ADMINISTRATIVE REPORT

Report Date:

September 28, 2016

Contact:

Andreea Toma

Contact No.:

604.873.7545

RTS No.:

11421

VanRIMS No.:

08-2000-20

Meeting Date:

October 5, 2016

TO:

Standing Committee on Policy and Strategic Priorities

FROM:

Kaye Krishna, General Manager, Development Services, Building and

Licencing

SUBJECT:

Regulating Short-Term Rentals in Vancouver

RECOMMENDATION

A. THAT Council endorse the approach described in this report to allow short-term

rentals in principal residences, subject to a business licence.

B. THAT Council direct staff to engage key stakeholders and the public to refine

the proposed policy approach, and report back with the bylaws required to

enact these regulations and a plan, schedule and resourcing proposal for

implementation.

REPORT SUMMARY

In the city of Vancouver short-term rentals (i.e. fewer than 30 days) are allowed in licenced

hotels and bed and breakfasts only. Despite these rules, there has been rapid growth in

nightly rentals offered in Vancouver on platforms like Airbnb and VRBO. At Council’s direction,

staff have studied the issue of short-term rentals in Vancouver and how other cities with low

rental vacancy rates and high tourist demand are regulating this type of visitor

accommodation. This report presents information on the nature and impacts of the local

short-term rental market, and recommends a proposed approach for new short-term rental

regulations for Vancouver. This report also describes proposed next steps for detailed program

design, in consultation with key stakeholders, prior to reporting back to Council with bylaw

amendments and an implementation plan.

Regulating Short-Term Rentals In Vancouver - 11421

2

COUNCIL AUTHORITY/PREVIOUS DECISIONS

On April 6, 2016 Council directed staff to study the issue of short-term rentals in Vancouver, in

particular the impact of short-term rentals on Vancouver’s long term rental housing stock.

CITY MANAGER'S/GENERAL MANAGER'S COMMENTS

The City Manager and General Manager of Development, Buildings and Licensing RECOMMEND

approval of the foregoing.

REPORT

Background/Context

In the last decade there has been rapid growth in online marketplaces that connect people

looking for short-term accommodation with people who want to rent or sublet their own

accommodation for the same purpose. These platforms charge a fee for hosting listings,

managing bookings and payment, and sometimes providing insurance. Airbnb, the largest of

the short-term rental platforms, started in 2008 and now has 2.3 million listings in 34,000

cities.

Airbnb and several other short-term rental platforms are active and growing in Vancouver.

Only a fraction of local listings require a minimum stay of 30 days or are licenced hotels or

bed and breakfasts; therefore almost all short-term rental activity in Vancouver is currently

illegal.

1

Short-term rentals have been the subject of considerable debate in Vancouver. Proponents of

short-term rentals have asked the City to amend zoning and licensing regulations so short-

term rentals can occur lawfully. On the other hand many stakeholders concerned about the

impacts of short-term rentals have asked the City to curb tourist rental activity in residential

neighbourhoods, particularly in units that could be rented long term to Vancouver residents.

Strategic Analysis

1. SHORT-TERM RENTAL MARKET SUMMARY

The following sections summarize recent information about short-term rental activity in

Vancouver. The data comes from a report prepared for the City by Host Compliance LLC (see

Attachment 1 for full report), and from The Airbnb Community In Vancouver report published

by Airbnb in July, 2016.

2

1

Section 10.21.6 of the Zoning and Development By-law states, “No person shall use or permit to be used any

dwelling unit for a period of less than one month unless such unit forms part of a hotel or is used for bed and

breakfast accommodation.” Section 10.20.5 sets the same 30 day rental minimum for housekeeping units (i.e.

private rooms).

2

https://www.airbnbaction.com/the-airbnb-community-in-vancouver/

Regulating Short-Term Rentals In Vancouver - 11421

3

1.1. The Short-Term Rental Market In Vancouver Is Large and Growing

In June 2016 Host Compliance found 5,353 active, unique listings in Vancouver.

The absolute

number of active short-term rental listings in Vancouver changes daily as new listings are

added and others are removed.

Airbnb’s report is not a point-in-time count; rather it summarizes all short-term rental

activity in 2015. In that 12 month period, 6,400 Airbnb listings in the City of Vancouver hosted

at least one short-term rental.

3

Airbnb listings in Vancouver have almost doubled each year

since 2013.

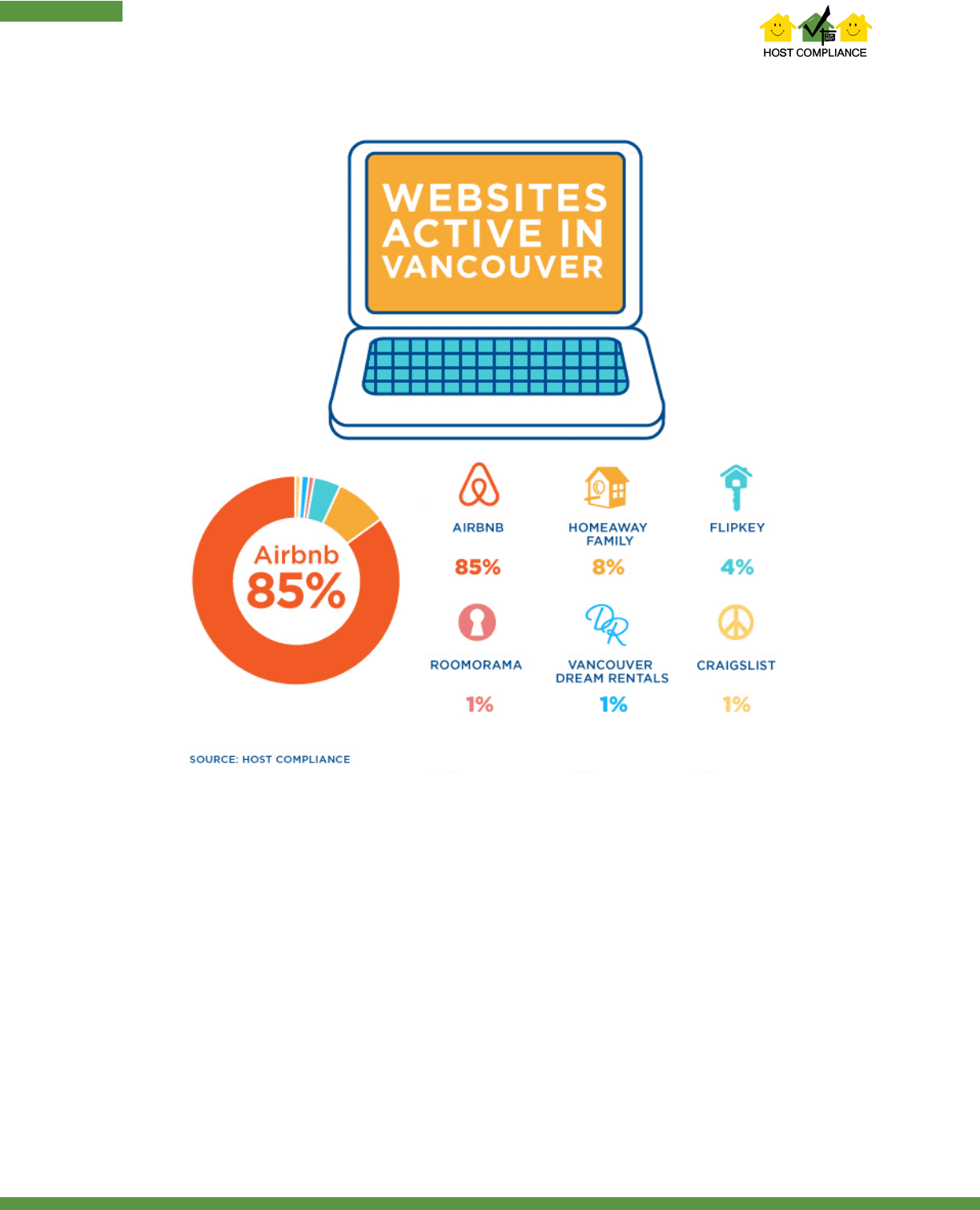

1.2. Airbnb Is The Largest Player In The Vancouver Market

Host Compliance found Vancouver listings on 10 of the 16 short-term rental websites they

monitor.

4

This multi-platform data shows that Airbnb is by far the largest player in Vancouver

with 85% of the listings active in June 2016. Another 8% of listings are on Homeaway or one of

seven other websites in the Homeaway family.

5

The third largest site is Flipkey (owned by

TripAdvisor) with 4% of local listings.

3

Some hosts have more than one listing at the same address (e.g. multiple private rooms for rent, or a private

room listing they rent while home and an entire unit that they rent while they are away). Therefore 6,400 listings

does not mean 6,400 physical addresses.

4

Host Compliance monitors Airbnb, HomeAway, VRBO, Flipkey, VacationRentals.com, Travelmob, Homelidays,

Abritel, Ownersdirect, and BedandBreakfast.com.

5

According to Wikipedia, Homeaway is a vacation rental marketplace owned by Expedia that operates 40 websites

globally. Eight sites in the Homeaway family are active in Vancouver: Homeaway, Homelidays, Abritel,

OwnersDirect, Travel Mob, VacationRentals.com, VRBO and BedandBreakfast.com.

Regulating Short-Term Rentals In Vancouver - 11421

4

Staff research found three more short-term rental websites with at least 100 listings in

Vancouver: Craigslist, Roomorama and Vancouver Dream Rentals.

In June 2016 staff sent letters to each of the 13 platforms, inviting them to participate in the

policy review. Airbnb was the only platform to respond.

Staff research also identified several other websites with fewer than 50 furnished rentals in

Vancouver that appear to be bookable on a nightly basis. Sites such as Wimdu, 9flats, and

Booking.com operate like Airbnb but have few local listings, while sites such as Highstreet

Rentals, Premiere Suites, and CorporateStays.com appear to target corporate customers (e.g.

relocating companies, film industry, insurance claims). Staff interviewed three of these

corporate housing providers, all of whom said that their clients generally stay at least a

month and short-term rentals shorter than 30 days are rare.

1.3. Three Quarters Of Short-Term Rentals In Vancouver Are Entire Units

Both Airbnb and Host Compliance report data in two categories:

− Entire unit listings: the visitor

6

has full use of the unit during the stay and does not share

space with anyone else (e.g. the operator).

− Shared space listings: the visitor rents part of a larger unit – a private room or shared

sleeping space - and shares common areas and sometimes a bathroom with either the

operator or with other visitors.

6

This report uses operator (Airbnb says host) to refer to an individual offering a space for short-term rental and

visitor (Airbnb says guest) to refer to an individual renting a space short-term.

Regulating Short-Term Rentals In Vancouver - 11421

5

Of the 5,353 active, unique listings in June 2016, 74% were for entire units, 23% were for

private bedrooms and 2% were for shared rooms.

7

The proportion of entire unit listings in the

Host Compliance report is slightly higher in comparison to the Airbnb report (69% entire units,

28% private rooms, 3% shared rooms) because all of the listings on the other nine platforms

monitored by Host Compliance are entire unit listings.

1.4. Most Short-Term Rental Listings Are Concentrated In and Around Downtown

The map below shows the relative concentration of short-term rental listings in 10 sub-areas.

This highest concentration of listings is Downtown (29%) which includes the West End east of

Denman Street. The next highest concentrations are in Kitsilano/Point Grey (15%), East

Hastings (15%) and Mount Pleasant/Renfrew (14%).

1.5. A Quarter Of Entire Unit Short-Term Rental Listings Were Rented on a Nightly

Basis For More Than 90 Days Last Year

Airbnb reports that 62% of entire unit listings active in 2015 were rented on a nightly basis for

fewer than 60 days last year (see Figure 1 below). Conversely, 26% of entire unit listings were

rented nightly for more than three months last year. While it is not known how each listing is

used when it is not being rented short-term, it is reasonable to assume many of the listings

with high rental frequencies are not someone’s principal residence.

7

A small number of listings are not classified so the sum does not equal 100%.

Regulating Short-Term Rentals In Vancouver - 11421

6

Figure 1: Annual Rental Frequency For Airbnb Entire Unit Listings, 2015

1.6. At Least 17% of Operators In Vancouver Have Multiple Active Listings

Host Compliance used a combination of published operator names and unique host IDs to

determine the number of listings per individual. In June 2016 83% of operators had only one

active, unique listing. Another 10% had two listings and 7% had three or more listings (Figure

2). A small number of operators (around 25) each control more than 10 listings.

Figure 2: Listings Per Short-Term Rental Operator - June 2016

1.7. Current Bylaws Are Being Enforced

In June 2016 there were 55 licenced bed and breakfasts in Vancouver, and 51 short-term

rental listings that require a 30 day minimum stay. This means at most, 3% of short-term

rental listings in Vancouver meeting current bylaw requirements; the other 97% are illegal.

Regulating Short-Term Rentals In Vancouver - 11421

7

Bylaw violation complaints about illegal short-term rentals are low but rising. In recent

months the City has stepped up enforcement, starting with hosts or listings with significant

impacts on the public good. Enforcement priorities include:

− Short-term rentals in unsafe buildings.

− Buildings with multiple listings (e.g. ‘Airbnb hotels’) or where a long term tenant has

been evicted so a unit can be rented short-term instead.

− Operators running multiple listings (e.g. short-term rental property management

companies).

− Short-term rentals in publicly-funded rental housing.

The City may also pursue enforcement against individual units reported to 3-1-1, provided the

complaint includes a street address (including unit number) of the alleged rental and an

active short-term rental listing.

Overall, enforcement is challenging and is contingent on observing illegal use of a specific

unit. In a few cases, the city has observed positive behavior changes from building owners

who seek to comply with the laws, for example changing their listings to 30-days minimum

rentals.

2. LOCAL IMPACTS OF SHORT-TERM RENTALS

As the number of short-term rental listings grows in Vancouver, so does public debate about

the positive and negative impacts of this use of the local housing stock. Those concerned

about short-term rentals say they reduce the supply and increase the price of long term

rental housing, and increase noise and damage in residential buildings and neighbourhoods.

Proponents of short-term rentals say they make Vancouver a more attractive tourist

destination and provide extra income to Vancouver residents and businesses.

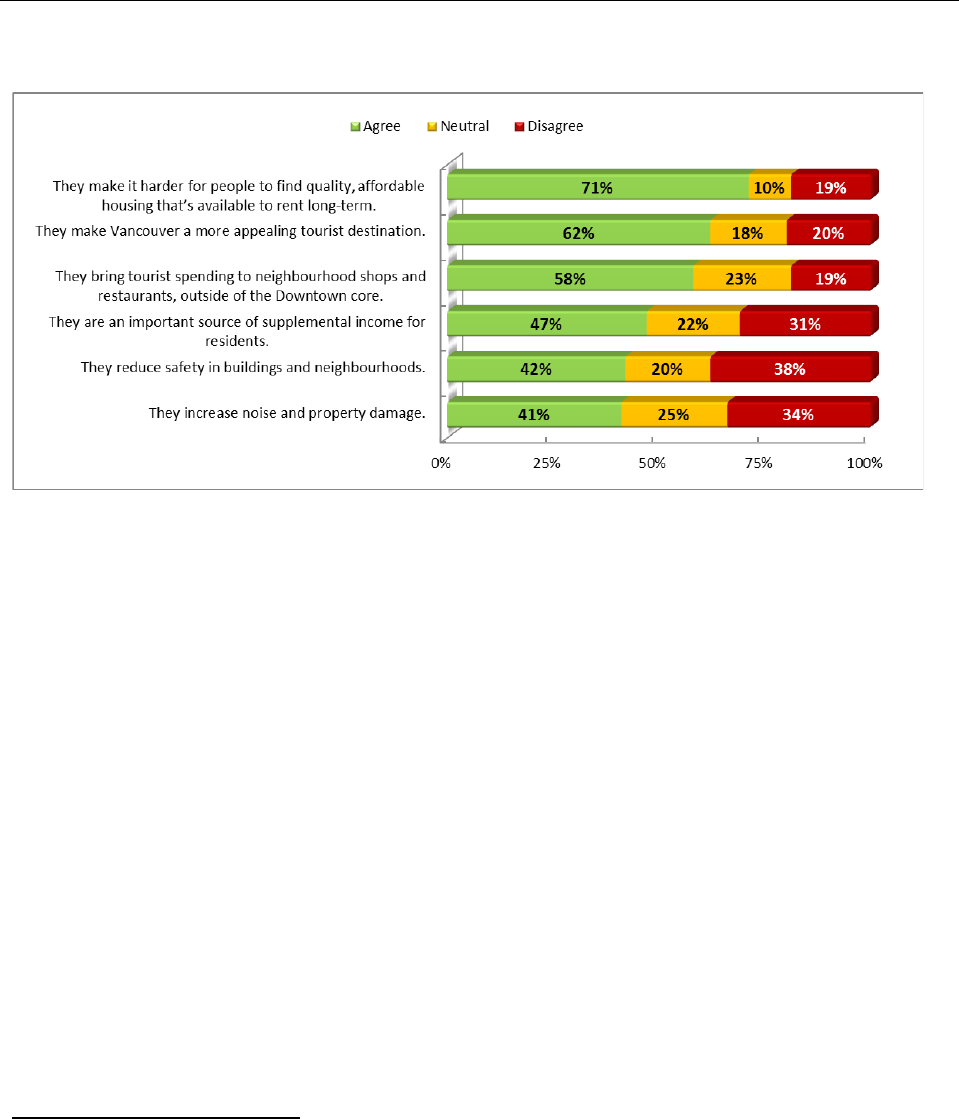

Over the summer, City staff met with the Renters Advisory Committee, Tourism Vancouver,

The Hotel Association of Vancouver and The Condominium Homeowners Association of BC to

better understand local impacts. Members of the public were also invited to comment on

these perceived impacts of short-term rentals via a Talk Vancouver online survey in July and

August, 2016. In the 14-day survey period, 6,475 individuals completed a survey (see

Attachment 2 for full survey findings). Survey responses were evenly balanced across age

groups, between genders, and between owners and renters. Of the total respondents, 10%

indicated they have operated a short-term rental in the last 12 months. Figure 3 below shows

survey respondents’ perceptions of the impacts of short-term rentals in Vancouver.

Regulating Short-Term Rentals In Vancouver - 11421

8

Figure 3: Talk Vancouver Survey: Perceived Impacts Of Short-Term Rentals

Scholarly analysis of the short-term rental impacts is scarce, as is credible published

information about Vancouver-specific impacts. With the information available, staff have

investigated the validity of the perceived impacts.

2.1. Rental Housing Impacts

Finding: There Is A Strong Financial Incentive To Rent Short-Term Instead Of Long-Term

Staff compared the average monthly rent

8

to the average nightly short-term rental rate

9

for

similar properties (i.e. same area, same number of bedrooms). The purpose of this analysis

was to estimate the ‘break-even point’, or the point at which it becomes more profitable to

rent a unit short-term instead of to a longer term tenant.

The analysis found that renting a one bedroom unit out nightly for 9 to 12 days per month

(varies by sub-area) will generate the same revenue

10

as renting the same property on a

monthly/yearly basis. For two bedroom units the break-even point is between 7 and 11 days

and for studio units it is between 7 and 15 days.

This break-even analysis shows there is a strong financial incentive to rent short-term in

Vancouver. Entire unit listings rented for more than three or four months a year are

generating more income as a short-term rental than they would if they were rented for the

8

Average monthly rents by Vancouver neighbourhood and bedroom type come from the CMHC Rental Market

Report: Vancouver and Abbotsford-Mission CMAs, October 2015.

9

Average nightly short-term rental rates by neighbourhood and bedroom type come from the Host Compliance

data set and were the rates posted for each listing on June 24, 2016, less the 3% Airbnb booking fee deducted from

the host’s gross revenue.

10

This analysis assumes the income in both scenarios is declared and taxed in the same way. It also assumes costs

such as unit repairs and upgrades, utilities, and cleaning between tenancies is similar in both cases. Anecdotally,

staff have been advised that short-term rental costs are higher (more frequent cleaning) and short-term rental

landlords are less inclined to declare rental income. But without evidence in either case, staff have treated these

variations as a wash.

Regulating Short-Term Rentals In Vancouver - 11421

9

full year to a long term tenant. According to Airbnb, 21% of entire unit listings in 2015 were

rented for more than four months that year.

Finding: Over 1,000 Frequently Rented Entire Unit Listings Might Be Available For Long

Term Rental

Cities like San Francisco and New York have previously attempted to quantify the number of

entire unit short-term rental listings that might be available for long term rental instead. To

do so, they identify entire unit listings that are rented so frequently that they are unlikely to

be someone’s principal residence. The hypothesis is that many entire units that are not a

principal residence could be rented long term if short-term rental was not permitted.

Staff replicated this assessment for Vancouver with a conservative assumption that entire

units rented more than 90 days were not a principal residence, and less conservative

assumption that entire units rented more than 60 days were not a principal residence.

There were 4,009 unique, active entire unit listings in Vancouver in June, 2016. Assuming the

rental frequency in 2016 will be similar to Airbnb rental frequencies in 2015, 1,082 of those

units will be rented more than 90 days this year and almost 1,564 units will be rented more

than 60 days (see Figure 4).

Figure 4: Frequently Rented Entire Unit Short-Term Rentals: Scenarios

11

Information is not available on how each of the frequently rented entire unit short-term

rentals would be used if the City actively enforced current bylaws that require minimum 30

day tenancies. However if some or all of these units were rented long term instead of short-

term, it would have a positive impact on Vancouver’s 0.6% rental vacancy rate.

Finding: Secondary Suites and Laneway Houses Are Being Rented Short-Term

The City legalized secondary suites in single family zones in 2004, and laneway houses in RS-1

and RS-5 zones in 2009 and the rest of the RS zones in 2013. Both housing forms are intended

to increase the supply and diversity of rental housing for Vancouver residents.

The City has received reports that secondary suites and laneway houses are being rented

short-term to visitors. Exact data is not available as short-term rental platforms do not

require operators to declare housing form. However a key-word search of listings titles for

4,009 entire unit listings found 243 listings with carriage, coach, basement, laneway or

garden+suite in the title.

11

Total entire unit listings from Host Compliance (June 2016), entire unit nights rented per year based on local

Airbnb activity in 2015 as reported in Airbnb’s July 2016 report.

Scenario

Airbnb Entire Unit List > x

days per year

% from Airbnb

STR Units That Could

Be Available for LTR

Active, Non-Duplicate

Entire Unit Listings (HC)

Conservative

x = 90

27%

1082

Less Conservative

x = 60

4009

39%

1563

Regulating Short-Term Rentals In Vancouver - 11421

10

2.2. Tourism Impacts

Finding: Short-Term Rentals Increase The Supply and Diversity of Visitor Accommodation

Tourism is an important economic sector in Vancouver and British Columbia. In Metro

Vancouver, the tourism industry contributes approximately $6.1 billion annually to the local

economy and provides over 66,000 full time jobs.

12

The availability and type of visitor accommodation is one of the factors that determines

Vancouver’s appeal as a tourist destination. There are 14,511 hotel rooms in Vancouver. This

year, the average occupancy rate for hotels in Downtown Vancouver is quite high at 77%

13

and

many properties are fully booked in peak periods.

14

Occupancy rates for short-term rental

listings are similarly high in the same peak periods. Airbnb reports that in June, 2016, 88% of

the 3,172 entire unit listings with availability hosted at least one booking that month. Of the

1,434 private or shared rooms with availability in June, 79% hosted a booking. It appears that

in peak periods at least, short-term rentals accommodate visitors that would not otherwise be

able to stay in Vancouver. Further, temporarily repurposing residential rooms and units for

visitor accommodation is an easy, inexpensive form of increasing accommodation supply

during event-related peaks (e.g. major sporting events).

Proponents of short-term rentals also say that less conventional visitor accommodation often

located outside of traditional tourist areas appeals to the growing ‘new urban tourism’ market

in which visitors forego conventional tourist experiences in favour of living like a local.

15

2.3. Local Economic Benefits

Finding: Some Neighbourhoods, Local Businesses and Individuals Benefit From Short-Term

Rentals

Short-term rental proponents point to the local economic benefits of drawing visitors and

their leisure spending outside of conventional tourist areas, and allowing residents in an

expensive city to generate income from unused space. There is no quantifiable local data on

either point, but surveys of operators conducted by both the City and Airbnb support both

claims. Regarding local economic benefit:

− 58% of Talk Vancouver respondents believe short-term rentals bring tourist spending to

neighbourhood shops and restaurants outside of the downtown core.

− 65% of local Airbnb visitors surveyed reported visiting a local business and spending on

average 52% of daytime (non-accommodation) spending in the same neighbourhood as

their accommodation.

12

2013 numbers based on actual 2012 data http://www.tourismvancouver.com/media/corporate-

communications/vancouvers-tourism-industry-fast-facts/

13

Destination British Columbia, “Provincial Tourism Indicators: August 2016”.

14

http://business.financialpost.com/personal-finance/mortgages-real-estate/vancouvers-hotel-room-rates-

hottest-in-canada-amid-all-round-property-boom

15

Henning Fuller and Boris Michel, ““Stop Being A Tourist!” New Dynamics of Urban Tourism in Berlin-Kreuzberg,”

International Journal of Urban and Regional Research 38 n. 4 (July 1, 2014.)

Regulating Short-Term Rentals In Vancouver - 11421

11

In terms of individual economic benefit, 10% of Talk Vancouver survey respondents claimed to

have listed a room or unit for rent short-term in the last 12 months. Of these respondents,

43% said they made less than $5,000 from their rental last year and 23% said they made

between $5,000 and $10,000. Most (81%) survey respondents reported using some of their

short-term rental income to cover housing costs. This is consistent with the Airbnb report

that states a ‘typical’ Vancouver operator in 2015 earned $6,500 and more than half of

operators surveyed reported using proceeds to cover housing costs.

2.4. Nuisance/Safety Impacts

Finding: Reports Of Noise And Safety Impacts Are Low But Rising

Introducing short-term visitor accommodation into residential buildings and neighbourhoods

creates the potential for conflict among the different users. Potential negative impacts of

short-term rentals observed in other cities include:

− Noise: high volumes due to over-occupancy, lack of awareness of quiet hours, and the

‘I’m on holiday’ mentality.

− Safety breaches: real or perceived impacts to personal safety and safety of private

and common property resulting from new non-residents frequently being given access

to semi-private areas (e.g. secure underground parking).

− Damage to common property: wear and tear on building hallways, improper use of

building amenities.

− Pressure on shared resources: on-street parking, utilities, garbage/recycling

facilities.

To understand the number and type of nuisance issues locally, staff reviewed the 80 bylaw

violation complaints referencing Airbnb or short-term rentals that have been logged by 3-1-1

since the beginning of 2013. Figure 5 below shows that 15% of complaints referenced specific

nuisance or safety issues. Of these, 9% reported noise in quiet hours, 5% reported concerns

about safety (e.g. strangers in the building, non-residents having access to secure

underground parking areas) and 1% reported concerns about property damage (e.g. damage to

common areas, excessive garbage/incorrect sorting of recyclables).

Figure 5: 3-1-1 Complaints About Short-Term Rentals 2013 - Present

2013

2014

2015

2016

TOTAL COMPLAINTS

2

4

19

55

Complaint Type

Suspected STR

1

3

16

19

Multiple Listings

-

-

-

28

Illegal Suite

-

-

-

1

Noise

-

-

2

5

Safety Concerns

1

-

1

2

Property Damage

-

1

-

-

Regulating Short-Term Rentals In Vancouver - 11421

12

3. SHORT-TERM RENTAL REGULATIONS IN OTHER CITIES

Staff reviewed short-term rental regulations in 20 cities that are already regulating short-

term rentals to control impacts on rental housing or the safety and character of residential

neighbourhoods and building. Cities reviewed include: Amsterdam (NL), Anaheim, Austin,

Berlin, Boulder, Chicago, Denver, London (UK), New York, Nashville, Philadelphia, Portland,

Sacramento, San Francisco, Santa Monica, Seattle, Tofino, Nelson, Sidney (AU) and Melbourne

(AU).

Each of the cities surveyed strikes its own balance between the competing pairs of

objectives: protecting housing impacts/maintaining neighbourhood livability vs. increasing

tourist accommodation/income-generating opportunities for residents. Figure 6 and the

following sections summarize the short-term rental regulations in three cities that cover the

spectrum of restrictive to permissive regulations.

Figure 6: Summary of Short-Term Rental Regulations In Berlin, Austin and Denver

3.1. Berlin, Germany: No Short-Term Rentals Of Entire Housing Units (Restrictive)

Berlin has 3.5 million residents, 85% of whom are renters.

16

The city’s population is growing,

and there is a shortage of available rental housing. The rental vacancy rate in 2014 was 1.5%

17

and in that year average rents increased by 5%. Berlin is also a popular tourist destination,

hosting up to 30 million overnight visitors a year.

18

Berlin introduced short-term rental restrictions in 2014 to protect the city’s long term rental

housing supply.

19

Berlin allows short-term rental of private rooms and shared rooms in the

operator’s home, up to 50% of the floor space of the unit. Owners and renters are allowed to

list private/shared room short-term rentals in any housing form (e.g. single family, multi-

family) and location in the city. There is no limit on the number of nights per year.

Berlin does not allow any short-term rental of entire housing units. Anyone wanting to rent

an entire unit short-term under special circumstances can apply for special permission from

16

http://www.berlinhyp.de/uploads/media/WMR_2016_EN_WWW_20160111.pdf

17

Ibid.

18

https://www.berlinjournal.biz/en/berlin-restrictions-vacation-rentals/

19

https://www.theguardian.com/technology/2016/jun/08/berlin-ban-airbnb-short-term-rentals-upheld-city-court

Regulating Short-Term Rentals In Vancouver - 11421

13

the local government. If special permission is granted, the apartment can only be rented for

the average long term rent per square meter in the area.

The ban on entire unit short-term rentals took effect earlier this year, after a two-year grace

period. The fine for breaking the law is 100,000 Euros (CAD$145,000). The number of entire

unit Airbnb listings dropped from 11,000 to 6,700 the month before the rules took effect.

20

Short-term rentals pay a 5% City Tax that applies to hotels, guest houses, and other forms of

short-term visitor accommodation.

21

3.2. Austin, Texas: Short-Term Rentals In Principal Residences And Investment

Properties (Permissive)

Austin has close to one million inhabitants

22

and like Berlin, is a popular tourist destination

with over 20 million visitors a year.

23

In 2016 there were 4,000 entire unit listings for Austin

on Airbnb. Austin’s rental vacancy rate is about 4.5%.

Austin has five short-term rental licence categories (see Figure 7 below). In Austin an owner

can rent his or her entire principal residence short-term up to 179 nights per year, or part of

the unit short-term with no limits. Austin also allows an owner to obtain a permit for one on-

site accessory dwelling (e.g. suite, laneway house) for short-term rental with no annual night

cap.

Austin also issues a limited number of short-term rental permits for units that are not

principal residences. The non-owner-occupied short-term rental permits in each census tract

are capped at 3% of total housing units in residential areas and 25% of housing units in

commercial areas. However given high complaint volumes against non-owner-occupied short-

term rentals, Austin has placed a moratorium on permits for this non-owner-occupied short-

term rentals in single/double family residential zones.

20

http://www.citylab.com/housing/2016/04/airbnb-rentals-berlin-vacation-apartment-law/480381/

21

https://www.berlin.de/en/tourism/travel-information/3298255-2862820-city-tax-in-berlin-who-is-to-pay-how-

muc.en.html

22

http://www.austintexas.gov/demographics

23

http://www.austintexas.gov/edims/document.cfm?id=239291

Regulating Short-Term Rentals In Vancouver - 11421

14

Figure 7: Short-Term Rental Licences In Austin, Texas

Short-term rental permits must be held by the property owner but with an owner’s

authorization, the property can be operated by someone else. The City of Austin’s 9% Hotel

Occupancy Tax applies to short-term rentals.

3.3. Denver, Colorado: Short-Term Rentals In Principal Residences Only (Balanced)

Denver is one of several cities that allows private room and entire unit short-term rentals only

in an operator’s principal residence. One short-term licence is allowed per property and can

be applied to the principal dwelling unit or an accessory unit, but not both. Denver issues

short-term rental licences online for a $25 fee. Random audits of licence conditions will

begin when the regulations come into effect in December 2016. Short-term rental revenue in

Denver will be subject to a 10.75% Lodger’s Tax.

With a healthy vacancy rate of 5.4%

24

, Denver’s motivation to regulate is to minimize noise

and traffic in residential areas. That said, cities such as San Francisco and Portland with low

vacancy rates and rising rents like Vancouver use Denver’s principal-residences-only approach

to achieve housing objectives. Staff chose Denver as the example instead of others as

Denver’s regulations are new and capture some of the emerging best practices learned from

watching challenges in other cities, particularly around the challenges and administrative

burdens associated with capping the number of rental nights per year.

3.4. Capping The Number of Rental Nights Per Year For Entire Units

Some cities set a maximum number of nights per year that a unit can be rented short-term.

Cities set these night caps for three reasons:

− Establish a licence threshold. Chicago and London (UK) only require operators to

obtain a licence if they rent more than the maximum annual night cap.

24

https://www.colorado.gov/pacific/dola/vacancy-rent-surveys

Regulating Short-Term Rentals In Vancouver - 11421

15

− Minimize conflicts. In cities that allow short-term rentals in non-principal residences,

night caps define the maximum tourist activity that can occur in residential

neighbourhoods and buildings.

− Create a Financial Incentive To Rent Long Term. Cities such as San Francisco do

break-even calculations to determine how many short-term rental nights a year would

generate the same revenue as long term rental for 12 months. They set the annual

night cap below this threshold so anyone motivated to maximize rental income from a

non-principal residence will choose to rent long term instead of short-term.

Cities that limit the number of nights per year that a unit can be rented report this regulation

is very difficult to enforce. Short-term rental platforms have not been willing to share

information about listing usage with regulators, and third party ‘data scraping’ firms cannot

access booked vs. available calendar data for listings.

25

Self-reporting by operators is

unreliable and auditing materials adds administrative cost.

Los Angeles and San Francisco recently adopted regulations requiring short-term rental

platforms to share information for compliance purposes, including rental frequency for

listings. In response, both cities have been sued by Airbnb.

4. PROPOSED SHORT-TERM RENTAL REGULATIONS FOR VANCOUVER

Using existing City policy documents

26

, and based on stakeholder and public feedback as well

as research in other cities, staff identified the following objectives for future short-term

rental regulations in Vancouver:

1. Long Term Rental Supply: Protect the supply and affordability of long term rental

housing for Vancouver residents.

2. Health and Safety: ensure residential space rented as tourist accommodation meets

Building Bylaw and Property Use standards.

3. Neighbourhood Fit: Maintain quality of life and safety in residential neighbourhoods

and buildings.

4. Tax and Regulatory Equity: Treat accommodation providers equitably from a tax and

regulatory perspective.

5. Supplemental Income: allow residents to earn income from renting their home

occasionally.

6. Tourism: Support growth in tourism and Vancouver’s ability to support peak tourism

season and to host major events.

7. Compliance: design a regulatory, licensing and enforcement system that is easy to

understand, inspires high levels of voluntary compliance and has effective means of

preventing unlawful behaviour.

25

Researchers have published occupancy estimates for Airbnb listings, based on the number of reviews per listing,

multiplied by a factor equal to the assumed likelihood of a visitor to leave a review. This method is not defensible

as a basis for bylaw enforcement.

26

The seven policy objectives echo existing policy direction in one or more of: Housing and Homelessness Strategy,

Healthy City Strategy, Greenest City Strategy, Vancouver Economic Action Strategy and the 2016 Corporate

Business Plan.

Regulating Short-Term Rentals In Vancouver - 11421

16

Figure 8 below shows the relative importance of some of these objectives to Talk Vancouver

survey respondents.

Figure 8: Talk Vancouver Survey: Objectives For Future Short-Term Rental Policy

Talk Vancouver survey respondents were also asked to comment on two regulatory questions:

− Who do you think should be allowed to offer units on the short-term rental market?

− What type of space do you think should be allowed for short-term rental?

As Figure 9 shows, there was strong support among survey respondents for short-term rentals

in the operator’s principal residence only. More than 80% of respondents said a homeowner

should be allowed to operate a short-term rental in his/her principal residence and almost

50% said renters should be allowed to do the same.

Figure 9: Talk Vancouver Survey: Who Should Be Allowed To Operate A Short-Term Rental?

Survey respondents had comparable levels of support for short-term rentals in a range of

housing types, provided the unit is the operator’s principal residence (see Figure 10).

Regulating Short-Term Rentals In Vancouver - 11421

17

Figure 10: Talk Vancouver Survey: What Types Of Housing Should Be Rented Short-Term?

Considering the City’s objectives, public and stakeholder input on this matter to date, and

lessons learned from other cities, staff recommend that new short-term rental regulations in

Vancouver allow owners and renters with a valid business licence to rent part or all of their

principal residence on a short-term basis. Short-term rental in non-principal residences (e.g.

investment properties) should remain illegal, which is in keeping with Council’s emerging

policy on taxing empty homes. All short-term units must be considered safe dwelling units, as

defined by the Vancouver Building Bylaw. Short-term rentals in structures such as boats or

trailers which are not considered dwelling units should also remain illegal.

Staff do not recommend setting a cap on the maximum number of rental nights per year.

Limiting short-term rentals to principal residences would achieve the same objectives of the

night cap, but in a way that is enforceable. A principal residence by definition is not

available for long term rental, so there is limited threat of loss of long term rental housing

stock. Also, much like empty homes, and based on all staff research on short term rentals,

tracking and enforcing a nightly rental cap is extremely difficult and poses a high

administrative burden with unpredictable results.

The hotel industry has asked that short-term rentals pay GST, PST and the 3% Municipal and

Regional District Tax (MRDT) paid by hotels. The City will explore a hotel tax or business tax

equivalent in the next phase of work.

If short-term rental activity in 2016 is similar to 2015, this proposed approach would legalize

approximately half of entire unit short-term rental listings and most short-term rental of

private rooms. It is likely that at least some of the 1,000 – 1,500 units that are not legalized

will enter the the long term rental stock.

Figure 11: Proposed Regulatory Approach For Vancouver

Regulating Short-Term Rentals In Vancouver - 11421

18

Short-term rentals in principal residences would be subject to the following limitations:

− The use of the property for short-term rental must not violate applicable strata

bylaws.

− If the operator is a renter, the tenancy agreement must permit short-term sublets.

− The unit is a safe accommodation, as defined by the Vancouver Building Bylaw.

− The operator must hold a valid City business licence and post the licence number in

any advertisement for the rental.

To obtain a short-term rental business licence, an operator must demonstrate Principal

Residence through:

− Control of the dwelling unit they propose for short-term rental. Acceptable proof

would include a copy of title or tax assessment for owners, and a signed tenancy

agreement for renters.

− Proof of regular personal business at this address. Acceptable proof would be a

piece of valid government ID with photo showing the same address, and a utility bill or

piece of government correspondence (e.g. tax notice, MSP invoice) dated within the

last three months.

Lessons learned from short-term rental licensing recommend a simple, inexpensive, online

licensing system where applicants post copies of the above evidence and self-declare the

evidence is true and that they will comply with short-term rental regulations. The City would

audit licencees on a regular basis to discourage fraud.

For regulatory simplicity the current requirements and permitting process for bed and

breakfasts would be removed and replaced by this approach, i.e. allowing bed and breakfast

operators to obtain a short-term rental licence instead. Provision of breakfast would no

longer be a requirement.

If new regulations are adopted, they should be accompanied by a proactive, effective

enforcement system to obtain high levels of compliance with new rules. Because regulation

enforcement is challenging with both online platforms and non-compliant short-term renters,

staff recommend three key frames in which to enable a strong enforcement environment:

1. Utilize the City’s bylaw and enforcement powers to establish a clear and consistent

enforcement escalation path. For example, each unlicenced operator will receive

notice to obtain a licence within 30 days or remove the listing. Anyone who continues

to operate without a licence would be subject to fines and legal action.

2. Partner with host platforms and third party vendors to establish and communicate

Vancouver’s guidelines and standards and to catch issues. For example, staff

recommend coordinating with short-term rental platforms to include a licence field on

the listing form, which has been done in other cities. Staff also recommend that the

City contract with a third party resource to identify unlicenced short-term rentals,

primarily through ‘data-scraping’ and online analysis. This third party resource will

provide regular reports and data to help identify trends, misuse, and fraud.

3. Coordinate with stakeholders and the public to communicate legal short-term uses

and to leverage the City’s complaint-driven (311) enforcement process. For example,

staff recommends listing licenced short-term rental locations online and enabling 311

Regulating Short-Term Rentals In Vancouver - 11421

19

call staff to immediately identify whether an address has a license. Staff also

recommend coordinating with strata councils to help identify ways to strengthen

strata rules to support compliance.

5. NEXT STEPS – CONSULTATION TO INFORM IMPLEMENTATION

I

f Council endorses the proposed regulatory and licensing approach described above, staff will

consult with the public and key stakeholders (e.g. Renters Advisory Committee, the tourism

and accommodation industries, strata council) to refine the approach. Key issues for further

discussion include taxing short-term rental revenue, and whether additional regulations are

needed to prevent conversion of long term room rentals to short-term rental instead.

St

aff will also consult with short-term rental platforms active in Vancouver regarding

potential cooperation in compliance and enforcement efforts. To date, only Airbnb has

responded to the City’s invitation to be involved in the policy review and has indicated they

do assist with compliance in other jurisdictions.

27

Staff also plan to engage other government

agencies (e.g. BC Assessment, Canada Revenue Agency, the British Columbia Real Estate

Association) that may be interested in collaborating against unlawful operators.

Staff will also work with stakeholders to develop a more detailed compliance and

enforcement system. Based on lessons learned from enforcement challenges in other cities,

it is recommended that Vancouver’s compliance and enforcement system:

− Be easy, fast, and inexpensive for operators to comply with the regulations (e.g. simple

regulations, online permitting, no inspection, low fees).

− Define bylaw violations that are easy to identify and prove.

− Set financial penalties for non-compliance high enough to encourage voluntary

compliance.

− Take swift legal action against non-compliant operators.

The implementation proposal will include a proposed rollout period, public information

campaign, and the resources needed to support successful implementation. Staff plans to

provide the implementation proposal and proposed bylaw amendments to Council in the first

quarter of 2017.

Implications/Related Issues/Risk

Financial

Implementing the proposed approach outlined in this report would generate additional costs

to the City (e.g. processing short-term rental business licences, compliance audits, legal

action against bylaw violations, technology and data updates). Business licence fees could be

set to recover the costs of licensing lawful operators, but likely not the ongoing cost of bylaw

27

Airbnb’s Community Compact states, “in cities where there is a shortage of long term housing, [Airbnb is]

committed to working with our community to prevent short-term rentals from impacting the availability of long-

term housing by ensuring hosts agree to a policy of listing only permanent homes on a short-term basis.”

Regulating Short-Term Rentals In Vancouver - 11421

20

enforcement. If fees are in excess of the cost to operate the program, those fees could be

directed toward affordable housing programs in the city.

Legal

Implementing the regulatory approach would require amendments to the Zoning and

Development By-law, License By-law, and Ticket Offences Bylaw.

* * * * *

Attachment 1

Short-Term Rental Market Overview For Vancouver

(Host Compliance LLC)

City of Vancouver: Short-Term Rental Market Overview

City of Vancouver:

Short-Term Rental Market Overview

By Host Compliance, LLC

August 2016

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

I. Introduction

In recent years there has been rapid growth globally in online platforms like Airbnb that allow

people to rent their rooms or suites out on a nightly basis, often to tourists. In Vancouver, the

number of short-term rental listings continues to grow despite the fact that City zoning

regulations only allow licenced hotels and bed and breakfasts to rent rooms for fewer than 30

days per tenancy.

In April 2016, the City of Vancouver began a review of current short-term rental regulations. The

purpose of this review is to investigate the short-term rental market in Vancouver, assess

positive and negative impacts, and determine whether changes should be made to current

regulations.

Host Compliance LLC was commissioned to provide data on the short-term rental market in

Vancouver, a key input to the policy review. This report summarizes the findings of this work.

2. Background & Methodology

Background

As a software, data and consulting services provider exclusively focused on helping local

governments overcome the challenges associated with short-term vacation rentals, Host

Compliance LLC has developed a set of proprietary data and analytics tools that can provide

deep insights into the scale and scope of the short-term rental activity in any community. In this

report, we will provide our findings from the City of Vancouver, with the hope that this fact-base

will help inform the debate about how short-term rentals should be regulated in the City in the

years to come.

General Methodology

Host Compliance’s data is collected weekly and we currently collect, aggregate and de-

duplicate all listing data, reviews, calendar info and photos across the world’s 16 top short-term

rental listing sites

28

. We estimate this represents 99% of the total vacation rental universe in the

City of Vancouver’s jurisdiction.

In order to avoid overstating the scale of the short-term rental phenomena, Host Compliance de-

duplicates its data to eliminate duplicate listings (units that are listing more than once on the

same listing site or within the same “listing site family”

29

) and avoid double-counting cross-listed

properties (i.e. units that are listed on more than one listing site).

To focus the analysis on properties that are actively being rented, data is segmented into active

and passive listings. A listing is considered active if either: a) the listing has received a review in

the past 12 months, or b) the listing description or calendar has been updated in the past 12

months.

28

Airbnb.com, Flipkey.com, HomeAway.com, VRBO.com, VacationRentals.com, travelmob.com,

BedandBreakfast.com, HomeAway.co.uk, OwnersDirect.co.uk, HomeAway.de, Abritel.fr,

Homelidays.com, HomeAway.es, Toprural.es, AlugueTemporada.com.br ,

HomeAway.com.au,Stayz.com.au, Bookabach.co.nz

29

By “listing site family”, we refer to the fact that Expedia owns multiple listing websites such as

HomeAway.com, VRBO.com and VacationRentals.com

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Host Compliance’s raw, de-duplicated and activity-based data can be segmented and analyzed

by a number of parameters including:

• Listing site

• Location (as defined by a boundary box or polygon i.e. a neighborhood)

• Property type (e.g. apartment, house, condo)

• Room type (e.g. entire home, private room, shared room)

• Number of bedrooms and bathrooms

• Minimum number of nights available for rent

• Host Name/ID

• Number of reviews

• First review date

• Last review date

• Date the property was first active

The data contained in this report is believed to be highly accurate and representative of the

scale and scope of the short-term rental activity in the City of Vancouver as of the date of this

report.

Data Used For This Report

The data contained in this report was collected during the week of June 20

th

, 2016. Given that

the Vancouver short-term rental is extremely dynamic and listings come, go and change daily,

the data in this report should be viewed as a “point in time snapshot” of the market. That said,

given the large number of listings in the city, the patterns, themes and ratios outlined in this

report are believed to be fully representative of the current state of the market.

Unless noted otherwise, the analysis in this report is based on active listings de-duplicated

within and across platforms. Due to rounding, some data lists will total more than 100%.

Team

The analysis contained in the report was led by Host Compliance’s team of data and short-

term rental experts including:

Jeffrey Goodman

Jeffrey is an urban planner and considered one of North America’s leading authorities on

short-term rentals and how they impact communities. He has previously contracted with

both the City of New Orleans and Airbnb, and advised researchers on short-term rentals in

range of cities including San Francisco, Pasadena, Portland, New Orleans, and New York.

Jeff has spoken about short-term rentals across North America, including at the APA's

National Planning Conference. He graduated from Yale College and earned his Masters of

Urban Planning from Harvard University. He is the author of a recent

featured article in

Planning Magazine on the topic of STR regulation.

David Marcus

David is a Caltech Applied and Computational Math graduate working at the intersection of data

science and geospatial information management with eight years of experience building well-

architected, scalable software.

Prior to Host Compliance, David founded Routefriend.com, a web-based application for

planning trips on buses and trains, serving 1.5 million monthly users.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

David's most recent experience was at DwellAware where he served as the Lead Data Scientist

for the data analytics company building products to quantify housing risks and costs for

businesses and their customers in the residential real estate sector. Prior to DwellAware, David

served in various technical roles at a number of software companies including aboutLife,

UrbanMapping, AmericanTowns.com, Nielsen Analytic Consulting and Hewitt Associates.

David earned his BS Degree in Applied & Computational Mathematics at California Institute of

Technology and his MA in Anthropology from University of Kent.

Ulrik Binzer

Ulrik is the Founder and CEO of Host Compliance, the industry leader in short-term rental

monitoring and compliance solutions for local governments. A pioneer in the short-term

rental enforcement solution space, Ulrik developed the first short-term rental compliance

monitoring tools and now uses his expertise and insights to help local governments across

North America implement, monitor and enforce short-term rental regulation. Ulrik previously

served in a variety of leadership roles in management consulting, private equity, startups

and the military and developed his strategic and analytical skill-set at McKinsey & Company

and the Harvard Business School.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

3. Global Context

Though people have been renting spare rooms for centuries, the creation of Internet-based

platforms have greatly expanded the availability of short-term rentals worldwide. Backed by

large public companies or venture capitalists, sites like Airbnb.com, VRBO.com,

HomeAway.com and Flipkey.com have expanded rapidly, from under 500,000 short-term rental

listings worldwide in 2008 to over 4,000,000 in 2016. This pace of change - Airbnb added nearly

35,000 listings per month in 2015 - has turned a traditional local resort community industry into

a global marketplace with active listings in more than 34,000 cities around the world. In North

America, the growth has been equally astounding, and in the U.S. and Canada, there are now

more than 2,700 cities with more than 50 active short-term rental listings.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

3.1 Platforms Active in Vancouver

Ten of the 16 sites surveyed by Host Compliance were active in the City of Vancouver in June,

2016: Airbnb, HomeAway, VRBO, Flipkey, VacationRentals.com Travelmob, Homelidays, Abritel,

Ownersdirect, and BedandBreakfast.com. Staff identified three more websites with at least 100

listings in Vancouver: Craigslist, Roomorama and Vancouver Dream Rentals, each with about

1% of all listings.

The short-term rental market in the City of Vancouver is dominated by Airbnb, which represents

85% of the active listings. The remainder of the market is split between a long list of websites,

with the sites in the HomeAway family (HomeAway.com, VRBO.com, Vacation Rentals.com

etc.) representing 8% of the market, and FlipKey.com representing 4%. These market-share

figures are consistent with the figures from most other large urban cities in North America.

The 3 largest players in the Vancouver short-term rental market are all multi-billion dollar

companies backed by large investors. In the case of Airbnb, the company is currently valued at

USD 30 Billion and backed by major private venture capital investors. The companies in the

HomeAway family were recently acquired by the travel company Expedia (Nasdaq:EXPE) for

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

close to USD 4 Billion, and FlipKey was sold to Trip Advisor (Nasdaq:TRIP) in 2008 for an

undisclosed amount.

3.2 Listings

3.2.1 Total vs. Active vs. Unique

On June 24

th

, 2016 there were 6,269 online short-term rental listings in the City of Vancouver on

the 16 sites surveyed.

Because listings do not expire on many platforms, the raw number alone can give a false

impression of activity, as orphaned and abandoned and unused listings still appear in searches.

For this report, a listing was deemed active if the listing description or calendar was updated in

the last 12 months, or if the listing received a review in the last 12 months.

98.5%, or 6,176 of total listings in Vancouver were active in the last year.

From the listing data it is possible to refine this number by filtering out duplications, either the

same unit posted across multiple platforms or the same unit posted in different ways on the

same platform. There were 5,353 active, unique listings in Vancouver at the time of data

collection. This means approximately 13% of total listings were duplicates.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

3.3 Listing Types

3.3.1 Entire Units vs. Private/Shared Rooms

Most platforms allow hosts to label their units as different kinds of spaces: entire unit, which

could be whole apartments, condos, or houses; private room, a bedroom within a larger unit; or

a shared room, such as a bed in a bedroom or a couch in a living room.

Of the 5,353 active, unique listings, 4,012 or 74% were for entire units - The other 26% of

listings were for either private bedrooms (23%) or shared rooms (2%). A small number of listings

could not be categorized (numbers do not add to 100% due to rounding).

3.3.2 Number of Bedrooms

The number of advertised bedrooms varies considerably. While nearly four hundred listings

claim zero bedrooms, almost a hundred listings have five or more bedrooms, with one listing

even offering an eleven bedroom unit. A large majority of both listings and unique units have

either one bedroom (64.4% of listings) or two bedrooms (19.9%).

For a small number of listings (<.1%), the number of bedrooms are unknown, both here and in

the neighbourhood profiles.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

3.4 Listings/Units by Location

Three quarters of Vancouver’s active, unique short-term rental listings are located in four

neighborhoods: Downtown (29%), Mt. Pleasant/Renfrew Heights (14%), East Hastings (15%)

and Kitsilano/Point Grey (15%). The geographic distribution remains largely the same when the

data is segmented by entire units vs. private/shared rooms, although the analysis reveals fewer

private/shared room listings Downtown and more of such units in Mt. Pleasant/Renfrew Heights.

The following tables show this neighbourhood-level analysis in more detail. The ‘% of Total’

refers to the total within each table.

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Unique, Active Listings By Neighbourhood

Neighbourhood

Listings

% of Total

1 - West End, Stanley Park

66

1.2%

2 – English Bay

175

3.3%

3 – Downtown

1578

29.4%

4 – South Granville / Oak

490

9.2%

5 – Kitsilano / Point Grey

824

15.4%

6 – Westside / Kerrisdale

346

6.5%

7 – Marpole

59

1.1%

8 – Mt. Pleasant / Renfrew Heights

746

14.0%

9 – East Hastings

818

15.3%

10 – Southeast Vancouver

251

4.7%

Unique, Active Entire Unit Listings By Neighbourhood

Neighbourhood

Listings

% of Total

1 - West End, Stanley Park

52

1.3%

2 – English Bay

131

3.3%

3 – Downtown

1320

32.9%

4 – South Granville / Oak

365

9.1%

5 – Kitsilano / Point Grey

606

15.1%

6 – Westside / Kerrisdale

174

4.3%

7 – Marpole

30

0.7%

8 – Mt. Pleasant / Renfrew Heights

584

14.6%

9 – East Hastings

560

14.0%

10 – Southeast Vancouver

190

4.7%

Unique, Active Private Room or Shared Room Listings By Neighbourhood

Neighbourhood

Listings

% of Total

1 - West End, Stanley Park

14

1.0%

2 – English Bay

44

3.3%

3 – Downtown

258

19.2%

4 – South Granville / Oak

125

9.3%

5 – Kitsilano / Point Grey

218

16.3%

6 – Westside / Kerrisdale

172

12.8%

7 – Marpole

29

2.2%

8 – Mt. Pleasant / Renfrew Heights

162

12.1%

9 – East Hastings

258

19.2%

10 – Southeast Vancouver

61

4.5%

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Zone 3: Downtown

At the time of data collection there were 1602 unique properties (1930 total listings). This is 29%

of Vancouver’s total number of short-term rental units, and nearly twice as many units as the

next highest neighbourhood. Around 85% of these listings are for entire units. About 98% or

1903 of all listings have been active in the last year, representing 1578 active, unique units. A

large majority of units are either one or two bedrooms.

Listings and Unique Units by Listing Type

Unique Units

Listings

Entire Units

1334

1655

Shared Units

268

275

TOTAL

1602

1930

Activity in Last Year

Unique Units

Listings

Active

1578

1903

Unique Units by Bedroom

0 bedrooms

1 bedrooms

2 bedrooms

3 bedrooms

4 bedrooms

5+ bedrooms

129

1016

374

54

1

2

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Zone 5: Point Grey/Kitsilano

At the time of data collection there were 830 unique properties (896 total listings). This is 14% of

Vancouver’s total number of short-term rental units, and the third most units of any

neighbourhood. Around 75% of these listings are for entire units. About 98% or 884 of all listings

have been active in the last year. A large majority of units are either one or two bedrooms

though there are several units with 5+ bedrooms available.

Listings and Unique Units by Listing Type

Unique Units

Listings

Entire Units

614

669

Shared Units

216

227

TOTAL

830

896

Activity in Last Year

Unique Units

Listings

Active

818

884

Unique Units by Bedroom

0 bedrooms

1 bedrooms

2 bedrooms

3 bedrooms

4 bedrooms

5+ bedrooms

47

479

190

72

19

10

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Zone 8: Mt. Pleasant / Renfrew

At the time of data collection there were 842 unique properties (943 total listings). This is 15% of

Vancouver’s total number of short-term rental units, and the second most available units of any

neighbourhood. Around 68% of these listings are for entire units. About 97% or 925 of all listings

have been active in the last year. While most units have only a few bedrooms, Zone 8 does

have a larger than average number of 4 and 5+ bedroom units.

Listings and Unique Units by Listing Type

Unique Units

Listings

Entire Units

595

645

Shared Units

247

298

TOTAL

842

943

Activity in Last Year

Unique Units

Listings

Active

827

925

Unique Units by Bedroom

0 bedrooms

1 bedrooms

2 bedrooms

3 bedrooms

4 bedrooms

5+ bedrooms

50

542

133

74

16

8

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

City of Vancouver: Short-Term Rental Market Overview

Zone 9: East Hastings

At the time of data collection there were 768 unique properties (868 total listings). This is 15% of

Vancouver’s total number of short-term rental units, and the fourth most units of any

neighbourhood. Around 73% of these listings are for entire units. About 97% or 846 of all listings

have been active in the last year. About 65% of all units in Zone 9 are for one bedroom listings.

Listings and Unique Units by Listing Type

Unique Units

Listings

Entire Units

570

637

Shared Units

198

231

TOTAL

768

868

Activity in Last Year

Unique Units

Listings

Active

746

846

Unique Units by Bedroom

0 bedrooms

1 bedrooms

2 bedrooms

3 bedrooms

4 bedrooms

5+ bedrooms

62

480

141

43

13

6

© Host Compliance LLC | 735 Market St, Floor 4, San Francisco, CA 94103 | www.hostcompliance.com

3.5 Listing Per Host

Using both published names of hosts in online profiles and the unique id numbers given to hosts

on certain platforms, it is possible to get a sense of how many listings each hosts is managing.

These numbers are not perfect for a number of reasons - hosts posting under multiple names on

one platform or across several, for example - but give a general sense of the shape of the

marketplace.

There are at least 4393 hosts in Vancouver, with a large majority (83%) managing only one

listing. Another 10% operate two listings, and the remaining 7% of hosts have three or more

listings. A small number of hosts (around 25) control more than 10 listings each. The largest

number of listings by one host is at least 28.

Attachment 2

Talk Vancouver Survey Summary

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

SUMMARY OF SURVEY RESULTS

1. Who We Heard From

6,475 participants

Responses were even distribution across age, gender, and the tenure of their housing. Additionally, 83%

participants were Vancouver residents

2. Public Opinion

We Must Protect Affordable Rental Housing

Nearly two thirds of the participants believe that short-term rentals make it harder for people to find

quality, affordable long-term rental housing (Table 2.1). At the same time the participants believe that

short-term rentals are good for the tourism industry, but this a low priority for them as seen in Table 2.2.

49%

47%

4%

Responses by Gender

Male Female Other

50%

45%

5%

Responses by Housing

Tenure

Rent Own Other

83%

17%

Resident of Vancouver

Yes No

0%

10%

20%

30%

40%

50%

19 and

under

20-29 30-39 40-49 50-59 60-69 70+

Age Group

Responses by Age

Table 1.3

Table 1.2

Table 1.1

Table 1.4

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

Protecting the supply of affordable rental housing was seen as the top priority with more than three

quarters of respondents agreeing. Meanwhile almost half of respondents cited allowing residents to

earn income from short-term rentals as the lowest priority. Additionally, the second most important

objective was to ensure that residential areas and buildings are kept quiet and safe. However the

perceptions above in Table 2.1 noted that safety and property damages are not seen as a major

detriment of short-term rentals

0% 25% 50% 75% 100%

They increase noise and property damage.

They reduce safety in buildings and neighbourhoods.

They are an important source of supplemental income for

residents.

They bring tourist spending to neighbourhood shops and

restaurants, outside of the Downtown core.

They make Vancouver a more appealing tourist destination.

They make it harder for people to find quality, affordable

housing that’s available to rent long-term.

41%

42%

47%

58%

62%

71%

25%

20%

22%

23%

18%

10%

34%

38%

31%

19%

20%

19%

General Perceptions of Short-Term Rentals

Agree Neutral Disagree

Table 2.1

0% 25% 50% 75% 100%

Allowing residents to earn income from short-term rentals.

Supporting tourism.

Regulating all types of tourist accommodation fairly.

Collecting business taxes from short-term rental properties.

Keeping residential areas and buildings quiet and safe.

Protecting the supply of affordable rental housing (i.e. monthly)

31%

35%

50%

51%

56%

76%

24%

35%

29%

23%

28%

13%

45%

30%

21%

26%

16%

12%

How does the public prioritize City policy objectives?

High Proiority Neutral Low Priority

Table 2.2

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

3. Policy Options

Restricting to Principal Residence is the Key

Participants felt strongly that short-terms rentals should only take place in the principal residence of the

operator. Almost everyone agreed that homeowners would be allowed to join to short-term rental

market at will, while nearly half also believed renters should be able to participate as well (Table 3.1).

As long as the space was the principal residence of the operator, every type of space was deemed

supportable by the participants (Table 3.2).

Table 3.1

Table 3.2

0% 25% 50% 75% 100%

Other

Property managers.

No one, I don’t think short-term rentals should be allowed.

Owners of entire rental apartment buildings.

Investors or people who own property they do not live in.

Renters, in their primary residence

Homeowners, in their primary residence

6%

12%

13%

17%

25%

47%

82%

Who should be allowed to offer units

on the short-term rental market?

0% 25% 50% 75% 100%

Other

None of the above, short-term rentals should not be allowed.

An entire residential unit

Two or more spare rooms.

A laneway house.

A basement/secondary suite.

One spare room.

3%

14%

57%

58%

58%

65%

69%

What type of space should be allowed

for short-term rentals?

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

In general renters and owners shared very similar opinions, however when asked about a potential

night-cap their opinions diverged. Nearly a third of renters believe nights should be capped at a

maximum of 30-nights per year for each short-term rental. On the other hand over a third of home

owners believe the number of nights a unit could be listed as a short-term rental should be unlimited

(Table 3.3 and 3.4). A possible reason for this variance could stem from the reality of how renters and

owners currently utilize their space on the short-term rental market, shown in Table 4.2 and 4.3.

6%

10%

11%

13%

18%

41%

0% 25% 50%

Other

Up to 90 nights of the year.

Up to 60 nights of the year.

Short-term rentals shouldn’t be allowed.

Up to 30 nights of the year.

No limit on the number of nights in a year.

If the amount of nights were capped,

what would be a fair limit?

Owners

Table 3.3

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

4. Host Profile

Vancouver Hosts are benefiting from the Short-Term Rental Market

At the end of the Talk Vancouver Survey, a section was dedicated to those who have hosted a short-term

rental in the last twelve months. The results showed 10% of the total 6,745 survey respondents, 676

people, had listed a space on the short term rental market. The most common option for a host was to

have rented an entire unit, rather than a private or shared room (Table 4.1).

7%

12%

15%

17%

19%

30%

0% 25% 50%

Other

Up to 90 nights of the year.

Short-term rentals shouldn’t be allowed.

Up to 60 nights of the year.

No limit on the number of nights in a year.

Up to 30 nights of the year.

If the amount of nights were capped,

what would be a fair limit?

Renters

Table 3.4

68%

28%

13%

0%

25%

50%

75%

100%

An entire unit One or more rooms

in a unit

Other

What type of space did you list?

Table 4.1

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

The survey results demonstrated that the total number of nights these hosts rented varied significantly.

Renters were most commonly renting their space for less than 30 nights per year (Table 4.2), while

owners were most likely to rent their space out for 90 days or more annually (Table 4.3).

In order to understand the individual economic impacts of the short-term rental markets, host were

asked how much they earned in the last twelve months and how they use it (Table 4.4 and 4.5).

Evidentially, two-thirds of the hosts who responded in the survey made less than $10,000 in the year,

and a majority of all hosts used their income on housing costs and necessities such as groceries and bills.

0%

25%

50%

1-30

nights

More

than

90

nights

31-60

nights

61-90

nights

Prefer

not to

say

Don’t

know

45%

27%

10%

9%

8%

1%

Renters

Table 4.2

0%

25%

50%

More

than

90

nights

1-30

nights

31-60

nights

61-90

nights

Prefer

not to

say

Don’t

know

44%

20%

17%

11%

6%

2%

Owners

Table 4.3

Short-Term Rentals

Talk Vancouver Survey

July 20th 2016 – August 3rd 2016

The final question asked to the hosts aimed to uncover how their space would be used if it was not listed

as a short-term rental. Less than one fifth of the respondents claimed that their space would have ended

up on the long-term rental market (Table 4.5).

0% 25% 50%

Prefer not to say

More than $15,000

$10,000 to under $15,000

$5,000 to under $10,000

Under $5,000

8%

16%

9%

23%

43%

How much did you earn from short-term rentals in the last 12 months?

Table 4.4

0% 25% 50% 75% 100%

Entertainment (e.g. eating out etc.)

Other

Savings or Investment

Travel

Necessities (e.g. groceries, bills etc.)

Housing costs (e.g. rent/mortgage)

10%

15%

19%

22%

49%

81%

How did you use the additional income?

Table 4.5

0% 25% 50% 75% 100%

Would have rented to a long term tenant

(more than 30 days)

Other

You would have lived there

Family or friends would have it

It would have been vacant

17%

17%

24%

27%

55%

If it wasn't a short-term rental, how would the space be used?

Table 4.6