Page 1

TABLE OF CONTENTS

Message From Finance ................................................................................................................ 2

Board of Directors ....................................................................................................................... 3

Executive Staff ............................................................................................................................ 4

About the Reno-Sparks Convention and Visitors Authority ............................................................... 5

Board Adopted Financial Policies ................................................................................................... 5

Reno-Sparks Convention and Visitors Authority Facilities ................................................................. 5

National Bowling Stadium ......................................................................................................... 6

Reno Events Center .................................................................................................................. 6

Reno-Sparks Convention Center ................................................................................................ 7

Reno-Sparks Livestock Events Center ......................................................................................... 7

Room Tax ................................................................................................................................... 8

Occupied rooms .......................................................................................................................... 9

Average Cash Rate ...................................................................................................................... 9

Occupancy Rate .......................................................................................................................... 9

Taxable Room Revenue ............................................................................................................... 9

Financials ................................................................................................................................. 10

Governmental Funds - Revenues ............................................................................................. 10

Tourism Surcharge ................................................................................................................. 10

Statement of Revenues, Expenditures and Changes in Fund Balance .......................................... 11

General Fund Expenditures ..................................................................................................... 12

Capital Assets ........................................................................................................................ 12

Long Term Debt ..................................................................................................................... 13

Requests for Information ...............................................................Error! Bookmark not defined.

To view this report and other financial information, including the Comprehensive

Annual Financial Report, please visit the Financial Information link at

https://www.rscva.com/impact/finance/

Page 2

MESSAGE FROM FINANCE

I am pleased to present the Reno-Sparks Convention & Visitors Authority Popular Annual Financial Report for the

fiscal year ended June 30, 2019. This Popular Annual Financial Report (PAFR) is a summary of the financial

activities of the Reno-Sparks Convention & Visitors Authority (Authority) as reported in the 2019 Comprehensive

Annual Financial Report (CAFR). The CAFR, with accompanying auditor’s report for the fiscal year ended June 30,

2019, is an annual report that was prepared in conjunction with the outside auditing firm, Eide Bailly LLP.

Responsibility for the accuracy, completeness and fairness of the presentation, including all disclosures, rests with

the Authority.

Unlike the CAFR, the PAFR is not an audited document

and does not include details by fund or other disclosures

required by GAAP. Therefore, the PAFR is not intended to

present a complete financial picture of the Authority in

accordance with GAAP. This report is a simplified view of

our financials and is a reflection of our effort to keep you

informed about how tax dollars are being spent.

The Government Finance Officers Association of the

United States and Canada (GFOA) awarded a Certificate

of Achievement for Excellence in Financial Reporting to

the Authority for its Comprehensive Annual Financial

Report for the fiscal year ended June 30, 2018. This was

the thirty-second consecutive year the Authority has

received this prestigious award. In order to be awarded a

Certificate of Achievement, a government must publish an

easily readable and efficiently organized comprehensive

annual financial report. This report must satisfy both

accounting principles generally accepted in the United

States of America and applicable legal requirements.

A Certificate of Achievement is valid for a period of one

year only. We believe that the current comprehensive

annual financial report continues to meet the Certificate of Achievement Program’s requirements and are

submitting it to the GFOA to determine its eligibility for another certificate.

For more in-depth information, the CAFR is available online at www.rscva.com

, the PAFR is also available online

at the same location.

Sincerely,

Robert Chisel

Director of Finance

REQUESTS FOR INFORMATION

This financial report is designed to provide a general overview of the financial activity and condition of

the Reno-Sparks Convention & Visitors Authority to all having such an interest. Questions concerning

any of the information provided in this report or requests for additional financial information should be

addressed to the RSCVA Finance Department, PO Box 837, Reno, Nevada 89504.

Page 3

BOARD OF DIRECTORS

Page 4

EXECUTIVE STAFF

Page 5

ABOUT THE RENO-SPARKS CONVENTION AND VISITORS AUTHORITY

The Reno-Sparks Convention & Visitors Authority, an independent governmental entity, was established

in February 1959 as the Washoe County Fair and Recreation Board. The Authority is the operating

instrumentality in the Washoe County area for promoting conventions, tourism, and outdoor recreation.

To provide revenue for such purposes, pursuant to the Fair and Recreation Board statutes and related

provisions of the Nevada Revised Statutes, a tax on the income from room charges of transient rental

facilities is imposed by the state, county, and the incorporated cities of Reno and Sparks.

The Authority consists of a nine-member board comprised of (a) one member of the Board of County

Commissioners of Washoe County Nevada; (b) one member of the City Council of the City of Reno,

Nevada; (c) one member of the City Council of the City of Sparks, Nevada; and (d) six members

appointed by the aforementioned elected officials. The six members set forth are selected from

nominations made by gaming, industry associations, Incline Village/Crystal Bay Visitors Bureau, or the

Greater Reno-Sparks Chamber of Commerce. Furthermore, these members must be actively engaged

in the gaming industry (three members), airline industry (one member), the Incline Village/Crystal Bay

Visitors Bureau Board (one member), and general business or commerce (one member). Private sector

members serve two-year terms and are limited to a maximum of two consecutive terms.

Representatives of the various governmental entities serve until the expiration of their respective terms

of office.

BOARD ADOPTED FINANCIAL POLICIES

The Board Financial Policies that were adopted in 2016 in the Strategic Plan and to be funded in order

of priority order, are as follows:

• Capital Reserve Account: 0.5% of room tax revenues to capital reserve account up to $1

million.

• Debt Sinking Fund 15% of room tax revenues in excess of $22 million annually.

• Rainy Day Fund: 1% of room tax revenues, to build towards a goal of $1-2 million in General

Fund Balance.

• Annual Capital Funding: 10% of all room tax collections up to $2.5 million annually.

• Air Service Fund: Dedicate $.5 million annually to build up to $1.5 million revolving fund to

support new airlift.

• Discretionary Fund: When Policies above are fully funded, remaining funds will be brought to

the Board for allocation, based on the strategic opportunities articulated in the Strategic Plan.

RENO-SPARKS CONVENTION AND VISITORS AUTHORITY FACILITIES

The Authority owns and operates the Reno-Sparks Convention Center and the Reno-Sparks Livestock

Events Center. The Authority also manages the National Bowling Stadium and Reno Events Center

which are owned by the City of Reno. By Agreement, ASM Global (ASM) manages and operates the

National Bowling Stadium, Reno Events Center, Reno-Sparks Convention Center and Reno-Sparks

Livestock Events Center, commencing in June 2018. ASM is responsible for all day to day operations

of the Authority facilities.

Page 6

NATIONAL BOWLING STADIUM

Owned by City of Reno

Managed by ASM

Year Built – 1995

300 covered parking stalls

The National Bowling Stadium, the only facility

of its kind in the world, (referred to as the “Taj

Mahal of Tenpins” by The Los Angeles Times) is

dedicated to the classic sport of bowling.

The National Bowling Stadium is an 88-lane

tournament bowling facility situated within

downtown Reno. The stadium offers 78

championship lanes and the Stadium Club with

a full-service bar, large screen TV, pool table

and a spectacular view of the downtown

corridor beckon competitors.

Located on the first floor is the Satellite

International Bowling Hall of Fame/Museum

showcasing ABC, WIBC and PBA Hall of Fame

members and bowling memorabilia from all over

the world.

Also, on the first level is the newly constructed

Kingpin Club, a ten lane VIP bowling center that

can be used for tournaments and rented for

corporate/convention parties for up to 125

people.

RENO EVENTS CENTER

Owned by City of Reno

Managed by ASM

Year Built – 2005

The Reno Events Center is owned by the City

of Reno and operated by ASM through a

contract with the RSCVA. The 118,000 square

foot facility opened in January 2005. The

Center consists of 56,000 square feet of free

span exhibit space (which is utilized for both

convention and meeting space, as well as

concerts, boxing, indoor football and

basketball), 4,954 square feet of dedicated

meeting space with nine rooms varying in size

from 400 to 850 square feet, two loading

docks, six dressing rooms and two event and

promoter offices. When utilized for concerts,

the Facility can accommodate up to 7,500

patrons.

Page 7

RENO-SPARKS CONVENTION CENTER

Owned by RSCVA

Managed by ASM

Year Built – 1965

Total Acreage 47.798, Building Acreage 13.95

The Reno-Sparks Convention Center, located

south of the downtown area at over 600,000

square feet, offers 381,000 square feet of

contiguous exhibit space in five adjoining halls.

More than 105,000 square feet of meeting room

space in 53 meeting rooms with seating

capacities ranging from 125 to 3,000 persons is

available for breakout sessions. The facility is on

ground level with unlimited floor load capacity.

On-site parking capacity totals 1,800 (including

35 disabled) stalls.

The Convention Center also features a 30,000

square foot ballroom. A full range of food

service capabilities are available ranging from

concession stands, portable food stations and

cocktail lounges to catered banquet

arrangements for more formal dining. In

addition, the RSCC features 106,000 square feet

of public concourse/registration space and

improved show load-in/out capabilities,

enabling concurrent major events.

RENO-SPARKS LIVESTOCK EVENTS

CENTER

Owned by State of Nevada

Managed by ASM through 50-year agreement

between RSCVA and Washoe County

Year of Management Transfer – 1986

Total Acreage 43

The Reno-Sparks Livestock Events Center

(RSLEC) is a large multi-purpose public

assembly facility located on the northern edge

of downtown Reno. The RSLEC has 19 barns,

wash racks for horses, 216 multi-use stalls, 266

exhibitor truck and trailer spaces, 67 full hook-

up RV spaces and 22 partial hook-up RV spaces.

The indoor Main Arena has seating for 6,200

people, three show offices, VIP Lounge, and a

150’x300’ dirt floor arena. The enclosed

Livestock Pavilion, connected to the Main Arena

is comprised of a 1,000-seat arena or auction

area, a 90’x200’ dirt area; an outdoor 100’x200’

covered Cutting Arena. The fully-lighted

outdoor Rodeo Arena seats 9,500 and the arena

dirt floor is 325’x170’.

Page 8

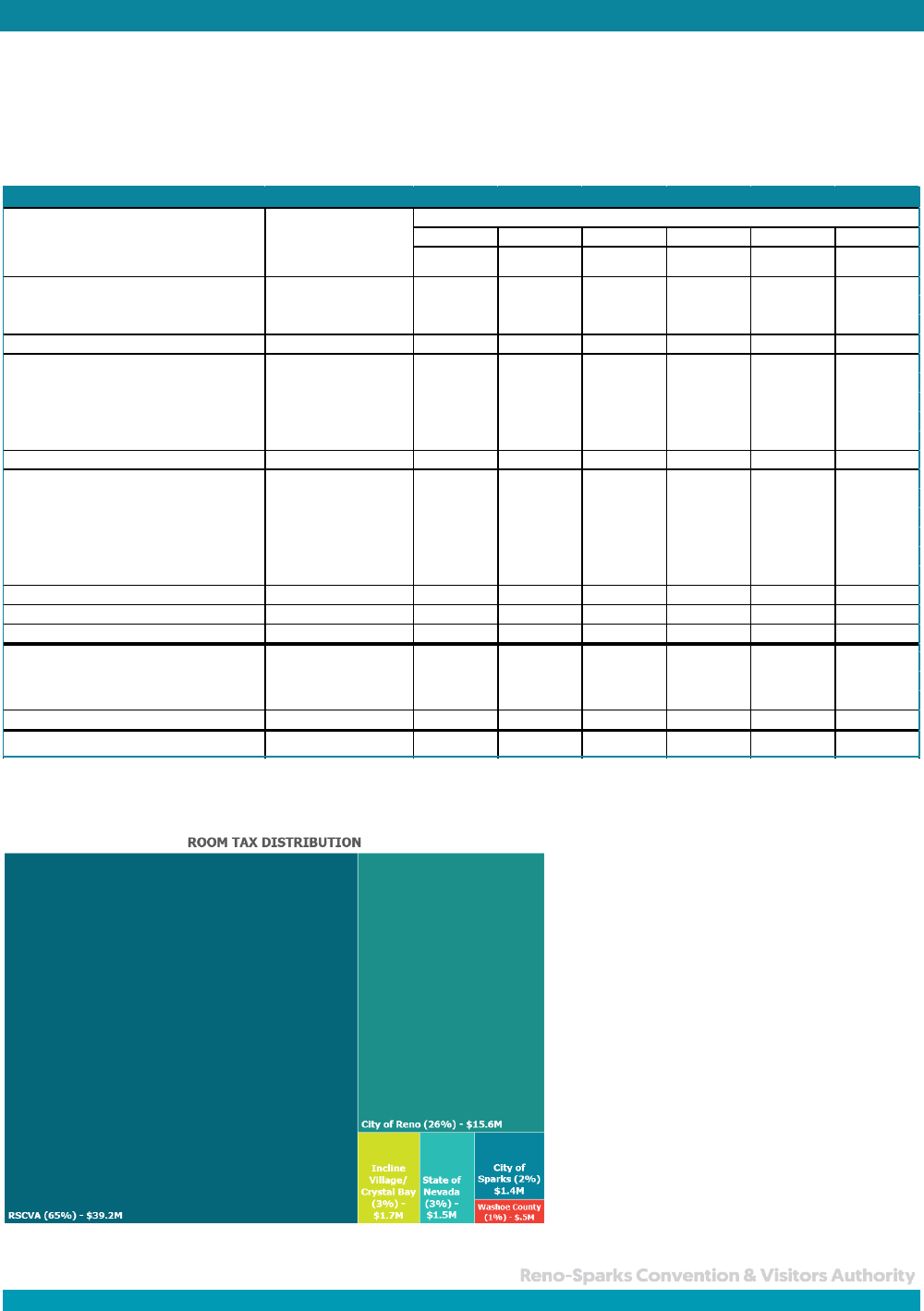

ROOM TAX

The tax rates were last changed as of July 1, 2009, and remain at 13% in non-downtown Reno and,

13.5% in downtown Reno, 13.5% in Sparks, and 13% in the unincorporated areas of Washoe County.

The Authority collects these taxes and retains a total of 8 5/8%, with the other taxes distributed to

state and local governments in accordance with Nevada Revised Statutes.

Nevada Revised Statutes 244A.645, 244.335 (7) and 268.095 (7) permit the county and cities to

delegate authority to collect, enforce and administer the Transient Lodging Tax and certain Surcharges

to the county fair and recreation board if

they so desire. Washoe County, City of

Reno, and City of Sparks delegated this

authority to the RSCVA to collect the

Transient Lodging Tax and certain

Surcharges on their behalf. The

Transient Lodging Tax, often referred to

as Room Tax, is collected by the RSCVA

and the rate varies throughout Washoe

County.

As the chart to the left shows, the

RSCVA keeps only 65% of the Room

Tax, the remainder goes to other

government entities for various

programs or debt as identified.

Reno B Reno D

Reno E Sparks

Washoe A Washoe B

Reno General

Reno

Downtwon

Reno Greater

Downtown

Sparks

Unincorporated

Washoe

Washoe - Lake

Tahoe

RSCVA

RSCVA General Fund

RSCVA 6.625% 6.625%

6.625% 6.625%

6.625%

6.625%

Convention Center-Debt RSCVA-Debt 2.000% 2.000% 2.000% 2.000% 2.000% 2.000%

Total to RSCVA

8.625% 8.625% 8.625% 8.625% 8.625% 8.625%

City of Reno

National Bowling Stadium-Debt City of Reno-Debt 1.000% 1.000% 1.000% 1.000% 1.000% 1.000%

City/Civic Center City of Reno-Debt - 1.500% 1.500% - - -

Reno Parks & Recreation City of Reno 1.000% 1.000% 1.000% - - -

Reno-Railroad District City of Reno-Debt - 1.000% - - - -

Total to City of Reno

2.000% 4.500% 3.500% 1.000% 1.000% 1.000%

Other

City/Civic Center Reno/Sparks/RSCVA 1.000% - 1.000% 1.000% 1.000% 1.000%

Sparks City of Sparks - - - 2.500% - -

Nevada Commission on Tourism State of Nevada 0.375% 0.375% 0.375% 0.375% 0.375% 0.375%

State General Fund & School Support State of Nevada 1.000% - - - 1.000% 1.000%

Washoe County Washoe County - - - - 1.000% 1.000%

Total to Other

2.375% 0.375% 1.375% 3.875% 3.375% 3.375%

Total Rate 13.000% 13.500% 13.500% 13.500% 13.000% 13.000%

Room Surcharge-Hotels*

Capital Projects Surcharge City of Reno -$ 2.00$ -$ -$ -$ -$

Tourism Surcharge RSCVA 2.00$ 1.00$ 2.00$ 2.00$ 2.00$

Total Surcharge-Hotels 2.00$ 3.00$ 2.00$ 2.00$ 2.00$ -$

*Surcharge - See Toursim Surcharge

Washoe County Transient Lodging Tax Districts and Rates

Jurisdiction

Receiving Funds

Description

Room Tax Rates

Page 9

OCCUPIED ROOMS

Occupied rooms are defined as the number of rooms

occupied, through either cash, comp, or exempt. Cash

rooms are rooms paid for by the guest, or other. Comp

rooms are rooms given free by the property to the

guest, and exempt rooms are long term guests that

have met the requirement for exemption from transient

lodging tax.

AVERAGE CASH RATE

The Average Cash Rate is the total

taxable room revenue divided by the

number of taxable room nights as

reported in the Transient Lodging Tax

return.

The Average Cash Rate has seen an

increase of 11% to $115.53 from

$104.41 in Fiscal Year 2018-19. Since

Fiscal Year 2013-14 the rate has

increased by over 46%.

OCCUPANCY RATE

The Occupancy Rate is the overall number

of rooms occupied (cash, comped, and

exempt) divided by the available rooms.

The occupancy rate for Washoe County had

a slight decline for the last fiscal year to

67.70% for Fiscal Year 2018-19.

TAXABLE ROOM REVENUE

The Taxable Room Revenue is the total taxable transient

lodging revenue reported.

For Fiscal Year 2018-19, the increase was 3.1% to

$401,157,233 from $389,144,926 in Fiscal Year 2017-18,

and has increased 47% since Fiscal Year 2014-15.

$78.88

$81.34

$89.84

$96.29

$104.41

$115.53

$50.00

$60.00

$70.00

$80.00

$90.00

$100.00

$110.00

$120.00

2014

2015 2016 2017 2018 2019

Fiscal Year

Average Cash Rate

62.40%

64.50%

66.80%

69.30%

71.50%

67.70%

0.00%

25.00%

50.00%

75.00%

100.00%

2014 2015 2016 2017 2018 2019

Fiscal Year

Occupancy Percent

Segment Amount Percent

Hotel 3,910,726 67%

Motels 300,685 5%

28 Day Motel 912,087 16%

RV Parks 462,103 8%

Vacation Rentals 179,589 3%

Timeshares 34,719 1%

Homeowner Rentals 14,191 0%

5,814,100

Fiscal Year

Total Taxable

Room Revenue

FY 2014-15 272,041,067$

FY 2015-16 317,014,070$

FY 2016-17 347,426,006$

FY 2017-18 389,144,926$

FY 2018-19 401,157,233$

Page 10

FINANCIALS

In order for the RSCVA to manage the finances smoothly, it divides the activities into several different

funds.

The General Fund accounts for revenues and expenditures that provide for the basic operations of

the RSCVA. The Debt Service Fund tracks revenues and expenditures related to repayment of long

term debt. The Capital Projects Fund allocates the expenditures toward construction or major capital

expenses. A Proprietary Fund is

used to account for and allocate internal costs to the various

departments of the RSCVA for workers compensation and insurance. Governmental funds focus on the

current inflows and outflows of resources. The three separate funds that make up the governmental

funds are the General Fund, Debt Service Fund, and Capital Projects Fund. The financial information

herein is for the RSCVA’s Governmental Funds.

GOVERNMENTAL FUNDS - REVENUES

The increase in revenues can

be attributed to an overall

improvement in the economic

conditions of the region,

resulting in the average cash

rate increase (Average Cash

Rate – page 9), and limited

occupancy rate decrease

(Occupancy Rate – page 9). In

addition, in Fiscal Year 2016

there was the implementation

of the Tourism Surcharge.

TOURISM SURCHARGE

Pursuant to legislative action, in 2015, a

new nightly surcharge (Tourism Surcharge)

was added to all hotels (gaming and non-

gaming) within a 20-mile radius of

downtown Reno at $2.00 per night and

$1.00 per night on the hotels in the existing

Downtown District holding non-restricted

gaming licenses.

This is in addition to a $2 Capital Projects

Surcharge in the Downtown District for

hotels with an unlimited gaming license that

is remitted to the City of Reno.

$32.1

$41.7

$44.1

$49.3

$50.4

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

2015 2016 2017 2018 2019

$ In Millions

Fiscal Year

Governmental Funds

Revenues

$30.6

$34.4

$35.7

$5.0

$5.4

$5.2

$-

$10.0

$20.0

$30.0

$40.0

$50.0

2017 2018

2019

$ In Millions

Fiscal Year

Room License Tax

Room Tax Tourism Surcharge

$39.8

$35.6

$40.9

Page 11

STATEMENT OF REVENUES, EXPENDITURES AND CHANGES IN FUND BALANCE

At the close of the current fiscal year, the Authority’s governmental funds reported combined ending

fund balances of $27,254,953, an increase of an increase of $47,283 compared to the prior year. The

unassigned fund balance for the General Fund was $3,992,778 or 11% of total General Fund

expenditures.

Debt

Capital

Total

General Service

Projects

Governmental

Fund

Fund

Fund

Funds

REVENUES

Taxes

Room license taxes

$

40,884,774

$

-

$

-

$

40,884,774

Miscellaneous

Facilities revenue

7,907,188 -

-

7,907,188

Convention and visitors service revenue

360,125 -

-

360,125

Golf course operations 1,340 -

-

1,340

Interest on investments 235,112 167,338 29,372 431,822

Other

859,007 -

-

859,007

TOTAL REVENUES

50,247,546

167,338

29,372

50,444,256

EXPENDITURES

Current

General government

3,648,825

-

-

3,648,825

Community support 32,275,168 - - 32,275,168

Debt Service

Principal - 5,435,000 - 5,435,000

Interest - 4,161,794 - 4,161,794

Other bond costs - 3,513,876 - 3,513,876

Capital outlay - - 2,480,818 2,480,818

TOTAL EXPENDITURES 35,923,993 13,110,670 2,480,818 51,515,481

EXCESS (DEFICIENCY) OF REVENUES

OVER EXPENDITURES 14,323,553 (12,943,332) (2,451,446) (1,071,225)

OTHER FINANCING SOURCES (USES)

Transfers from other funds - 11,240,002 3,877,000 15,117,002

Transfers to other funds (15,117,002) - - (15,117,002)

Sale of capital assets 984,673 - - 984,673

Issuance of refunding bonds - 68,897,000 - 68,897,000

Payment to refunded debt escrow agent - (68,763,165) - (68,763,165)

TOTAL OTHER FINANCING SOURCES (USES) (14,132,329) 11,373,837 3,877,000 1,118,508

NET CHANGE IN FUND BALANCES 191,224 (1,569,495) 1,425,554 47,283

FUND BALANCES, JULY 1 11,770,668 12,726,101 2,710,901 27,207,670

FUND BALANCES, JUNE 30

$

11,961,892

$

11,156,606

$

4,136,455

$

27,254,953

FOR THE YEAR ENDED JUNE 30, 2019

Page 12

GENERAL FUND EXPENDITURES

The Total Expenditures from the General Fund in Fiscal Year 2018-19 was $35,923,993, an increase

$1,508,550, primarily a result implementation of the Strategic Plan and changes in the Food and

Beverage contract.

CAPITAL ASSETS

The RSCVA’s capital assets for its governmental activities as of June 30, 2019, amount to $55,277,397

(net of accumulated depreciation). These capital assets include water rights, construction in progress,

buildings, improvements and furniture and equipment. Current year projects included restroom

remodels, LED lighting in the Halls, roof repairs, technology upgrades, painting and carpeting at the

Reno-Sparks Convention Center and roof repairs, lighting, and building repairs at the Reno-Sparks

Livestock Events Center. The Capital Projects Fund has an assigned fund balance of $4,136,455 at year

end. The ending fund balance is assigned to ongoing approved projects and fluctuates based upon

project status.

2019

EXPENDITURES

General government

Salaries and wages $ 1,426,972

Employee benefits 839,328

Services and supplies 1,271,193

Capital outlay 111,332

Total general government 3,648,825

Community support

Facility operation

Salaries and wages 6,250

Employee benefits 1,596

Services and supplies 12,383,771

12,391,617

Golf course operations

Employee benefits 2,104

Services and supplies 384,749

386,853

Convention and tourism promotion

Salaries and wages 3,070,252

Employee benefits 1,690,161

Services and supplies 13,049,507

17,809,920

Community grants and miscellaneous 1,686,778

Total community support 32,275,168

TOTAL EXPENDITURES $ 35,923,993

FOR THE YEAR ENDED JUNE 30, 2019

Page 13

Reno-Sparks Convention & Visitors Authority’s Capital Assets

Governmental

Activities

Water Rights

$ 3,445,200

Construction in Progress

515,798

Buildings and Improvements

45,442,306

Improvements

3,434,632

Furniture and Equipment

2,439,461

Total

$ 55,277,397

The Authority’s Capital Improvement Plan provides a comprehensive plan to design, construct,

maintain, and repair Authority assets and facilities. The size, age and diverse facilities of the Authority

require significant consideration to determine the best investments to make. The plan also serves as a

financial tool to set aside funds for the wide variety of capital projects as well as a planning tool to

ensure capital projects are consistent with the Authority’s Strategic Plan. The Plan identified changes

and additions, consulted with professionals in the various specialties, and developed a revised Capital

Project Plan. The needs of the projects were based on established criteria:

• The ability of the project to meet health, safety and legal concerns and mandates;

• The value of the project to prolong the life of the asset or avoid/minimize future repair costs;

• The benefit the project will provide the Authority in support of the goals articulated in the

Strategic Plan; and

• The potential for the project to generate revenue, savings or increase productivity.

LONG TERM DEBT

During Fiscal Year 2018-19, the Authority made payments of $5,435,000 in principal and

$4,161,794 in interest on its outstanding debt. The 2011 Refunding Bonds had a principal amount of

$1,665,000 defeased. In June 2019, bonds were issued in the amount of $68,897,000 (the 2019A Series

Refunding and 2019B Series Refunding). The bonds were issued for the purposes of refunding a portion

of the 2011 Series Refunding Bonds, with interest rates between 3.09% and 3.27%. The chart below

summarizes the Authority’s outstanding bonds. Additional information regarding the Authority’s debt

structure is presented in Note D in the Notes to Financial Statements.

The Authority’s total debt decreased by $4,373, 535 during the fiscal year, due to principal payments

on existing debt exceeding the accretion on capital appreciation bonds, defeasance of $1,665,000 of

principal and the refunding of bonds.

Reno-Sparks Convention & Visitors Authority’s Outstanding General Obligation Debt

Debt Series

Original Issue

Amount

Amount

Outstanding as of

June 30, 2019

RSCC Expansion Bonds (Capital Appreciation)

$ 19,384,075

$ 10,522,095

2011 Series Refunding

88,680,000

19,270,000

2019A Series Refunding

20,000,000

20,000,000

2019B Series Refunding

48,897,000

48,897,000

Total

$ 176,961,075

$ 98,689,095