New Issue: Retiro Mortgage Securities

DAC

Primary Credit Analyst:

Fabio Alderotti, Madrid + 34 91 788 7214; fabio[email protected]

Secondary Contact:

Giuseppina Martelli, Milan + 390272111274; giuseppina.mar[email protected]

Table Of Contents

Overview

The Credit Story

Collateral And Originator

Servicing

Credit Analysis And Assumptions

Macroeconomic And Sector Outlook

Transaction Summary

Counterparty Risk

Sovereign Risk

Surveillance

Appendix

Related Criteria

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 1

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global

Ratings' permission. See Terms of Use/Disclaimer on the last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Ratings Detail

Ratings

Class Rating*

Class

balance

(mil. €)

Credit

enhancement

(%)§ Index

Margin

(%)

Additional

note

payment

(%)†

Couponcap

(%)§§

Additional

note

payment

date

Legal final

maturity

A1 BBB- (sf) 260 67.7 Three-month

EURIBOR

2.00 2.00 5.00 April 30, 2024 July 30,

2075

A2 NR 77 N/A Three-month

EURIBOR

2.00 2.00 5.00 April 30, 2024 July 30,

2075

B NR 34 N/A Three-month

EURIBOR

3.00 3.00 6.00 April 30, 2024 July 30,

2075

C NR 15 N/A Three-month

EURIBOR

4.00 4.00 8.00 April 30, 2024 July 30,

2075

D1 NR 10 N/A Three-month

EURIBOR

5.00 N/A N/A N/A July 30,

2075

D2 NR 10 N/A Three-month

EURIBOR

6.00 N/A N/A N/A July 30,

2075

D3 NR 10 N/A Three-month

EURIBOR

7.00 N/A N/A N/A July 30,

2075

E NR 54 N/A Variable rate N/A N/A N/A N/A July 30,

2075

*Our rating addresses timely receipt of interest and ultimate repayment of principal on the class A1 notes. §This is the initial credit support

based on total gross recoveries from the servicer's business plan-class balance/total gross recoveries from the servicer's business plan, plus the

reserve fund. †Additional note payments are paid from the additional note payment date and are not rated. §§The coupon cap applies after 60

months from the closing date and is a cap on the all-inclusive interest rate of the notes.

NR--Not rated. N/A--Not applicable.

Overview

• S&P Global Ratings has assigned its 'BBB- (sf)' credit rating to Retiro Mortgage Securities DAC's class A1 notes. At

closing, the issuer also issued class A2, B, C, D1, D2, D3, and E notes that S&P Global Ratings has not rated.

• Retiro Mortgage Securities is a Spanish nonperforming (NPL) and real-estate-owned properties (REO) transaction

that securitizes a portfolio of loans totaling approximately €678 million in current balance (with a valuation amount

of approximately €344 million), and a portfolio of REO with a total valuation of approximately €396 million. The

collateral comprises residential properties (including annexes), commercial properties (including 0.8% classified as

other), and land (80.7%, 10.6%, and 8.7%, respectively).

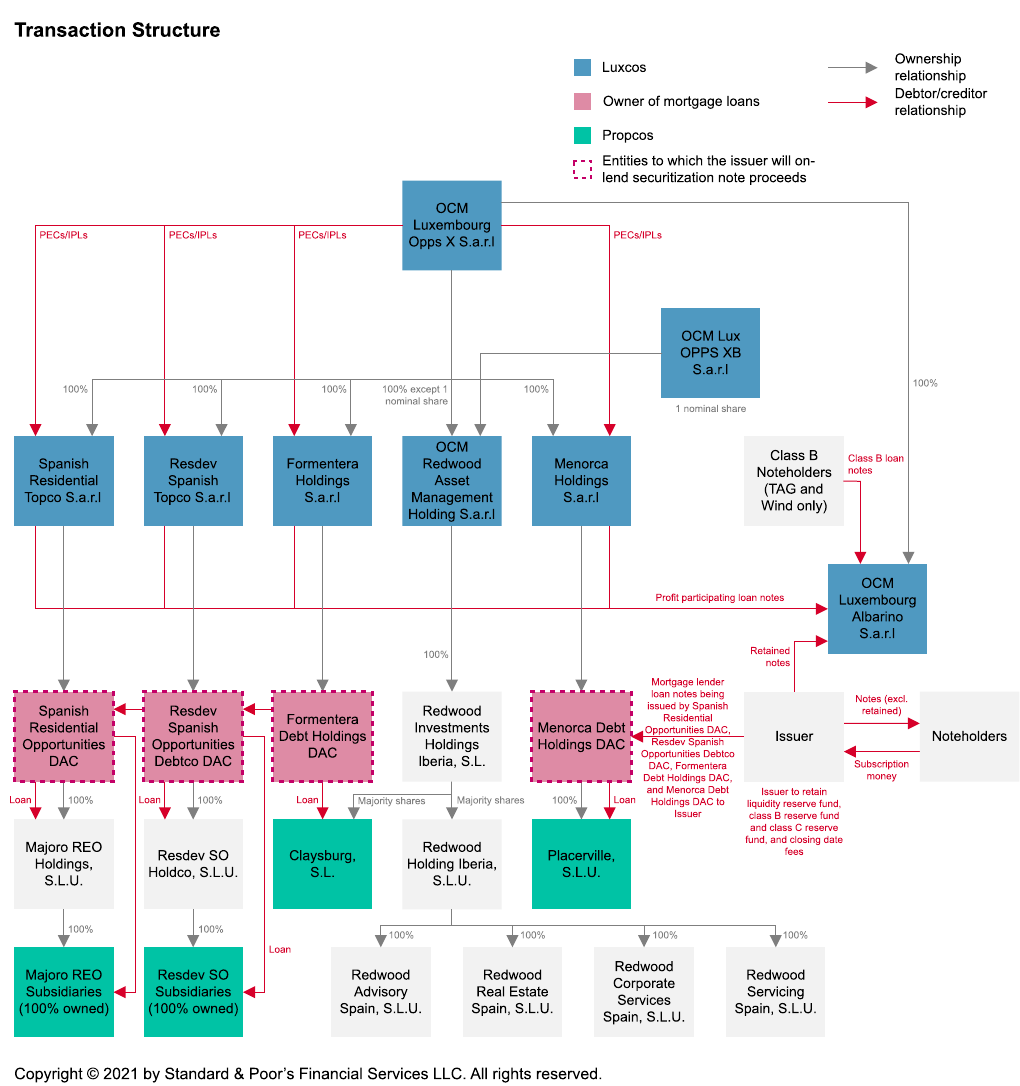

• Oaktree Capital Management, through this structure (see "Transaction Structure"), acquired the portfolio at various

stages from different Spanish originators between 2015 and 2017. As of this report's publication date, the loans are

owned by Irish entities called mortgage lenders, while the REO assets are owned by Spanish property companies

(propcos). The REOs are properties that the propcos have acquired through auctions after the foreclosure process

and will be sold or rented in the open market. We have analyzed both the loans and REO assets using our global

framework for assessing securitizations of nonperforming loans and our rating to principles criteria (see "Related

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 3

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

Criteria").

• The total portfolio is split in four subpools, called Wind, Tag, Normandia, and Tambo. The first three subpools' loans

and REO properties are serviced by RTA Management Gestion Integral de Activos, S.L. and Redwood Real Estate

Spain S.L.U., respectively. Tambo's loans and REO properties are serviced by Vicasset Holdings LLC. Vicasset

Holdings LLC also services a part of the small percentage of commercial assets in the Tag portfolio. Following the

review of the servicing process, we believe they can perform their functions in the transaction. There are also two

master servicers in the transaction, Redwood MS Ltd. and Vicasset Holdings LLC, both affiliates of the Oaktree

group.

• Our rating on the class A1 notes addresses the timely payment of interest and the ultimate payment of principal.

The timely payment of interest on these notes is supported by the liquidity reserve fund, which was fully funded at

closing to its required level of 5% of the class A1 and A2 notes' balance.

• At closing, the issuer used the issuance proceeds to advance the issuer-mortgage lender loan note advances to the

mortgage lenders, pay initial expense fees, and fund the liquidity reserves. We consider the issuer to be bankruptcy

remote under our legal criteria.

• The transaction's structure is complex. The issuer is an Irish entity and, among other types of security, has the

benefit of a pledge in all the bank accounts in the name of the mortgage lenders and the propcos, and it is entitled to

receive these collections. The issuer also has a pledge over the shares of each of the mortgage lenders and a pledge

over one of the propco's share (Claysburg S.L.U.). We have conducted our legal analysis on the whole structure

according to our legal criteria.

• Under our operational risk criteria, we have considered both the servicers and the master servicers as performance

key transaction parties. The transaction is capped at 'A' under this framework.

• According to the transaction documents, the issuer can invest in an instrument with a maturity not exceeding the

notes' immediate payment date that has a short-term rating of at least 'A-2' or a long-term rating of at least 'BBB'.

Under our global investment criteria, the transaction is therefore capped at 'A-'.

• There are no rating constraints in the transaction under our counterparty criteria and our structured finance

sovereign risk criteria.

The Credit Story

The Credit Story

Strengths Concerns and mitigating factors

We received two business plans from the master

servicers, one for the Wind and Tag subpools

and one for the Normandia and Tambo

subpools. The business plans are very detailed,

in terms of costs, workout strategies, and cash

flow, among other factors. We have taken them

into account in our analysis.

This is a nonperforming transaction, making the recoveries heavily dependent on the servicers'

business plans and execution. We have analyzed the business plans and applied adjustments

using our ratings to principles criteria. The pool is mainly residential; however, it has exposure

to nonresidential assets, such as commercial assets, including warehouses, shops, and land. We

associate these asset types with lower recoveries compared to residential assets, and we have

stressed them accordingly in our analysis.

The liquidity reserve fund was fully funded at

closing to meet revenue shortfalls for the class

A1 and A2 notes. The liquidity reserve fund can

also be used to pay senior fees.

The servicers became active in the Spanish servicing market between 2015 and 2018. They are

relatively small compared to the main players in this market, though the senior management

has many years of experience in the market. To mitigate this risk, our operational risk analysis

caps the ratings on the notes at 'A'. This is mainly driven by the high severity risk, given the

type of assets, and the high disruption risk, which is determined by the servicers' size and years

in operation.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 4

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

The Credit Story (cont.)

Strengths Concerns and mitigating factors

The interest rate cap minimizes the exposure to

liquidity risks in a rising interest rate

environment.

The servicers provided all historical property sales data on the four subpools, which, although

complete, we consider limited. We have taken this into account when calibrating our

market-value decline assumptions.

The capital structure is sequential for the

application of principal proceeds. Credit

enhancement can therefore build up over time

for the class A1 rated notes.

Claysburg S.L.U., one of the propcos, is part of a value-added tax (VAT) group, which Redwood

Real Estate Spain S.L.U., the servicer, is also part of. There is a risk that Claysburg could

become jointly and severally liable for other group companies' unpaid VAT obligations. We

have considered this risk in our cash flow analysis.

RTA and Redwood Real Estate Spain S.L.U. can terminate the servicer agreements before April

2024, with a 180 days' notice and without a new servicer being appointed. If a new servicer is

not found over this period, the master servicers will take up the servicing obligations.

Additionally, RTA and Redwood Real Estate Spain S.L.U. can terminate the servicing

agreement after April 2024 with a notice of 120 days without a new servicer being appointed.

These two situations increase the risk of disruption in the transaction. However, based on the

average time to transfer an NPL portfolio from one servicer to another in the Spanish market

(around two months), we consider the risk to be minimal. We will surveil the transaction and

monitor any changes to the servicing agreements.

While the mortgage lenders provide certain representations and warranties on the assets, we

consider the overall package of representations and warranties provided, along with the

mortgage lender's obligations in case of a breach, to be weaker than what we typically see in

transactions backed by performing collateral. Also, the indemnity that the retention holder

would need to pay if there is a breach is capped and can only be requested for a limited time

after closing. That said, the type of indemnity is overall similar to other NPL transactions.

Additionally, in our view, the level of stresses we have applied to the business plan mitigate a

weak representation and warranties package in the transaction.

Most of the audit report fields have been checked against the servicer's own system. However,

as material fields like the original valuation amount and the original valuation date have been

checked against external appraisal reports and showed a limited amount of errors, we have not

increased our stresses in our credit analysis.

RTA's fees are based on an hourly rate. We have compared the expected fee against the

previous year's actual fee and sized this risk in our cash flow analysis increasing the RTA fee.

Wind and Tag also have a cap in place.

COVID-19: Our credit and cash flow analysis and related assumptions consider the

transaction's ability to withstand the potential repercussions of the coronavirus outbreak,

namely, less recoveries, longer recovery timing, and additional liquidity stresses. Considering

these factors, we believe that the available credit enhancement is commensurate with the

ratings assigned. As the situation evolves, and as part of our surveillance activity, we will

consider whether our assumptions will still be relevant, and will update them as appropriate.

Collateral And Originator

The pool was originated by different Spanish banks, although Sabadell S.A. originated most of the loans (see chart 2).

Oaktree acquired the Wind, Tag, and Tambo portfolios in August 2015, October 2016, and December 2017,

respectively. Then it acquired Normandia in three tranches between June 2017 and December 2017, with the biggest

tranche in June 2017.

We received loan-level data as of Nov. 30, 2020. We also received two business plans, one for Wind and Tag, and one

for Normandia and Tambo.

Table 1

Collateral Key Features

Pool cut-off date Nov. 30, 2020

Jurisdiction Spain

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 5

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Table 1

Collateral Key Features (cont.)

Principal outstanding of the pool (€) 678,395,580 (including 47 million of performing loans)

Total underwritten valuation of the pool (€) 740,516,439 (including 396,186,250 of REOs)

Number of loans 3,634

Number of properties 9,480

Number of REOs 4,719

Percentage of each subpool based on the underwritten

valuation

Wind (32.26%); Tag (15.35%); Normandia (47.28%); Tambo (5.11%)

Borrower type Individual 33.1%; commercial 66.9% (commercial borrowers are concentrated in

Normandia and Tambo)

Property purpose Residential, including annexes (80.7%); commercial, including 0.8% "other" (10.6%);

land (8.7%);

Rented properties or on market for rent 4.9% of the underwritten valuation of the total portfolio

Top three regional concentration Comunidad Valenciana (27.1%); Cataluña (26.3%); Madrid (14.5%)

Asset description

The portfolio consists of nonperforming loans secured over residential properties, commercial properties, land, and

REO properties in Spain.

Chart 1 Chart 2

The loans defaulted mainly between 2011 and 2013 during the global financial crisis.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 6

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Chart 3

Although the pool is granular, there are concentrations in tourist areas that have high population density, like

Comunidad Valenciana and Cataluña. Demand in these regions dropped over the past few months during the

pandemic, particularly from foreign investors due to the limitations of the lockdowns. We have considered this when

calibrating our market-value decline assumptions.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 7

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Chart 4

Most of the loans are in the judicial phases, while approximately 31% of the REO properties are already in the market

to be sold.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 8

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Chart 5 Chart 6

We received historical sales information from the servicers as of the cut-off date of the pool. When looking at this

information, we noticed that the residential portion, which is the bigger part of the portfolio, has been sold with a

slightly discounted rate, in part driven by the pandemic. When looking at the total historical sales data, the gross sales

are about 94% of the gross indexed underwritten valuation. We have accounted for this in our credit analysis.

Table 2

Historical Sales Data Information

Properties type Number of properties sold Gross sale/gross indexed underwritten valuation (%)

Office, retail, commercial 51 109.52

Land 197 104.51

Residential, including garage 1,510 90.65

Industrial warehouse 36 91.84

Grand total 1,794 93.91

Servicing

Table 3

Servicers Of The Portfolio

Subpool Loan servicer REO servicer Master servicer

Wind RTA Management Gestion Integral de Activos S.L. Redwood Real Estate Spain S.L.U. Redwood MS Ltd.

Tag* RTA Management Gestion Integral de Activos S.L. Redwood Real Estate Spain S.L.U. Redwood MS Ltd.

Normandia RTA Management Gestion Integral de Activos S.L. Redwood Real Estate Spain S.L.U. Vicasset Holdings LLC

Tambo Vicasset Holdings LLC Vicasset Holdings LLC N/A

*Tag commercial real estate asset are serviced by Vicasset Holdings LLC. N/A--Not applicable.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 9

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Strategies and business plans

The servicer's effectiveness and liquidation strategies are more important for NPLs than for traditional transactions.

This is because most NPLs require more intensive efforts and specialized workout expertise, channels, and tools to

recover the economic value of the assets within the shortest practicable time frame.

The master servicers prepared the business plans. The servicers will conduct the day-to-day servicing of the portfolio

and implement the business plans. All the servicers have policies, mandates, and escalation processes in place for

day-to-day decision-making, depending on the size and the complexity of the asset. The primary objective of the

servicing plan is to maximize the recoveries using different strategies, like amicable solutions, foreclosure, or

bankruptcy process.

Amicable solutions may include deed in lieu, discounted payoff, or power of attorney. In Wind and Tag for discounted

payoffs, the servicer assumes a 90% recovery based on the lower of 125% of the loan's current balance and the

property's net value. However, the servicers always start foreclosure proceedings in parallel with amicable solutions in

case there are issues or delays with the amicable solutions. In Wind and Tag, about 50% of €77 million of the historical

underwritten valuations were achieved through an amicable solution, while in Normandia and Tambo, it was about

57% of €89 million. For the Normanida and Tambo loans, the servicers leverage their previous experience and decide

on a case-by-case basis how to proceed for a specific asset.

For the REO assets, which are owned by the propco, the servicers consider additional costs like capital expenditures

(capex) or operational expenditures (opex) to try to maximize the recovery once the assets are sold in the open

market.

Experience and performance data

We held meetings with the servicers before and during the COVID-19 pandemic.

In 2018, RTA Management Gestion Integral de Activos S.L. and Redwood Real Estate Spain S.L.U. created a new

platform and began managing the Wind and Tag assets. Therefore, the historical data provided to us refers only to

these portfolios. These two servicers started to service the Normandia subpool in January 2020. Vicasset, which was

established in Spain in April 2015, services the Tambo subpool. Similar to Wind and Tag, we have limited historical

performance data for the Normandia and Tambo subpool. That said, the servicers' senior management have many

years of experience in the Spanish servicing market. Before the dates above, the assets were serviced by other Spanish

servicers. We have received detailed valuation analyses carried out before Oaktree's acquisition of the portfolios,

which were done through drive-by, desktop, on site, or automated valuation model (AVM). We took this additional

information into account.

During the 2020 lockdown (between March and June), the servicers closed 222 amicable resolutions, closed the

repossession of 46 properties, advanced the payments for auctions, and started workouts on properties, where

possible. As a result, the effect of COVID-19 has been a short delay in recoveries and only a minimal discount on the

properties' value. We reviewed RTAManagement Gestion Integral de Activos S.L.'s, Redwood Real Estate Spain

S.L.U.'s, and Vicasset's servicing processes, and we believe they can perform their functions in the transaction.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 10

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Servicing agreement risk

RTA and Redwood Real Estate Spain S.L.U. can terminate the servicer agreements before April 2024, with 180 days'

notice and without a new servicer being appointed. If a new servicer is not found over this period, the master servicers

will take up the servicing obligations. Additionally, RTA and Redwood Real Estate Spain S.L.U. can terminate the

servicing agreement after April 2024 with a notice of 120 days and without a new servicer being appointed.

These two situations increase the risk of disruption in the transaction. However, based on the average time to transfer

an NPL portfolio from a one servicer to another in the Spanish market (around two months), we consider the risk to be

minimal. We will surveil the transaction and monitor any changes to the servicing agreements.

We have considered all the servicers and the master servicers as performance key transaction parties. Our operational

risk criteria cap our rating on the notes at 'A'. This is mainly driven by the high severity risk, given the type of assets,

and the high disruption risk, which is determined by the servicers' size and years in operation.

Credit Analysis And Assumptions

According to our NPL criteria, the key credit risks for these transactions is the higher sensitivity to uncertainty in the

amounts and timing of recoveries during the post-default workout process. We have therefore split our credit analysis

in two components: (i) an analysis of the market-value decline that the securitized pool can suffer in different rating

environments, and (ii) an analysis based on the time to recover the defaulted asset.

Given the various asset characteristics and complexity of the portfolio, directly applying our global RMBS criteria or

our European CMBS criteria in our analysis was not appropriate. We have instead followed our rating to principles

process, which considers the historical recovery rates, the servicers' strategy, and the recovery stage of the defaulted

assets.

Our starting point is the business plans provided by the master servicers. The stresses we have applied based on the

business plans are explained below.

Market-value decline analysis (residential assets)

We have applied our ratings to principles criteria and our global RMBS criteria to derive our market-value decline for

the residential portion of the pool (see "Related Criteria"). We received two business plans and historical sales for the

overall portfolio broken down by subpool.

The business plan for Wind and Tag uses a statistical approach with a force-sale discount that is constantly updated

based on recent information. The cost assumptions for Wind and Tag consider litigation cost, taxes, capital gains,

capex, and maintenance cost, among others.

The business plan for Normandia and Tambo, on the other hand, is borrower-based given that all the borrowers in

Normandia and Tambo are commercial, and some of the more complex and bigger assets, like multifamily properties

in the coastal area, are included in the Normandia subpool. The assumptions in the business plan are not standardized

as in Wind and Tag, because they are established property by property, and sizing costs and timing are both tailored to

the asset. The costs of consensual negotiations and insolvency proceedings are at the borrower level, too.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 11

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

The business plans also consider the house price index and consumer price index (CPI), although we have not given

credit to them in our analysis. Officially protected housing properties (Vivienda de Protección Oficial; VPO) and

vulnerable borrowers are limited in the portfolio (2.9% and 1.5%, respectively) and have been considered in the

business plans.

When calibrating our market-value declines, we based our analysis on the historical sales and recoveries provided by

the servicers. We have considered the limited historical information in our analysis and the fact that compared to the

business plan's indexed underwritten valuations, the gross sale proceeds of residential and some industrial and

warehouse properties are lower. However, we compared the original (indexed in our model) valuations provided to us

by the servicers against the business plan's underwritten indexed valuation, and the latter are more conservative. Our

analysis also considers any over- or undervaluation of the properties.

The starting point of our analysis of the market-value declines are those in our global RMBS criteria. To mitigate the

risk of limited historical information, and the fact that the portfolio comprises distressed properties with some of the

simple assets already solved, we have increased our fixed market-value declines from 'AAA' to 'BB' for all four

subpools. We have then applied our forced-sale discount (as opposed to the one used by the servicers) to the pool in

line with the global RMBS criteria. The results of this adjustment on the Retiro Mortgage Securities pool are shown in

the table below.

Table 3

Residential MVD Of The Retiro Mortgage Securities Pool

Rating level Fixed MVD (%) FSD (%) Final MVD (%)

AAA 46 10 51

AA 41 11 47

A 31 12 39

BBB 25 13 35

BB 20 14 31

B 15 15 28

MVD--Market-value decline. FSD--Forced-sale discount.

The pool includes about €47 million of performing residential loans. The servicer assumed that €7 million will default

in the business plans. Our analysis assumes that an additional €23 million will default given the performance

information, the low payment rates, and the current macroeconomic environment due to the pandemic. We have

applied our market-value declines as shown in the table above, assuming they will be recovered in 42 months

according to our global RMBS criteria. For the remaining loans, we have given credit in line with the business plan (this

accounts for about 2% of the current balance of the loans).

Market-value decline analysis (nonresidential assets)

We have applied our ratings to principles criteria and our European CMBS criteria to derive our market-value declines

for the nonresidential portion of the pool.

The pool has limited exposure to this asset type and limited historical information. To mitigate this exposure, we have

applied a 30% haircut to the underwritten valuations provided by the servicers in the business plan. In our view this

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 12

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

haircut is conservative enough because these assets are not the typical CMBS loans; rather, it is a diversified pool of

retail spaces, offices, and shops, among others. After applying this haircut, we derived the market-value declines for

the nonresidential properties. Finally, we compared these numbers against the additional 15% market-value decline

that we would have applied if using our global RMBS criteria, and we took the higher of the two.

The table below shows the market-value declines we apply to all the nonresidential assets, including commercial and

land, including the 30% haircut.

Table 4

Nonresidential MVD Of The Retiro Mortgage Securities Pool

Rating level Final MVD (%)

AAA 65

AA 58

A 50

BBB 43

BB 38

B 34

MVD--Market-value declines.

Liquidity analysis (residential and nonresidential assets)

The other aspect of our NPL criteria is the recovery timing, i.e. when the recoveries will enter in the transaction.

Therefore, our analysis captures liquidity risk if the assets are not sold when expected according to the business plan.

We received historical data on recovery timing for both amicable and nonamicable solutions, and we compared them

against our assumptions in our global RMBS criteria. On average, the data from the servicer are slightly more

conservative.

To capture the transaction's liquidity risk, we looked at the historical numbers of sales in the Spanish market over the

past 15 years. During the global financial crisis--equivalent to a 'A' recession--the number of residential properties sold

in the Spanish market dropped by almost 50% (see "S&P Global Ratings Definitions," published on Jan. 5, 2021).

Therefore, our assumptions assume a delay of 50% of the business plans' collections in a 'A' scenario, that is recovered

after three years, which is the span of a recession according to our methodology, for three years. We have tested this

stress at day one and after three years, with the first being more conservative. We have sized our delay expectations at

all other ratings levels for both the residential and nonresidential assets accordingly.

Table 5

Percentage Of Assets Delayed

Rating level Residential (%) Nonresidential (%)

AAA 70 90

AA 60 80

A 50 70

BBB 40 60

BB 30 50

B 20 40

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 13

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Wind and Tag portfolios' business plan projects recoveries to be spread out, accounting for seasonal variations,

including a drop in collections during the first and the third quarter of each year (i.e. the holiday periods). The business

plan also assumes a peak in 2050, assuming a sale of the remaining performing loans that will not have defaulted by

then.

The business plan for Normandia and Tambo expects recoveries to come in within the next three years. This is

partially because most of the REO properties of the entire portfolio are in the Normandia subpool, and for this reason,

we expect a shorter weighted-average life of the assets.

Chart 7

While the mortgage lenders provide certain representations and warranties on the assets, we consider the overall

package of the representations and warranties provided, along with the mortgage lender's obligations in case of a

breach, to be weaker than what we typically see in transactions backed by performing collateral. Also, the indemnity

that the retention holder would need to pay if there is a breach is capped and can only be requested for a limited time

after closing. That said, the type of indemnity is overall similar to other NPL transactions. Additionally, in our view, the

level of stresses we have applied to the business plan mitigate a weak representation and warranties package in the

transaction.

Most of the audit report fields have been checked against the servicer's own system. However, as material fields like

the original valuation amount and the original valuation date have been checked against external appraisal reports and

showed a limited amount of errors, we have not increased our stresses in our credit analysis.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 14

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Macroeconomic And Sector Outlook

S&P Global Ratings believes there remains high, albeit moderating, uncertainty about the evolution of the coronavirus

pandemic and its economic effects. Vaccine production is ramping up and rollouts are gathering pace around the

world. Widespread immunization, which will help pave the way for a return to more normal levels of social and

economic activity, looks to be achievable by most developed economies by the end of the third quarter. However,

some emerging markets may only be able to achieve widespread immunization by year-end or later. We use these

assumptions about vaccine timing in assessing the economic and credit implications associated with the pandemic (see

our research here: www.spglobal.com/ratings). As the situation evolves, we will update our assumptions and estimates

accordingly.

For Spain, our current expectations are described in the table below. We have considered these macroeconomic

forecasts when calibrating the credit risk in our analysis.

Table 6

Spanish Market Statistics

2019 2020E 2021F 2022F

Real GDP (% change) 2.0 (11.3) 6.5 6.4

Unemployment rate 14.1 15.9 17.6 16.4

Nominal house prices

2019 2020E 2021F 2022F

% change y/y 3.7 1.6 1.4 4.3

Sources: S&P Global Ratings, Oxford Economics Y/Y--Year on year. F--Forecast. E--Estimate.

Transaction Summary

The structure of Retiro Mortgage Securities is complex, as it involves Irish mortgage lenders, Spanish propcos, and

Luxemburg entities. The issuer is an Irish special-purpose entity (SPE), which we consider to be bankruptcy remote.

We analyzed its corporate structure in line with our legal criteria.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 15

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Chart 8

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 16

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

The mortgage lenders (Spanish Residential Opportunities DAC, Resdev Spanish Opportunities Debtco DAC,

Formentera Debt Holdings DAC, and Menorca Debt Holdings DAC, which own the NPL assets in Normandia, Tambo,

Wind, and Tag, respectively) are set up as a limited-purpose entities with restricted activities and are fully owned by

Luxemburg entities. However, to mitigate the risk of insolvency, all the mortgage lenders, at closing, had an

independent shareholders structure in place, with their shares pledged in favor of the issuer. We consider them to be

bankruptcy remote, and we analyzed their corporate structure in line with our legal criteria.

The propcos (Majoro REO subsidiaries, Resdev SO subsidiaries, Claysburg S.L.U., and Placerville S.L.U.) are also set

up as a limited-purpose entities with restricted activities and are fully owned directly or indirectly by the mortgage

lenders (except Claysburg S.L.U.; see "Claysburg S.L.U." section below). However, we did not consider them to be

bankruptcy remote in line with our legal criteria. In particular, the propcos did not create security over the properties

in favor of the issuer. Our analysis therefore considers the risk of insolvency of the propcos in the transaction. In our

view, this risk is mitigated in part by their restricted purpose covenants, the high percentage of residential properties,

and the insurance provided on all properties.

Transaction flow of funds

The notes' proceeds are used to grant four loans to each of the mortgage lenders, to top up the liquidity reserve funds,

and to pay initial expenses. The mortgage lenders repay this initial loan monthly through the mortgage lender priority

of payments, while the issuer priority of payments occurs quarterly.

The recoveries are collected in the mortgage lender collections accounts and the propco collections accounts. Two

business days before each mortgage lender payment date they are swept in the mortgage lender payment account. On

the 25th of each month, the mortgage lender payment date, the loan note is paid by the mortgage lenders, and the

collections move into the issuer account bank.

Loan agreement between the propco and the mortgage lender

During the life of the transaction, the propco will use the amounts of the propco working capital accounts to purchase

the properties and apply capex or opex to them where necessary. The propcos will have access to an uncommitted

facility from its related mortgage lender to top up the propco working capital account to its required level. This amount

will be drawn from the mortgage lender collections account, and if no funds are available, it can be funded through the

issuer available funds. Each of the mortgage lenders will also have access to the mortgage lenders working capital

accounts, which has similar utilization purpose and work with the same mechanism as described above.

The propco will repay this uncommitted facility in the following order:

• The payment of taxes and servicer expenses;

• Interest;

• Principal; and

• Excess amount.

The excess amount of collections will be transferred to the mortgage lender either through payment of dividends or a

loan from the propco to the mortgage lender. This loan can be granted only after the repayment of the loan from the

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 17

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

mortgage lender to the propco. Each propco will decide on a case-by-case basis if it's more efficient to repay this extra

amount through dividends or through a loan. If paid through a loan, the mortgage lender will repay this loan according

to the mortgage lender priority of payments, but only after the repayment of the rated notes.

This structure ensures that collections don't remain in the propco collections account but are constantly transferred to

the mortgage lenders and then, ultimately, to the issuer.

Profit participation loan

The propcos will also benefit from a profit participation loan agreement from the mortgage lender. It might be used if

the propco's net equity falls below 50% of the share capital (the propco's total equity falls below half of the amount of

its share capital). According to the Spanish law, if this happens and it's not remedied within six months, it will

automatically start a liquidation process of the propco. This profit participating loan structure automatically allows this

to be remedied via a profit participating loan injection, allowing the propco to avoid dissolution. This profit

participating loan will be repaid from the propco only at maturity, increasing the risk of delay of repayment to the

mortgage lenders. However, this risk is mitigated through the excess amount loan described in the paragraph above,

which allows the propco to send cash flow to the mortgage lenders.

Mortgage lender priority of payment

Table 7

Mortgage Lender Priority Payment

1 Senior fees including tax and retained profit.

2 Servicer and master servicers expenses.

3 Any guarantee or indemnity payments to the mortgage lender noteholder (issuer).

4 Following the repayment of the rated notes, to pay interest, unpaid interest, and principal loan to the propco or propco

guarantor for the repayment of the propco loan to the mortgage lender.

5 Interest amounts (5% on the outstanding amount of the loan).

6 Loan notes amount (the amount outstanding cannot fall below €1,000).

7 Variable amounts.

The costs, including taxes, to run this type of structure are included in the mortgage lender priority of payments. The

loan amount has a floor of €1,000; therefore, the loan note cannot amortize before the rated notes, mitigating the risk

of payment disruption in the transaction. The loan note will have a maturity date of two years before the legal maturity

of the rated notes.

In our model we only run one priority of payment (the issuer one), and all the senior costs and expenses have been

sized senior in the waterfall.

Claysburg S.L.U.

Claysburg is the propco for the Wind subpool. Unlike the other propcos, it has additional features that we have

considered in our analysis. First, it's not owned directly or indirectly by a bankruptcy remote mortgage lender but by

Redwood Investments Holdings Iberia, S.L. This increases the risk of Claysburg's insolvency. To mitigate this risk, an

independent shareholder structure, similar to that in place for the mortgage lender, has also been implemented for

Claysburg.

Second, Claysburg is part of a VAT group, which Redwood Real Estate Spain S.L.U., the servicer, is also part of. There

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 18

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

is a risk that Claysburg could become jointly and severally liable for other group companies' unpaid VAT obligations,

for example if one of the VAT group members became insolvent. We believe that this may increase Claysburg's risk of

insolvency by exposing it to potential claims from the Spanish tax authority unrelated to the securitized assets and

rated securities in this transaction. If Claysburg does not have the ability to pay these potential claims under the

transaction's structure, we believe this may increase the likelihood that it could be forced into insolvency proceedings.

Based on the historical exposure of Claysburg to the rest of the group's VAT, we believe the exposure is limited.

However, as the exposure can increase in the future, we have taken a conservative view, stressing five times the

current exposure as a loss in our cash flow analysis to mitigate this risk.

Ley de Cataluña

In our legal analysis, we have considered the potential effect of the Catalan Decree Law 17/2019, which is an

amendment of the existing law 24/2015. Under this law, large dwelling holders are obligated to offer social rent leases

for seven years prior to commencing foreclosure actions. We believe that this risk is partially mitigated based on the

lack of applications observed under both Law 24/2015 and 17/2019 on this portfolio and based on the conditions

which must be met. Additionally, in January 2021, the Spanish Constitutional Court declared unconstitutional some

provisions of the Decree-Law 17/2019, including some features of the expropriation scheme. Finally, the servicers

have experience in this kind of situation, which are also present in other Spanish regions, and have considered them in

the business plans. In our view, our current credit assumptions mitigate this type of risk and the exposure to this region

in this transaction.

Payment of interest

Our rating addresses the timely payment of interest and the ultimate payment of principal on the class A1 notes.

Additional note payment

After the additional note payment date in April 2024, the class A1 noteholders will be entitled to additional note

payments. However, our rating does not address the payment of class A1 additional note payment. In our view, the

initial coupons on the notes are not "de minimis," and nonpayment of the additional note payments are not considered

an event of default under the transaction documents.

Reserve fund

The liquidity reserve fund is available to cover senior fees and class A1 and A2 interest, and it has a required amount

of 5% of the class A balance. It can amortize in line with the class A outstanding balance, with no floor. This reserve

fund can be replenished from the issuer waterfall. Any excess amounts are released at the top of the combined

waterfall and can be used to pay down the notes.

Interest rate cap

The transaction benefits from an interest rate cap until the April 2026 note payment date, with a strike rate of 0.0% for

the first 36 months and 0.5% for the following 24 months. The interest cap provider should make payments to the

issuer to the extent that three-month EURIBOR will exceed the strike rate. The notional is a scheduled notional.

Coupon cap rate

Upon the interest rate cap's expiration, there will be a cap on the all-inclusive interest rate of the notes. As such, the

index will be capped at the coupon cap less margin less the additional note payment rate. We have accounted for it in

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 19

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

our cash flow analysis.

Table 8

Issuer Payment priority

1 Senior fees and expenses (including the working capital accounts to their required amounts).

2 Class A1 and A2 interest pro rata.

3 Liquidity reserve fund top-up.

4 Class A1 principal.

5 Class A2 principal.

6 Class A1 and A2 additional note payment pro rata.

7 Class B interest.

8 Class B principal.

9 Class B additional note payment.

10 Class C interest.

11 Class C principal.

12 Class C additional note payment.

13 Class D1 interest.

14 Class D1 principal.

15 Class D2 interest.

16 Class D2 principal.

17 Class D3 interest.

18 Class D3 principal.

19 Swap subordinated amounts

20 Principal and excess amounts on the class E notes.

Item 1 of the above priority of payments also captures payments from the issuer to a replacement interest rate cap

provider in case collateral amounts posted, or termination payments payable by the outgoing interest rate cap

provider, are insufficient to cover the costs of replacement. As this item is senior in the waterfall, it may diminish the

issuer's ability to make payments on the notes. We do not typically see such an item explicitly listed senior in the

waterfall. However, we consider the related risk to be remote because firstly, under the cap documents, the outgoing

cap provider is responsible for covering the cost of replacement or finding a guarantor, which is in line with interest

cap agreements that we typically see for other transactions. Secondly, as a first instance, if the costs are not covered

by the outgoing cap provider, amounts posted as collateral will be used. Only if the available amounts are insufficient

can the issuer's funds be used to cover these amounts. Finally, the documents do not require the issuer to enter a new

interest rate cap agreement.

Portfolio sale

The mortgage lenders or the propcos can sell all (or part) of the portfolio to a third party as long as the proceeds from

the sale maximize profit and are at least in line with the most recent business plan. We have not added additional

stress in our analysis.

Cash flow modeling and analysis

We stress the transaction's cash flows to test the credit and liquidity support that the assets, subordinated tranches,

and reserves provide.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 20

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

We apply these stresses to the cash flows at all relevant rating levels. In our stresses, the class A1 notes must pay

timely payment of interest and ultimate payment of principal. We have applied our credit assumptions above in our

cash flow model. The business plan provided by the servicer is our starting point in the analysis.

Fees

Contractually, the mortgage lenders and the propcos are obliged to pay periodic fees to various parties providing

services to the transaction, such as the servicers and the master servicers. The issuer is obliged to pay periodic fees to

various parties providing services to the transaction such as trustees and cash managers, among others. We accounted

for these in our analysis, including tax, where required.

We have stressed all the fees embedded in the business plans. We have increased the weighted-average servicing fee

of the portfolio by 0.8% as a cost of replacement in case new servicers are appointed. We think this additional cost is

adequate based on the servicing fees we have seen in the Spanish market. We have also accounted for additional costs

that might be required for capex or opex.

Finally, we reduced the servicing fees and the costs that are linked to the recovery amounts (like brokers) of the

properties by the same percentage of the market-value declines described in the credit analysis.

Of the servicing and master servicing fees (excluding RTA fees), 50% can be repaid after the payment of the rated

notes if on each interest payment date, the cumulative gross recoveries are below 80% of the business plan. Even if we

see this structure as an incentive for the servicers to respect the business plan, in our view, this 50% delay might not be

attractive if a new servicer is appointed. In other NPL transactions we have seen similar structures but typically with a

lower amount deferred. Therefore, in our analysis we partially gave credit to this structure, and we have assumed that

only 20% is deferred.

Most of RTA's fees are based on an hourly rate, and this could increase the total RTA fees during the life of the

transaction. We compared RTA's historical fees against the business plan. As of March 2021, RTA's actual fees have

been lower than the business plan. However, to mitigate the risk in the future, we increased the RTA fee by almost

10% in our analysis. RTA's fee for Wind and Tag is also linked to inflation. Based on our expectations for CPI and the

fact that according to the business plan, RTA's fees are expected to decrease during the life of the transaction, we have

sized an extra €10,000 yearly fixed fee to mitigate this risk.

If the master servicers, the mortgage lenders, or the propcos decide to unilaterally terminate the servicing agreements,

a break fee will be paid to the servicers. The REO break fee will be paid to the servicers after the repayment of the

rated notes, therefore we have not sized them in our cash flow analysis. However, the loans break fees will be paid

when the contract is terminated. To mitigate this risk, we have sized an additional €1.25 million in our cash flow

analysis.

The issuer will be also entitled to receive the recoveries of unsecured loans from the four subpools. The unsecured

loans are not part of the business plan, and accordingly, we have not given credit to those recoveries. However, related

servicing fees will be paid annually up to a maximum of €80,000. We have sized this amount in our cash flow analysis.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 21

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Interest rate scenarios

We have modeled three interest rate scenarios in our analysis: up, down, and forward curve.

Commingling risk

Recoveries are collected in the collection accounts held in the mortgage lenders' or propcos' name.

If the mortgage lenders or the propcos were to become insolvent, the collection amounts in the collection account

may become part of their bankruptcy estate. To mitigate this risk, collections are transferred monthly into the issuer's

bank account, and a pledge in favor of the issuer is in place over the collection account. The transaction documents

contain replacement language in line with our counterparty criteria.

Although we believe that the combination of downgrade language and the pledge mitigates against the loss of

collections if there is an insolvency, we have considered that collections could be delayed in an insolvency. We have

therefore applied a liquidity stress in which we delay one month of collections recovered after one year.

Scenario analysis

We analyzed the effect of a moderate stress on our market-value declines and liquidity assumptions and its ultimate

effect on our rating on the notes. We ran two stress scenarios adding 10% and 20% additional stresses to our market

value decline and liquidity assumptions to demonstrate the rating transition of a note, and the results are in line with

our credit stability criteria.

Counterparty Risk

The issuer is exposed to Citibank Europe PLC as the transaction accounts provider; Citibank Europe PLC as mortgage

lender payment account provider; BBVA S.A., Banco Santander S.A., and Caixa Bank S.A. as the mortgage lenders' and

propcos' collection account provider; and BNP Paribas S.A. as interest rate cap provider (see table below). The

documented replacement mechanisms mitigate the transaction's exposure to counterparty risk for the assigned rating

in line with our counterparty criteria.

Table 9

Supporting Ratings

Institution/role

Current counterparty

rating

Minimum eligible

counterparty rating

Remedy period

(calendar days)

Maximum

supported rating

Citibank Europe PLC, as mortgage

lender payment account

A+/Stable/A-1 BBB- 30 Max (A-; ICR (A+))

BBVA S.A. as collection account

provider

A-/Negative/A-2 BBB- 30 Max (A-; ICR (A-))

Banco Santander S.A. as collection

account provider

A/Negative/A-1 BBB- 30 Max (A-; ICR (A))

Caixa Bank S.A. as collection account

provider

BBB+/Stable/A-2 BBB- 30 Max (A-; ICR

(BBB+))

Citibank Europe PLC as transaction

accounts provider

A+/Stable/A-1 BBB- 30 Max (A-; ICR (A+))

BNP Paribas S.A. as interest rate cap

provider

AA-/--/A-1+ BBB- 90 Max (BBB-; RCR

(AA-))

ICR--Issuer credit rating. RCR--Resolution credit rating.

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 22

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

Sovereign Risk

Our unsolicited long-term credit rating on Spain is 'A', and we assess the underlying assets' sensitivity to sovereign risk

as moderate. This enables the notes to achieve a maximum potential rating of up to 'AA+' if they can pass our 'A' cash

flow run addressing a sovereign default scenario. The notes are rated below the sovereign rating. Therefore, our rating

in this transaction is not constrained by our structured finance sovereign risk criteria.

Surveillance

We will maintain surveillance on the transaction until the notes mature or are otherwise retired. To do this, we will

analyze regular servicer reports detailing the performance of the underlying collateral, monitor supporting ratings, and

make regular contact with the servicer to ensure that it maintains minimum servicing standards and that any material

changes in the servicer's operations are communicated and assessed.

Appendix

Transaction Participants

Role Participant

Issuer Retiro Mortgage Securities DAC

Mortgage lenders Formentera Debt Holdings DAC, Menorca Debt Holdings DAC, Spanish Residential

Opportunities DAC, and Resdev Spanish Opportunities DAC

Master servicers Redwood MS Ltd. and Vicasset Holdings LLC

Loan servicers RTA Management Gestion Integral de Activos S.L. and Vicasset Holdings LLC

REO servicers Redwood Real Estate Spain S.L.U. and Vicasset Holdings LLC

Legal advisers to mortgage lenders, propco,

and issuer

Dentons UK and Middle East LLP

Legal advisers to the arranger Linklaters LLP

Legal advisers to the trustee Linklaters LLP

Legal advisers to mortgage lenders, propco,

and issuer (Irish law)

Arthur Cox LLP

Legal advisers to the arranger (Irish law) A&L Goodbody International Financial Services Centre

Retention holder OCM Luxembourg OPPS X S.à r.l.

Trustee Citicorp Trustee Co. Ltd.

Arranger and lead manager Morgan Stanley & Co. International PLC

Principal paying agent and reference agent Citibank N.A., London Branch

Registrar Citigroup Global Markets Europe AG

Cash manager Citibank N.A. London Branch

Related Criteria

• Criteria | Structured Finance | General: Global Framework For Payment Structure And Cash Flow Analysis Of

Structured Finance Securities, Dec. 22, 2020

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 23

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

• Criteria | Structured Finance | General: Methodology To Derive Stressed Interest Rates In Structured Finance, Oct.

18, 2019

• Criteria | Structured Finance | General: Counterparty Risk Framework: Methodology And Assumptions, March 8,

2019

• Criteria | Structured Finance | General: Incorporating Sovereign Risk In Rating Structured Finance Securities:

Methodology And Assumptions, Jan. 30, 2019

• Criteria | Structured Finance | RMBS: Global Methodology And Assumptions: Assessing Pools Of Residential

Loans, Jan. 25, 2019

• Legal Criteria: Structured Finance: Asset Isolation And Special-Purpose Entity Methodology, March 29, 2017

• Criteria | Structured Finance | General: Global Framework For Assessing Securitizations Of Nonperforming Loans,

Sept. 7, 2016

• Criteria | Structured Finance | General: Global Framework For Assessing Operational Risk In Structured Finance

Transactions, Oct. 9, 2014

• Criteria | Structured Finance | General: Global Derivative Agreement Criteria, June 24, 2013

• Criteria | Structured Finance | CMBS: European CMBS Methodology And Assumptions, Nov. 7, 2012

• General Criteria: Global Investment Criteria For Temporary Investments In Transaction Accounts, May 31, 2012

• General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

Related Research

• Spain 'A/A-1' Ratings Affirmed; Outlook Remains Negative On Fiscal And Structural Challenges, March 19, 2021

• Europe's Housing Market Will Chill In 2021 As Pent-Up Pandemic Demand Eases, Feb. 22, 2021

• S&P Global Ratings Definitions, Jan. 5, 2021

• Economic Research: European Economic Snapshots: Policy Is Keeping The Impact Of The Second COVID Wave At

Bay, Dec. 16 2020

• Sovereign Risk Indicators, Dec. 14, 2020

• Reports Discuss How COVID-19 Could Affect European Structured Finance, March 30, 2020

• 2017 EMEA RMBS Scenario And Sensitivity Analysis, July 6, 2017

• Global Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

• European Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

WWW.STANDARDANDPOORS.COM MARCH 31, 2021 24

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2620283

New Issue: Retiro Mortgage Securities DAC

S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from

obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed

through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at

www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-

related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage

alleged to have been suffered on account thereof.

Copyright © 2021 Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Standard & Poor’s | Research | March 31, 2021 25

2620283