2023 State of the Industry Report

Plant-based meat,

seafood, eggs, and

dairy

Table of contents

Editor’s note............................................................................................................................................................................................................................................... 4

About the Good Food Institute...................................................................................................................................................................................................7

Executive summary..............................................................................................................................................................................................................................9

Commercial landscape........................................................................................................................................................................................................................................... 9

Sales........................................................................................................................................................................................................................................................................................10

Investments....................................................................................................................................................................................................................................................................10

Science and technology..................................................................................................................................................................................................................................... 10

Government and regulation........................................................................................................................................................................................................................... 10

Commercial landscape.................................................................................................................................................................................................................. 14

Facilities.............................................................................................................................................................................................................................................................................. 14

Company landscape...............................................................................................................................................................................................................................................16

Involvement by diversi

fied companies.............................................................................................................................................................................................. 18

Partnerships................................................................................................................................................................................................................................................................... 19

Product launches.......................................................................................................................................................................................................................................................21

Activity in blended meat.................................................................................................................................................................................................................................... 24

Consumer insights............................................................................................................................................................................................................................. 26

Conventional meat consumption, reduction, and substitution................................................................................................................................ 26

Consumer awareness and use.................................................................................................................................................................................................................... 29

Consumer motivations.........................................................................................................................................................................................................................................31

Sales.............................................................................................................................................................................................................................................................. 36

U.S. retail sales overview.................................................................................................................................................................................................................................. 36

Categories......................................................................................................................................................................................................................................................................... 38

U.S. consumer dynamics and research..............................................................................................................................................................................................40

Global retail sales overview........................................................................................................................................................................................................................... 41

U.S. foodservice sales overview................................................................................................................................................................................................................ 44

Investments............................................................................................................................................................................................................................................49

Liquidity events........................................................................................................................................................................................................................................................... 55

Other

financing............................................................................................................................................................................................................................................................ 55

Science and technology................................................................................................................................................................................................................ 58

Research across the technology value chain...............................................................................................................................................................................59

Environmental and social impact.............................................................................................................................................................................................................67

Health and nutrition............................................................................................................................................................................................................................................... 69

Scienti

fic ecosystem growth..........................................................................................................................................................................................................................70

Government and regulation.......................................................................................................................................................................................................74

Global public funding............................................................................................................................................................................................................................................ 74

Regulation by country/region.......................................................................................................................................................................................................................76

Global cooperation and coordination.................................................................................................................................................................................................. 80

Outlook........................................................................................................................................................................................................................................................ 83

2024 outlook................................................................................................................................................................................................................................................................. 83

Long-term outlook................................................................................................................................................................................................................................................... 84

External projections............................................................................................................................................................................................................................................... 85

Acknowledgements..........................................................................................................................................................................................................................92

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 2

Editor’s note

Over the past decade, the global plant-based food

market has grown substantially. This has been

largely driven by companies launching products that

appeal to mainstream consumers by mimicking the

taste, texture, and functionality of conventional

animal products. In 2023, new distribution around

the world led to pockets of regional sales growth,

particularly in markets where plant-based categories

are still emerging. Yet a number of challenges

persisted in more mature markets, including the

United States, where retail dollar and unit sales for

plant-based foods declined from 2022.

In the United States, plant-based price increases

coincided with elevated inflation and tightened

consumer budgets, and purchase dynamics

indicated weakening consumer engagement in many

plant-based categories. Plant-based meat sales

declined more sharply than plant-based food sales

overall, and surveys of lapsed consumers showed

that plant-based meat products are largely not

meeting consumer expectations, particularly in

regard to taste, texture, and price. Funding

constraints, scaling complexities, and a rise in

misinformation and disinformation all posed

additional obstacles to growth.

Yet U.S. consumers say they’d be more willing to eat

plant-based meat if it tasted better, became more

affordable, and overall provided a clear value. There

also remain strong consumer tailwinds supporting a

shift toward increasing consumption of plant-based

foods. None of the challenges facing plant-based

foods are insurmountable, but they do require

significant increases in government and private

sector support, with an eye toward meeting

consumer needs. Companies can innovate to

improve the eating experience of their products and

optimize production to deliver better affordability.

The industry can collaborate to better communicate

the benefits of plant-based meat and the unique

value of their products to consumers.

The past year saw progress made up and down the

supply chain. New products with improved health

propositions hit the shelves. Large companies

released plant-based alternatives to popular

branded products, leveraging those brands’ equities.

Research continued to optimize plant protein

cultivation, take advantage of agricultural

by-products, and create processes and ingredients

that more closely match the sensory attributes of

conventional meat, seafood, egg, and dairy products.

Despite tough market conditions, the stark realities of

our food system remain: Global meat consumption is

projected to rise significantly by 2050, and animal

agriculture alone accounts for between 11 and 20

percent of greenhouse gas emissions. Taken together,

these projections point to the urgent need for the

kinds of solutions provided by alternative proteins.

If the world is to achieve our climate, biodiversity,

public health, and food security goals, reimagining the

way meat is made will be as essential as the global

transition to renewable energy. When compared to

conventional meat, alternative proteins dramatically

reduce emissions, feed more people with fewer

resources, reduce pandemic and antibiotic-resistance

risks, and free up lands and waters around the world

for restoration and recovery.

GFI’s annual State of the Industry Reports equip

food system stakeholders with an in-depth

understanding of the alternative protein market and

its challenges and opportunities. These reports also

serve as a global call to action:

Alternative proteins are agricultural

innovations that, with proper levels

of government and private support,

will help ensure planetary and public

health, transforming our global food

system for the better.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 3

Plant-based meat is a powerful tool for tackling such

challenges. At scale, alternative proteins including

plant-based meat, seafood, eggs, and dairy could

enable a shift toward less resource-intensive ways of

producing protein. But first, the industry must

overcome challenges like distorted nutrition

narratives and premium pricing compared to

conventional meat, and must continue to improve

taste and sensory attributes so that plant-based

products more closely resemble meat. The next

generation of consumers is signaling enthusiasm for

plant-based meat as a solution to food made with

fewer resources and less harm to the environment.

With additional funding and support, the industry is

poised to satisfy that growing interest.

This report details the innovations and developments

that moved the field forward in 2023. But there is still

much to be done. As a nonprofit and international

network of organizations, GFI is accelerating

alternative protein innovation and bringing more

people into the field. Policymakers and governments,

scientists and students, industry leaders and global

citizens can all ensure that the sector of

nature-positive proteins continues to progress,

offering the world a far more sustainable food future.

With gratitude and deep respect to all those on this

journey, we invite you to dig deep into this 2023

State of the Industry Report.

Best,

Caroline Bushnell

SVP of Corporate Engagement

Liz Specht, PhD

SVP of Science and Technology

Jessica Almy

SVP of Policy and

Government Relations

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 4

About GFI’s State of the Industry Report series

GFI’s State of the Industry Report series serves as our annual alternative protein sector deep-dive. The

series compiles business developments, key technologies, policy updates, and scientific breakthroughs

from around the world that are advancing the entire field. This year’s reports include:

Cultivated meat and seafood

Plant-based meat, seafood, eggs, and dairy

Fermentation: Meat, seafood, eggs, and dairy

Global policy: Public support, regulation, and labeling

The Plant-based meat, seafood, eggs, and dairy report synthesizes 2023 updates across the global

industry focused on plant-based alternatives to conventional animal products. For a primer on the latest

science and technological developments of plant-based alternative proteins, please visit GFI’s science of

plant-based meat deep dive page.

Symbols to look for

Throughout the 2023 State of the Industry Report series, look for symbols highlighting how developments in the

past year advanced the alternative protein sector in the areas of health and nutrition, sustainability, and

path-to-market progress. Dig deeper and Opportunity icons are calls to action for researchers, investors, and

others seeking to learn more and advance the

field.

Health

Sustainability

Opportunity

Path-to-market

Dig deeper

Please note that The Good Food Institute is not a licensed investment or financial advisor, and nothing in this report

is intended or should be construed as investment advice.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 5

About the Good Food Institute

As a nonpro

fit think tank and international network of organizations powered by philanthropy, GFI works alongside

scientists, businesses, and policymakers to make alternative proteins as delicious, affordable, and accessible as

conventional meat. In Asia Paci

fic, Brazil, Europe, India, Israel, and the United States, our teams are mobilizing

the international community to use markets and technology to replace harmful practices with ones that are better

for the climate and biodiversity, food security, and global health.

We focus on three programmatic priorities:

1.

Cultivating a strong scientific ecosystem

GFI’s science and technology teams map out the most neglected areas that will allow alternative proteins t

compete on taste and price. We produce open-access analyses and resources, educate and connect the ne

generation of scientists and entrepreneurs, and fund research that benefits alternative protein developmen

across the sector.

2.

Influencing policy and securing government investment

GFI’s policy teams ensure that alternative proteins are a part of the policy discussion around climate chang

mitigation and global health. In every region where we have a presence, we advocate for government

investment in alternative proteins and educate regulators on novel proteins such as cultivated meat.

3.

Supporting industry to advance alternative proteins

GFI’s corporate teams are replicating past market transformations and partnering with companies and

investors across the globe to drive investment, accelerate innovation, and scale the supply chain—all faster

than market forces alone would allow.

Stay connected

Newsletters | GFI’s suite of expertly curated newsletters puts timely news, insights, and opportunities right

in your inbox. Check out gfi.org/newsletters to find the ones most suitable for your interests.

Monthly seminar series | Each month, we host online seminars with leading experts from around the world:

The Business of Alt Protein series is geared toward a commercially focused audience on topics related to

starting and scaling a good food business. The Science of Alt Protein series addresses a technical audience

and focuses on cutting-edge research developments that enable alternative protein innovation.

This State of the Industry Report series, as well as all of GFI’s open-access insights and data, are made possible by

gifts and grants from our global community of donors. If you are interested in learning more about giving to GFI,

please visit here or contact philanthropy@g

fi.org.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 6

Executive summary

Executive summary

The plant-based meat, seafood, egg, and dairy

sectors experienced both headwinds and tailwinds in

2023. While some regions, especially those with

emerging plant-based markets, saw growth in

product distribution, U.S. sales of plant-based foods

declined as inflation continued and many consumers

signaled that products weren’t yet meeting their

expectations on taste, texture, and affordability.

Governments such as Canada, Denmark, and Germany

increasingly committed significant public funding to

plant-based research, while private investment into the

sector fell—albeit at a slower rate than global venture

funding across all sectors. Plant-based meat products,

on average, continued to be sold at significant price

premiums compared to conventional meat, and

sensory gaps to conventional meat remained. All the

while, consumers—especially in the United States and

Europe—contended with high interest rates and

elevated inflation, limiting consumers’ willingness to

spend on higher-priced protein products.

Amid these conditions, the industry continued to

mature. New scientific and technical groundwork

was laid. Companies conducted analyses that proved

out sustainability benefits of plant-based products.

Governments and investors financed researchers

and companies. And manufacturers introduced new

products, developed strategic partnerships, and built

new production facilities. However, although pockets

of progress across categories and geographies are

clear, plant-based meat is facing significant

challenges. The sector needs more progress on price

parity, taste parity, manufacturing capacity, and

consumer understanding, especially in nutrition, if it

is to deliver on its promise of serving as a

commonplace center-of-plate protein for

mainstream consumers.

Plant-based meat, seafood, eggs, and dairy, part of

our 2023 State of the Industry Report series, takes a

field-wide, global view of the progress made over the

past year.

Commercial landscape

New products and categories

Hundreds of new plant-based meat, seafood, egg,

and dairy products hit retail shelves in the U.S.

market in 2023, including plant-based steak, sushi,

boiled eggs, Wagyu-style beef, ribs, and more.

Retail and foodservice trends

● Large companies continued to engage in the

sector, including the release of plant-based

versions of popular branded products like

Tyson plant-based nuggets, Nestlé

plant-based mince meat and plant-based

Häagen-Dazs products, and Kraft Heinz

plant-based cheese slices and a plant-based

version of Kraft Mac & Cheese product.

● Plant-based meat continued to launch on menus

at major chains globally including Burger King in

Scandinavia, Subway in Europe, Taco Bell in the

United Kingdom, and Starbucks in Malaysia.

● Impossible Foods launched a lower-fat version

of their signature plant-based beef, Impossible

Beef Lite, with 75 percent less saturated fat.

New partnerships

Companies continued to collaborate to develop new

products, scale production, and leverage

mainstream distribution channels. Notable strategic

partnerships in 2023 included Modern Plant-Based

Foods and Carbone Restaurant Group developing

plant-based pizzas; JUST Egg and Cheryl’s Cookies

developing plant-based cookies; and MorningStar

Farms and Pringles developing a new line of

plant-based chicken fingers.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 8

Manufacturing capacity

Continuing to expand manufacturing capacity and

further develop supply chain infrastructure will be

critical to the success of plant-based proteins. New

facilities opened in 2023, including SunOpta’s

285,000-square-foot facility in Texas, which will

manufacture plant-based milk and creamer. Many

more facilities broke ground, such as one for German

plant-based food company Planteneers in Illinois, or

were announced, such as agricultural company

Bunge committing $550 million to build a new

facility in Indiana.

Sales

Total U.S. retail plant-based food dollar sales were

$8.1 billion in 2023, a slight decline from $8.2 billion

in 2022. Plant-based meat and seafood sales

declined, which indicates that opportunities exist to

better meet consumer needs on key product

characteristics like taste and price.

● Eighty-one percent of households that

purchased plant-based foods in 2023 purchased

more than once throughout the year.

● Plant-based milk held nearly 15 percent market

share of total milk dollar sales in 2023.

● Across the majority of plant-based categories,

repeat purchase rates held relatively steady year

over year.

Investments

According to GFI’s analysis of data from the Net Zero

Insights platform, plant-based meat, seafood, egg,

and dairy companies raised $907.7 million in 2023

(representing 11 percent of all-time investment),

bringing total private investments in the sector to

$8.5 billion. The number of unique investors in

plant-based companies grew by 10 percent to more

than 1,293 unique investors.

Science and technology

New sources of plant-based ingredients, new ways

to cultivate these plants, and novel processes to

optimize taste, texture, and nutrition were key

technological themes driving research for

plant-based foods in 2023. Advances were made in

ingredient development, from new animal-free fats

and emulsifiers to novel aquatic, leguminous, and

upcycled protein sources. Improved scalability of

traditional texturization methods like extrusion was

achieved, and promising newer bottom-up methods

like fiber spinning and a patent-pending

“process-controlled microstructure design”

expanded available technologies for scalable

plant-protein texturization. In 2023, Beyond Meat

released their second ISO-reviewed Life Cycle

Assessment (LCA) which showed the Beyond Burger

3.0 patty generates 90 percent fewer greenhouse

gas emissions, uses 97 percent less water and land,

and requires 37 percent less non-renewable energy

than an average conventional beef patty.

Government and regulation

Milestones in 2023 government support of

plant-based alternative proteins spanned the globe.

In the Americas, Canada continued its investment

leadership with CAD 150 million ($110 million) in

public funding that will support plant-based protein

market growth, while in Europe, the United Kingdom

and Germany both announced large commitments to

alternative protein R&D and commercialization.

Government support of alternative protein startups

and product development was announced in Brazil,

Japan, Singapore, South Korea, and more.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 9

Table 1: Invested capital in plant-based meat, seafood, eggs, and dairy

Category

2023

2006–2023

Highlights

Total invested

capital

$908MM

$8.5B

2023 invested capital represented 11% of all-time

investment.

Invested capital

deal count

125

1,211

2023’s largest investment was the $300 million

convertible note raised by Oatly.

Unique

investors

187

1,293

The number of all-time unique investors grew by

10% in 2023.

Liquidity event

capital

$389MM

$25.7B

Above Food, a plant-based ingredient and end

products company, announced plans to merge with

Bite Acquisition Corp., a publicly traded special

purpose acquisition company (or SPAC). Above Food

was valued at $319 million in the announced deal.

Source: GFI analysis of data obtained from Net Zero Insights platform

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 10

Figure 1: Timeline of key plant-based updates in 2023

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 11

Commercial

landscape

Commercial landscape

Overview

The global plant-based meat, seafood, egg, and dairy

industry continued to grow and evolve in 2023.

Euromonitor’s estimate for the total global retail

sales of plant-based meat, seafood, milk, yogurt, ice

cream, and cheese was $29 billion in 2023

(Euromonitor does not report on plant-based eggs).

Despite a 34-percent increase over 2019 sales

($21.6 billion), the global market for alternative

proteins remains small compared to conventional

animal products. Advancements in product

innovation, affordability, accessibility, and more are

needed to grow this industry. New activity in 2023

included the announcement and/or completion of

new facilities, the launch of new products, and the

formation of strategic partnerships. Some key trends

that emerged include:

● Large food and meat companies continued to

engage in the sector including Tyson, Nestle,

and Kraft Heinz.

● Products continued to be added to menus at

major chains such as Burger King, Subway,

Taco Bell, and Starbucks.

● Companies expanded distribution into new

markets and new channels such as

noncommercial foodservice environments like

airlines, hospitals, and schools.

● New formats, product types, formulations,

and line extensions launched in the global

market including plant-based steak, sushi,

and boiled eggs.

● Companies and organizations formed new

partnerships to advance current and future

products and grow the sector as a whole.

These events from 2023 all contributed to an

ever-evolving global market for plant-based

alternatives. Continued activity such as the examples

described in this section will be key to delivering

products that meet consumer needs across regions

and allow these products to compete with

conventional foods.

Check out our monthly Alternative Protein

Opportunity newsletter for updates

Across the globe, plant-based products

launch or expand distribution every week.

GFI’s monthly Alternative Protein Opportunity

newsletter tags and categorizes notable

plant-based distribution updates, new

product launches, partnerships, facility

openings, and more, helping you keep up with

the fast-moving plant-based landscape.

Sign up here.

Facilities

Continuing to build manufacturing capacity and further

develop supply chain infrastructure for plant-based

proteins will be critical to the success of the industry in

the short and long term. GFI’s latest analysis

underscores the opportunities that exist to optimize

the manufacturing landscape for plant-based meat.

Retrofitting existing facilities, developing strategic

contract manufacturing partnerships, and building new

facilities will be important in the growth of the industry

across the globe.

In 2023, a variety of companies and organizations

announced, broke ground on, and opened facilities

throughout the world.

Opened in 2023

● Food and beverage producer SunOpta opened a

$125 million, 285,000 square-foot plant-based

beverage production facility in Texas, which

created 175 jobs and will allow the company to

double their plant-based beverage business by

2025 over 2020 levels.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 13

● Plant protein manufacturer Ojah, which

specializes in high-moisture extrusion

technology, expanded their Netherlands facility

from 6,500 square meters to 10,000 square

meters, more than doubling their current

production capacity.

● Plant-based baby formula brand Else Nutrition

added a second U.S. powder production facility

and began manufacturing at a new plant in

Europe as the company aims to triple their

production capacity.

● United Arab Emirates-based food producer The

IFFCO Group opened their first 100-percent

plant-based meat factory in the Middle East. The

Dubai facility is producing The IFFCO Group’s

THRYVE brand of products made from fava beans.

● Plant-based oils and food producer AAK

officially opened their Innovation Center of

Excellence in Zaandijk, the Netherlands, which

aims to improve the taste and functionality of

plant-based products.

● Sweden-based Lantmännen Biorefineries

opened a $77 million wheat protein extraction

facility in Norrköping, Sweden to broaden their

production capacity.

● Spain-based Mommus Foods opened a new

factory that has the capacity to produce 100,000

units per month of plant-based cheese.

● France-based ingredients company Roquette

opened a new €4.5-million innovation center

that provides technical and R&D support,

equipment, labs, and scale-up testing for the

plant-based ingredients market.

● Chicago-based food and commodities company

ADM opened an 800-square-meter plant-based

innovation center in the United Kingdom that

includes a kitchen, chef’s presentation theater,

and flavor development lab.

● ADM also purchased Canadian pulse processor

Prairie Pulse, adding another facility to their

plant protein operations.

Broke ground in 2023

● The University of British Columbia broke

ground on a 9,500-square-foot Food & Beverage

Innovation Centre intended for both teaching

and product development. The facility is

expected to be complete by 2024, and one of its

research projects will include the development

of a plant-based Wagyu-style beef product.

● German plant-based food company Planteneers

has started construction on a plant-based meat

production facility in Illinois that is expected to

open in summer 2024.

Announced in 2023

● French plant-based meat producer Umiami

announced their acquisition of a

14,000-square-meter Unilever factory in

Duppigheim.

● Large agricultural company Bunge committed to

invest around $550 million in a new Indiana

facility for soy protein concentrate for use in

plant-based foods and other products.

● Climax Foods, a Berkeley-based alternative

dairy company, announced the construction of

their first production facilities, timed with the

introduction of their first artisanal plant-based

cheeses in Los Angeles, New York, and San

Francisco.

● Danone North America announced a plan to

invest $65 million over the next two years to

build a new bottle production line in Florida that

will help expand production of key U.S. brands,

including Silk coffee creamers.

● ADM and Marel are partnering on an alternative

protein taste and texture innovation center in the

Netherlands, which is expected to open in the

second half of 2024.

● Plant-based food supplier Finnebrogue invested

£2.8 million to upgrade their plant-based meat

facility in Northern Ireland. The upgrade will

reduce carbon dioxide emissions and increase

capacity.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 14

● New Zealand beverage manufacturer Free Flow

Manufacturing announced plans to open the

country’s first dedicated plant-based milk facility

in 2023.

● Canadian plant-based company No Meat

Factory announced plans to open their first U.S.

facility in Stanwood, Washington, producing a

line of plant-based meat products.

A few trends emerge from the facility news above.

Many companies, including AAK, Roquette, and

ADM opened innovation-focused facilities. Other

companies expanded current facilities or entered

new markets for the first time. Continuing to

prioritize research and development to create tasty

and affordable products while growing production

to improve accessibility are crucial actions needed

to address industry barriers and challenges.

Company landscape

Tables 2 and 3 provide alphabetized lists of the top plant-based meat and milk brands by Euromonitor’s global

retail dollar sales estimates in 2023.

Table 2: Brands with the most total plant-based meat & seafood retail dollar sales globally (alphabetized)

Brand

Parent company

Headquarters

Year founded

Beyond Meat

Beyond Meat Inc.

United States

2009

Field Roast

Maple Leaf Foods

Canada

1991

Gardein

Conagra

United States

1919

Garden Gourmet/Hälsans Kök

Nestlé SA

Switzerland

1866

Impossible

Impossible Foods Inc.

United States

2011

Lightlife

Maple Leaf Foods

Canada

1991

Morningstar

Kellanova

United States

1906

Quorn

Monde Nissin Corp.

United Kingdom

1985

Rügenwalder Mühle

Rügenwalder Wurstfabrik Carl

Muller GmbH & Co KG

Germany

1834

Yves Veggie Cuisine

The Hain Celestial Group Inc.

United States

1993

Source: Euromonitor International Limited [2023] © All rights reserved. Data displayed is from Staple Foods 2023, retail value RSP, Meat &

Seafood substitutes top global brands, listed in alphabetical order.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 15

Table 3: Brands with the most total plant-based milk retail dollar sales globally (alphabetized)

Brand

Parent company

Headquarters

Year founded

Almond Breeze

Blue Diamond Growers

United States

1910

Alpro

Danone Group

France

1919

Coconut Palm

Coconut Palm Group Co Ltd.

China

1956

Dou Ben Dou

Fujian Dali Food Co Ltd.

China

1989

Kikkoman

Kikkoman Corp.

Japan

1917

Lolo

Wanxiang Sannong Co Ltd.

China

1969

Oatly

Oatly

Sweden

1994

Silk

Danone Group

France

1919

Vitasoy

Vitasoy International Holdings Ltd.

China

1940

Yangyuan

Hebei Yangyuan Zhihui Beverage Co Ltd.

China

1997

Source: Euromonitor International Limited [2023] © All rights reserved. Data displayed is from Dairy Products and Alternatives 2023, retail

value RSP, Plant-based milk, top global brands, listed in alphabetical order.

More information on these and other companies is available in GFI’s company database.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 16

Involvement by diversified companies

Many of the global leaders in consumer packaged goods (CPG) and meat production have some level of

involvement in the alternative protein industry. Whether through investment, acquisitions, partnerships, or

production, this engagement can and has played an impactful role in supporting the growth of the sector.

Table 4: Conventional companies with involvement in plant-based meat, seafood, eggs, and dairy

Source: GFI analysis of publicly reported industry news and events

Table 5: Conventional companies with involvement in alternative proteins

Source: GFI analysis of publicly reported industry news and events

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 17

Partnerships

Partnerships in the plant-based sector play a major role in the growth and success of the industry. Companies and

organizations can share knowledge and expertise to develop new products, optimize inputs, conduct research,

scale production, and share distribution channels to make these products more accessible across markets.

While not comprehensive, the list below highlights some notable partnerships from 2023.

Table 6: Partnerships table

Product development partnerships

Many of the partnerships happening in the plant-based industry are centered around product development as

companies collaborate to leverage each other’s product knowledge, infrastructure, and brand equity.

Companies/organizations

Details

Modern Plant-Based Foods & Carbone

Restaurant Group

Developing plant-based pizzas

CP Kelco & Chr. Hansen

Developing shelf-stable plant-based yogurt

SimpliiGood & Haifa Group

Developing spirulina products

Nepra Foods & a U.S. bread company

Developing gluten-free bread with plant-based eggs

Schouten Europe & Grassa

Developing alternative protein products from grass protein

More Foods & Tivol

Developing plant-based meat products from pumpkin seeds

Vly & KWS

Developing plant-based foods from pea protein

Plant Based Seafood Co. & ICL Group Ltd.

Developing technologies for plant-based seafood

JUST Egg & Cheryl’s Cookies

Developing plant-based cookies with plant-based eggs

MorningStar Farms & Pringles

Developing a new line of plant-based chicken fingers

Plant Based Foods & Violife

Developing plant-based ready-to-eat meals

Alpha Foods & The EVERY Company

Developing a range of plant-based foods

Foody’s & Cocuus

Developing 3D printed plant-based bacon

DayDayCook & Nestle

Developing a range of plant-based meal products

Hunger Brands, Heura Foods, & Väcka

Developing a plant-based meat brand

Alpha Foods & Eat JUST

Expanding Alpha Foods’ plant-based breakfast items

Green Rebel & AirAsia

Providing plant-based meat on inflight menus

Wunderkern & Bauer

Developing alternative dairy products

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 18

Ingredient-focused partnerships

One key to developing and improving products is optimizing ingredients. In 2023, a variety of partnerships

focused on plant-based ingredients.

Companies/organizations

Details

Ready Burger & Givaudan

Working to improve fat used in burgers

Nepra Foods & Scoular

Develop and market specialized plant-based ingredients

Megmilk Snow Brand Co. & Agrocorp

International

Making plant-based ingredients for alternative meat and dairy

products

Amfora & McClintock LLC

Improving protein content and yields of soy varieties

Roquette & Daiz

Producing texturized, pea-based protein ingredient

Cargill & Cubiq Foods

Incorporating plant-based fats into ingredient offerings

R&D partnerships

Organizations are coming together to tackle major research needs and uncover opportunities across the

plant-based sector.

Companies/organizations

Details

Hunch Ventures & Earth First Food Ventures

Build Net-Zero Food Innovation project

Group of public and private Netherlands entities

Identify food safety and quality risks in plant-based products

Protein Industries Canada & Wageningen

University

Support alternative protein research and development

Food Systems Innovations & Noa Weiss

Launching an AI tool to optimize plant-based proteins

Scaling and distribution partnerships

Growing scale and increasing the distribution of products is a signi

ficant barrier in alternative proteins. Partnerships

in this area can allow companies to access existing infrastructure to reach more markets and consumers.

Companies/organizations

Details

Fresh Del Monte & Vertage

Scale production of plant-based cheese products

DUG & Haofood

Expanding plant-based milk brand to China

Vgarden & MCT Dairies

Expanding plant-based products to the United States

PURIS & Palmer Holland

Expanding PURIS’ distribution of pea ingredients

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 19

Product launches

New plant-based products are hitting grocery

shelves every year, and distribution on current

products is expanding. While not a comprehensive

list of every launch in 2023, below are some notable

launches that demonstrate the ever-changing

plant-based landscape.

Retail

Large food and meat companies continue to get

involved in the plant-based sector. A variety of

companies announced plant-based product

launches in retail in 2023.

● Tyson Foods, a leading U.S. meat company,

introduced plant-based nuggets under their

flagship brand. The decision marked the first

time plant-based products are available under

the Tyson brand rather than the Tyson-owned

Raised and Rooted brand. The nuggets are

available in both retail and foodservice in the

United States.

● Nestlé, the world’s largest food and beverage

company, announced the launch of shelf-stable

plant-based meat brand Maggi Veg in Chile. The

Maggi Veg line includes plant-based minced

meat made from soy. The company also debuted

their first plant-based line of Häagen-Dazs

products set to appear first in Canada.

● Kraft Heinz launched Kraft Heinz Not Company

plant-based cheese slices in retail stores across

the United States and their NotMayo product in

U.S. Target locations. The partnership with NotCo

also produced a plant-based version of the

classic Kraft Mac & Cheese product. They also

debuted three new flavors of their plant-based

Philadelphia Cream Cheese line across the

United States after a successful trial.

Retailers are also getting involved. Whether it be

through developing their own private label line of

plant-based products or making commitments to

expand store sets, retailers are demonstrating their

commitment to plant-based foods.

● Albertsons, the U.S. grocery chain, is expanding

their private-label Open Nature brand with 12

new plant-based products, including shredded

cheese, yogurt, and ice cream.

● Spain-based supermarket chain Eroski revealed

a private-label range of plant-based products,

including milks, burgers, and chicken nuggets,

and more products were added in 2023.

● German budget retailer Aldi announced that

they will expand their plant-based offerings to

over 1,000 plant-based products by the end of

2024, including a variety of plant-based meat

and dairy products.

Plant-based categories, particularly plant-based

meat, continued to evolve in 2023 with innovation in

the form of new product types, formats, formulations,

and line extensions hitting retail shelves.

● Canadian plant-based seafood brand Konscious

Foods announced that their plant-based frozen

sushi range will now be available in Whole Foods

Market locations across North America.

● South Korea’s UNLIMEAT announced the launch

of plant-based tuna made from soy. UNLIMEAT’s

existing plant-based pulled pork product line is

distributed at Albertsons stores across the

United States.

● Plant-based brand Daring announced they are

releasing their first line of frozen entrees, which

will be available in several varieties and will

feature Daring’s signature plant-based chicken,

along with new teriyaki pieces and buffalo wings

products.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 20

● Impossible Foods launched a lower-fat version of

their signature plant-based beef. Impossible Beef

Lite has 75 percent less saturated fat and 45

percent less total fat than 90/10 conventional beef.

● Beyond Meat introduced Beyond Burger

Chicken-Style, Beyond Schnitzel, and Beyond

Tenders at supermarkets across the

Netherlands. The company also expanded

distribution on their Beyond Steak, the first

plant-based steak to be certified by the

American Heart Association, and Popcorn

Chicken products in the United States.

● Whole-cut plant-based meat producer Juicy

Marbles launched their plant-based filet steak at

the Austrian supermarkets BILLA PLUS and

BILLA PFLANZILLA. They also reached a

long-term distribution agreement with British

retailer Waitrose for Juicy Marbles’ plant-based

filet mignon and announced the development of

the first plant-based rib with edible bones.

● Plant-based company Crafty Counter is

launching their egg-free hard-boiled

WunderEggs made with cashews, almonds, and

coconuts into Whole Foods Market stores in the

United States.

● Israel-based Redefine Meat is now offering their

plant-based products at Shufersal, the largest

supermarket chain in Israel.

● Spanish food tech companies Foody’s and

Cocuus launched 3D-printed plant-based bacon

in Carrefour supermarkets across Spain.

Foodservice

In 2023, the foodservice sector rebounded from

historic traffic declines in 2020 due to the COVID-19

pandemic. People are returning to their favorite

restaurants and in turn, plant-based companies are

continuing to lean into this unique channel.

Foodservice environments can be pivotal in

delivering a unique, oftentimes first, experience

with plant-based alternative products, setting the

stage for future encounters.

Convenience plays a major factor in consumer

behavior, and no operators do it better than quick

service and fast-casual restaurants. Below are

examples of how chains are incorporating

plant-based alternatives into their menus.

● Starbucks Malaysia launched sandwiches

containing plant-based chicken and beef in

partnership with Green Rebel Foods.

● Jackfruit-based meat producer Jack & Annie’s is

partnering with fast-casual chain Smashburger to

offer a jackfruit burger at select Smashburger

locations in Colorado, New York, and New Jersey.

● Subway locations across Northern Europe will

now feature The Vegetarian Butcher’s

plant-based beef slices as part of the new

Plant-Based Steak Sub.

● Burger King restaurants in three Nordic

cities—Oslo, Stockholm, and Copenhagen—went

entirely plant-based for a month with burgers

made from The Vegetarian Butcher patties.

● Chile-based NotCo launched new NotCheese

products at JUMBO, one of the largest retailers

in Chile, and partnered with Burger King Peru to

provide plant-based cheese products for their

plant-based Whopper.

● Californian plant-based seafood company

Impact Food entered a strategic distribution

agreement with fast-casual chain Pokeworks.

● Fast-casual chain TGI Fridays UK announced

that Brazilian company Future Farm will supply

TGI Fridays plant-based burger patties for their

plant-based menu offerings.

● Taco Bell UK launched a plant-based seasoned

beef product at 132 locations.

● NotCo’s plant-based milk and cheese products

are now available at Starbucks locations across

Mexico and Argentina.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 21

● Fast food chain Shake Shack launched new

plant-based custard and shake products at all of

their 260+ locations across the United States.

The ice cream treats are made with the

plant-based company NotCo’s NotMilk product.

Shake Shack also introduced a plant-based

burger to their national menu.

● Caribou Coffee and Eat Just announced that

Caribou’s JUST Egg Roasted Tomato & Pesto

Flatbread is now a permanent menu option at

400 locations in the United States after

outperforming the chain’s existing vegetarian

breakfast option by 45 percent.

● Oatly partnered with Insomnia Cookies to make

available Oatly’s original and chocolate-flavored

oat milk at more than 250 Insomnia Cookies

locations in North America.

Full-service restaurants offer plant-based companies

the perfect place to deliver their product in an

elevated setting. In 2023, young brands debuted at a

variety of specialty restaurants.

● Redefine Meat, the Israel-based maker of

3D-printed plant-based meat products, said

their products are now on menus at nearly a

dozen restaurants across Italy.

● Israeli startup Chunk Foods launched their

whole cut plant-based steak at Talk of the Town

Restaurant Group’s Charley’s Steak House in

Orlando, Florida. This launch represents the first

time a steakhouse chain has featured a

plant-based steak option.

● Israel’s Yo Egg, which produces runny-yolk eggs

from chickpeas and soy, debuted at six Los

Angeles restaurants: Real Food Daily, Junkyard

Dog, Flore, Swingers Diner, Coyote Grill, and

Loma Linda’s Vegan District Asian Eatery.

● Plant-based egg company Zero Egg will launch

their Zero Egg Breakfast Sandwich at all The

Friendly Toast restaurant locations in the United

States.

Sometimes overlooked but ever-present are

noncommercial foodservice locations such as

schools, businesses, airports, hospitals,

entertainment, and more. Below are a few examples

of plant-based alternatives showing up in ubiquitous,

everyday locations that reach significant numbers of

consumers.

● After a successful pilot program, New York

City’s public hospitals began serving

plant-based meals as the primary dinner option

for inpatients at all of their 11 public hospitals.

● Movie theater chain AMC Theaters will now

feature a plant-based grilled chicken sandwich,

patty melt, and gourmet tenders made with Dr.

Praeger’s plant-based products.

● German airline Eurowings Discover is

integrating Beyond Meat’s meatballs into their

in-flight menu, becoming the first German airline

to incorporate plant-based meats on flights.

● Germany’s national train service, Deutsche

Bahn, continued their plant-forward approach

with a plant-based currywurst.

● Heura, a plant-based meat producer based in

Spain, has collaborated with over 450 schools in

the region to bring their plant-based meat to

school lunch menus.

● U.S. plant-based chicken company Rebellyous

Foods secured a distribution agreement with

Vizient, a purchasing organization for healthcare

and educational institutions in the United States.

E-commerce

E-commerce is another channel where products and

brands can get their foot in the door by selling

products directly to consumers. This platform is

important in a company’s distribution strategy,

allowing them to reach consumers quickly and

across regions while limiting upfront time and costs

needed to get products on shelves and menus.

E-commerce developments in 2023 include:

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 22

● Following a successful trial in the eastern and

midwestern United States, the Plant Based

Seafood Company’s Mind Blown Crab Cakes are

now available nationwide through online retailer

Hungryroot.

● Singaporean plant-based seafood company

Growthwell launched the HAPPIEE! brand in

the United Kingdom via Ocado’s and Tesco’s

e-commerce websites.

● Beyond Meat launched five new products in

China, including new varieties of burgers and

dumplings. The products are available at

METRO, Ole, and Sam’s Club in addition to

e-commerce platforms Tmall and Pinduoduo.

● South Korean plant-based cheese brand

Armored Fresh is launching a U.S.-wide

e-commerce platform for their plant-based

sliced, cubed, and spreadable cheeses.

● Oatly and Amazon announced a distribution

agreement that will make Oatly products

available on Amazon’s marketplaces in Germany,

France, Italy, Spain, the Netherlands, and

Belgium.

● Romil Ratra, a hotelier and restaurateur based

in India, partnered with Graviss Good Foods to

found Plantaway, a brand offering plant-based

meat, milk, cheese, dips, and dressings. The

brand will launch via its online store and other

e-commerce platforms such as Amazon, Vegan

Dukan, and Big Basket.

● India’s Wakao Foods launched a new

Continental Burger Patty made from jackfruit,

pea protein, and spices, which is now available

on Wakao’s website and select e-commerce

platforms.

Activity in blended meat

Blended meat is another area with involvement from

major conventional meat companies, recent product

launches, and new start-ups. Blended meat is

defined here as products that combine plant protein

or mycoprotein (and sometimes vegetables) with

conventional meat components to form an end

product. Hybrid meat refers to alternative protein

products made from multiple production platforms

such as cultivated fat and plant-based proteins.

More research and industry alignment are needed

around the nomenclature used to describe these

emerging product formulations.

Hormel produces their Applegate Well Carved line of

burgers and meatballs combining whole vegetables

with conventional meat. Perdue, in partnership with

the Better Meat Co., owns the brand Perdue’s

Chicken Plus, a line of kid-focused chicken products

mixing in a quarter cup of chickpeas and cauliflower

per serving. One recently announced start-up,

Momentum Foods, launched products under the

brand name Paul’s Table that feature 90 percent

plant-based ingredients and 10 percent

animal-based ingredients such as collagen and fat.

Other examples of blended meat companies include

Rebel Meat, Grateful Market, Phil’s Finest, Mush

Foods, and Nanka.

Despite recent activity in blended meat, this

category remains relatively small and discrete.

These companies and brands, as with any emerging

category, will not only have to create products that

successfully meet consumers’ needs but will also

have to craft and hone clear messaging that drives

home the benefits of these foods to consumers.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 23

Consumer insights

Consumer insights

This section focuses on U.S. consumer perceptions,

behaviors, and needs for plant-based meat

Comparisons to global consumers and specific

regions are noted, and additional consumer insights

for other regions can be found in reports by GFI’s

affiliates and partners in Brazil, Europe, Israel,

Asia-Pacific, and China.

Overview

In the United States, 36 percent of consumers

reported eating plant-based meat in 2023, with 25

percent eating it monthly or more frequently,

according to research conducted by Morning Consult

on behalf of GFI in December 2023. This research

also showed that 95 percent of plant-based meat

eaters also reported eating conventional meat, which

parallels panel data showing that 95 percent of

households that bought plant-based meat also

bought conventional meat (based on GFI and Plant

Based Foods Association (PBFA) analysis of data

commissioned from SPINS). This underscores that

omnivore shoppers are a significant market for

plant-based proteins, and suggests the food’s broad

appeal. While plant-based meat sales were down in

2023, 25 percent of Americans reported continuing

to eat plant-based meat products at least once per

month and former consumers who have not eaten

plant-based meat in the past year say they are likely

to repurchase products as taste and texture improve

and costs decline.

Research conducted by Morning

Consult on behalf of GFI

Polling firm Morning Consult conducted

multiple surveys of the U.S. population on

behalf of GFI throughout 2023 to understand

their evolving perceptions of and behaviors

toward alternative proteins. Results from our

December research are summarized

throughout this section.

Conventional meat

consumption, reduction, and

substitution

Meat consumption and the role of

protein:

Conventional meat sales in the United States have

risen every year for the past decade, according to

USDA estimates.

In recent years, protein has become an increasingly

important driver of food choice, likely contributing to

increases in meat consumption. In 2023, “high

protein” overtook “low-fat” and “low-carb” in

Google search trends for the first time (see figure 2).

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 25

Figure 2: Google searches for protein overtake other nutrition topics, 2019-2023

Source: Google Trends: Nutrition Topics in U.S., 2019-2023; numbers are indexed to maximum value of any included search during period

According to research conducted by Morning

Consult on behalf of GFI, 66 percent of U.S.

consumers claim it is important to them to eat a

high-protein diet. For most, this is due to the

association between protein and health: a 2022

Euromonitor poll of global consumers found that

more than 57 percent of consumers sought to

increase their protein intake because it is “better for

[them]” or “makes [them] feel healthier.”

Many plant-based meat brands communicate protein

content on the front and back of their packaging.

Including this metric connects with consumers who

are seeking to increase protein intake. Continuing to

develop products that contain protein content

similar to conventional meat, and communicating the

presence of that protein content on packaging, will

be important for plant-based meat companies as the

industry grows.

Meat reduction:

Despite Americans’ high meat consumption and

desire for protein, a significant number express

interest in reducing meat consumption, primarily due

to health concerns. A total of 59 percent of U.S.

adults claim to consider “negative health effects”

when choosing whether to consume conventional

meat.

But rates of vegetarianism and veganism in the

United States are low. Morning Consult’s polling on

behalf of GFI found three percent following

vegetarian and three percent following vegan diets; a

2023 Gallup poll and a 2022 McKinsey poll found

comparable rates.

While few Americans are eliminating meat entirely, a

significant minority report reducing meat

consumption.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 26

In a 2023 survey by AP-NORC, 43 percent of consumers

reported eating less meat than they used to. Morning

Consult’s polling on behalf of GFI found 11 percent of

consumers report reducing their consumption of all

major non-seafood meat types (beef, pork, and poultry)

in the past year, with 18 percent reporting eating less

beef and 18 percent less pork.

Health and social factors:

Consumers reducing meat consumption consistently

cite health as a reason, with 57 percent claiming this

contributes “a lot” or “some” to their meat reduction

(GFI/Morning Consult, Dec. 2023). An AP-NORC

survey similarly found that 50 percent of consumers

claim health as their top reason for reducing meat

consumption when asked to choose between health,

money, the environment, and taste.

The experience of the COVID-19 pandemic seemed

to influence much of consumers’ health concerns

about meat. A total of 55 percent of Americans say

they consider the use of antibiotics in meat when

choosing whether to eat meat, and 55 percent say

they consider the risk of foodborne illness

(GFI/Morning Consult, Dec. 2023). While these are

higher than the number of consumers who report

actually reducing their meat consumption, they point

to public health concerns as a tension many

consumers face. Many consumers also say they

worry about the individual health effects of meat

consumption. A 2021 study found eight to 28

percent of those surveyed were aware of increased

risks of various conditions including heart disease,

cancer, and diabetes from red meat consumption,

with heart disease awareness highest at 28 percent.

Plant-based meat is uniquely positioned as an

alternative to conventional meat that can offer

consumers the protein they want while allowing

them to reduce their meat consumption, which many

consumers say they aspire to do for a variety of

reasons: personal health benefits like lower

cholesterol and lower risk for heart disease; public

health benefits like not contributing to antibiotic

resistance: and environmental benefits like less

water and land use and fewer greenhouse gas

emissions. These aspirational benefits, if messaged

effectively and balanced with core consumer drivers

of taste, texture, and price parity with conventional

meat, are opportunities to tap into consumer drivers

that can grow the category.

Om Noms are plant-based protein strips

Photo credit: YUMASOY FOODS LTD.

Consumer awareness and use

While U.S. plant-based meat retail sales decreased

in 2023, usage patterns suggest that plant-based

meat enjoys a strong core of loyal consumers, has

room to grow with a large number of still-unaware

consumers, and that even lapsed and holdout

consumers remain open to plant-based meat if

companies continue to innovate and improve the

taste and price of their products (see figure 3).

Awareness, familiarity, and appeal:

A December 2023 poll conducted by Morning

Consult on behalf of GFI found that 58 percent of

U.S. adults claim awareness of plant-based meat and

47 percent say they are “very” or “somewhat”

familiar. While 41 percent claimed to have seen,

read, or heard “a lot” or “some” about plant-based

meat in the past year, only 10 percent claimed to

have heard “a lot,” suggesting many remain unaware

of recent coverage of the category, giving companies

room to shape perceptions (see figure 3). The more

consumers hear about plant-based meat, the more

likely they are to express an interest in purchasing it

(see figure 4).

Trial:

Only 43 percent of U.S. adults report having ever

tried a plant-based meat product (GFI/Morning

Consult, Dec. 2023). This leaves almost 6 in 10

Americans completely untapped for the plant-based

meat market. Ensuring these potential consumers

consider trying it, and that their taste, affordability,

and other product needs are met, will help set up the

category for deeper consumer engagement past an

initial trial.

Purchase and eating frequency:

While most Americans have not yet tried plant-based

meat, most who have continue to enjoy it regularly:

● 13 percent of Americans eat plant-based meat

once a week or more frequently.

● 12 percent eat it less than weekly but at least

once a month.

● 11 percent report eating it a few times or at least

once per year.

This points to a loyal core of consumers who are

likely to continue using the category in the future,

despite overall sales declines in 2023 (GFI/Morning

Consult, Dec. 2023).

Consumers’ increasing and

decreasing consumption of

plant-based meat:

A total of 51 percent of Americans have not yet tried

plant-based meat (GFI/Morning Consult, Dec. 2023).

Of those who haven’t tried it, about half don’t expect

to purchase plant-based meat in the future, while

the other half do. Meanwhile, lapsed users who

have not purchased it in the past year remain very

open to repurchasing if products more closely

match the taste and texture of meat.

Many consumers reported increasing their

consumption of plant-based meat in 2023. Morning

Consult found that 29 percent of consumers

reported eating “significantly” or “somewhat” more

plant-based meat, 42 percent ate a “comparable”

amount, and only 21 percent ate “somewhat” or

“much” less. Mintel saw even higher numbers of

consumers intending to purchase plant-based meat

products in the coming year, at 32 percent.

Overall, these usage rates align with household

penetration rates seen in retail data and suggest a

core of loyal users and further room for plant-based

meat to grow.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 28

Figure 3: Plant-based meat consumer metrics

Source: Poll by Morning Consult on behalf of GFI, n=2,228 US adults, December 2023

Figure 4: How likely are you, if at all, to purchase plant-based meat products?

Source: Poll by Morning Consult on behalf of GFI, n=2,228 US adults, December 2023

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 29

Consumer motivations

Lapsed consumers of plant-based meat tend to point

to taste and price as reasons they stopped

purchasing. Looking ahead, products more closely

mimicking the sensory experience of conventional

meat will be important to acquire new consumers

(see figure 5). Meanwhile, most consumers see

plant-based meat as healthy and believe it is as

healthy as or healthier than conventional meat.

Health as a reason to try

plant-based meat:

A 2021 survey by Consumer Reports found that 51

percent of consumers eating plant-based meat

claimed it was healthier than conventional animal

meat. And a 2023 survey by Mintel saw 55 percent

of consumers who reported increasing their

plant-based meat consumption cite health as their

top reason. Taste and environmental concerns

consistently rank as additional drivers of stated

purchase intent (see figure 6).

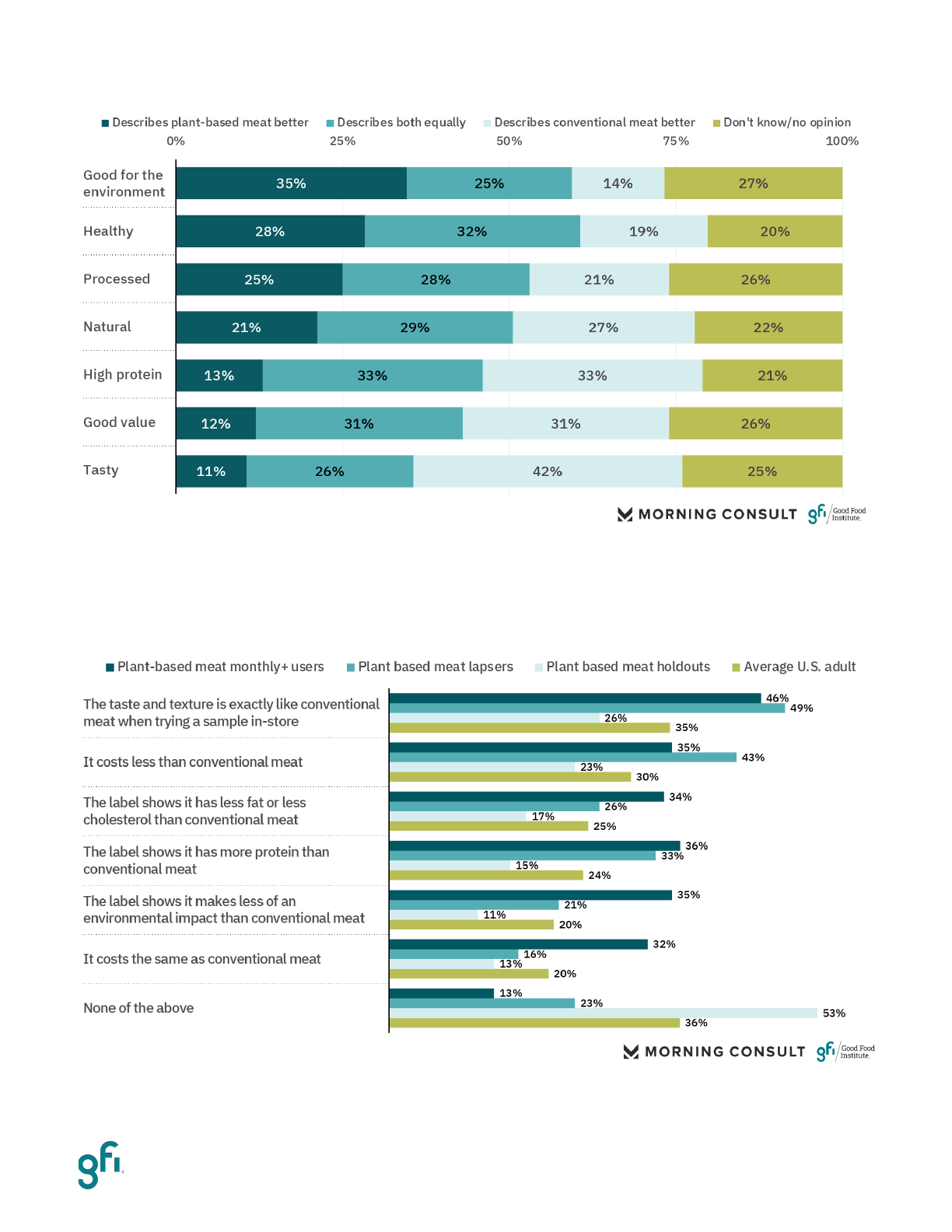

Perceptions and comparisons to

conventional meat:

U.S. adults rate plant-based meat positively on most

of the key factors driving their decision-making: safe,

healthy, good for the environment, and nutritious.

However, a slight minority of consumers describe the

products as tasty, affordable, and good value,

suggesting gaps remain around sensory quality and

price. A total of 45 percent of U.S. adults also

describe the products as processed, which signals

an opportunity to gain a deeper understanding of

health-related motivators and barriers (GFI/Morning

Consult, Dec. 23).

Consumers are more likely to rate conventional meat

as tasty, high-protein, affordable, good value, easy to

find, and easy to cook, and they are more likely to

rate plant-based meat as healthy, good for the

environment, and low in saturated fat and

cholesterol. This suggests many consumers already

see the unique benefits of these products, but there

is also a need for product innovation, cost reduction,

and consumer education to maximize plant-based

meat’s appeal (see figure 7).

Perceptions of plant-based meat as processed: In

2023, processed foods gained media attention.

Some coverage mentioned deliberate

misinformation and disinformation campaigns

focused on plant-based meat, as documented by a

2023 social media analysis by Changing Markets

Foundation and Ripple Research. However, most

consumers do not appear to be aware of or

concerned by these claims: a majority of consumers

in 2023 who reported hearing media coverage of

plant-based meats said the coverage was primarily

positive (47 percent) or neutral (45 percent)

(GFI/Morning Consult, Dec. 23).

Consumers report seeking out healthy and

high-protein foods. U.S. adults are most likely to

rate plant-based meat as “better” (in the case of

overall healthiness) or “equal to” (in the case of

protein) animal-based meat (see figure 7).

A majority of Americans claim it is “somewhat” or

“very” important for them to avoid eating processed

foods, and also claim to avoid foods for other

reasons, including nutritional components like

saturated fat and cholesterol where a majority rate

plant-based meat as equal to or better than

conventional meat. Plant-based meat companies

have explored marketing about or featuring on-pack

health benefits, including low cholesterol and low

saturated fat content.

While the 2022 McKinsey survey found that 43

percent of consumers want to reduce their intake of

processed food, 2023 saw few changes in consumer

behaviors around plant-based meats.

2023 State of the Industry Report / Plant-based meat, seafood, eggs, and dairy 30

Consumer opportunities

in Southeast Asia

A study conducted in late 2023 by the Good Growth

Co. and released by GFI APAC revealed that most

consumers in Southeast Asia intend to continue

eating animal meat and nearly a quarter want to

increase their consumption. Interestingly,

enthusiasm for plant-based meat was highest not

among vegetarians or even flexitarians, but among

consumers who eat the most conventional meat and

are most likely to consume more of it.

The study showed that Southeast Asian consumers

broadly view plant-based meat as a healthy and

delicious product, but that cost remains a major

barrier. If plant-based meat manages to achieve a 20

percent lower price than conventional meat, more

than 80 percent of Southeast Asian consumers say

they would buy it, including about half of those who

would otherwise reject it. Conversely, if plant-based

meat is priced 20 percent higher than conventional

meat, there are large drop-offs in potential interest

among everyone except the most enthusiastic

consumers. With the average plant-based meat

product price 35 percent higher than its conventional

counterpart, there is an enormous opportunity to

bring consumers into the category.

Since Southeast Asian consumers primarily view

plant-based meat as an opportunity to diversify their

protein consumption, interest in trying blended meat

products—which mix plant-based meat and

conventional meat within a single product—was

nearly unanimously positive, even garnering support

among consumer segments uninterested in fully

plant-based products. The vast majority (93 percent)

of surveyed consumers expressed interest in trying

blended meat, including more than 75 percent of

people who were skeptical of trying fully plant-based

meat and 80 percent of those who have eaten

plant-based meat but don’t intend to again. This

research indicates strong market opportunities for

novel protein products and innovation that can meet

consumer needs on taste and affordability.

Appealing to lapsed consumers:

Around 50 percent of lapsed consumers claim they

would buy a new plant-based meat product if they

were offered a sample and found its taste and

texture were exactly like conventional meat, and 43

percent would consider purchasing if it cost less than

conventional meat (GFI/Morning Consult, Dec. 23).

Improving taste and texture and exposing

consumers to new products should be a top priority