to in those states whose insurance or other laws and

regulations so require.

C. Retirement plan assets

1. Donors may designate the university or foundation as the beneficiary of their retirement plans on their

retirement plans’ beneficiary designation forms, but should be encouraged to name the foundation (as

opposed to the university).

2. The development officer must work with the donor and Estate and Gift Planning to develop a gift

agreement or other written documentation outlining the donor’s wishes.

3. Retirement plans will be valued at face value at time of transfer.

4. If possible, the development officer should obtain a copy of the portion of the donor’s beneficiary

designation form naming the university or foundation as a beneficiary.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 11 of 15

D. Charitable remainder trusts and charitable lead trusts

1. Development officers must work with Estate and Gift Planning when a donor wishes to name the

foundation as a beneficiary of a charitable trust.

2. Charitable remainder trusts (CRTs) are valued at the present value of the remainder interest.

Charitable lead trusts (CLTs) are valued at the present value of the income interest.

3. The remainder interest of a CRT must be at least 50% of the projected 3% annual inflation-adjusted

original principal.

4. Estate and Gift Planning, in conjunction with the Treasurer’s Office, accepts charitable trusts on behalf of

the foundation when the foundation is trustee. The university will not serve as trustee of a charitable trust.

5. In the event real estate is transferred to a CRT, it is preferred that the donor or other donor representative

serve as trustee until the real estate is sold, but the foundation may serve as trustee if requested by the

donor.

6. Distributions from CRTs not trusteed by the foundation, and distributions from CLTs will be accepted

and processed based on the type of assets distributed and restrictions, if any, applicable to the gift.

7. The foundation may choose to have charitable trusts administered by a third party administrator.

E. Life insurance policies

1. Development officers must work with Estate and Gift Planning when a donor wishes to make a gift of life

insurance.

2. Life insurance policies with outstanding premiums will be valued at the lesser of the policy’s fair market

value or the donor’s cost basis. Fully “paid up” policies will be valued at the lesser of the donor’s cost

basis or the policy’s replacement cost.

3. A life insurance policy will be accepted only if it is an irrevocable policy and complete ownership and

control is transferred to the foundation.

4. The policy must be a whole or universal life policy with a death benefit of no less than $100,000.

5. The policy must be a first or second to die policy.

6. The policy must be “paid up” or the donor must agree to pay no less than the minimum level of annual

premium required to keep the policy in full force and effect to maturity, as periodically determined by the

foundation’s in-force review of the policy.

7. If the policy is in existence when gifted, the policy may not have any outstanding loans as of the date of

the gift.

8. There must be a fully signed insurance gift agreement, a copy of which must be on file with the

foundation, which includes, at a minimum:

a. The foundation’s acknowledgement of ownership of the policy, and

b. The right of the foundation to cash in the policy.

9. If the donor does not pay the required premiums to keep the policy in full force, the policy may be

surrendered and the donor’s recognition will be decreased to the surrender value of the policy.

10. Donors may name the university or foundation as a primary or contingent beneficiary of life insurance

policies they own, including term policies, which will not be counted as a gift until the money is received.

Such policies should be confirmed with written documentation and will be counted as revocable bequests.

If possible, the development officer should obtain a copy of the portion of the donor’s beneficiary

designation form naming the university or foundation as a beneficiary.

F. Pledges

1. Pledges will be received and acknowledged by the foundation.

2. Pledges must be documented with a gift agreement, memorandum of understanding, or other written gift

instrument that includes the terms and length of the pledge. Gift Agreement Services prepares and

facilitates approvals of documentation of pledges. Pledges resulting from the student calling center or

from online giving sites are exempt from the written agreement requirement because these pledges

typically do not have special restrictions or stewardship requirements.

3. A pledge payment period will be no longer than five years, unless an exception is made by the senior vice

president for advancement or his/her designee.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 12 of 15

4. Pledges from the phone and online systems are recorded electronically and are set up with automatic

reminder schedules accordingly.

5. Pledge payments for an endowment pledge will be held in a pending endowment fund until at least the

minimum endowment funding level is received. Other than required fees, no expenditures will be made

from pending endowment funds.

6. If a pledge intended to meet a minimum endowment funding requirement is not fully realized during the

pledge period, the fund will be converted to a current use fund.

7. Pledges will not qualify a donor for certain recognition societies or programs. However, the university

recognizes pledges when considering a donor’s total lifetime giving.

G. Gifts from the Ohio State University Foundation Donor Advised Fund at The Columbus Foundation (TCF)

1. The donor must work with Estate and Gift Planning, in conjunction with TCF, to establish the fund.

2. Minimum funding amount is $10,000.

3. Donors must designate at least 50% of their gift to one or more areas at the university.

4. Pursuant to IRS rules, the donor-advised fund advisor(s) may receive no more than an incidental benefit

from any donor-advised-fund gift.

5. TCF will issue gift receipts to the donors.

6. The gift must be documented with a signed gift instrument. The gift instrument must designate which

areas at the university will benefit if any funds are left at the termination of the fund.

7. See Procedure IV.C. for the procedures once TCF makes a distribution from the fund.

VII. Exceptions

A. Exceptions to this policy or unresolved issues will be considered on a case-by-case basis by the senior vice

president for advancement, who will make a decision to accept, reject, or escalate the gift discussion, in

consultation with university and foundation leaders, or the Gift Acceptance Committee as appropriate.

B. Gift Acceptance Committee. The senior vice president for advancement may, in their sole discretion, convene

the Gift Acceptance Committee to review and advise on such issues relating to gift acceptance as the senior

vice president for advancement may specify. The membership of the Gift Acceptance Committee will be

determined by the senior vice president for advancement from time to time and will be comprised of at least

three individuals, one of whom must be the senior vice president for business and finance.

Responsibilities

Position or Office

Responsibilities

Advancement Corporate

Relations office

Evaluate qualified sponsorships with applicable college/unit, Gift Agreement Services, and OLA.

Advancement Records

1. Receive gifts and issue receipts to donors as set forth in the policy.

2. Notify the Treasurer’s Office of gifts of publicly traded securities, and transfer any stock certificates to the

Treasurer’s Office.

3. Complete donee acknowledgment section of a completed IRS Form 8283.

4. Provide donors with gift acknowledgment letters for IRA charitable rollovers.

College/Unit/Department

that will use/benefit from

the gift

1. Direct cash gifts received to Advancement Records.

2. Evaluate qualified sponsorships with Gift Agreement Services, OLA, and Advancement Corporate

Relations office.

3. Approve acceptance of gifts in kind valued at less than $50,000.

4. Pay due diligence costs for gifts of real property if not paid by donor.

The Columbus

Foundation (TCF)

Issue receipts to donors for gifts from the Ohio State University Foundation Donor Advised Fund at TCF.

Development officer

1. Work with donor to understand and document how a gift may be used.

2. Approve acceptance of gifts in kind valued at less than $50,000.

3. Inform donors who provide gifts in kind/tangible personal property or gifts of real property that the

foundation or university may choose to sell or dispose of the property as set forth in the policy.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 13 of 15

Position or Office

Responsibilities

4. Contact Estate and Gift Planning as soon as reasonably possible whenever there is a proposed gift of

real property, restricted securities or other business interests, or IRA charitable rollovers as set forth in

the policy.

5. Work with donor and Estate and Gift Planning office to develop a gift agreement or other written

documentation outlining the donor’s wishes for bequests and retirement plan assets as set forth in the

policy.

6. Work with Estate and Gift Planning when a donor wishes to name the foundation as a beneficiary of a

charitable trust or make a gift of life insurance.

Donor

1. Work with development officer to understand and document how a gift may be used.

2. Provide confirmation of planned/deferred gift through gift agreement, commitment form, or other

documentation.

3. Request matching gift from company for company matched gifts.

4. Secure qualified appraisal for certain gifts as set forth in the policy.

5. Pay costs associated with completing due diligence when required.

6. Work with Estate and Gift Planning, in conjunction with TCF, to establish Ohio State University

Foundation Donor Advised Fund at TCF as set forth in the policy.

Estate and Gift Planning

1. Advise about acceptance of gifts as set forth in the policy.

2. Conduct due diligence and make recommendations about proposed gifts of real property and restricted

securities or other business interests.

3. Provide suggested estate planning language for the donor and advisors to consider.

4. Handle bequest distributions.

5. Prepare charitable gift annuity agreements and associated gift agreements.

6. Review proposed gift annuities funded by property other than cash or publicly traded securities.

7. Accept charitable trusts on behalf of the foundation when the foundation is trustee.

8. Work with the donor and TCF on gifts from the Ohio State University Donor Advised Fund at TCF.

Foundation

1. Comply with federal and state laws regarding review and reporting requirements for gifts or grants from

foreign sources, foreign governments, or foreign persons.

2. Receive and acknowledge all outright gifts, approved real property accepted with the intent to sell,

approved restricted securities and other business interests, IRA charitable rollovers, and pledges.

3. May accept gifts in kind only with the intent to sell.

4. May issue a charitable gift annuity.

Gift Acceptance

Committee

Review and advise on issues relating to gift acceptance as specified by the senior vice president for

advancement.

Gift Agreement Services

1. Evaluate qualified sponsorships and gifts of restricted securities and other business interests.

2. Prepare and facilitate approvals of documentation of pledges.

Head of a college or unit

Approve acceptance of gifts in kind valued at less than $50,000.

Office of Legal Affairs

1. Evaluate qualified sponsorships and gifts of restricted securities and other business interests.

2. Advise on acceptance of gifts in kind valued at $50,000 or more.

3. Conduct due diligence and make recommendations about proposed gifts of real property and restricted

securities or other business interests.

4. Review proposed gift annuities funded by property other than cash or publicly traded securities.

Planning and Real Estate

Office

Provide assistance when appropriate to support the evaluation of proposed gifts of real property.

President of the

Foundation

Accept and approve complex gifts on behalf of the foundation as set forth in the policy.

Senior vice president for

advancement

1. Consider exceptions on a case-by-case basis and make decision to accept, reject, or escalate the gift

discussion, in consultation with university leaders and Gift Acceptance Committee as appropriate.

2. Determine membership of Gift Acceptance Committee as set forth in the policy.

Senior vice president for

business and finance

1. Approve acceptance of gifts in kind valued at $50,000 or more, gifts of real property, and gifts of restricted

securities or other business interests.

2. Advise on requests for exceptions and participate in Gift Acceptance Committee as appropriate.

Sponsor

Contact Trademark and Licensing Services if wish to purchase advertising.

Student Financial Aid

Coordinate reporting related to gifts from foreign sources.

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

The Ohio State University – University Policies policies.osu.edu Page 14 of 15

Position or Office

Responsibilities

Treasurer’s Office

1. Sell gifts of publicly traded securities as soon as practical.

2. Advise on acceptance of gifts as set forth in the policy.

3. Conduct due diligence and make recommendations about proposed gifts of real property and restricted

securities or other business interests.

4. Evaluate potential gifts of restricted securities or other business interests, and if accepted, attempt to sell

the securities or other business interest as soon as practical.

5. Review proposed gift annuities funded by property other than cash or publicly traded securities.

6. Consult on acceptance of charitable trusts on behalf of the foundation when the foundation is trustee.

Resources

University Policies, policies.osu.edu

Board of Trustees Review and Approval of Facilities Improvement Projects and Real Estate Transactions,

go.osu.edu/bot-review-approval-facilities-policy

Deposit of Funds, go.osu.edu/deposit-funds-policy

Expenditures, go.osu.edu/expenditures-policy

Fund Transfers–General Ledger, go.osu.edu/ftgl-policy

Fund Transfers–Unrestricted to Endowment, go.osu.edu/ftue-policy

Investment, go.osu.edu/investment-policy

Naming of University Spaces and Entities, go.osu.edu/naming-policy

Outside Activities and Conflicts, go.osu.edu/outside-activities-policy

University Fleet, go.osu.edu/university-fleet-policy

Other University Governance Documents

Guidelines for Grants, Gifts and Contracts, osp.osu.edu/development/sponsors/guidelines-for-grants-gifts-and-contracts

Wexner Medical Center’s Vendor Interaction Policy, wexnermedical.osu.edu/about-us/employee-onesource

Additional Guidance and Forms

Bequest Language, ohiostate.mylegacygift.org/bequest-language

Cryptocurrency, osu.edu/giving/cryptocurrency-procedures

Depository Services, busfin.osu.edu/university-business/treasury/banking-services

Endowments, osu.edu/giving/how-to-give/endowments

Estate and Gift Planning, ohiostate.mylegacygift.org

IRS Forms, Instructions & Publications, irs.gov/forms-instructions

Matching Gifts, osu.edu/giving/how-to-give/matching-gifts.html

Ways to Give, osu.edu/giving/how-to-give/ways-to-give.html

Wills and Living Trusts, ohiostate.mylegacygift.org/wills-and-living-trusts

Contacts

Subject

Office

Telephone

E-mail/URL

Complex Gifts

Estate and Gift Planning

614-292-2183

800-327-7907

giftplan@osu.edu

ohiostate.mylegacygift.org

Endowed Gifts

Gift Agreement and Endowment Services

614-292-2441

osu.edu/giving/how-to-

give/endowments

Outright Gifts

Advancement Records

614-292-2141

gifts@osu.edu

osu.edu/giving

Outright Gifts

Estate and Gift Planning

614-292-2183

800-327-7907

giftplan@osu.edu

ohiostate.mylegacygift.org

Gift Acceptance

University Policy

Applies to: Faculty, staff, donors of The Ohio State University, and donors of The Ohio State University

Foundation

Page 15 of 15

Subject

Office

Telephone

E-mail/URL

Planned/Deferred Gifts

Estate and Gift Planning

614-292-2183

800-327-7907

giftplan@osu.edu

ohiostate.mylegacygift.org/wills-

and-living-trusts

History

Issued: 06/10/2009

Revised: 07/01/2018

Revised: 04/18/2023

Edited: 09/05/2023

The Ohio State University – University Policies policies.osu.edu