Product switch rate guide

For existing The Mortgage Works customers switching products

Contents

• BTL 3 to 7

• HMO 8 to 9

• Large Portfolio (Over 10 properties at completion) 10 to 13

• BTL 10 to 11

• HMO 12 to 13

• Limited Company 14 to 18

• BTL 14 to 16

• HMO 17 to 18

• Residential & Legacy 19 to 25

• Residential 19 to 21

• Legacy 22 to 25

• Additional Information 26+

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2

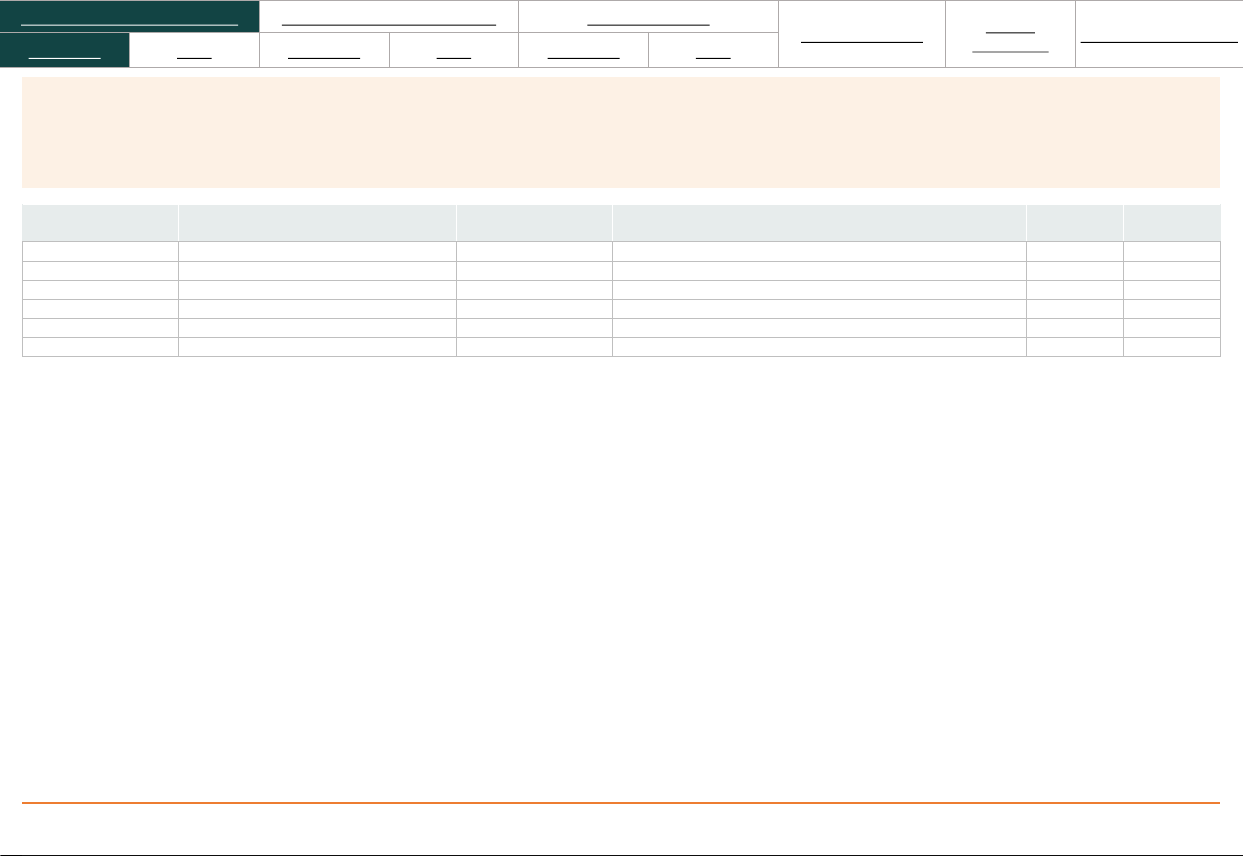

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

55% 3.59% 3% of Loan Amount MR6 currently 8.49% Variable 7.7% APRC B26612

55% 3.84% £3995 MR6 currently 8.49% Variable 7.9% APRC B26613

55% 4.39% £1495 MR6 currently 8.49% Variable 8.0% APRC B26614

55% 4.94% £0 MR6 currently 8.49% Variable 8.1% APRC B26615

65% 3.59% 3% of Loan Amount MR6 currently 8.49% Variable 7.7% APRC B26616

65% 3.84% £3995 MR6 currently 8.49% Variable 7.9% APRC B26617

65% 4.39% £1495 MR6 currently 8.49% Variable 8.0% APRC B26618

65% 4.94% £0 MR6 currently 8.49% Variable 8.1% APRC B26619

75% 3.74% 3% of Loan Amount MR7 currently 8.99% Variable 8.2% APRC B26620

75% 4.24% £3995 MR7 currently 8.99% Variable 8.5% APRC B26602

75% 4.59% £1495 MR7 currently 8.99% Variable 8.5% APRC B26621

75% 5.14% £0 MR7 currently 8.99% Variable 8.5% APRC B26604

80% 4.99% 2% of Loan Amount MR8 currently 8.99% Variable 8.5% APRC B26605

80% 5.99% £0 MR8 currently 8.99% Variable 8.7% APRC B26606

None 6.19% £0 MR8 currently 8.99% Variable 8.8% APRC B26607

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

3

3 Year Fixed

ERC: 3% until 31/12/2025*, then 2% until 31/12/2026*, then 1% until 31/12/2027*,

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

65% 3.74% 3% of Loan Amount MR6 currently 8.49% Variable 7.3% APRC B30390

65% 4.34% £1495 MR6 currently 8.49% Variable 7.6% APRC B30391

65% 4.84% £0 MR6 currently 8.49% Variable 7.7% APRC B30392

75% 3.79% 3% of Loan Amount MR7 currently 8.99% Variable 7.7% APRC B30393

75% 4.54% £1495 MR7 currently 8.99% Variable 8.0% APRC B30388

75% 4.99% £0 MR7 currently 8.99% Variable 8.1% APRC B30389

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

4

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

55% 3.74% 3% of Loan Amount MR6 currently 8.49% Variable 6.6% APRC B93843

55% 4.04% £3995 MR6 currently 8.49% Variable 7.0% APRC B93844

55% 4.19% £1495 MR6 currently 8.49% Variable 6.9% APRC B93845

55% 4.44% £0 MR6 currently 8.49% Variable 6.9% APRC B93846

65% 3.74% 3% of Loan Amount MR6 currently 8.49% Variable 6.6% APRC B93847

65% 4.04% £3995 MR6 currently 8.49% Variable 7.0% APRC B93848

65% 4.19% £1495 MR6 currently 8.49% Variable 6.9% APRC B93849

65% 4.44% £0 MR6 currently 8.49% Variable 6.9% APRC B93850

75% 3.79% 3% of Loan Amount MR7 currently 8.99% Variable 6.9% APRC B93862

75% 4.09% £3995 MR7 currently 8.99% Variable 7.3% APRC B93852

75% 4.19% £1495 MR7 currently 8.99% Variable 7.2% APRC B93863

75% 4.49% £0 MR7 currently 8.99% Variable 7.2% APRC B93854

80% 4.99% 2% of Loan Amount MR8 currently 8.99% Variable 7.5% APRC B93855

80% 5.39% £0 MR8 currently 8.99% Variable 7.7% APRC B93856

None 5.49% £0 MR8 currently 8.99% Variable 7.7% APRC B93857

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

5

2 Year Tracker | Benefit: ¹Switch to Fix

ERC: 0.75% until 31/12/2025, 0.5% until 31/12/2026

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

65% 5.04% (BBR 0.04% until 31/12/2026) 3% of Loan Amount MR6 currently 8.49% Variable 8.1% APRC B71043

65% 5.89% (BBR 0.89% until 31/12/2026) £1495 MR6 currently 8.49% Variable 8.3% APRC B71044

65% 6.29% (BBR 1.29% until 31/12/2026) £0 MR6 currently 8.49% Variable 8.4% APRC B71045

75% 5.14% (BBR 0.14% until 31/12/2026) 3% of Loan Amount MR7 currently 8.99% Variable 8.5% APRC B71046

75% 5.99% (BBR 0.99% until 31/12/2026) £1495 MR7 currently 8.99% Variable 8.8% APRC B71047

75% 6.39% (BBR 1.39% until 31/12/2026) £0 MR7 currently 8.99% Variable 8.8% APRC B71048

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

6

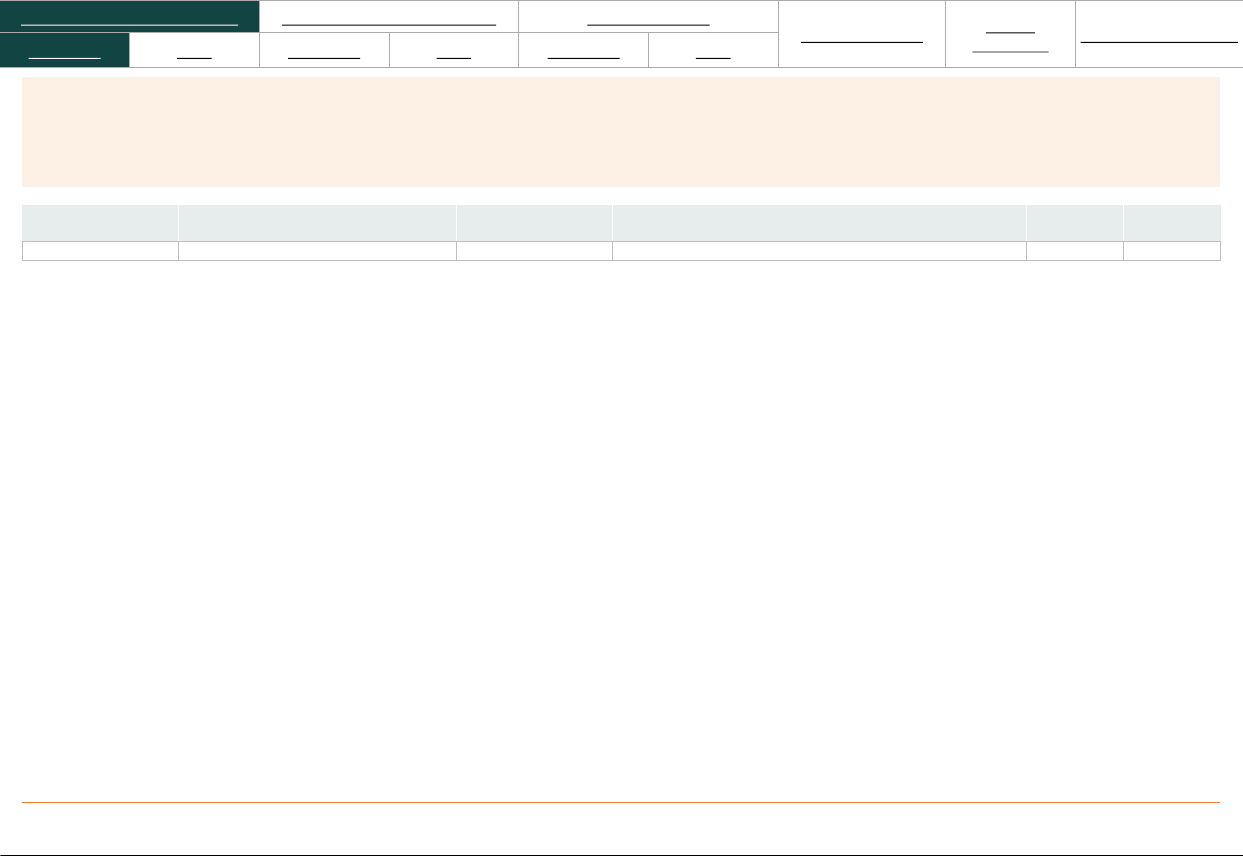

Lifetime Variable

ERC: 0.75% until 31/03/2024

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

65% 8.49% £0 MR6 currently 8.49% Variable 8.9% APRC B08232

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

7

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.79% 3% of Loan Amount MR7 currently 8.99% Variable 8.4% APRC T20401

75% 5.89% £1495 MR7 currently 8.99% Variable 8.8% APRC T20402

75% 6.79% £0 MR7 currently 8.99% Variable 8.9% APRC T20403

None 6.99% £0 MR8 currently 8.99% Variable 9.0% APRC T20400

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

8

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.99% 3% of Loan Amount MR7 currently 8.99% Variable 7.5% APRC T90530

75% 5.59% £1495 MR7 currently 8.99% Variable 7.8% APRC T90534

75% 5.89% £0 MR7 currently 8.99% Variable 7.9% APRC T90535

None 5.99% £0 MR8 currently 8.99% Variable 7.9% APRC T90533

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

9

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 3.99% 3% of Loan Amount MR7 currently 8.99% Variable 8.2% APRC Q20739

75% 4.79% £1495 MR7 currently 8.99% Variable 8.5% APRC Q20740

75% 5.29% £0 MR7 currently 8.99% Variable 8.5% APRC Q20741

80% 4.99% 2% of Loan Amount MR8 currently 8.99% Variable 8.5% APRC Q20731

80% 5.99% £0 MR8 currently 8.99% Variable 8.7% APRC Q20732

None 6.19% £0 MR8 currently 8.99% Variable 8.8% APRC Q20733

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Large Porfolio: Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

10

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 3.89% 3% of Loan Amount MR7 currently 8.99% Variable 7.0% APRC Q90757

75% 4.34% £1495 MR7 currently 8.99% Variable 7.2% APRC Q90758

75% 4.64% £0 MR7 currently 8.99% Variable 7.3% APRC Q90759

80% 4.99% 2% of Loan Amount MR8 currently 8.99% Variable 7.5% APRC Q90749

80% 5.39% £0 MR8 currently 8.99% Variable 7.7% APRC Q90750

None 5.49% £0 MR8 currently 8.99% Variable 7.7% APRC Q90751

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Large Porfolio: Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

11

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

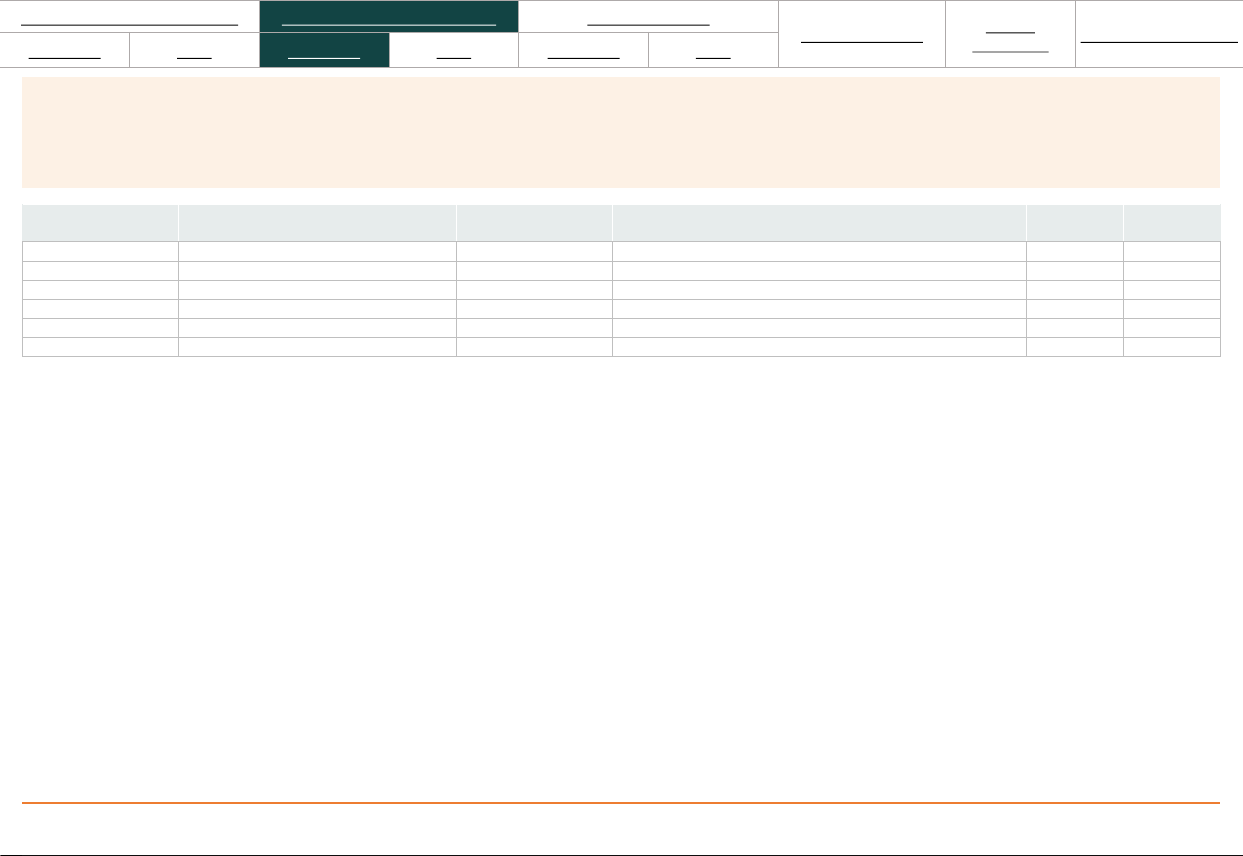

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.79% 3% of Loan Amount MR7 currently 8.99% Variable 8.4% APRC TQ2166

75% 5.89% £1495 MR7 currently 8.99% Variable 8.8% APRC TQ2167

75% 6.79% £0 MR7 currently 8.99% Variable 8.9% APRC TQ2168

None 6.99% £0 MR8 currently 8.99% Variable 9.0% APRC TQ2165

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Large Portfolio: Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

12

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.99% 3% of Loan Amount MR7 currently 8.99% Variable 7.5% APRC TQ9174

75% 5.59% £1495 MR7 currently 8.99% Variable 7.8% APRC TQ9178

75% 5.89% £0 MR7 currently 8.99% Variable 7.9% APRC TQ9179

None 5.99% £0 MR8 currently 8.99% Variable 7.9% APRC TQ9177

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Large Portfolio: Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

13

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.69% 3% of Loan Amount MR7 currently 8.99% Variable 8.4% APRC W20706

75% 5.19% £3995 MR7 currently 8.99% Variable 8.7% APRC W20707

75% 5.79% £1495 MR7 currently 8.99% Variable 8.8% APRC W20708

75% 6.39% £0 MR7 currently 8.99% Variable 8.8% APRC W20709

80% 5.99% 2% of Loan Amount MR8 currently 8.99% Variable 8.7% APRC W20710

80% 6.89% £0 MR8 currently 8.99% Variable 8.9% APRC W20711

None 6.99% £0 MR8 currently 8.99% Variable 9.0% APRC W20712

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Limited Company: Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

14

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

70% 4.59% 5% of Loan Amount MR7 currently 8.99% Variable 7.3% APRC W90858

70% 4.99% 3% of Loan Amount MR7 currently 8.99% Variable 7.5% APRC W90859

70% 5.19% £3995 MR7 currently 8.99% Variable 7.8% APRC W90860

70% 5.44% £1495 MR7 currently 8.99% Variable 7.8% APRC W90861

70% 5.59% £0 MR7 currently 8.99% Variable 7.7% APRC W90862

75% 4.99% 3% of Loan Amount MR7 currently 8.99% Variable 7.5% APRC W90863

75% 5.19% £3995 MR7 currently 8.99% Variable 7.8% APRC W90864

75% 5.44% £1495 MR7 currently 8.99% Variable 7.8% APRC W90865

75% 5.59% £0 MR7 currently 8.99% Variable 7.7% APRC W90866

80% 5.59% 2% of Loan Amount MR8 currently 8.99% Variable 7.7% APRC W90867

80% 5.99% £0 MR8 currently 8.99% Variable 7.9% APRC W90868

None 5.99% £0 MR8 currently 8.99% Variable 7.9% APRC W90869

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Limited Company: Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

15

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Tracker | Benefit: ¹Switch to Fix

ERC: 0.75% until 31/12/2025, 0.5% until 31/12/2026

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 5.99% (BBR 0.99% until 31/12/2026) 3% of Loan Amount MR7 currently 8.99% Variable 8.7% APRC W70048

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Limited Company: Buy to Let

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

16

Portfolio Size (0-10 properties)v Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Fixed

ERC: 2% until 31/12/2025*, then 1% until 31/12/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.79% 3% of Loan Amount MR7 currently 8.99% Variable 8.4% APRC WT2186

75% 5.89% £1495 MR7 currently 8.99% Variable 8.8% APRC WT2187

75% 6.79% £0 MR7 currently 8.99% Variable 8.9% APRC WT2188

None 6.99% £0 MR8 currently 8.99% Variable 9.0% APRC WT2185

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Limited Company: Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

17

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

5 Year Fixed

ERC: 5% until 31/12/2026*, then 4% until 31/12/2027*, then 3% until 31/12/2028*, then 1% until 31/12/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

75% 4.99% 3% of Loan Amount MR7 currently 8.99% Variable 7.5% APRC WT9196

75% 5.59% £1495 MR7 currently 8.99% Variable 7.8% APRC WT9200

75% 5.89% £0 MR7 currently 8.99% Variable 7.9% APRC WT9201

None 5.99% £0 MR8 currently 8.99% Variable 7.9% APRC WT9199

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 10% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Limited Company: Houses of Multiple Occupation

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

18

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

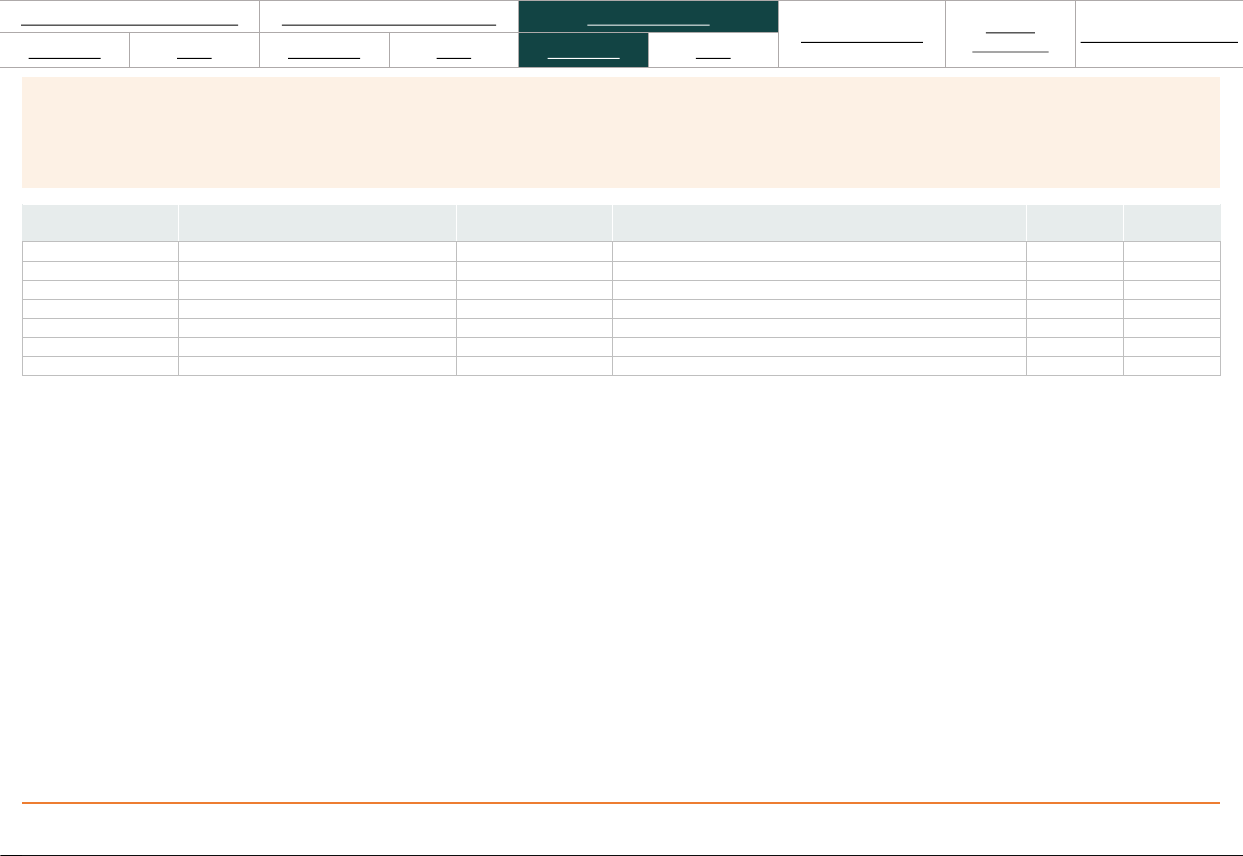

2 Year Fixed

ERC: 2% until 31/10/2025*, then 1% until 31/10/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 4.39% £0 MR5 currently 7.74% Variable 7.3% APRC A20463

75% 4.59% £0 MR5 currently 7.74% Variable 7.4% APRC A20464

90% 5.44% £0 MR5 currently 7.74% Variable 7.6% APRC A20465

None 5.69% £0 MR5 currently 7.74% Variable 7.6% APRC A20466

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Prime Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

19

5 Year Fixed

ERC: 5% until 31/10/2025*, then 4% until 31/10/2026*, then 3% until 31/10/2027*, then 2% until 31/10/2028*, then 1% until 31/10/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 4.04% £0 MR5 currently 7.74% Variable 6.3% APRC A99165

75% 4.14% £0 MR5 currently 7.74% Variable 6.4% APRC A99166

90% 4.79% £0 MR5 currently 7.74% Variable 6.7% APRC A99167

None 5.19% £0 MR5 currently 7.74% Variable 6.9% APRC A99168

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Prime Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

20

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Tracker | Benefit: ¹Switch to Fix

ERC: None

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 5.89% (BBR 0.89% until 31/12/2026) £0 MR5 currently 7.74% Variable 7.7% APRC A07315

75% 5.89% (BBR 0.89% until 31/12/2026) £0 MR5 currently 7.74% Variable 7.7% APRC A07316

90% 6.07% (BBR 1.07% until 31/12/2026) £0 MR5 currently 7.74% Variable 7.7% APRC A07317

None 6.34% (BBR 1.34% until 31/12/2026) £0 MR5 currently 7.74% Variable 7.8% APRC A07318

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Prime Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

21

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Fixed

ERC: 2% until 31/10/2025*, then 1% until 31/10/2026*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 4.39% £0 MR2 currently 7.74% Variable 7.3% APRC J02637

75% 4.59% £0 MR2 currently 7.74% Variable 7.4% APRC J02638

90% 5.44% £0 MR2 currently 7.74% Variable 7.6% APRC J02639

None 5.69% £0 MR2 currently 7.74% Variable 7.6% APRC J02640

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Legacy Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

22

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

5 Year Fixed

ERC: 5% until 31/10/2025*, then 4% until 31/10/2026*, then 3% until 31/10/2027*, then 2% until 31/10/2028*, then 1% until 31/10/2029*

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 4.04% £0 MR2 currently 7.74% Variable 6.3% APRC J19607

75% 4.14% £0 MR2 currently 7.74% Variable 6.4% APRC J19608

90% 4.79% £0 MR2 currently 7.74% Variable 6.7% APRC J19609

None 5.19% £0 MR2 currently 7.74% Variable 6.9% APRC J19610

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Legacy Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

23

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

2 Year Tracker | Benefit: ¹Switch to Fix

ERC: None

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

60% 5.89% (BBR 0.89% until 31/12/2026) £0 MR2 currently 7.74% Variable 7.7% APRC J07040

75% 5.89% (BBR 0.89% until 31/12/2026) £0 MR2 currently 7.74% Variable 7.7% APRC J07041

90% 6.07% (BBR 1.07% until 31/12/2026) £0 MR2 currently 7.74% Variable 7.7% APRC J07042

None 6.34% (BBR 1.34% until 31/12/2026) £0 MR2 currently 7.74% Variable 7.8% APRC J07043

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Legacy Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

24

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

Lifetime Variable

ERC: 0.75% until 31/03/2024

Maximum LTV Initial Rate Product Fee

Followed by TMW Managed Rate for the remainder of the

mortgage term, currently:

Total Cost for

Comparison

Product code

None 7.74% £0 MR2 currently 7.74% Variable 8.1% APRC J08015

₁Switch to Fix is available for Buy to Let Tracker products, which allows a customer to switch to an existing customer fixed rate, within the same product range, at any time without incurring

early repayment charge. Maximum loan amount (unless otherwise stated) is £1,500,000

Rates are only secured once a full application and any applicable fee(s) have been received. Mortgages are secured on your property.

You can make lump sum or regular overpayments of up to 20% of the initial mortgage balance in each 12 month period from the anniversary of completion, without having to pay any early

repayment charges. This isn’t available if the whole loan is being repaid or security released.

Legacy Residential

Product Switch Rate Guide 03/10/2024 | The Mortgage Works |

25

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

Additional information

The Mortgage Works (UK) plc. is a wholly owned subsidiary of Nationwide Building Society and is authorised and regulated by the Financial Conduct Authority (FCA) under registration number 189623.

Most buy to let mortgages are not regulated by the FCA. You can confirm our registration on the FCA’s website fca.org.uk. Registered Office: Nationwide House, Pipers Way, Swindon, SN38 1NW.

Registered in England. Company Registration Number 2222856.

This guide is to be read in conjunction with the Lending Criteria | Telephone: 0345 600 31 31

• If a mortgage product with TMW is either approaching maturity, has matured or has a Switch to Fix facility, it may be possible to switch to another mortgage product, subject to

eligibility criteria.

• Eligibility for this range of products is subject to no current mortgage arrears. Customers subject to a Bankruptcy Order or Individual Voluntary Arrangement (IVA) are not eligible to

complete a product switch until their bankruptcy or IVA is discharged and the trustee has confirmed they no longer hold an interest in the mortgage.

• Product switches are subject to an automated valuation. This will be used to determine the current loan to value for the purposes of product selection. Results are based on the

valuation of other properties in the same area and of a similar description and size.

• Please note, if switching Legacy Residential products, we will offer a product on the same basis as the original application.

Buy to let, Legacy Residential & Residential

The Mortgage Works (UK) plc (Company No.2222856) is a wholly owned subsidiary of Nationwide Building Society and is authorised and regulated by the

Financial Conduct Authority (FCA) under registration number 189623. Most buy to let mortgages are not regulated by the Financial Conduct Authority. You can

confirm our registration on the FCA’s website (www.fca.org.uk).

The Mortgage Works (UK) plc also acts as agent and mortgage administrator for Derbyshire Home Loans Ltd (Company No. 2628265, FCA No. 302586) and for E-

Mex Home Funding Ltd (Company No. 02124900, FCA No. 305370). All three companies are wholly owned subsidiaries of Nationwide Building Society, are registered

in England and Wales with their registered office at Nationwide House, Pipers Way, Swindon, SN38 1NW and are authorised and regulated by the FCA.

All information correct at time of publication. The Company reserves the right to withdraw any of the products at any time or to change or vary the actual rate

quoted. The Mortgage Works reserves the right to change Bank of England Base Rate (BBR) tracked products within 60 days of a Bank of England rate change.

Please note that for our mutual protection and to improve service standards, we may monitor and/or record telephone calls.

Portfolio Size (0-10 properties) Portfolio Size (10+ properties) Limited Company

Prime Residential

Legacy

Residential

Additional Information

Buy to Let HMO Buy to Let HMO Buy to Let HMO

26

Need support?

Please don’t hesitate to contact our dedicated expert team.

Phone: 0345 605 40 60

Monday to Friday, 8am to 6pm

Saturday, 9am to 2pm

themortgageworks.co.uk